Funds credited to your mobile phone account can be spent on other purposes.

In this article, read about all the ways to withdraw funds from your SIM card balance to receive cash:

- cash out at an ATM;

- transfer to bank;

- receive by mail;

- transfer to an electronic wallet;

- issue a money transfer;

- obtain directly from the operator.

Contacting the MTS office

Receipt of money in the office is available upon termination of service. When changing a cellular operator or refusing services, the client has the right to return the funds on the balance in a way convenient for him, including in cash.

Contact the MTS office with your passport and write an application in the prescribed form. In the application, indicate the number of the personal account or card where the money is to be credited.

The review process takes up to 45 days. After a decision has been made on the application, the money will be issued in the required manner.

Shall we cash out?

Certainly! But you just can’t do it without a commission. We need to remember this. All operators charge interest for cashing telephone money. The difference is in their size. Moreover, this is a very important point: the range is very wide! Affect the situation:

- selected mobile phone company;

- the amount that you would like to withdraw from your phone;

- cashing ways.

You cannot withdraw money from your mobile phone completely free of charge. You have to pay for everything, but there is some cunning in how and for what it should be done. They usually write that the percentage of... For any initially stated figure, immediately increase it by 50-100 percent without looking back. Comparing the capabilities of mobile networks gives us an approximate rating of the most popular operators, whose withdrawal of funds is most beneficial to the client:

- Beeline;

- MTS;

- Tele 2;

- Megaphone.

If you have the time and desire, search the Internet for services for withdrawing cash from your phone. But it is wiser to trust the official representatives of mobile companies. This way you can get by with minimal losses.

Is it possible to withdraw money through a bank?

Withdrawals are made using the bank card number or the recipient's account details through your personal account on the MTS website:

- In the payments section, select “Loan repayment”.

- Select a bank and enter the required data - card number or current account.

- If yours is not in the list of banks, select the “Transfer by payment details” item.

- To transfer by account number, enter the 20-digit account, BIC, recipient details, amount. After this, confirm the transfer via SMS.

Important! When transferring by current account number, the commission is 2.3–2.6%, and by card number 4.3–4.6%. Each bank card is linked to an account number. To save money, enter the card's current account details, not its number.

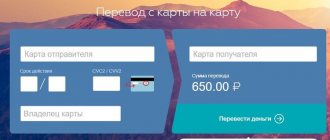

Transfer to a card using its number is available from the personal account menu – “Transfer from phone account to card” – https://pay.mts.ru/webportal/payments/2463/Moskva:

- On the specified tab, enter the phone number and amount.

- On the next tab, enter your bank card details.

- Confirm the debiting of money by sending a message. A write-off report will be sent to your phone.

Transfer via USSD request or SMS

To transfer money via USSD to a card:

- Dial a request in the following format - *611*(card number without spaces)*(transfer amount)#(press the call button).

- In response, you will receive a message asking you to confirm the operation; to do this, send a response message with any text. To cancel the transfer, send "0".

Transfer to card via SMS:

- Send the text to number 6111 – card_(card number)_(transfer amount).

- After receiving the transfer message, confirm the transfer.

The commission size and maximum amount are the same for any method of sending money to a bank card. The duration of the operation is from several minutes to 5 working days.

Qiwi - a universal payment system

To know how to withdraw money from an MTS phone, you need to remember an important thing: the number must be linked to Qiwi. That is, first a wallet is created in the payment system for the SIM card, from where you will need to withdraw funds. This is not at all difficult to do on the official Qiwi website. Once the account is created, it can be replenished. To do this, select the “Top up” item, and in the drop-down window, check “All methods”.

Since there are many options for depositing funds into a wallet, you can filter them down to one – “Mobile account”. From the indicated operators, just select the desired MTS, estimate the size of the commission that the system charges for the operation, and then click on the “Details” button.

How to cash out money from a mobile phone through a transfer system?

Receive cash from your mobile account by sending yourself a transfer through the transfer system in your personal account:

- To make a payment, select “Money Transfers” in your personal account menu, select the “Cash Transfer” tab – https://pay.mts.ru/webportal/payments/2462/Moskva.

- The site offers 2 systems - CONTACT and UNISTREAM. After choosing a convenient system, proceed to registration:

- on the first tab, enter your phone number and amount, click “next”;

- the second tab indicates the recipient's last name, first name and patronymic. It is important to provide this information in accordance with your passport, otherwise you will not be able to receive the money;

- for the UNISTREAM system you need to enter the sender's data;

- Next, a data confirmation field will appear. Click on the link to receive your password. Enter the code received in the received message in a special window. After that, click “Confirm transfer”. After this you will receive a message with a code.

- To receive money, go to the nearest point of issue, present your passport, state the amount and transfer code.

The table provides a description of the translation systems:

| Transfer system | Amount, rub. | Limit on the number of transactions per day | Limit on amount per day, rub. | Transaction fee |

| CONTACT in Russia | From 1000 to 15000 | 5 payments | 30000 | 4,3% |

| UNISTREAM in Russia | From 1 to 15000 | 5 payments | 30000 | 4,3% |

What restrictions does the telecommunications company set?

You can transfer a maximum of 15 thousand rubles and a minimum of 50 rubles at a time. MTS established such restrictions to control the movement of funds between its subscribers and to minimize its risks. Unidentified users will also face a number of restrictions.

Restrictions from Sberbank

When making a payment, it is also necessary to take into account the restrictions of banks, in particular Sberbank:

- maximum per month – 75,000 rubles, including commission payments of 3,000 rubles;

- no more than five transfers per day;

- maximum per day – 40,000 rubles.

For your information.

The required minimum balance on the phone balance of 10 rubles is needed for the subscriber to be able to use communications.

Available number of transfers from MTS

MTS, like Sberbank, allows you to transfer a maximum of 40,000 rubles per day. Money can be broken down into five parts. It is worth considering that if the transaction amount is less than 1,500 rubles, the commission percentage will increase and exceed 4.3%. There are no specified time intervals between transfers. There are also no restrictions on the amounts of each part.

Russian Post

Send yourself or another person a postal transfer from your personal account on the MTS website:

- To do this, in the “Manage Payments” menu in the “Money Transfers” tab, select “Cash Transfer”. Shipping methods include Russian Post.

- In the menu that opens, enter the phone number and the required amount - click “next”.

- On the next tab, fill in the recipient's last name, first name, patronymic and post office code. It is important to correctly fill in the recipient’s data in strict accordance with the passport data - it will not be possible to change it later.

- Select the type of transfer - on demand or with acknowledgment of delivery. The difference is that when you select “with notification,” the recipient will receive a notification about the money received at the specified postal address.

- The completed data will appear on the next tab. If everything is correct, then click the “get password” link, after which you will receive a message with a confirmation password. Enter your password in the box on the website and click the “Confirm transfer” tab.

For withdrawing cash via postal transfers, a commission of 4.2% of the amount plus 55 rubles is deducted from the phone balance. The amount cannot exceed 14,000 rubles. You can send no more than 5 transfers per day for a total amount of up to 30,000.

Issue is carried out by the post office, the index of which is indicated when filling out the transfer. The money will arrive by mail in 4 business days. To receive it, you need to present your passport and inform about the directed transfer.

The money remains in the post office for 32 calendar days. If you do not receive them during this time, they will be sent back to your personal mobile phone account, without taking into account the commission amount.

Features of funds transfer

Those who are interested in how to withdraw money from an MTS phone account should prepare for some points. Firstly, as mentioned above, the SIM card must be linked to the wallet. Secondly, when selecting the amount to be credited, two columns are displayed: one indicates the amount that will be debited from the phone, the other indicates how much will be credited to the account. On average, a commission of ten rubles is taken from one hundred rubles.

Thirdly, after completing the procedure for entering the amount, you must confirm the payment. A message will be sent to your phone, to which you need to respond with any text (not numbers). The message is not paid for. Funds are credited from your phone to your wallet instantly after confirmation. Withdrawing rubles from Qiwi is quite simple, turning them from virtual into real cash.

To an electronic wallet

MTS offers to top up electronic wallets using your Personal Account on the bank’s website - https://pay.mts.ru/webportal/payments/2372/Krasnodar.

The procedure is as follows:

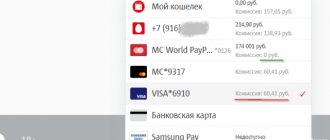

- In the MTS personal account menu “Manage payments”, select the “electronic money” tab. This tab presents all electronic wallets available for topping up from a mobile phone account.

- Having entered the menu of the desired electronic wallet, enter the phone number and amount, then click “next”.

- A tab will open with the terms of the entered payment and the result, and you will receive an SMS requesting confirmation of the transfer.

- Approve the payment by reply message. If you change your mind about withdrawing money, send “0”.

You can also withdraw money using your personal wallet account. In the menu for replenishment methods, select - from phone balance and enter the required data.

Table 2. Conditions for crediting funds to electronic wallets.

| Online wallet | Limit on one payment, rub. | Limit on payments per day. | Transaction fee. |

| VISA QIWI WALLET JSC QIWI Bank | 5000 | 5 payments | 9.9% +10 rubles |

| YANDEX.MONEY P.S.Yandex.Money LLC | 15000 | 5 payments | 11.35% +10 rubles |

| WALLET ONE RNKO “Unified Cash Desk” | 15000 | 5 payments | 10.5% +10 rubles |

| I-TRANSFER United Settlement Center LLC | 15000 | 5 payments | 7.35% +10 rubles |

| ONPAY LLC "MAGNUM" | 5000 | 5 payments | 9.00% +10 rubles |

| PAYANYWAY Pay Any Way LLC | 15000 | 5 payments | 10.35% +10 rubles |

| TELEMONEY Comfort Plus LLC | 15000 | 5 payments | 5.35% +10 rubles |

| WEBMONEY LLC "Guarantee Bureau" | 5000 | 5 payments | 10.3% +10 rubles |

Through your MTS personal account

All transfer operations are available from your personal account on the MTS website. To enter your personal account, enter your phone number and password.

If you have not used your personal account before or have forgotten your password, you can recover your password by receiving it via SMS.

Registration in your personal account allows you to carry out many cash transactions:

- payment for goods and services;

- withdrawal to electronic wallets;

- sending to a bank account or card;

- transfers through mail and banks;

- payment of loans.

MTS virtual card

If you don’t have time to issue a payment card, you can open a virtual MasterCard of MTS Bank. When opening such a card, the bank provides only its details, without physical media.

You will be sent a number, expiration date and cvc2 via SMS - this data is enough to make non-cash payments.

To pay for a hotel reservation or purchase of goods, you must enter card details. It is not possible to pay for such services from a mobile phone account.

Open a virtual card within a few seconds, transfer funds from your SIM card personal account to it, and pay online.

This card is sufficient for making online payments of all types. Money is transferred to the card from a mobile phone for 1.5% of the amount.

Apply for such a card through the MTS mobile application and MTS Personal Account - https://login.mts.ru/amserver/UI/Login.

Sending USSD command

With a short request, an MTS user can withdraw cash from his phone account. The main thing is that the recipient of the payment has a Visa or Mastercard. The transfer is carried out through the MTS virtual service.

- In the empty dialing line, enter the combination of numbers * 611 * XXXXXXXXXXXXXXX * Y * call key, where X is the 16-digit card number, Y is the amount to be withdrawn.

- The system will accept the customer's request and then send a payment confirmation notification. If you do not want to withdraw the specified amount from the account, the user must send the number 0.

In order to make such a request to the operator, the client will have to pay a fee and will be limited to the amount of money transferred from the mobile phone.