For several years now, subscribers of the Megafon operator have been able to use the Megafon-Bonus incentive program. Its participants receive rewards simply for habitual communication, without fulfilling any special conditions.

At the beginning of each month, the operator credits points to a personal bonus account, the number of which depends on the volume of communication services of the previous month - these can be telephone conversations, SMS correspondence, mobile Internet.

Most often, program participants are interested in the question: how to convert points from Megafon into money?

Is it possible to exchange Thank You points for rubles and how?

Objectively speaking, from the very beginning, Sberbank’s cashback service was implemented, frankly speaking, not entirely successfully.

Clients complained about slow replenishment of the bonus account due to the “greedy percentage” of deductions. They were also unhappy with the fact that points could not be directly converted into cash, which meant they had to deliberately search for some companies that accepted Thank You as payment. The bank's management is thinking hard: is it possible to allow clients to convert bonuses into money? Thank you, and if they do allow it, how will this affect the entire system? It should be noted that the Sberbank team actively worked to improve the service: a multi-stage system was introduced to encourage and support active users; the number of partners where you can “shop” accumulated bonuses has increased rapidly; Finally, a system for converting points into real rubles was introduced.

So yes, it has recently become possible to convert Thank You bonuses into money. But here, too, the bank, of course, could not play fair to the end: the exchange rate for bonuses into rubles was set far from being in favor of the client. To be precise, for every 2 bonuses the card holder receives 1 real ruble.

The system was developed this way because the bank primarily benefits from cooperation with partners. And it consists of a very simple scheme: the partner gives the bank an extension of the cashback service, and in exchange receives an increased flow of customers and an increased turnover of the enterprise. Of course, if all Sberbank clients begin to transfer points into rubles, attachment to the bank’s partners will significantly weaken, and this, in turn, will undermine the very essence of cooperation between the bank and its partner.

There is one more significant limitation: you can exchange Thank you bonuses from Sberbank for money only if the user is at the highest level of “More than Thank you” privileges. Achieving it is now quite simple, although until recently the level was received by no more than 4 percent of Sberbank’s entire client base. And yet, even taking into account the increased loyalty of the conditions, this is still an obstacle to free exchange.

FAQ

Is it possible to transfer bonuses into rubles without a 50% commission? According to the rules, withdrawal of cumulative bonuses is made at a rate of 1 bonus - 50 kopecks.

What should I do if my phone number has changed and I can’t log into the “Thank You” application? You need to contact the organization’s office with a passport and a phone with a new SIM card.

Is it possible to pay for goods partly with bonuses and partly in rubles? Yes. This must be reported to the store clerk.

How could you spend it before?

- Only in partner stores that are participants in the promotion (as you understand, the list is limited and may change over time, you can check the relevance of the data in your personal account)

- Not all stores in the chain can participate in the promotion.

- You should have warned the seller in advance that you are going to buy an item or service from them for bonuses, and how much you want to write off (there are percentage restrictions)

- Write-offs can occur in the amount of up to 99% of the purchase with accumulated “Thank you”, but it all depends on the partner

And now points can be exchanged for rubles. The program is constantly changing, acquiring new opportunities and conditions. We continue to monitor developments!

Loading …

Reviews from Sberbank clients

The program’s website states that the bonus system is popular among bank clients. The number of participants is growing steadily and now amounts to more than 40 million people.

- Olga, 32 years old, Moscow

I buy books for the whole family and friends at Liters, and receive 10% cashback in the form of bonuses. I don’t see any point in exchanging them for money, because... unfavorable course. It’s easier to take advantage of discounts from partners, since there are many of them in Moscow.

- Andrey, 23 years old, Voronezh

Participation in the program does not require any effort, and bonuses accumulate little by little.

Most often I use it to top up my mobile phone, but a couple of times it came in handy for discounts at entertainment centers. It's a small thing, but nice. Have you exchanged Thank You bonus points for rubles?

Constantly! I want to try

- Nikolay, 27 years old, Podolsk

Exchange of bonuses is an interesting idea when you urgently need money. But constantly maintaining the “More than thank you” level is not easy, especially when the turnover does not take into account transfers within Russia. It seems that only investors can do this. So let the bonuses accumulate. Discounts are always useful.

Is it possible to cash out Thank you points from Sberbank?

Bonus points are interest accrued to the account after paying for goods in the promotion’s partner stores through the card. Thus, the balance of bonuses is replenished after each purchase made. Bonuses have their own cash equivalent and can be exchanged for money. So, 1 accrued point is equal to 1 ruble.

The question remains how to convert Thank You into money. The user can convert Thank You points into money by topping up their phone account with them, with 99% of the amount debited from the card being points and 1% being cash. The minimum money transfer amount is 500 rubles.

Funds from your own phone balance can be transferred to any card. This can be done online. MTS subscribers can do this using their personal account. Here you need to log in, go to the appropriate tab, enter your phone number and bank details. After the operation, the user will be able to exchange bonuses for money, receiving them using his card at an ATM.

Each person can withdraw money from the bonus account by selling the coupon issued during the points exchange. This method allows you to cash out bonuses in exchange for existing promotional codes and certificates. Reselling certificates can be difficult as they are often personalized and cannot be transferred to third parties.

Where can I withdraw money?

You can exchange bonuses for rubles without restrictions, i.e., if desired, even 2 bonuses can be converted into 1 ruble. Only the upper limit is set: no more than 10,000 bonuses per month can be converted.

The money received can be transferred exclusively to accounts opened by the client with Sberbank. It does not matter whether a debit or credit card is linked to the account - it can simply be a current/current account opened for savings or business activities.

So you cannot send money to someone else or make a transfer to a “foreign” bank. But this can be easily done as soon as the converted rubles arrive in your Sberbank account, since from that moment all received money will be no different from ordinary money.

About how to check your points balance Thank you, read here.

Bonus program conditions

How to get points in cash

Before you start using points, you should check how many have accumulated in your bonus account. You can do this:

- in your personal account on the Sberbank Online website;

- at an ATM or terminal;

- by sending an SMS request to number 6470 from a phone connected to a bank card;

- from the bank service center operator.

Having collected a sufficient number of bonuses, you can choose the most suitable method for converting them into rubles.

Paying for purchases for another person

A common way to exchange bonuses is to purchase goods for another person, who then returns the money. First, you should agree with the buyer on the calculations and select the required product. After this, you need to pay the purchase price using the maximum possible number of bonuses. Since the buyer will pay the entire amount in cash, the points will be converted into rubles.

Transferring bonuses through a mobile operator account

Another convenient way you can exchange Thank You points for money is by transferring them to your bank account through your mobile phone number. To do this, the operator must be on the list of partners. Companies such as MTS, Beeline, Megafon, Tele2 have been cooperating with Sberbank for a long time, and their users can safely top up their phone account with bonuses.

To carry out this procedure for an MTS client, you must:

Money will be credited at the rate of one ruble per point. A prerequisite for this operation is partial payment for communication services from the client’s bank card. So you can deposit 99 rubles with points, and add another ruble from a bank card.

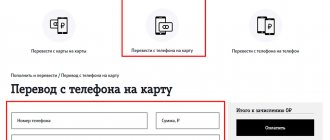

Once the funds are credited to your phone, they can be transferred to any bank account. To do this you need on the official MTS website:

- Go to the “Financial services and payments” section.

- ABOUT.

- Click on the “From phone account to card” icon.

- Enter the payer's mobile phone number.

- Specify the transfer amount.

- Fill in the number of the bank card to which the money should be transferred.

- Enter the password from the SMS message.

- Confirm the transfer.

The disadvantage of such an operation is the mandatory fee for the service provided. When crediting the client’s account, a commission of 4.3% will be charged, but not less than 60 rubles.

In addition, if you plan to exchange points into rubles, you should take into account the restrictions on withdrawal of funds:

- The minimum amount for transferring bonuses to an MTS account is 500 rubles.

- You can withdraw no more than 15,000 rubles per day to your bank account.

- The number of transfers from an MTS account to a card should not exceed 5 transactions.

In this way, bonuses will be converted into cash. But at the same time, their equivalent is slightly reduced due to the payment of commission fees.

Is it possible to display it on a map?

{banner_h22}

Sometimes people think about how to transfer Sberbank bonuses into money on a card. Each program participant is allowed to transfer Thank you bonuses from Sberbank to a card. To do this, he needs to accumulate at least 495 points, with which he must first pay the balance of his mobile MTS. The subscriber can withdraw these funds from his SIM card. In order to transfer accumulated points into money, i.e., to a bank card, you must log in to the MTS website.

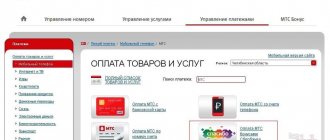

The user should log into their personal account using their username and password. On the page that opens, you need to select the item that helps you manage any payments, and then select “Transfer to a bank card.” This includes information such as:

- payer number;

- required amount for replenishment.

After this, the user performs the following actions:

- enters payment document details;

- confirms the transaction;

- indicates the secret code received via SMS.

There are some limits regarding the payment amount. So, it should not exceed 15,000 rubles. In this case, the commission amount will be 4.3%. You are allowed to make no more than 5 transfers per day.

Additional methods of using bonuses in favor of third parties

When you accumulate a large number of bonuses, you can use them to purchase goods for someone close to you. At the same time, you must understand that using points you can only pay a percentage of the price, and you will have to pay the rest from your card account or in cash.

You can use this technique to exchange bonuses for real money. You can agree with someone you know that you use bonuses to buy the goods he needs, and he will compensate you for its cost with real money

It is important to note that this method does not contradict the rules of the promotion

Another fairly common method of using bonuses in favor of third parties is to use them to purchase coupons. Current rules allow the transfer of electronic coupons and gift certificates to third parties.

How to exchange Thank you bonuses from Sberbank for money? Conditions for exchanging Thank you bonuses for rubles.

So, in order to turn the accumulated “Thank you” bonuses into pleasant cash equivalents, you need to be not just a user of a card from Sberbank, but a very active user. Only those Russians who managed to reach the “More than thank you” level - and this is considered the highest level of privileges - now have the opportunity to exchange bonuses for rubles at the rate of 1 bonus = fifty kopecks

You can exchange bonuses from Sberbank starting from yesterday, October seventeenth. As noted in the bank, the transfer of funds to the client’s account at the “bonus money” rate will be made within seven business days. To exchange “Thank you” bonuses, you need to go to the official website of the program, or do it in a special mobile application. Let us note that the “Thank you” program from Sberbank reaches a huge audience, therefore qualitative changes will interest many Russians. So, about thirty-four million people use these bonuses. However, how many people have reached the “highest level” and can exchange accumulated bonuses for money is still unknown. But bank representatives are confident that the innovation has received a lot of positive feedback from Sberbank clients. What is “More than thank you” from Sberbank Since July 2021, Sberbank has radically changed the “Thank you from Sberbank” loyalty program, establishing four levels of privileges for clients - “Sp thank you”, “Thank you very much”, “Thank you very much”, “More, than thank you.” These levels differ both in the amount of bonuses accrued for spending on cards and in the options for their use. To move to each level, a set of conditions and tasks are set for three months. For the period from July to September 2021, all Sberbank card holders were assigned the “Big Thank You” level, corresponding to the procedure for accruing bonuses before the program was transformed. Only clients of the highest level of privileges “More than thanks” received the right to convert bonuses into rubles.

Terms of the bonus program from Sberbank

“Thank you” is not awarded to all plastic card holders, but only to those who have joined the program. There are several ways to join the bonus program: through a terminal, online bank and mobile bank.

Instructions for registering through the terminal:

- You need to find a self-service device.

- Enter your PIN code.

- Select “Bonus program from Sberbank”.

- Indicate your mobile phone number.

- Agree to the terms of service.

- Receive an SMS confirming registration from the contact center.

3 conditions for accruing “Thank you”:

- Availability of Sberbank plastic.

- Registration in the program.

- Payment for goods and services with a card.

There is an extensive list of categories for which you can receive bonuses. Here are some of them: food, entertainment, books, mobile communications, travel, clothing and shoes. Bonuses are not awarded for paying for utilities, cellular communications and replenishing electronic wallets. There are several rules for scoring:

- “Thank you” is accrued automatically. For each purchase, 0.5 of the purchase amount is transferred.

- It is more profitable to shop with partners of a financial institution. For purchases from partners, an additional 50% is awarded.

- Almost all Sberbank payment instruments can be used. The exception is co-branded cards.

- If you withdraw funds from an ATM, there will be no bonuses. You need to make cashless payments at retail outlets and online stores.

How to save

Gift gratitude points can be received when making non-cash payments for purchases both in retail chains and online. Different Sberbank partners offer different percentages of return for a completed purchase. Also, the amount of accrued interest depends on the type of card. For premium types of debit cards, offers with increased bonuses often appear on the market.

The full list of partners of more than 100 names can be viewed on the official website of Sberbank. The most popular are:

Important! Some partners only provide the option of saving for purchases, but do not accept points for payment.

You can filter the list of partners who can pay for your purchase with points by clicking on the icon in the form of a gift box, which means that the seller accepts Thank you for payment. For other partners, bonuses are only credited when making purchases.

Thus, you can save “Thank you” by spending money on entertainment, food, clothing, buying air and train tickets, paying for hotel and car reservations while traveling, as well as various types of services.

In some cases, points are not awarded for card spending. Such cases are:

- Cash withdrawal or funds transfer.

- Payment via the Internet for utilities, Internet providers, duties and other similar bills.

- Transferring money to electronic wallets.

- Currency conversion. If you convert rubles into foreign currency or vice versa, bonuses will not be awarded.

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

Main partners of "Spasibo"

You will see the entire list of partners who participate in the Sberbank of Russia loyalty program in your personal account. They are constantly updated, expanding their representation. The most famous are:

- Burger King. One of the most famous restaurant chains where you can quickly and with great pleasure taste fast food.

- Euroset. The most famous store of electronic equipment products, which has an expanded network of branches throughout the country;

- BAON. A popular clothing store that stocks a large number of brands;

- Glam. A network of jewelry stores throughout the Russian Federation that is in great demand.

Bonus program Thank you

One of the advantages of Sberbank is the ability to make most payments by bank transfer. Bonuses are awarded under three loyalty programs: Thank you, Aeroflot, Give life. The first involves accruing points for any spending transaction. And you can control the accrual online. The scope of benefits depends on the partner company and the type of bank card.

Briefly about the program and where bonuses are transferred

Withdrawing bonuses to a card is a service that has appeared recently. Previously, points were awarded for making purchases at Sberbank partner stores. But from October 17, they can be transferred to the card in the form of real rubles and even withdrawn from it when cash is needed. The bank, protecting its interests, allows this to be done by those who actively use the services under the Thank You program.

You can convert bonuses on the official website, in your personal account and using the mobile application. The procedure for debiting from a bonus account will take no more than a week; this time is required to verify the data and determine the conditions. Sberbank allows you to exchange bonuses into rubles at a rate of 1 to 1. At the same time, the opportunity remains:

- Pay for goods using plastic card data.

- Pay for goods offered by partner trading companies.

- Take advantage of discounts and special offers from Sberbank partners.

- Increase the level, i.e. receive more bonuses.

Bonuses can be exchanged at the client’s request without restrictions, provided that the card user has become a member of the program. The latest changes made by the bank's management relate to the fact that there are now 4 levels of privileges provided. And if at the minimum you save up to 30% of the price of the product, then from the second, in addition to partner bonuses, points from Sberbank are awarded. To move to the next level, you must fulfill a number of conditions that are valid for three months.

You can convert bonuses into money if you raise the level to the fourth, which is called “More than thanks.” At the same time, 30% is given by partners, 0.5% by Sberbank, 20% is available because the last stage allows you to take advantage of the three previous ones.

To enjoy level four privileges, you must:

- 85% of expenses are paid by bank transfer using a card.

- Buy for at least 5,000 rubles. monthly.

- Avoid transactions using ATMs and terminals.

- Open a credit card within the last three months.

At the same time, Sberbank requires specific conditions to be met in order to withdraw bonuses. For example, you need to pay for mobile communication services from MTS via Apple Pay, Samsung Pay, Android Pay. It is also required that the client spend bonuses within the framework of the offered products “Travel”, “Experience”, “Online Market”. On average, expenses repaid from the card should be 10 thousand rubles. monthly. Moreover, this amount cannot be less than half of the established limit. The program involves the accrual of bonuses in the amount of 0.5% of the amount of the settlement check.

However, no crediting occurs if the plastic card user pays utilities, fines, taxes, and also withdraws cash. But by replenishing a mobile phone account using Internet banking, the card holder automatically receives additional bonuses. Sberbank allows you to spend them within the product, and if you make purchases from partners, this will become an indirect way of exchanging bonuses for money, since part of the cost is paid with points.

Main partners Thank you

To start using bonuses and receiving discounts, you need to spend money in partner stores. The easiest way to get the maximum benefit is to purchase goods from the Pyaterochka supermarket chain. The card user has the right to enjoy benefits when purchasing:

- In "Beru". Benefit – 5% of the amount spent.

- In "Kari". The benefit reaches 15%.

- In Technopark. Benefit - 5% of money spent.

- In Svyaznoy and TezTour. Benefit - 5%.

- In “Velostrana”, “Read-city” - up to 7%.

Using the list of partners, you can purchase any products and use services for a comfortable, carefree life. There is everything here: pharmacies, grocery stores, travel agencies, mobile operators, boutiques, cafes and much more.

Other ways to use bonuses

The possibility of converting Sberbank bonuses into Russian rubles at a rate of 1 to 1 does not limit the use of banknotes. And even if you can’t pay for a mortgage directly online with points, by cashing them out, you can always pay off the obligatory payment with real money. In addition, many people use Sberbank bonuses to pay for the services of mobile operators, which allows them to save a lot, because they don’t need to spend more than 1%.

Payment for goods

To receive bonuses or use them within the framework of the provided discounts, the seller must be a partner of Sberbank. However, there are also restrictions regarding payment:

- State duties, fines, penalties.

- Consumer loans, mortgages.

- Utility payments, taxes.

- Lottery tickets and other gambling ways to earn money.

It is also impossible to pay for bookmaker services. Sberbank does not encourage casinos, other gaming platforms, or exchanges of any type. It is impossible to buy shares, other securities, currencies and precious metals.

How to exchange Thank you points for rubles?

Sberbank clients automatically move to the second level of the program, which allows them to save up to a third of costs and receive an additional 0.5%. Persons who have reached level 4 “More than thanks” are allowed to withdraw bonuses in cash using standard methods. The conditions, or tasks as they are commonly called, must be completed monthly for 90 days. The user is obliged:

- Be a client of Sberbank for at least the last three months.

- Spend at least 5 thousand rubles by non-cash method.

- Withdraw (cash out) no more than 15% of the amount spent.

- Receive and activate a card, open a credit line.

- Every month replenish the deposit kept in Sberbank.

- Do not use the card at ATMs and electronic terminals.

To withdraw Sberbank bonuses, you must use the payment systems Apple Pay, Android Pay, Samsung Pay. An alternative is to actively use the Sberbank Internet Banking service for mutual settlements. It is enough to spend more than half of the allotted limit per month on your credit card and deposit funds on time to pay off the debt. On average, you need to spend about 10 thousand rubles.

All methods on how to exchange Thank you bonuses from Sberbank for rubles

Considering that 1 bonus is equal to 1 discount ruble, users are faced with a problem due to ignorance of how to use points. Buying a product at a discount is an indirect way to avoid spending currency. But you cannot withdraw them from an ATM or cash desk, since bonuses are stored in a special account assigned to the card. The provided transfer is a special solution for those wishing to receive an amount in rubles.

The operation assumes that the Sberbank client uses the online banking service. The list of functions does not include the output of points in rubles. But they can be converted if you top up your phone, for example, MTS, and then transfer the amount to the card. In this case, 1% will have to be paid with real money, and 99% will have to be paid off with bonuses. The step-by-step instructions are as follows:

- Top up your cell phone account by paying with Sberbank bonuses. This can be done in your Personal Account or on the website. The minimum amount for depositing is 500 rubles.

- Go to the mobile network services user page and in the payment management section, enter the recipient's card number. Send money.

- Withdraw money from an ATM, use the funds to pay for any goods and services, fines, taxes, duties at your own discretion.

Please note that for transferring funds to a mobile operator a commission of 4.6% of the deposited amount is charged. In this case, the amount of deduction cannot be less than 60 rubles.

In addition to the fact that the minimum enrollment on MTS is 500 rubles, there is another limitation. In the described manner, you can withdraw no more than 15,000 Sberbank bonuses within five days. In any case, the costs are scanty - a maximum of 60 rubles. from 1 thousand

How to find out your bonus account?

The check is carried out using one of the convenient methods provided by Sberbank:

- Take your card and go to any ATM. Knowing your PIN code, you can easily use the built-in menu to view the balance of the account in which the bonuses are stored.

- Go to your Personal Account, then go to the “Thanks from Sberbank” section, use the function to view bonus account data.

- Launch the Sberbank Online mobile application and follow the same steps to see how many bonuses are currently available.

- Send an SMS command to number 900, indicating the last 4 digits of your plastic card number. The result is a message with information on the balance of available funds.

When sending a request for the balance of bonuses to Sberbank, indicate only the last characters written on the card. For example, if the number is 6940, you don't need to dial anything else. Use the phone number linked to the card with bonuses.

Opportunities to use bonus points

To spend Sberbank bonuses, do the following:

- Check out the list of partner companies.

- Select the one that offers the product you are looking for.

- When placing an order, indicate how many bonuses should be spent.

- Enter your card details to debit funds.

This algorithm is used when ordering goods on the Internet.

Can points be canceled after transfer?

After being credited as cashback, bonuses are stored in a special account. There can only be 1, even if the owner has several plastic cards. In order for the client to control the number of bonuses and use them in a timely manner, Sberbank practices full or partial cancellation.

Possible reasons for the complete burning of bonuses:

- no card payments within the last 12 months;

- non-use of accrued points for 2 years;

- termination of the agreement with the bank with cancellation of cards and accounts.

Partial cancellation is possible if the client returned a purchase for which cashback was awarded. In addition, if a partner store leaves the program or ceases to exist, the bank will cancel the bonuses accumulated for purchases in this store.

If we are talking about points that have already been exchanged for money, no refund is possible. The funds received by withdrawing bonuses have already become the property of the client, not the bank.

How to get points in cash

The same loopholes exist for transferring savings into cash, although this is officially prohibited. You can cash out “Thank You” bonuses in two ways:

- Reselling purchases or coupons you received in exchange for points.

- Transfer to MTS number, and then from mobile account to card.

- From the MTS balance you can send it to a QIWI wallet and from there to a conscience card, to pay off debt or other needs.

This opportunity exists because MTS is one of the bank’s main partners.

The first method of withdrawing to a card is specific, but the second will allow you, albeit with a high commission, to get cashback in the form of cash. It is enough to do the following:

- Using your personal account or the Sberbank Online mobile application, transfer bonuses to your account. The transfer can also be made through the client’s account on the MTS website, there is no difference in this. The peculiarity of such payment for mobile operator services is that you pay 99 percent using points, but 1 percent must be paid from the card. And at the same time, a minimum amount of 500 rubles is set for one transaction.

- When you receive funds, use the MTS or Sberbank Online application and make a transfer to a bank card. All you need to do is provide your details and your number. The minimum transfer is the same 500 rubles.

- Confirm the operation and wait for an SMS notifying you that your account has been updated. Next, you can simply withdraw money from the nearest ATM.

How to use THANK YOU bonuses?

How do I know how many THANKS I have?

The bonus program provides several ways to check your bonus balance:

– In your Personal Account on the program website; – In the mobile application of the “Thank you from Sberbank” or Sberbank program

– In the Sberbank Online Internet bank, in the “Thank you from Sberbank” section

– In Sberbank terminals and ATMs in the “Bonus program” section

– Via SMS to number 900 with the text “THANK YOU XXXX”, where XXXX is the last 4 digits of your card number. Check your connection to the SMS-bank SMS service (the cost of an SMS message is set by the relevant mobile operator on the date the corresponding message is sent)

How to exchange THANK YOU bonuses for a discount?

To exchange accumulated THANK YOU bonuses for discounts in partner stores of the bonus program, you must: 1. Come to the partner’s retail store or to the website of the bonus program partner (the full list of partners can be found in the Partners section); 2. Select a product; 3. Warn the cashier that you want to use THANKS bonuses when paying; 4. State the amount of THANK YOU bonuses that you want to spend to the cashier or indicate it in the payment form on the Partner’s website; 5. Buy goods using a Sberbank card at a discount.

Is it possible to combine THANK YOU bonuses with rubles when paying?

Yes. You can use any number of THANK YOU bonuses from your bonus account when paying for goods, and pay the rest by credit card or cash. If there are enough THANK YOU bonuses in your account, the maximum discount can reach 99%, that is, almost the full cost of the product. In this case, you will need to pay only 1 ruble.

What happens to THANK YOU bonuses if I return/exchange my purchase?

Exchange/return of goods is made only at the retail outlet where the goods were purchased, in the manner and under the conditions provided for by the current legislation of the Russian Federation. When exchanging/returning a product, the number of THANK YOU bonuses that were credited when you purchased the specified product is debited from the bonus account, or the number of THANK YOU bonuses that were used to pay for the returned product is returned to the account.

Can I exchange THANKS for money?

Bonuses can be exchanged for rubles by participants who have reached the More Than Thank you level. Bonus exchange is available in the Personal Account of the Program website and in the “Thank you from Sberbank” mobile application. The rubles received in exchange for bonuses will be credited to your debit card. Check the exchange rate for bonuses into rubles in the channel in which the bonuses will be exchanged or in the Program Rules.

Is it possible to use THANKS from different bonus accounts when paying for one purchase?

THANK YOU bonuses are a personal discount for the cardholder and the rules of the program do not provide for its transfer to anyone else.

What is the lifespan of THANK YOU bonuses (Do bonuses expire at the end of the year?)

The lifespan of bonuses is 24 months. According to the Program Rules, if bonuses have not been used by you within 24 months or more from the date of their accrual, they will be cancelled. The Cancellation procedure is carried out monthly after the month in which the bonus period expired. You can find out the amount of bonuses that can be canceled in the Bonus program section in the Sberbank Online Internet bank.

More about exchange

Before the exchange operation, you need to clarify exactly how much virtual currency has accumulated; there are different options for finding out this data:

- in the Sberbank Online service,

- at a company ATM,

- via SMS,

- by calling the customer support center (number 900),

- using a smartphone application.

You need to think carefully before cashing out bonuses. After all, it is more profitable to pay with them in stores or organizations providing various services. When converting virtual currency into rubles, a large commission is charged.

Other ways to use points

The collected points can be used as a discount when purchasing goods.

A large number of partners are grocery stores and supermarkets. Bonuses under the “Thank you” program are accrued when paying for goods by card. You can cover the cost not only in full.

The list of partners participating in the bonus program operating in various fields is large:

- vehicles (carrying out auto payments, purchasing fuel at gas stations);

- healthcare (pharmacy chains);

- food (cafes, snack bars, restaurants, Pyaterochka grocery stores);

- light industry (clothing, shoe, toy, jewelry stores);

- cosmetology();

- education (bookstores “Read the City”);

- tourism;

- mobile communications (MTS, Megafon, Tele2, Beeline);

- maintenance services (taxi, insurance).

Many of the named enterprises and organizations develop their own promotions, accompanied by the accrual of bonuses. Detailed information about retail outlets and the discount system is posted on the official website of Sberbank.

Privilege levels and how to achieve them

More recently, the rules for achieving levels have been rewritten. Most users reacted positively to this news, because in essence the conditions became softer and more loyal.

- "Thank you" level. Assigned automatically; Regardless of the frequency of use of Sberbank cards, this level is always maintained. But it gives very little - cashback is only in partner stores, accrued by this same partner (we wrote about how Thank you is accrued here). So, for example, at this level the client will receive 0.5% of the purchase amount if he paid for goods at Pyaterochka with a Sberbank card;

- "Thank you very much" level. This can be achieved if the client spends at least 5,000 rubles by non-cash method every month. In addition, the ratio of money spent to money withdrawn must be equal to or greater than 50% of the monthly turnover. That is, for example, if you withdrew 2,500 rubles from an ATM or bank cash desk, this month you must pay with a card for any purchases totaling at least 2,500 rubles. “Thank you very much” differs from the default level in that 0.5% cashback is credited to the account for all purchases;

- "Thank you very much" level. To the conditions of the previous level, a requirement is added to pay for something through Sberbank Online or mobile banking - this could be housing and communal services, mobile communications, fines, online purchases, etc. At this level, you can connect to one free and one paid category, where increased cashback is available;

- “More than thanks” level. Spending on cards is more than 85%, monthly non-cash expenses from 5,000 rubles, paying for something in a mobile bank or Sberbank Online, as well as opening or replenishing a deposit for any amount (even a savings account will do). Here, it finally becomes possible to exchange bonuses into money. In addition, you can connect two free and two paid categories with increased returns.

The above conditions must be met every month during the billing period (season), otherwise the automatic “Thank you” status will be assigned.

Summary

Yes, the exchange became possible after the bank’s management carried out a radical reassessment of the cashback service. But the rate set is not the most pleasant: for each point the client will receive 50 kopecks, i.e. Exactly half of the nominal value of the bonuses will be lost. Moreover, you can only get the conversion option at the “More Than Thank You” level, and for this you will have to fulfill four conditions: keep cash withdrawals in relation to non-cash expenses at a level of 15% or lower; pay something monthly via mobile or online banking; spend at least 5,000 monthly with a card; replenish or open a deposit.

More about categories

So, according to the new rules, each participant in the bonus promotion is assigned a certain client status. There are four of them in total:

- Thank you;

- Thank you very much;

- Thanks a lot;

- More than thanks.

By default, each new client, as well as everyone who participated in the program at the time the rules were changed, is assigned the “Thank you very much” status. To change the level to a higher one, you must complete certain tasks from the bank every month. If the client fails to complete the required tasks, his status will be automatically demoted and the privileges received will be revoked.

Important! To maintain the achieved level, it is necessary to complete the proposed tasks monthly for 3 months