Not everyone knows that it is possible to cash out rubles stored on a Megafon SIM card. I will share available methods on how to withdraw money from Megafon from your phone account.

- 2 ways to withdraw without commission

- Via Megafon plastic card

- Transfer to PVN to receive cash

- Service Megafon.Money

- On the card - commission 7.35% and another 95 rubles.

- To a bank account - commission 8% and 40 rubles.

- Virtual card

- Payment systems

- Electronic wallets

Withdrawal without commission

There are two options, using which you can withdraw money from your phone, or rather the SIM card balance, without spending on commissions. Both methods are feasible only at the Megafon sales office.

- After writing an application, indicating the required amount, in the company’s service center, the money will be returned to the owner within a period of 3 to 10 days.

- A radical way is to block Megafon’s SIM card forever and cancel the contract with the company. Soon after this, they will provide the funds on the phone to the owner.

The funds are transferred to the client's bank account. Therefore, when making an application, you should accurately indicate your bank details.

Details can be easily found at the bank where the account is opened. You can find out by phone, also on the bank’s website in LC, and the easiest way is to find this information in the document issued upon receipt of the card or when opening a bank account.

Of course, these methods require free time. And not everyone is ready to terminate the contract. Therefore, there are still options.

How to cash out without commission?

To do this, you need to come to the operator’s service center and cancel the contract or fill out a return application (discussed above).

Funds are sent only by transfer to a bank account or payment card. The duration of the operation is 3 – 10 days. In the application, indicate the bank details that are recommended to be looked for in the card issuance agreement. Information about them can be found out by calling a financial institution.

When you find funds in your phone account that you want to cash out, choose an acceptable method for yourself and start acting.

The following table shows all available ways to withdraw money from a mobile phone:

| Methods | |||

| Transfer to a plastic card | Cashing at money transfer offices | Direct payment for goods and services | Transfer without commission |

| SMS to number 8900 | SMS to number 3116 | Virtual card | Return Application |

| Megafon website | |||

| Mobile operator's online transfer portal | Personal Area | Termination of an agreement | |

| Electronic wallets | |||

By transfer to the PVN

You should start from the page https://moneу.megafon.ru/pау-cash-point/pау-unistream.

After going to this page, you should enter the following data:

- transfer amount;

- information about the recipient: his last name, first name and patronymic;

- and details about the sender: full name, phone number, personal information from the passport and address.

Next, you should choose a bank to receive this money. You will need to confirm your actions with the code from the incoming message and receive an SMS with details about the transfer number, bank address and time of issue. We must remember that without a passport you will not be able to get anything.

Withdrawing money through third-party services

Let's take for example one of the most popular services - withdrawing funds from a mobile account to Kiwi Wallet. Go to the website or e-wallet application and select “Finish”, and from the proposed list of sources, select “Mobile phone account”. This commission will range from 0 to 9.9%, which is quite disadvantageous for users in some cases. This is due to the fact that in addition to the system commission, users must pay separately for withdrawals from the same Kiwi through a bank or terminal.

Before experimenting with this method of withdrawing personal funds, it is recommended to visit the official Qiwi website and familiarize yourself in detail with the terms of the service, as well as the commission percentage system.

How to transfer money from a smartphone to a bank card

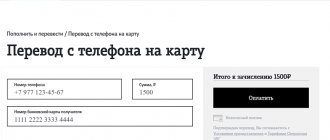

After going to the Megafon.Money service page you need to:

- Right-click on the “From phone to bank card” window.

- Click “On site”.

- Next, you should carefully fill out the required items. In the “Sender Details” column, correctly indicate the telephone number from the account from which the transfer will be made.

- Activate the "Translate" button.

- This will be followed by an automatic transition to a page where all the information regarding the transaction being performed will be displayed: you can once again verify the amount of the transferred amount and commission payments. The procedure will be completed after clicking on “Transfer”.

- Almost immediately after the “Data Processing” message appears, you will receive an SMS with a verification code.

- The user agrees by confirming the code.

A very important point: if the device is set to prohibit receiving messages from content short numbers, such operations will not be possible. Without SMS and without a confirmation code, the transfer procedure will not start.

Here are some other conditions when carrying out such an operation. Money can take as long as 5 days to reach the recipient. Transfers can be made starting from 50 rubles, no less.

If you make a transfer of less than 5,000 rubles, you must be prepared to part with a commission fee - 7.35% and another 95 rubles.

More than 5,000 rubles are withdrawn, and the commission will correspond to 7.35% and 295 rubles. This means that it is not difficult to calculate, if you transfer, for example, 100 rubles, 202.35 rubles will leave your account. When withdrawing 2,500 rubles, you will have to fork out another commission of 331.25 rubles.

I note that there is a more profitable plan of action - to send funds to a bank account. A slightly more favorable commission is 8% and 40 rubles, whatever the size of the withdrawn amount.

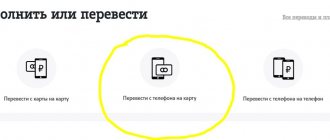

Withdrawal of money through the site

You can donate your funds not only through the SMS service, but also through the website of the Megafon money service. First, you need to log in to it. All you have to do is enter your mobile number in the provided field and you will receive an SMS with an OTP. You log in and gain access to the portal functionality. In general, the system is similar to the Personal Account familiar to many. To send money, you need to enter basic information including the amount, card number and expiration date. Then click “Transfer Funds” and wait for the notification. The duration is similar to the previous method - from several minutes to 5 days.

If you still plan to use this service in the future, you can create some templates to make the process easier. This saves you time when entering data. You can also view your payment history here.

Let's take a look at how the fees for this service are charged. When sending money from 50 to 4999 rubles, the commission will be 7.35% + 95 rubles. When sending money from 5 to 15 thousand rubles, the commission will be 7.35% + 259 rubles.

Please note that some banks do not always support this or that transfer option. If you are denied, the transfer will take a little longer to complete. Let's take a closer look at this method.

Withdraw to bank account

Again, on the website money.megafon.ru you can withdraw money by clicking on the inscription “Other money transfers”.

Next, here's what to do.

Click on “To bank account” and the next page will open with special fields that cannot be left blank.

You should fill out all the lines with great care, entering all the numbers from the bank details without errors: account number, etc.

- Then activate the green button at the bottom, which is responsible for the final stage.

- All that remains is to send the verification code from the incoming message to complete the operation.

The money can take up to five days, but it is possible that it will show up in the “place” after just a few minutes.

Commission fee and tariffs

Cash withdrawal without commission is not possible. The money either remains on the balance, or the user will pay the operator’s fee. That's what the system is designed for.

Important! The only way to get the full amount without losses is to terminate the agreement with Megafon by visiting the office.

Commission fee from the mobile provider:

- when transferring amounts up to 5,000 – 7.35% plus 95 rubles;

- over 5,000 – 7.35% plus 295 rubles.

These tariffs can be viewed on the Megafon website. Sometimes they may change, so it is better to check the information periodically.

Russian Post charges between three and five percent.

In addition, a small value is added - this needs to be clarified on site.

A tricky way - a virtual plastic card from Megafon

Thanks to this card, the company’s client has the opportunity to pay online with money that is on the phone.

To receive such a card, you will need to enter the USSD request *455*1# from your smartphone keyboard. Despite the fact that such a card will not have plastic that can be touched, it will have the same details as a standard plastic card.

These details will be sent in a message. Then, having everything you need, you can use it to pay; moreover, you can pay for most services, including utility bills and withdraw cash.

Financial wallet Visa QIWI Wallet

You can use the system’s functionality both directly on the qiwi.com website and through the mobile application, which exists for the iOS and Android mobile platforms.

The phone number is your login to the Visa QIWI Wallet. When logging in with a MegaFon number, the subscriber has access to a number of options that other users do not have. For example, the “payment” balance (money available for use in mobile commerce) is displayed right on the main page of the website and mobile application.

The “My MegaFon” section appears in the Visa QIWI Wallet Personal Account, where the client can:

- See your phone balance – both general and “payment” (with an explanation of how they differ);

- Add other numbers (for example, numbers of loved ones or your devices) and view their balance here;

- See the reward (cashback) accrued to the client for various transactions performed.

Cost of transactions in the wallet:

| Commission amount | To your QIWI | To your MegaFon | To someone else's QIWI | To someone else's MegaFon |

| From QIWI account | – | 0% | 0% | 0% |

| From MegaFon account | 8,50% | – | 8,50% | 7,91% |

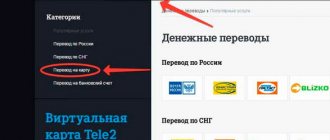

Through payment systems

You can use the services of incredibly popular payment systems UNISTREAM, Zolotaya Korona, Blizko, CONTACT, Russian Post if you go to https://money.megafon.ru/.

The next steps will be:

- You need to get to the appropriate section.

- Activate the required service system.

- A page will appear to fill out the form.

Carefully enter all the data in the required lines and click on “Transfer”, immediately after that confirm your actions with the verification code from the SMS. And that’s it – the amount transferred from the phone will wait for the recipient at any office of the selected system.

SMS for withdrawal

You need to write an SMS and send it to 8900. For example:

"Card 0000000000000000 1111." Where the zeros after “Card” indicate the individual number of the card awaiting replenishment, and the numbers “1111” indicate the amount of the transfer, rounded up.

We withdraw money from MegaFon using transfers

If you do not want to deal with bank accounts and cards, use the transfer of funds to the UNISTREAM, Contact, Leader, Anelik and BLIZKO money transfer systems. Fund distribution points are located throughout the country, in almost all localities. In addition, using the UNISTREAM and Leader systems, you can send money even to the CIS countries . You can also withdraw funds from your phone to post offices of the Russian Post. In order to withdraw funds from your MegaFon account to one of the above systems, you must fill out the appropriate form on the operator’s payment portal. Depending on the selected money transfer system, the recipient’s details, passport details, as well as the addresses of the selected delivery points are indicated here.

The terms for crediting money, depending on the chosen money transfer system, range from several minutes to seven days (typical for slow Russian Post).

Rate this article

Through electronic wallets

Top up your e-wallet with one of these systems: Yandex. Money, Qiwi or WebMoney from the balance of a mobile device is an excellent transfer option, after which you can easily withdraw money. Here's what to do:

- Login to the system website.

- Log in to your account.

- Click on “Top up”.

- Go to "Online".

- Select "Megaphone".

- Activate the “Pay” button and confirm the code from the incoming message.

A commission of 8.5% of the transfer amount will be charged.

Withdrawing money at Megafon office

To receive all funds from your SIM card balance, you need to come to the operator’s salon. A statement is written stating that the subscriber no longer needs the company’s services and is terminating the contract. Be sure to take your passport with you, otherwise the document will not be accepted.

It is worth getting your card details in advance from the bank where it was issued. The entire amount from the account will be transferred to it. Cash will not be issued. The refund process is not fast, but there is one plus - they will be refunded in full, without deducting a commission.

Online transfers Mastercard MoneySend

This is a service designed for any transfers between MasterCard cards.

As in the previous case, you will need an issued Megafon bank card - plastic or “virtual card”, since they belong to this payment system.

If the recipient's card is Mastercard (including Maestro), then the transfer can be made through the form on the official Mastercard website.

You must enter the full details of your card, including number, expiration date and CVC2 code, as well as the recipient's card number. The Megafon virtual card, like the plastic one, has all the standard details - you can find them in your Megafon Bank personal account.

The commission when transferring money from a Megafon card via Mastercard MoneySend will be 1.99%, but not less than 25 rubles. In this case, the minimum transfer amount is 100 rubles. The maximum is limited by Megafon Bank - 15,000 rubles per operation and no more than 40,000 rubles per day.

The service page may indicate that the commission is 0% (during promotions) or 1%. You should not pay attention to this: the commission in any case will be 1.99% in accordance with the terms of Megafon Bank.

There is a peculiarity: money transfers to some banks may not be available due to sanctions. However, payments to the largest Russian banks (Sberbank, VTB, Gazprombank, Alfa-Bank, etc.) go through without problems.

Mastercard has responsive support; any problems with cash transactions can be resolved through feedback from employees.