Depositing funds to a card via MTS Internet Banking

You can top up your card balance through online banking using a special service. The client needs to enter all the data of two banking products and confirm the transfer with an SMS code. You can deposit no more than 150,000 rubles. Depositing funds without commission is possible only through intrabank transfers. In all other cases, the commission will be 1% (minimum 49 rubles).

You can also make a transfer through online banking - you need to go to your personal account and select the appropriate item in the “Payments and transfers” column. Then enter the details of the recipient of the money and confirm the transfer with an SMS code.

- You can transfer a maximum of 500 thousand rubles to an MTS client card. in a day.

- To a client of MTS Bank from a card of another issuer - no more than 15 thousand rubles. for the operation.

In both cases, there is no commission and funds are credited immediately.

Depositing through ATMs and terminals

To put money on an MTS Bank card, you need to find the nearest terminal in your city, insert the plastic card, enter the PIN code and go to the “Top up card” section. Place all banknotes (no more than 40 pieces) into the receiver and confirm their enrollment. You can top up your MTS Money credit card in the same way.

Restrictions:

- Crediting to the card – no more than 600 thousand rubles. for one transaction.

- Account replenishment – no more than 15 thousand rubles. for the operation.

No commission for deposits is charged only when depositing funds through MTS Bank terminals; in all other cases, the plastic holder will need to pay to replenish his balance.

Limits and commission

Like any other system, MTS has its own limitations and fees for services provided:

- The minimum transfer size is 50 rubles.

- Maximum per day – 15 thousand rubles.

- Maximum per month – 40 thousand rubles.

- There cannot be less than 10 rubles left on the account.

- The account must have an amount sufficient for the transfer + commission + balance of 10 rubles.

- The commission for transferring funds is 4.3%, but cannot be less than 60 rubles. Thus, it is more profitable to send a large amount once than to send small payments several times.

Example: you need to transfer 5,000 rubles to the card. The account must have the amount of 5000+4.3% (215 rubles)+10 rubles=5225 rubles, otherwise the payment will not go through. The client will be able to make such transfers up to 3 times a day until the amount of 15 thousand is exhausted. The next day you can repeat the procedure and do this until the maximum monthly limit of 40 is reached.

Transfer from a card of another bank

You can transfer money to an MTS Bank card from any other plastic card using Internet banking or a mobile application. To do this, you need to log in to the system, go to the “Transfers and Payments” section and click on “To another bank”. After entering the recipient's details, indicate the amount to be written off. To make a transfer from a card, you will need to confirm the transaction via SMS.

Funds will arrive in 1-5 days. The commission is determined by the sender's bank, most often it does not exceed 2%.

other methods

An alternative transfer option, if for some reason more standard methods are not suitable or do not work: withdraw the money first in cash or to an electronic wallet, and then put it on the card. In the first case, you can use the money transfer services Unistream, CONTACT, Blizko or Russian Post. All of them are located in the same “Money transfer” menu, where the “Transfers to card” section is located, but in the “Cash transfer” item.

Having chosen the appropriate system, the client must create a transfer for himself (or any other person), receive it and put it on the card of the desired bank in the way that this financial institution offers.

The second option is also possible through the MTS website. In the “Electronic money” section you need to find a suitable wallet (if it doesn’t exist yet, you will first need to create it). All that remains is to withdraw the money to your wallet and from there transfer it to the card of the desired bank.

Using an electronic payment system

You can deposit funds into your account through the “Golden Crown” system; for this you will need card or account details, as well as a passport. The translation is prepared by the employees of the MTS store. No commission is charged.

You can transfer funds to your card through an MTS e-wallet using a special service. The translation is free of charge.

Transfer from wallet to bank account You can also top up your balance through the Yandex. Money”, the commission will be 3% of the amount plus 15 rubles. The payment will arrive in your account within a week.

Popular methods and instructions for them

There are several current ways to top up your MTS wallet.

Important! The most convenient and profitable way to replenish a credit card is to replenish it in the bank’s own stores or service offices, since the organization is not only a mobile communications provider, but also a credit institution, which makes it possible to receive a replenishment service in its branches without commissions and instantly.

To use this option you should:

- go to an office or store;

- hand over the plastic card and passport to the cashier;

- then transfer the required amount.

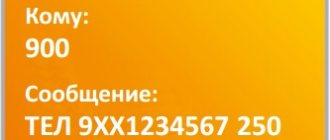

Top up your card from your phone

MTS Bank also offers MTS. To do this, just fill out all the points in a special form on the mobile operator’s website.

Form for transferring from a phone account to a card. The commission is 1.9%, minimum 10 rubles (for registered users).

Time of funds crediting

The term for crediting funds depends on the selected replenishment method, the maximum is up to 5 working days.

| Deposit method | Arrival time |

| ATM, online bank, branch, mobile phone store | Instantly |

| Sberbank | Up to 5 working days |

| EC "MTS-Money" | During the day |

| System "Golden Crown" | Up to 3 working days |

| "Post office" | Next business day |

| "Eldorado", "M. Video" | Up to 3 working days |

| Shoe store "Kari" | Up to 3 working days |

| Western Union | Next business day |

| Communication salon "Megafon", "Beeline" | 1-3 working days |

| Eleksnet, QIWI, WebMoney, Yandex. Money" | Instantly |

General information about card replenishment

There are several types of products from MTS Bank, and when choosing them, the client can focus on his capabilities and needs, here he can take into account the permissible threshold for depositing funds, the grace period, the validity period of the product and the limit. At the same time, the institution provides the client with the opportunity to use various and convenient options for returning funds. These include stores created by the organization, ATMs and self-service terminals, for example, Excelent, through mobile applications or bank offices.

In this case, it is possible to top up the MTS Money card without a commission or with a commission fee, it all depends on the prevailing circumstances and the location of the nearest devices so that accounts can be topped up. The client is free to choose the options provided, taking into account the circumstances prevailing on the day of entry.

Advantages of MTS Money cards

The main advantages of bank cards from MTS Bank:

- You can receive up to 5% cashback for every purchase.

- Up to 6% per annum is charged on the card balance.

- Privilege card holders can access business lounges and receive travel insurance.

- Credit cards have a favorable grace period of 111 days, free servicing and a good credit limit.

- You can replenish and withdraw funds from your card free of charge through the cash register and terminals.

Nuances you should know

If the owner of a bank card withdraws money from a financial institution that is not a partner, the commission can reach 3.9%. At the same time, for each withdrawal made you will need to pay an additional 350-450 rubles. In addition, it is recommended to pay attention to the following aspects:

- For owners of smartphones and tablets, you can install the MTS Money application. With its help, you can view information about financial institutions that provide the opportunity to either withdraw money from the card completely free of charge, or where you can do it much more profitably.

- In the absence of banking products “MTS Money” or “MTS Deposit”, even the bank itself provides for its clients to withdraw funds from credit cards with a commission of 3.99%, and for each transaction you will need to pay 399 rubles for its implementation.

If there is no “MTS Money” or “MTS Deposit”, you will have to pay for withdrawing funds from credit cards with a commission of 3.99%.

You can call the hotline number – 8 800-250-05-20 and clarify information about the location of MTS Bank’s partner banks.

How to pay a loan at MTS Bank through Sberbank-Online

Payment for an MTS Bank loan through Sberbank Online must be made 3-5 days before the payment is written off to avoid delays.

Algorithm of actions:

▪ Go to the bank’s official website in the “Online Banking” section.

Sberbank home page

▪ Authenticate by entering your username and password in the appropriate field. 3. Confirm login with SMS password.

▪ Go to the “Transfers and Payments” section. 5. Click on “Loan repayment from other banks”.

Section “Repaying a loan from another bank”

▪ Enter “MTS Bank” in the search.

Choosing an organization to pay the loan

▪ Select the appropriate lender from the list that appears. 8. Select the debit account, indicate the card/account number and the recipient's full name.

Filling out the loan repayment form

▪ Specify the amount and confirm the transaction by entering the sent code.

Before you pay for a loan with a Sberbank bank card via the Internet, you need to decide which details to use. Funds are transferred not to the credit account, but to the bank card to which it is linked. Once the money is credited, it can be transferred to repay the loan.

You can also pay off a loan at MTS Bank through Sberbank-Online using autopayment, connecting it in a similar way. If you liked the video, share it with your friends:

Paying off debt through a mobile application

Active users of the mobile application can repay the loan using their phone:

- You need to log into the application.

- Go to the “Transfers and Payments” section.

- Enter “MTS Bank” into the search.

- Click on the appropriate banking organization.

- From the pop-up list, select the debit account, card number and full name of the recipient of the funds.

- Enter the amount and confirm the transaction.

Replenishment via the official website

The easiest way to top up your MTS account with a bank card is to use the mobile website of the mobile operator. To do this you need to do the following:

- Go to the website oplata.mts.ru and select “Payment from a bank card”.

- You will be redirected to a special page where you can enter your bank card details. Enter the card number, enter the amount with which you want to top up your account, be sure to indicate other plastic details and the phone number you want to top up. Also enter your email address, receipts will be sent there.

- If you want, you can check the box below, after which your card number will be saved and can be used by you for similar operations in the future.

- Next, you click on the “Pay” button - and you are redirected to a third-party service, where you enter the data specified there and confirm the payment. After this, all you have to do is wait until the money is transferred to your account.

Please note that if you top up your account with a certain amount, you can receive a special discount code. Details of the promotion will be indicated next to the amount entry field.

Alternative ways to repay a loan at MTS Bank

A complete list of methods for making loan payments can be found on the bank’s official website.

The most common options for replenishing your balance:

| Replenishment options | Commission | Enrollment period |

| ATM, online bank, branch, mobile phone store | 0 rub. | Instantly |

| Electronic wallet "MTS-Money" | 2.5%, not less than 30 rubles. | During the day |

| System "Golden Crown" | 1%, not less than 50 rub. | Up to 3 working days |

| "Post office" | 1.9%, not less than 50 rub. | Next business day |

| "Eldorado", "M. Video" | 1%, not less than 50 rub. | Up to 3 working days |

| Shoe store "Kari" | 1%, not less than 30 rub. | Up to 3 working days |

| Western Union | 3%, not less than 100 rub. | Next business day |

| Communication shops "Megafon", "Beeline" | 1%, not less than 50 rub. | 1-3 working days |

| Eleksnet, QIWI, WebMoney, Yandex. Money" | 1%, not less than 50 rub. | Instantly |

Like others

Competition between mobile operators is great. Everyone tries to create an offer that is attractive to customers and profitable for the companies themselves. In the market of digital products, MTS took eighth position among such giants as Sberbank, Post Bank, Megafon, Yandex, etc.

Competitors' offers look tempting in comparison with MTS.

For operators such as Tele2 and Beeline, the mobile phone balance is equal to the card balance. The issue is made instantly, without any fees.

Advantages of Megafon:

- offers a number of tariff plans with free services;

- cashback 10% on purchases, with partners up to 20%;

- services for informing and notifying clients are free;

- money transfers throughout the country without commissions;

- reliable protection against accidental subscriptions;

- free balance replenishment.