More and more users are choosing Qiwi for its versatility and the absence of commissions for most transactions. Qiwi allows you to make payments and money transfers, pay fines, repay loans, shop online and much more. In addition, the service combines electronic and cash payments. The main advantage is that you are not tied to a specific bank.

You can top up your balance using a card from any bank or payment terminals. The transfer is possible without cash, and the user does not even need to leave home. For example, to transfer funds you can use money on your mobile number.

The service is available to subscribers of almost all operators. The differences are in the available withdrawal methods and costs

One way to transfer money

Considering how to transfer money from a phone to a Qiwi wallet, first of all, let’s analyze a universal method that is relevant for all mobile operators. The fact is that each cellular company has its own principles of operation, its own tools for communicating money with electronic systems. Qiwi itself offers a single method.

The operation is carried out on the system website from an account already registered there. In fact, it turns out that in this way it is only possible to top up your wallet. For someone else, you need to choose other methods.

Features of the operation:

- Money from your phone to Qiwi is received online, that is, instantly.

- You can only top up your wallet.

- A high commission is charged. On average, this is 8-10% of the amount, depending on the operator servicing the SIM card, each with its own tariff.

- You can only use the mobile phone that is linked to the system. It is impossible to choose someone else’s or even just your own for replenishment.

Such conditions are largely related to security measures. If topping up was possible from any phone, it would give rise to a wave of fraud. For example, if your mobile phone falls into the wrong hands, a person can take advantage of this and withdraw money to his Qiwi wallet. To avoid such situations, transfer is only possible from the system’s “native” phone number.

How to pay for Qiwi wallet through Sberbank online

How to top up your Qiwi wallet through Sberbank Online? You can carry out a transaction using the website qiwi.com. First, you should go through a simple registration process to create a personal account, and then log in to the system. Next, verify your plastic card. This is necessary for the system to work smoothly, otherwise more actions will need to be taken.

Go to the menu in the appropriate “Top up” section, select the “Bank card” option and fill in the following details:

- Owner's full name.

- Number and CVC2

- Validity periods.

Be sure to double-check the information entered. Otherwise the transaction will not be completed

Please note that the transaction is carried out securely. That is, a money transfer can only be made if a unique verification code is entered, which is sent to the user’s phone number specified during registration

In this case, limits are set: for 1 day - no more than 15 thousand rubles, per month - up to 50 thousand rubles.

Step-by-step process for transferring from mobile to Qiwi

If you already have an account in the electronic system, log into it. Without login, the operation cannot be performed. If you have not registered before, just go through this procedure, it takes no more than a couple of minutes. The wallet number is assigned to the phone number specified by the client.

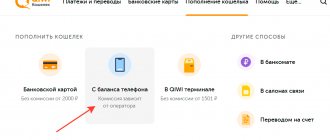

How to transfer money from a mobile phone to a Qiwi wallet:

- Go to the “Wallet Replenishment” tab.

- Select the option “From mobile balance”.

- The number will already be entered into the system; you just need to indicate the amount.

- A message arrives on your phone, to which you need to respond with any symbol - this confirms the operation. No money is taken for this SMS.

- Money is immediately sent from the phone to Qiwi

The total amount including commission cannot exceed 15,000 rubles.

Step-by-step instruction

The operator's subscribers should acquire a debit card. This will allow you to better save your own money and receive considerable bonuses and discounts. You should bind the plastic directly on the site:

- access to the page occurs after specifying the phone number and password;

- Click on the right side to register the card;

- select a financial institution from the list;

- enter card details;

- in the future, use the replenishment section;

- there is a transition to the bank cards item;

- fill out the form that opens, taking into account the commission;

- the sent secret password is overwritten.

Transferring money from plastic to the phone balance of an operator that is part of the partner network will allow you to use online mode. The algorithm will lead to:

- authorization on the Qiwi website;

- go to the wallet replenishment section and the operator’s balance item;

- opening the name of the operator and transferring between accounts;

- indicating the amount and password sent to the smartphone.

Similar actions take place after installing the mobile application. You can use the terminal and avoid commission.

Transaction fee

Direct transfer from phone to Qiwi is always paid and always expensive. Qiwi immediately indicates that the commission amount will be within the range of 7.5-12%, depending on the operator. The fact is that such conditions are dictated by the cellular companies themselves: they are against withdrawing money from the system, which is why they set their own high commissions.

The size of the commission changes regularly, it is better to look at it during the transaction. The system will immediately indicate both the size of the fee and the total amount of the transaction. At the time of preparation of the material, the following tariffs apply:

- MTS. Transfers from a mobile phone to Qiwi will incur a fee of 11%;

- Tele 2. Charges 9.9%;

- Megafon - 8.5%. This is the cheapest option;

- Beeline - 8.98%.

That is, for a payment of 500 rubles, the client will be charged an average of 50 rubles in excess of this amount. If you pay 1000, then it’s already 100 rubles. Therefore, it is logical that many want to find a cheaper option, and it exists.

Top up in the VISA Qiwi Wallet application

The program for smartphones allows you to quickly and conveniently deposit money into your wallet and perform expense transactions.

The “Top up” application menu shows possible options for transferring finances to the wallet account:

- Using a bank card.

- From the balance of the phone to which the Qiwi wallet is registered.

- Cash through terminals, the program will show a map with the nearest devices and communication shops where you can deposit cash into your electronic wallet.

- Through Internet banking.

Online, from the Qiwi-Wallet application, you can top up your account from your phone balance or through a bank card.

When transferring from a phone, these numbers are already entered into the program; they cannot be changed. You need to dial the amount and confirm the operation with the code from SMS. The transfer amount is subject to restrictions established by cellular companies.

To top up from a card, you will need to provide all the plastic details, including the CVV code, and confirm the operation.

Cheaper translation method

You can transfer money from your mobile phone to a Qiwi wallet using a cheaper method if you use a bank card. This can be either your means of payment or another person’s card. In short, it goes like this:

- First, the client tops up his bank card from his mobile phone. This service is offered by all major cellular operators in Russia; it can be performed through their websites or personal accounts of subscribers.

- The second stage is replenishment of the Qiwi wallet from this card via Internet banking or even easier - on the website of the electronic system.

Credits to both the card and electronic account are carried out instantly.

The commission is mainly formed by the tariffs of the mobile operator: each of them sets its own fee for transferring from phone to card. Qiwi itself does not charge a fee for this operation if the payment exceeds 2,000 rubles. If less, there is a commission, but it is only 1% of the amount.

As a result, it turns out that for transactions worth approximately 1000 rubles or more, it is more profitable to use the second method and use a bank card. But in any case, everything depends on the exact tariffs of the operator.

Restrictions on transferring funds

Cellular operators limit the number of transactions and transfer amounts for the Qiwi wallet. Megafon sets a limit of 3 thousand rubles. and commission. Other operators vary - from 5 to 15. Beeline additionally charges 10 rubles, MTS and Tele2 - 4.6. Weekly and monthly limits apply. If the limit is exceeded, a message is sent asking you to make an official payment.

The minimum transfer amount is 1 rub.

How to deposit money on Qiwi from a Tele2 phone

Let's consider the terms of transfers for each operator separately, since they all establish their own operating schemes. You can withdraw from your Tele2 account to Qiwi either on the electronic operator’s website, or by first transferring to a card. In the second case, the commission for the operation is charged according to the following tariffs:

Top up your Qiwi wallet without commission

You can top up your Qiwi wallet without commission using the online bank of credit institutions that have partnership agreements with Qiwi. The banks through which the transaction takes place also do not charge additional fees. Ultimately, as much money will be credited to the e-wallet as was debited from the bank account. This is the best option for replenishing a Qiwi wallet, which does not have any restrictions or additional costs.

When transferring money through banking applications, there are no restrictions on the amount of replenishment.

Depositing money via bank transfer is not subject to additional fees from Qiwi. The sender will have to pay an additional fee to the bank where the transfer was made. The amount of bank remuneration ranges from 1 to 3% of the amount.

When applying for a microloan, the Qiwi payment system does not take money for the transfer; the user will have to pay interest for using the funds of the microfinance organization. The average fee is 1 – 2% per day of the loan amount.

When transferring money from a bank card through your Qiwi personal account, you can top up your account with an amount of 2,000 rubles or more without commission. When transferring a smaller amount, the company withdraws its reward in the amount of 1%.

You can deposit funds in cash to your Qiwi account without commission at the Contact, Leader, Anelik transfer acceptance points, if the transactions were carried out in Russia. When sending money from CIS countries, the payment will be paid.

You can send funds to Qiwi for free through Svyaznoy and Euroset stores; there will be no commission, regardless of the transfer amount.

In terminals, no commission is charged for depositing money if the deposit amount is more than 501 rubles.

Transfers from one Qiwi wallet to another are not subject to commission, regardless of the transaction amount.

If we are talking about the operator Megafon

If you use the services of this operator, then you can transfer money from your phone to Qiwi using three methods. In addition to the classic direct and using a card, you can use the capabilities of Megafon Bank.

Megafon offers its subscribers the issuance of instant virtual cards. They are created in the client’s personal account, in a special mobile application or directly on the Megafon Bank website. And the card account is the phone account, which you can use.

That is, you create a virtual card and immediately receive its details (the plastic itself does not exist). Next, go to the Qiwi website and perform a standard replenishment of your wallet from the card. As a result, if the transaction amount is over 2000, there will be no commission at all. And if less than 2000, then only 1%.

Megafon virtual debit card

| Cost from | 49Р |

| Cashback | Up to 20% |

| % on balance | To 10% |

| Withdrawal without % | From 0 rub. |

| Overdraft | No |

| Delivery | No |

Topping up your QIWI wallet

This method of depositing money on QIWI from a phone is no more complicated than the previous one. To begin, as in the previous case, go to your personal account

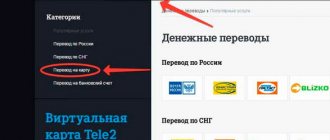

Now pay attention to the toolbar, which is located below the search bar. In it you will find several points:

- Pay.

- Translate.

- Fill up a purse.

- Bank cards.

- Withdraw.

Select the third item “Top up…”. Several categories will open below:

- Cash – via ATM.

- Bank cards.

- Online.

- Translations.

From them you need to select “Online”. Below you will see a whole list of ways by which you can transfer funds to QIWI via the Internet. Select your mobile operator from the list.

That's it, after that we get to the translations page. The first (left) column indicates the account from which funds will be debited. The second (right) column indicates the account to which the money will be credited. Enter the amount and click “Pay”.

For MTS clients

Most recently, MTS allowed transfers to Qiwi wallets from the MTS Money application and through the client’s personal account. Now transfers specifically to this electronic system are not available. At the same time, they can be done using the same Yandex wallet without any problems.

Perhaps the situation will change soon, but now you can top up your wallet from an MTS mobile phone only using standard methods directly on the Qiwi website or through a transfer to a card. In the latter case, the commission will be 1.9%, but the minimum is 10 rubles.

Qiwi replenishment methods

To carry out transactions and make bank payments, you need to create and top up an “electronic wallet”. This is done in two ways - in cash or by transfer from accounts.

You can transfer money to your wallet through:

- Qiwi terminals. The minimum replenishment amount is 501 rubles. (0%).

- Banks, ATM network. Transfers are made without commission when the amount exceeds 2 thousand rubles. If the transaction is smaller, the financial institution charges 1%.

- Cellular communication stores (Euroset, MTS, Svyaznoy - 0%).

For Beeline subscribers

Here you can transfer money from your mobile to your Qiwi wallet using four methods:

- through the Qiwi system with a commission of 8.95% of the amount;

- directly from a mobile phone from your personal account or directly from the Beeline operator website. A one-time payment can be in the range of 10-5000 rubles. The commission will be 8.95% plus another 10 rubles on top;

- via SMS. qiwi 9065555555 500 to number 7878 . This is the wallet number and the transaction amount separated by a space. Fee - 8.95% plus 10 rubles;

- through cards. That is, first make a transfer from your phone to the card, then from it to your wallet. But in this case, Beeline’s commission will be large compared to other operators - 10% of the amount, minimum 60 rubles.

We have considered all the options of the main Russian mobile operators. Learn how to withdraw money from your phone to a Qiwi wallet, compare fees and choose the most profitable option. Operations of this type are always carried out instantly around the clock.

Is it possible to top up a Qiwi wallet from the Motive phone balance?

Qiwi offers a fairly simple registration procedure. The numbering of a personal smartphone will become the account of an anonymous user. Elementary loan repayment in the terminal immediately allows you to get a wallet and make a transfer to your credit card account.

You can immediately go to the website and find your personal account along with the necessary accounts in rubles and foreign currency. Owners of plastic cards tend to bind them to their wallets in order to facilitate transfers in two directions.

Allowed to use mobile device balance. The phone must be linked to the wallet, and this makes the task easier. However, there is a small important nuance.

The system expands the partner network, but does not work with all telecom operators, especially those located in the regions. The list is not so long, it includes Megafon and MTS, Beeline and Yota, Tele2 and the recently joined Matrix.

The difficulties that arise will not prevent you from transferring money from Motive. All you need to do is transfer funds from your phone balance to your card account. Another method will allow you to resort to the services of the Payeet payment service, which provides benefits to Motiv subscribers.

A certain algorithm is followed when replenishing the balance of a smartphone linked to a wallet. It is possible to withdraw money from Motive, not forgetting about limits and commissions.

Questions and answers

Why can't I top up my Qiwi wallet from my mobile phone?

Most likely it's a matter of balance. If it is in the negative, the operation cannot be performed. Also, operators do not allow transfers to customers who are not identified or are currently using the promised payment.

How to top up Qiwi from MTS Ukraine?

On the Qiwi system website you can top up your e-wallet from an MTS phone registered in Ukraine. Since Qiwi does not work with hryvnias, the transaction will be carried out in dollars at the current conversion rate.

Is it possible to top up Qiwi from a phone in Ukraine?

It depends on your operator. If he allows such operations, there will be no problems. Try starting a top-up operation on the Qiwi website. If possible, the system will allow the transaction to proceed.

How to top up Qiwi from another phone number?

On the system website, you can top up your wallet only from the phone linked to your account. If the speech is on another phone, then use the tools of the mobile operator. If it allows, make a direct transfer to your Qiwi wallet through your personal account. When this is not possible, first transfer money from your phone to any card, then top up Qiwi from it.

Is it possible to transfer money from a mobile phone to a Qiwi wallet through a promised payment?

Many operators allow their subscribers to borrow a little to stay connected. This is the promised payment. But if you want to withdraw this borrowed amount to an electronic wallet, you will not succeed. Such an operation is prohibited.

Information sources:

- MTS website.

- Beeline website.

- Tele2 website.

- Megafon website.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What to do if problems arise?

Users who try to transfer money to Qiwi from their phone encounter the following problems:

- The payment does not go through, and the system message displays an error. To correct the situation, refresh the page and re-enter the details . We reduce the payment amount. If this does not help, we try to carry out the transaction after some time.

- The money was withdrawn from the account, but did not arrive in the wallet. First you need to check the payment status. If we complete it successfully, we contact support. Sometimes transferring funds can take 5 – 7 days.

REFERENCE

You must send a screenshot of the receipt or payment report to the technical support service.

The service of transferring funds from a mobile account to an electronic wallet can only be used by residents of the Russian Federation. That is, the SIM card must be exclusively from one of the Russian operators cooperating with the payment service.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya