Bank card holders are often faced with the need to check the status of their account, the amount of loans and accrued interest. There are 5 ways to check the balance of an MTS Bank card.

Options for checking card balance for MTS Bank clients:

- Through Internet banking.

- Via SMS notification.

- Contact the customer service center.

- Using mobile banking.

- At an MTS Bank ATM.

Ways to find out the status of debt on an MTS Bank loan

Loan debt at MTS Bank can be found out in five different ways. Employees of the financial company provide all data only to the client; personal information is not available to outsiders.

It is necessary to take into account that the borrower can only find out the amount of the principal balance and accrued interest from a bank specialist: by phone or in person, at a branch of a credit institution. Remote methods reflect the actual debt for the current month, that is, for the future date of payment.

Important! Instead of the borrower, any person can find out information about the loan, but only with a notarized power of attorney. The document is drawn up solely by the decision of the bank client. In all other cases, confidential data is a secret, even if there is a receipt or passport of the main borrower.

Checking MTS balance from your phone via SMS

You can check your balance simply by sending an SMS message. To do this, open the “Messages” tab and create a new one. Next, in the line to whom we dial three units – 111. In the text of the message we dial two units – 11. That’s it, click “Send”. In response, you will receive a message indicating the balance at the current time.

Everything is very simple. Moreover, messages are sent to the operator’s number even if the balance is insufficient.

How to find out the loan debt to MTS Bank

It is very important for a loan client of any bank to be aware of their remaining debt on an existing loan. Otherwise, even after making the last monthly installment, the loan may remain outstanding and lead to serious consequences. Even for a small amount of overdue debt, banks begin to charge penalties, which grow every day. In this article, we will figure out how to find out the debt on an MTS Bank loan and avoid penalties by paying the creditor in full, down to the penny.

MTS Bank loan balance

If you have a debt to the bank, it is important to know exactly when and in what amount payment is required. To find out the balance on an MTS Bank loan, there are several options.

It is recommended to check the loan balance periodically, even if the borrower adheres to the payment schedule. A technical glitch or incorrect enrollment cannot be ruled out.

There are also cases when a debt arises due to the difference between the day of payment and crediting, which can reach up to 3 days, depending on the chosen payment method. In such a situation, a fine or penalty is assessed, which causes the debt to increase. It is better to pay it off immediately with the next payment.

There are several situations when a client needs to find out the loan balance. In each of them, he can choose the verification method that is most convenient for him.

You may need to find out the balance if the borrower has missed payments for some time or made smaller payments due to financial difficulties.

If the client wants to repay part of the loan or repay it in full ahead of schedule, he will need to find out the current loan balance from MTS Bank at the moment. This will help you pay your loan correctly. If even a few kopecks remain on the balance, and the borrower is confident that the loan will be closed and stops making payments, interest will be charged on them. Over time, this will lead to the accumulation of debt and also damage your credit history.

To check your loan balance at MTS Bank, they offer several options, including remote ones. Users prefer online methods due to their accessibility: online banking and mobile application. You can view the information from anywhere, as long as you only have Internet access.

When applying for a loan or credit card at MTS Bank, access to online banking is provided mainly automatically. In this case, the login and password are sent to the client via SMS. You can also register later, for which it is better to contact the MTS Bank office or use an ATM.

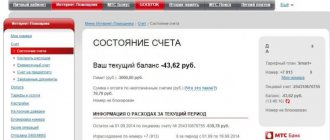

After logging into the service, you should go to the Credits section. Here you can find information about all the user's credit products. Opposite each loan is the current balance and the next payment date.

Having opened the required loan, you can see the details: the initial loan amount, interest rate, contract expiration date, payment details, etc.

You can view your MTS Bank loan balance using an ATM. You need to insert a credit card into the self-service device and then select Balance. The screen displays information about the current debt. You can also print the balance on a receipt.

The disadvantage of this option is the not very widespread network of MTS Bank ATMs. It cannot be found in every locality.

In this case, it is more convenient to call MTS Bank by phone. You can find out the balance from the operator using MTS Bank’s toll-free number: 8 (800) 250-0-520. First, he will ask for passport information to verify the client’s identity. He carries out the check using the contract number, so you also need to prepare this before making a phone call.

You should also not forget about the traditional option - find out everything you need at the MTS Bank office. You need to take your passport and contract number with you. The employee will check the data and provide the balance and other required information.

After you have looked at the balance of your MTS Bank loan, you will need to pay it off. MTS Bank offers many options for this.

Payments in offices, through ATMs and terminals of MTS Bank, as well as transfers from other MTS Bank cards in a mobile application or online bank are free. If you make a payment through the latter, crediting takes up to 24 hours, in other cases it happens instantly. To pay a loan, you only need to know the account number.

- Zolotaya Korona (in MTS stores): 1%;

- Euroset: 1%;

- Svyaznoy: 1%;

- Russian Post: 1.9%;

- Eldorado: 1%;

- Technosila: 1%;

- EuroPlat terminals: 1%;

- MVideo: 1%;

- Qiwi terminals: 1.6%;

- Elexnet: 1.3%;

- Beeline: 1%;

- Megafon: 1%;

- Dr.

When depositing more than 15 thousand rubles, you must have a passport. To carry out the procedure, you need a credit account number. Some intermediaries require you to provide the phone number and last name of the borrower to fill out the payment form.

You can also pay for a loan at MTS Bank by transfer from a card of any issuer through its services and devices. Tariffs in this case are set by the relevant bank.

Cashback when purchasing a smartphone in installments

In addition to the mentioned installment and discount programs, the phone company provides cashback to customers. After paying for the purchase, customers can receive money up to 15 thousand rubles into their MTS personal account.

You can use the received amount for any purpose, but to credit money to your wallet balance you must:

- select a smartphone from the list of participants in the promotion;

- purchase an additional accessory.

You can clarify the exact conditions for selling goods, crediting cashback, or ways to receive an already paid device by calling the contact center or personally visiting the store and receiving advice from the manager.

It is important to emphasize that making a purchase in an online store does not deprive customers of the right to privileges from the mobile operator. The main thing is to follow the rules of the promotion and meet the requirements of the seller.

PJSC MTS Bank official website - how to find out the loan balance

How to find out the balance on an MTS Bank loan? There are several different solutions available. Currently there are the following:

- Internet banking.

- Application.

- Terminals or ATMs.

- In the department.

- By phone.

The first two require a mandatory connection to the network.

Account management

This is perhaps the most popular and most sought after team among subscribers. You can find out your account balance using the combination *100#. If there are not enough funds in your account, you can use. To do this, you need to enter the combination: *113* desired amount of the promised payment# - it is this MTS USSD command that is responsible for connecting the service. You can cancel the service with the command: *113*0#. If you want to top up your balance using a card, then dial the command on your phone: *115*card code#. In the case when you need to top up the balance with a card for another subscriber, you must enter: *115*card code* subscriber number #. The enrollment history can be viewed using the command *111*32#.

How to find out the loan balance at MTS Bank

MTS Bank offers clients several ways to find out the balance of debt on a loan or installment plan. The check can be carried out without leaving your home or by visiting the nearest branch.

Through the Internet

Immediately after applying for a loan, each borrower has the right to find out the loan balance at MTS Bank via the Internet by going to the official website. In the upper right corner, click on the “Online Banking” section. Go through authorization or registration using your phone number (when you log in for the first time). Next, in the menu that appears, open the tab with a description of the current loan and study all the information provided.

In this section you can see which part of the debt is principal and which is interest. If there is a delay, the amount due will be indicated in the appropriate paragraph.

The presence of active overdue debt may be reflected in the credit history bureau, and the resulting report will show the full amount that must be returned to the bank. Unfortunately, there are no other ways to check your debt online.

Call the hotline

The easiest way to find out the balance of debt on an MTS Bank loan is to call the hotline 8 (800) 250-0-520, give your name and agreement number. Sometimes during the check, a call center specialist asks for passport data or a code word. Calling the hotline is free.

Using a terminal

Unfortunately, at the moment it is impossible to find out the debt on an MTS Bank card through the terminal. The device will help you make a loan payment, but will not reflect the necessary information.

At the bank office

For some MTS Bank clients, it is much easier to visit the office of a credit institution and entrust the account verification to a specialist. To do this, you need to select the nearest branch and visit it with your passport and loan agreement.

This is the longest and most labor-intensive process, but also the most informative, since during communication with a bank employee you can get answers to all your questions. Also, if necessary, you can immediately deposit money into your credit account through the operator.

At an MTS Bank ATM

Using an ATM, you can only view the balance on a credit card. You need to insert it into the receiver, enter the PIN code and press the “Balance” button. All information about the loan will be displayed on the screen or printed on the check.

Through your personal account in the application

The easiest way to check your debt balance is through a mobile application on your smartphone. First you need to download it on iOS or Android. After downloading, open the program, enter your username and password to log in. Access to your personal account can be obtained upon first registration in online banking.

Loan balance and why you need to know it

Knowing your loan balance is important not only to maintain your own confidence in its repayment and to enjoy the reduction of the amount of debt. This is also required for purely utilitarian reasons, such as:

- Checking the crediting of a payment deposited into a credit account.

- Knowing the specific amount of debt if you need to repay the loan early.

- Make sure that the obligatory payment is not overdue if you are in doubt about the payment date.

- To control the amount on the account and prevent additional debits.

All these reasons relate, first of all, to the borrower’s specific living money, and therefore it is extremely important to know and be able to control your credit account. This will allow you not to lose money that the owners of loan obligations already pay to the bank in large quantities.

Financial institutions do not hide this information, but on the contrary are ready to provide this information to the borrower upon the first request, since this is directly in their interests.

Via SMS

SMS service is a fairly simple way to find out the loan balance at OTP Bank. This service should be activated in advance, since initially the client does not have this option. However, in OTP, SMS services are most often provided to the client free of charge and provide the opportunity to manage their account, even if it is not possible to connect to their personal account.

To receive all the data, you should send an SMS request with the text CREDIT to the number 5927 . Important: the request should be sent from the phone number to which the loan agreement was issued. Otherwise, you will not be able to obtain information.

Through online services

Online services are the easiest and most popular way to find out the status of a loan at OTP Bank. This is not surprising, because the data in them is updated in real time and allows the client to access it at any time, without directly contacting employees of the banking organization.

To find out your credit balance in this way, just connect to the bank’s Internet banking service, download the application to your mobile phone, or go to the official website. After this, the client will need to use a login and password for authorization. The client either receives a login or password at the branch when registering for the service, or registers it independently through his phone number. It is most convenient to clarify all this directly at the department.

After the client has logged into Internet banking, a list of all the products that he has in this bank will appear directly in front of his eyes on the main page. To understand what the debt is for a specific product, just find it in the list. And to track your transaction history, you just need to click on it.

By contract number in the branch

What to do if all of the above methods are not available? OTP Bank has provided the most conservative way to find out the loan balance - by the agreement number.

In fact, at OTP Bank you can find out the debt by agreement number in several different ways:

- Through a call to the call center.

- By requesting a loan statement to support staff.

- Directly at the department.

Depending on what is expected to be received as a result: just information or an official certificate to be provided anywhere, the client must choose the preferred option.

To receive data through the call center, just dial 8-800-200-70-07, enter the telecode received when concluding the agreement (authorization code) and your credit card number, if you intend to collect the debt on it (or the credit agreement number directly, if it was a cash loan). Next, listen to information about the loan balance.

By ordering a statement, receiving the balance is even easier: you need to log in to the official website, go to the “Funds Control” tab and enter the requested data. This will not only be the contract number and telecode, but also a one-time activation code that will be sent to your mobile phone.

Of course, you can freely and at any time visit a bank branch and receive a complete account statement. This will take some time, but the client will receive a complete certificate about the status of his account, which can be provided, for example, to another credit institution upon request.

Sources

- Ivan, Aleksandrovich Zenin Civil and trade law of foreign countries / Ivan Aleksandrovich Zenin. - M.: Yurayt, 2009. - 150 p.

- Yuri, Fedorovich Bespalov Cases of inheritance: some controversial issues of law enforcement. 2nd edition / Yuri Fedorovich Bespalov. - M.: Prospekt, 2014. - 700 p.

- Polezhaev, Oleg The rights of the developer to the land plot and the building erected by him. History of formation and foreign experience / Oleg Polezhaev. - M.: Justitsinform, 2021. - 209 p.

- Tax disputes. Magazine about tax security and risk reduction. No. 11/2014 / Absent. - M.: MCFR, 2014. - 362 p.

- Economic bulletin of law enforcement agencies No. 01/2014: monograph. / Absent. - M.: MCFR, 2014. - 188 p.