Since smartphones have offered their users more options than standard calls and SMS, the principle of handling mobile balance has also changed. Today, using a positive account, you can pay for services and make purchases, and in a number of situations it can be useful to make a financial transfer from the account to the balance of a bank card.

Online service "Market Tele2"

The most varied and at the same time advanced method is to use a special service from Tele2, designed to carry out the widest possible range of transactions with money on a mobile account.

The service opens in any browser at market.tele2.ru, after which on the main page the user can choose any of the methods of transferring money or paying for various services, as well as get acquainted with special promotions and offers.

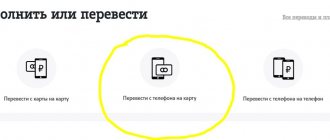

Top up and transfer

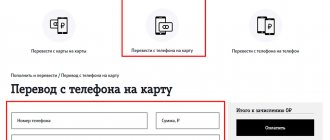

The first subheading on the Market website is the most popular directions for moving funds. Just below which you can find the functionality you are looking for: money transfer from a phone number account to a bank card. To transfer money to a Sberbank card from Tele2, just click on the “Transfer from phone to card” item, after which an additional form will open.

The user will be required to fill out three cells: dial the phone number with the “donor” account, the selected amount in rubles and the card number where the funds should go. It is important to note that the client can make a transfer from Tele2 to a Sberbank card, and also perform a similar operation in the direction of cards from other Russian banks:

- Tinkoff;

- Alfa Bank;

- WORLD;

- Binbank;

- VTB 24;

- Bank "Revival;

- Raiffeisenbank;

- Rosselkhozbank and others.

Completing the transaction will require the user to confirm key steps via the phone from which the money is being withdrawn. The transfer will not be carried out if the required amount (and commission %) is not on the phone balance.

Pay for goods and services

Just below the “Top up or transfer” section there is the “Pay for goods and services” item, which can be considered an alternative option for transferring money to a card. Under the heading, you must select the “Loan repayment” link, after which the site will redirect the user to a page with a list of available banks (compatible with the Tele2 system).

To successfully transfer money, you will need to fill out a list of empty fields, including the account number, bank BIC and full name of the borrower. On the same page, the system will automatically calculate the amount required for transfer, taking into account the accrual of commission interest.

It may be noted that you can get to the desired page with loan repayments directly from the main page of the Market, using the “Popular payments” section.

Tele2 translation

More conservative and does not require an Internet connection is the Tele2-transfer menu, which can be called up on the phone screen by dialing the short number *135#. Thanks to this functionality, you can send rubles from a Tele2 SIM card to a smartphone or bank account.

It is important to add that although the transfer itself is instantaneous, the actual crediting of money to the card can take up to several days.

Cancel payment

It is quite simple to return money using a credit or payment instrument if you paid for your own telephone service. After all, each cell phone holder has a personal account on the company’s website, through which he can perform certain functions with his account.

By going to the official website of the operator providing communication services, you can find a tab dedicated to reverse transfer. It may be called differently in each company, but the meaning remains the same. Having visited the desired resource and gone through identification, you enter the account.

The subscriber even has the right to add a personal plastic instrument to his mobile phone account, which will allow him to receive a wider range of services. Of course, for the reverse transfer of the amount, such a procedure is not provided.

You can return accidentally sent money using the “Transfer” tab, where you need to indicate the plastic number and the amount of the return. By clicking on the “Send” icon, the user will complete the transaction minus the interest rate and transfer the money within the time frame specified in the agreement between the telecommunications company and the bank.

Communications companies MTC and Beeline return amounts within a few hours, Megafon takes longer - at least a day and a half. However, the latter has the highest return rate - 8.5 of the transfer. Compensation may include the absence of tax on the part of the receiving banking institution.

The “Mobile transfer” option is intended, first of all, to transfer money from Tele2 from one mobile account to another, but it can also be used as an alternative to the basic transfer from Tele2. To activate this menu and withdraw rubles to the card, you need to do the following operations:

- dial the button combination *145# and press call;

- in the menu that appears, select “cards and cash” (number 2);

- in the new menu, select the “map” item (number 1);

- enter the transfer amount and click “OK”.

Next, an SMS containing a web address will be sent to your phone. After clicking on it, you will need to perform a few more simple manipulations, including entering the card number. This method of withdrawing money from a Tele2 phone to a Sberbank card (or another) has a limit on the size of the transfer - from 1 to 14,200 rubles one time, and no more than 100,000 per day in total.

You can also manage your finances using the Tele2 Payment mobile application by installing it on your smartphone.

Transferring money without a bank card

ATTENTION!

To withdraw funds in the absence of a bank card, you need an SMP Bank ATM. Commission fees for cash withdrawals will be 3% of the amount withdrawn. The minimum limit for withdrawing funds is 100 rubles, and the maximum is 5,000 rubles.

To receive cash through SMP Bank ATMs, we perform the following actions:

- Dial *787# on your phone and press “enter”.

- An SMS message with a PIN code is received.

- We approach the ATM and find the desired section.

- Enter the received PIN code.

- We collect the amount to withdraw cash.

- We take cash.

SMS message

For users who want to save their time and act as efficiently as possible, the method of transferring money via SMS is suitable, for which they will need to remember the correct format of the operation and the short number itself.

Thus, the message being sent must contain the word card, 16 digits of the card ID and the amount of the amount - all three positions must be delimited with a space card 1234425656789123 500. The SMS should be sent to number 159.

An analogue of this method is the USSD command, which consists of the same positions, formatted as follows: *159*1*1234567891234256*999#, where one means the transaction number, and 999 is the amount of the amount sent.

Additionally, for transfers you can use the Mobile Bank service from Sberbank.

In order for the system to work, you need to register the service with your mobile phone number and select the “full” package. After this, the client will have the opportunity to send money to a Sberbank card from Tele2.

TRANSFER 1234561234561234 1000 – this text must be sent to number 900. In the response message you will receive a code to confirm the operation. After this, the funds will be transferred.

Transfer money from Tele2 balance to Sberbank account

Many users confuse the concepts of “bank card” and “bank account”. In order not to confuse them, we will tell you how they differ. A Sberbank card consists of 16 digits (maximum 18 digits), which are indicated on the front side of the plastic. A bank account consists of 20 numbers, which can be found either at the bank office, or in the product registration agreement, or in the Sberbank-online system. It is worth noting that the numbers on the account and the card differ from each other.

In the case of some banks, when sending money, the funds may arrive in the same minute, or may be delayed up to three business days (depending on the bank). In some cases, it is not possible to make such a transfer of funds at all. The system will give you a refusal, and your money will remain on your balance.

In the case of Sberbank, sending to an account is possible, since this bank is a partner of this mobile operator. Therefore, you can safely transfer money in the following way:

- Open the operator’s payment system on the company’s official website,

- Select "Money transfers"

- Select the “Transfer to bank account” section,

- Next, specify the method “Transfer by details”,

- Enter the phone number from which funds will be debited,

- Indicate the amount sent, the account and the name of the person for whom the account is registered.

You can transfer money to your account from your Tele2 balance via SMS message. In the message you need to enter a text that will contain the command word “rec”, the recipient’s account, the recipient’s full name, and the bank’s BIC. All data is entered separated by a space. The message is sent to number 159.

Example: “rec 46895276431598734610 Full name Bik_bank.”

How to send money without commission

Such withdrawal operations still remain relatively non-standard, in terms of organizational features and the relationship between the mobile operator and banks. For this reason, it will not be possible to transfer money from Tele2 to a Sberbank card without a commission, which is also true for other banks.

The size of the commission may vary as it depends on various factors, including the size of the transferred amount. In any case, before completing the operation, the user will be notified by the operator about the amount of the commission charged.

Tele2 virtual card

In 2013, a virtual card was released, that is, it does not have a physical medium and is used only on the Internet.

Advantages

- Safety.

It cannot be stolen, cannot be lost, and cannot be paid without a phone attached to it. To pay for purchases, you must request the card's CVC code, which will be sent in a message. It is sent with every purchase. The code is valid for an hour. If they try to pick it up, the card is blocked after three unsuccessful attempts.

- Convenience.

It does not exist in material form and it is impossible to forget it at home. Like any regular card, the virtual one has its own number. There is no need to remember it, since it is linked to your phone. There is no need to replenish it separately. It is enough to deposit money into the subscriber's account.

- Speed of receipt.

You don’t have to wait for the card to be issued or come get it. The release procedure takes a few minutes.

How to use?

Payment occurs in the same way as with a regular one. Enter the number, CVC2, expiration date, first and last name. You can find out the details by sending an SMS to number 338. You will learn that the payment has been processed in a message received on your phone. Considering that the card balance is the phone balance, there is no need to track it separately. You just need to remember to have enough funds. The minimum account balance is 10 rubles.

There are restrictions on use. You can spend no more than 15 thousand rubles per day (including commission). There is a monthly limit of 40 thousand rubles.

If the card is not useful, it can be easily blocked. Send the word “Block” (“Stop”, Block, Stop) or the command *338*# to number 338.

Rules for receiving the mycard tele2 service

Subscribers using corporate tariffs, tariffs without an advance payment system and those who have been a Tele2 client for less than 60 days cannot use this service.

IMPORTANT!

The commission for transactions using a virtual card is 3%.

How to connect ?

You can connect this financial instrument in the following ways:

- send an SMS with the text card or “card” to number 338;

- send command *338*#;

- access the mobile portal by dialing *338#;

- download the application on IOS or Android.

To track payments, you can order details through your personal account or via SMS messages.

Transfer conditions and limits

There is a list of conditions and restrictions imposed by Tele2 on all money transfers from a mobile account to a bank account:

- the service is available to individuals and corporate subscribers;

- You cannot use existing bonuses on your account, credit funds or money transferred through the “Promised Payment” for the transfer;

- minimum and maximum amounts, including commission - from 1 to 15,000 rubles (depending on the product or service).

It is important to note that after the payment has been made, the minimum balance on the personal account cannot be less than 0 rubles. As for the commission, its standard size is 5% of the amount sent, while repaying a bank loan from a phone takes a slightly different amount - 3% + 30 rubles.

Translation in the Tele2 office

You can transfer funds from your balance to a bank card at any office of the company. Even though this method is less convenient, it still works quite well.

Contact a company employee with a request to help resolve this issue. The employee will ask for your passport and then give you an application form in which you need to indicate the details of the banking product where the funds will be sent and the amount to be transferred.

The commission and restrictions when sending through the company's office do not differ from the commission and restrictions in other transfer methods.

Withdrawal restrictions

Additionally, you can note specific restrictions that prevent the implementation of a money transfer from a mobile account to a bank card.

Today Tele2 allows transfers to Visa, MasterCard and MIR cards, while Maestro cards are supported only if they are of a personal type.

In addition, transfers are only made to cards with a 16-digit identification number (printed on the front of the card).

It remains to add that some methods of transferring money today are already outdated and therefore cannot be used. So, it will not be possible to withdraw rubles from your account and send them to a card through your Tele2 (LK) personal account.

Return nuances

Instructions for returning funds to the card.

Large sums transferred by mistake cannot be called news. This could be brute force numbers or paying for services to a random subscriber when an error has crept into your number. A citizen has the right to cancel the transfer by using the services provided to him by communication companies. The latest applications allow you to legally cancel without any penalties.

Sberbank Online

The financial institution provides for the user to cancel his actions. This is facilitated by a personal visit to one of the organization’s branches or a call to the support line.

You need to have a payment receipt with you, which confirms the financial transaction. If the plastic holder has a personal account at the official launch site of the structure, this will serve as additional evidence.

The refund procedure follows established rules posted on the main portal of the institution. It should be noted that the reverse transfer of money does not occur instantly; this also seems to be one of the rules. If the subscriber immediately noted that the payment was incorrect, he has the right to contact a specialized specialist of the financial institution via the hotline. This will help speed up the cancellation of the financial transaction made.

There are often situations when funds are accidentally transferred from a mobile bank to a card. Therefore, such transfers do not occur immediately; the credit and financial structure gives the subscriber a certain period to resolve the situation. This period is determined by the temporary absence of payment.

Contact Center

It is also recommended to return erroneously transferred money to your MTS phone by calling the operator on duty. The service department number is located on the Sberbank Internet launch site.

The appeal is a free service of the company, but to carry it out you should prepare the following information in advance:

- numbering of the plastic instrument or current account that served as payment to the network subscriber;

- client's civil passport data;

- answer to a secret security question as an additional caller ID;

- information on the erroneous transaction - transaction number, details of the check or payment receipt, other materials that will help confirm the completed financial transaction.

When contacting the call center, you need to remember that the operator does not return cash - the employee can only block the transfer. To do this, you need to tell him what stage the operation is at. But this procedure will increase the possibility of getting back the money spent.

If the amount has already been credited to the user’s balance, the contact group is unable to do anything; the subscriber needs to negotiate with the payee. The wrongfully injured person has the right to file a lawsuit, but the costs of a lawyer and the costs of the case may exceed the transferred amount.