Megafon Bank conducts most of its transactions via Internet banking. This solution is convenient for both parties. The company gets the opportunity to save on offices and employees, and the client does not waste time and nerves on visits and waiting. The financial institution has a certain feature: cards are opened directly to a phone number. Therefore, the company’s services are relevant for subscribers of the cellular network of the same name. Read more about registering in Internet banking, its functionality and capabilities below.

About the bank

Megafon Bank is an online service addressed to subscribers of this operator. It allows you to control the movement of funds in your account, make payments, and view the history of transactions.

You can register in the system without a bank card, but for payment and a number of other actions you need to create a “plastic” card or its digital equivalent .

Main advantages of the product:

- the possibility of receiving interest on the balance (up to 10% per annum);

- cashback up to 1.5% on all purchases and up to 30% in partner stores;

- free service if appropriate conditions are met;

- bonus in the form of 10 MB of Internet traffic for every 100 rubles spent on purchases.

It is possible to transfer funds to MTS phone accounts without commission.

Note! The Megafon Bank card is suitable for withdrawing money from electronic wallets WebMoney, Yandex.Money or others. Simply top up your mobile phone balance, then withdraw cash from any ATM.

Funds control

Each client has a personal account - you can find it on the official website (). Here you can take full control of your account from anywhere in the world with Internet access.

What does the client get?

- Possibility of constant access to your funds and their control.

- There are many ways to influence your phone bill: any transfers and expenses in Internet services, settlement of invoices.

- Pleasant cashbacks - for purchases from partners, the return can be 50% of what was spent, a return in the form of megabytes of Internet traffic (10 MB for the next 100 rubles in the receipt). If this is payment of bills from partner stores, you receive cashback in the amount of up to 50% of the purchase amount.

- A clear statement for all categories of spending - now it is much easier to track which areas the most funds are spent on.

- Availability of quality banking.

- Deposit account – you are credited with 8% per year on your account balance.

- There is no subscription fee for use - it's all absolutely free.

Where to start using

The registration process will not cause difficulties. First you need to get the coveted card. The principle is similar to connecting the Sberbank Online service. You need to do this:

- Find and visit your nearest Megafon store. Ask managers to issue a Megafon Bank debit card. You will need your passport and work phone number.

- Activate the card upon receipt. To do this you need to make any purchase. Having received the card, you need to activate it by dialing 5555 from your phone and proceed further according to the instructions. If you have a Gold card, you must make your first purchase, which requires entering a PIN code.

How to create your own account

If you have not previously carried out the registration procedure with Megafon, then you need to do the following:

- Go to .

- By dialing *105*00# from your phone, wait for the password.

- Enter it in the appropriate field on the site, and “Login” can be determined by phone number.

Subscribers who have gone through this procedure previously can use the old data - they are still relevant.

- Megafon personal account: login. Megaphone blocked personal account

After completing all the procedures, you can safely go to a website specializing specifically in the bank, find the “My Bank” button at the top and start using it.

Important conclusion! Megafon employees will always be able to answer all your questions, the answers to which can be found at the link:. Here are solutions to the most frequently encountered problems.

Megafon Bank application

The fastest and most convenient access to money stored on your phone balance is mobile Megafon Bank. From a functional point of view, this is an analogue of a personal account, which differs in that all the tools are located on a mobile device.

The Megafon Bank application is a mobile personal account.

Application features:

- check account balance, make money transfers;

- pay for services;

- make purchases in online stores;

- monitor the accrual of bonuses, interest on the balance, cashback;

- generate financial reporting (receipt, expense, balance for specified periods of time).

It is possible to top up Megafon balance from any banks without commissions, with checks and payment receipts sent to the specified e-mail. Reporting can be obtained not only in text, but also in graphical representation.

Requirements for borrowers

The company's clients must comply with the following requirements when conducting transactions:

- It is mandatory for a citizen to send a request to the company for a loan.

- The borrower must be an adult.

- The client must have experience interacting with the company as its subscriber for at least one year.

- All documents related to the case had to be prepared by the client.

Liquidation of debt by the client had to be completed exactly within the specified time frame.

- Payment of the client's debts must be carried out by him using one of the options that the company itself offers him.

How to connect mobile bank Megafon

Download for Android

The program is compatible with all devices using Android version 5.0 and higher. The distribution size is 26 MB.

Download for iOS

The program is suitable for all iPad, iPhone, iPod Touch running iOS 10.0 and higher. The distribution size is 120.9 MB.

To download the Megafon Bank application for free from content stores, click on the appropriate button above. Or go to www.bank.megafon.ru, select the link to go to the page with the version for iOS (1) or for Android (2).

Buttons for downloading Megafon mobile bank.

There is no connection provided as such. The application is ready for use immediately after installation and authorization , which can be done through a login/password or using an access code sent by SMS to the specified phone number.

Shutdown

There is no provision for disabling mobile banking. You can simply delete the application from your smartphone.

Login to your personal account

Login to Internet Banking

- To enter your Megafon Bank personal account from the main page www.bank.megafon.ru, use the “My Bank” link in the upper right corner.

- A window will open where you will need to enter a phone number, then click the “Continue” button.

- An SMS message containing a code for further authorization in Internet banking will be sent to the specified number.

Types and tariffs of Megafon bank cards

There are two types of cards available – digital and plastic. Their release is free, service is according to the selected tariff plan. Megafon Bank is not a bank in the traditional sense . This is only a service for the operator’s subscribers that provides access to money stored in the account. Cards are issued and funds transferred by Round Bank .

The cards work in the MasterCard system, the phone number account is the same as the card account. All of them support contactless payment.

The Megafon virtual card is a fully functional analogue of “plastic”. Its peculiarity is stricter limits, due to a simplified identification system. There are two plastic cards: Megafon Standard and Megafon Platinum, the latter allows you to receive many discounts, bonuses, and other privileges from partners of the MasterCard system (shops, taxi companies, restaurants, other suppliers of goods or services).

Terms of use depend on the selected tariff (see table).

| Rate | Cashback | Interest on balance* | Maintenance cost |

| "Light" | – | 6% | Free with a monthly turnover of 3,000 rubles, otherwise – 49 rubles. |

| "Standard" | 1%, but not more than 1000 rubles. per month | 8% | Free with a monthly turnover of 10,000 rubles, otherwise – 149 rubles. |

| "Maximum" | 1.5%, but not more than RUB 3,000. per month | 10% | Free with a monthly turnover of 30,000 rubles, otherwise – 199 rubles. |

* for an amount up to 200,000 rubles. with a daily balance of 500 rubles.

Important! Regardless of the tariff, for every 100 rubles spent on purchases you are given a bonus in the form of 10 MB of traffic, free SMS banking is provided (you can view your balance and payment history even in the absence of the Internet) and built-in protection against accidental subscriptions to paid services.

Ordering and receiving a bank card

“Plastic” is available in all operator’s salons and is issued without prior online applications or registration , upon a personal visit. A digital card is ordered through the application or personal account and is issued in a maximum of 5 minutes.

Additional Information. The same card can be linked to several devices. You are allowed to issue up to 5 cards for yourself and link them either to one account or to different ones, but opened in the same name. A Megafon subscriber has the right to issue up to 15 cards per year.

Instructions for obtaining a virtual card

- In online banking or the mobile application, select the “Issue digital card” button.

- Confirm your agreement with the terms of the offer.

- Specify the tariff - “Lite”, “Standard” or “Maximum”.

The card will be ready no later than in 5 minutes. The fee according to the tariff is debited from the subscriber's account immediately after the card is issued. If you have other cards, the conditions of the selected tariff will apply to them.

Users of the electronic services Google Pay, Samsung Pay or Apple Pay can immediately link Megafon’s virtual card to their wallet and use it in the same way as “plastic”.

Video: Review of the Megafon virtual card.

Card activation

The new card will appear in the mobile application marked “Not activated.” Click “Activate”, enter the PIN code - automatic activation will occur in half a minute.

There is another way: call the short number 5555 (it’s free) from the phone to which the card is linked. Next, follow the instructions from the answering machine (keep the card with you, you will need its data).

Attention! The first operation through the POS terminal after activating the card must be carried out by entering a PIN code.

Benefits for clients

Anyone who receives a card is prohibited from using content subscriptions. For free.

UPD12.

This option will be permanent, i.e. will not automatically turn off after 3 months, as happens with cardless subscribers.

If you want to use content services, you will be offered to open a special content account and pay for services from it.

Cardholders will not be charged money after 45 days of non-use of Megafon's paid services. If anyone has forgotten, they will write off 15 rubles per day after 45 days of subscriber inactivity.

@mtumanov warns that if there is no card, and several numbers are linked to one personal account, then they will begin to write off if any of them is inactive!

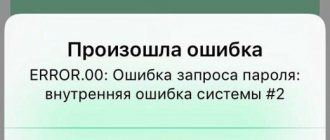

Answers on questions

Does Megafon have a credit card?

No, all products offered are debit.

Is it possible to get a loan from a bank?

No, this is only a financial service for subscribers of the Megafon operator. If there are not enough funds on your phone account, you can leave a connection request.

How to get cashback and discounts from partners?

Holders can receive additional cashback and discounts from Megafon Bank partners. Participate in promotions, information about which is regularly updated on the page www.bank.megafon.ru/loyalty.

Where to withdraw cash?

You can withdraw money through any ATMs . There is no commission if the withdrawal amount per month does not exceed 10,000 rubles, and the account turnover for the same period is more than 3,000 rubles. (if not, the tariff will be 2.5%).

When withdrawing from 10,000 to 50,000 thousand rubles. a commission of 3.5% is charged per month, more than 50,000 rubles. – 4.5%. It is also allowed to withdraw money at cash points, the commission is 4.99%.

How to top up the card?

The easiest way is to deposit money into your phone account using any available method. You can also top up your card through ATMs and terminals of all banks, in your personal account or mobile application.

How to check your balance?

Check your account balance at ATMs, through a mobile application or in the personal account of a Megafon bank client. Use SMS banking: it is free for “Lite”, “Maximum”, “Standard” tariffs. For tariff-free cards, the cost of the service is 30 rubles. monthly. To check your balance, send the message BALANCE to 5555 .

Locking and Unlocking

To block a Megafon Bank card, call the support service at 5555 or send an SMS message with the text BLOCK. It is also allowed to do this in the mobile application.

Customer support service specialists will help you unlock the card; if this is not possible, a new “plastic” will be issued instead.

How to close or disable the card?

Block it, call support, or remove the card from your e-wallet yourself using the application. The money on the balance of the phone number will be retained and will be available for use according to the current mobile communication tariff.

What is the hotline phone number?

To contact Megafon Bank specialists, there are telephone numbers 8-800-550-55-00 (toll-free for Russia) and +7-495-540-82-92 (for calls from abroad).

Hotline

There is a separate hotline for bank clients. You can make a complaint, solve a problem or get information by calling 8

or

5555

.

Only cardholders will be able to reach the operator using the short number 5555 All calls are free for residents of Russia, regardless of the locality in which they are located.

In addition, company employees can write messages in a special chat online on the website or in the mobile application. But chat operators respond to requests much slower than call center specialists. The response time may take 30-60 minutes.

Reviews about the Megafon Bank card

The majority of users are satisfied with the level of service and see more advantages in it than disadvantages. Some only complain about the relatively high service fee.

In the process of using the card, Megafon clients find both pros and cons.

You can read reviews from holders, as well as share your own impressions of using cards on this page. Use the special form below this article.

Terms of service

Any card can be lost or hacked by fraudsters, or perhaps the subscriber has simply forgotten the password to it. In such cases, you need to do some things. In order not to go straight to the company salon, use the phone number and codes from Megafon:

- To use other parameters, you can send a message with any text to the short number 4554.

All Megafon communication clients can use Megafon-Bank. This is an online resource that allows you to fully control your active cards. In addition, you can register in it even without receiving a card.

It is also worth noting that all residents of Russia who use this connection can receive a card, but the only exceptions are people who use the services on credit. Another advantage is that money can be withdrawn not only throughout the country, but also abroad.