“How to find out the balance of an MTS Bank card?” - one of the first questions from users who have services from a cellular provider. The card provides a number of advantages, and the main one is the possibility of free access to MTS money (deposit funds). This is very convenient when you need to buy a product, but there is no free money. It is only important that the level of financial expenses does not exceed the limits of possibilities. And for this you need to know all the ways to check the balance on an MTS card and control it in time.

Balance information via SMS

MTS Bank offers a convenient MTS banking option. Its essence lies in the fact that you can receive the necessary information in the form of messages that come in response to the corresponding request. So, you can find out your balance by sending a message to the number +7 916 777 3331. In the SMS you write the word balance and indicate the last 4 digits of your card.

How to check your card balance

You can view the amount of funds in your credit or debit card account via the Internet on the organization’s website, in smartphone applications, via SMS, at ATMs and terminals, or at the company’s office.

By SMS

To find out the balance of an MTS Bank card, you should send an SMS with the text “Balance XXXX” to number 2121, where XXXX is the last 4 digits of the payment instrument number. The answer will come in a few seconds in the form of SMS.

In your Personal Account

To view the balance of funds on a payment instrument through your Personal Account, you should log in to the service and look at the desired card in the section of the same name.

MTS Bank Online

You can find out the amount of funds on the card in MTS Bank Online after authorization in the application. The information will be visible in the section of the same name.

MTS Money

This application also displays all client cards opened in MTS Bank. The amount of funds for them will be visible on the initial page.

ATMs and terminals

You can check the balance on the card through ATMs and terminals of the organization. There is no commission charged when performing the operation. You can also view your balance through ATMs or terminals of third-party banks, but you need to remember that in this case a commission may be debited from your account.

Organization office

You can also check the balance on the card at the organization’s office. You will be required to present your passport to confirm your identity.

Contacting a bank branch

To obtain information about the balance of funds on the card, the client can contact the bank branches directly. It is necessary to provide employees with an identification document of the owner. All information about the card can be presented to the client in printed or electronic form.

How to find out the balance of an MTS Bank card without a card

If you don’t have your card with you, but you need to determine its condition, you can do this using an ATM. To do this, click “Without a card”, confirm your entry (enter the code sent by SMS to your phone number) and click the appropriate item. The results are displayed on the screen and can also be printed.

Internet bank

Internet banking allows you to obtain information about the status of agreements that are assigned to one credit institution. Follow these steps:

- Go to the website www.mtsbank.ru.

- Log in or fill out the requested fields to register on the resource.

- Request a credit limit.

The service can be activated in the office or through an ATM.

Balance control is carried out by a statement, which displays expenses made during the requested period.

Mobile app

The last way to check your balance is to use the official mobile application “My MTS”. It can be downloaded completely free of charge from the AppStore or Play Market. After installation, you will need to create a password for further login.

When starting the application, the user will be shown information about the remaining call time within the TP, the amount of traffic or SMS (if they are included in the package). Also, using this application, it is possible to control the connection of additional services and check the balance.

MTS Bank support service

You can get an answer to your question by calling the hotline. MTS Bank has a voice menu, which allows the client to take the necessary actions without waiting for the operator’s response.

If you need to make a call and contact an operator, you will need to select the desired number. There are 3 multi-channel numbers available:

- +7 (495) 777-000-1 – for citizens living in Moscow and the Moscow region.

- 8-800-250-0-520 - for residents of the regions.

- 0512 - for subscribers of other cellular operators.

By contacting an employee or using the voice menu, the user can perform a number of actions and obtain the required information, namely:

- blocking or unblocking a card;

- obtaining information about the limit;

- mini statement;

- submit an application to transfer cashback to a new number.

Are there any other ways to find out the balance on an MTS card?

You can get information about your card balance by visiting a bank office. For identification you must have your passport with you. This is the longest method. But thanks to a visit to the bank, you can get comprehensive information about the status of your account. A customer service specialist will provide a printed card statement. It will also send an email with your data.

Finding out your card balance is quick and easy in any situation. For this purpose, MTS Bank has developed all the ways to conveniently use financial services. Using the card is accessible and convenient for every client.

Andrey Firsov

About the author : First education as a system administrator. The second is “Finance and Credit”. Total work experience 14 years. I am a regular author and resource administrator. I actively apply my knowledge in the information project lkbank.ru, where I am ready to answer any questions. Go to the author's page.

Other verification methods

Bank card holders should not ignore Internet banking. This option stands out due to the completeness of the information contained in it. Here you will be able to find out not only the remaining cash balance, but also look at the last completed transactions, transfers and payments, study the terms of use of the payment instrument and clarify some other nuances.

Similar information is available in mobile banking. But its advantage is that it is always at hand. To use it, you just need to have access to the Internet and remember your login and password for authorization.

Another advantage of these approaches is the ability to quickly make a payment or transfer money to another account. You definitely won’t be able to do this by calling the contact center.

Checking MTS balance through the service/portal

Another way is to use the MTS Service (Portal) . Access to information is carried out by entering the USSD code. There are several queries, each requiring the following actions:

- To find out the balance , the subscriber will need to dial *100*1# .

- If a service package was activated for a certain time period , then information about it is provided by dialing *100*2# .

- To find out about the balance of funds taken from the company on credit (), the subscriber must dial *100*3#.

Interesting! Using the above combinations, it is convenient to keep track of your money. A person will be able to deposit the amount in advance if he notices a lack of funds on his phone balance.

Call technical support

To find out the amount of call time remaining under your tariff, you can call 0890 or 880025008890. For Russian subscribers, calls are completely free. A certain difficulty with this method is the frequent congestion of hotlines, which complicates the process of calling an operator.

After waiting for the specialist’s response, the subscriber will need to provide his phone number and his own contact information (full name) to receive the necessary data. The specialist will tell you in detail about the balance or clarify other information on the tariff.

How to check the balance of an MTS money card through the customer service center?

Telephone service for MTS Bank clients is provided around the clock. To do this, you need to dial 8800 250 0520 or 495 777 0001 (Moscow). The necessary information can be obtained from the operator or answering machine. In the second case, in tone mode you should dial the number 1 (card information), then 1 again (account balance). All calls within Russia are free.

MTS card with cashback - terms of use and detailed description

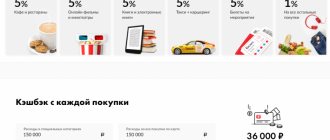

The main advantage is the accrual of up to 25% cashback from the purchase amount on certain categories and partner products. Cashback refers to bonuses - real rewards from MTS, and not money that can be withdrawn to your account.

There are 2 card options:

- MTS Cashback: a plastic carrier that is provided to everyone.

- MTS Cashback Lite: a virtual card, which can be issued exclusively based on a personal offer.

There is a limit set for the product - a maximum of 299,999 rubles, but this is extremely rarely approved, even for cellular subscribers. In most cases, clients are provided with plastic or virtual media with a limit of up to 50,000 rubles.

Cards with the PayPass system and 3D-Secure protection technology are available to users. For convenience, the card can be added to Apple Pay, Samsung Pay or Android Pay.

Advantages of the card

Even opponents of loans note the advantages of the MTS cashback card, because the developers have included the most interesting offers in it. So:

- Maintenance per year is free.

- Interest-free period up to 111 days.

- Credit limit – up to 299,999 rubles.

- Favorable bonus program - bonuses from 5 to 25% for completed purchases.

- Storing personal savings and credit funds in an account.

- Free withdrawal of personal funds.

- Minimum commission for transfers of own funds.

- Simple application process - only 1 document required.

- The card is issued at any office or delivered by courier.

- A prestigious card is issued - Mastercard World, which makes it possible to use the prerogatives of the payment system.

- The cost of payment for mobile banking is 15 rubles per month.

- You can repay your credit card either in the office or through alternative free services.

- Interesting promotions are organized for clients.

Disadvantages of the MTS card

Like any banking product, the MTS cashback card has several disadvantages, namely:

- The production of plastic is paid - 299 rubles.

- You can withdraw a maximum of 50,000 rubles per day.

- For the transfer of credit money, an impressive commission is charged - 3.9% +350 rubles. There is no grace period for these transactions.

- There is no “direct cashback” - the bonus program provides for a cumulative system of points, which can only be exchanged for rewards from MTS, and not for real money.

- If payment is late, the system of calculating fines is activated.

- If there are no transactions on the account for six months, it may be closed.

Checking your balance via online banking

- To access the online bank, you need to obtain a login and password from the operator when receiving the card.

- By registering in the Internet bank ( personalbank.ru ), you can not only receive current information about your balance, but also carry out any payment transactions with your personal account.

- If you decide to use the mobile application, then this login and password will also be valid for the application.

If you have lost or forgotten your password and login, you can find it out by calling the support service. After answering all the operator’s questions, a message will be sent to your phone with new information for logging into the online bank.

Checking MTS balance via USSD

Information is received via USSD - short number . The number for subscribers of this operator: *100# . You need to enter it in the phone number dialing line and press the “Call” . After processing the request, a window with the necessary information will appear or an SMS message will be sent.

Advice! Sometimes the service gives an error or the number balance is denied. The client should wait a little and then repeat the request.

Check your personal account balance through the mobile application

The most convenient and fastest way to view the balance of a debit card or find out the balance of a credit card is to use the mobile application provided by MTS Bank to all its users.

By downloading the application and registering using the login and password obtained from the bank operator, you can view the balance on your balance, as well as use any other services provided by the functionality of the mobile application.

Methods for transferring cashback to an MTS card

Transferring cashback to an MTS card is permitted exclusively for replenishing the balance, paying for services and making purchases in stores. Existing customers of a cellular operator can spend their savings in the following ways:

- Payment for cellular communications, the “All MTS” package, Internet and entertainment services. The target is set upon receipt of the plastic carrier. Savings are credited to your phone number on the 1st of every month. If the user wants to transfer cashback to pay for the services of another person, then he will need to set an additional goal in his personal account.

- Shopping in salons. When the required amount has been accumulated, the subscriber will need to go to his personal account and order a certificate, which will be sent by email, and the code will be sent via SMS. Certificates are provided in amounts from 10 to 80 thousand rubles.

For corporate users, cashback transfers are provided for:

- Shopping goods in stores.

- Payments for communication services for loved ones.

The transferred cashback is distributed according to the following scheme:

- payment for communication: if several numbers are selected, then by date of addition;

- for the purchase of goods;

- for MTS services.

Cashback cannot be used to obtain actual cash or to pay off credit card debt. Upon termination of cooperation with the bank, the cash equivalent is not issued.

Find out your balance via autoinformer and SMS

Also, subscribers should have an idea of how to find out the balance on MTS by calling the service number. To do this, you need to call 111 back and listen carefully to the voice menu. The necessary information will be announced after clicking on the appropriate buttons.

You can also send a message to this phone, in the text of which you should write the number 11 . The requested data will be provided in the response SMS.

You should know that 111 is a toll-free number, so when making calls or sending messages, money will not be debited from your account.

How to close an MTS card?

To block a lost or stolen card, you should choose one of the following methods:

- Call the hotline and ask the operator to block it.

- Log in to online banking and click on the “Block” button.

- Download the mobile application, register, select a card and click on “Block”.

In a similar way, you can block not only the plastic medium, but also the account itself, but only if there is no debt. If the debt to the bank remains, the credit card must be reissued, which will take about 10 days.

If there is no longer a need for the product and the user wants to close the card, then he will need to pay off the debt, if any. To deposit funds, you can choose one of the following options:

- Replenishment via the Internet:

- through your personal account or from an MTS Bank account - crediting occurs instantly, there is no commission.

- through your personal account from a card of another bank - the money is credited immediately, the commission can be debited by the bank from whose account the debit is made.

- MTS Money wallet - it is best to activate the service at a mobile phone store, since in this case no commission is charged for completed actions.

- At MTS Bank ATMs.

- Cash replenishment is instant, there is no commission.

- from another card - the transaction fee is 1% of the amount, but the minimum is 49 rubles.

- At partners. Through MKB terminals it is possible to transfer up to 10,000 rubles without commission.

- Transfer between banks. Some institutions offer free money transfers.

- After replenishing the credit card, all that remains is to complete the blocking procedure; to do this, you should select one of the methods presented above.

An alternative way to check the MTS Bank balance using SMS

Since users do not always have the opportunity to connect to the Internet to find the nearest branch or at least an ATM and log into the application, the developers offer SMS notifications. How it works:

Within a few minutes you will receive a notification showing information about connected cards. Additionally, you can contact the hot support number to check your main account and get advice. If for some reason the notification does not arrive, you must call technical support or leave a message in the feedback form, which is located on the main page of the site in the “contacts” section.

Source

How to get an MTS card with cashback?

The advantage is the absence of any difficulties during registration. You can get an MTS card with cashback:

- At any bank office.

- In the MTS cellular communication salon.

- Via the Internet - by leaving an application.

In the first two cases, you will need to visit a branch or mobile phone store with a passport.

The easiest and fastest way is to fill out an application online on the website. After reviewing the application, the bank sends an SMS notification to the potential client’s number. If the decision is positive, then you can receive the plastic carrier in the office, salon, or arrange delivery by courier.

The bank makes a decision to provide the product within 5 days. But in practice, the final verdict is made earlier - within a few hours.

Why do you need to control the balance on your card?

Nowadays, being financially literate is not just a luxury, but a vital necessity. Therefore, absolutely anyone should monitor the state of their bank account. This is necessary in order to find out what amount is currently available and avoid possible losses.

You need to control the current card balance in order to:

- correlate your expenses with the availability of funds;

- understand that there were no unauthorized charges on the card by criminals;

- plan future purchases.

Knowing your balance on the card, you will always be aware of your current financial status and will be able to use the money as needed.