Beeline has lost third place in the telecommunications market in terms of the number of subscribers, industry sources told Izvestia. According to the results of the third quarter of 2021, the operator’s subscriber base decreased by a record 9% in recent years, it follows from the reporting that it invested insufficiently and untimely in the construction of networks, which led to a deterioration in the quality of communication services, analysts say. This will intensify competition between companies, and the possibility of price wars in certain regions cannot be ruled out, experts say.

Telecom 2021: Rostelecom with Tele2 against the Big Three

Telecommunications companies - the Veon group (owns the Russian VimpelCom, Beeline trademark), Mobile Telesystems (MTS), Megafon and Rostelecom - presented their financial and operational results for 2021. Based on their CNews prepared a comparative table with the results of the operators’ work.

For the first time, such analytics included the results of Rostelecom. Historically, this operator was engaged in fixed-line communications, so comparison of its results with the results of the Big Three (VimpelCom, MTS, Megafon) was previously incorrect.

However, in 2021, Rostelecom completed the consolidation of the mobile operator T2 Mobile (Tele2 trademark). Accordingly, the results of Tele2 are now reflected in the results of Rostelecom, and the company can be compared with the Big Three operators (Vimpelcom, MTS, Megafon). Since Rostelecom has virtually no international assets, its results in the table are presented only in the section on Russia without separately indicating the results of the entire group.

Cellular results 2021: only Veon has a serious presence outside Russia

Operators Megafon, Mobile Telesystems (MTS) and the Veon group (its Russian subsidiary VimpelCom operates under the Beeline trademark) summed up the results of 2021. CNews compared the results of all three companies.

In 2021, MTS sold its subsidiary in Ukraine. The company remains with a small foreign presence: in Armenia and a non-controlling stake in the Belarusian company of the same name, historically there has been no serious presence abroad: the operator has subsidiaries only in Tajikistan and in the partially recognized republics of Abkhazia and South Ossetia.

Now only the Veon group can “boast” of a serious presence outside of Russia. Among other things, Veon owns the largest mobile operator in Ukraine, Kyivstar. But due to MTS leaving the Ukrainian market, CNews no longer includes indicators for Ukraine in its final table.

Megafon is becoming less and less public

At the same time, Megafon, after ceasing its listing on the London Stock Exchange, discloses the parameters of its reporting less and less. This time, financial results were disclosed only for a group of companies without indicating individual parameters for Russia. For our country, only the number of cellular subscribers is indicated. At the same time, Megafon does not have a significant foreign presence - only Tajikistan, Abkhazia and South Ossetia (the operator also recently entered the Uzbekistan market), so the results of the entire Megafon group can be considered close to the results of work in Russia.

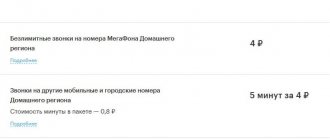

How much does it cost to call from MTS to Megafon and vice versa

When it comes to calls to numbers within the network, you should give preference to Megafon, here the tariff is free. MTS offers such conditions only for the home region. Each solution with a subscription fee includes a certain number of minutes that can be spent on calls to numbers of any operators. Exceeding this volume will be accompanied by additional tariffs. The cost of a call from MTS to Megafon is much more profitable (the price per minute can vary from 0.95 to 0.25 rubles). For example, a minute of conversation with a subscriber of another operator over and above Megafon’s package on the “Turn on! Write" will cost 12.5 rubles.

Reducing the international presence of Russian companies

In general, the presence of Russian telecommunications companies abroad is declining. In terms of foreign presence, MTS only has Armenia, as well as a subsidiary in Belarus, the results of which are still not consolidated in the company’s general reporting.

| MTS | Veon | Megaphone | Rostelecom + Tele2 | |

| Whole group | ||||

| Revenue, billion rubles | 494,9 | 573,54 | 332,16 | — |

| Service revenue, billion rubles. | n/a | 536,89 | 303 | — |

| Revenue from mobile Internet, billion rubles. | n/a | 183,99 | n/a | — |

| OIBDA/EBITDA, billion rubles | 215,2 | 247,96 | 147,8 | — |

| OIBDA/EBITDA margin, % | 43,4 | 43,2 | 44,5 | — |

| Operating profit, billion rubles. | 112,9 | 45,6 | 73,44 | — |

| Net profit (loss), billion rubles. | 61,4 | loss 25.08 | 26,3 | — |

| Net profit margin, % | 12,4 | — | 7,9 | — |

| Capital expenditures, billion rubles | 96,9 | 135,84 | 54,72 | — |

| Net debt, billion rubles. | 317,6 | 438,4 | 308,9 | — |

| Number of cellular subscribers, million | 86,3 | 209 | n/a | — |

| Number of broadband subscribers, million | n/a | 4,4 | n/a | — |

| Russia | ||||

| Revenue, billion rubles | 488,5 | 274,48 | n/a | 546,9 |

| Service revenue, billion rubles. | 396,6 | 247,2 | n/a | n/a |

| OIBDA/EBITDA, billion rubles | 210,6 | 107,78 | n/a | 194 |

| OIBDA/EBITDA margin, % | 43,1 | 39,3 | n/a | 35,5 |

| Operating profit, billion rubles. | n/a | n/a | n/a | 68,97 |

| Operating profit margin, % | n/a | n/a | n/a | 12,6 |

| Net profit, billion rubles. | 57,7 | n/a | n/a | 25,35 |

| Net profit margin, % | 11,8 | n/a | n/a | 4,6 |

| Capital expenditures, billion rubles | 95 | 98,45 | n/a | 107,14 |

| Net debt, billion rubles. | n/a | n/a | n/a | 362,2 |

| Revenue from mobile communications, billion rubles. | 334,5 | 209,5 | n/a | 177 |

| Revenue from mobile data transfer, billion rubles. | n/a | 62,9 | n/a | n/a |

| Revenue from equipment sales, billion rubles. | 69,1 | 26,5 | n/a | n/a |

| Number of cellular subscribers, million | 78,5 | 49,9 | 70,4 | 46,6 |

| Number of mobile Internet users, million | n/a | 33 | n/a | n/a |

| ARPU of cellular subscribers, rub. | 372 | 353 | n/a | 341 |

| MOU of cellular subscribers, min. | n/a | 340 | n/a | n/a |

| Cellular subscriber churn rate (Churn), % | n/a | 11 | 8,1 | |

| MBOU (average traffic of mobile Internet users), GB | n/a | 10,87 | n/a | n/a |

| Revenue from fixed-line business, billion rubles. | 62,1 | 37,66 | n/a | 183 |

| Number of broadband subscribers, million | n/a | 2,8 | n/a | 12,4 |

| ARPU of broadband subscribers, rub. | n/a | 350 | n/a | 350 |

| Number of pay TV subscribers, million | 6,6 | n/a | n/a | 10,8 |

| ARPU of pay TV users, rub. | n/a | n/a | n/a | 250 |

Financial and operational results in 2021 of the Veon group, MTS, Megafon and Rostelecom

Only the Veon group retains a significant foreign presence, which, being created on the basis of the Russian VimpelCom, positions itself as an international group with headquarters in Amsterdam. But Veon has also recently gotten rid of many of its assets: the group’s cellular operators in Canada, Italy, the countries of Southeast Asia and Sub-Saharan Africa were sold. Veon began to retreat from the CIS countries: the group’s subsidiaries in Tajikistan and Armenia were sold.

MTS and Megafon tariffs: comparison table

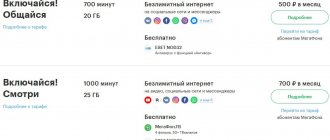

Considering which is better: MTS or Megafon in 2021, we will provide a comparison of current tariff applications. Megafon distinguishes 2 main lines - “Turn on!” and “Warm welcome.” The first option is intended for everyday use, the second - for frequent calls to other regions, CIS countries and Asia.

Let us highlight separately:

| Rate | Description | Included Features | Subscription fee |

| “Turn on! Communicate" | The option is in the “Recommended” category, and allows you to meet your monthly needs for calls, social messengers and the Internet | For a small subscription fee, the client receives: · 600 minutes for calls; · 15 GB of Internet; · unlimited access to popular social networks VK and Facebook, Instagram, instant messengers WhatsApp, Viber and some other projects | 600 rubles for 30 days of use |

| Get involved! Write | A budget option that also stands out for the amount of prepaid functionality | In addition to 300 minutes, 3 GB of Internet and 300 SMS, the client has access to unlimited conversations in WhatsAPP, Viber, Facebook Messenger | 400 rubles per month |

The MTS line is more innovative: in addition to ready-made options, everyone can independently indicate the required volumes of prepaid minutes, messages and traffic for active use.

Here we highlight the following TPs:

| Rate | Description | Included Features | Subscription fee |

| Tariff | The solution has recently appeared in the list of services offered and allows you to take advantage of unlimited access to the World Wide Web and a selected amount of minutes | Unlimited Internet is provided subject to all additional conditions. The number of minutes and message may vary from a 500 min package. and SMS up to 3000 min. and SMS | The minimum package will cost the client 650 rubles. per month, maximum – 1550 rub. |

| My unlimited | Here you can independently choose the volume of traffic and minutes for calls. There are promotions for the first month of service and activation of the “My MTS” service | The client can choose from 5 to 30 GB of Internet, as well as from 300 to 900 minutes and messages | The minimum price is 480 rubles for 30 days, the maximum is 780 rubles. |

All of the above TPs are given for the Moscow region. As you can see, both options are relevant for everyday work. However, MTS can boast of a more modern set of services with the ability to obtain unlimited access to the World Wide Web.

Veon group indicators

However, due to its foreign assets, Veon remains the leader in terms of its performance among all designated companies. The group's revenue for 2021 was $7.98 billion, OIBDA/IBITDA (earnings before taxes, interest on loans and depreciation expenses) was $3.45 billion, operating profit was $635 million. EBITDA/OIBDA margin was 43 .2%.

At the same time, the group received a net loss for 2021 in the amount of $349 million. The group’s net debt is $6.1 billion, capital expenditures are $1.89 billion. The number of cellular subscribers of the group reached 209 million, the number of broadband Internet access (broadband) subscribers - 4.4 million

In Russia, Veon's subsidiary, VimpelCom, is now only in fourth place in terms of its financial performance. The company's revenue amounted to 274.5 billion rubles, OIBDA/IBITDA - 107.8 billion rubles, OIBDA/EBITDA margin - 39%, capital costs - 985 billion rubles.

VimpelCom's revenue from mobile communications amounted to 209.5 billion rubles, including 62.9 billion rubles from mobile data transmission. Revenue from the sale of equipment amounted to RUB 26.5 billion. The number of cellular subscribers amounted to 49.9 million, including the number of mobile Internet users - 33 million. ARPU (average monthly revenue per subscriber) amounted to 353 rubles, MOU (average voice traffic per subscriber per month) - 340 min. , the level of churn of cellular subscribers is 11%, MBOU (average traffic of mobile Internet users) is 107.87 GB.

VimpelCom's revenue from its fixed-line business amounted to RUB 37.66 billion. The number of broadband subscribers was 2.8 million, their ARPU was 350 rubles.

Which is better: MTS or Tele2?

Tele2 AB, originally known as Comvik, is a Swedish telecommunications company founded in the 1970s. Since 1997, it has become international and offers its services in Russia, Kazakhstan and some European countries.

The Russian subsidiary of Tele2 began operating in 2003, and is now owned by Rostelecom. We know her as the operator Tele2 - the fourth most popular in Russia.

Over the past six months, the company has connected 1.88 million new customers, and now its subscriber base has grown to 45.9 million people. This is 18% of the Russian cellular communications market.

Which connection is better: Tele2 or MTS

In terms of the quality of cellular communications, Tele2 is the absolute favorite in Moscow and the region. Compared to MTS, in Tele2:

- Speech intelligibility is slightly better;

- Problems with making calls are 3 times less common;

- The share of calls with interference and poor speech intelligibility is 10-11 times less.

At the same time, the number of undelivered SMS is 4 times higher. On average, message delivery takes 8.9 seconds. - for 5 sec. longer than MTS. This is the longest delivery time among all the Big Four operators.

Which Internet is better: MTS or Tele2

On average, Tele2 both downloads and uploads files slower than its competitor.

- Download speed is slower by 2.9 Mbps;

- Upload speed is worse by 0.6 Mbit/s.

At the same time, Tele2 has a more stable connection and the Internet disappears less often, especially in the regions.

Where are the best rates?

Tele2 offers only 5 basic tariffs, as well as a constructor that combines them with each other. The cost and content are approximately comparable to MTS.

Let's collect average offers with the same price from competitors' constructors. For 550 rubles per month the client will receive:

- In Tele2 - 500 minutes, 15 GB and 300 SMS;

- In MTS - 400 minutes and SMS, 15 GB.

An important nuance of the Tele2 designer: not in every option you can get minutes for calls throughout Russia. If you connect 200 minutes or 5 GB of Internet, calls within the package can only be made to numbers in your home region.

Which is better: MTS or Iota?

Yota is a popular virtual operator that runs on the Megafon infrastructure. The company entered the market in 2007 and now serves over 4.5 million subscribers.

Users love Yota for its flexibility, ease of setting up tariff plans and transparent connection conditions. Let's see if this provider can compete with MTS.

Connection quality

Since Yota uses Megafon towers to operate, it has all the same communication problems as its parent company:

- Call drop and forwarding;

- Interference, slurred speech;

- Complete or partial loss of sound;

- Messages not sent.

In general, Yota demonstrates more stable connections and fewer network failures. But still, to the question of which connection is better, MTS or Iota, the answer will be clear - MTS.

Internet connection

Yota's Internet speed is significantly higher than that of the Big Four providers. It is even ahead of the parent company whose infrastructure it uses to connect.

Yota's maximum download speed in Moscow reaches 150 Mbit/s, while other operators demonstrate from 60 to 105 Mbit/s.

Unfortunately, the connection problems that are typical for Megafon have not gone away on Yota. There are often lags, packets are lost, and sometimes there is no 4G reception in the building.

Tariff plans

The main feature of Yota is the most flexible constructor. You can customize your tariff down to the minute and gigabyte!

Not a single Big Four operator offers such a function, but it’s really convenient. You pay only for what you use - and not a ruble more.

In terms of cost, the tariffs of this provider are also more profitable:

- MTS offers 400 minutes and 15 GB of traffic for 550 rubles;

- Yota is asking RUB 492.28 for a similar offer.

The only difference is that the MTS version includes 400 SMS, while Iota does not have them. But Yota allows you to connect unlimited SMS for 50 rubles. per month.

If you add this service, the tariff plan will cost RUB 542.28. And you can send more messages, and it's still slightly cheaper than MTS.

Indicators of Rostelecom and Tele2

Rostelecom, in tandem with Tele2, is second (after Veon) in terms of financial parameters among the companies under consideration and first in terms of financial indicators in Russia. The company's revenue in 2021 amounted to 546.9 billion rubles, OIBDA/EBITDA - 194 billion rubles, OIBDA/EBITDA margin - 35.5%, operating profit - 69 billion rubles, net profit - 25.35 billion rubles capital expenditures—RUB 107.14 billion. Net debt reached 362.2 billion rubles.

Share and Earn: Network Segmentation Creates New Sources of Revenue

Telecom

The company's revenue from mobile communications amounted to 177 billion rubles. The number of cellular subscribers reached 46.6 million (the fourth figure in Russia after MTS, Megafon and VimpelCom), their ARPU was 341 rubles. The churn rate of cellular subscribers is 8.1%.

Rostelecom's revenue from fixed-line business amounted to RUB 183 billion. The number of broadband subscribers has reached 12.4 million, their ARPU is 350 rubles. The number of pay TV subscribers was 10.8 million, their ARPU was 250 rubles.

How did the operators compare?

We considered the tariffs of mobile operators that are part of the “Big Four”, that is, they have the largest number of subscribers in Russia. These are MTS, Tele2, Megafon and Beeline. The tariffs offered by operators for smartphones in the Moscow region were considered. Fares offered as part of promotions were not considered. If one operator had several tariffs in the category under study, then the cheapest one was selected. For example, when choosing a tariff for those who like to make calls, operators calculated the cost of a minute of call without taking into account additional options included in the package. Tariffs were ranked according to cost: from lowest to highest. Tariffs are current as of May 14, 2019. They may be changed in the future.

Sources:

- https://operator-m.com/chto-luchshe-mts-ili-megafon.html

- https://operator-wiki.com/chto-luchshe-mts-ili-megafon.html

- https://telefongid.ru/obshhie-voprosy/kakoj-operator-luchshe.html

- https://www.Sravni.ru/text/2019/5/16/bitva-mobilnykh-tarifov-mts-tele2-megafon-i-bilajn/

MTS indicators

MTS is the third in its financial parameters among the companies under consideration and the second after Rostelecom in Russia. The group's revenue in 2021 amounted to RUB 494.9 billion, OIBDA/EBITDA was RUB 215.2 billion, OIBDA/EBITDA margin was 43.4%, operating profit was RUB 112.9 billion, net profit - 61.4 billion rubles.

The group's capital expenditures amounted to 96.9 billion rubles, net debt - 317.6 billion rubles. The number of cellular subscribers reached 86.3 million.

In Russia, MTS revenue amounted to 488.5 billion rubles, OIBDA/EBITDA - 210.6 billion rubles, EBITDA/OIBDA margin - 43%, net profit - 57.7 billion rubles, capital costs - 95 billion rub.

The company's revenue from mobile communications amounted to 334.5 billion rubles, revenue from the sale of equipment - 69.1 billion rubles. The number of cellular subscribers has reached 78.5 million, their ARPU (according to CNews calculations) is 372 rubles. The company's revenue from the fixed-line business amounted to RUB 62.1 billion.

Which is better: Beeline or MTS?

The third most popular operator in Russia is Beeline. This is a trademark of VimpelCom, which was also launched in 1993.

Now VimpelCom owns 21% of the total market - 54.3 million subscribers use its services. Beeline's coverage map is somewhat smaller than that of Megafon or MTS.

To decide what is better in 2021, we use the same parameters: communication, Internet and tariffs.

Which connection is better: Beeline or MTS

In terms of the quality of communication services, Beeline is a strong middle peasant. In some ways it is superior to its competitors, in some positions it is inferior.

When compared with Mobile TeleSystems, Beeline:

- Sends SMS for 2.5 seconds. longer;

- Drops voice connection 0.2% more often;

- Delivers 1% fewer messages;

- 0.6% more likely to be unable to establish a voice connection;

- 2 times less likely to demonstrate unintelligible speech during phone calls.

Based on customer comments, Beeline more often has problems in the regions. In the Central Federal District, the level of communication between competitors is approximately the same.

Which Internet is better: Beeline or MTS

In terms of Internet connection speed, Beeline is significantly inferior to other Big Four operators.

- The average download speed is almost half that of MTS: only 7.6 Mbps.

- Data is uploaded 0.9 Mbps slower.

The answer to the question of where the Internet is better - on Beeline or on MTS, greatly depends on the place of use. In the regions, Beeline has a more stable connection, while in Moscow customers often complain about the inability to connect, Internet failures in buildings (especially in basements), and disconnections in the metro.

If you count based on average results and decide whose Internet is better - Beeline or MTS, the victory will be for MTS.

Which tariff is better: MTS or Beeline

Unlike MTS, Beeline offers users a very limited range of tariff plans. There are no construction kits here, and the new offers are more “tailored” for family clients.

For single use, only 2 tariffs are offered: “Unlim” and “First Gigs”. Let's compare the latter with a similar offer from MTS.

- “First gigs” from Beeline: 400 minutes, 10 GB of internet, 30 TV channels, “beautiful room” as a gift.

- “My Smart”: 400 minutes, 10 GB of Internet, 400 SMS.

Beeline's offer costs 14 rubles. per day - that is, only 420 rubles. per month. “My Smart” in a similar configuration will cost a person much more - 525 rubles.

It’s not possible to immediately decide which provider is better - Beeline or MTS. MTS has a higher overall quality of communication and a larger selection of tariff plans, Beeline has reasonable prices and higher quality communication in some regions.