You can make a transfer from your mobile account on Beeline to a bank card, as well as to a bank account. In order to withdraw money, you can use the following types of cards:

- VISA;

- MasterCard;

- Maestro (For this type of card, you can only use those whose number consists of 16 digits);

For transfers, only your card type plays a role and does not depend on which bank issued the card. Operations are successfully carried out for cards of Sberbank, Alfa Bank, VTB24 and others.

Receipt of funds is expected within 5 days from the date of the transaction.

Beeline SIM card to third-party accounts or transfer it to other subscribers. It is connected and used for free. Together with the Beeline.Money connection, the subscriber gets the opportunity to transfer and withdraw funds as follows:

- to bank accounts and cards;

- to various electronic wallets (WebMoney, QIWI);

- at ATMs of partner banks;

- Beeline subscribers;

- subscribers of other mobile operators (Megafon, MTS and Tele2);

- at points of issue (Russian Post, UNISTREAM and CONTACT).

You can also pay utilities, fines, buy goods and services, and much more.

If there is a need to transfer money from a Beeline , then this service is a must. Without it nothing will work.

Fortunately, it is enabled for all Beeline by default. But the service has some limitations:

- Transfers are possible to no more than five different bank cards (from one phone number);

- These cards must be attached to the subscriber's current account;

- You cannot make a transfer to one account from more than two different Beeline within 30 calendar days.

Each method of transfer and withdrawal (ATM, card, number of another subscriber, etc.) has its own fees and limits. We will get acquainted with them a little later.

How to pay for a product or service via phone?

This service is a privilege of a corporate SIM card. All you need is to have a starting balance on your Beeline SIM card. In practice, everything will look like this:

- They issue you an invoice;

- You send an SMS to number 7878 with the command;

- You receive a message to confirm your payment.

For sellers, this is the same as if you paid with a regular bank card or electronic currency.

The transfer is made through Unistream or Contact. The command looks like this: “vendor code your full name transfer amount.”

How to withdraw money from a Beeline account

There are plenty of ways to withdraw funds from a subscriber’s account. Now operators are trying not to limit clients in this regard, not forgetting about the commission. It's worth considering all possible options.

Remember that when withdrawing money, there must be at least 50 rubles left on the subscriber account.

To a bank card

To transfer from a Beeline to a bank card, plastic from any bank is available. You can deposit money using Maestro, MasterCard and Visa. To do this, you don’t need to download special applications or look for the nearest ATM.

In particular, it is very easy to withdraw money from Beeline to a Sberbank . And there are two ways to do this.

To make a transfer using only a mobile phone, just send an SMS message to the short number 7878 with the following content:

Visa **************** 1000

Now let's decipher this code:

- Visa is a type of card. In this place you need to insert the name of your bank card (MasterCard, Maestro or, in fact, Visa);

- asterisks are the card number to which you need to transfer funds. It must be entered in full, not the last four digits;

- 1000 is the transfer amount. Here you can substitute any within the limit (from 50 to 14,000 rubles).

In addition to using your phone, you can make a transfer from Beeline to a card as follows. Go to the website beeline.ru and in the menu section “Payment and Finance” - “Money Transfers” fill out the appropriate form called “Transfer to a bank card from a mobile phone” by clicking on the “Transfer from site” button.

The official website beeline.ru is convenient because through it you can transfer money to bank cards, mobile subscribers (including other operators) and to electronic wallets. All these functions are hidden in the “Money Transfers” section.

Depending on the transfer amount, a different commission will apply. Moreover, the higher the amount, the more profitable it becomes to transfer money as a percentage:

- from 50 to 250 rubles the commission will be a fixed 50 rubles;

- from 250.01 to 730 rubles – fixed 70;

- from 730.01 to 1430 rubles – 95 rubles. commissions;

- from 1430.01 to 1880 rub. – 120 rubles;

- from 1880.01 to 3800 rub. – 230 rubles;

- from 3800.01 to 5660 rub. – 350 rubles;

- everything that falls in the range from 5,661 to 14,000 rubles is subject to a commission of 5% of the transferred amount - that is, from 283.05 to 700 rubles.

, you can transfer no more than 14,000 rubles per day to Sberbank You can withdraw the same 40 thousand per week, but only in 20 steps.

To electronic wallets

Only two electronic wallets are available for transfers - QIWI and WebMoney (ruble). There are no Yandex.Money or other options.

Again, there are two translation methods available:

- Through the website (similar to transfer from bank cards, you just need to select the “Transfer to electronic wallet” function);

- Via SMS message.

So, in order to top up QIWI or WebMoney using SMS from a Beeline number, you need to send a message to the short number 7878. The content should be structured according to the following scheme:

wm ************ 1000

Let's decipher:

- wm – service provider code (WebMoney). For QIWI you will need to enter “qiwi” without quotes;

- asterisks – wallet number. When transferring to WebMoney, you do not need to indicate the ruble wallet identifier “R”, and to Qiwi – “+7”;

- 1000 – transaction amount.

By the way, if the QIWI number matches the Beeline subscriber number, then you just need to indicate the identifier and the amount.

In this case, you can transfer money from Beeline to Qiwi Wallet without additionally entering a number - the system itself will find the right place for the money.

The fees for both wallets are different. When transferring to WebMoney, you will need to pay 8.5% + 10 rubles on top, and on QIWI - 8.95% plus the same 10 rubles.

You cannot transfer less than 10 rubles. There are certain maximum amounts:

- one-time – no more than 5,000 rubles;

- daily allowance – 15 thousand rubles in 10 transfers;

- weekly – 30 thousand rubles in 20 transactions;

- monthly – the same 30 thousand, but with 50 transfers.

Remember that exactly as much money will be transferred to your wallet as was indicated. And the commission will be debited from the subscriber’s mobile account. And this must be taken into account.

To another Beeline account

Russian Beeline does not want to provide a free service for transferring cash from phone to phone, even between network numbers. The commission is removed along with the transfer at the same moment.

You can transfer from the website (similar to all previous methods) and via SMS. The minimum payment amount is 30 rubles, the maximum is 5000 rubles. At the same time, there are no weekly or monthly restrictions - you can transfer as much as you like.

Beeline will allow you to transfer money from Beeline to Beeline using a short template. You must enter the combination #detailspan#*145*recipient number*transfer amount# #/detailspan# in the dialing window and press call. The number must be entered without “8” or “+7”. Commission – 15 rubles for any transfer.

Or you can use the method indicated in the next section to transfer from Beeline to Tele2 and other operators, but the commission in this case will be higher - 15 rubles for transfers from 30 to 200 rubles, for an amount from 201 rubles - 3% and 10 rubles additionally.

To another operator's number

Beeline does not restrict its subscribers from transferring money to the accounts of other operators. Naturally, this service comes with a higher commission than when transferring within the operator network - withdrawing money from Beeline to Megafon, MTS and Tele2 will be noticeably more expensive. The same restrictions apply.

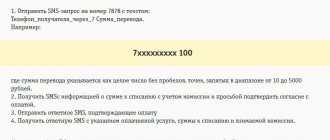

To transfer to absolutely any mobile account (including Beeline), you need to send an SMS message from your phone to number 7878 with the following content:

7********** 500

Seven with stars is the number to which you need to send money. The asterisks hide everything that comes after “+7” in the phone number. Plus there is no need to specify. The number 500 is the amount the subscriber wants to send. Then you just need to follow the instructions.

The commission for transfers to numbers of other operators will be 7.95% of the transfer amount and a fixed 10 rubles on top.

Through money transfer systems

For such a withdrawal of finances from the Beeline balance, three options are available - UNISTREAM, Russian Post and CONTACT. The first and last also allow you to send money across the CIS, and not just in the Russian Federation.

Transfer via SMS is available only for Contact and Unistream. SMS messages are sent to number 7878. You need to compose a message like this:

cont<country code> Sender's full name ********** Recipient's full name 1500 RUR

Let's break it down into components:

- cont is the service provider code. For Contact it will remain “cont”, for UNISTREAM you will need to enter “uni”;

- The country code is indicated without brackets together with the service provider code and is written only if the transfer is carried out outside of Russia;

- The sender's full name is written in Russian;

- asterisks – number and series of the sender’s passport;

- The recipient's full name is also written in Russian and in full;

- 1500 – transfer amount;

- RUR – transfer currency code. You can also indicate the recipient's currency code (hryvnia, Belarusian ruble and other currencies) and EUR (euro) if the transaction is intended for other countries. Indicated only for CONTACT

All data is entered separated by a space (except for the series and passport number, between which there is no space). Then you need to follow the instructions received via reply SMS. At the end you will receive a transfer number, which will need to be communicated to the recipient.

The same person cannot be both the recipient and the sender!

And to withdraw through Russian Post, you need to use the website, section “Payment and Finance”, item “Transfer to Russian Post”.

The commission will differ:

- To transfer within Russia through UNISTREAM and CONTACT you will have to pay 2.99% and another 10 rubles. International transfers are free;

- Russian Post will request a commission of 2.6% and an additional 50 rubles. If you order the service of delivering money to your home, the amount will increase to 4.37% +80 rubles.

The commission will be debited directly from the subscriber's account, and not from the final transfer amount.

Limits are similar to commissions and are separate.

UNISTREAM and CONTACT:

- one-time - from 100 and 1000 rubles, respectively, to 15 thousand;

- daily allowance – 15 thousand rubles, 10 transfers available;

- weekly – 40 thousand rubles for 20 transactions;

- monthly – 40 thousand rubles in 50 transfers.

Post office:

- one-time – from 1000 to 14000 rubles;

- daily allowance – 30 thousand rubles. in 10 transactions;

- weekly – 40 thousand rubles. with 20 transfers;

- monthly – 40 thousand rubles. in 50 doses.

You will need to receive money in cash at issuing points after the transfer. Russian Post will deliver money within 3-7 days, other systems – within a few minutes or hours.

ATM withdrawal

The method is convenient when you urgently need money, and a specialized ATM of an institution cooperating with Beeline happens to be at hand. In order to receive money in cash, you must complete the following procedure:

- Send a message from the phone number to 7878 with the content: RUB 100. Where 100 is the amount to be withdrawn. The number must be a multiple of 100 and not less than this amount. The maximum you can get is 5,000 rubles;

- Wait for a response message from number 8464 and confirm the payment by sending the number 1 in response. After this, the money will be immediately debited from the account, and it can only be returned by calling 7070 from the same number;

- Receive an SMS with a PIN code, which you will need to enter at the ATM along with your phone number.

The ATM must have the Dengi.Beeline logo. The following institutions cooperate with the operator: SMP Bank, Asian-Pacific Bank and BIN Bank. A list of ATMs by city in Russia is available directly on the operator’s website.

The commission is fixed – 5.95%. At the same time, you can withdraw no more than 40 thousand rubles per month. If the received PIN code was entered incorrectly into the ATM three times, you will not be able to withdraw money for 24 hours.

To Russian Post offices

Like any other type of translation, it is performed in two ways:

- From the site https://kazan.beeline.ru/customers/how-to-pay/oplatit-so-scheta/#/services/category-9, on the website or in the RURU application. To do this, fill in the sender's information: last name, first name, patronymic, passport details. For the recipient, only the last name, first name and patronymic are entered. Be careful when filling out this field, as an error will result in the recipient being denied the issuance. Next comes the index column. Here, too, it is worth maintaining accuracy, since receipt is carried out only in this department. Then you should choose a delivery method: post restante or home delivery. Payment will depend on the chosen method. Self-collection costs 50 rubles, with home delivery – 80 rubles. All that remains is to fill in the sender's number. It will receive confirmation from number 8464. Confirm the transfer - “1”, refuse - “0”.

- Via SMS to service number 7878 . The text must indicate <mail/full name of the sender/series and passport number of the sender/amount/full name of the recipient/index>. Parts of text are separated from one another by spaces. Other signs are not allowed. For example, mail Sergeev Sergey Sergeevich 3300123456 500 Petrov Petr Petrovich 159159.

The commission will be 2.6% + 50 or 80 rubles. Delivery time is from 3 to 7 days. Receipt of payment takes place at the branch that was indicated when making the transfer. The recipient will be notified about this by mail, but the sender will not receive any messages. For home delivery, an employee will come to your home during post office opening hours. If he doesn’t find you, you will have to receive the transfer at the branch or order delivery for another time.

Receipt is carried out using the passport in person by the person whose details were specified when sending. Third parties will receive cash only with a notarized power of attorney. If the money is not received within 32 days, it will be sent back to the sender and credited to the account within 10 days. Refusal of money is also issued upon application.

If an error was made in the transfer or the sender changed his mind, then the money cannot be withdrawn. Only upon written application from the addressee or failure to receive the item within 32 days.

Is it possible to transfer funds without commission?

Unfortunately, this is not possible with self-translation. The operator will withdraw the interest due to him in any case.

But there is still a way not to give Beeline money. To do this, you need to contact the mobile operator’s office directly and either permanently terminate the contract with it (in this case, you will have to be left without a phone, so it’s suitable for those who no longer need a Beeline ), or write an application for a refund of funds credited to the account by mistake.

In this case, you can get money at the office cash desk or ask for a free transfer to another phone number or bank card.

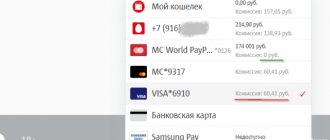

Commissions and amount restrictions when transferring to a bank card

For withdrawal from the device, an additional fee of 60 rubles is charged. for transfers up to 600 rubles and 10% for amounts up to 13,500 rubles. Moreover, if a network user wants to transfer 10 rubles, he will still have to pay a commission of 60 rubles. That is, you will have to pay 6 times more for the service. The same reward will need to be paid when withdrawing money from a phone account to a Beeline consumer number.

When collaborating with UNISTREAM, a fee of 5.95% + 10 rubles is charged. In this case, the recipient will have to visit the company branch to receive the transfer.

Through Sberbank online and in its application, the commission for replenishing the card and phone account is not taken into account. The consumer does not have to overpay.

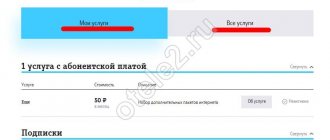

Beeline card

The mobile operator decided to please subscribers by creating a payment card. And at the same time he hung enough bonuses on it. This card can be used as the main one when paying in stores or other places where you can pay with plastic. And cashback will be awarded for every purchase.

In addition, the balance of funds on the card may attract annual interest. Therefore, it can also be used as a savings account, where the finances will simply lie, and interest will begin to drip on them.

The important thing is that with its help you can easily transfer money to other accounts through the operator’s Personal Account, as well as “draw” finances from bank cards to it. In fact, the card has functionality similar to the “Kukuruza” plastic card. All functionality is available on the operator’s website in the subscriber’s Personal Account.

Conditions for transferring funds

All methods of sending funds from a Beeline OSS mobile device to a card account of Sberbank or another financial and credit organization imply compliance with certain restrictions imposed on the user of the services. To transfer money using the required details, you must meet the following conditions:

- Have a SIM card for this OSS.

- Perform transactions only for an account containing no more than 16 digits. If there are 18 or more of them, like Maestro’s social plastic media, then payments cannot be made in any of the 3 ways.

- Comply with the maximum and minimum contribution limits established by the OSS.

- Be prepared to pay a transaction fee.

- The procedure for processing compensation for pensioners in social security

- The leaves on the pear are turning black, what to do?

- How to make soap bubbles at home

Action plan

To replenish funds on Beeline, the following algorithm will describe how to transfer funds:

- On your cell phone, dial the combination in the form ✶145✶replenishment number✶transfer#.

- In this combination, the subscriber number is entered in the format of a 10-digit number, without dialing 8 or 7 before the number.

- The transfer amount is entered in rubles.

- After sending the request, you must wait until you receive a response SMS.

- The message will contain a three-digit code.

- Next, the received code is sent to the same USSD request number *145*, which serves as confirmation of the intention to send money from your own funds to the previously specified number. The code must be sent in the format *145*code and press pound.

“Refill later” from Beeline

The ability to carry out mobile money transfers between Beeline subscribers without commission is automatically provided to all clients of the network, without requiring an additional connection. If the service is activated, in some cases you can refuse this option by sending the command ✶110✶171#. In the future, if you need to re-enable the option of transferring funds from a Beeline card, the subscriber must contact the support service at 0611.