Yandex.Money has moved to the new YuMoney website: https://money.yandex.ru/main. In YuMoney you can pay online, transfer money, order bank cards, and receive cashback. YuMoney is not part of the Yandex group of entities, is not an affiliate of Yandex, and its products and services are not associated with Yandex. Go to the Yumoni website.

Yandex.Money has moved to the new YuMoney website: https://money.yandex.ru/main. In YuMoney you can pay online, transfer money, order bank cards, and receive cashback. YuMoney is not part of the Yandex group of entities, is not an affiliate of Yandex, and its products and services are not associated with Yandex. Go to the Yumoni website.

Those who often use electronic money for work or convenience sooner or later face questions about how to transfer funds to their phone to top up their balance using Yandex Money. The ability to put Yandex Money on your phone has existed since 2013. The algorithm is quite simple. First you need to go to the Yandex website and type “Pay cell phone” or a similar request in the search, then click “Find” or just Enter.

Bankiros recommends!

VTB Bank, Lit. No. 1000

Business card Special privileges for business owners

Apply for a card

How to top up your MTS balance using debt?

MTS continues to work on developing a loyalty program for subscribers and personal services. One of the directions is to replenish your account with debt. The provider offered clients several balance management options. This is the “On Full Trust” service, when you connect to it you can use a credit limit of 300 rubles per month, installment plans and the instant replenishment function will help solve the issue of a zero balance on your phone.

"In full confidence"

This service involves the use of a credit limit for communication services, which upon connection will be 300 rubles and can subsequently be increased by 50%.

This service eliminates the need to constantly monitor your balance and top up your phone at a convenient time, while always being in touch. The credit limit depends on the average monthly expenses. Connecting to the service only requires activation; there is no fee for the service provided. Upon first activation, 120 points are credited to your account (10 days after connection). You can connect in your Personal Account on the website, using the mobile application and the command *111*32#.

For the convenience of subscribers, MTS also offers an instant credit replenishment service. This is a specialized service that is offered by many companies and has already become commonplace. With its help, you can top up your account by entering a standard command and use the service a convenient number of times when paying off your previous debt. Additionally, MTS makes it possible to arrange an installment plan for existing debt on your phone, subject to making a 20% advance payment, but it will take at least 1 day to receive this service.

You can instantly top up your balance using one of the following methods:

- top up using the command *111*123# and ;

- ask to top up your friend's account by dialing *116*(friend's number).

These services provide for the crediting of a certain amount to the phone number’s account; it can be paid at any convenient time by topping up your or someone else’s phone. These opportunities are provided on a paid basis, payment is made at the time of repayment of the debt.

To repay debts on and “In full confidence”, it is proposed to top up the balance on MTS through a bank card, electronic transfer systems or using an instant replenishment card.

How to top up your MTS Yandex account with Money

After registering with Yandex Money, you need to top up your wallet. You can do this in several ways:

- Receive funds from another user of the service.

- Transfer funds from a bank card or using another payment system.

- Top up your wallet through the terminal.

It is especially convenient to replenish your Yandex MTS personal account using the Sberbank Online application. Since Sberbank has a share of Yandex, you can make a transfer using Sberbank online instantly. To do this, you need to download the official Sberbank Online application, enter your wallet number and confirm the transfer.

Translation options

MTS subscribers have several ways to top up their phone balance using the Yandex Money service. Clients of the system do not need to have funds on their virtual wallet balance - a plastic card linked to their account will do.

If a subscriber does not have a virtual storage on Yandex Money, in order to top up an MTS phone through this system, it is recommended to create it. The wallet must be registered by following the following steps:

- log in to the Yandex Money main page;

- click on the “Create wallet” item located in the middle of the page;

- fill in the requested fields of the form;

- confirm the action;

- wait for the one-time code from SMS, enter it in the empty field.

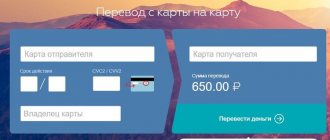

Payment from a card of any bank on the MTS website

Payment for MTS services using pay.mts.ru is quick and easy

- How can I withdraw money from an MTS phone to a Sberbank card?

Using the service https://pay.mts.ru/ you can top up any MTS phone number on the website, as well as pay for housing and communal services, communications and others from a bank card. To use the account top-up service, follow these steps:

- visit the page https://pay.mts.ru/webportal/payments/3565/;

- enter the card number and identification data;

- confirm payment if required.

Please note that it is proposed to top up MTS from a card in a secure interface, specially certified for payment services, so that the card data will only be used for one payment and is not stored by trusted systems. MTS uses its own data transmission network with implemented security services

Other operators cannot create such an infrastructure as MTS has on their base.

To avoid falling victim to scammers, when paying for services on Internet resources, carefully look at the top of the browser (site url).

As a rule, for Internet payments a secure connection is used with confirmation of the name of the organization, and on such pages you can see who owns this page/site. If, when paying on the MTS website, you see a crossed out padlock or another organization, you should be wary. Be careful.

Example of a secure MTS connection

Suspicious MTS account payment site

Via the app

The Easy Payment service has a separate application. It can be downloaded to your mobile device in a special operating system store. The program indicates the number, and authorization occurs using the received code.

In the future, you go to the appropriate item and enter all the data to complete the operation. The money is sent to your Yandex wallet, you will receive a corresponding email and a message on your phone.

Transfer money from MTS to card

What are the advantages of this option:

- There is no need to personally visit the site; the payment application is more convenient.

- The procedure will take a minimum of time.

- You confirm once and in the future you will not have to constantly go through authorization. But this fact reduces security, so you should not share the code with anyone.

- To complete the transaction, you only need your account number. You can find it on the payment system website or in the Yandex Money application.

How to link a mobile number to an electronic wallet

Users often wonder whether it is possible to perform operations with a Yandex.Money account without a mobile phone. You can, but only if you have emergency codes, which are issued only upon confirmation via SMS.

A linked mobile phone is needed not only to top up your mobile phone account, but also to restore your account if it is hacked or lost.

If you registered in the payment system before 2014, then the procedure for linking a number is similar to replacing it. Let's look at it:

- In the left vertical menu, select the last section.

- Click on the pencil to the right of the number.

- We receive the access code via SMS.

- Click “Add new number”.

- Enter the number.

- We receive the code on the new mobile phone and click the “confirm binding” button.

- The old one can be deleted by clicking on the cross on the right.

- If you click on the “Set as current” button, then all confirmations will be sent to the new one when the balance changes.

You can top up your MTS Yandex account with Money in two ways

In person on the official website, in full or mobile version

You can use a computer or smartphone for this. The mobile version of the service works great, so there will be no problems using it.

How the procedure goes:

Payment confirmation can be made in two ways:

- Through the payment password, which is entered when registering in the service.

- Using a code that is sent in an SMS message.

Payment is made without any commission. After confirmation of the payment, the amount is debited from the wallet and sent to the balance of the mobile phone. Enrollment takes place within a minute, sometimes a little longer.

Attention! The advantage is the ability to set up automatic payment.

There are also two options:

- Define the date and amount in the settings.

- Determine the balance and the amount that will be transferred when the balance is reached.

By choosing one of these options, you will no longer need to log into your wallet every time to make a payment. Money will be credited to your account automatically on the set date or when the set balance is reached.

How to transfer money from a megaphone to a Yandex money wallet?

You can also connect your bank card to your Yandex Money account. If there is no money in your wallet at the right time, then replenishment will be made from a bank card.

Via mobile application

You need to go to the mobile application store and download the application to manage Yandex Money. In it you need to find payment for mobile telephone services, then indicate the desired phone number and the transfer amount. After confirming the operation, the funds will be sent to your mobile phone.

The advantage of this solution is its ease of use and the ability to pay for mobile communication services while away from the computer.

If you need to top up MTS Ukraine through Yandex Wallet in Ukraine, then at the moment there is no truthful information related to this. The Yandex system offers to send funds only to MTS in Armenia, Russia and Belarus. Therefore, it is better to contact your telecom operator and find out whether such a transfer is possible at all. You can use another replenishment option, since residents of this country have a choice.

Through the operator’s personal account

For each consumer of MTS mobile communication services, a personal space has been created on the official website of the provider - a personal account. It is a service for monitoring and managing all options and tariff plans. It also allows you to make transfers and payments. To enter it, you will need to go through a simple registration procedure.

After completing all operations, you will be authorized and find yourself in the main menu of your personal account. Here you will see the latest statistics and balance status at the moment. To proceed to the payment procedure, click on the “My Payments” tab. A list of available services and products will appear. Find Yandex money and fill out all the specified lines, phone number and transaction amount. Confirm sending by reviewing the commission.

To link your bank card, click on the “My Cards” button and provide the details. After this simple operation, you will be able to pay for any services through your bank account. Here you can top up your MTS account via Yandex money.

Top up your balance with MTS bonuses and payment cards

You can top up your phone without spending extra money. The provider provides this opportunity through two of its products - the Cybersdacha card and the MTS Bonus program. In addition to the general bonus program, subscribers can take advantage of various promotional bonuses with preferential replenishment of funds. Typically, information about replenishment is sent via SMS.

You can top up your phone with bonuses via MTS Online or apps, as well as:

- from the MTS Bank mobile application;

- using your personal account or Sberbank card with “Thank you” bonuses;

- from a MTS Bank bank card;

- using a mobile phone;

- in MTS communication stores if you have a payment or bank card and a mobile phone.

Cyber delivery: payment for communication services with a plastic card

Cyber change

To simplify the replenishment process without the need to use a bank card, MTS developed and offered its own card product - Cyber change. This plastic card, which can be used in MTS terminals, can be ordered and received at any MTS communication store.

Paying for an MTS phone with bonuses (instructions):

- go to the website https://bonus.ssl.mts.ru/ to the “How to spend points” menu;

- then to “Catalog” and “Communication Services”;

- select the package you are interested in;

- Enter the ussd command on your phone or order a service via the Internet (for example, the “60 minutes to MTS numbers” package, 300 points – purchase *111*455*12#).

MTS bonus block in your MTS personal account on the right

Bonuses from MTS - catalog of rewards.

To top up your account with bonuses, you need to accumulate them. Find out how to do this to save on communication services and purchases.

Cash replenishment

If you plan to top up your phone account and then transfer this money to Yandex, then you should not do this. Thus, you will only lose some of your funds due to commissions. It is best to top up your wallet immediately in the terminal, which will be much easier. To do this you need to do the following:

- Find a working terminal.

- Select the “Payments” section, and then “Electronic wallets”.

- In this section find “Yandex”.

- Enter your account number. That being said, you definitely need to check it very carefully. The fact is that Yandex wallets have very long numbers, which are easy to make a mistake. Next, you must insert the money, click “Pay” and collect the check.

Under no circumstances leave the receipt or throw it away. If you made a mistake in the wallet number, then only if you have a receipt you will be able to return your funds. A forgotten check can be used by scammers who will contact support with the fact that they made a transfer to the wrong number, and in the end you will lose your funds. That is why such moments should be treated very carefully.

Transfer conditions and commission amount

Any payment transaction has certain restrictions and fees, this is required to secure the transaction. Before you begin, carefully read the features and conditions of the service:

- If you carry out the transaction on the official website of the payment service, the commission amount will be 10.3 percent, as well as an additional 10 rubles. Therefore, it is not profitable to send small amounts to your wallet; most of it will be consumed by additional fees.

- When making a transaction on the main website of the MTS company using , in addition to the main amount, 11.35 percent of the fee of the total transfer amount is charged, as well as an additional 10 rubles for completing the procedure.

- You can send no more than 15,000 rubles to one account at a time.

- Within 24 hours, the total amount must be less than 30,000 rubles.

- Within a month, you can top up your wallet with 40,000 rubles.

- During the day, the operator allows no more than 5 transaction repetitions, after which the service is unavailable.

If you analyze the restrictions, it becomes clear that transferring funds from your balance to Yandex is a rather expensive idea. And it is advisable to do it only in extreme cases. This method is suitable if you urgently need to top up your account, as well as when terminating a service agreement with a provider.

Possible problems and frequently asked questions

Question: I transferred money from my MTS account to my wallet. But the balance was never replenished. Why?

Answer: You may have entered the details incorrectly, please clarify the details. Find out whose account the funds went to and ask the owner to return them.

Question: 12 hours have passed since sending, what should I do?

Answer: It's okay, payment can take up to two business days. Due to heavy overload, your order has not yet been processed. Wait.

Question: If I send money to someone else's account, can it be returned?

Answer: Unfortunately, it is not possible. Try to negotiate with the recipient of the funds.

Question: I'm going to send 12,000, how much is the commission?

Answer: The fee is levied at 11.35% of the payment amount. When the transfer is completed, the final size will appear on the screen.

Transferring money from MTS to Yandex money is quite simple, but commission fees should be taken into account (when transferring funds from Tele2 to Yandex wallet, a lower commission is provided). Unfortunately, they are very large. But other virtual wallets have worse conditions. Choose the method that suits you and pay for services from anywhere.

You can top up your MTS Yandex account with Money in two ways

In person on the official website, in full or mobile version

You can use a computer or smartphone for this. The mobile version of the service works great, so there will be no problems using it.

How the procedure goes:

Payment confirmation can be made in two ways:

- Through the payment password, which is entered when registering in the service.

- Using a code that is sent in an SMS message.

Payment is made without any commission. After confirmation of the payment, the amount is debited from the wallet and sent to the balance of the mobile phone. Enrollment takes place within a minute, sometimes a little longer.

Attention! The advantage is the ability to set up automatic payment. There are also two options:

There are also two options:

- Define the date and amount in the settings.

- Determine the balance and the amount that will be transferred when the balance is reached.

By choosing one of these options, you will no longer need to log into your wallet every time to make a payment. Money will be credited to your account automatically on the set date or when the set balance is reached.

You can also connect your bank card to your Yandex Money account. If there is no money in your wallet at the right time, then replenishment will be made from a bank card.

Via mobile application

You need to go to the mobile application store and download the application to manage Yandex Money. In it you need to find payment for mobile telephone services, then indicate the desired phone number and the transfer amount. After confirming the operation, the funds will be sent to your mobile phone.

The advantage of this solution is its ease of use and the ability to pay for mobile communication services while away from the computer.

If you need to top up MTS Ukraine through Yandex Wallet in Ukraine, then at the moment there is no truthful information related to this. The Yandex system offers to send funds only to MTS in Armenia, Russia and Belarus. Therefore, it is better to contact your telecom operator and find out whether such a transfer is possible at all. You can use another replenishment option, since residents of this country have a choice.

Auto payment

Yandex Money account owners can set up automatic replenishment of their mobile phone balance. The procedure is configured once. When the set limit is reached, the money is debited automatically. If you link a bank card, then if there is no money in your wallet, the transfer will be made from plastic.

The setting is available in two options:

- setting the date and amount of replenishment;

- a regulated balance amount at which a certain amount will be replenished.

How to top up your MTS mobile phone balance in Russia

You can top up your mobile number in many different ways:

- cash;

- from a bank card;

- at the post office;

- in the Internet;

- using electronic wallets.

But since almost every resident of Russia is a client of one of the banking institutions, most often subscribers are concerned about how to transfer money from a card to an MTS phone.

There are also several options for replenishing your MTS balance from a bank card. The translation is easy to do:

- via SMS;

- in the terminal;

- on the bank's website;

- through the web portal of the mobile operator.

There will be no difficulties with how to top up your MTS account from a bank card online. To do this, they suggest using the Internet banking service. Or make a transfer through the website mts.ru.

There are other ways to top up your MTS account via the Internet with a bank card. For this purpose use:

- virtual exchangers;

- payment systems;

- special web resources.

For example, in Russia this is the site a-3.ru, in Ukraine – popolni.com.ua.

However, for such a service you will have to pay an additional percentage. And in order to save money, everyone would like to find a way to top up an MTS account without commission. There are also two ways to do this:

- via terminal;

- on the official MTS Internet portal.

If you don’t want to leave the house again, you should learn how to top up your MTS account with a bank card without commission using the website mts.ru. The form for transferring funds to your phone account is located on the main page of the site. Payment can be made from a Visa or Mastercard.

To do this, it is not even necessary to have a plastic carrier at hand. All you need to know is:

- card number,

- validity;

- security code for online transfers.

When you need to figure out how to top up your MTS account from a SberBank bank card, then remember the following. This is done not only through an ATM or website, but also using your phone. . And with its help they transfer money to the MTS account via SMS to number 900.

It is possible to transfer money to your phone balance not only from a bank card account, but also from electronic wallets. Let's look at how to top up MTS via WebMoney:

- Log in to your account on the online portal of the payment system.

- Go to the “Payment for services” section.

- Select the “Mobile Communications” category.

- Find an MTS operator.

- Enter the phone number and payment amount.

Unforeseen situations happen when you urgently need to find a way to top up the account of another MTS subscriber. This is not a problem when you have money on your balance. Then it’s easy to resort to and transfer finances from your number.

Of course, anyone would like to know how to transfer money from phone to phone using MTS for free. This service is provided through the web portal of the mobile operator. To receive it, you will have to register on the mts.ru Internet resource. And then resort to the “Easy Payment” service. It allows you to send funds from your balance to another network subscriber without commission.

Situations are different. And sometimes, instead of topping up your number, you accidentally send money to someone else’s phone. Fortunately, there is an algorithm on how to get your money back if you made a mistake with your MTS number. To do this, you will need to contact the contact center of your mobile operator. You can contact him:

- through the MTS website;

- by mobile;

- via a city phone number.

The instructions on how to return money from MTS are simple. You will need to fill out an application form and wait for a refund. But the funds will be returned only if the subscriber to whose number the top-up was sent has not yet had time to spend it.

Secrets of the Yandex.Money service: how to use without commission and with cashback

It is difficult to find a person who has not heard anything about the Yandex.Money service. However, many people simply do not understand why this electronic wallet is needed and what its benefits are.

An inexperienced client, when trying to use Yandex.Money, will definitely encounter all sorts of commissions: for replenishing a wallet, for payments, and also for withdrawing funds.

However, for fans of free bank cards who are accustomed to cashback and interest on the balance , using free interbank and C2C transfers , Yandex.Money can still offer something interesting.

Today we will not compile detailed instructions on how to use the Yandex.Money service; this boring information can be read directly from Yandex . The purpose of this article is to search for the competitive advantages of the Yandex.Money service (affectionately referred to in narrow circles as YAD), which would distinguish it favorably from other wallets and bank cards.

So, as it is written on the website, Yandex.Money is more than a wallet, it is a convenient online payment service, as well as a money transfer service.

UPD: 05/28/2018 The Yandex.Money service now has a “Bring a Friend” promotion. When you create a Yandex.Money wallet and order a plastic card (costs 199 rubles for 3 years) using this link, YaD will award 100 points. 1 point = 1 rub., with points you can compensate for the payment of taxes, fines, utilities, top up your Troika card, pay for the Internet, and also use them for a discount on purchases in some stores, such as Wildberries, MVideo, re:Store, EMEX and etc. A plastic card is useful for free cash withdrawal, more on that below.

GET 100 POINTS FOR THE POISON CARD

Subscribe to the @hranidengi channel on Telegram - only there is the most up-to-date information about updates, useful life hacks and other interesting things from the world of finance

Save the Money! recommends:

Yandex money. Chips

1 Payment by payment card using free details.

Through the Yandex.Money service, you can pay for various services with any bank card, without even registering or creating an electronic wallet, for example, housing and communal services, taxes (without commission), fines, telecommunications and transport services, etc.

Please note that “any bank card” with which you can pay for something through the Yandex.Money service may well be, for example, a Megafon card , in which the phone balance is equal to the card balance. You can first top it up from the desired bank, which gives cashback for paying for a mobile phone, and then pay for her services on Yandex.Money.

Something can be paid without a commission, something with a commission, you need to look at the conditions for each service of interest, each operation also has its own MCC code (you can find it out using a flagometer - the Avangard card , in order to select the optimal card that gives cashback for such transactions).

However, this will not surprise anyone. There are a lot of services where you can pay for services with a bank card, these include various Internet banks, the GosUslugi portal, websites of mobile operators, websites of service providers, etc.

However, Yandex.Money has its own trick: with the help of this service you can pay for the payment of any legal entity or individual entrepreneur, even a very, very small and unknown one, which is not available in any other online bank or service. To do this, go to the “Goods and Services” section and click on the “Receipts” icon:

Next, you just need to enter your tax identification number and other payment details:

The service commission is 2%, minimum 30 rubles, MCC code for this operation is 4900 Utilities-Electric,Gas,Water.

And for this code, “Raife” on the “Everything At Once” card or Vostochny Bank on the “Teplo” card will give 5% cashback, which covers the service commission:

UPD: 03/22/2018 When paying using free details for housing and communal services, the Yandex.Money service still shows a normal MCC of 4900, but when paying using free details for other services, the MCC will be bad.

Please note that in order to make a payment, it is not at all necessary to link a bank card to the Yandex.Money service (especially since linking, say, a credit card, threatens to leave Grace , since a test amount is debited from it, and the MCC code for debiting the test amount is completely bad).

2 The Yandex.Money service is free.

You can open a Yandex.Money wallet in a couple of minutes. It is enough to have mail on Yandex. Wallet maintenance is free, the only thing is that there is a fee for inactivity for 2 years. If you do not make a single operation using the Yandex.Money wallet, then a commission of 270 rubles per month will begin to be debited from it, but no more than the balance on the wallet, until the balance becomes 0.

There are 3 wallet statuses: anonymous, personal (you need to indicate your passport details and SNILS or INN), and identified (you need to be identified by partners). They differ in limits and range of available operations. You can store no more than 15,000 rubles in an anonymous wallet, 60,000 rubles in a registered wallet, and 600,000 rubles in an identified wallet.

When registering, I strongly recommend that you provide up-to-date information, remember all logins and passwords, and also use a phone number registered in your name. If any problems arise with the service, you will need to prove that you are really you.

UPD:08/16/2018 In order to be able to cash out 10,000 rubles/month. from a Yandex.Money wallet without commission, in addition to ordering a plastic card, you will also need to identify the wallet.

You can make your wallet identified using Sberbank Online (you need a Sberbank card with 10 rubles in an account connected by Mobile Bank and, the phone number linked to the YaD wallet and to Sber Mobile Bank must be the same ):

If identification fails, check whether the data specified when registering Yandex.Wallet matches the real data specified in Sberbank. Also very often clients forget to connect.

3 Free virtual card.

The Yandex.Money service allows you to issue an absolutely free virtual card.

Just click on the “Get card” button (in the “Bank cards” section in Yandex wallet):

The release of the virtual card takes a couple of seconds, after entering the confirmation password, the YaD service tells us our card number. The CVV and card expiration date are sent via SMS (the virtual card is valid for 1 year):

A virtual card can be useful if you want to pay on some site and not show the details of your non-virtual card. After making the payment, you can immediately close the card:

The YaD virtual card can be linked to Apple Pay or used for NFC payments on Android; in this case, a plastic YaD card is not needed (issuing a non-virtual Yandex.Money card costs 199 rubles, the service is free).

The virtual machine is useful for withdrawing money through mobile operators; with its help, you can top up your mobile phone balance on the operators’ websites, thereby significantly expanding the limits.

Let me remind you that the Yandex.Money service itself allows you to top up your mobile phone for free only in the amount of 5,000 rubles per month. for each Big Three operator:

to steal money from the YaD virtual machine for free.

4 You can receive payments online to your Yandex.Money wallet.

There are a huge number of different cashback services and discount sites, referral programs and affiliate services, etc. on the Internet. As a rule, these services do not provide the service of withdrawing honestly earned money to a bank account, but they do withdraw it to the Yandex.Money e-wallet.

For those who receive some money on the Internet, the Yandex.Money wallet will be a good addition to the QIWI wallet, WebMoney, etc.

5 Yandex.Money can be withdrawn with a minimum commission.

Withdraw money from your Yandex.Money wallet directly, i.e. by cashing at an ATM from a plastic YaD card or by withdrawing it from it, by transferring to a bank card, to the bank account of Alfa-Bank, Promsvyazbank or Tinkoff Bank - not a good idea, paying a commission of 3%+15 rub., minimum 100 rub., or just 3% - this is not for us:

● Poison can be withdrawn to an MTS Bank card with a commission of 1.5% . The scheme is simple, we top up the balance of the MTS mobile operator on the MTS website using a Yandex.Money virtual card (if you have a non-virtual one, you can use that too). The Yandex.Money service itself is also suitable for replenishment (even without a virtual card or plastic card), but there the monthly limit for such commission-free transactions is only 5,000 rubles/month.

Next, go to the “Financial Services and Payments” section on the MTS website, select “MTS Money Wallet” there:

In the “MTS Money” wallet, go to the “Transfer to card” section:

Now all that remains is to enter your MTS Bank card number (in this case, the MTS Money card was used, about which you can read in detail in the article “MTS Money Card, 3% cashback on everything: to take or not to take” ) and indicate the required amount, the commission will be 1.5%:

We enter the password from the SMS, and the system reports that our transfer was successful:

Test 550 rubles to bank account. arrived the next day:

The cheapest card in MTS Bank is the MTS Smart Money card. Its service is free for MTS subscribers; you will only need to pay for the issue (199 rubles). You can read more about the MTS Smart Money card here .

UPD: 03.22.2018 There is no official document on the MTS website in which one could find out the limits for withdrawing money from the balance of an MTS phone to an MTS Bank card with a commission of 1.5% through the MTS Money wallet.

However, the support service does not hide this information at all; the maximum transfer amount from one phone number to a card is 14,999 rubles, the daily limit is 30,000 rubles, the monthly limit is 40,000 rubles. You can make no more than 5 such payments per day. By day we mean a calendar day, by month we mean a calendar month.

After the transfer, there should be at least 10 rubles left on your phone.

UPD: 11/15/2018 As of 11/15/2018, the commission for transferring funds from an MTS mobile phone to an MTS Bank card through the MTS Money service is 0.9%.

UPD: 04/18/2020 As of 04/18/2020, the limits for payment for mobile communications are as follows:

● Yandex.Money can be withdrawn using a Megafon card with a commission of 1.99% . This scheme is also not particularly original; to implement it we will need a Megafon bank card . On the website of the mobile operator Megafon, you can top up your Megafon balance using a virtual or regular Yandex.Money card without commission.

And then all that remains is to withdraw money from the Megafon card (the balance of which is equal to the balance of the mobile phone) to the card of another bank, which can freely withdraw money to its cards from cards of third-party banks (for more information about free C2C transfers, read the article “Card2Card: How to transfer money from card to card for free .

In principle, you can not withdraw money from your Megafon card to another card, but make purchases with it and get a good cashback. For example, in my region, by paying with a Megafon card, you can currently get 10% cashback at the RIVE GAUCHE store, 11% cashback at the Neopharm pharmacy, 20% on your first purchase at Vkusville, 5% at gas stations "EKA":

Promotions are constantly changing, you can wait for the right one. If you make at least one purchase per month using a Megafon card (replenishing your Megafon balance also counts), interest is charged on the balance over 500 rubles, now it is 8%. Megafon has constant problems with cashback payments; you have to kick them to get your money, but they are trying

● Withdrawal of Yandex.Money without commission by returning goods . The scheme is quite dirty, but simple. You need to first buy something unnecessary, and then sell something unnecessary and return it. The main task is to find a retail outlet that will agree to make a refund not to the card with which the purchase was made, but to other details, or return the money in cash.

Thus, Yandex.Money simply does not know that you have received a refund for the goods, and payment for purchases at merchants using a Yandex.Money card is carried out without commission.

UPD: 04/25/2018 The Yandex.Money service now allows you to withdraw cash from ATMs from your personal plastic cards up to 10,000 rubles/month. no commission. The wallet to which the card is linked must have the status “identified” ( identification can be done for free through Sberbank-Online or for 300 rubles in any Euroset or Svyaznoy store). The same limit also includes commission-free withdrawal of poison from registered plastic using third-party services:

It is worth noting that this is not some kind of temporary promotion; this opportunity will be specified in the tariffs:

By month we mean a calendar month:

UPD: 12/01/2018 From November 22, 2021, the limit is 10,000 rubles/month. for free cash withdrawal at ATMs or by pulling an identified wallet from a personalized Yandex.Money card applies to the passport, not the wallet.

UPD: 12/13/2020 In the Yumoney service (formerly Yandex.Money) you can now issue a free virtual “Cyberpunk” card valid for 3 years.

Unlike a regular virtual card, from this card, like from a plastic card, you can withdraw 10,000 rubles per month without commission. at any ATMs with NFC (using Apple Pay, Samsung Pay, Google Pay), if the wallet has the “Identified” status.

In other words, you can save 499 rubles. If you order a regular plastic YuCard, the Cyberbank virtual card has the same functionality.

UPD: 02/05/2021 If you try to steal from a personalized plastic card YuMoney or a Cyberpunk card, while having an identified wallet, a commission will be drawn, regardless of the limits. In fact, it will not be written off unless the limit of 10,000 rubles/month is exceeded. (it is common with cash withdrawal at an ATM). Yandex.Money (now YuMoney) specialists have been promising to correct the incorrect display for almost 2 years:

6 You can top up your Yandex.Money wallet with cashback.

There are many ways to top up Yandex.Money, both with and without commission:

However, we are interested in ways to replenish Yandex.Money not just without commission, but also with cashback. To do this, we will need a terminal or ATM of Sberbank, where you can top up the poison without commission from any card:

The MCC code for this operation is 4814 (there are exceptions, you need to check the specific terminal), for which some banks award cashback. “Corn” is just one of them.

UPD: 04/18/2020 This method no longer works; when you top up your Yandex.Money wallet at Sberbank ATMs, you will be issued an MCC 6012 R, for which banks do not give cashback.

You can top up your funds with cashback by monitoring reliable exchangers . For example, at a specific moment of observation, 1000 rubles. in the Sberbank Internet bank it was possible to exchange for 1005.4 rubles in Yandex.Money (which corresponds to a cashback of 0.5%):

1000 rub. on the Tinkoff Bank account could be exchanged for 1010.2 rubles. in Yandex.Money (i.e. 1% cashback):

7 Cashback for paying with Yandex.Money.

UPD: 09/04/2018 The Yandex.Money service launched a very tasty promotion “Bonus points for payments and purchases”. In September, for purchases using a Yandex.Money card in offline stores with MCC 5411 (this code is available in the chain supermarkets Pyaterochka, Dixie, Auchan, Perekrestok, Magnit, etc.) you will receive a 5% cashback points. For every fifth offline purchase (exceptions and purchases in supermarkets are not taken into account), YaD will also award 5% cashback points. Before making purchases, you need to join this promotion on the page money.yandex.ru/loyalty/ by clicking on the “I want to start” button.

The promotion is also valid when using Samsung Pay, Apple Pay and Google Pay:

For online payment using a wallet (including using a linked card) or a YaD card, you get 1% cashback. The monthly point limit is 2000. It is important that in order to receive 5% cashback next month (in which category is not yet known), you need to spend at least 1000 rubles using Poison during the current month. Otherwise, the interest rate will drop to 0.5%:

UPD: 03/19/2019 On March 16, 2021, the Yandex.Money service updated the points cashback program, or rather, worsened it. Now you can pay with points no more than 50% of the cost of the product (previously you could pay the full price, with the exception of 1 ruble).

Also, do not forget about another unpleasant point of the rules, which was also in previous editions: the right of the service to set the minimum amount of points that can be used to pay for a particular product or service. In other words, nothing prevents Yandex from making it possible at any time to compensate for a purchase with points only if, say, 1000 points are written off. So far, however, YaD still does not use this right.

UPD: 06/08/2019 In the terms of the bonus program, the wording about the possibility of compensating only 50% of the purchase with points was missing, but it states that “NPOs have the right to establish a different maximum and/or minimum amount of Points that can be used to pay for the Goods.” In practice, the same 50% remained:

UPD: 10/08/2019 There will be no cashback for a purchase for which part of the cost was compensated with points.

Now you can choose the cashback option for offline purchases: either receive 5% cashback on your fifth purchase (but it should not exceed the amount of all previous four purchases without cashback), or 1% cashback on each.

Cashback in certain categories is valid when choosing any option.

UPD: 12/03/2019 In December, YAD is offering 5% cashback for offline payments using a Yandex-Money card in the categories: ● Bars and nightclubs (MCS 5813 - a very rare MCC, almost elusive); ● Cinemas (MCS 7832); ● Theaters (MCS 7922).

UPD: 02/05/2020 The Yandex.Money service began to offer individual categories for 5% cashback on its cards:

Judging by the reviews, most clients still have the same categories: “Gifts”, “Flowers” and “Jewelry” (I have exactly the same ones). True, some are luckier:

8 Yandex.Money can be exchanged for other currencies.

By monitoring reliable exchangers, Yandex.Money can be profitably exchanged for other currencies. you could exchange Yandex.Money for dollars from the international Payeer system

For comparison, it was possible to exchange rubles from an account in Alfa-Bank to Payeer at the rate of 60.1804 rubles for 1 Payeer USD:

9 Free transfers in the mobile application.

In the Yandex.Money mobile application, you can transfer money to another Yandex wallet without commission (if you do this not from the mobile application, the commission will be 0.5%):

This feature will be very useful if, for example, you need to transfer money to some freelancer or repay a debt. Saving a little by being able to replenish your poison with benefits never hurts.

Please note that in order to send or receive transfers, you need to provide personal data in the service (transfers from anonymous wallets do not work):

10 Yandex.Money as a way to raise funds for Internet services.

Quite often, POISON is one of the most accessible and profitable ways to transfer your money to some Internet site, especially a foreign one.

For example, you need to top up your account in the Cryptonator crypto wallet to buy bitcoins, litecoins and other cryptocurrencies.

If we want to do this using a bank card, we will have to pay a commission of 3.9%:

But for Yandex.Money the commission is lower, and is already 2.9%. In addition, do not forget that POISON can be replenished with cashback:

You can read about other ways to buy cryptocurrencies in the article “How to buy cryptocurrency on an exchange: Bitcoin, Litecoin, Ethereum .

11 Top up your mobile phone from 5 rubles.

Using the Yandex.Money service, you can top up your mobile operator balance with any bank card from 5 rubles:

When choosing to pay with a bank card, you can check the “Link a card” checkbox (in this way you can even link a credit card or a Megafon card, for example, to the poison. There will be no departure from Grace and no fine for replenishing an electronic wallet, as with the usual linking of a card “on the spot” ):

The MCC for this operation is quite decent, 4814 Telecommunication Services:

Although in reality there are very few benefits from “tying” the card to the wallet:

The ability to top up your mobile phone balance by 5 rubles will be useful if you need to make some purchase using your card from another bank to receive interest on the balance or cashback (on a RIB card , for example). Or if you need to top up your non-main phone number with a small amount (which you, for example, use to receive one-time passwords from online banks) so that the silence fee .

UPD: 12/28/2020

12 Free transfers through SBP.

In the YuMoney mobile application, it has become possible to make outgoing transfers through the Fast Payment System without commission (from an identified wallet). Daily limit is 3,500 rubles, monthly – 100,000 rubles:

UPD: 03/08/2021 Following Yumoney, it has become possible to withdraw money without commission through the Fast Payment System from the Qiwi Wallet (the daily limit here is the same: 3,500 rubles/day, monthly – 100,000 rubles). Before making such transfers, you must first connect them (in your “Profile”, go to “Settings” and in the “Fast Payment System” section, move the slider to the right).

To send transfers, you need to go to the “Payments and Transfers” section, find the “Money Transfer Systems” section in the long list there, and only then click on the “Fast Payment System” item).

13 Possibility of subscription.

It is now possible to subscribe to your YuMoney wallet for 69 rubles/month. (first month free) to expand capabilities. With a subscription, the limit for free cash withdrawal from a personalized card of an identified wallet will increase to 45,000 rubles. (instead of 10,000 rub.). Cashback for payments by wallet in monthly categories will be 10% (instead of 5%), for the rest - 2% (instead of 1%). Fees for paying fines and housing and communal services will be waived. Details can be found here :

Conclusion As you can see, the Yandex.Money service is not so useless. Any loopholes can be closed, but you can always find new options on your own if you know where to look.

Any loopholes can be closed, but you can always find new options on your own if you know where to look.

Don’t forget about the “Refer a Friend” promotion; when you create a Yandex.Money wallet and order a plastic card using this link, YaD will award 100 bonus points, equivalent to 100 rubles.

GET 100 POINTS FOR THE POISON CARD

The main disadvantage of using any electronic wallet is that the money there is not insured by the DIA, and if the license of an NPO is revoked, you are not entitled to insurance up to 1.4 million rubles. However, in the case of NPO Yandex.Money, I think this risk is minimal, since almost 75% of NPO Yandex.Money LLC belongs to Sberbank:

You can find many reviews online that Yandex.Money blocks wallets due to Federal Law 115 or allegedly due to security reasons:

This risk can only be reduced by identifying yourself in the system and reducing the number and volume of questionable and suspicious transactions .

Oh yes, I almost forgot about another useful feature of Yandex.Money. This service helps us receive chocolates from you , for which we thank you and him very much :)

I hope my article was useful to you; write about any clarifications and additions in the comments.

You can follow updates in this and other articles on the Telegram channel: @hranidengi .

Due to the blocking of Telegram, a channel mirror was created in TamTam (a messenger from Mail.ru Group with similar functionality): tt.me/hranidengi .

Subscribe to Telegram

Subscribe to TamTam

Subscribe to stay updated on all changes :)

comments powered by HyperComments

Use of MTS resources

An equally popular way to top up your MTS account with Yandex.Money is to go to the provider’s page and carry out the same payment transaction as on the YaD website. Its advantage is that there is no need for authorization in any of the systems. The steps to replenish your account are approximately the same as when using a Yandex account:

- Open the MTS page;

- Go to the “Payment for goods and services” section in the menu on the left;

- Select the “Mobile phone” item and the “MTS” sub-item;

- Go to the menu for replenishing your MTS account from a card (the method is suitable not only for Yandex.Money, but also for any payment instrument issued by electronic services or banking systems);

- Specify the replenishment amount, phone number and payment card details;

- Wait for your account to be replenished.

Using this replenishment method involves a complete absence of commission fees. However, there are restrictions (the amount must be within 100–15 thousand rubles). By topping up your account with fairly large amounts (from 400 rubles and more), you can receive bonuses for the purchase of accessories for mobile phones.

In the name form, you must enter information in the same form as it appears on the payment card. If the owner's last name and first name are not listed here, you do not need to enter any information. It should be noted that replenishment will not be possible if the owner of the Yandex.Money e-wallet does not have a card linked to it (see Activating a Yandex.Money card). Therefore, all clients of the YaD and MTS service who want to use this method should either order a new means of payment (and, accordingly, undergo authorization in the system, which is required to obtain a personal status), or link an existing one to the YaD account.

How to top up MTS with YaD through third-party services

If for some reason the methods of transferring money from Yandex.Wallet to an MTS phone using the services of a mobile operator and payment system are not available (technical problems on the website, etc.), you can use the services of other services.

You can find them using generator sites. And in order to transfer money from YaD to MTS using such sites, you just need to indicate the telephone operator, number and transfer amount. The transfer fee is usually higher compared to the services of Yandex.Money websites and telephone providers, so you should use third-party services only as a last resort.

Top up your phone from the Yandex.Money website

One of the easiest and most profitable ways to top up MTS from a Yandex.Money bank card is to use the built-in functions of the payment system. To do this you need to do the following:

- Log in to the Yandex.Money website;

- Go to the “Popular services” item (the icon resembling a bag, immediately below the payment history);

- Select the mobile phone replenishment section;

- After a new window opens, find the MTS operator in the list of several dozen providers;

- Enter the phone number and transfer amount;

- Make sure that the number is entered correctly and select “Pay” (see Refunds from Yandex Wallet);

- Wait for the funds to arrive in your account (see Payments in Yandex.Money: processing, control, cancellation).

The average time for money to arrive on an MTS card is only a few minutes. And the amount of the commission fee is 3 rubles, regardless of the size of the transfer.