Tinkoff Mobile is a unique mobile operator that has won love and demand among users from the very moment it appeared, or rather since the end of 2021. An excellent new development in most of its features.

Let us dwell in detail on the main advantages of this mobile operator:

- You can use only the most necessary services. This is a great way to save money. Any subscriber will be able to create a tariff himself, adding a package of minutes, SMS, and Internet if necessary.

- No roaming in the Russian Federation. You can make calls from one area to another and share news at a standard cost.

- The ability to independently change the tariff conditions.

- Affordable price for international calls.

- You can transfer funds from Tinkoff Mobile to a Tinkoff card and to other wallets.

It is necessary to consider in detail how to withdraw money from Tinkoff Mobile. This question may be of interest to the majority of clients of this mobile operator and subscribers who want to join the use of its services.

Methods for transferring money from Tinkoff Mobile to a bank card

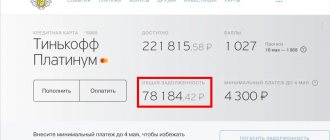

Tinkoff Bank provides clients with more than just traditional financial services. He is the owner of the cellular operator Tinkoff Mobile. When receiving a SIM card, a special virtual debit card is simultaneously opened for the client. The amount of money on it is equal to the phone balance.

If clients of this mobile operator have unused funds in their account, they can be withdrawn to:

- Tinkoff or other bank card;

- virtual wallet.

Telephone translation is also available.

Two-step transfer: to a Tinkoff card, then to a card of another bank

There is no direct withdrawal of money to accounts in other financial institutions for the payment instrument in question. This complicates the procedure and increases the number of steps:

- You need to go to the website and open your “Personal Account”.

- Click “Home”, then “Tinkoff Mobile Card”.

- Select the “Top up” or “Pay” items.

After this, they move on to the second stage.

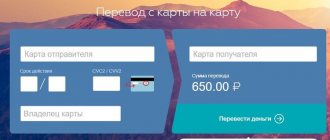

Through your personal account

This service allows you to obtain information on your credit and debit cards and send funds to a client of another bank. It is easier to use than the application, since you can log into your “Personal Account” on the official website not only from your phone, but also from your computer. To transfer money you need:

- Go to the "Payments" tab.

- Select “Transfers”, then “Card to Card”.

- Specify the account from which funds will be sent.

- Enter the recipient's card number.

- Enter the amount.

- Click the “Translate” button.

Through the application you can send up to 100,000 rubles per day, and using your personal account - no more than 150,000.

To an electronic wallet

As an alternative, you can withdraw funds to one of the electronic wallets, including:

- Yu.Money (Yandex.Money);

- WebMoney;

- QIWI Wallet;

- Rapida Online;

- MONETA.ru;

- ONPay.ru;

- SpryPay.ru.

The money transfer is carried out from the website of the selected payment system or from the official website of Tinkoff Mobile, where the procedure is as follows:

- in the “Payments” tab, select the “Electronic wallets” section;

- The required payment system is selected from among the wallets;

- In the field that opens, enter the wallet and virtual card details.

Considering that Tinkoff Bank carries out this procedure free of charge, the costs depend solely on additional commissions charged by the supplier.

How to transfer money from Tinkoff Mobile to your phone

Funds can be sent to a subscriber of either your own or someone else’s cellular operator.

To another network subscriber

This operation can be carried out through the application or “Personal Account”.

In the first case it is necessary:

- Go to the “Pay” tab.

- Select the menu item “Translations”, and then “People”.

- Click the “By number” button.

- Open your contact list or enter the 10 digits of the recipient's phone number.

- Enter the amount.

- Select "Translate".

In the “Personal Account” the algorithm is similar. The only difference is the name of the first tab “Payments” instead of “Pay”.

Other operators

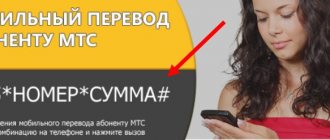

Payment can be made to a client of another mobile phone, MTS, Beeline or Megafon.

You can transfer money from Tinkoff Mobile to another operator using the same algorithm that is described for a subscriber in your network, but only through the “Personal Account” if you have a virtual account. This cannot be done through the application.

To another phone

Another way to withdraw funds from your phone account is to transfer them to another phone number of a similar or different cellular operator.

The ability to top up phone numbers of other operators is available through a virtual card. And in case of a transfer, a Tinkoff Mobile subscriber will not have to use a virtual card. The service is provided through the company's mobile application. The path for transferring money includes a step-by-step transition from one tab to another, namely: “Pay – Transfers – People – By number”. After selecting from the list or manually dialing a number, press the “Transfer” key.

Since the introduction of a system for linking a SIM card to a virtual bank card by Tinkoff Bank in 2021, every year there are more and more ways to withdraw money from a telephone account. And the company is unlikely to stop at the listed resources, although the current state of affairs opens up extensive opportunities for users.

Limitations, fees and terms for crediting funds to the account

The bank has set the following limits for transfers:

- transfers from debit to other cards of the same client - without any restrictions on the amount and number of payments;

- one-time transfer – no more than 100,000 through the application and 150,000 in the “Personal Account”;

- maximum – 10 transfers per day.

The commission fee is:

- to your own card or to a Tinkoff client – free;

- up to 20,000 using the services of another bank - no commission. For a larger payment - 1.5 of the amount exceeding 20,000 rubles.

The money will be transferred to the Tinkoff card instantly, and the transfer to another bank will take up to 24 hours.

Tinkoff fast payment system, limits, commission

The main advantage of SBP is the absence of additional fees for transactions with debit cards. For transfers from a Tinkoff credit card, a fee is charged according to the issuance program.

The limit on transferring funds without commission through the Fast Payment System at Tinkoff Bank is set at 1.5 million rubles per month. At the same time, no more than 150 thousand rubles can be transferred for free in one transaction.

- Domestic banking clients by phone number or bank card number.

- For clients of other banks by card number.

- For clients of other credit institutions with full bank account details.

- To your own ATMs with receipt via SMS code and passport data.

How to transfer a number to Tinkoff Mobile

First you will need to purchase a SIM card from this operator, download and log into the mobile application:

- Click on the SIM card icon.

- In the drop-down menu, select the “Transfer your number” tab, then “Continue”.

- The client is sent an SMS with a code. You will need to enter it in the appropriate field and click “Submit”.

You will also need to fill out an application for number porting at the Tinkoff office.

All about the mobile operator Tinkoff Mobile

- Conditions: the same as the previous promotion

- Dates: The promotion is valid until June 30, 2021

Stock

Rates

New technology that eliminates the current plastic SIM cards due to the built-in chip in the phone. In general, this is very cool and modern and you don’t even need to leave home to change your telecom operator, but, alas, there are very few smartphones that support eSIM:

Beeline:

700 rubles per month for 700 minutes, 30 GB of traffic + unlimited messengers and 300 SMS.

Connection Guide

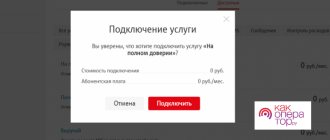

In order to enable SBP in Tinkoff Bank, you need to log into your account. The action can be performed using a computer or through an application. Login to your personal account is carried out using your phone number. The system checks the entered data and sends a password for authorization.

If the user is not in the Tinkoff Bank database, then you need to check that the phone number is entered correctly or leave a request to connect to the mobile bank.

Connecting from your phone

Initially, the user needs to open the application and log in to the system. Then you need to go to the “More” > “Settings” > “Contacts and Transfers” section. After this, you need to switch the toggle switch opposite the “Fast payment system” tab and click the “Connect” button. An SMS with a transaction confirmation code will be sent to your phone number. If necessary, the user can immediately synchronize contacts.

On a note! If there are 2 or 3 cards, the user can give priority to one of them. As a result, all money transfers through SBP from Tinkoff Bank cards and other organizations will be transferred to the specified means of payment. You can select a card at the stage of connecting to the service.

Connecting from a computer

To connect to the online service, you need to log in to the Tinkoff Bank website. Then select the “Settings” > “Basic Settings” section. After this, you need to switch the toggle switch opposite the “SBP” tab and confirm the action using an SMS code.

How to transfer money from a computer

Monetary transactions are carried out on the Tinkoff Bank website. Account owner procedure:

- We go to your personal account.

- Select the section “Payments” > “Transfer” > “By phone number”.

- We indicate the phone number of the recipient of the money. If necessary, write a text message.

- Enter the transfer amount. By default, the system uses the customer's priority card.

- Click the “Translate” button.

Transfer by phone number

Account holders can make intra-bank or inter-bank transfers. To do this, you need to know the recipient's phone number and the name of the bank where he has an account. All operations can be carried out using the mobile application.

To a client of a partner bank

Citizens can transfer money through SBP in two ways - using an application or using a personal computer.

Account owner procedure:

- Open the application.

- Go to the section “Payments” > “Transfers by phone” > “By phone number”.

- Select a subscriber from the phone book or enter his number.

- We indicate the name of the bank from the proposed list.

- Enter the required amount.

- Click the “Translate” button.

If the desired financial organization is not in the selected list, the cardholder needs to click on the “Other Bank” tab.

If the recipient is not connected to the SBP, then when sending money to his bank card, a commission may be withheld.

If you wish, you can send money to the account the recipient chooses. To do this, go to the “Payments” section > “Transfers by phone” > “By number...”. Then you should enter your phone number and select the “Send link to receive money” tab. Next, enter the amount and click the “Done” button.

The bank will send a short message to the recipient. It will contain a link to a page for entering bank card details. Transfers up to 20,000 rub. are done for free. If the limit is exceeded, a commission of 1.5% of the payment amount is withheld, but not less than 30 rubles.

To the Tinkoff client

The procedure for sending money within the bank is the same. The card owner needs to open the application, go to the “By phone number” tab, select the subscriber from the phone book, indicate the name of the bank, the transaction amount and click the “Transfer” button.

On a note! Intrabank or interbank money transfers using a computer are carried out according to a similar scheme. The money is credited to your account instantly.

Which mobile banking card is the best?

Best Banking Apps of May 2021

| Bank mobile application | Great feature | Next steps |

| Capital One | No foreign transaction fees | Learn more |

| Charles Schwab | No ATM or foreign transaction fees | Learn more |

| chase | Branches and ATMs | Learn more |

| Chime * | Early Direct Deposit | Learn more |

Reviews about the bonus program

Based on existing reviews, Tinkoff Bank clients mostly approve of the program. Problems arise in two cases:

- Points are being credited incorrectly.

In some cases, purchases are mistakenly classified as not earning points. The program is still being improved, so errors like this are understandable. Bank employees are aware of the problem, so they invite anyone who has it to contact the support service and provide a receipt for the purchase. After this, points will be credited in the required amount. - Nowhere to spend it.

Not all card users need to travel somewhere by train or regularly visit cafes/bars/restaurants. At the moment, it is not possible to solve the problem, however, the bank is actively working to expand the partners of its bonus program. As a result, for now you can simply accumulate points and wait for new opportunities to spend them.

FAQ

No. 1. What is a priority card?

Each bank client can have more than 1 card. When connecting to the service, the user can specify a specific payment instrument that will be used to deposit money (by default). You can activate the service while linking your bank card.

No. 2. How are transfers made in euros or US dollars?

Transactions with foreign currencies are not yet available to users. Transfers can only be made in Russian rubles.

No. 3. If a person has not connected to the SBP, can he make a transfer?

Tinkoff Bank clients can send money to other users within the system or to any other bank. However, a fee is charged for payments outside the SBP.

No. 4. What does payment by QR code give?

Using a matrix barcode, citizens can pay for goods and services purchased from individual entrepreneurs or other business entities.

Conditions for making transfers within the SBP

First you need to check whether the bank is a member of the fast payment system. Information on all financial organizations is available on the SBP website. The user needs to go to the “Participating Banks” section and use the search bar. The search for a specific organization is carried out by the name “Tinkoff”. If the bank is connected to the service, the system will display it in the search results.

After this, you can connect to the SBP project. To do this, you need to go to the bank’s website – https://www.tinkoff.ru/mobile-operator/login/. You can log in using your phone number.

To use the service on your smartphone, you need to download the Tinkoff Mobile application. This can be done by scanning the QR code on the Tinkoff Bank website or in the Google Play store. The application for an Android smartphone is available at the link – https://play.google.com/store/apps/details?id=ru.tinkoff.mvno.

After this, the user needs to click the “Install” button and wait for the program to download to his phone.

The next stage is connecting the SBP. After this, you can start using the payment service as needed.

Advantages and disadvantages of Tinkoff SBP

Advantages of the service at Tinkoff Bank:

- Instant transfers within the system.

- To send money, all you need is a phone number and bank name.

- No commissions on transactions up to RUB 150,000. at once.

- You can make transfers not only on a smartphone, but also using a PC.

- 24/7 access to the payment system.

Tinkoff has automated connecting stores to the fast payment system. The service allows entrepreneurs to instantly receive payment for goods using a QR code.

The disadvantages of SBP include the inability to make transfers in foreign currency. However, this applies not only to Tinkoff Bank, but also to other participants in the project.

Phone versions for accessing SBP functionality

The device version depends on the type of mobile application and the OS used. Tinkoff offers several software products to its clients. Let's look at three applications:

| Name | Tinkoff Mobile | From card to card | Government debts |

| Phone version | Android – 5.0 and higher iOS – 12.0 and higher | Android – 4.1 and higher iOS – 11.0 and higher | |

| Mac – 11.0 and above | |||

Conditions and nuances of funds transfer

In order to safely use the option of transferring funds from a Tele2 account to other numbers within the network, as well as numbers of other operators, you need to know all the details and conditions. We present the most important of these below:

- Transfer to numbers of other Russian operators is available exclusively for Tele2 subscribers who registered on the network no earlier than 60 days before the transaction;

- After making the transfer, there must be an amount of at least 10 rubles left in the account;

- The transfer amount should not exceed 1000 rubles for transfers to other Russian operators;

- When transferring to other mobile operators, the amount should not be less than 10 rubles.

Which bank has the best banking app?

And you can log in securely through your phone using your fingerprint.

- Ally Bank: The best mobile banking app for customer service. ...

- Bank of America: The best mobile banking app for security. ...

- Varo: The best mobile banking app for money management. ...

- Wells Fargo: The Best Mobile Banking App for Monitoring Investments.

10 Feb 2021