To activate the limit, any MTS client must familiarize himself with certain conditions that must be adhered to before activating the service. To do this, the user must top up his personal account. It is also necessary to have a SIM card that was purchased no earlier than 3 months ago. Over the last month, at least 200 rubles should have been received into the main account.

When the subscriber is convinced that all conditions have been met, then you can start connecting the credit limit. It is worth noting that at a certain period of time this service was connected to everyone automatically, but now to do this you will have to independently perform a number of the following actions:

- Visit your personal account on the official website of the mobile company MTS. To do this, you will have to authenticate by entering your username and password. If the user has not registered in advance, you will need to click on the password button on the main page of the site. Within a few minutes, an SMS notification will be sent to the subscriber’s number, which will contain a unique security code for registration. After introduction, you can proceed to activation.

- Call the hotline to the technical support department at 8800 250 0890. Next, you need to ask the operator to activate the service and dictate personal data for verification. This feature should automatically activate within a few minutes.

- Contact the nearest MTS service center for help, and then provide the organization’s employee with your passport and phone number. In this case, the connection is also instantaneous.

Transferring funds from your phone account to your card

In the modern world, almost any virtual account (electronic wallet, cell phone balance, bank account, etc.) can be linked to a bank card in order to make necessary financial transactions from anywhere where there is Internet access. The opportunity provided by MTS to transfer funds from a mobile phone balance to a card is the beginning of the creation of a full-fledged payment system.

Often, subscribers of a mobile operator need to withdraw either the unused balance of funds or the missing amount for a purchase. The main disadvantage is the higher commission compared to other transfer methods. This service allows you to use your cell phone balance as an additional payment system. To withdraw funds, MTS has provided several methods:

- through the official website of the operator;

- via SMS messages and USSD commands;

- through a mobile application.

Users have the right to choose any method convenient for themselves; the company does not set any restrictions on this. The only condition is that the service allows transfers only to Visa and MasterCard cards. For the convenience of users, transfer operations do not require filling out numerous details of the parties. Upon termination of the contract with the company, funds from the balance can be withdrawn in any convenient way, including to a current account or card.

Attention!

When making transfers from a mobile phone balance to a bank card, it is important to remember that this is a paid procedure. To avoid unforeseen situations, be sure to take into account the size of the commission, as well as the established restrictions and requirements.

Description of MTS

MTS has come up with a truly useful function that can provide insurance at any time. Firstly, it can be used in emergency cases, for example, when a subscriber needs to call but there is no money in the personal account. It is worth noting that the credit limit, upon activation, will remain the same amount as it was during its last deactivation.

However, this service also has a downside that can turn against the user. For example, if the phone is stolen by an attacker, then the personal account may drop to the maximum minus. We also must not forget that attackers are able to attach various paid subscriptions to a stolen number, which will result in large debts in the name of the owner of the stolen phone.

To find out your own balance in the credit limit, you need to use a special USSD request - *123# . During this operation, the operator will notify the user about the amount of funds that can still be used.

How to make a transfer to Visa and MasterCard?

MTS works with all Visa and MasterCard cards of the most popular banks, so the transfer procedure is no different from the standard operation. To transfer, you must perform the following steps:

- Open the MTS website.

- Log in to your personal account.

- Click on the “MTS Money” tab.

- Select "Transfers" and "To card".

- In the window that opens, fill in the required fields.

- Enter the card number for crediting funds and the phone number from which they should be debited.

- Click "Pay".

- Confirm the action with an SMS code.

To find out whether your bank is supported by the service, click on “MTS Money”, “Transfers”, “All transfers”. You will be taken to the “Transfers and Payments” tab that opens. Here you need to click on “Banks” and see which institutions are available for transactions. You can also transfer money to a bank account. To do this, find the one you need in the “Banks” tab and click on it. Next, fill in the details, indicate the transfer method “MTS Money Wallet” and click “Pay”.

Cashback from partners

With MTS Bank cards you can receive an increased cashback of 5% for purchases at gas stations, supermarkets and cinemas, 8-9% at the Medsi clinic and 1% for all other transactions. By making monthly expenses in these categories, you can save 3-10 thousand rubles. The reward is received every Friday into the savings account.

You can get 5% in special categories and 1% for each purchase with the following cards:

- Virtual MTS CASHBACK Lite.

- Credit MTS CASHBACK, MTS Money Weekend classic and for payroll clients.

- Debit MTS Money Weekend and Weekend 14+.

CASHBACK credit and virtual cards boast the largest cashback of 25% on purchases from partners.

To a Sberbank card

Transfers are available to Sberbank clients through their personal account, as well as via SMS messages and USSD requests. This operation may be required when you urgently need money, and the required amount is only on the balance of your cell phone. There is a higher commission for such an operation, in contrast to standard transfers, and certain restrictions apply.

When withdrawing funds to a Sberbank card, its size will be 4.3%, and the minimum payment amount should not be less than 60 rubles. The smaller the transfer amount, the greater the percentage of it. For withdrawing 120 rubles to a card, you will have to pay 50% in the form of a commission payment. The final balance on the balance sheet must be more than 10 rubles.

Reference!

Sometimes MTS may refuse a financial transaction. The reason for canceling the transfer is usually written in the response SMS. If it does not arrive, contact technical support to find out the reasons. When the message indicates that the operation was rejected by the bank, you should contact the Sberbank hotline for information.

Card activation procedure

To activate the card, you need to call the hotline number: 8 (800) 250-0-520, after the autobot answers, press the “1” button. Then enter the code that will be sent to your phone as an SMS message. The next step is to enter the PIN code you created. After approval from the autoinformer, you can start using the card.

Pin

Experts do not recommend using your year of birth or a combination of repeating numbers as a PIN code. It is also unsafe to use identical passwords for all bank cards.

What restrictions are there?

MTS sets the maximum amount for one payment at 15 thousand rubles, and the minimum is 50 rubles due to the need to control the movement of funds between subscribers and minimize risks. There is also a restriction on transactions for unidentified users within the country. Sberbank introduces additional restrictions:

- no more than 75 thousand rubles per month including commission (3000 rubles);

- 5 transfers per day;

- 40 thousand rubles per day.

Important!

As a result of the operation, at least 10 rubles should remain on your mobile phone account. This requirement has been introduced to preserve the ability to use communication services in the future.

Tariffs and conditions for MTS cards

Each card has its own individual terms of use, which can be found on the bank’s official website. It will be possible to compare all banking products only within a specific group, so we will conduct an analysis separately for debit, credit and virtual cards.

Tariffs for MTS Money debit cards

| MTS Money Weekend | MTS Money Weekend 14+ | MTS Money Premium | WORLD | |

| Card issue | 299 rub. | 1000 rub. | For free | |

| Annual maintenance | 60 days free, then 99 rubles/month. If you have a monthly turnover of 15 thousand rubles. or minimum balance of 30 thousand rubles. the holder does not pay for the service | 30 days free, 1000 rub. - from the second month. No fee is charged if the monthly turnover exceeds 100 thousand rubles. or account balance – from 400 thousand rubles. | 0 rub. | |

| Cash withdrawal | Free at any ATM in the country | No commission at ATMs of MTS Bank, partners and 3 transactions per month abroad | Free at MTS ATMs | |

| Cashback | For special categories - 5%; For all purchases - 1%; For Medsi services - 9% | For special categories - 5%; For all purchases - 1%. | Up to 1% | Absent |

| Interest on balance | 6% per annum on balances up to 299,999 rubles and 4% on balances above. | Up to 5.5% | Not provided | |

| Additional features | — | — |

| Only employees of budgetary organizations can receive a card |

Tariffs for MTS Money credit cards

| MTS CASHBACK | MTS Money Weekend | MTS Weekend for clients receiving salaries | MTS Money ZERO | ||

| Card issue | 299 rub. | For free | 299 rub. | ||

| Annual maintenance | For free | 900 rub. | Free in the first year, all subsequent years - 900 rubles. | 30 rub./day if there is active debt | |

| Interest on the card | 11,9-25,9% | 24,9-27% | 19,9-27% | 0-10% | |

| Grace period | 111 days | 51 days | up to 36 months + 20 days | ||

| Credit limit | RUB 299,999 | 400,000 rub. | 150,000 rub. | ||

| Cashback accrual | 5% – in special categories, 1% – in all others | 8% for the first purchase in the first year, 3% for all subsequent payments at the MEDSI clinic. | |||

| Minimum payment | 5% of the debt amount, minimum 100 rubles. | 5% of the debt amount, minimum 500 rubles. | |||

| Cash withdrawal | Per day up to 50 thousand rubles, per month no more than 600 thousand rubles. | ||||

| Commission for withdrawal of credit funds | 3.9% of the transaction amount + 350 rubles. | No commission. | |||

| Top up your balance | Free via ATM, from a mobile account and intrabank transfer, in other cases 1-3% | ||||

| Fine for late payment | 0.1% per day of the debt amount | ||||

Tariffs of MTS Bank virtual cards

| Debit virtual card MTS Bank | Cashback card Weekend | |

| Payment system | MasterCard | MasterCard |

| Issue cost | For free | For free |

| Annual maintenance | For free | Free or 180 rub. if there has been no movement on the card for six months. |

| Lifetime | 3 years | 3 years |

| Account balance | Up to 100 thousand rubles. | Up to 60 thousand rubles. |

| Maximum monthly turnover | No limits | For one operation - 60 thousand rubles, per month - 200 thousand rubles. |

| Deposit fee | 0.75% of the receipt amount, but not less than 50 rubles. | No commission for intrabank transfers |

| Cashback | — | 25% in partner stores; 5% at gas stations, supermarkets and cinemas. 1% for all other transactions. |

Credit limits, grace period and interest

The most profitable credit card of all those considered can be called MTS CASHBACK. The bank offers one of the largest credit limits - 111 days, during which no interest is charged on the debt. Another advantage of the product is free annual maintenance, which allows you to save significantly.

“Weekend” offers a good credit limit, but only for salary clients. If desired, each employee can contact his employer’s accounting department and fill out an application to transfer his salary to another bank.

In comparison with others, “MTS Money ZERO” can be considered the most expensive in the entire line of credit cards. Even despite the low interest rate and a good grace period, 30 rubles will be debited from the client daily if there is active debt. You will have to pay 900 rubles for a month, and 10,950 rubles for a year, which is 12 times more than the MTS Money Weekend service.

Restrictions on bank cards

Any bank, as an issuer of plastic cards, bears full responsibility for transactions performed by users. Withdrawing funds from an MTS account is no exception, therefore there are strict requirements for the types of bank cards and subscriber verification.

Owners of MasterCard or Visa systems have access to transfers without restrictions, as they have increased security. Student, social, youth, Momentum Maestro, cards without paid annual maintenance are not allowed to work with the service. Transfer to them is possible only with the help of additional manipulations or intermediaries, and therefore the final commission for the payment becomes much higher.

How to close a card

To close a card account, you need to visit the nearest branch and communication center with your passport and sign the appropriate application. In the case of a credit card, you need to pay off the entire debt in advance. The card will be canceled within 5-7 days.

If it is not possible to go to the bank, you can close the MTS Money card via the Internet.

statements

Fill it out and send it to the Federal State Unitary Enterprise Russian Post at the address: 115035, Moscow, st. Sadovnicheskaya, 75 by registered mail with declared value. After receiving the form, the card will be closed, you will be informed about this via SMS message.

Transfers from your MTS personal account

MTS offers its subscribers to use their personal account on the website to make transfers. Its interface is intuitive and convenient for every user. The account allows you to make one-time payments or set up periodic payments. The services of the most common banking institutions, many payment systems and online stores are also presented here.

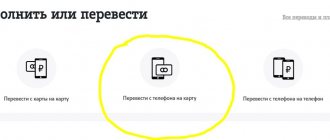

To transfer from an MTS balance to a bank card, in the “MTS Money” tab, select “Transfers”, and then “To card”, after which you will have access to “Transfer from phone account to card”. Enter the phone number from the balance of which you want to withdraw funds, and indicate the card number, as well as the transfer amount. You can transfer money to a foreign bank card by clicking on the appropriate link.

It will not be possible to completely reset the account, since there is a restriction on the minimum balance of funds on the balance sheet. To verify the user and confirm actions with funds, an SMS message with a code will be sent to the specified phone number. It must be entered in the appropriate field to complete the payment. The money will be credited to your account almost instantly, but there are unforeseen exceptions (no more than 5 business days).

If the transfer is rejected, check whether your card meets the stated requirements. This method is the most convenient, but requires Internet access. If you are unable to connect to the network, use alternative options.

Via mobile application

The My MTS application does not allow you to transfer money from your phone balance to a card. For this operation, you need to set another one - “Easy payment”. You can get a link to download the application from a technical support specialist, or find it in the AppStore and Google Play stores. After installation, do the following:

- Log in to the application.

- Select the "Money Transfers" tab.

- Then “Transfers from account to card.”

- Click the "Transfer" button.

- Enter your phone number and payment amount.

- Fill in the “Card number” column.

- Confirm the operation using the SMS code.

- Confirm the action again.

Via SMS messages

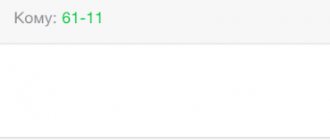

In 2015, MTS introduced an additional method of money transfers. For the operation, you need to send a corresponding request to number 6111. To transfer money to a card, send an SMS message to number 6111 with the text: CARD XZ, where X is the card number and Z is the transfer amount.

The Mobile Bank service from Sberbank allows you to find out your card balance via SMS. To do this, send a message to number 900 with any of the following commands: “01”, “BALANCE”, BALANS, BALANCE, “RESIDENT”, OSTATOK and the last 4 digits of your card number separated by a space.

Via USSD commands

You can transfer money using USSD commands. Dial in the telephone number dialing window: “*611*Х*Z#”, where X is the card number, and Z is the transfer amount. The card number must be indicated in full, and the transfer amount must be in Russian rubles. After you confirm the transaction, the money will be credited to your account, and the equivalent amount will be debited from your phone balance. Using USSD commands you can perform the opposite action: top up your MTS account from a Sberbank card.

This method is an alternative to SMS and is absolutely free, while messages may charge a fee. To find out your card balance, dial *900*01# and press the call button. After this, the balance will be displayed on the phone screen. Please note that there is a charge for this request in Economy fare.

List of USSD commands for Sberbank clients:

- *900*SUM#. Top up your phone balance from a card.

- *900*PHONE NUMBER*AMOUNT#. Top up any phone number.

- *900*X*PHONE NUMBER*AMOUNT#. Topping up another person’s card, where X is the number of the corresponding operation.

Transfers by number 900

By activating Mobile Bank, the client will be able to manage other financial transactions on the card using SMS or USSD requests. In order to make a transfer using the 900 number, you just need to have any device with Internet access, a linked card and an activated Mobile Banking service. Do not forget about the restrictions that are set not only by the cellular operator, but also by Sberbank.

It is advisable to have a “fireproof” balance of 50 rubles on your balance in order to always be in touch. When making transfers, include a commission in the cost of payment and other conditions for the transaction (limits, restrictions). In this case, you will be able to have unhindered access to your mobile phone account at any time, using it as an additional electronic wallet or payment system.

900 is a short service number of Sberbank for those who have a Mobile Bank connected. To transfer funds to a card, send an SMS with the text: “X YYYY Z” separated by a space, where X is the phone number (11 digits), YYYY is the last 4 digits of the card, and Z is the payment amount in rubles. The conditions and restrictions do not differ from other transfer methods. The minimum balance on your account is 10 rubles. Funds are credited instantly or within an hour.

Call 6111

Transferring funds by sending messages to number 6111 is no different from transactions via SMS described above. This short number is intended only for this type of service; you cannot perform other actions using it.

Using the "Easy Payment" service

To withdraw funds to a card through the service, you need to do the following:

- Download and install the application.

- Login and log in to the service.

- Select the item “Money transfers”.

- Click “Transfers from account to card.”

- Fill in the phone number and enter the required transfer amount.

- Indicate the card number to which the payment will be received.

- Confirm the operation using an SMS code.

The money will be transferred within five working days. Typically, this procedure takes much less time, and they arrive instantly or no later than one hour from the moment the application is created.

What can you pay?

MTS Bank allows you to make payments in various areas and services. Popular ones include:

- mobile phone account replenishment;

- payment of administrative fines from the traffic police;

- purchasing games and add-ons;

- repaying the loan with a monthly payment included;

The functionality also includes built-in payment systems for transport, housing and communal services, and transfer of funds in a store using a QR code.

Attention. During the service, an additional fee may be charged. This applies to payment for transport, games, fines. Before the final confirmation, a special window pops up in the application with a warning and indicating the amount of the commission.

For convenience, the main menu of the application contains all the necessary services and lists of available stores for making payments. Money transfer in the system is carried out instantly with a good mobile Internet signal or a high-speed WiFi point.

Transfer limits

MTS imposes restrictions on all transfer operations due to liability for payments made by subscribers. If a limit is not set, the amounts will become uncontrollable, which in turn will lead to risks for mobile operators and financial institutions. This requirement was established not by MTS, but by the government in accordance with the current law on money laundering, terrorist financing and economic crimes. Therefore, the mobile operator provides the following limits on transfers between subscribers:

- minimum amount – 50 rubles;

- minimum balance – 10 rubles;

- maximum – 15 thousand rubles at a time and 30 thousand rubles per day;

- per month – 40 thousand rubles monthly;

- commission – 4% (at least 25 rubles);

- number of operations per day – no more than 5.

Attention!

The fee for small payments can be more than 4.3%, so it is better to send one large payment rather than splitting it into several small ones. Please note that in order to successfully complete a transaction, you must have an amount in your account that exceeds the transfer amount + commission + minimum balance.

Let's consider an example: you need to withdraw 10 thousand rubles from your mobile phone account. In addition to the specified amount, your balance must have funds for the commission (400 rubles) and a minimum balance of 10 rubles. Thus, to successfully complete the operation you will need 10,410 rubles. Otherwise, the system will reject the current transfer.

Reviews from cardholders

Maria, Moscow. In the capital, it seems to me that you can’t do without a credit card. I use two, Alfa Bank and MTS Bank, but in comparison I still like the second one. In the first case, I pay 2 thousand rubles a year, in the second - 0 rubles. Plus, it’s a convenient application, and also a good cashback. Considering Moscow prices, I always collect the maximum possible amount per month.

Andrey, Rostov-on-Don. I have been a regular customer of the bank for three years now and receive various lucrative offers every month. I fell for one thing and got myself a “Weekend” debit card with a 5% cashback. It’s very convenient, because I leave almost 60 thousand a month in restaurants and gas stations. I also have a Zero credit card, but I rarely use it, because 30 rubles a day is a robbery, most often I withdraw money from it if I urgently need it.

Violetta, Sochi. I don’t like all kinds of plastic cards, but since I trust MTS Bank, I decided to get two Weekend cards at once - a debit and a credit, especially since their annual service is free, and the cashback is good. I purposefully use it only at gas stations, cafes and cinemas in order to get 5% back. Otherwise I always use cash. I used the credit card only once, when I celebrated my birthday in a restaurant, then I received 1,575 rubles in cashback from one check.

Transfers without commission

It is impossible to transfer finances without a commission, but you can significantly reduce its size. The larger the one-time payment amount, the smaller the percentage of it will be the commission. When transferring a small amount, it can be more than 50% of the transfer. Although the telecommunications company does not provide its subscribers with the possibility of commission-free transfers, 4% is much better than 9% from other operators.

If none of the above methods suits you, there are alternative options for withdrawing funds from your mobile phone balance. You can withdraw funds in cash at the office of the operator’s representative or in your personal account, and only then put the money on the card. To do this, you can use the money transfer systems Unistream, CONTACT, Blizko, and Russian Post. You will find these services in the “Money Transfers” tab, the “Transfers to Card” subsection, but then you should select “Cash Transfer”.

After choosing a suitable system, redirect the money to yourself or any trusted person, and then you can manage the finances at your own discretion. The disadvantage of this method is that these services also do not support all types of bank cards. Another option is to create an electronic wallet in your MTS personal account, to which you can transfer money, and then withdraw it from there to a card of any convenient bank.

Card replenishment methods and cash withdrawals

You can withdraw money from debit cards without commission at MTS Bank ATMs and partner terminals. As for credit cards, this function is available only to holders of the “Money ZERO” plastic card; in all other cases you will have to pay 3.9% + 350 rubles for each transaction.

Receiving funds is also possible using virtual cards, but provided that the ATM is equipped with NFC technology.

You can top up your plastic account in any convenient way (for ease of reference, information is given in the table).

| Deposit method | Commission |

| ATM, online bank, branch, mobile phone store | 0 rub. |

| Post office | 1.9%, minimum 50 rub. |

| Eldorado, M.Video | 1%, not less than 50 rub. |

| Kari Shoe Store | 1%, minimum 30 rub. |

| Sberbank | 1-2%, maximum 1000-2000 rub. |

| Western Union | 3%, min. 100 rub. |

| Communication shops Megafon, Beeline | 1%, not less than 50 rub. |

| Elexnet, QIWI, WebMoney, Yandex.Money | 1%, minimum 50 rub. |

How to secure funds during transfer?

MTS tries to ensure the security of all transactions carried out using its services. This includes a 2048-bit key encryption system, 3D-Secure authorization, MasterCard SDP and VISA AIS. In addition, access to the servers is strictly controlled by third parties to maintain the reliability of data about users and their transactions.

You can protect yourself from the actions of scammers by increasing your level of Internet literacy and understanding all the processes that take place.

Important!

To protect personal data and funds on your balance, never share your data, passwords, SMS codes with unauthorized persons, even if they represent themselves as employees of a company or bank. Constantly monitor the status of your account, regularly change your passwords on the website to access your personal account. It is desirable that it be long and consist of several letters in different cases and numbers.

Brief overview of the wallet

MTS Money is a multifunctional service for managing your own funds using a mobile phone and computer. The wallet combines all the strengths of the payment systems of modern banks and is a complete tool for saving personal time and money.

To enable the MTS Money wallet, you do not need to submit documents or pay for the service. To do this, just download the application and register or create a profile on the official MTS website.

Clients who open a wallet are offered the following functions:

- transfer of funds to a card or personal account;

- payment for goods in shopping centers, cafes, restaurants, gas stations and other places with access to a terminal;

- tracking the status of your own funds;

- connecting automatic payment;

- creating and saving templates with data and amounts;

- use of a free application with data protection;

- ordering and receiving a plastic card for payment at terminals.