Transfer money from Tele2 to card

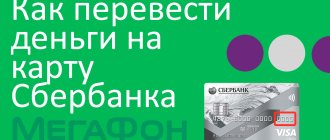

The telephone has long become not only a tool for negotiations, a portable computer, but also a means of payment. Financial services are provided by most telephone networks today. Transfers to a bank card of any financial institution, for example, Sberbank, VTB24, can be made throughout Russia and the CIS countries. You can now withdraw funds from your Tele2 account at any time. So methods indicating how to transfer money from Tele2 to a card will be very useful. The company has created a convenient service for users called “Money Transfers,” which allows you to transfer a certain amount from your phone balance in a matter of minutes.

Via USSD request

Transferring funds from your phone to a Sberbank card can be done by dialing just one simple command: *159*1*NNNN*X#, where

- NNNN – 16-digit number of your bank card;

- X is the desired transfer amount.

Another option is to dial the command “*135#” on the phone screen and click “Call”. Follow the instructions of the voice assistant, complete a few required steps, and the translation will be carried out.

To transfer funds using the above method, users do not have to search for and install additional applications on their phones or look for a place where they can connect to the Internet. Therefore, this particular method of transferring money from Tele2 is the most practical and accessible.

Payment via Sber ATM

- Insert the Tinkoff card into the ATM slot;

- Enter the secret code;

- Select the “Payments and Transfers” section;

- Go to the “Transfer of Funds” subsection;

- Enter the card number to which funds are transferred;

- Click on the button corresponding to confirm the action and pick up the check.

What is the difference between topping up a credit card and a debit card?

Technically, the procedure for replenishing a debit card is no different from crediting a credit card - all the methods described in this article are used for this. However, credit card owners should consider a number of details:

- When withdrawing borrowed funds, the bank charges interest, as well as a cash withdrawal commission, so the amount actually spent is always less than the amount that needs to be returned (if the product’s interest-free lending period has expired).

- The replenishment amount and the amount of the available balance on the card always differ due to the repayment of interest - after crediting you will be able to use a smaller amount.

- According to a special order of priority, when depositing funds on a credit card, interest, commissions, penalties and fines are repaid first. If the top-up amount does not exceed these fees, the card balance will remain unchanged.

In Euroset and Svyaznoy stores

When paying this way, the money is credited to your account almost instantly. There are no longer delays in enrollment, as was the case several years ago.

You can quickly top up your balance through mobile applications of all the considered payment systems.

In addition, the universal form allows you to quickly pay for the services of local operators when traveling abroad

If you only have cash in your pocket and need to top up your Tinkoff Mobile account, then you can use any ATM of the bank of the same name. To do this, select “Pay – Mobile communications” at the ATM, and then deposit cash. Please note that the ATM cannot issue change, so the entire deposited amount is credited to the balance. ATMs from Tinkoff work with banknotes in denominations from 100 to 5 thousand rubles. In addition, currencies are accepted for payment - US dollars and euros, but only in denominations of 50 and 100.

The website tinkoff.ru has a special online service with which you can top up your account with Tinkoff Mobile and other operators. To go to it, you need to open the “Mobile” section, then scroll to the bottom of the page, and in the bottom menu you will see the “Replenishment” subsection.

[THERE IS A SOLUTION] How to pay a Tinkoff loan through the Sberbank application - analysis of the issue

If you constantly forget when you need to top up your account or this procedure generally causes you inconvenience, you can set up the auto-pay service once and your balance will be topped up automatically. To do this you need:

Payment through the Tinkoff website or personal account. RU

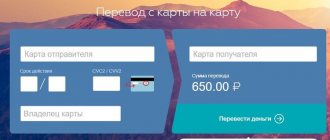

Transfers through a personal account created on the Tinkoff Bank website via the link www.tinkoff.ru on the World Wide Web are made in the “Payments and Transfers” category and the “Card to Card Transfer” subcategory.

This option allows you to act in the direction of any financial institutions. It is enough just to indicate the sixteen-digit card numbers of the sender and recipient, as well as the amount of the transfer in Russian currency, the limit for which is the amount of 75 thousand rubles.

Next, after checking the correctness of the completed information, you must read and agree to the terms of the public offer. They indicate the procedure for executing transactions through the Tinkoff banking system, as well as data on the amount of the commission fee, and then click on the “Transfer” button.

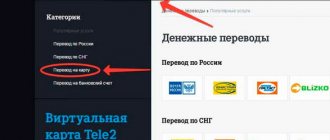

How to withdraw money to a bank account

Carrying out this transaction can sometimes be very difficult. Some cards contain 18 numbers instead of 16. For example, the Sberbank Maestro card. To solve this problem, you need to go to your personal account on the Tele2 website, select the “money transfers” tab, after which you will see the “transfer to bank account” option. To make a transfer, please indicate the twenty-digit account number, last name, first name, patronymic of the recipient and the bank's BIC. Click the "pay" button. It is worth remembering that transferring money to your account may take one day or more.

Replenishment with PayPal title units

A resident of an urban settlement with a population of more than 5 thousand has no problem how to put money on a Tinkoff card.

In addition to mail, free replenishment is available in cities:

There are three ways to deposit funds into your Tinkoff card account for free:

Advantages of this path:

After that, press the “Call” button. This will complete the submission. If you can’t cope with these methods, then Tele2 translation comes to the rescue. The client calls *135# and follows the commands written on the screen.

[THERE IS A SOLUTION] How to transfer money to Tinkoff without commission - all methods

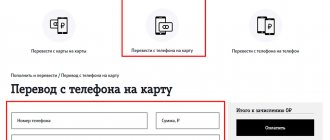

The mobile operator works exclusively with cards issued in the Russian Federation. Clients go to the page https://market.tele2.ru/ and select the icon with the caption “Transfer from mobile to card.” A form appears that you need to fill out. Next, click on the “Pay” button and wait for credit.

Mobile operators provide services for transferring money to bank cards. Some companies can perform such an operation in several ways. This expands the possibilities for clients when collaborating with a bank and a mobile operator. However, do not forget about the commission that will be charged for the transaction.

Tinkoff partners (for replenishment)

Once upon a time there were no Tinkoff ATMs, but until 2021 there were none. And Black debit cards were replenished through the bank’s partners (these are special partners, only for replenishment).

Important! Tariff limit for replenishment through partners - 150,000 rubles per billing period (month)

There, in the mobile application, you can go to filters and see a long list of these partners, some of which I have never even heard of:

- MTS - no commission per card or agreement number. In the terminal up to 15,000, through the cash desk - up to 500,000 rubles. There is no need to insert a card; in the “Bank Services” terminal, select Tinkoff Bank.

- Megafon - no commission per card number or agreement. In the terminal up to 15,000, through the cash register - up to 200,000 rubles (in Moscow and St. Petersburg up to 400 thousand).

- Beeline - no commission based on card number or agreement. Through the cash register - up to 500,000 rubles.

- MKB - terminals of the Moscow Credit Bank . When authorizing using a Tinkoff card with a PIN code - up to 40,000 rubles, no commission. For credit cards - 40 thousand without a PIN and 100 thousand with a PIN code.

- Otkritie Bank - ATMs, up to 85,000 rubles. Just insert the card into the ATM and enter the PIN code.

- Elexnet - terminals, up to 15,000 at a time, up to 90,000 through the same terminal.

- Cyberplate - terminals, up to 15,000 at a time.

- PSKB - terminal, only for credit cards, up to 15,000 at a time.

- Mosoblbank - terminal, only for credit cards, up to 15,000 at a time.

- Post Bank - ATMs, up to 15,000 at a time.

- Svyaznoy - no commission, by card or agreement number. In the terminal up to 15,000, through the cash desk - up to 500,000 rubles. (there was a commission in the period from 10.2019 to 02.2020)

- Zolotaya Korona - cash desk of the partner bank of the Zolotaya Korona system (koronapay.com), up to 100,000 at a time or more.

- Contact - transfer system, rubles without restrictions, currency - up to $5000 (note, you can deposit dollars into a dollar account).

- Unistream - rubles up to 900,000 at a time, up to 5,000 dollars or 4,000 euros - unistream.ru.

- TelePay - terminals, up to 15,000 at a time.

- Know-How - payment terminals and cash registers in showrooms, up to 15,000 at a time.

- Amigo - terminals, up to 15,000 at a time.

- Forward Mobile (Krasnodar Territory) - payment terminals and cash registers, up to 15,000 at a time.

- Russian Post is the most exotic way. The amount is up to 500,000, but will take up to 3 working days.

- QIWI - terminal commission 1.8% of the amount , but not less than 120 rubles. For 1 time up to 15,000 rubles.

In total, almost all methods provide instant replenishment (except Russian Post) and without commission (except Qiwi). In rare cases, enrollment may be delayed by up to 1 business day. And keep track of the replenishment limits, how much has already been spent and how much is left, you can always check in the mobile application: click on the account, gear, first line - “Tariff limits”.

Restriction on withdrawal of funds

Transferring money from the Tele2 mobile operator account to a mobile number is not free. The commission depends on the amount withdrawn. For example, from one to two hundred and fifty rubles you need to pay seven rubles. When withdrawing from 251 to 499 rubles, the commission will be fifteen rubles. Transferring an amount from five hundred to a thousand rubles will cost thirty rubles. Transfer from one thousand to 14 thousand 635 rubles - the commission will be two and a half percent of the amount. If you want to top up the phone of another operator, you will need to pay a commission of seven percent plus fifty rubles. Transferring funds to a current bank account in the amount of one to 14 thousand 184 rubles will cost 5.75% (at least ten rubles).

The Tele2 operator sets a limit on the number of payments. You cannot make more than ten transfers per day, and more than a thousand per month. If you have bonus funds or credit money on your mobile operator account, you will not be able to transfer them to another account.

There is a limit on all transfers. The maximum you can withdraw from your mobile account is up to fifteen thousand rubles, taking into account all commissions and payments. You can find out your account balance by sending the request “asterisk one hundred and four hash marks”.

Auto payment service

For Tinkoff clients who often have to pay for their mobile phone, an auto-payment service has been created, and template installation is also supported. To enable automatic payment, all you need to do is top up your mobile phone via Internet banking, and the service itself will offer to automate this process for the future.

After that, top up your cellular connection automatically by using this service and specifying:

- the amount that will be withdrawn from the card and transferred to the mobile balance;

- the minimum amount of funds on the mobile account, upon reaching which the auto-replenishment service is activated;

- dates for replenishing your phone for the future, for example, depositing funds into your cell phone balance every 1st day of the new month;

- the card from which funds will be debited.

When activating autopayment, the client creates a template indicating the phone number and replenishment amount. For convenience, you can give the templates appropriate names, which simplifies navigation if you top up the phones of friends, relatives or, for example, employees from one card.

To make an auto payment, the minimum replenishment amount is 50 rubles, and the maximum is limited to 10 thousand per month.

The bank does not charge fees for using autopayment or creating templates, so the client does not need to be afraid of hidden costs for additional convenience.

Through the Tinkoff Bank application

You can top up your Tinkoff Mobile balance through Sberbank Online in two ways:

The money will be credited to your balance within a few seconds or minutes (most often instantly - payments are processed very quickly).

As an example, let's take the Yandex.Money payment system. Log in to the service with your username and password, go to the “Payment for services – Mobile phone” menu, enter your phone number and enter the amount. Confirm the operation via SMS or mobile application, wait for the funds to be credited. There is no commission, but in Webmoney you need to pay 0.8% for each payment transaction.

Tinkoff Mobile virtual card: may come in handy

The mobile operator Megafon was the first to come up with a bank card , the balance of which is equal to the balance of the mobile phone. Competitors did not support the idea; co-branded cards from Beeline , MTS and Tele2 do not have such functionality.

Tinkoff Bank tried to adopt this experience. At the end of 2021, the mobile operator Tinkoff Mobile appeared, where the phone account balance is equal to the balance of the virtual card, which opens when receiving a SIM card.

Today we will try to find out whether this virtual machine has any practical meaning. Today we will not evaluate mobile communications or the Internet from the mobile operator Tinkoff Mobile, as well as its tariff policy. In short, in my opinion, standard communication services are a little expensive, but roaming, on the contrary, looks good. One of the advantages is the presence of pleasant additional promotions with bonus minutes and Internet traffic.

Subscribe to the @hranidengi channel on Telegram - only there is the most up-to-date information about updates, useful life hacks and other interesting things from the world of finance

Save the Money! recommends:

Tinkoff Mobile virtual card. Peculiarities

1 Free issue and delivery.

You can order a Tinkoff Mobile SIM card online . Delivery is carried out free of charge by couriers to many cities of the Russian Federation, as is the case with regular plastic bank cards. New clients (who did not yet have such a SIM card) are entitled to 7 days of free communication.

GET A TINKOFF MOBILE SIM CARD

UPD: 09/29/2020 There is another promotion: if you order a Tinkoff Mobile SIM card using this link , the bank will give you 1000 rubles. to get in touch. The bonus must be used within 50 days after delivery.

GET 1000 RUB. CONTACT US

And if you order using this link , you will receive a month of free communication (600 minutes and 20 GB of Internet).

GET A FREE MONTH OF COMMUNICATIONS

Together with the SIM card, a virtual card bank account is opened for the client, the balance of which corresponds to the balance of the Tinkoff Mobile mobile phone.

For the welcome period, a free package is included for 600 minutes and 20 GB of Internet, which will need to be changed to a more suitable one for you, otherwise after 7 days it will simply be extended, only for money:

To be honest, I didn’t plan to use the full functionality of the mobile operator; I was only interested in the virtual card. Therefore, in the Tinkoff Mobile application, I disabled all packages (in this case, calls and SMS will cost 2.9 rubles, but there will be no mobile Internet, no subscription fee). I found the application convenient and informative; it is clearly visible whether any additional services are connected or not:

When applying for a SIM card, Tinkoff will offer to move to it from another operator along with the number and promise 500 rubles for this. Here it is worth considering that these promotional 500 rubles. can only be spent on communication services and only for 90 days. I was not interested in this offer.

There is no need to go to a communication store (Svyaznoy or Euroset) to get a Tinkoff Mobile SIM card, since in this case they will not open a virtual bank card and will also require you to immediately deposit 200 rubles into your account:

How to withdraw money from a credit card without commission and maintaining the grace period. Interest-free loan for a year. Legal way. All the details are in the article.

Save the Money! recommends:

2 Free service.

Servicing of the Tinkoff Mobile virtual bank card is carried out without commission (TPS tariff plan 8.0) without any additional conditions:

SMS notifications about transactions are also provided free of charge:

Megafon cards for new clients are now free only when a certain turnover is made (the “Light” tariff costs 49 rubles/month, free with a turnover of spending from 3,000 rubles/month; the “Standard” tariff costs 149 rubles/month. , the fee is not charged when the turnover of card expenses is from 10,000 rubles/month; the “Maximum” tariff costs 199 rubles/month, the fee is not charged when the turnover of card expenses is from 30,000 rubles/month). Those. at this point, the Tinkoff Mobile virtual app looks preferable.

The details of the virtual card can be viewed in the Internet bank or the Tinkoff Bank mobile application, where you can also generate a PIN code.

To use a virtual card for purchases and cash withdrawals, you need to add it to Google Pay, Samsung Pay or Apple Pay.

3 Interest on the balance.

For a daily balance on a virtual card from 1000 rubles. 5% per annum is charged:

At Megafon, the percentage on the balance is noticeably higher - from 6 to 10%, however, to accrue it you need to make a monthly turnover of spending on the card from 3,000 rubles.

As of September 29, 2020, the daily balance on the virtual card is from RUB 1,000. accrued at 3.5% per annum.

4 Cashback 1% on everything.

For all purchases using the Tinkoff Mobile card, 1% cashback in rubles is credited (it can be spent on purchases or on communication services, but withdrawn only with a commission). There is an unprofitable rounding of porridge down to the whole value (for a purchase of 199 rubles they will give only 1 ruble). Cashback is credited once a month on the statement date:

Monthly cashback limit is RUB 3,000.

The list of exceptions for calculating remuneration is not so long:

Unlike the Megafon card , there is a hassle for taxes (MCS 9311), but Megafon gives cashback for MCC 4816:

In addition, the Tinkoff Mobile card participates in the Tinkoff Target program, through which you can receive additional cashback for purchases from partners.

The main point of cards whose balance is equal to the balance of a mobile phone is that they can be topped up with cashback, or, at a minimum, while maintaining the grace period on a credit card with a long grace period .

When replenishing the Tinkoff Mobile balance in the Tinkoff Mobile or Tinkoff Bank application from a card of another bank, MCC 4814 (“Telecommunications Services”) is issued; for some cards, cashback is provided for such an operation (for example, for “ ALL AT A TIME” from “ Raiffeisenbank , debit cards of Rosselkhozbank , Fora-Bank , Ozon.Card , Kukuruza, etc.).

Why pay for purchases with credit cards with long grace without cashback directly (for example, using the new Otkritie credit card with a grace period of 120 days ), when you can first top up your virtual card without a commission and into grace, and make the same purchases with it, only this time with cashback from Tinkoff Bank.

The Megafon card has a 1% cashback on the Standard tariff, which is free for purchases over 10,000 rubles/month. On the “Maximum” tariff, cashback is 1.5%, but it is free only for purchases over 30,000 rubles/month.

The limit for replenishing Tinkoff Mobile through the application of the same name is 50,000 rubles. 30 days in advance, there is no limit for replenishment via Internet banking or the Tinkoff Bank mobile application:

5 You cannot withdraw money for free.

Withdrawing from the Tinkoff Mobile virtual machine, as well as cashing out at an ATM (you need devices that support NFC, Sberbank has a lot of them) will cost a commission of 2.9%. You can transfer money for free only to a Tinkoff Bank payment card if the virtual card was topped up from it by transfer in the Internet bank, mobile application or ATM (not as a top-up to a phone number).

You can also transfer money to another Tinkoff Mobile virtual machine for free:

To withdraw money from your Tinkoff Mobile balance with minimal losses, you can, for example, on the MTS website top up your MTS balance from the Tinkoff Mobile virtual machine without commission, and then in the MTS Money application transfer funds from your phone balance to MTS Bank card with a commission of 0.9%.

Here, Megafon cards look much more advantageous when making purchases over 3,000 rubles. You can withdraw 10,000 rubles/month from them. at any ATM without commission, and also withdraw through third-party services with a commission of 1.9%.

6 Commission for inactivity.

Tinkoff Mobile, like all other mobile operators , has a fee for inactivity. If there is no activity for 90 days in a row, a daily fee of 5 rubles begins to be charged until the account is reset to zero. If there are no movements on the account within 120 days, the contract may be terminated.

To avoid this, any action that leads to a change in the balance (for example, replenishment) is sufficient; therefore, purchases with a virtual card should also reset this counter:

Conclusion The Tinkoff Mobile virtual card is free, and it can be used, although it certainly cannot be called universal. The Megafon map, in general, looks better.

If the basic services of the mobile operator Tinkoff Mobile interest you (I know many who are very pleased with this service, and many with the opposite point of view), then a virtual card will be a good addition.

GET A TINKOFF MOBILE SIM CARD

Don’t forget about other promotions: if you order a Tinkoff Mobile SIM card using this link , the bank will give you 1000 rubles. to get in touch. The bonus must be used within 50 days after delivery.

GET 1000 RUB. CONTACT US

And if you order using this link , you will receive a month of free communication (600 minutes and 20 GB of Internet).

GET A FREE MONTH OF COMMUNICATIONS

Still, it would be worth adding a small limit on free withdrawal, and removing the unfavorable rounding of cashback, oh, dreams, dreams

A similar card from the mobile operator Yota is approaching, which means competition will intensify, so we can expect some improvement in conditions.

I hope my article was useful to you; write about any clarifications and additions in the comments.

You can follow updates in this and other articles on the Telegram channel: @hranidengi .

Due to the blocking of Telegram, a channel mirror was created in TamTam (a messenger from Mail.ru Group with similar functionality): tt.me/hranidengi .

Subscribe to Telegram

Subscribe to TamTam

Subscribe to stay updated on all changes :)

comments powered by HyperComments

Commission and restrictions

Transfers of funds from the subscriber's account are necessarily accompanied by the collection of a commission fee. The company changes the amount of overpayment depending on the direction of the funds transfer. For example, when crediting a card product, the commission is 3% + 30 rubles, for a current account - 5.75%, minimum 10 rubles. The amount of overpayment may vary. Accurate information is displayed in the transaction form. When transferring money from a mobile account, the following restrictions also come into force:

- The number of transactions cannot exceed 10 pieces. per day, per month – 1000 pcs.;

- The operation is not carried out using bonus or credit funds;

- The payment amount must be between 1 and 15,000 rubles, including commission.

The amount available for transfers can be found using the USSD command *104#.