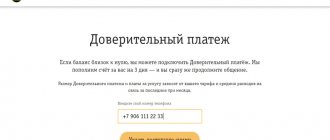

If there is no money on the cell phone balance, the provider automatically blocks data transfer, voice communication and basic functions of the mobile phone. In order not to unexpectedly be left without communication, the Beeline company has released, thanks to it, the consumer will be able to continue communication even if the personal account status is zero. But not everyone wants to take out a loan from the operator and pay a commission, so there is a need to disable the “Trust payment” on Beeline. There are many effective ways to do this.

Necessary conditions for disabling Trust Payment on Beeline

Trust payment can be made either on demand or automatically.

In the first case, a person must independently request a loan as soon as his balance goes into minus. The amount that will be sent to your phone depends on various factors. As a rule, it ranges from 15 rubles to 250 rubles. Important! The client must inspire confidence in order for Beeline to issue a loan. That is why he is obliged to use the operator’s services for at least two months.

The loan will need to be repaid within 3 days of receipt. As soon as this period passes, this amount will be withdrawn from the balance, and the service itself will be disabled. But, if a person has activated an automatic payment, then he will have to personally refuse it.

Almost nothing is required to cancel this service. A person only needs to choose any of the available methods and then perform a series of simple steps. If you want to ban a function so that you cannot use it, then you will need to confirm your identity and provide personal data. As a rule, turning off the option is not difficult, and for convenience you can follow the instructions.

Disconnection methods

There are several ways by which you can cancel the promised payment service on Beeline. A person can choose any one that seems most convenient for him. But first, it’s worth finding out what methods exist.

Available options:

- Personal Area. In this case, you need to have Internet access to block the service. You will need to go to the mobile operator’s website and go to the connected options section. There you should select an auto-trust payment and cancel it.

- Call the hotline. You can call technical support to help you achieve what you want.

- Special team. You will need to dial the combination on your phone and send the request. Immediately after this, you will be notified that the service has been disconnected.

- Visit to the communications department. This option is suitable for those people who cannot block the service on their own. They can come to the operator's office to ask for help from employees.

Any of these methods will help remove the function so that a specific number is no longer issued credit. This is especially important for those people who have the automatic option enabled. After all, as soon as the balance reaches a certain point, a loan will be issued. It is known to charge an additional fee, which is inconvenient for many people.

Office visit

You can come directly to the company's office. The client will need:

- View the map on the website and find the nearest salon.

- Check the opening hours and visit.

- Provide your passport and state the reason for your application.

- An employee will perform deactivation.

The disadvantage is that you need to set aside time to visit the office. The operator may not have branches in your area; it will take a long time to get to the salon. Therefore, few people use this option.

How to cancel a Trust payment

There is nothing difficult about refusing the “Trust Payment” option. This can be done by both residents of Russia and Kazakhstan. All you need to do is follow simple instructions to remove an unnecessary function.

Procedure for disconnecting through your personal account:

- You can use a computer or smartphone to log into your personal account on the site.

- After authorization, you should go to the requests section.

- There you need to select the service of interest and deactivate it.

If there is no Internet access, then it is best to disable the function through a special command. The person will be required to enter the request: *141*0#. After this, you just have to wait for confirmation that the option is deactivated. If desired, a person will also be able to subscribe in the future.

If self-service is not suitable for a person, then you should come to the operator’s office. There are similar branches not only in Moscow, but also in many other cities. All you have to do is write a statement, after which the service will be disconnected. You can also call the hotline to cancel the service.

Deactivation methods

There are different deactivation methods for manual and automatic functions.

Using your personal account

In your personal account on the mobile operator’s website there is functionality to disable “Auto-trust payment”. The subscriber needs to go to the connected options section, find the one he needs, move the slider next to it to the left and confirm deactivation.

Via USSD request

The short command to disable is installed only for the option that provides automatic replenishment of the balance. The combination installed by Beeline: *141*10#.

Call to operator

Making a call to a cellular company is one way to set a ban on connecting a non-automatic promised payment. Required Beeline numbers:

- 0611. This service is also called a smart answering machine. It is available from the numbers of this cellular company. When making a call, the subscriber first hears the recorded messages. At the end, the user is asked to start communicating with a specialist by clicking the desired button. After connecting, the subscriber can ask to set a connection ban. In order for the employee to perform this operation, he must additionally provide his passport information.

- 8. This number is intended for calls from any numbers not serviced by Beeline.

- +7. This number can be useful when you are in international roaming.

Visit to the salon

Employees working in communication shops are always ready to help with setting a ban on the use of non-automatic options. Subscribers are recommended to visit any service and sales office. A passport is required to apply.

Communication via email

To set a ban on connecting manual replenishment of the balance, there is another method. Any subscriber can write an email. Address for sending - [email protected] Information that should be contained in the letter: telephone number, last name, first name and patronymic of the subscriber, passport details, message with a request to establish a ban on connecting a non-automatic service.

Sources used:

- https://kakoperator.ru/operators/kak-otklyuchit-uslugu-doveritelnyj-platezh-na-bilajne

- https://finansytut.ru/banki/elektronnyie-dengi/bilayn-kredit-doveriya.html

- https://mysotos.ru/operatory/beeline/otklyuchenie-funktsii-doveritelnogo-platezha-na-bilajne

- https://vashoperator.com/operator/beeline/otklyuchenie-avtoplatezha.html

- https://beelineguru.ru/uslugi/kak-otklyuchit-doveritelnyj-platezh-na-bilajne.html

What is a “Trust payment”

“Trust payment” or “Credit of trust” is an opportunity to borrow money from Beeline. This is a paid service, for the use of which you will be charged from 15 to 130 rubles, depending on the loan amount. The specific figure is calculated by Beeline based on average expenses for the last 3 months.

This option has 2 varieties: one-time and auto:

- The one-time option starts working only after the subscriber sends a request to receive a Beeline “Trust Payment”. The money, together with the payment for use, is written off at the end of the service period, that is, after 3 days. You can independently disable Beeline “Trust Payment” ahead of schedule only if you pay the bill before the expiration of 3 days. The service will be terminated, but if necessary, the request is re-entered and the client receives money.

- “Auto-trust payment” is a long-term option that is activated once and is valid constantly. When the subscriber’s account reaches a critically low level of 30 or 15 rubles, the service works independently, replenishing the balance for a short period, and then withdrawing money, including the loan fee. Using this option is not convenient for everyone, since it is difficult for most Beeline clients to keep track of their account status and the need to replenish the balance.

How to top up your balance

How to take a trust payment from Beeline is clear, all aspects have been considered.

The main thing is to pay on time; 3 days are allotted for this. If payments are not made, the account will go into the negative. And if you dial the Beeline combination again for the promised payment, the loan money will not be issued again if the obligation is outstanding.

There are plenty of payment methods. If you use an account or card of any bank and are connected to online banking, just go to banking and make a payment, usually there is no commission for this. You can also replenish your account on the Beeline website from a card, and you can also set up automatic replenishment there.

No one has canceled the standard cash payment options. Everywhere there are payment acceptance terminals, where payment services are provided for a small commission. You can also visit any communication shop, pay at a bank, or at the post office. There are plenty of methods.

Sources

- https://beelinex.ru/kak-vzyat-v-dolg/

- https://beeline365.ru/kak-vzyat-v-dolg-obeshhannyj-doveritelnyj-platezh-bilajn

- https://beelinehelp24.ru/oplata/obeshhannyj-platezh

- https://BeelineExpert.ru/balans/platezh-v-dolg/

- https://beeline77.ru/doveritelnyy-platezh/

- https://MyTariffs.ru/finansy/obeshhannyj-platyozh-bilajn.html

- https://protarify.ru/beeline/kak-brat-obeshchannyy-platezh-na-bilayne.html

- https://www.Sravni.ru/enciklopediya/info/usluga-doveritelnyj-platezh-ot-bilajn/

- https://BeelineExpert.ru/balans/dover-platezh/

- https://brobank.ru/beeline-vzyat-obeshchannyj-platezh/

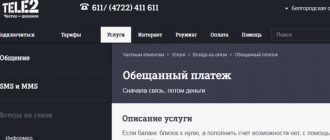

How to disable the service

Instructions on how to disable the “Trust payment” on Beeline are required only for those subscribers who have activated the “Auto” degree, since in the simple version the disabling is done automatically after a few days. You can cancel the service in two remote ways:

- by command *141*0#;

- through your Personal Account on the Beeline website.

Such methods allow you to mark an automatic loan, but if desired, the client can re-activate the function. It is worth deciding whether you want to permanently exclude the possibility of taking out a loan from Beeline, or whether this is only a temporary solution. For example, most pensioners do not need the promised payment, since they do not talk much and control the balance of the account. You can also set a ban on a child’s gadget, whose parents still control his expenses. There may also be personal reasons for refusing the service. In this case, we are talking about a ban on lending.

Only the owner of the SIM card can refuse the promised payment and completely ban this function, since they will need to provide passport details and confirm their identity.

You can do this:

- Call the hotline number 0611. Remember that complete deactivation of the service may be paid, so check this information with a specialist before the procedure so that charges do not come as a surprise to you.

- At the Beeline service office. Employees will fill out an application for refusal, and after a while an SMS will be sent to your phone with the successful blocking of the promised payment.

Even a complete blocking is not permanent, so it can be canceled. But in order to again take advantage of receiving a loan from Beeline, you will have to re-activate this function in the office or by calling the hotline. Before you disable a service, consider whether it is really necessary.

Perhaps everyone has been in a situation where it is absolutely necessary to contact someone or access the Internet, but the funds on their mobile account have run out. And, unfortunately, the time and circumstances do not always allow you to quickly deposit money into your account. In this case, Beeline helps out its subscribers. Let's look at what you need to know about this service and who can use it.

The principle of operation of a trust payment is as follows: the subscriber sends a short request, after which money is instantly credited to his account. The credit amount is calculated based on the tariff plan and communication costs for the last two months. Five days later, or after the balance is replenished, the funds lent and the amount for their use are debited from the subscriber’s account.

However, there are some limitations to using the service that are important to be aware of:

- The promised payment is available only to individuals on prepaid plans.

- To borrow money from Beeline, you need to be a subscriber of the company for at least 2 months (at least six months on certain tariffs).

- The subscriber must spend at least 50 rubles per month on communications (statistics from the last 12 weeks are taken).

The comparative table will tell you more about some of the nuances of the Trust Payment service:

| Rates | Amount of promised payment | Conditions | Service cost |

| Tariffs for phones with daily subscription fees and tariffs for Beeline USB modems | Depends on communication expenses for the last 2 months. From 30 to 500 rubles | Be a Beeline subscriber for at least 8 weeks (in the Beeline World line - more than 12) | If the payment amount is 30 rubles, the service is free, in other cases it depends on the amount of the payment. |

| Line “Welcome!” | Maximum – 100 rubles | Be a Beeline client for at least six months. | Up to 20 rubles |

| Tariffs with a one-time subscription fee | Depends on the tariff. It is possible to receive a trust payment equal to the subscription fee. From 90 to 3000 rubles | Spend from 200 rubles monthly on communications and be on the Beeline network for at least 12 weeks. | Depending on the tariff. From 15 to 180 rubles |

| Line “All in one for 1 ruble” | In the amount of the subscription fee +1 ruble | Based on the tariff, from 25 to 130 rubles |

Please note that for subscribers in international roaming, individual conditions for receiving the promised payment apply; you can clarify them by calling toll-free numbers 0611, 8-800-700-0611 and +7-495-974-88-88.

The cost and size of the trust payment may change; to clarify the information on the validity of the service on your tariff, you can go to your Beeline Personal Account, contact technical support or dial the USSD request *141*7# “call”.

How to receive a Beeline trust payment?

In order to receive a trust payment on Beeline, just send a short request *141# “call”. After this, the borrowed money and an SMS notification about its crediting will be sent to your account. You can take the promised payment again only after writing off the previously borrowed funds from the subscriber’s account.

You can connect a trust payment only to an unblocked number with a zero or positive balance: how to check your Beeline balance.

Any subscriber can set a ban on connecting to the service by submitting a passport to the Beeline office. If you have set a ban on receiving a Beeline trust payment, you can also remove it only in person at the company’s office by presenting your passport.

What should you do if you run out of money in your account, there is no place to top up your phone number due to circumstances, and you need to call urgently? There is an exit! You can top up your account from Beeline.

How to get a Beeline “Trust Payment” (formerly called “Promised Payment”)?

You need to dial the combination - *141#

Amount of “Trust payment”

If your expenses for cellular communications over the last 3 months were more than 3,000 rubles per month, the amount of the “Trust payment” will be 300 rubles. At the same time, the balance on your account should be in the range from 0 to 90 rubles. For communication expenses from 1500 to 3000 rubles per month, the “Trust payment” will be 150 rubles. The balance on your account should be from 0 to 60 rubles. For communication expenses from 1000 to 1500 rubles per month, the “Trust payment” will be 70 rubles. The balance on your account should be from 0 to 60 rubles. If you spend from 100 to 1000 rubles per month on communications, the amount of the “Trust payment” will be 50 rubles, while the balance on your account should be from 0 to 60 rubles. If you spend less than 100 rubles per month, 30 rubles can be credited to your account, and you can order a service if your account balance is from 0 to 30 rubles.

How to find out your Beeline Trust Payment amount?

You need to dial the combination - *141*7#

Validity period of the accrued amount

3 days, after which the amount of the “Trust payment” will be debited from your account automatically.

While roaming

If you are in international roaming and ordered a service from there, you will be credited with an increased “Trust Payment”, which will be valid for 7 days. If your communication expenses are from 450 to 1000 rubles, you will be credited 100 rubles. If your communication expenses are from 1000 to 1500 rubles, you will be credited 150 rubles. If your communication expenses are from 1,500 to 3,000 rubles, you will be credited 300 rubles. If communication expenses are from 3,000 rubles per month, we will credit you with a “Trust payment” of 300 rubles.

How much does the Trust Payment cost?

The fee for each “Trust Payment” is 15 rubles including VAT and is written off upon expiration of the “Trust Payment”. You can set a ban on receiving trust payments from your phone by dialing the command: *141*0#. You can only lift the ban on receiving a “Trust Payment” at service and sales offices or at the Beeline Customer Support Center, upon presentation of your passport.

Did you know that you can also talk on a mobile phone on credit? Very simple! You can take a trust payment to MTS, and you will not depend on the balance on your mobile phone account. What is a trust payment? Your balance on your phone is close to zero, and there is an important call ahead? The mobile operator gives you a certain amount as an advance so that your connection with the world is not interrupted.

You can take a trust payment by activating the “Promised payment” option at once or by activating it, which will allow you to continue communicating on your mobile phone even with a negative balance.

How to pay off debt

If the subscriber activated the promised payment service or it was activated automatically and the debt has already been accrued, then it must be repaid within 3 days inclusive. There are several options for depositing funds into your account:

- Using an electronic wallet;

- In the nearest terminal;

- From a bank card. If necessary, you can activate the Autopayment service, in which case money will be automatically transferred to your mobile account from the card when a certain limit is reached;

- Through an ATM;

- Through Internet banking. To do this, install the required program on your smartphone and register in the system.

Such a service is undoubtedly a very useful thing, especially when there is no way to top up your account, but you need to stay in touch. But if for some reason the subscriber is not satisfied with it, then the option can always be deactivated.

0 0 Votes

Article rating

How to take the “Promised Payment”?

The promised (trust) payment in the amount of 50 rubles can be received by anyone who has a positive account balance. The maximum amount of the trust payment depends on your monthly communication expenses and cannot exceed 800 rubles.

You can activate this service very easily:

- by calling the number – 1113;

- in your MTS Personal Account – ihelper.mts.ru;

- from a mobile phone by dialing *111*123#.

A fee is charged for each use of the trust payment. It ranges from 0 to 50 rubles depending on the amount.

The debt must be repaid within 3 days, replenishing the balance in the usual way for you in an amount exceeding it. If you do not do this, the operator will write off the amount of the advance payment, your phone will be disconnected and you will fall into the company's debts.

How to take out a loan “In full confidence”?

If you are not a corporate subscriber of MTS, a free “On Full Trust” loan is available to you. You can safely communicate until your balance reaches the minimum limit of -300 rubles.

If you want to increase the trust payment limit you need to:

- use MTS services for at least three months;

- constantly increase communication costs;

- pay all bills on time.

You can activate or deactivate the deferred payment service by using the “Internet Assistant” in your Personal Account, or you can dial the command on your phone in the form of a combination of numbers *111*32#.

How to receive a “Trust payment” on Beeline?

Customers who have been using a Beeline SIM card for at least 2-3 months (depending on the tariff) are entitled to replenish their account on credit. To make the promised payment, you need to use the keys to dial the combination *141#, and then “call” - and receive an answer from the auto-informer about replenishing the balance. The loan amount is proportional to your monthly expenses for Beeline services over the previous 3 months. The more money you spend on communications, the greater the allowable account balance that allows you to borrow money.

Beeline lending conditions are shown in Table 1

Beeline has tariff plans that do not allow you to receive a loan of more than 60 rubles - for example, the “Welcome” guest tariff. To find out the exact loan amount, just send the command *141*7#.

Beeline issues “Trust payment” on a paid basis: the service costs 15 rubles and is valid for only three days. At the end of this period, the loan along with the commission is debited from the subscriber’s account. One day after repayment of the debt, the service can be reactivated.

To block the possibility of receiving credit funds on your phone, call the Beeline operator helpline at 0611.

Beeline loan amounts

In Beeline, credit of trust involves the ability to “borrow” a certain amount, which must be returned in three days or less. This is very convenient if you need to make an urgent call when the balance has reached zero. The refund occurs through a regular replenishment, while the company itself will write off the client’s debt. If the account does not have the required amount, the phone is blocked. When replenishing an amount less than the debt, this part is withdrawn and another payment must be made.

In Beeline, you can connect a credit of trust with one request

User Requirements

To take advantage of the loan, you need to meet some requirements:

- Cooperate with Beeline for at least 2 months;

- Spend more than 50 rubles in previous months;

- Don't "go into the red." However, for each request there is an obligation regarding the balance.

Command to request

The command *141# helps to request credit on Beeline. It is worth knowing that there is no possibility for the client to request any amount. Each person is assigned a limit, which depends on the frequency of spending. You can find out your parameter by command *141*7#. The available size will be displayed on the screen. For example, the minimum you can ask for as a loan is 50 rubles. This is possible with a balance of 30 rubles or more and with average costs of up to 100 rubles.

Factors influencing the loan amount

If the client spends more, then the limit for him shifts:

- 80 rubles: if expenses are in the range of 100-1000 rubles.

- 100 rubles: 1-1.5 thousand rubles.

- 200 rubles: 1.5-3 thousand rubles.

You can make a request when your balance reaches 60 rubles. Clients who spend over 3 thousand rubles, even when the balance decreases to 90 rubles, have the opportunity to request a loan of 450 rubles.

- Beeline “Promised trust payment” - how to receive it in 3 minutes

When you are in roaming, the amounts increase. So, having spent the same amount up to 100 rubles, but outside the country, the client can request up to 80 rubles. When spending up to 1 thousand rubles – 150 rubles. And if expenses exceed 1.5 thousand rubles, the maximum amount of 450 rubles is immediately available.

It’s very easy to gain trust in Beeline, just type a certain command

Connection to MTS

To borrow money without leaving your office or apartment, you can use one of three methods:

- dial manually or using the MTS Connect Manager program *111*123#

- go to the official MTS website and, through the online assistant, find the “Payment” section, and in it – the “Promised payment” option

- make a call to number 1113

The credit can be used for 7 calendar days, its size can be set independently, without exceeding the maximum limit established for MTS subscribers.

The following table will help you navigate.

MTS lends to customers even with a negative balance - if you are in the red by up to 30 rubles. If the trust payment does not exceed 20 rubles, then no commission fee is charged. In other cases, you will have to pay 5 rubles for the service.

You will not be able to borrow money from MTS in the following cases:

- you are already using a credit payment system

- you have connected the “Credit” or “On Full Trust” services

- you have already connected the promised payment

If there are concerns that someone (for example, children) will order a loan without your knowledge, you can refuse the service by calling the MTS helpline at 0890. To confirm the refusal, you will need your passport information.

Trusted minutes and SMS

If the extra balance is not available to you, you can activate additional SMS messages and minutes. For 80 tenge, the operator provides the subscriber with a package for 30 minutes of calls and 15 SMS within the network. The extra package is valid for 30 days from the moment of connection.

Payment for the service will be debited when you top up your account with the required amount.

You can activate an extra package of additional minutes and SMS using the command *341#.

Terms of provision:

- Subscribers whose number is blocked are not provided with this option;

- The extra package of SMS and minutes is used only within the Beeline network;

- Re-activation of the package is possible one day after payment;

- The number must have a prepaid payment system;

- The SIM card must be used for more than two days;

- The balance to enable this option must be positive.

How to activate a trust payment for subscribers of the Megafon mobile network?

You can take out a loan for Megafon, even if you are roaming in Russia, and the service fee depends on the region in which the SIM card is registered. The loan amount limit is 100 rubles. with a balance of up to minus 70 rubles, or 300 rubles. – if the negative balance does not exceed minus 250 rubles.

You can activate the service on almost all Megafon tariff plans, except for Ring-Ding and Megafon-Login. There are tariffs that set restrictions on the issuance of credit. For example: the Megafon SIM card has at least 3 months of experience and the use of paid operator services in the previous month.

To receive a trust payment to Megafon, use one of four methods:

- Dial number 0006 using the telephone keypad and act according to the recommendations of the autoinformer

- send an SMS indicating the top-up amount (100 or 300 rubles) to number 0006

- dial the combination *106# - after this a menu will open on the display in which you should select the “Promised payment” option; this is the only possible option for roaming

- go to the website of the Megafon operator, through your personal account in the Service Guide, go to the “Payments” section and connect the desired service

It remains to be reminded that the service is valid for three days, after which funds are debited from the balance.

Repeated extra balance

If the amount provided is not enough, you can activate the option again. The amount provided is fixed and equals 100 tenge, and the cost of the service is 59 tenge.

The repeated extra balance is valid for three days from the moment of connection, after which the provided amount and the cost of the option will be written off automatically.

Important! You can only request to borrow money again once.

To connect, use the command *141#.

You can borrow a balance from Beeline for the second time in a row only if the previous payment has not yet been written off.