In the twenty-first century, mobile operators, in addition to offering communication services, also offer financial services to customers. Recently, the mobile operator Tele2, together with several banks, has created specialized bank cards. Tele2 “Other Rules” bank cards help you perform various operations: paying for cellular communications, making purchases, applying for a loan and much more without leaving your home.

Card functionality

The Tele2 card is designed specifically for the company’s clients. You can get it absolutely free by filling out an application.

Tele2 bank card allows you to:

- Receive cashback in the amount of 1% to 3% for purchases made or payments for services.

- Get back up to 10% of the money spent when replenishing your mobile account using a card.

- Apply for loans in real time at bank branches, or without leaving home through the official website of the campaign.

- Make withdrawals at any ATM or bank branch without commission.

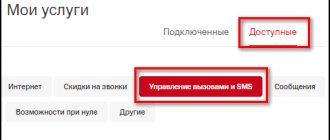

- Manage funds through a mobile application or online banking.

- Make purchases, top up your mobile phone account or make any other transactions without leaving your home.

- Receive 7% per annum on your bank card balance and use it freely.

- Also, the company’s clients can independently choose the design of their Tele2 card.

Use of credit funds:

- The interest rate on loans starts from 12% and ends at 39.9%.

- If the loan is repaid in advance, before the end of the grace period, interest is not taken into account.

- The interest-free grace period ranges from 55 to 100 days.

1. The client gives consent to HKF Bank LLC (hereinafter referred to as the Bank, 125040, Moscow, Pravdy St., 8, k.1) to the processing of his personal data, communicated orally and/or provided in the documents presented for conclusion with by the Bank of credit and bank account agreements documents, as well as documents collected by the Bank on the Internet or in other open sources (hereinafter referred to as the Data), in order to verify them and assess the solvency of the Client to conclude credit and bank account agreements with the Bank, and in the event of overdue debt - for the purpose of returning it; offering the Client products (services) of the Bank and its partners. In the latter case, the Client agrees to receive information from the Bank by mail, by phone, by email or in the form of SMS messages/Push notifications.

2. The Client agrees to the Bank making audio recordings of telephone conversations and recording electronic correspondence, taking photos and videos, as well as logging the Client’s actions by any means that do not contradict the legislation of the Russian Federation, as well as to use these materials as evidence in controversial situations.

3. The Client consents to the Bank transferring and/or entrusting the processing of Data to the following third parties - partners of the Bank:

| Name and addresses of the Bank's Partners | Purpose of processing |

| Mail.Ru LLC, 125167, Moscow, Leningradsky Prospekt, 39, building 79 Instam LLC, 125316, Moscow, st. 1st Aeroportovskaya, 6, room 6, room 1-4 Yandex LLC, 119021, Moscow, st. Lev Tolstoy, 16 LLC "Russian Blogs", 121151, Moscow, Kutuzovsky Prospekt, 22 LLC "Double", 125040, Moscow, 1st street Yamskogo Polya, 17, building 12, floor 3, room 21 JSC "KIWI", 115201, Moscow, 1st Varshavsky proezd, 2, building 8 LLC "Directory", 127254, Moscow, Dobrolyubova proezd, 3, room .1 room 16 JSC "GK Accord", 142180, Moscow region, Klimovsk, st. Industrialnaya, 11 CJSC "United Credit Bureau", 127006, Moscow, st. 1st Tverskaya-Yamskaya, 2, building 1 JSC National Bureau of Credit Histories, 121069, Moscow, Skatertny per., 20, building 1 Equifax Credit Services LLC, 129090, Moscow Moscow, st. Kalanchevskaya, 16, building 1 Russian Standard Credit Bureau LLC, 105318, Moscow, Semenovskaya Square, 7, building 1 Comfortel JSC, 302020, Orel, Naugorskoye Shosse, 5 , room 8, 20-24 | Assessment of the Client's solvency; search and verification of his place of work, actual residential address, telephone number and other data received from the Client and third parties; identifying the Client’s interest in the Bank’s products; assigning the Client to marketing segments; promotion of the Bank’s services or goods and services of the Bank’s Partners; return of overdue debts; analytical purposes |

| LLC "Financial Innovations", 124482, Moscow, Savelkinsky proezd, 4, floor 13, room XXI, room 13 | Providing legal services and representing the Bank’s interests in courts |

| Insurance companies: | |

| Home Credit Insurance LLC, 125040, Moscow, Pravdy street, 8, building 1 Insurance LLC, 115114, Moscow, Derbenevskaya embankment, 7, building 22 JSC D2 Insurance, 630007 , Novosibirsk, st. Kommunisticheskaya, 2 LLC "PPF Life Insurance", 108811, Moscow, kilometer Kievskoye Highway 22 (Moskovsky settlement), house 6, building 1 OJSC "AlfaStrakhovanie", 115162, Moscow, st. Shabolovka, 31, building “B” Insurance LLC, 129110, Moscow, st. Gilyarovskogo, 42 Rosgosstrakh - Stolitsa LLC, 119017, Moscow, st. B. Ordynka, 40 building 3 OJSC "Liberty Insurance", 196084, St. Petersburg, Moskovsky pr., 79a, lit. A CJSC "MetLife Insurance Company", 127015, Moscow, st. Butyrskaya, 76, building 1 | Transfer of Data within the framework of interaction under concluded insurance contracts |

4. The Client consents to the processing of Data (including automated, non-automated and mixed) in all ways provided for by the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data” (hereinafter referred to as the Law “On Personal Data”) and, in addition, by negotiating in person, by telephone, sending correspondence by mail or e-mail, including the following actions: collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution , provision, access), depersonalization, blocking, deletion, destruction of personal data (hereinafter referred to as the List of actions with personal data).

5. The client consents to automated, non-automated and mixed processing in accordance with the List of actions with personal data, mobile radiotelephone operators: MTS PJSC, 109147, Moscow, st. Marxistskaya 4; PJSC VimpelCom (Public Joint Stock Company "Vympel-Communications"), 117623, Moscow, st. On the eighth of March, no. 10, p. 14; PJSC "Megafon", 115035, Moscow, Kadashevskaya embankment, 30; T2 Mobile LLC, 125212, Moscow, Leningradskoe highway, 39A building 1; APEX LLC, 454048, Chelyabinsk, st. Vorovskogo, 77A; JSC "AKOS", 690048, Vladivostok, prospectus 100 let Vladivostok, 38a; St. Petersburg Telecom LLC, 197374, St. Petersburg, Torfyanaya doroga, 7, letter F, in order to assess its solvency, as well as transfer to the Bank the result of processing the Data and the following information about the subscriber: last name, first name, patronymic or pseudonym of a citizen subscriber, passport data, as well as the subscriber’s address or terminal equipment installation address, subscriber numbers and other data allowing to identify the subscriber or his terminal equipment, information from databases of payment systems for communication services provided, including connections and traffic , blocking, tariff plan and subscriber payments. The Client confirms his consent to the transfer to the Bank by the above mobile radiotelephone operators of the result of processing the information specified in this Consent, obtained on the basis of exclusively automated processing of Data, information about the communication services provided and payments for these services. 6. The Client agrees to receive his credit history from the credit history bureau for the purpose of deciding on the possibility of concluding agreements with the Bank, including a consumer loan agreement, as well as to analyze the possibility of offering new loans to the Client:

• CJSC "United Credit Bureau", 127006, Moscow, st. 1st Tverskaya-Yamskaya, 2, building 1; • JSC National Bureau of Credit Histories, 121069, Moscow, Skatertny per., 20, building 1; • Equifax Credit Services LLC, 129090, Moscow, st. Kalanchevskaya, 16, building 1; • Russian Standard Credit Bureau LLC, 105318, Moscow, Semenovskaya Square, 7, building 1. Consent to obtain a credit history is considered valid for two months from the date of its registration. When concluding a consumer loan agreement within the specified period, it remains in force for the entire duration of the consumer loan agreement.

7. Consent to the processing of personal data is valid from the date of signing. The Client has the right at any time to withdraw the Consent in whole or in part, including refusing to receive offers of products (services) from the Bank and its partners, by submitting a written application to the Bank in any form with the obligatory indication of the full name, series and passport number. The application can be sent by the Client by mail or through Information services, the description of which is posted on the Bank’s website www.homecredit.ru. After receiving the Client’s application to withdraw consent, the Bank has the right to continue processing the Client’s personal data only on the grounds specified in the Law “On Personal Data”.

8. The Client understands and agrees that his communication to the Bank of the code received in an SMS message from the Bank is a confirmation of his will to sign this Consent, which is carried out through the use of a simple electronic signature. The Client agrees that the simple electronic signature received from the Client attached by the Bank to this Consent is considered to be affixed by the Client directly to the Consent, as if his signature was affixed on a paper copy of the Consent in his own hand. Attaching a simple electronic signature to this Consent is carried out after the Bank has identified the Client in accordance with the requirements of the legislation of the Russian Federation, including presenting to the Bank an identification document specified in the “Signature of the subject of personal data” field of this Consent.

Terms of service

Before starting registration, it is recommended that you familiarize yourself with the existing rules for obtaining a Tele2 bank card. They have a number of aspects and limitations.

- Only individuals can receive a credit card. For various business firms, a restriction has been established, since the created card is issued to the client personally, and not to a corporate organization.

- To avoid refusal to receive a card, an individual must have Russian citizenship, a permanent income, and be over 18 years of age.

Applying for a Tele2 bank card

- To order a card, you just need to enter *599# on your phone and press the call button.

- After a few seconds, the gadget will receive a message in which the client must agree to participate in this promotion using a special command contained in the letter.

- Next, an operator will call you and you will need to provide your personal information. They will be needed to engrave the first and last name on the plastic.

- Provide the delivery address and accept the envelope with a credit card from the courier. Then verify the data indicated on the plastic with your passport data in order to avoid misunderstandings.

- Follow the instructions that came with the bank card and activate it.

You can also order it on the official Tele2 website located at cards.tele2.ru.

To perform this operation, you need to go to the website, find the item “Bank cards for Tele2 subscribers” and go through a simple registration procedure.

User comments:

It is worth noting that the “Other Tele2 Rules” Home Credit card is not available for ordering in all regions of the country. The website contains a list of cities where you can order the “Other Rules” card: Moscow, St. Petersburg, Kemerovo, Chelyabinsk, Perm, Voronezh, Rostov-on-Don, Irkutsk, Nizhny Novgorod, Omsk.— The bank has a team of young, active, ambitious guys. They are also backed by a “senior” partner bank (OTP Bank. - Note by Banks.ru). We are similar in spirit - we are also very active. It only took our team six months to launch the map. This is a very short period of time for such a large-scale project.

Card activation

A mandatory step when using a credit card is its activation.

The activation process begins from the moment the card is handed over by the courier. He sends the client's photo to the bank. After the verification, which lasts no more than two days, the user receives an SMS message on their phone notifying them of its completion. This completes the activation process.

After this, another SMS arrives, which contains information for logging into the Internet bank. When logging into your personal account, you must set a PIN code for your credit card. This action is mandatory, since without it it is impossible to make purchases and various other operations.

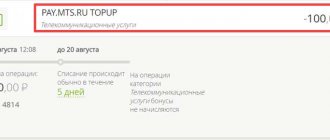

Money to your mobile phone account

To use a microcredit, you need to connect.

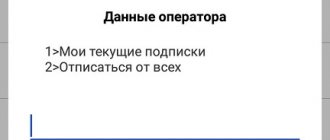

To activate it, you need to send an SMS with English letters to number 112:

- USSD * 112 * 1 # and press the “call” button;

- After a successful operation, a response SMS will be sent to the number from which the message was sent. Where is all the information about the loan that was added to the balance sheet. The message will also contain additional information about the service.

Credit

In order to take out a loan for a short period of time, Tele2 bank card users need to go to the website t2.finspin.ru. Indicate the loan amount you are interested in and the time of repayment.

After that, a loan is selected that suits the selected criteria. The loan will be sent within minutes of submitting your application.

IMPORTANT!: After filling out the form, the interest rate may change. It is worth paying attention to this in order to avoid misunderstandings.

To purchase a consumer loan for a longer period, you need to go to the website cards.tele2.ru and apply for a loan in the “Products” section.

The maximum repayment period for such a loan is 7 years.

After applying for a loan, the client can receive money in any convenient way.

How to borrow funds on Tele2 with a zero balance?

Special instructions will help resolve this issue. You can view it in your personal account. The borrower must meet certain requirements.

The funds limit can only be provided to those people who have a Tele2 SIM card and have been using it for more than 2 months. The subscriber has the right to spend money for various purposes; it is only important to return it at the right time. You can re-borrow a cash limit after paying off the previous loan.

Important! In case of systematic violation of payment terms, the provider has the right to block the possibility of taking out a loan on this number.

Only carriers of federal license plates are entitled to receive a loan. Subscribers of corporate networks, as well as landline telephones Corporate clients and direct landline numbers operate only on a prepaid basis and cannot accumulate debts.

The user can take an amount in the amount of: 50, 100, 200 or 300 rubles. At the same time, a commission fee for this service is charged depending on the loan amount. The user must return the due amount within 3 days.

The “Promised Payment +” tariff has different conditions. The difference will be in the loan amount and commissions.

Types of Tele2 bank cards

In order to apply for a debit or credit card from Tele2 “Other rules”, you must follow the link f.tele2.ru/#card Familiarize yourself with the list of current cards and their bonus programs, select the option you are interested in, find the form to fill out and indicate your personal data to obtain a bank card cards.

Many people are interested in cards from Tele2 “Other Rules” as their list is constantly growing, which allows the telecom operator’s clients to choose the most suitable conditions for themselves.

If necessary, you can contact the Tele2 hotline for all service issues.

Information about offers

The cellular operator Tele 2 offers Russian citizens three types of microcredit programs.

| Type of loan | Size in rub. | Duration in days | Overpayment/RUB |

| First | 50 | 3 | 5 |

| Second | 100 | 7 | 10 |

| Third | 200-300 | 10 | 20-30 |