The MTS virtual card is intended exclusively for paying for purchases and services. It will not allow owners to withdraw cash or use an ATM. But such cards are extremely easy to use, and obtaining them will not cause any difficulties. To do this, it is enough to perform a few simple steps and top up the balance if there is no money in the subscriber’s personal account.

But the mentioned simplicity and accessibility do not free users from the need to carefully study the current rules and restrictions, so as not to find themselves in an unpleasant position later. It is especially important to familiarize yourself with the limits, since the amount available for the client's use and expenses is not unlimited.

In short, to use a virtual payment instrument, you need to spend a little time familiarizing yourself with the requirements and conditions of the operator, after which you can issue a card and proceed to purchases.

MTS Bank Virtual debit card: an advantage for subscribers!

The MTS Bank Virtual debit card is offered to customers using MTS mobile communications. It is designed for the convenience of making payment transactions on the Internet.

Card design features

An analogue of plastic cards was developed for the safety of using an online payment instrument, because when paying you do not need to indicate the details of the main card. MasterCard Virtual from MTS Bank is a full-fledged electronic wallet with wide functionality.

When paying for purchases in online stores with a virtual card, the user confirms the transaction with a code received in an SMS message. A PIN code is not provided; in a regular store, a special application on a smartphone is used for payment, and the transaction is confirmed by a code in SMS. The card currency is rubles only.

Advantages of the Virtual tariff plan:

- The maximum amount of available funds on the balance is 100,000 rubles;

- There are no restrictions on the amount of transactions per month or per individual transaction;

- Validity period – 36 months;

- Cash withdrawal is possible at the cash desk;

- Free card issue, no annual maintenance.

How to use the card via smartphone

To add a card to a special application and use it via a smartphone, you must perform the following steps:

- Download and install the Android Pay app, or open the pre-installed Apple Wallet or Samsung Pay app.

- Enter your card details manually.

- Confirm the operation with the code from SMS.

The mobile device must be equipped with an NFC chip and have official firmware.

To use the card on the Internet, you need the details that the user received in the message when registering the card.

Payments within Russia are made without commission. 3D Secure technology is provided to protect transactions. Notification of all transactions is free and is carried out via SMS message. Confirmation occurs using the CVC2 code, which is generated for each payment and is valid for 60 minutes.

If your mobile device is lost, the virtual card must be blocked by calling 8-800-250-05-20. It can be restored on another smartphone, but the balance will remain the same.

Advantages

What are the advantages of an electronic card?

- You don't have to carry it with you all the time.

- You can make contactless payments in regular stores.

- I can use it on the Internet.

- You definitely won't forget the card at home.

- The receiving process will take a few minutes.

- You can top up your account in various ways.

Compared to a plastic card, the restrictions are minor. At the same time, you do not have to personally visit the office to register it. Virtual plastic can be released in a special application from the company, spending a few minutes.

Methods for replenishing and transferring funds

Funds from a virtual card can be transferred to a card with physical media from MTS Bank or top up your mobile phone account through the MTS Money application.

You can top up your debit virtual card in the following ways:

- from mobile phone balance;

- transfer within the bank;

- from a card of another financial organization;

- external translation according to details.

Money is credited instantly, with the exception of bank transfer.

A virtual card allows you to protect your own funds when making contactless payments or in online stores.

What do other mobile operators offer?

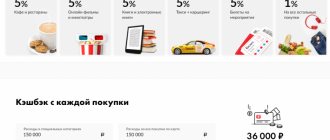

Compared to offers from Megafon, TELE2 and Beeline, the MTS virtual card looks pale. There are no “benefits” for clients (interest on the balance, the ability to withdraw cash, cashback, etc.).

In the ranking of digital products, MTS is in 8th place after Megafon, Yandex, Kviku, Sberbank, QIWI, Post Bank, Russian Standard.

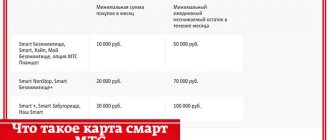

Advantages of Megafon (card balance is equal to the mobile phone balance):

- 3 tariffs to choose from with the possibility of free annual service;

- cashback up to 10% for regular purchases and up to 20% from partners;

- 10 MB of Internet additionally for every 100 rubles spent;

- free transfers within the Russian Federation;

- free SMS information and SMS banking in the absence of the Internet;

- MegaFon protection against accidental paid subscriptions;

- replenishment without commission.

Beeline and TELE2 cards are issued instantly free of charge, support contactless payment technologies, and are serviced free of charge. The balance is equal to the mobile phone balance. Any payments are subject to a commission (no more than 3%). Beeline makes it possible to receive cash from Alfa Bank (commission 4.95%).

Current tariffs

| Payment system | Mastercard |

| Card type | World |

| Card currency | Ruble, dollar, euro |

| Validity | 5 years |

| Cashback | 5% cashback in supermarkets with an MTS Premium subscription Up to 25% on purchases from partners 5% - clothes and shoes, cafes and restaurants, children 1% on other purchases Maximum cashback per month - 10,000 rubles. |

| Service cost | Free issue and maintenance |

| Cash withdrawal | Free at any ATM with NFC function Limits: - RUB 50,000. per day - 600,000 rubles. per month |

All tariffs Documents

Review analysis

Active users evaluate the MTS Money virtual card differently. Most people like the complete security of payments, instant remote issuance, no need to activate the card (you can use it right away), convenient methods of instant replenishment, and no commission for any payments.

They are not satisfied with the strict limits on the balance and the restrictions on spending per month for Virtual Mobile; the result is an inferior banking product. Moreover, it only works on Android smartphones. The technology for protecting credit cards is higher than that of payment cards. I don’t like the presence of a commission for replenishment, the short validity period and the lack of a loyalty program.

Not all clients, but only a select few, can count on a credit limit. These are mainly salary earners, employees or bank clients who keep large sums in their accounts. The offer will not be available to ordinary users in the near future.

Deposit methods without commission

| Way | Commission | Term |

| Branch | 0 rub. | Instantly |

| ATM | 0 rub. | Instantly |

| MTS (communication shop) | 0 rub. | 1 day |

| Bank. translation | From 0 rub. | Up to 5 days |

| QIWI | From 0.5% (min. 50 rub.) | 1 day |

| Euroset | 1,5% | 1 day |

| From cards of other banks | 0 rub. | Instantly |

| Svyaznoy | 1,5% | 1 day |

| Eleksnet | 1.3% (min. 50 rub.) | 1 day |

Advantages and disadvantages

Most of the benefits of virtual cards come from ease of use and accessibility. At the same time, plastic holders will like:

- speed of registration (just download the application and top up your balance);

- ease of use, requiring you to bring your smartphone to the payment terminal and enter a PIN code;

- secure payments - each operation requires entering a PIN code, so it will not be possible to write off money from the account without the owner’s knowledge;

- accessibility – modern people constantly keep their phone at hand.

Among the shortcomings are:

- the presence of strict limits that do not allow large purchases;

- lack of a cash-out function in the MTS money wallet;

- technical requirements - not all modern smartphones have the NFC function functioning in Russia (usually a similar drawback is typical for Chinese manufacturers).

In addition to the above, there are other positive and negative aspects of a virtual card. But they are minor and will be invisible to most users.

FAQ

How is the card delivered?

A card is a payment instrument without a physical medium. It will appear in the list of cards immediately after registration. How to activate the card? No additional steps are required to activate the card. It becomes active immediately after release.

How can I find out my account status? The card balance is displayed in the MTS Money application.

How to change or restore your PIN code? There is no PIN code provided for the MasterCard Virtual card.

How to reissue a card? Reissue is carried out through the MTS Money application.

Ask a question All questions

Locking and Unlocking

You can block or unblock any of the products in a number of ways:

- using the SMS assistant: send an SMS to number 2121 with the text “STOP XXXX” or “START XXXX”, where XXXX is the last 4 digits;

- by calling 8-800-250-0-520, extension 1.

Blocking is possible through MTS Money for smartphones:

- Click on the payment instrument.

- On the page that opens, click on the gear icon at the top right.

- Near the “Lock” line, move the switch to the right or left.

- Confirm action.

If the subscriber has access to the MTS Bank service, he will be able to block or unblock the payment instrument online on the website.

Instructions for your Personal Account:

- In the list of cards on the right opposite the one you are blocking, click on the button with three dots.

- Select "Block" or "Unblock".

How to use the card

Replenishment does not cause problems. The most convenient way to do this is by transferring from another account. There is no commission from the bank for such an operation, and limits allow you to top up your account several times a month with the maximum amount available for storing funds.

The only possible problem is that the money is not credited to the account quickly enough. If you make a debit transaction immediately after replenishment, then there is a chance to go into a technical overdraft, for which the bank charges 0.1% of the debt per day.

Cash replenishment is possible without commission in MTS salons and branches, “native” ATMs with a cash acceptance function and through the Golden Crown payment system.

You should be careful when topping up via interbank transfer. If you send money from an individual’s account, there will be no commission, but crediting a payment from a legal entity or individual entrepreneur will cost 5% of the receipt.

You can make purchases, withdraw cash and transfer money from your card account. There are daily and monthly limits for all transactions:

| Limits | Payments | Translations | Cash withdrawal |

| Daily, rub | 60 000 | 5 000 | |

| Monthly, rub | 200 000 | 40 000 | |

The small volume of transactions allowed is compensated by their being free. This also applies to transactions for which other credit institutions usually charge a commission, for example, withdrawing cash from “other people’s” ATMs or cashing out through a bank cash desk.

You can also transfer money from the virtual card to other card accounts. The commission for this is not charged as a percentage, but a fixed one - a modest 15 rubles per operation. This is beneficial when transferring large amounts. The only thing that CASHBACK Lite cannot boast of is free interbank transfers - for such an operation you will have to pay 0.3% (minimum 20 rubles).

MTS mobile applications

An active owner of a virtual card needs to prepare a lot of memory on his smartphone, because he will need to install as many as four different applications. “MTS Money” is responsible for issuing, “MTS Bank” is an analogue of an online bank, allows you to manage your account, “MTS Cashback” is a personal account for distributing accumulated points, “My MTS” manages the balance of a mobile phone.

Each of the applications is convenient and beautiful in terms of design, but does not replace the others. Users are often confused. Now it is possible to link a bank account to MTS Money, but this only slightly simplifies account management issues.

Sources

- Official website of MegaFon Bank

- Official website of MTS Bank

- YuMoney official website

- AirLoans official website

- Official website of Sberbank

- Official QIWI website

- Official website of Rosbank

- Official website of Post Bank

- Official website of Russian Standard

- AB Russia official website

Recommended for you

- How to secure personal data when applying for a microloan?

- Testing the first Kviku virtual credit card

- Testing VK Pay - payment system on VKontakte

Ellina Baitemirova Content Manager #VZO, is responsible for filling the site with content and updating the information provided. Graduated from KNRTU with a degree in

. Elina has been working in our project since 2021. She actively studies the financial products market and monitors all important changes.

Anastasia Chantseva Worked as an editor in many major publications, including Izvestia and Vechernyaya Moskva. He actively writes news and articles, including on financial topics, and promotes projects on social networks. Anastasia knows how to interest the right audience and convey the necessary information to them.

(13 ratings, average: 4.2 out of 5)

Ease of use

The virtual payment instrument “MTS Money” provides its owner with:

- Use your MTS mobile number to top up your account balance.

- Information about the card balance and statements of transactions in the mobile application and in the personal account of Internet banking.

- Using a smartphone to make contactless payments in retail stores. This function is only available on devices that support the NFC payment function.

- Receiving details in the mobile application after entering a code word set by the user.

- Security of transactions – ensured by 3-D Secure (sending one-time SMS passwords to the user’s phone to confirm the operation).

Despite all the listed functions, you will not be able to pay with your virtual card for goods whose cost exceeds 15,000 rubles. This tool is suitable for making small purchases. It is also important to note that the company issues only one type of virtual cards - MasterCard, so MTS Visa cannot be issued.

Tariffs and terms of service

| Payment system | MasterCard |

| Card type | Unembossed/Virtual |

| Service cost | For free |

| Cash withdrawal | Not provided |

| Money transaction | Not provided |

| Cashback | Not credited |

| Interest on balance | No |

All tariffs

Cash withdrawal fee

| Virtual |

|

| MTS Smart Money |

|

| MTS Money Weekend |

|

| Child's world |

|

| MTS Money Premium |

|