Megafon's bank card provides its holders with a lot of benefits and opportunities. The card is issued by Megafon's partner, Round Bank.

Any subscriber of the Megafon operator can apply for it. The card account is actually a phone account. You can use it to make any payment transactions just like with any bank card: paying for purchases online and offline at retail outlets, housing and communal services, cash withdrawals, all kinds of transfers, etc.

Official website of Megafon Bank - https://bank.megafon.ru

Advantages of the card

Judging by the reviews, the creators' idea was a success. The card is popular and in demand. Even those users who write negative comments note the ease of use and instant transfer of funds. Among the advantages of the card, owners highlight the following:

- easy to refill. Add money to your phone number and it will be transferred to your card;

- Safely pay for purchases in online stores. You don’t have to show your main salary card;

- service is free;

- 8% per annum is charged on the money remaining in the account;

- you can receive up to 15% cashback at Megafon partner stores;

- free internet - for every 100 rubles spent - 10 MB;

- contactless payment technology;

- the same card can be added to multiple devices. For example, on a smartphone and tablet.

Some users have adapted it to withdraw money from webmoney and credit cards. Just top up your phone account and then cash out. With the card, these operations can be performed without commission.

Unistream

Cash withdrawal is possible on the same website in the “Get Cash” section. It is best to choose Unistream, but you can use Contact.

All that remains is to form an application and click on the “Get cash in Russia” button. You must select one of the proposed options - sending money via SMS or filling out a special form.

In the first option, in the message you need to indicate the type and amount of payment, the full name of the recipient, and then send this information to the short number 3116.

If you use the second option, you will need to log in to the site in the same way as when withdrawing money to a bank card.

Card Features

The card is issued in the MasterCard payment system and is prepaid.

That is, in order to activate it and make transactions using it, you need to top up your account with a certain amount. In the first three months after activation, owners cannot dispose of the entire amount in the account. Depending on the tariff plan, the system will block a certain limit of funds. For example, 200 rubles. Whatever you put on top of this amount, you can use for expense transactions, but you will not be able to spend these 200 rubles.

Only after 3 months will it be possible to spend any amount of money on the card.

The card is replenished very easily in any convenient way: through terminals, Megafon personal account, and other services. The balance of funds, as noted above, will be charged 8% per annum, provided that the account has at least 500 rubles.

To control your expenses, you can use the Megafon-Bank service. It's easy to register:

- Go to the company's website.

- Click on the “My Bank” button and enter your phone number.

Here you can view the balance of not only your phone, but also the phones of loved ones.

Security questions

- The Megafon card meets all security standards of the MasterCard payment system. When making transactions, the transfer of payment data from the issuing bank is carried out in encrypted form.

- Under any circumstances (including in the event of liquidation of the issuing bank), the money remains in the client’s personal account with the mobile operator.

- When paying for goods and services worth more than 1,000 rubles using the PayPass system, you must enter a PIN code. This measure has been taken to protect the client from losing large sums in the event of a lost or stolen card.

What to do if you lose your card?

As with any bank card, if it is lost, the first thing you need to do is block it. If you lose your phone, you should immediately block the SIM card.

Types of cards

At the moment, there are 4 types of Megafon bank cards: 3 plastic and 1 virtual. You can release a plastic one for the virtual one. The table shows the comparative characteristics of the cards.

| Possibilities | Virtual card | Megafon Gold | MegaFon Standard NFC | Megafon standard | |

| Card Features | May have a plastic carrier, or can be used without it | Card with contactless payment | Card with chip and contactless payment | Card with chip | |

| Payment for goods and services | No commission | ||||

| Payment for banking services, for example, transferring money, replenishing a bank account of another MCC bank - 6012 | 0% for transfer amounts up to 10 thousand rubles per month; 0.75% of the total amount if the transfer amount is more than 10 thousand rubles per month. | ||||

| Transfer from a Megafon card to another card through the Mastercard MoneySend | 1.99% of the transfer amount | ||||

| Replenishment of an electronic wallet | 8% of the transaction amount | ||||

| Cashback | Up to 20% | ||||

| Cash withdrawal fee | 0% at an ATM with an NFC module up to 10 thousand inclusive | ||||

| 2.5% of the transaction amount (up to 10 thousand rubles); | |||||

| 3.5% for transaction amount over 10 thousand and up to 50 thousand. | |||||

| 4.5% for transaction amount more than 50 thousand rubles | |||||

| Currency conversion | 3% of the transaction amount | ||||

| SMS banking cost | 30 rubles | ||||

| Balance request | 20 rubles at an ATM with an NFC module | ||||

| Decor | for free | 0 rubles – tariff plans Get involved! Listen, Talk, Chat, Watch, Premium”, “All inclusive” M,L,XL,VIP | 0 rubles - for tariffs “Turn on!”, “All Inclusive” M, L, XL, VIP, XS, S | 0 rubles – for tariffs “Turn on!”, “All Inclusive” M, L, XL, VIP, XS, S | |

| 99 rubles - tariff plans “Turn on! Open, Write", "All inclusive" XS,S | 149 rubles for other tariff plans | 99 rubles for other tariffs | |||

| 249 rubles – other tariffs | |||||

| Bonus megabytes | 10 rubles for every 100 rubles | ||||

You can have up to 5 cards. All of them can be easily linked to one personal account or to different ones.

Hotline and contacts

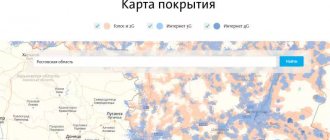

Megafon technical support numbers are available around the clock:

- 8 – within Russia (free from any phone);

- 5555 – for Megafon subscribers (free from a cell phone);

- + international number for calls from anywhere in the world.

Megafon's bank card is not the first and, most likely, not the last financial product of the operator. Previously, the company acted as a co-issuer of co-branded credit cards, which after a few years were converted into cashback cards and withdrawn from circulation. But we can assume that the operator will not change its chosen course of creating joint projects with the banking sector and will surprise its subscribers more than once with other innovative developments.

How to activate the card

You can activate the card yourself or ask a consultant at the salon:

- Buy a Megafon bank card.

- Call number 5555 and follow the instructions.

- A PIN code will be dictated to you. Remember it or write it down.

- Top up your phone account (and therefore your card account) in a convenient way.

- Perform some action with the card and enter the PIN code. For example, buy something in a store (online stores are not suitable for your first purchase) and pay for the purchase using it or cash out at an ATM.

All! The card is activated.

Withdrawing money without additional commission

There are several ways to withdraw money from Megafon. But if you want to do without a commission, then to do this you need to contact the service center, write an application to terminate the contract with the company, and then the client must pay every penny.

When filling out the forms, it is important to correctly enter personal data - full name, bank card details, INN, KPP, BIC and correspondent account. All this information can be found at the bank office or on the hotline.

The slightest inaccuracy and withdrawal of money will be denied. And all previous steps will need to be repeated from the very beginning.

Note! You should not trust other methods that promise to withdraw money from Megafon without commission. Most often, these are simply fraudulent schemes with the help of which they try to deceive honest citizens.

Loyalty program

One of the advantages of Megafon cards is bonus megabytes of Internet traffic.

For online purchases, you can get free megabytes of Internet. They are credited within a month after payment for the purchase. For every 100 rubles spent, you are credited with 10 MB of internet. And owners of the “Turn On” tariff can receive 1 GB of Internet for the first purchase worth more than 100 rubles. You will learn that you have been awarded points via SMS. It will contain information about the number of bonuses received. Anyone can participate in the program. But first he must purchase a Megafon card.

Using bonus megabytes is very simple. There is no need to activate or connect anything. As soon as you use up your traffic package, the megabytes received for purchases will begin to be spent. But remember! They cannot be used while traveling.

How to withdraw cash

Money can be withdrawn from any ATM or terminal. The commission is:

- If less than 10 thousand rubles are withdrawn. – 0%. But the turnover on the card must be at least 3 thousand rubles.

- If the turnover is less than 3 thousand rubles and less than 10 thousand are withdrawn, then the commission is 2.5%.

- From 10 thousand to 50 thousand – 3.5%;

- 50 thousand to 100 thousand rubles - 4.5%;

- 100 thousand – 300 thousand rubles;

If you want to receive money at special collection points, the commission will be 4.99%.

The idea of creation

When creating the card, we started from the vision of the subscriber’s account as a full-fledged payment instrument. That is, in fact, the funds in the subscriber’s account become liquid again. These are no longer just some credits added to your account that provide you with minutes of conversation, the number of SMS or megabytes of traffic.

This is exactly the money with which you can buy a cup of coffee in a cafe, pay with it in any store that accepts cards, or transfer it to someone’s account (subscription or any bank). In general, you can treat the funds in your account like regular money. You put 1000 rubles on your phone - and this no longer means that this thousand is only for communication services. It's still your thousand rubles.

At the moment, we are the first in the world to launch such technology.

One of the main problems with this combination is that mobile billing usually simply does not keep up with processing. But we were able to overcome this during development.

How to find out your card balance using SMS

To do this, you need to connect SMS banking. After connecting, by sending various SMS commands to number 5555, you can find out how much money is left in the account, receive a statement for a given period and perform other operations.

The service is free for the first month of connection. In the future, 30 rubles will be debited from the account monthly.

Use these commands:

- BALANCE – to determine the account balance;

- PIN – to change the PIN code;

- HISTORY – information about the last 10 operations;

- HISTORY XXXX - if there are several cards, then you can find out the history of a specific card by typing the last 4 digits of the card together with the word “HISTORY”;

- BLOCK №№№№- block a specific card. Instead of “№№№№” enter the last 4 digits of your card. The operation is relevant if you have lost or had your card stolen;

- BLOCK ALL – block all Megafon cards.

You can also simply block by calling 5555 or in your Megafon-Bank personal account.

Closest competitors

To make the right choice, you should conduct a small comparative analysis of the offers of competitors. This will allow you to quickly decide on the choice of one or another payment instrument.

Among the debit cards it is worth highlighting:

- Tinkoff plastic . Allows you to receive up to 30% cashback on purchases. Can be used in the process of making cashless payments in most stores that support this option.

- Rocketbank card . Issued free of charge. Serviced remotely, delivered by courier. Allows you to receive cashback up to 10%, withdraw cash up to 5 times every month, and also receive 5.5% per annum on the balance.

- Home Credit and its payment instrument. There is a good cashback for purchases, the possibility of free cash withdrawals from ATMs around the world has been implemented, and 7% per annum is charged on the balance of the account.

Virtual card

A virtual card can be obtained in two ways: in the personal account of a Megafon subscriber or on the Megafon Bank website. Let's look at the second method in more detail:

- Go to the company's website, and then to the "Maps" section.

- Select "Virtual Card" and click "Issue Now".

- Enter your phone number. You must be a Megafon subscriber.

- They will send you a code via SMS. Enter and click Continue.

- Create a password and confirm it. Then click "Issue Card".

In a few seconds the virtual card will be ready. After this, you will need to download the Megafon Bank mobile application and add the card to a contactless payment application, for example, Apple Pay, Samsung Pay or Google Pay.

The virtual card has certain limits. To remove restrictions, you need to purchase a plastic card. To do this, visit the Megafon office with your passport.

The table shows the limits on the use of funds with and without a plastic card.

| Without plastic card | ||

| Overall size | Daily limit | Monthly limit |

| 60 thousand rubles | 100 thousand rubles | |

| Cash withdrawal | 5000 | 40 thousand |

| Translation | 15 thousand rubles | 40 thousand |

| Online shopping | 60 thousand rubles | 100 thousand |

| With a plastic card | ||

| Overall size | 100 thousand rubles | 600 thousand rubles |

| Cash withdrawal | 100 thousand rubles | 300 thousand rubles |

| Translation | 100 thousand rubles | 300 thousand rubles |

| Online shopping | 100 thousand rubles | 600 thousand rubles |

It is not necessary to purchase a plastic card, but as you can see, the limits increase significantly if you have one.

Review analysis

The holders are satisfied with the conditions and it is convenient to pay. It is allowed to withdraw money to Sberbank plastic without commission. You only have to put up with low transaction limits. Most of the complaints are about incompetent support service and slow resolution of issues.

The application for smartphones based on iOS and Android is unfinished; they prefer to use the online service. Cashback is credited on time, but often with errors. The statistics for displaying transactions is also lame; all transactions have to be monitored.

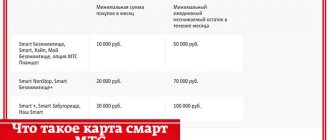

Rates

You must connect a tariff plan to any bank card from Megafon. It will determine the amount of cashback, the level of savings and other bonuses. The following options are currently available:

Light

- A simple offer for those who do not intend to top up their card with large sums and use it only for convenient payment for mobile communications;

- A trial period is provided. There is no need to pay for 1 and 2 months of using the tariff;

- 6% on the balance provided that the daily balance exceeds 500 rubles;

- The balance accumulates up to 200 thousand rubles;

- Subscription fee - 49 rubles per month;

- Does not require payment for maintenance if turnover exceeds 3,000 rubles per month;

Standard

- Medium option recommended for most clients;

- 1% cashback on all card purchases. Up to 1000 rubles per month;

- 8% on the balance provided that the daily balance exceeds 500 rubles;

- The balance accumulates up to 200 thousand rubles;

- Subscription fee - 149 rubles per month;

- Does not require payment for maintenance if turnover exceeds 10,000 rubles per month;

Maximum

- Offer for the most ardent card users;

- 1.5% cashback on all card purchases. Up to 3000 rubles per month;

- 10% on the balance provided that the daily balance exceeds 500 rubles;

- The balance accumulates up to 200 thousand rubles;

- Subscription fee - 199 rubles per month;

- Does not require payment for maintenance if turnover exceeds 30,000 rubles per month.