Under the Beeline brand, a payment card is issued by the same “RNKO Payment Center” from Novosibirsk, which issues the more famous Kukuruza card (elder sister, so to speak), and also of the MasterCard payment system. Since the fall of 2021, the Beeline card has a 5% cashback in some categories, cash withdrawals without commission, etc. Strictly speaking, this is not a bank card, but a payment card, but its functions are completely similar to a debit bank card.

We especially note the new co-branded credit card of Beeline and Alfa Bank “100 days” - a free analogue of the famous Alfa credit card “100 days without interest”, but this is a completely different story.

Cashback categories

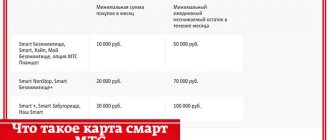

Since the winter of 2018-2019, the current bonus program of the Beeline payment card consists of 4 packages (and not 9 categories as before). All packages have become paid (!) - 159 rubles per month. At the same time, you can only write off points for purchasing goods at Beeline offices!

"In move":

- Music (5733, 5735) — 10%

- Public transport (4111) — 5%

- Taxi and car sharing (4121) — 3%

"On style":

- Beauty salons (7230) — 10%

- Cosmetics and perfumes (5977) — 5%

- Men's and women's clothing (5691) — 3%

"With kids":

- Cinema (7832) — 10%

- Children's clothing (5641) — 5%

- Fast food (5814) — 3%

"Pleasures":

- Duty Free (5309) — 10%

- Restaurants abroad (5811, 5812, 5813) - 5%

- Gas stations abroad (5172, 5541, 5542,5983) — 3%

In other words, there are few people willing to pay for these packages and then have to struggle with purchasing the bonuses they received.

Transfer to electronic wallets

One of the popular services is electronic wallets. Funds are withdrawn from the Beeline balance to Webmoney and Yandex Money. The methods do not change:

- Via the website. The procedure is standard: fill out all the required fields and confirm the operation via message.

- SMS to number 7878.

| Message text | Commission | |

| WebMoney | wm number without R amount | 8.57% + 10 rubles |

| Yandex money | yamoney amount (money will be transferred to the wallet attached to the number) | 7.95% + 10 rubles |

News and changes to conditions

- 11/30/2020 - the “interest on balance” function will be completely disabled, the funds on the card will no longer be insured by the DIA, free interbank banking will disappear

- 04/01/2020 — reduction of the cash withdrawal limit without commission to 50,000/month

- 03/26/2018 - Now the PNO option is paid or you need to make purchases on the card for 3000 rubles per month (and not just movements on the account). You can disable it at Beeline offices, in which case the funds on the card will no longer be insured by the DIA and free interbank banking will disappear.

- 12/15/2018 — As it turns out, you can no longer spend bonuses in any amount. “Use your bonuses to pay for Beeline Home Internet.” The amount of bonuses for replenishing your account depends on your monthly Internet spending. You can top up by an amount that is a multiple of 50 bonuses "

- 12/01/2018 — The bonus program has been completely changed. There are 12 categories instead of 9, but you can only select them in ready-made packages (1 of 4 packages, 1 package has 3 categories). The cashback percentage is not fixed - 5%, and varies - from 3% to 10%. In addition, two packages have restrictions on the implementation of bonuses. Do not forget to select new categories (package) for the winter in the Internet bank at bank.beeline.ru.

- 02/15/2018 — The Beeline World personalized card has increased in price from 200 to 300 rubles.

- 01/06/2017 — Beeline cards can now be topped up with cash at MKB Bank terminals; there are about 4,000 of them in the Moscow region. To credit funds to the card, at the terminal you must select the “Payment - “Beeline Card” option. Crediting funds to your card account takes no more than 5 minutes, there is no commission.

- 01/06/2017 — Categories for the summer have been updated. There are no more gas stations, pharmacies, or fast food. Don't forget to select again.

- 05/13/2017 — You can now top up Beeline cards with cash at MKB bank terminals (Moscow region), there is no commission. A separate section, an “icon” with an image of a card (the one with a cat). It can be easily found by searching using the word “Beeline”. You select an icon, insert your card, enter your PIN.

- 03/01/2017 - do not forget to select new categories of increased cashback, now there are 9 of them left.

- From 12/15/2016 you can choose 3 of 12 categories of increased 5% cashback, see below. This appeared in the new personal account and online banking - bank.beeline.ru

New Beeline card personal account

Restrictions and fees

When transferring funds from a mobile operator account to a Sberbank card, the following fees are charged:

- Up to 600 rub. – 60 rub.;

- More than 600 rub. - 10%.

There is no fee for replenishing a Beeline subscriber's account from a Sberbank card, but it should be taken into account that the cost of servicing a mobile bank is 60 rubles. per month.

Beeline imposes additional restrictions on transfers:

- From one phone it is possible to top up no more than 5 card accounts that belong to one user;

- One Sberbank card can be topped up from two different operator accounts;

- When transferring to a Sberbank credit card, there may be additional restrictions depending on the type of credit card.

How to order and receive a card

You can get a Beeline payment card at any Beeline office with a passport. There are several card options:

Unnamed Beeline MasterCard

- MasterCard Standard - free, unnamed, without a chip - you need to put 100 rubles on it

- MasterCard World - free, unnamed, without a chip - you need to put 500 rubles on it

- After that, you can order the same card in your personal account, but personalized with PayPass, it will be sent by mail, for this you will have to pay 300 rubles (exactly like Kukuruza)

Beeline MasterCard World PayPass personalized card

The card class can be determined by the first digits (EAN) on the 13-digit barcode on the reverse side: 28600 - standard, 28601 - world, 28606 - personalized world.

The service is free for all three cards, SMS information is free , the card issuer is RNKO Payment Center.

Install the mobile application, enter the promotional code FR6TTS37V, and receive 300 bonuses after paying for any purchase (the promotional code is valid for 7 days from the date of card issue. To receive Bonuses, you have 30 days from the date of card issue to pay for the first purchase with a Beeline World card).

How to get a credit card

The card is issued without certificates; for registration you only need a passport. The offer is valid for all adult citizens of the Russian Federation. An application for release can be submitted online or at the Beeline office, the review lasts no more than 30 minutes. Upon review, the bank sets a possible limit and an exact interest rate. If the limit is small, there is always the possibility of increasing it in the future; to do this, you just need to actively use the credit card without delays.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Beeline card replenishment

- the most convenient way to replenish is from linked bank cards through your personal account (up to 100 thousand per replenishment). Replenishment no commission for amounts over 3,000 rubles. At the same time, it is important that the “donor” bank does not take a commission when “pulling” money (

MKB, UBRD, Avangard, Yandex-Money, Promsvyazbank). You can only link your own card. For replenishment amounts less than 3000 rubles, Beeline takes a commission of 50 rubles. - You can top up in cash at Beeline offices. A maximum of 100 thousand rubles can be stored on a non-named card, and 600 thousand on a registered card.

- in the terminals of MKB Bank (Moscow Credit Bank), no commission, fast depositing

- a convenient way to top up is by interbank transfer using the details, they are in the card’s personal account. You need to send it to the legal entity RNKO "Payment Center" (LLC) to a consolidated account. The purpose of the payment is very important here; without it, the transfer will not get to the desired card: “Transfer of funds without opening a bank account. Recipient (full name), card No. NNNNNNNN. VAT is not assessed." Therefore, it is strictly not recommended to send a transfer through banks, which can change the purpose of the payment to their own. The interbank replenishment is credited quite quickly, the 2nd flight from Tinkov arrived at 14:50.

And vice versa, you can “pull” money from a Beeline card without commission where it is also free: Tinkoff Internet Bank, Kukuruza, Rocketbank, etc.

Cheap interbank . The address of the new personal account is bank.beeline.ru (the old one is paycard.beeline.ru, the old card website is card.beeline.ru). You can send money from a Beeline payment card to another bank for 10 rubles, but this must be done in the “Loan repayment” section. You will need the bank's BIC (or its name), and then it depends on the bank. For example, for Tinkoff the contract number (10 digits) is suitable. When the deposit is replenished and the necessary conditions are met, Tinkoff will accrue the required bonus for the interbank transfer. When you activate the “Interest on Balance” function, interbank transfers become free, and the limits increase to 500,000 per transaction (for a personalized card) and 1 million per month.

Cheap MoneySend . You can inexpensively send transfers using a card number with a commission of 0.5%, but not less than 10 rubles (in Sberbank it is 3 times more: 1.5% and 30 rubles, feel the difference).

Pulling from a Beeline card .

The card allows you to withdraw funds through third-party services. For example, the MasterCard payment system service https://card2card.mastercard.ru/ or the CreditEuropaBank transfer service.

List of ATMs where you can withdraw money from Beeline

One of the key points that highlight the weakness of the development of this service is the small number of ATMs that allow you to withdraw funds. In this regard, it is worth noting the list of those in which the user can withdraw money from a Beeline phone:

- SMP Bank

- Asia-Pacific Bank

- BIN Bank

At the moment, this is the main problem in using this service - the small number of ATMs that allow you to withdraw money.

In this regard, one of the conclusions suggests itself is that the company is not interested in funds being withdrawn from subscribers’ balances.

Perhaps the company is more interested in the opposite direction. Therefore, you should not expect an immediate expansion in the number of banks that provide the opportunity to withdraw money from Beeline.

Bonuses (cashback)

Like Kukuruza cards, there is a bonus program that awards points. Only World cards (registered and non-registered) are eligible - 1% of the purchase amount. In the summer of 2021, we added the opportunity to receive promotional bonuses of up to 5% on certain categories of purchases, for example at gas stations, cafes, and pharmacies. Bonuses are not credited immediately after the purchase, but only after the transaction is processed (usually 2-3 days). They become available for use after another 2 weeks (+14 days). The bonus accumulation limit is 6,000 per month. Bonuses are not awarded for some transactions (purchase of gift cards, alcohol and tobacco). After 6 months, bonuses expire. You can spend bonuses for Beeline mobile communications, for landline Internet from Beeline and for goods sold in the offices of this telecom operator. You can usually pay up to 90% of the cost of services and goods, the rest will have to be paid in cash.

Interest on the balance - alas, from 01/01/2019 (PNO) new clients are not connected to the Beeline card; for existing clients, the contract is extended at a rate of 0.01%, regardless of the deposit amount. The PNO option for the Beeline card was also useful for free interbank banking, as well as for ensuring that the funds on the card were insured by the DIA. But now I don’t see the point in it at all.

Cash withdrawal . Cash can be withdrawn from a Beeline bank card at ATMs of any bank without commission if the withdrawal amount is 5,000 rubles or more (otherwise the commission is 149 rubles). Limits on free withdrawal - 50,000 rubles / month (from 01/04/2020 - 30,000 per month), then the commission is 2%. Viewing your card balance at an ATM costs 35 rubles.

Withdrawing cash from a Beeline card

Instead of interest on the balance, those who wish can turn a Beeline payment card into a credit card by connecting to it a credit limit provided by Tinkoff Bank.

UNISTREAM or CONTACT

As in the previous option, there are two sending methods:

- From the site https://moskva.beeline.ru/customers/how-to-pay/oplatit-so-scheta/#/init-payment/34235. Fill in all required fields: last name, first name, middle name of the sender, passport data, if available, UNISTREAM card number. Please provide real information. If the data differs when transferring again from the same number, the payment will be blocked. The owner of the SIM and the sender of the payment may be different persons, but if problems arise, the request must be submitted by the owner of the SIM card. Data about the recipient is reduced to last name, first name and patronymic. To confirm payment, please provide your phone number. The message will contain a transfer control number, which should be passed on to the recipient.

- When making a transaction via SMS, send a text. For example, uni Sidorov Ivan Sergeevich 3300123123 Petrov Petr Petrovich 2000. The rules for formatting the text do not change. When transferring to a CONTACT department, the transaction code will be Cont. The rest of the procedure is unchanged.

The transfer fee will be 5.95% +10 rub. Issuance takes place at any UNISTREAM or CONTACT branch throughout Russia using a passport and a control combination of numbers. Unclaimed payment is sent back minus a fee after 30 days. They will not be credited back only if the sender has changed his cell number, tariff, or activated a service that prohibits mobile commerce.

Procedure for ordering and receiving a Beeline personalized card

In your personal account bank.beeline.ru in the “Order a contactless card” section, order a personalized card with delivery by Russian Post. In this case, you should have 300 rubles in your account, which will be written off. Then events developed like this:

- 15.11 — order a card

- 17.11 - the message “A personalized World MasterCard® Beeline contactless card has been produced and transferred to the delivery service” appeared in the personal account, the departure number is XXXXXXXX.

- 28.11 - a notice of a registered letter was found in the mailbox and on 29.11 I received it at Russian Post

In total, it took 2 weeks, of which the map was made in 2 days.

Having received the card, you need to go to the same page again in your personal account, the “Activate card” button will appear there and the inscription “After activation, your card 2 xxxxxx xxxxxx will be blocked. Cash, bonuses and credit limit will be transferred to the new card.” After pressing the button, a form appears: “Enter the barcode number of your new personalized World MasterCard® Beeline contactless card.”

“The card limit is 600 thousand rubles.

Card xxxxxx xxxxxx is blocked. Cash, bonuses and credit limit have been transferred to the new Beeline contactless card.

You received 2 SMS:

- SMS with a code word for a personalized card. Remember the code word and do not share it with anyone except the Information Center employees.

- SMS with a password to log into the Internet bank of your personal card. After completing this session, log into the Internet Bank using your personal card number and set a new password"

After leaving your account, log in again; the barcode of the new card will be automatically entered as your login. You need to take the password from SMS and set a new password immediately after logging in.

You can get a PIN code for your Beeline card by calling from the number that you specified when registering the card within 14 days at 88005550401 (toll-free). In automatic mode, a PIN code will be assigned to you. If more than 14 days have passed, then you need to call the helpline number 88007006119. In the future, you can change the PIN code on the card at any time by calling the hotline.

That's it, you can top up the card and use it.

You can get additional Beeline cards, 2 more for your passport, but each card will have a separate account. It is convenient to use one card with PNO to store large sums and not show it anywhere, and use the second card for everyday purchases and not keep large sums on it. This is more optimal in terms of security.

Credit

This type of plastic allows you to receive an additional amount for purchases with a delay in depositing money into your account. The features are:

- Up to 300,000 credit limit;

- Free service;

- The maximum number of days without interest is 55.

How to use: accepting and issuing money

The rules for using the card are quite simple. You can withdraw cash from any ATM:

- Withdrawal of credit money involves a commission of 4.9% + additional 500 rubles;

- Withdrawal of personal funds occurs with a commission of 1% (at least 100 rubles).

- Detailed information and current credit card conditions can be found here.

Replenishment methods are similar to those suitable for a debit card. You can also connect the card to your mobile phone and use contactless payment services for Android and iPhone. Additionally, read: Beeline payment without commission.

Loan repayment

It is necessary to make a mandatory replenishment of the balance every month to pay off the accumulated debt:

- You can find out the amount by receiving an SMS from the bank or calling the hotline 8-800-700-0611

- Simply deposit cash through an ATM or transfer money from another source.

You can easily find out your balance status through the application or your personal account on the Internet. You can also send an SMS with the word “Balance” to the short number 6119.

Promotions and discounts from Beeline partners

In addition to cashback and a good exchange rate, you can receive additional discounts from Beeline partners through the bonus program. To do this, go to the “Promotions and Offers” section in your personal account at bank.beeline.ru. There's a big list of offers. In all cases, you must first follow the link at the bottom of the offer. For example:

- Burger King - 30% discount

- Platypus - 50 bonuses

- Crossroads - 2% bonuses

- Delivery Club - 6% bonuses

- AliExpress - 2% bonuses

- Yulmart, MVideo, OLdi, MediaMarkt - 1% bonuses

etc.

How to find out your balance

In this section we will briefly describe how to check and find out the balance of a Beeline MasterCard card. The current account status and history of transfers and payments can be found:

- in the Personal Account of the Beeline payment card (follow the link we will tell you how to enter it);

- in the application of the same name;

- in the call center (you just need to know your code word);

- at any ATM marked MasterCard - the cost is 15 rubles;

Other Beeline cards

Debit from Alfa Bank

05.11.2020 — Alfa Bank

and

Beeline

launched a co-branded debit card

Cashback 1-5-25

.

Service is free. You can receive an instant card in Beeline stores.

- A 25% cashback is promised for payment / “Alfa-Click” / “My Beeline”) - payment limit 500₽/month (spending 2000₽/month).

- 5% cashback for purchases at Pyaterochka and Perekrestok supermarkets (payment limit 1000₽/month).

- Other purchases - 1% cashback, total payment limit 5000₽/month, but subject to purchase volume of at least 10k/month.

- Unfavorable “hundred-ruble” cashback rounding.

- Interest on balance: 4% per annum for purchases over 10k/month. 5% per annum on purchases over 100k/month.

- SMS info: 99₽/month

- SBP: free up to 100k, interbank: 9₽/transfer.

Information:

- Promo website

- Card tariff (pdf)

- Detailed conditions for the bonus program (pdf, see pages 16-17)

Withdrawing money through Contact, Unistream, Russian Post and Zolotaya Korona

It is possible to withdraw funds from the operator’s personal account virtually throughout the entire territory of the Russian Federation, including those places where there are no bank branches and ATMs. This is possible where there are divisions of the Russian Post or institutions that can carry out issuance through the Contact, Unistream or Zolotaya Korona transfer systems:

- On the operator’s portal, you need to go to the “Payment and Finance” section – subsection – “Money transfers”, then subsection – “Send a transfer”;

- Then select the location where you want to receive the transfer;

- Next, in the form that opens, you need to fill in the fields containing information about the persons who will send and receive funds, indicate the amount and number of the subscriber from whose account the debit will occur;

- Confirm the transfer, i.e. enter the code sent by the operator via SMS in response to the transfer application.

The system allows you to withdraw up to 15,000 rubles at a time. There is also a minimum amount - 100 rubles, and for transfers via Contact - 1000 rubles. Additionally, the client will incur costs associated with paying the commission (from 2.6% + 50 rubles for Russian Post and 5.95% + 10 rubles for Contact and Unistream). The commission is applied only for transfers within the territory of the Russian Federation; for transfers within the CIS (the list of countries is specified in the photo) no commission is charged. Before going to the point of issue of funds, you need to make sure that you have a passport and a code word (the client receives it after all the steps to send the transfer).

Cash withdrawal

The company's client can contact any office of the mobile operator, regardless of location, to withdraw cash. There is no withdrawal fee. The maximum cash withdrawal limit per month is 1,000,000 rubles.

Important! The exception is a credit card. When withdrawing cash, a commission of 4.9% of the amount plus 500 rubles is charged. At the same time, the amount should not exceed the established credit limit.

At an ATM

Withdrawing funds using an ATM is carried out in the same way as when using other cards. Cash withdrawal without commission is possible only at ATMs of Alfa-Bank, MKB, UBRD and others. The full list can be found in your personal account.

At a bank branch

Withdrawals are carried out at any bank in the Russian Federation. In this case, a commission of 4% of the total amount will be charged, but it should not exceed 350 rubles.

An additional option for withdrawing money from a Beeline mobile account

In addition to the above options, it is possible to withdraw funds by simply topping up another mobile account.

It is possible to make such a transfer not only within the Beeline network, but also in favor of other mobile operators. To make a transfer, dial the USSD command – *145# and the call button. Next, you need to follow the simple recommendations that follow the command. A one-time transfer is limited to an amount of 5,000 rubles, the lower limit corresponds to 10 rubles. A commission is applied, the amount of which varies depending on the transfer amount. So, if the transfer is made to a Beeline number from 30 to 200 rubles, then the commission will be 15 rubles. If from 201 rub. – 5000 rubles, then the commission will be 3% + 10 rubles. in the home network and at 4.95% + 10 rubles. It will cost the user to withdraw funds in favor of subscribers of other operators. Especially for you: How to unsubscribe from Beeline?

How to pay for goods/services using your phone?

For SIMs issued as part of corporate services, it is possible to pay for goods and services from a mobile account; only a sufficient amount of funds is required in the initial balance. Payment is made as follows:

- An invoice for payment is issued indicating a unique supplier code;

- An SMS is sent to 7878 with the necessary data;

- In response, a message will be received that will confirm payment.

Sellers of goods and service providers receive payment as an ordinary non-cash payment. Payment is possible thanks to the Contact and Unistream systems. As a request, the SMS should look like: <vendor code, user’s full name, amount>.