The number of available funds to pay for electronic (and other) services and conduct banking transactions is growing every year.

Now almost every major IT company has its own electronic wallet services (Apple Pay, Google Wallet, Yandex.Money, WebMoney, Mail.ru Money, Rambler.Money, RBK Money, QIWI and others), not to mention the number of banks. Each of these systems requires registration, and routine transactions such as card withdrawals or cash withdrawals may require additional proof of identity. To transfer funds to a partner or friend, it is ideal to have an account in the same bank or an account in the same system in order to make this payment with minimal fees and as quickly as possible. Our new card from MegaFon is designed to solve such problems and make the process of transferring funds more convenient and faster. The only thing you need to receive it is to be a MegaFon subscriber.

Maxim Potapov (IT Financial Services MegaLabs) and Andrey Vengerov (Financial Services Marketing) will tell you more about the new project.

Advantages of the card

Judging by the reviews, the creators' idea was a success. The card is popular and in demand. Even those users who write negative comments note the ease of use and instant transfer of funds. Among the advantages of the card, owners highlight the following:

- easy to refill. Add money to your phone number and it will be transferred to your card;

- Safely pay for purchases in online stores. You don’t have to show your main salary card;

- service is free;

- 8% per annum is charged on the money remaining in the account;

- you can receive up to 15% cashback at Megafon partner stores;

- free internet - for every 100 rubles spent - 10 MB;

- contactless payment technology;

- the same card can be added to multiple devices. For example, on a smartphone and tablet.

Some users have adapted it to withdraw money from webmoney and credit cards. Just top up your phone account and then cash out. With the card, these operations can be performed without commission.

Card Features

The card is issued in the MasterCard payment system and is prepaid.

That is, in order to activate it and make transactions using it, you need to top up your account with a certain amount. In the first three months after activation, owners cannot dispose of the entire amount in the account. Depending on the tariff plan, the system will block a certain limit of funds. For example, 200 rubles. Whatever you put on top of this amount, you can use for expense transactions, but you will not be able to spend these 200 rubles.

Only after 3 months will it be possible to spend any amount of money on the card.

The card is replenished very easily in any convenient way: through terminals, Megafon personal account, and other services. The balance of funds, as noted above, will be charged 8% per annum, provided that the account has at least 500 rubles.

To control your expenses, you can use the Megafon-Bank service. It's easy to register:

- Go to the company's website.

- Click on the “My Bank” button and enter your phone number.

Here you can view the balance of not only your phone, but also the phones of loved ones.

MegaFon Bank debit cards

Today I will write a negative review!

For two years I successfully used a card from Megafon. For me, it is beneficial and interesting because it has a common balance with a SIM card from this operator. But not everything was as rosy as we would like.

In most cases, to top up the card it was enough to transfer the required amount to the mobile balance. But in July I topped up my phone number myself from an electronic wallet. The amount was decent - more than 4 thousand rubles. Then I paid with the card in the store twice, the total amount was approximately 250 rubles. But a few hours later I decided to check the balance again and discovered that my account was missing 1 thousand rubles.

I decided to call technical support to clarify the situation. But the manager never told me anything meaningful. All he could do was create a return request. A few days later I called again to find out when the refund would be available. Then they told me that the money would be returned no earlier than in a month. But the most interesting thing is that no one can really track where this amount went.

Three weeks have already passed since my application - and guess what? But nothing, I received neither an answer nor money. Moreover, he clarified it on his own more than once, but the answer was still the same - “Wait.” So before entrusting your funds to a Megafon card, you should think several times. Because a good story can end badly.

In addition, today I left a letter on the website with an appeal to the bank. I hope that now the matter will get off the ground. The text was like this:

Good afternoon I have already called your hotline more than once to resolve a situation that arose regarding the disappearance of my money in an unknown direction. without my knowledge. I submitted a request back on July 20, and after three weeks no decision has been made. The interesting thing is that this operation is not displayed in any way in your personal account. I am outraged that my funds have disappeared in an unknown direction and I have no access to them. In addition, I still have not received my money back. I notify you that I will proceed as follows:

- On the website I leave a description of the current situation in full detail.

- I’m writing about the same thing on the review page.

- I am writing a statement to the Central Bank of the Russian Federation

I took a screenshot of the letter, which will confirm the fact of the request.

Another minus

I issued the card back in December, minor flaws did not prevent it from working. But about a month later I issued a withdrawal of funds from Yandex wallet and WebMoney. Then I tried to pay for services in one of the services with a card. But as a result, I received a message about an error. Accordingly, the payment was not made. And this was not only on one specific service, the same thing happened on several others.

I contacted support with this question. And, as it turned out, I wasn’t the only one who had this problem. Many people had similar problems with the card from Megafon. The point is that from the 7th to the 11th, payment with this particular card was unavailable anywhere. But I was never warned about this. This all speaks of terrible service and disrespect for customers.

And now about the most important drawback!

When I decided to pay for a purchase with this card in a store, an error appeared on the terminal. But the funds were withdrawn from the balance, although there was no message about this. I started calling the hotline - they answered that it was not their problem and they would not help. The store told me that such a write-off was erroneous and usually the funds are returned to the account from which they were written off within 24 hours - for this you do not need to call the hotline of the bank that issued the card. But, as you can guess, no one returned anything.

I called technical support again - they answered that the amount had been credited to the account. But they made this conclusion on their own due to the fact that there was already other money in the account. But I doubt the competence of the manager who spoke to me. Because she was completely unable to understand the situation and take steps to not just open a balance sheet, but look at the history of transactions.

After that, I had to wait for more than an hour - it’s just terrible, I’ve never been on the line with operators for so long. In the end, they just turned me off and that’s it. Since then I have been trying to get my money back, but to no avail. Moreover, when I call the hotline, no one picks up, regardless of the time of the call. In general, the service is not just terrible, but disgusting - you can’t have a normal conversation with them.

After a while, I decided to withdraw cash so that there would be nothing on the account. But again an error occurs, and the balance becomes empty. This time I decided to go to their office and write a written complaint. But even there they don’t know what to do in such a situation. They said that within two weeks the application would be reviewed and appropriate measures would be taken. But, to be honest, I no longer believe that I will get back at least part of the amount.

The result is the following.

Among the advantages:

- Easily and quickly withdraw money from online wallets

- Card service is free

This is where the list ends. Now about the disadvantages:

- SMS notifications do not work correctly

- Customer service is just no good

- There are interruptions in the operation of the card

- If there was an error during payment or withdrawal, it is impossible to return the money

This is my first experience of using a card with such a long list of shortcomings, although I have come across inconvenient cards before. But it definitely didn’t happen like that.

Another point that I just can’t understand is who else uses this card, because it is convenient only for those who work on the Internet and receive payments into their wallets. Withdrawing from them to the Megafon card is easy and quick. But my nerves are more valuable to me. If you do not want a repeat of my situation, then do not apply for this card.

Addition.

Some of the lost amount was returned to me about a month after the date of publication of my negative review. For this, special thanks to one Megafon representative. He himself found me and offered his help in solving the situation. But if I had not written my story here, the cart would still be there today.

Thank you everyone, I have everything!

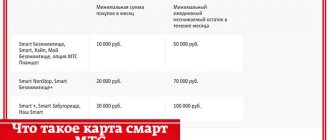

Types of cards

At the moment, there are 4 types of Megafon bank cards: 3 plastic and 1 virtual. You can release a plastic one for the virtual one. The table shows the comparative characteristics of the cards.

| Possibilities | Virtual card | Megafon Gold | MegaFon Standard NFC | Megafon standard | |

| Card Features | May have a plastic carrier, or can be used without it | Card with contactless payment | Card with chip and contactless payment | Card with chip | |

| Payment for goods and services | No commission | ||||

| Payment for banking services, for example, transferring money, replenishing a bank account of another MCC bank - 6012 | 0% for transfer amounts up to 10 thousand rubles per month; 0.75% of the total amount if the transfer amount is more than 10 thousand rubles per month. | ||||

| Transfer from a Megafon card to another card through the Mastercard MoneySend | 1.99% of the transfer amount | ||||

| Replenishment of an electronic wallet | 8% of the transaction amount | ||||

| Cashback | Up to 20% | ||||

| Cash withdrawal fee | 0% at an ATM with an NFC module up to 10 thousand inclusive | ||||

| 2.5% of the transaction amount (up to 10 thousand rubles); | |||||

| 3.5% for transaction amount over 10 thousand and up to 50 thousand. | |||||

| 4.5% for transaction amount more than 50 thousand rubles | |||||

| Currency conversion | 3% of the transaction amount | ||||

| SMS banking cost | 30 rubles | ||||

| Balance request | 20 rubles at an ATM with an NFC module | ||||

| Decor | for free | 0 rubles – tariff plans Get involved! Listen, Talk, Chat, Watch, Premium”, “All inclusive” M,L,XL,VIP | 0 rubles - for tariffs “Turn on!”, “All Inclusive” M, L, XL, VIP, XS, S | 0 rubles – for tariffs “Turn on!”, “All Inclusive” M, L, XL, VIP, XS, S | |

| 99 rubles - tariff plans “Turn on! Open, Write", "All inclusive" XS,S | 149 rubles for other tariff plans | 99 rubles for other tariffs | |||

| 249 rubles – other tariffs | |||||

| Bonus megabytes | 10 rubles for every 100 rubles | ||||

You can have up to 5 cards. All of them can be easily linked to one personal account or to different ones.

Digital card

Digital does not have a physical design, but despite this, the functionality is not inferior to ordinary plastic. Registration is available through the Megafon Bank mobile application.

In the start section there is a corresponding key, pressing which release is carried out instantly. In this case, you need to choose one of the available tariff plans: Light, Standard or Maximum. Payment for use is debited immediately after registration.

Digital banking products have lower limits than standard ones. This is due to the simplified client identification procedure. To go through the full procedure, you should contact the nearest branch with a passport of a citizen of the Russian Federation. If you have a plastic card, the limit on a digital one will be the same.

For clients, it is important how much registration costs. Megafon issues the card for free. The subscriber pays only the cost of the selected tariff plan. Payment is taken for the remaining days in the month.

During the registration process, a passport is not needed because the company verifies the details of mobile account holders. Owners of this type can take advantage of bonus offers and cashback from Megafon Bank.

Through the MegafonBank application, the PIN code is set by the user independently. The digital card belongs to the MasterCard Prepaid payment system, its validity period is 3 years. Each user has the right to open up to 5 accounts, both digital and plastic. Using the gadget application, only one is issued.

Depositing money to the card is carried out in several ways:

- Internet transfers.

- Mobile app.

- Payment terminal.

- ATMs of any bank.

- Electronic wallet and others.

Depositing money is replenishing your phone account. Standard plastic replenishment methods are also available to subscribers.

How to activate the card

You can activate the card yourself or ask a consultant at the salon:

- Buy a Megafon bank card.

- Call number 5555 and follow the instructions.

- A PIN code will be dictated to you. Remember it or write it down.

- Top up your phone account (and therefore your card account) in a convenient way.

- Perform some action with the card and enter the PIN code. For example, buy something in a store (online stores are not suitable for your first purchase) and pay for the purchase using it or cash out at an ATM.

All! The card is activated.

Interest and Cashback

We charge 8% per annum on balances above 500 rubles and up to 200,000. Interest is credited once a month subject to one condition - at least one transaction must be made on the card this month (there is no minimum transaction size, you can spend at least 1 ruble per month).

That is, having 10,500 rubles in your subscriber account every month, you will receive 800 rubles in annual interest.

You can withdraw cash from the card at any ATM for 2.5% of the withdrawal amount. You urgently need to withdraw 1000 rubles from your mobile account into cash - and for 25 rubles you can do this at the nearest ATM. At the same time, there is no minimum commission amount (for example, 100 rubles) or a withdrawal threshold - you do not need to withdraw a minimum of, say, 3000.

As for transferring funds to the account of this card, the whole matter is simplified by the fact that you can transfer them not to the card number (so that other banks do not charge interest for this), but replenish your (or the recipient’s) telephone account from any other bank account. There is usually no commission for this.

Even while in Moscow, you can transfer money to a card to a relative in the Far East by simply topping up his mobile account with the required amount, without commissions. Of course, if the relative is our subscriber who received the card.

Well, where would we be without cashback if we are talking about a full-fledged bank card? We return up to 10% of purchases from our partners to the card. Of course, it’s not bonus points, minutes, etc. that are returned, but money that you can spend on anything you want.

Loyalty program

One of the advantages of Megafon cards is bonus megabytes of Internet traffic.

For online purchases, you can get free megabytes of Internet. They are credited within a month after payment for the purchase. For every 100 rubles spent, you are credited with 10 MB of internet. And owners of the “Turn On” tariff can receive 1 GB of Internet for the first purchase worth more than 100 rubles. You will learn that you have been awarded points via SMS. It will contain information about the number of bonuses received. Anyone can participate in the program. But first he must purchase a Megafon card.

Using bonus megabytes is very simple. There is no need to activate or connect anything. As soon as you use up your traffic package, the megabytes received for purchases will begin to be spent. But remember! They cannot be used while traveling.

How to withdraw cash

Money can be withdrawn from any ATM or terminal. The commission is:

- If less than 10 thousand rubles are withdrawn. – 0%. But the turnover on the card must be at least 3 thousand rubles.

- If the turnover is less than 3 thousand rubles and less than 10 thousand are withdrawn, then the commission is 2.5%.

- From 10 thousand to 50 thousand – 3.5%;

- 50 thousand to 100 thousand rubles - 4.5%;

- 100 thousand – 300 thousand rubles;

If you want to receive money at special collection points, the commission will be 4.99%.

Credit card

Clients of a mobile operator can obtain a credit card from a bank. The huge possibilities of the bonus system allow you to pay for cellular communications and additional options. In addition to using credit funds, owners of such banking products can accumulate bonuses, which are later spent on paying for communications.

The credit card is issued in cooperation with Avangard and Citibank banks. Each of the products has its own distinctive features and advantages. But there are a number of general advantages. These include:

- Hotline, whose specialists work around the clock.

- Online support service.

- Connecting to promotional programs that reduce the interest rate for using borrowed money.

- Cashless payment for goods and services.

- Maximum benefit when paying for communications.

- Simple payment mode PayPass.

Citizens living in the Moscow region can become owners of credit cards from Megafon and Citibank. The set of documents for registration is minimal. Only citizens of the Russian Federation can become credit card owners.

For this purpose, a passport is provided to Megafon. If the subscriber wishes to expand his capabilities, then he must submit a 2-NDFL certificate confirming legal income. This will allow you to connect. Citizens aged from 22 to 60 years can apply for a credit card.

Subscribers must soberly assess their solvency, and only after that contact a financial institution. Income per month should not be less than 15 thousand rubles. For beginners, the pressing question will be “how to get a bank card?”

There's nothing complicated about it. An installment card is issued based on an application, which is completed through a special form. The form contains basic personal and contact information of the borrower. The application is submitted on the official website or at a permanent office.

Online application will significantly save time because it eliminates the need to visit a branch. It is also possible to submit a request for registration from home by calling a courier.

The employee will tell you all the details of filling out the form and the conditions for receiving it, and how to use Megafon credit cards. For most clients, a passport will be sufficient, but a certificate confirming the citizen’s income may be required.

Today, issuing banking products via the Internet is a fairly popular service. Go to the lender’s official website, go through a simple registration and fill out the application form. The following should be specified:

- Personal passport details are identical to those indicated in the official document. Even with the smallest error, the probability of failure is 100%.

- Registration address, as indicated in the passport. In addition, the organization asks to indicate the client’s actual residential address if they do not match.

- Job details. The bank provides loans only to employed citizens. The client must indicate the name of the company, address and contact phone number of the organization, length of service, as well as salary.

- Additional information. The borrower will need to answer questions from the lending institution, which may subsequently influence the decision.

When answering additional questions, you must be extremely honest, otherwise refusal to receive a Megafon credit card cannot be avoided. The bank is primarily interested in the presence of existing credit obligations to other organizations, property ownership, marital status and children, as well as the presence of a foreign passport with travel stamps.

On the official website, customers will be able to find complete information on how to obtain a card and how to block it.

How to find out your card balance using SMS

To do this, you need to connect SMS banking. After connecting, by sending various SMS commands to number 5555, you can find out how much money is left in the account, receive a statement for a given period and perform other operations.

The service is free for the first month of connection. In the future, 30 rubles will be debited from the account monthly.

Use these commands:

- BALANCE – to determine the account balance;

- PIN – to change the PIN code;

- HISTORY – information about the last 10 operations;

- HISTORY XXXX - if there are several cards, then you can find out the history of a specific card by typing the last 4 digits of the card together with the word “HISTORY”;

- BLOCK №№№№- block a specific card. Instead of “№№№№” enter the last 4 digits of your card. The operation is relevant if you have lost or had your card stolen;

- BLOCK ALL – block all Megafon cards.

You can also simply block by calling 5555 or in your Megafon-Bank personal account.

Use cases

The map can be a good addition to the maps you already have.

It can be used wherever you do not want to provide your salary or credit card information. For example, link its data to a taxi calling application, use it for online purchases and while traveling, pay for freelancers’ services (or accept payments on a card if you freelance), quickly transfer funds to friends and relatives. Or give a card to a child so that he learns how to use them.

Yes, and the pressing question is that you won’t be able to go into the red with such a card—you can pay with the card only if you have a positive account balance.

We will be happy to answer your questions in the comments.

Virtual card

A virtual card can be obtained in two ways: in the personal account of a Megafon subscriber or on the Megafon Bank website. Let's look at the second method in more detail:

- Go to the company's website, and then to the "Maps" section.

- Select "Virtual Card" and click "Issue Now".

- Enter your phone number. You must be a Megafon subscriber.

- They will send you a code via SMS. Enter and click Continue.

- Create a password and confirm it. Then click "Issue Card".

In a few seconds the virtual card will be ready. After this, you will need to download the Megafon Bank mobile application and add the card to a contactless payment application, for example, Apple Pay, Samsung Pay or Google Pay.

The virtual card has certain limits. To remove restrictions, you need to purchase a plastic card. To do this, visit the Megafon office with your passport.

The table shows the limits on the use of funds with and without a plastic card.

| Without plastic card | ||

| Overall size | Daily limit | Monthly limit |

| 60 thousand rubles | 100 thousand rubles | |

| Cash withdrawal | 5000 | 40 thousand |

| Translation | 15 thousand rubles | 40 thousand |

| Online shopping | 60 thousand rubles | 100 thousand |

| With a plastic card | ||

| Overall size | 100 thousand rubles | 600 thousand rubles |

| Cash withdrawal | 100 thousand rubles | 300 thousand rubles |

| Translation | 100 thousand rubles | 300 thousand rubles |

| Online shopping | 100 thousand rubles | 600 thousand rubles |

It is not necessary to purchase a plastic card, but as you can see, the limits increase significantly if you have one.

What types of Megafon cards are there?

Firstly, debit only. There are no credit options available at this time. That is, the client manages exclusively his own funds.

Secondly, the Megafon card can be issued both in the form of standard “plastic” and without physical media. The latter is called “virtual” or “digital”.

All plastic cards are offered as “contactless” - you can pay with “one touch”, as well as from smartphones that support NFC technology (using Apple Pay, Samsung Pay, Google Pay).

When registering, the user will need to select:

- card type (Standard or Platinum). How they differ from each other - read the article about card design;

- tariff that determines the terms of use and the accrual of bonuses (“Lite”, “Standard” or “Maximum”).

In 2021, a tariff system is in effect. When applying for a card, you must select one of them. Read more about the new tariffs here.

All Megafon bank cards belong to the Mastercard payment system. The process of issuing any type of card is free.