Registration and replenishment of a virtual card

You can get a card without a preliminary application at Megafon stores. The client can receive up to 5 active payment instruments in his name, linking them to one or more personal accounts. A payment instrument account is a telephone account where money is transferred in any convenient way. In addition, the owner of a Megafon virtual bank card has access to the usual replenishment methods: ATMs of any banks, the Internet, an application, payment system terminals.

What is a banking product from a cellular communication company?

A special feature of all MegaFon cards is that they are linked to a phone account. That is, the amount of money on the phone is the amount of money on your card. It is clear that MegaFon should be the cellular operator.

Thus, every time you top up your phone balance, you also top up your card. It is convenient to pay for goods and services using your cell phone. Up to 5 plastic wallets can be linked to one account.

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

Many users have a fair question. What to do if your phone is lost or stolen? Call your mobile operator's hotline and block your SIM card. Access to the mobile application is only possible using a PIN code, which only you must know.

A mobile operator is not a financial and credit organization, and therefore cannot be an issuer of banking products. To gain the right to work with them, he entered into an agreement with Round Bank. Not the most famous financial institution, it occupies 204th place in the ranking.

Loyalty program tariffs

As part of the bonus program, the Megafon virtual card holder can receive additional privileges. Let's look at them in more detail:

- “Lite” – after connecting, the first and second months will be free. With a turnover of up to 200 thousand rubles (the daily balance must exceed 500 rubles), 6% is charged on the balance;

- “Standard” – cashback accrual of 1% (up to 1000 rubles per month), 8% on the balance when spending up to 200 thousand rubles (daily balance must exceed 500 rubles);

- “Maximum” – cashback 1.5% (up to 3,000 rubles per month), 10% on the balance when making transactions worth up to 200 thousand rubles (daily balance must exceed 500 rubles).

For every 100 rubles spent on a virtual card, a Megafon subscriber receives 10 MB. When purchasing from partners (KOMUS, Sportmaster, Hotpoint, Indesit, Togas and others), up to 20% of the money spent is returned to your account.

How to use

When issuing a virtual card, it is not at all necessary to also have a plastic one. But if you want to increase the existing transaction limits, then you should stop by the operator’s office and apply for a plastic card. Let's see how the limits of plastic and virtual cards differ.

| Restrictions on the amount of transactions | Virtual | Plastic |

| Daily | RUB 60,000, incl. | RUB 100,000, incl. |

| 5,000 rub. | 100,000 rub. |

| 15,000 rub. | 100,000 rub. |

| 60,000 rub. | 100,000 rub. |

| Monthly | RUB 100,000, incl. | RUB 600,000, incl. |

| 40,000 rub. | 300,000 rub. |

| 40,000 rub. | 300,000 rub. |

| 100,000 rub. | 600,000 rub. |

The difference is significant if you plan to pay for large purchases. For example, travel packages, furniture, etc.

The virtual card can be used to pay through a payment terminal if the phone has an NFC function.

The same operations are available for all types of cards from MegaFon as for bank payment instruments. Payment for goods and services, including in online stores, cashing out money, replenishing an account, transfers, etc. Since the card and phone account are the same account, you can top it up in the usual way:

- in special terminals,

- through the Internet,

- through an ATM of any bank,

- at the office of the mobile operator.

If your card is equipped with a contactless payment system, then after activation the first operation must be carried out with the introduction of a PIN code, then without it.

How to spend bonus megabytes?

Megabytes will be credited within 30 days after the operation. Their number can always be tracked in your personal account through the mobile application. First of all, traffic according to the tariff plan will be consumed, and then bonus megabytes. However, you cannot use them in international roaming. There is no need to activate points; they are activated automatically immediately after the limit is exhausted.

Types of payment instruments

The following types are produced:

- Virtual

To obtain it, it is not necessary to visit the operator’s office. It is enough to order an issue online in your personal account or in the MegaFon Bank application. You won’t need a passport either, since the operator has your passport information.

The virtual card has the same details as a regular instant card: number, expiration date and security code (on plastic these are the last 3 digits on the back).

- Plastic: Gold and Standard

These are real plastic cards that must be received at the office of a mobile operator with a passport. Only MegaFon clients can issue them. The procedure takes no more than 5 minutes. The payment system is international MasterCard, so there will be no problems when paying abroad.

After receiving the card, you must activate it using the toll-free number 5555. In the Standard option, you can take plastic with the ability to pay by phone, i.e. with NFC technology.

Gold and Standard cards are equipped with a contactless system, but according to the rules of the transaction, over 1,000 rubles. require entering a PIN code. Keep this in mind.

Additional costs for Megafon Virtual

Registration, blocking and unblocking of a Megafon virtual debit card is absolutely free. For all transactions, no commission will be charged for expenses up to 10,000 rubles per month if the turnover for the current period exceeded 3,000 rubles. The billing period is 1 calendar month. The following procedures have exceptions:

- 0.75% – withheld from the operation (part of it) if expenses exceed 10,000 rubles for the settlement period;

- 8% – charged when replenishing an electronic wallet (MCC 4829, 6050, 6051, 6539, 6540);

- when withdrawing cash from ATMs and service points, the commission is 2.5% for amounts up to 10 thousand rubles per month, 3.5% for 10–50 thousand rubles, 4.5% for withdrawals over 50 thousand rubles for the current period ;

- when withdrawing cash at points of issue – 4.99%.

is provided free of charge.

Megafon bank card: looking for applications

The appearance of any new card always arouses interest. After all, the card issuer always faces the task of attracting customers, i.e. occupying a specific niche. You need to offer something profitable and unique, otherwise no one will simply use the newly released product.

And Megafon really offered something special, namely a bank card that has a common account with the balance of a mobile phone:

The Beeline payment card and the MTS-Money card have a very distant relationship with the balances of the mobile telecom operators of the same name. At Beeline, cashback from transactions is awarded with points, which can be used to top up the balance of a Beeline phone, and cashback from purchases is credited to an MTS mobile phone when the “Mobile” option is activated.

Let's get back to the product. This is what an advertisement for a Megafon bank card looks like on the website:

We are promised 8% per annum on the account balance, cashback up to 10%, free service and instant receipt.

You can access Megafon-Bank via the link bank.megafon.ru .

Let's take a closer look at the conditions for providing the product and try to identify the main advantages and disadvantages of the card.

Subscribe to the @hranidengi channel on Telegram - only there is the most up-to-date information about updates, useful life hacks and other interesting things from the world of finance

Save the Money! recommends:

Megafon bank card. Peculiarities

1 What is a Megafon bank card?

On the Megafon website in the “frequently asked questions” there is the following definition: a Megafon card is a bank card with full functionality, the account of which is a mobile phone account. Those. When making purchases using a Megafon card, the money will be debited from the phone balance. And after topping up your phone balance, you can use the funds when paying by card:

However, this formulation is not entirely correct; a rather significant detail is missed. The Megafon card is a prepaid card, it does not have a separate bank account:

The issuer of the card is Bank Round LLC.

To make a payment using a card, the mobile operator Megafon increases the amount of electronic means of payment in the Bank at the expense of funds in the personal account, which are an advance payment for the Operator’s communication services. Data:

That is, in fact, at the time of the transaction, the funds on the Megafon card turn into electronic funds (EMF), which you provide to Round Bank for making payments. EMF is not insured by the Deposit Insurance Agency:

In general, as they assured on the hotline, if the license of Round Bank is revoked, the money on the balance of the Megafon mobile operator will not be lost. Only funds that were authorized to make payments using the card, but did not have time to leave the bank will be burned (i.e. the EMF balance was increased due to the phone balance, but in fact the bank did not have time or was unable to make the payment).

Bank Round LLC is a small credit institution, 290th in Russia in terms of net assets, controlled by representatives of the main shareholder of the Metalloinvest holding, Alisher Usmanov.

2 Conditions of receipt.

The first owners of the card were our saber fencers-champions of the Olympic Games in Rio:

And already from August 23, 2016, any Megafon subscriber in Moscow and the region, St. Petersburg, Yaroslavl, Tver, Kaliningrad, Murmansk, Arkhangelsk and Vologda can receive a Megafon card.

To receive an instant card, all you need to do is be a Megafon subscriber and provide your passport.

The card is issued unactivated. To activate and receive a PIN code, you need to call 5555. After receiving the PIN code on the card, you can immediately make purchases (checked in person).

Residents of other regions will be able to obtain this card from October.

UPD: 05/06/2018 As of 05/06/18, the Megafon card can be obtained throughout Russia.

UPD: 06/24/2021 Since May 2021, the issuance of Megafon plastic cards has been suspended; virtual cards can still be issued in the Megafon application.

3 Cost of production and maintenance.

UPD: 04/27/2019 From 04/26/2019, the Megafon bank card is issued free of charge.

When registering, you will need to choose one of three service tariffs: “Lite”, “Standard” or “Maximum”. All of them are paid, but there are conditions for not charging a service fee. The payment is debited on the first day of the month based on the results of an analysis of the turnover for the previous month. During the month of connection, the fee is debited in an amount proportional to the number of days before the end of the month (except for the “Lite” tariff for the initial connection).

All tariffs provide bonus megabytes for purchases (10MB for every 100 rubles of purchase), as well as interest on the daily balance from 500 to 200,000 rubles. subject to spending from RUB 3,000/month:

UPD: 07/31/2020 From 08/01/2020, MCC 4900 was added to the list of exceptions that are not taken into account in the turnover for the payment of PIT and the accrual of bonus megabytes.

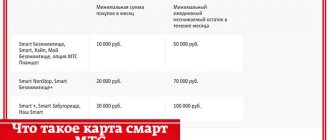

● “Light” tariff costs 49 rubles/month. When connecting for the first time, no fee is charged for the first two calendar months (taking into account the incomplete month of connection). Further, it is free with a spending turnover of 3,000 rubles/month. The daily balance is charged 6% per annum;

● The “Standard” tariff costs 149 rubles/month, the fee is not charged for card spending turnover of 10,000 rubles/month. (except for the list of exceptions). The daily balance is charged 8% per annum. All purchases receive 1% cashback.

● The “Maximum” tariff costs 199 rubles/month, no fee is charged if the turnover of card expenses is over 30,000 rubles/month. (except for the list of exceptions). 10% per annum is charged on the daily balance. All purchases receive 1.5% cashback.

The tariff on the Megafon card can be changed once a month if necessary:

In addition to plastic cards, you can issue a virtual Megafon card; it will have the same tariffs as on a plastic card. With this card you can make purchases in brick-and-mortar stores using Apple Pay, Google Pay and Samsung Pay.

Megafon Bank conducts various campaigns to popularize this payment method:

You can also withdraw cash from an ATM using a virtual card:

Those who issued a Megafon card before March 26, 2019 do not have to switch to new tariffs; you can stay on the old one until the end of the card’s validity period (without turnover requirements for free service).

If the card is reissued for any reason other than a malfunction, you will have to choose a card servicing tariff; you won’t be able to stay on the old one.

4 Interest on the balance.

The terms of the Megafon loyalty program indicate that 8% is accrued daily on balances greater than 500 rubles (if the account balance is less than 500 rubles, then interest is not accrued on that day):

Please note that 500 rubles is always deducted from the amount on which interest (bonus) is calculated.

The bonus is awarded for an amount less than 200,000 rubles:

To receive bonuses you need to make at least one purchase using the card per month:

UPD: 04/27/2019 From 04/26/2019 new tariffs apply: when making purchases from 3,000 rubles/month. on the “Light” tariff 6% per annum is charged, on the “Standard” tariff – 8% per annum, on the “Maximum” tariff – 10% per annum

For those who received the card before 04/26/2019 and have not switched to new tariffs, the conditions for calculating interest on the balance remain the same, 8% per annum on the balance from 500 to 200,000 rubles. when making at least one purchase per month:

UPD: 12/15/2020 Before deciding to place serious funds on a Megafon card, you should at least read the review below, where 80,000 rubles were stolen from a client. The scammers issued a new SIM and virtual card using his passport data and withdrew money using them.

1000 rub. for a free Cashback card from Raiffeisenbank, 1000 rubles. for “100 days without %” from Alfa-Bank with a free year, 1,500 rubles. for Tinkoff Black, 4000 rub. for Tinkoff Platinum, 500 rub. for “EVERYTHING is possible” from Rosbank, 500 rubles. for “Moscarta” from “ICB”, 3000 rubles. for an Opencard credit card, 8,000 rubles. for Citi Select, 1000 rub. for “110 days without interest” from Raiffeisenbank with free cash withdrawal and free service.

Save the Money! recommends:

5 Cashback 1-1.5% on everything.

UPD: 04/27/2018 On the “Standard” tariff for all purchases (except for the list of exceptions 4812, 4813, 4814, 4829, 6010, 6011, 6012, 6050, 6051, 6211, 6529, 6532, 6533, 6534, 6536, 65 37, 6538 , 6539, 6540, 7299, 7311, 7372, 7399, 7995, 8999, 9311) cashback is 1% on everything, on the “Maximum” tariff - 1.5%:

UPD: 06/03/2020 MCC 4900 (utilities) was added to the list of exceptions for cashback on the Megafon card from 06/05/2020. In circulation for free, interest on the balance and commission-free withdrawal of 10,000 rubles/month. such transactions are still counted.

UPD: 06/24/2021 From 07/01/2021 MCC 4900 will not be taken into account in turnover for calculating PNO (in turnover for free tariffs and for withdrawing 10,000 rubles/month without commission, MCC 4900 will continue to be taken into account).

Now cashback for utilities can be obtained on Vostochny credit cards (5%), on the Universal Card from ATB (10%), on the Comfort card from UBRiRA (5%), on the Raif card “EVERYTHING AT A TIME” (2-5%, depending on the certificate), on a credit card “UBRIRA” “I want more” (up to 3%, depending on turnover), on an “Alfa Card” (1.5-2%) , on the Yandex.Plus card from Alfa (1%), on Fora-Bank cards (1-1.2%), on the Host Card from RSHB (1%), on the card " MTS Weekend (1%), on MKB cards (1%).

There is rounding that is unfavorable for the client. To calculate cashback, the purchase amount is rounded to a multiple of 100 rubles. to a lesser extent. Those. for a purchase of 990 rubles. on the “Standard” tariff there will be a cashback of 900 * 0.01 = 9 rubles, on the “Maximum” tariff 900 * 0.015 = 13.5 rubles.

For the “Standard” tariff, the monthly cashback limit is 1,000 rubles, for the “Maximum” tariff - 3,000 rubles.

In addition to these limits, there is also a general remuneration limit of 5,000 rubles/month. (it is relevant when connecting additional options with a 5% cashback, more on that below):

UPD: 07/31/2020 From 08/01/2020, the minimum cashback amount that can be paid will be 100 rubles. If, taking into account rounding when calculating, it accumulates less, then it will simply burn out:

For some regions, basic cashback on the Megafon card is no longer provided; we are talking about phone numbers registered in the Bryansk, Vladimir, Kaluga, Kursk, Nizhny Novgorod, Oryol, Ryazan, and Tula regions. They only have a percentage of the balance, bonus megabytes and promotional rewards from partners.

UPD: 06/24/2021 From 07/01/2021 cashback on the Megafon card is canceled for all regions and for all tariffs.

As an alternative, you can consider other cards with cashback, where the phone balance is equal to the balance on the card: – The Tinkoff Mobile provides a 1% cashback on everything – The MTS Cashback Mobile provides 1% on everything and 3% for clothes , catering and children's goods

6 Options for increased cashback.

UPD: 10/02/2019 The promotion for the Megafon card with 5% cashback in selected categories ended on October 1. Rewards for purchases made in September will be credited on October 28th.

Megafon has not yet come up with anything to replace it, so now the card only provides cashback of 1 and 1.5% on all purchases on the “Standard” and “Maximum” tariffs, respectively. Also in the “Promotions” section in your personal account or mobile application there are cashback offers at selected retail outlets. These offers are individual, for example, someone has 7% cashback in Lenta in October:

From a more or less decent place, I have 15% cashback on the first purchase at Kari, 5% cashback at EKA and Shell gas stations, 3% at Stolichki pharmacies, 5% at Gorzdrav, 10% at Leonardo and etc.

7 Transaction limit.

The tariffs for the Standard and Gold cards indicate a limit on card transactions - 100,000 rubles per day, 600,000 rubles per month.

UPD: 10/05/2018 The virtual card has slightly lower transaction limits compared to a plastic card:

UPD: 11/28/2020 8 You can withdraw 10,000 rubles/month from the Megafon card. at any ATM without commission after making purchases in the amount of 3,000 rubles/month. If you withdraw cash without spending 3,000 rubles, the commission will be from 4% for amounts up to 10,000 rubles. and then 5-6%, depending on the total withdrawal amount:

Transactions with the following MCCs are not counted as purchases: 4812, 4813, 4814, 4829, 6012, 6050, 6051, 6529, 6530, 6532, 6533, 6534, 6536, 6537, 6538, 6539, 6540, 7299, 5960, 7399, 7995, 9754, 9311.

In addition, you can withdraw funds from the card through third-party services (MSC should be 6538), the commission for such an operation will be 3% (before 12/01/2020 it was 1.99%). For replenishing electronic wallets, a barrier commission of 10% is established (MCC: 4829, 6050, 6051, 6539, 6540), for MCC 6012R - 2%.

The daily limit for withdrawals from the Megafon card is 100,000 rubles, the monthly limit is 300,000 rubles:

9 You can set separate limits on the card for transactions (cash withdrawals, purchases per day/month, etc.):

10 Megafon bank card holders agree to receive spam.

11 Under the terms of the offer, the client agrees to transfer all data on transactions to some other persons:

12 Conditions and rates may change at any time.

13 The bank may refuse the transaction, citing 115-FZ .

UPD: 01/17/2018 14 When making purchases in foreign currency using a Megafon card, a favorable MasterCard IPS conversion rate on the day of the actual account transaction:

UPD: 11/28/2020 From 12/01/2020 the conversion rate will become even worse, the commission will be 5%:

Conclusion The Megafon bank card is a rather interesting product. The ability to make purchases using your phone balance with cashback is a very unusual service. Moreover, the balance of the Megafon phone itself can be topped up with cashback using many cards. The interest on the balance of 6-10% per annum also looks very decent, however, it is worth remembering the commission for withdrawing funds from the Megafon card (free only 10,000 rubles/month after making purchases from 3,000 rubles).

I hope my article was useful to you; write about any clarifications and additions in the comments.

You can follow updates in this and other articles on the Telegram channel: @hranidengi . Channel mirror in TamTam: tt.me/hranidengi .

Subscribe to Telegram

Subscribe to TamTam

Subscribe to stay updated on all changes :)

comments powered by HyperComments

Terms of service

To control their card, subscribers can use the service combination *455*3#. This request will allow you to view the balance on the card.

People who use smartphones can download a convenient application from the company onto their phone. Thanks to it, it will be possible to obtain card details, keep records and control over payments and funds. If the client’s number is changed or the contract is reissued to another person, then the card will be blocked automatically. The service will have to be reactivated.

Any card can be lost or hacked by fraudsters, or perhaps the subscriber has simply forgotten the password to it. In such cases, you need to do some things. In order not to go straight to the company salon, use the phone number and codes from Megafon:

- To obtain an access code, you can dial *455*2#. Afterwards you will receive a message with the data;

- To block a card, you can dial *455*0# on your phone. After this, you need to write the word “stop” in the window that appears.

- To use other parameters, you can send a message with any text to the short number 4554.

All Megafon communication clients can use Megafon-Bank. This is an online resource that allows you to fully control your active cards. In addition, you can register in it even without receiving a card.

It is also worth noting that all residents of Russia who use this connection can receive a card, but the only exceptions are people who use the services on credit. Another advantage is that money can be withdrawn not only throughout the country, but also abroad.

How to get a MegaFon card

If you are ready to issue a card, order it on the website by choosing the appropriate tariff. It should be remembered that only an adult citizen of Russia who has the number of this telecom operator can become the owner of the plastic card. If you don’t have a SIM card yet, it’s okay, just register for both products at the same time.

Up to 5 active MegaFon debit cards can be issued per person (but no more than 15 per year). Moreover, you have the right to connect them to different mobile numbers opened with a given operator.

After receiving the plastic, it must be activated. This can be done through the MegaFonBank mobile application:

- Log in using your username and password. By the way, you can register in the smartphone program without having a card.

- Find your debit card, it will be in an inactive state.

- Click “Activate” and create a PIN code. It will definitely be requested when performing the first debit transaction on the terminal. In the future, you can change your password at any time through the mobile application or by calling the hotline.

- Almost immediately the card will be activated and you will be able to use it at your discretion.

The second option for activating the plastic card is through the call center at 5555. You need to contact the operator from the phone number that is linked to your card account. Follow the instructions from the answering machine to help you activate your debit card. Then all you have to do is connect your tariff plan.

Advantages and disadvantages

I do not depart from tradition and analyze the advantages and disadvantages in my subjective opinion and the opinion of users who were not too lazy to leave reviews. I didn’t notice any disagreements with my assessment.

Pros:

- Free service.

- Accrual of 8% on the account balance. This is more than most bank deposits.

- Linking the card to your phone account. You can pay for purchases without taking the plastic out of your wallet.

- Possibility to pay abroad.

- Possibility to open up to 5 cards per account.

- NFC technology and contactless payment.

Minuses:

- Extortionate withdrawal fees. You can withdraw cash without commission only if certain conditions are met.

- Weak loyalty program.

- The Standard card does not have contactless payment technology.

- Frequent technical problems during use.

And the main disadvantage. Round Bank does not charge interest or pay cashback. This is what MegaFon does. On the financial portal Banki.ru there is simply a flurry of angry requests from customers who, if all conditions are met, are not charged interest on the account balance and cashback for purchases. The bank sends it to its partner, and there, apparently, is not able to solve the problem.

Card Features

The card is issued in the MasterCard payment system and is prepaid.

That is, in order to activate it and make transactions using it, you need to top up your account with a certain amount. In the first three months after activation, owners cannot dispose of the entire amount in the account. Depending on the tariff plan, the system will block a certain limit of funds. For example, 200 rubles. Whatever you put on top of this amount, you can use for expense transactions, but you will not be able to spend these 200 rubles.

Only after 3 months will it be possible to spend any amount of money on the card.

The card is replenished very easily in any convenient way: through terminals, Megafon personal account, and other services. The balance of funds, as noted above, will be charged 8% per annum, provided that the account has at least 500 rubles.

To control your expenses, you can use the Megafon-Bank service. It's easy to register:

- Go to the company's website.

- Click on the “My Bank” button and enter your phone number.

Here you can view the balance of not only your phone, but also the phones of loved ones.

Let's sum it up

Nowadays the telephone has become more than just a means of communication, so it is not surprising that the possibilities of mobile communications are constantly expanding. An example of this is the Megafon Bank card, with which it is impossible to take out a loan, but you can simplify the implementation of typical transactions.

For some clients, the card is not only interesting, but also beneficial, especially for everyday purchases.

The only unfinished side of the new tool is the insufficiently developed network of partner companies for cashback circulation.

A Megafon plastic card is allowed to be issued not only to persons with a Russian passport, but also to foreigners (you must provide a visa or a version of your passport translated into Russian). Age limit – upon reaching 18 years of age.

It is worth considering that the card has an “inactivity fee” - if no paid action has been performed in 90 days, then the next day a fee of 5 rubles will be charged. per day . As a result, we can conclude that you don’t plan to use the card, just don’t apply for it.

Established restrictions on available operations

The following limits are provided for a debit card:

- daily - 100,000 rubles (including cashing out - 50,000), for transfers or payment for goods also 100,000 rubles;

- monthly - 600,000 rubles (cash withdrawal - up to 300,000), transfers or purchases - 600,000 rubles.

However, remembering that the restrictions apply only to the card itself, and not to the entire mobile bank account, you can issue additional cards for the same number for your loved ones. This will allow you to spend and withdraw cash in multiples of money.

Tariff plans for card services

Before you get a Megafon bank card, you should familiarize yourself with the proposed tariffs:

- Registration of a Megafon Standard, Standard NFC and Gold bank card is free for owners of tariffs Get involved! Listen, Talk, Communicate, Communicate Promotion, Look, Watch Promotion, See VIP, Look +, Look + Maximum, Look + VIP, Premium, Premium Light, All inclusive M, L, XL, VIP.

- Tariff owners Get involved! Open, Write, Try, Try +, All Inclusive XS, S will be able to issue Standard and Standard NFC cards for free, and Gold - for 99 rubles.

- Owners of other tariffs with voice communication capabilities have the opportunity to acquire a Standard card for 99 rubles, NFC Standard for 149 rubles, Gold card for 249 rubles.

- Blocking a bank card is free.

- SMS account notifications are free.

- Interest on the balance is calculated daily. At the beginning of the month, interest calculated for the previous month is credited.

In order for interest to be credited, the holder must make at least one payment transaction on the card during the billing period and maintain a mobile phone account balance of more than 500 rubles.

Functions

Users can log into their personal account both on the website and in the mobile application. You can download the program from the official store for smartphones based on Android and iOS operating systems.

Subscribers receive the following opportunities in their Megafon bank card personal account:

- View transaction history;

- Receiving reports on expenses and income;

- Setting spending limits;

- Transfers to other users;

- Payment for goods and services.

Separately, it is worth mentioning existing promotions. Megafon bank card partners offer to make purchases and receive cashback in the form of bonus points, which are returned to your balance in real rubles. You can view the full list of offers on the operator’s website in the Promotions section.

Finally, we note the reviews of Megafon debit bank card owners. Subscribers note the following advantages:

- Availability of a welcome bonus that can be spent on communication services;

- Convenience of using a single mobile and plastic account;

- Wide selection of promotional offers.

So you have become acquainted with all the banking products from Megafon, we hope you can easily make a choice. If you have any questions, ask them in the comments.

Receipt and activation

You can get a plastic carrier at the company office:

- Find the nearest communication store on the map located on the official website of Megafon Bank (just scroll to the very end of the page);

- Visit the office and a specialist;

To conclude a contract, you must take your passport with you.

You can order a virtual product on the website or in the mobile application:

- Click the “Release Now” icon next to the product;

- Enter your mobile to receive the code;

- Enter the code sent by SMS into the required field and follow the instructions on the screen.

The registration process takes a few minutes, after which you will become the owner of a banking product in virtual mode or in the form of plastic. Now you need to understand how to activate a Megafon bank card:

- Call 5555 from the mobile phone to which the product is linked. You will receive an SMS with a PIN code;

- Dial the phone, tell the operator your passport details and get the necessary numbers.

The pin code will be activated after making your first purchase, where you must enter a confirmation. Now you know how to activate a Megafon bank card.

Well, now you can get acquainted with the available functions of online banking and mobile application.

Internet bank

Users are offered a convenient online service from Megafon Bank, which allows them to monitor the actions performed when using the card. To access the Internet bank you need to go to the resource bank.megafon.ru.

For convenience, an application has been developed with the appropriate name “Megafon-Bank”, available for all modern platforms in a minimalist style. Free online banking functions no worse than similar services of other banks.

With its help, you can quickly set up expense accounting and bill detailing; you can pay for services, cable TV or the Internet at any time.

Numerous transactions can be carried out instantly online, free of charge using the remote service system. The system is accessible not only using the application, but also through the browser after registration.

In any place where there is Internet, you can log in and use Megafon Internet banking, regardless of location.

Possibilities of Internet banking Megafon

The Internet banking resource is intended for the following:

- Transfer funds to similar MasterCard accounts.

- Formation of limits.

- Payment for the desired services.

- Identification of MMC operation codes.

- View ongoing transactions on your card.

- Set up useful SMS notifications.

Video on the topic:

Advantages of using an operator card

The many advantages of the card include:

- The ability to use your smartphone account as a universal wallet - make purchases, spend available funds on services or goods;

- Bonus points in the form of 8% per annum are awarded to the client when making at least one purchase per month;

- There is a cashback system, when paying for goods with a Megafon card from partners, the returned amount can reach up to 50% of the money spent;

- Quick registration - contact the salon, where you will immediately be issued a plastic card;

- Unlimited number of cards linked to a subscriber account.

How to find out your card balance using SMS

To do this, you need to connect SMS banking. After connecting, by sending various SMS commands to number 5555, you can find out how much money is left in the account, receive a statement for a given period and perform other operations.

The service is free for the first month of connection. In the future, 30 rubles will be debited from the account monthly.

Use these commands:

- BALANCE – to determine the account balance;

- PIN – to change the PIN code;

- HISTORY – information about the last 10 operations;

- HISTORY XXXX - if there are several cards, then you can find out the history of a specific card by typing the last 4 digits of the card together with the word “HISTORY”;

- BLOCK №№№№- block a specific card. Instead of “№№№№” enter the last 4 digits of your card. The operation is relevant if you have lost or had your card stolen;

- BLOCK ALL – block all Megafon cards.

You can also simply block by calling 5555 or in your Megafon-Bank personal account.