An MTS bank card is a convenient tool for performing many credit and financial transactions. MTS Bank offers unique conditions, tariffs and cashback to all clients. Thanks to modern protection technologies, owners' savings are safe.

The principle of operation of the cards fully satisfies the requirements of the Central Bank of Russia and global payment systems.

Choosing the right MTS Bank card is a guarantee of receiving the right assistant, simplifying the solution of financial difficulties. It is enough to simply correctly determine the following points:

- Main function of the card: credit card, debit card with opening a savings account, virtual;

- Purpose of use: salary transfers, payment for online purchases, etc.;

- Account currency;

- Territory of application: Russia or foreign countries;

- Additional functionality: contactless payment, interest accrual when paying for purchases, cashback.

When all these points have been determined, you can begin to choose the most profitable plan. You can apply for a card either at any bank branch or using a specialized service.

Debit card MTS Money Weekend

This debit card is distinguished by a full range of modern important functions and low costs of use.

Visa Platinum is an offer for clients who actively use the card. In order for the annual service to be free, it is enough to always keep a balance exceeding 30 thousand rubles on it, or pay monthly purchases in the amount of at least 15 thousand.

You can withdraw money from your card at any ATM; no fees are charged. Payment at retail outlets can be made using the PayWave contactless method.

When the card is issued, a “Savings Weekend” account is immediately opened. Every month, on the 5th, you can receive 6.5 percent of the account balance. To use this opportunity, you need to keep more than 1,000 rubles on your card for a month.

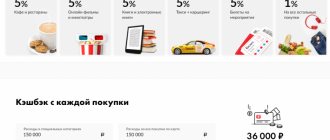

An additional advantage of the offer is a five percent cashback when paying bills in cafes and restaurants, calling a taxi, or purchasing sports goods. Cashback is set at 1% for other purchases.

Which card is better to choose?

Having decided to issue a bank debit card, clients usually choose one of two options - MTS Money Weekend and MTS Cashback. The second option looks more interesting - this card has free service, and it can also work as a credit card.

Money Weekend 14+ is intended for young people, and the MIR debit card is for employees of budgetary organizations.

The Money Premium card will appeal to customers who want improved service and an additional package of privileges.

Features of the MTS Smart Money debit card

The offer offers very favorable conditions.

The main feature is a discount provided to subscribers of the MTS network, which allows them to compensate 100% of the payment for the MTS Tablet, Smart and Hype tariff plans. The security technology “Verified by Visa” is used, the essence of which is confirmation of payments on the Internet using a code sent to the phone via SMS. Registration of the card will cost 199 rubles, its further use is free if the holder is an MTS subscriber.

When you issue a card, the “SMS Bank” service is activated free of charge, and you receive notifications about all financial transactions in the form of text messages.

Democratic commissions guarantee that cash withdrawals from MTS branded ATMs occur without overpayments. Contacting the operator at the cash desk requires a 0.5 percent fee of the total transaction amount, while issuing cash at ATMs of other banks requires a commission of 1 percent with a minimum amount of 100 rubles.

Non-cash transfers to MTS cards are not subject to commission, to cards of third-party banks - a commission of 1 percent, but not less than 49 rubles.

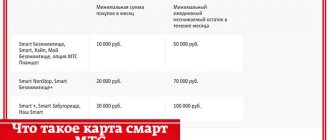

To receive a discount, the amount of which corresponds to the price of the “Smart” or “MTS Tablet” tariffs, you must meet one of the following requirements:

- Tariffs “My Unlimited”, “MTS Tablet”, “Smart Unlimited”, “Hyip” - you need to make purchases worth more than 10 thousand rubles per month, or maintain a balance of more than 50 thousand;

- “Smart NonStop” and “Smart Unlimited” – purchases for 20 thousand or 70 thousand balance;

- “Smart Zabugorishche” and “Smart +” – 100 thousand balance or purchases for 30 thousand.

When determining the possibility of reward, the system takes into account all transactions related to debiting funds from the card, paying for services and goods using it. If transactions occurred on the last day of the month and were not taken into account by the system, they are transferred to the next month.

Subscribers using city telephone numbers need to be aware that the discount is provided without taking into account the security of the number.

Using an MTS Bank card

Using MTS plastic should not be difficult. Payment on the Internet or through a terminal is carried out in the same way as with cards from other banks.

Debit #Cashback card

Apply online

You can top it up:

- at the company office;

- at the bank's cash desk;

- through the electronic wallet “MTS Money”;

- transfer from another individual or company;

- through payment systems.

Sometimes there are cases of card blocking. Most often this happens due to the expiration of the plastic card or suspicion of fraudulent activity. To sort out the problem and find ways to solve it, you need to contact the company’s employees using the hotline number, using the feedback form on the website and sending a registered letter to the bank branch.

Features of the MTS Money Premium debit card

When registering a card, the holder will receive a whole range of services:

- Privileges from the MasterCard system, in particular, the opportunity to use business class lounges without restrictions, the Priceless Cities program;

- The ability to pay for purchases contactless through the “Android Pay”, “Apple Pay”, “Samsung Pay” systems;

- Insurance offer from “MasterCard”;

- Ability to call emergency services;

- Additional card “Priority Pass”;

- MasterCard Concierge.

The included plastic “Priority Pass” should be considered separately. It perfectly suits the needs of people who regularly use air transport. You can use it to wait for your flight in the VIP lounges, regardless of what class you purchased your ticket for.

Issuing a card is free, as is its annual maintenance if the total amount of transactions exceeds 100 thousand, or a balance of 400 thousand is always maintained. Upon issuance, a service of SMS notification by phone, insurance and an insurance policy are issued, which is valid even when traveling outside the Russian Federation.

The map also has the following differences:

- You can top it up without any commissions;

- Regardless of the purchase, the cashback amount is 1%;

- Interest on account balance – 6.5;

- Withdrawals from branded ATMs of MTS, as well as other banks participating in the preferential program, are not subject to commissions. You can also withdraw money abroad three times without commissions.

If the card is lost outside the Russian Federation, it can be replaced free of charge. There is also a free cash withdrawal service.

About the bank

The bank was opened in 1993, initially called the Moscow Bank for Reconstruction and Development. The bank is part of the holding company PJSFC Sistema, which, in turn, includes the telecom operator MTS. In 2012, MBRD changed its name to MTS Bank and acquired Dalcombank, a medium-sized bank with a developed network of branches in the Far East. From 2013 to 2021, MTS PJSC bought a controlling stake from the holding company PJSFC Sistema.

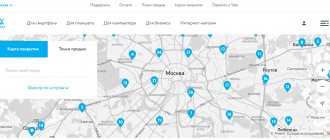

More than 99% of the bank's shares are controlled by MTS PJSC through Mobile TeleSystems BV and MGTS PJSC. The head office of MTS Bank is located in Moscow. MTS Bank offices are open in 50 cities of Russia, including St. Petersburg, Yekaterinburg, Novosibirsk, Krasnodar and others. There are also service points in MTS communication stores throughout the country. The bank operates on the basis of the general license of the Central Bank No. 2268 dated December 17, 2014.

MTS Bank works with both individuals and legal entities. The bank offers loans, cards, deposits, money transfers and premium services to private clients. Cash settlement services, loans, investment services, deposits, acquiring, factoring and foreign trade services are available for business.

Features of the MTS Weekend credit card

The loan limit is 299 thousand 999 rubles.

The cost of service per year is 900 rubles, the duration of the grace period is 51 days. At the end of this period, the loan rate varies from 23 to 31.5, depending on the individual conditions established by the bank. The amount of mandatory payment on debt is 5 percent, but it cannot be less than 100 rubles. The most important conditions for issuing a loan are as follows:

- Availability of a valid passport of a citizen of the Russian Federation;

- Must be at least 18 years old.

About debiting MTS CASHBACK

MTS CASHBACK is one of the universal card products. This means that the holder can use both his own and borrowed funds.

If the card has a zero credit limit, then it is a debit card. In the process of using plastic, the bank can offer the client a certain amount of credit. The limit will be granted automatically unless the holder refuses it.

The client has the opportunity to independently change the type of card. For example, if the need for borrowed funds suddenly arises, the owner of the plastic can request a credit limit at any time. Conversely, if there is no need for a credit card, you can make it a debit card by reducing the limit amount to zero. In both cases, you should contact the MTS Bank hotline.

As part of this offer, an instant card of the MasterCard World category is issued. Card account is maintained only in rubles. The issue of additional cards to the main plastic is not provided.

Technical features of debiting:

- payment for purchases on the Internet using 3D Secure technology (confirmation of transactions with a password from SMS);

- the ability to make contactless payments at retail outlets using the PayPass option;

- connecting the card to payment services Apple Pay, Google Pay or Samsung Pay.

Customers aged from 20 to 70 years can apply for an MTS CASHBACK debit card. A prerequisite is the presence of a passport of a citizen of the Russian Federation.

Apply for a card

Features of the MasterCard World card

The best option for salary transfer. It is possible to obtain a loan of up to 400 thousand, and numerous bonuses are offered.

When crediting funds on a credit basis, the interest-free period is 51 days. The interest rate is minimal and amounts to 21 percent. There is no commission when withdrawing cash from any terminal.

Additionally, you can sign up for contactless payment services, mobile banking and Internet banking.

Features of the MTS World bank card

The card is serviced by the national payment system, but works anywhere in the world.

This card is issued to employees of Russian budgetary institutions and is used to transfer social benefits and scholarships. The issue is free, there is no annual maintenance fee. The positive features of this proposal are as follows:

- A wide list of operations available for execution, from cash withdrawal to payment for housing and communal services;

- Maximum security;

- Participation in the deposit insurance program with compensation payments up to one million 400 thousand rubles;

- Using “PayWave” for contactless payments.

Features of the MTS Student bank card

This offer is specifically designed for students aged 18 to 24 years. A mandatory condition for using the program is Russian citizenship.

There are no annual maintenance or registration fees. Cashback on the card is three percent during the first three months of use, one and a half percent after their expiration.

As an addition, you can connect Internet or mobile banking services, which make it easier to control expenses, make money transfers quickly, and pay for certain services. The “PayPass” function is provided.

Protection is provided by a reliable electronic chip.

Card design

You can order an MTS debit card in two ways: at the organization’s office and via the Internet.

In the first case, you need to contact a bank representative and have a Russian passport with you. Next, you fill out the form and issue the plastic.

In the second case, you must fill out the application yourself on the MTS Bank website. It states:

- last name, first name and patronymic;

- passport details;

- Date of Birth;

- place of residence;

- contact information (phone number);

- code word (for further identification).

Within 24 hours, the manager will call you back and schedule a visit to the salon to receive plastic.

The card is valid for 3 years. Adult citizens of the Russian Federation can receive it. There are no other requirements for clients.

Features of the MTS virtual bank card

This card has no physical image.

In other words, this is a set of details, that is, a 16-digit number, code, and expiration date. When registering, all this information is sent to the client as a text message to his phone. The main function of a virtual account is to pay for various products and services using the Internet, from traffic police fines to housing and communal services.

When replenishing your account, a commission fee of 0.75% is expected with a minimum value of 50 rubles.

Managing and using a virtual card is as simple and easy as possible:

- There is no need to dial PIN codes, the information received by text message is enough;

- Transactions are possible all over the world, you just need to know the card details;

- For protection, the modern “3D Secure” method is used.

You can deposit money into your account from a mobile number or from another open account.

How to re-release

An unnamed card is reissued instantly in MTS salons and offices of the organization. Reissue of a personalized MTS Bank card takes up to 5 working days and is issued at the company’s offices. A passport will be required.

The card will be issued free of charge in the following cases:

- at the initiative of the bank;

- due to damage to the payment instrument due to an error by the organization;

- if the validity period expires.

In other cases, the user will be required to pay a reissue cost equal to the price paid for the first issue.

If you need to close or block the card, read the instructions on our website.

How to get cashback using MTS cards?

Cashback means a refund in the amount of a certain percentage of the purchase amount paid by card.

According to the bank's policy, funds are returned weekly, on Friday. When calculating the amount, only purchases made between Monday and Sunday of the previous week are taken into account. Cashback does not apply to transactions related to cash withdrawals, transfers, and some purchases. The maximum monthly cashback amount is limited to three thousand rubles.

Additional options

They are necessary to gain access to all features of the banking product:

- Mobile. Allows you to return 3% of the amount spent to an MTS phone number.

- Shopping. Refund of 3% of the amount spent on business needs. The maximum refund amount is 1,500 rubles per month. The bonus can be received when making purchases of 15,000 rubles or more.

- Trips. Earning points for purchases abroad and in Russia.

- Cumulative. To accrue interest, you must maintain a minimum balance on your card account of 1,000 rubles.

Useful banking services

Cardholders can use a specially developed mobile application and online banking. Using these services, it is very convenient to control expenses, make payments and transfers in any convenient place.

Online banking functions look like this:

- Payment of bills for mobile phone, Internet, housing and communal services, traffic police fines;

- Generating a report on completed transactions;

- Currency exchange at favorable rates;

- Blocking the card or removing the blocking.

To install the application, you can download it from the Google, Windows or Apple brand store, use the QR scanner on your smartphone, or click on the link in the text message sent when you issue the card. Personal login information is also sent via text message.

Samsung Pay

The functions of this application are identical to the previous ones, but it is developed for phones of the Korean concern Samsung. A distinctive feature is that the application emulates the magnetic stripe of the card, making it compatible even with terminals that do not support the contactless payment function. To link an MTS card, use the following instructions:

- Install the latest version and log into the application;

- Adding a card by entering its details;

- Acceptance of the terms of service;

- Confirmation by entering the password sent in a text message.