Hello all egg lovers!

UPDATED-10/20/2019. I've attached a poll and let's see what people think.

Let's talk today about the No. 1 mobile operator in Russia and look into cashback from MTS.

UPDATED – 07/30/2019. MTS has a new universal format card called “Cashback”. I did a full review here.

The official website of the program is //cashback.mts.ru

I’ve always wondered why the “MTS” symbol is an egg?

And they chose Nagiyev for advertising because of his hairstyle?

When else will there be time to reveal this great secret, if not now?

It turns out that the symbol is not an egg, the symbol is in the shape of an egg.

It covered a little, right? It is simplicity and innovation, excellence and potential.

This is such a complex simplicity, the chicken has practically nothing to do with it.

Bank card "MTS Cashback": detailed description

Withdrawing cash from a MTS Cashback bank card

Replenishment of the MTS Cashback card

Transfers by card

Own funds

- Transfers from card to card through MTS services - commission 15%.

- Transfers from account to account in MTS Bank branches - the commission is 1.5% (not less than 20 ₽ and not more than 2,000 ₽ per transaction).

- Online transfers by account number - commission 0.3% (not less than 20 rubles, but not more than 150 rubles per transaction).

Credit funds

- Transfers from card to card or to account - commission 3.9% + 350 ₽.

- Transfers in MTS Bank branches - commission 7%.

Commissions for transferring money from MTS to Sberbank cards

The cellular network operator charges a commission for each transaction, even if its size is 50 rubles.

The official document on the MTS company website does not specify the size of the commission. In the offer agreement you can find clause 6.3, which states: as part of the transfer, the user may be charged a commission, depending on the source of funds.

In fact, the minimum commission for transfers up to 500 rubles is 10 rubles. Above this amount, the commission will be 1.9% of the transferred amount. If you are transferring money from your own balance.

Where to spend cashback

Here’s the most important thing: cashback does not come to card users exactly in the form in which they would probably like to see it: points can only be used for payments or purchases in the operator’s official showrooms .

p, blockquote 5,0,1,0,0 —>

The accumulated cashback can be “shared” with other MTS subscribers by paying for their communication services.

p, blockquote 6,0,0,0,0 —>

Therefore, if a client who is not an MTS subscriber receives an MTS Cashback card, then he can only spend bonuses on purchasing smartphones, accessories and other equipment in MTS stores.

p, blockquote 8,0,0,0,0 —>

You won’t be able to cheat and try to withdraw bonuses credited to your subscriber account into real money.

p, blockquote 9,0,0,0,0 —>

How to spend cashback on communications from MTS

Program participants who have accumulated a sufficient number of cashback points can spend them through the personal account interface on the operator’s website, or in the official mobile application. For this purpose, the company’s specialists have developed so-called “goals” that are set via the Internet.

p, blockquote 11,1,0,0,0 —>

Users can, for example, set up a mobile recharge goal. I would like to emphasize that replenishment is not carried out instantly, but only on the 1st day of the month following the setting of the goal. Thus, if you set a goal to replenish your phone account with 200 rubles for bonuses, for example, on July 20, the actual replenishment of the account will occur only on August 1.

p, blockquote 12,0,0,0,0 —>

How to spend cashback on purchases at MTS stores

To apply for a discount on goods and services in MTS service stores, you must order a special certificate in your personal account or mobile application. Today, certificates are available in denominations starting from 100 rubles. After ordering a discount, you will receive a text message to the previously specified phone number containing a promotional code with a discount. It will need to be used in a communication salon, voicing numbers and letters to MTS employees. Promotional codes are not valid if used when paying for online orders, and are only relevant for use directly in the operator’s stores.

p, blockquote 13,0,0,0,0 —>

Payment using a certificate may not be 100% - at least 1 ruble of the cost of the goods must be paid in cash. The discount is valid for 1 quarter. I note that the promotional code can be transferred to third parties, that is, used as a gift to a relative or friend.

p, blockquote 14,0,0,0,0 —>

How to apply for a card

Note! Already at the registration stage, the client can refuse the credit limit and use the card as a debit card.

You can apply for an MTS cashback card in one of 4 ways:

- In the MTS salon.

- Call the hotline operator.

- Submit an electronic application on the State Services portal.

- Submit an online application on the official website.

The last option is the most convenient and popular. All you need is to fill out an application, indicate the credit limit you are interested in and your mobile phone number. Within 5 minutes you will receive an SMS message confirming whether you have received approval or not, and within 24 hours you will be able to pick up the card at an MTS store or bank branch. The card can only be picked up on weekends.

The decision when submitting an application online is preliminary. Only after submitting all original documents will the employee announce the final answer.

Initial credit limit calculator

The loan calculator will help you calculate the approximate interest on the deposit and clarify the approximate credit limits. With its help, the future borrower can, by entering the amount of his income and the desired amount of payments, create the most convenient credit limit. The loan calculator helps make the borrower more aware of the future loan and, therefore, responsible for obtaining a loan.

You will find out the preliminary amount of the credit limit that the bank can provide you. The calculation is for informational purposes only; Each bank has its own conditions for providing a limit.

The calculation is not final, since the bank takes into account many other parameters of the application. The credit limit will be increased over time. Apply for a credit card and get a decision online.

Receiving bonuses for purchases from program partners

As I said above, the main “item of income” from using MTS Cashback is making purchases from the company’s partners.

p, blockquote 16,0,0,0,0 —>

MTS Cashback offers fairly favorable refund rates for many of the company’s partners. Here, for example, you can find such “giants” as Aliexpress, Ozon, Yandex.Taxi or Sportmaster. However, “MTS Cashback” has no significant differences from, for example, “ePN” or “Letishops”, only the latter two offer to withdraw accumulated points into real money, rather than pay for services with them.

p, blockquote 17,0,0,1,0 —>

However, despite this, among the MTS Cashback partners there are many companies in which every person systematically makes purchases, and the cashback amount here is very, very decent.

p, blockquote 18,0,0,0,0 —>

The payment refund goes to the MTS Bank client's account within 90 days (or less). However, if you dig deep on the Internet, you can find reviews from users who did not receive cashback even after the agreed upon 90 days. In such cases, you must contact support.

p, blockquote 19,0,0,0,0 —>

"Citylink"

This store interested me after I saw the rate from MTS.

And Citilink itself has not interested me for quite a long time, because after the fall of the ruble in 2014, it raised prices to the skies.

For a more detailed debriefing about this store and how to get a refund for purchases there, read yesterday’s article.

Now, if you sort products on Yandex.Market by price, you won’t find “Citylink” on the first or second pages.

Before it was easy.

MTS offers a full 1% refund on orders from this store.

Yes, this seems undignified now, but you haven’t seen offers from cashback services yet.

One of the reasons why I criticized Citylink was because the rates were lousy.

Competitors

- "ePN Cashback" will return as much as 0.2% of the order. Let's say Petya bought a computer worth 50 thousand rubles. This means he will receive 100 rubles cashback. In my opinion, now you can’t even buy a mouse pad with this money.

- Cashback.ru, which usually shows good results, this time offers only 0.25%. And not all products are eligible for returns: the exceptions include mostly children's items and furniture. Not impressive, right?

- “Kopikot” gives cashback, but it would be better not to give it at all: here they will return only 0.15% of the order. That is, Petya would receive 75 rubles for his computer for 50k. For this reason, I wouldn’t even bother with cashback.

- “Biglion” is another stranger among its own, because initially it was not a service for returning interest, but now it has created such a function for itself. And it gives a “generous” 0.25% of the order in Citylink.

I have prepared a separate material for you about the latest service, in which I tell you about saving options and shopping rates.

Mini-conclusion : MTS’s offer for Citylink is simply excellent. Cashback services could not reach him . This is amazing, in my opinion. A big plus for the operator.

Cashback rounding and expiration date

Separate attention should be paid to the issue of rounding the accrued cashback. The fact is that the cunning, prudent specialists from MTS thought about developing special conditions for rounding the amounts of payments and purchases from which cashback is calculated. Thus, if a client pays for a purchase in the amount of 49 rubles, the amount of 1% cashback will be 0 points. If the purchase size is 50 rubles, the amount of the refund will be 1 point, even though 1% of 50 rubles is equal to 50 kopecks.

p, blockquote 20,0,0,0,0 —>

As for the expiration date of accrued points, there is simply no expiration date; accumulated bonus rubles can be stored on the client account for an unlimited amount of time.

p, blockquote 21,0,0,0,0 —>

"Booking"

The situation here is the same: I saw the rate, so I decided to include this service for booking hotels and apartments in the review.

The fact is that MTS offers only 3% for booking a hotel through Booking.

And since this is an expensive thing, every hundredth of a percent plays a role.

So let's see what the competitors have prepared.

I’ll warn you right away: you have to wait a very long time for cashback from Booking, since it is credited only after you check out of the hotel. Yes, yes, that’s right: even if you pay for all the hotel rooms, but don’t arrive, you still won’t get a refund.

Competitors

- Letishops seems to offer the same 3% as MTS. But let's not forget about the cunning scheme for increasing cashback using promotional codes, which I described above. Thanks to her, it will be possible to increase the rate on Booking from Letishops to 3.9%. What a beauty!

- “Kopikot” decided not to bother with different promotional codes, but immediately set a rate of 4%. Well done this time “Cop and Cat” - they did a good job. But you must read the terms and conditions of this generosity very carefully, since no refunds will be issued for reservations made two or more months prior to entry.

- “Cashback.ru” returns the same 4% as the previous service. As you remember, the minimum payment for withdrawal is the same - 500 rubles. Boring.

- “ePNCashback” this time went completely downhill and offered only 3% from a hotel booking. And in the case of such large purchases, the minimum wage most often does not play a role, since it is always accumulated, so the main focus is on the bet. Otpison.

- "Skidka.Ru" offers 4%, that is, at the level of "Kopikot" and "Cashback.ru". Although the minimum wage is not important, I will still say that it starts from just 1 ruble. If the rate were higher, it would be a total WOW .

Mini-conclusion: again MTS offers average, but not WOW rates. Well, he seemed like an average guy to me, if only not for his disadvantages.

Eventually

The offer is only for MTS subscribers (or those who are planning to become one). 5% cashback in supermarkets (and we all go grocery shopping) will allow many subscribers to use communications from MTS only at the expense of cashback.

p, blockquote 22,0,0,0,0 —> p, blockquote 23,0,0,0,1 —>

You were awarded cashback for purchasing a smartphone or tablet from MTS as part of the promotion. You probably want to get it in cash or spend it profitably. We have collected for you all the ways to do this quickly.

This post has not been updated for a long time. The information may have become irrelevant over time. Check the conditions on the pages with a full description of services on the MTS website.

Where is cashback credited for purchasing gadgets at MTS?

When purchasing a phone, cashback is credited to the “My Wallet” electronic account in the “MTS Money” service. You can see the status of this account and manage the funds on it by logging into the MTS Money service on the website or through the mobile application.

What can you do with cashback?

In order to put money from the My Wallet account in your pocket, first transfer it to your bank card. Click “Transfer” in the “MTS Money” application, indicate the card number and transfer amount. Then select the “Withdraw from My Wallet” option.

There is no commission for transferring to an MTS Bank card; to a card of any other bank - 2% + 40 rubles.

Translated? Withdraw this money from your card at any ATM.

2. Transfer to a friend by phone number

Funds can be sent to your friend’s “My Wallet” account, and you only need to know his mobile number. Just as in the previous case, in the MTS Money application, click “Transfer” and select “To Wallet” as the recipient. Indicate the recipient's mobile number, the transfer amount and, if desired, a comment on the transfer. Then select the “Withdraw from My Wallet” option. There is no fee for such a transfer.

If the recipient is not a user of the MTS Money service, he will receive an SMS informing him about the transfer. By installing the MTS Money application, the recipient will be able to manage the transfer at his own discretion by crediting the money to the account:

- your phone;

- electronic wallet;

- bank card.

If the recipient is a new user of the MTS Money service, then the transfer occurs without commission.

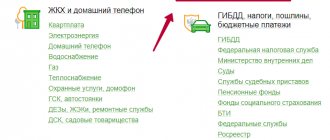

From the “My Wallet” account in the “MTS Money” application you can:

- top up your phone account with any mobile operator;

- pay for housing and communal services, home Internet and TV;

- repay a loan;

- pay for purchases in online stores;

- much more.

To do this, click “Pay” in the “MTS Money” application and select the desired item. More than 1000 services can be paid without commission. If a payment is subject to a fee, you will learn about its amount before making the payment.

Not all mobile operators can boast that they have a special service for returning money to their customers. But MTS has such a service. Moreover, it has been working for a long time and has received many rave reviews from satisfied clients.

“MTS cashback” is a special program under which the user is awarded bonus points for purchases. But the peculiarity of this program is that bonus points are credited to the user only on his mobile phone, i.e. He can only pay for cellular communication services with them.

Frequently asked questions about the service

When starting to use the MTS cashback service, users often have the same questions. You can find answers to the most popular ones below.

How to get MTS cashback when buying a smartphone

MTS PJSC expanded the MTS Cashback program in 2021, and from that moment on, customers began to receive refunds from smartphone purchases in stores or online stores to the MTS Money wallet. Not all phones sold at MTS participate in the cashback program, but among those that allow you to receive a substantial portion of bonus points are premium models of Apple iPhone, Samsung, Sony, Huawei, etc. Customers are allowed to receive and transfer cashback when purchasing a smartphone in installment plan, compensating yourself in this way for the interest on it.

The checkout and cash back process is simple. For example, when purchasing a Samsung mobile device at an MTS store, the user:

- selects the model you like;

- informs the seller of his desire to purchase it;

- indicates that he is a participant in the MTS Cashback program;

- provides his number on the network, which serves as an identifier for the MTS Money wallet.

As soon as the purchase is completed, bonus funds will instantly be credited to the e-wallet balance, even if the client has never used it before. To gain access to these funds, all you need to do is download the MTS Money application or enter the payment.mts.ru section.

How to check the amount of bonuses on your account

To view the balance of bonus funds, use one of 3 options:

- send a USSD request from a mobile phone to *101*2#;

- go to the personal account section, where they find the subsection “Cashback accrual history”;

- open the MTS cash back application.

How to withdraw cashback to an MTS Money wallet

In MTS you cannot withdraw cashback to your MTS Money wallet. However, on a regular basis they hold promotions where the refund is not in the form of points, but in real money. After the purchase, they are credited to the balance of the MTS Money electronic wallet.

In addition, MTS Bank issues a debit card with Weekend cashback. To return part of the funds from purchases, it is enough to use it to pay for goods or services, receiving up to 10% cashback.

Is it possible to transfer money from MTS to a card or cash out

To withdraw funds from a smartphone to a card, use the following options:

- "Easy payment" service;

- money transfer systems BLIZKO, Contact, Unistream, etc.;

- MTS offices;

- electronic payment systems Qiwi, WebMoney, etc.

To withdraw the funds in your account to a Sberbank card or any other financial institution, it is more convenient to use the first option. Those who are interested in the opportunity to withdraw money in cash will be disappointed; such a method is not provided in the MTS system. Therefore, you will first have to transfer funds to a card or wallet of an electronic payment system, and only then will they be able to cash out.

Cashback doesn’t arrive: what to do and where to go

If points have not been credited after the purchase, then users act in accordance with the following algorithm:

- check the maximum period for cashback accruals in the selected store; for some sellers it reaches 75 days;

- if the maximum period for enrollment has already been passed, then contact the MTS support service, whose specialists will check why the cashback did not arrive;

- If it is determined that the store is at fault, then contact its contact center with a request to confirm the purchase and transfer the information to the cellular operator.

Where to get a promo code

To get the maximum cash back return, watch for the appearance of special promotional codes. To do this, you need to subscribe to the MTS operator’s newsletter and regularly visit the official website so as not to miss a new promotion.

Pros and pitfalls

Like any other service, MTS Cashback has both positive and negative qualities.

Its positive qualities are as follows. With its help the operator:

- attracts new clients;

- activates the interest of its subscribers;

- promotes its promotions and does not spend a lot of money on promotion;

- significantly saves on the marketing program;

- receives additional income for attracting new clients to its partners.

In addition, using this service the subscriber:

- buys goods in favorite stores at good discounts;

- pays for the selected goods in any way convenient for him;

- receives bonus points for purchases;

- receives increased cashback for purchasing promotional items;

- saves on cell phone payments.

This service has several disadvantages:

- Firstly, in order to use the service, the user must buy a cell phone in a store belonging to a given cellular operator, or be a subscriber of this operator. Thus, if the client is not a subscriber of the MTS mobile operator, then this service will be completely useless for him.

- Secondly, the user can only get a discount of 3,000 rubles. Moreover, the user cannot summarize the accumulated discounts.

Of course, this system has disadvantages, but they cannot be called significant. Now developers are trying their best to cope with them and make the service more convenient for users.

Transfer to Maestro card

Using Mobile Sberbank or Personal Account, you cannot complete the procedure for transferring funds to this type of bank card.

This procedure is acceptable if you use the services of intermediaries.

To do this, follow a few simple steps:

- Transfer funds from MTM to Visa, Master Card. Use one of the above methods. You can choose a different type of card, the main thing is to pay attention to the size of the commission.

- Transfer funds from the card to the Maestro card. The procedure will take a little time.

What is the size and calculation scheme?

Bonus points are awarded in different ways. Moreover:

- 50% is credited to the user when paying for services and tariffs, services offered by this operator. For example, a client wanted to connect to the Tariffishche tariff. This is the most expensive tariff in MTS, but with bonus points it becomes the cheapest tariff for the client.

- 1% is accrued when using the MTS Money electronic wallet. Moreover, points are awarded for all transactions made from this wallet.

They are also charged for payment:

- Housing and communal services, communications;

- traffic police fines, kindergarten fines;

- account created in the game, social network;

- goods in a store or on an electronic platform.

Remember: anyone has the right to open an electronic wallet. It is not necessary that he have a SIM card belonging to MTS.

Moreover, you can link any plastic card or card issued at an MTS mobile phone store to the wallet created on the website of this cellular operator.

Remember: each partner store has its own special scheme for accruing bonus points.

We will consider only the most popular retail outlets and the size of their bonuses. This:

| Shop | Bonus size, features |

| AliExpress | 2000 points, but they are awarded separately for each product. |

| Lamoda | With the accumulated bonus points, the client can buy only 5 products per week. |

| Goods, Delivery Club | There is no cashback when using a promotional code. |

| "Letual", "Vichy", "Labyrinth" | Bonus points are credited when purchasing goods for a certain amount. |

Disadvantages of installment services

- risks of not receiving cashback on time, which is why you can find a lot of negative reviews online

- the imposition of insurance by some employees. In such cases, people are advised to show character and not allow themselves to be pressured. If the employee continues to push the service, feel free to go to another salon

- it is necessary to pay a substantial amount under conditions of high interest rates

- lack of 100% insurance against the use of personal data by 3rd parties

- Some employees are not competent in certain issues and, instead of turning to more experienced colleagues for help, they begin to mess up the drafting of the contract. Hence, if an error occurs, the client has to waste not only nerves, but also money

What can you spend it on?

Firstly, the client can use them to pay for the services of his cellular operator. He can add them to his account, pay for additional services, and extend his tariff plan.

Moreover:

- on the first day of the new month, points are debited from the user’s account and transferred to his cell phone;

- Bonus points will be debited from the user's account at the right time. With their help, the client can add a selected tariff plan, pay for mobile Internet, send SMS messages, and make calls.

And if the user does not know how to check the balance of his bonus account, then he just needs to dial the following combination on his cell phone: *100#.

Also, the client can use bonus points to pay not only for his cell phone, but also for the phone of his close relative. To do this, he needs to log into his personal page and add the desired mobile phone to the contact list. Bonus points will be credited to the user’s account at the right time.

Remember: first, the user’s account is replenished with bonus points, and then with the sender’s personal finances.

And with bonus points, the client can buy himself a smartphone. To do this, the user must log into his personal account and select “Smartphone” in the tasks. The system will notify the user that the required amount of bonus points is already in his account. After that, he receives a certificate for the purchase of a smartphone. They can pay for the goods in full.

Remember: 1 ruble = 1 bonus point. They are enrolled for 90 days, but usually this period is reduced to 30-45 days.

How to start receiving refunds

To activate the refund, you need to be an MTS user; bonus points are awarded to your mobile device number. To gain access to discounts, you must register by creating a personal account on the official website or downloading the MTS Cash Back application. Below you will find information on how to create it, as well as a link to download the mobile application, which you need to follow, indicate your mobile phone number and click the “Submit” button.

What else to read How to connect cashback to the Sberbank Mir card: registering a card for the cashback service on the official partner website - PrivetMir

Log in to the MTS.ru website or mobile application and start exploring the offers of 780 popular services and online stores that act as partners of the operator.

The refund amount depends on the offers you choose:

- up to 5% refund when ordering a table in a restaurant;

- up to 15% for purchases in retail stores;

- up to 15% for travel;

- up to 25% for gifts to loved ones;

- up to 25% on purchasing goods in online stores;

- up to 75% for leisure and entertainment;

- up to 80% for payment for services.

In order not to get lost in the variety of profitable offers, you can use filters when sorting them:

New; popular; with higher returns.

Despite the fact that you can use the MTS Cash Back mobile application directly from your phone, to study the offers it is more convenient to study them in the browser of your PC or laptop, but to do this, register on the operator’s official website.

Accrual conditions

Refunds are credited for transactions:

- up to 25% from partners through the MTS Cashback service or offline;

- 5% in hypermarkets, gas stations and cinemas;

- 1% for other expense transactions.

Accrual occurs at the time of purchase confirmation (up to 90 days). A rare rule is applied when calculating - rounding to a whole number is done according to the rules of arithmetic, and not downwards.

For example, if you buy a movie ticket:

- 505 rub. * 0.05 = 25.25 = 25 points;

- 510 rub. * 0.05 = 25.5 = 26 points;

- 515 rub. * 0.05 = 25.75 = 26 points.

Additional rewards are paid for filling out a profile in your personal account, as part of special promotions and for invited friends. A number of partners offer higher refunds for customers who subscribe to the Premium service.

The minimum possible accumulation is 1 point, the maximum per month is 10,000. If the purchase is returned, the reward is canceled. If there are not enough savings (they have already been spent), then the bonus account does not fall into deficit. Points are deducted in subsequent billing periods. Points have no expiration date.

How to earn bonuses

The average return period is 30-50 days and depends on the conditions of the partner store you choose. If you placed an order in June, it will be confirmed in July, so the money will only be credited to your mobile account on August 1st.

It's simple - to earn points, you need to make purchases in online stores through the MTS Cashback website. The loan is reported in your personal account and in an SMS message. You can check that the bonuses on your account are displayed correctly in your profile, where they are broken down for each purchase you make.

Please note important points that may affect the crediting of funds:

- Be sure to empty your cart in the online store before placing an order (if you were previously registered);

- Turn off your ad blocker;

- Exit plugins from other return services, as they may replace links with their own;

- Do not log out of your browser session during checkout.

And, of course, you can only access the online store’s website through the MTS Cashback service. What to do if you followed all the recommendations, but there was no refund:

- Check whether the online market is a real partner of MTS;

- Check the maximum period for which points are awarded. If it has already passed, write to support;

- Specialists will check the reason for the delay in payment. If the delay occurred due to the fault of the store, contact its technical support and ask to transfer the data to MTS Cashback. In this case there is no charge

No reward is expected for:

- cash withdrawal and replenishment;

- Money transfers;

- replenishment of electronic wallets;

- gambling;

- insurance;

- purchase of securities;

- purchasing prepaid cards;

- telecommunications services (telephone, Internet, etc.).

- fines for utilities, taxes, etc.;

- purchases in partner mobile applications (except AliExpress and Yandex Taxi).

Payment for housing and communal services is not included in the list of exceptions. There is an interesting nuance in the program rules. It says that there is no refund for replenishing the balance of MTS and Megafon phones, and nothing for Beeline and TELE2 phones.

Instructions for working with MTS cashback

It is very easy to make purchases through the MTS cashback system and receive pleasant bonus points for this.

The user only needs:

- Follow the following link: https://cashback.mts.ru/.

- Click on the “Login” tab and log in to your personal account.

- Find the “Stores” category and click on it.

- Go to the desired store, select a product, and add it to your cart.

- Pay for the selected product, save receipts.

And the user can click on the “Details” button next to the name of the selected store and read about the amount and terms of refund.

Remember: accumulated bonus points are displayed in the user’s personal account, created on the website of his mobile operator. They are usually transported at the beginning of the new month. The main thing is that the seller confirms the purchase made.

Established restrictions (limits) on transfers

Regardless of which card you send the transfer to, the MTS system will issue a limit on the maximum transaction amount.

According to the offer agreement posted on the mobile operator’s website:

- The lower transfer threshold is set at 50 rubles.

- The upper limit for one transaction is 15,000 rubles at a time, and no more than 60,000 rubles per day.

- The maximum amount of total monthly transfers is 120,000 rubles.

The full terms of the offer agreement can be viewed at: https://payment.mts.ru/transfer/CardToCard.

Features of your personal account

Becoming a member of the MTS cashback bonus program is very simple. But before this, the user must register on this site.

To do this he will need:

- Follow the following link: https://cashback.mts.ru/.

- Find the “Login” tab and click on it.

- Fill out the electronic form.

You need to enter:

- Your cell phone;

- Password. You can enter the password that the user already knows.

Additionally, the client can enter his electronic form and promotional code into the form. Moreover, upon registration, he receives 15 welcome points. And if he entered his personal information into the form, then he receives another 200 points.

If the client is not an MTS subscriber, then registering his personal account will proceed somewhat differently.

Initially, he will need to enter his email and click on the “Receive code via SMS” tab. Next, he receives a code on his cell phone and enters it into the form. Then he indicates his email and enters the code sent to it. Now he can create a password for his personal account independently. Next, he needs to click on the “Become a participant in the bonus program” tab and fill out the electronic form again.

Remember: any user has the right to register a personal account on the MTS Cashback website. And it doesn’t even matter which cellular operator you use.

Now the client can easily use his personal account and receive pleasant bonus points for purchases.

How else to save when buying a phone from MTS

In addition to general special offers, MTS regularly runs additional promotions on certain phone models, which will make purchasing a smartphone even more profitable.

In 2021, a unique promotion was held in the operator’s communication stores for Samsung phones: the buyer received a docking station as a gift, while MTS returned cashback for the purchase of a smartphone, and the phone could be purchased in installments.

December 2018-January 2021 pleased us with an excellent promotion in the form of a discount on Samsung Galaxy - minus 50% when purchasing a smartphone on credit using a trade-in and with a tariff for a year.

Today you can get wireless headphones, a fitness tracker, a discount on glass, a discount when you sign up for a tariff for a long time, and much more.

The entire list of current promotions is listed on the online store website https://shop.mts.ru/actions/ and is constantly updated.

How to activate MTS cashback?

It’s very easy to connect to the MTS cashback service. To do this, the user must:

- Follow the following link: https://cashback.mts.ru/.

- Find the “About” tab and click on it.

- Scroll to the end of the page, find the “Register” tab, click on it.

- Enter your email details into the form and click on the “Register” tab.

- Fill out a short form and agree to the terms of the program.

Additionally, the client will need to enter his email and promotional code. Moreover, in the office there will immediately be a goal for what bonus points will be debited for. But the client can change the goal at any time.

Registration in the system can be considered complete. Now the client can receive bonus points for his purchases.

He can also receive bonus points on his cell phone. But to do this, he needs to download a special mobile application developed by the MTS operator. This application operates on phones running on the Android and IOS operating systems.

Remember: the user does not need to pay to download the application.

It requires you to log in, and then go to the “MTS Cashback” tab, and then find the “Become a Member” category.

Remember: the user does not need to pay to connect to the MTS cashback system.

Points are not a monetary currency. They always remain bonus points. You can only spend them with this mobile operator.

The whole truth about refunds from MTS

The maximum refund amount you can receive from MTS is up to 80%. But such generous offers only apply to purchases of services from this mobile operator.

MTS Cashback is a special service of a popular mobile operator, promoted in order to attract and retain subscribers. The company benefits from building its customer base while users save up to 50% on purchases! Having heard about such an impressive MTS advantage for the first time, users are wondering what it is and how to get discounts.

What else to read All about the Tinkoff AliExpress card with cashback

To get answers and at the same time understand how to use the refund program, it is enough to study a brief overview of the characteristics of MTS subscribers.

Why does MTS give its customers such a gift?

Having made your first purchase in any online store through MTS cashback, you receive a bonus return of 250 rubles, regardless of the purchase price, but not less than 20 rubles. Even for the purchase itself you will receive a standard 5% return. That is, you buy goods through this service for pennies (like on AliExpress), and you receive a refund of 250 rubles. In order for these rubles to be poured quickly, please confirm receipt of the order immediately after the seller ships the goods. Read more about your first purchase below.

IMPORTANT: 250 rubles will be withdrawn only when registering using a promotional code. It must be entered upon registration for a refund. If you do not enter it, the bonus amount for your first purchase will be less. Since you don't have your own promo code yet, you can use this one: fRJIdt5y

So, we have already received 450 rubles, only 1000 rubles remain. You will receive them when you register up to 10 relatives or friends and perform all the same manipulations, but in order to register them, you will already have your own promotional code, it will be available in your personal account after registration. For each friend you refer you will receive 100 rubles. (after he also makes a one-cent purchase).

How to transfer money from MTS to your card in Sberbank

Today, anyone can transfer money from their phone to their credit card. This is one of my favorite procedures and ways to withdraw money.

Now I will tell you how to transfer MTS cashback to a Sberbank card.

- You can use special USSD requests or do it via SMS.

- You can also do this using your personal account. It is available at the link – https://login.mts.ru/.

- To do this, you need to log in, then click the “Manage Payments” button and select the desired payment purpose from all available ones.

It's simple and easy!

The Sberbank card has quite favorable conditions

However, keep in mind: before you withdraw money, you need to find out what the minimum is on the service.

So, I found out that only amounts of 50 rubles and above can be transferred from a mobile phone to a card.

And the maximum amount can be up to 15,000 Russian rubles.

Commission for transfer to a Sberbank card

This point, I think, is very important: how can you withdraw money to a card, and in such a way that it is also profitable?

It is important to weigh and analyze everything here.

If the service has a commission of 11%, then you will have to pay 1,100 rubles for a larger amount of 10,000 rubles.

For another service, the amount may be insignificant - 5%, then you will have to share with the service and pay 500 rubles from the amount of 10 thousand rubles.

Therefore, my advice is to always carefully consider, study, and analyze the terms of provision of refund services.

Commissions for withdrawal of money

After analyzing the options for withdrawing funds from services, I compiled my own analytical table, thanks to which you can get an idea of the size of commissions and fees.

| Withdrawal method | Commission |

| Dollar wallet Webmoney (WMZ) | From 0.8 to 1 US dollar |

| Ruble wallet Webmoney (WMR) | 3-5% |

| Qiwi wallet | 3% |

| Yandex money | There is practically no commission or there is only a small one |

| Bank cards | Very large commission |

I came to the conclusion that the most convenient option for me personally is to withdraw money to electronic wallets and make purchases in online hypermarkets.

The most unprofitable one is on the card.

Firstly, you will be charged a huge fee, and secondly, the conversion of, for example, dollars into rubles is always done at a very unfavorable rate.

Since the minimum withdrawal amount for some services is small. I did a simple thing and withdrew money to my mobile. Plus, you can save a ton of money using the app.

What is the minimum withdrawal amount

As a rule, there are restrictions on withdrawals and withdrawals. Unfortunately, there are currently no refunds without a minimum withdrawal amount.

But for some services, such as EPN, you can withdraw from as little as 20 cents.

Especially when I haven’t made orders for a long time, like in the summer when I was on vacation, you can withdraw money by phone.

But in other services, withdrawals start from 500 rubles. For example, in “Letishops” and “Kopikot” from 500 rubles, and in “Alibonus” from 300 rubles.

Important note! I hope you remember that we already talked about Letishops, and also conducted a full analysis of “Kopikot”, finding out all the return percentages? If you suddenly become my new reader, be sure to check out the links, I guarantee you a useful and interesting reading.

In this case, there is only one way out - to save money faster, you need to make a lot of purchases or actively promote the service among friends and acquaintances.

Please also be aware that if you do not have access to the refund service for several months, your funds may be blocked. So keep that in mind!

Possible difficulties and solutions

It often happens that a user has selected the product he needs, accumulated the required amount of bonus points, entered the mobile application, but cannot make a purchase. And so it is. All purchases at MTS Cashback can only be made through a browser opened on a stationary electronic device.

This could be a regular computer, laptop, or cell phone. Through the MTS Cashback mobile application, the user can make a purchase. Bonus points cannot be spent. But you can spend bonus points through the AliExpress mobile application.

It also happens that the user makes a purchase, but bonus points are not credited to his account. In this case, he must:

- Go to your store and read about the deadlines for crediting bonus points;

- Contact the contact center. You need to contact us if the deadline for crediting funds has expired. Typically, operator employees immediately talk about the reasons for the delay;

- Contact the store's technical support service and provide all information about the purchase. Support phone number: 0890. They transmit all the information the user needs via SMS.

The buyer should not worry ahead of time. It happens that bonus points are not credited to his account for technical reasons.

They arrive after the developers have established the service. And if the service has been established, but the bonus points have not arrived in the user’s account, then he needs to contact the support service. This can be done by calling the hotline or through the official website.

Mobile applications

It turned out that the operator has many different mobile applications:

- and bank;

- and money;

- and music;

- and memory;

- and books;

- and much, much more.

Of course, we are only interested in cashback.

Applications for Android and Apple have been written for it.

I even tried to download them, but they stupidly didn’t let me in because I don’t have a valid MTS number.

Based on reviews and screenshots, the application is simple and clear. But there are many complaints in reviews that cashback refunds from MTS are not transferred. This is understandable, because after all, we are talking about a mobile application, and their stores are not liked, and I will not get tired of repeating this. And some strange glitches happen regularly (judging by the reviews) - so we keep our ears open.

In addition, such complaints may be due to the fact that immediately after payment the order is not displayed in the personal account, people begin to panic, because they do not know when and where the cashback in MTS is returned, and shout everywhere that they were deceived.

And this operator is not deceiving, but simply has not completed everything.

Also, in reviews of the MTS Cashback program, as usual, I came across referral promotional codes with an explanation that the inviter will be given only 30 rubles.

That's too damn small.

Usually services pay 100 rubles per referred person, but here it’s only 300 rubles. for 10 souls.

Ugh.

After this, I immediately want to google how to disable cashback in MTS.

No matter how much I crawled around their website, I couldn’t really find anything, unfortunately. Perhaps my hands are crooked (I hope not), but I have come to one single conclusion.

In fact, there is no need to disable it.

Just don't go there and that's it.

But for the sake of objectivity, I will still give the answer from the official website: “Each client can stop participating in the system in the Program’s personal account or in the Program Application in the App Store and Google Play.”

How to purchase a certificate for purchasing a smartphone?

As soon as you have accumulated at least 100 rubles in the “Buying a smartphone” goal, you can purchase a certificate for a discount equal to the accumulated discount.

You don’t have to take the certificate right away, but wait to accumulate up to a larger amount - available denominations are 100, 500, 1000, 2000, 3000, 5000, 10,000 rubles, and so on, with a maximum of 80 thousand.

Remember that you can only spend one certificate on one purchase, but you can cover up to 100% of the cost of the product.

So, you have ordered a certificate with the denomination you need, what next? You will receive an SMS with a code - this is the certificate number that you need to announce to the cashier at the MTS salon when paying for the gadget.

Note

: if you made an order in an online store with home delivery, the certificate will not be valid - it only works when paying for goods in MTS stores.

The client can order an unlimited number of certificates and use them at his own discretion, even transfer the SMS code to other hands.

In principle, this is an original and convenient system for saving for an expensive phone or other gadget - you don’t need to particularly control anything, and you won’t be able to spend the money on anything else.

Advantages of the site and personal experience of cashback from Biglion

I love the BIGLION website not only because you can spend bonuses and coupons here.

In addition, you can accumulate money using the site’s affiliate program.

They can then be transferred and cashed in real life.

How to withdraw money from cashback in Biglion?

Such a question once tormented me, but, having figured it out, I realized that everything here is simple and clear.

You can withdraw money from the Biglion website itself, if you have the required minimum amount of money on your balance - three hundred rubles.

Withdrawing funds from Biglion

So, here's how I made the withdrawal:

- Go to the service and submit an application on the website to withdraw your hard-earned money from your account. Try to fill it out carefully and correctly.

- After this, you will receive an email stating that the service administration has received your notification to withdraw your hard-earned money.

- After approximately three days, the money will arrive in your e-wallet or plastic card.

This is the essence of cashback

Step-by-step guide to withdrawing money

So, now to the very essence.

Let's start with Biglion.

- Visit the site using the link

- Go to “Biglion” after registration “in one click”

- Buying goods

- Get cashback

- Next, click on your profile (on the right)

- You see the word “Cashback”

- Next, see how much money is “under review” and how much is “approved”

- Choose a payment system (the most popular is a plastic card)

- Leave a request for payment and wait

- The money will be credited to your account

IMPORTANT ! I do not recommend using turbo cashback.

And now I’ll make a detailed guide based on my favorite service “SecretDiscounter”.

- We go to the service website, we see the amount that has accumulated for purchases

- Click on it with the mouse

- On the left we see “Withdrawal of money”, click there

- Select the desired payment system

- Fill out the information, wait 2-4 days, after which the money will be sent to your details

That's all.

Everything is simple and clear.

Gentlemen, in the same “Letishops”, “Megabonus” and any other services, everything is done SIMILARLY .

How to withdraw funds from the service

How to withdraw money from cashback on various sites? I concluded that they work almost identically.

- As a rule, in all services you will have your own personal account from where you can withdraw money.

- The account has a “money withdrawal” section.

It is important to first attach the correct e-wallet or card number during registration or later.

In order to transfer funds, you must reach the minimum amount available for withdrawal. After submitting an application to receive funds, your hard-earned money will be transferred to you within a few hours or days.

Factors influencing cashback amounts

First, you need to understand which e-wallets, mobile phone or plastic card are convenient for you to withdraw your cashbacks to.

At a minimum, losses when returning funds will depend on this.

Cashback amounts may depend on where it is returned

It is important to pay attention to the following points:

- Bank or service commission (electronic wallets) for withdrawing funds;

- Currency rate and conversion.

- Cashback service commission.

- There may be fees in the future, for example, when paying for your purchases or for withdrawing funds from ATMs.

How is the grace period calculated?

The grace period is the period during which you can repay the full amount of loan funds spent, without interest on use.

MTS claims 111 days of grace period. In order to understand what it is and how to calculate it, it is worth familiarizing yourself with the theoretical basis:

- The grace period consists of a reporting and payment period.

- Reporting - the time during which interest is accrued for the use of loan funds. To avoid paying them, you need to repay the entire amount before the end of the payment period.

- Payment period - the period for which it is proposed to pay the full amount of the debt calculated for the reporting period so that there is no interest for use.

The reporting period for the MTS cashback card is 30-31 days, from the 1st to the 1st of each month. This is followed by a payment period of 81-80 days.

In simple words, if you made purchases during September in the amount of 5,000 rubles, then by the end of November, within 2 months, you need to fully repay the debt. This will be a grace period without interest.