| Peculiarities: | Explanation: |

| Issue price: | 299 rubles one-time |

| Service: | Completely free |

| Loan interest: | 11.9% - 25.9%. Grace period - 111 days (can be used without interest) |

| Credit limit: | 299.999 rubles |

| Cashback: | 1. 1% - on any purchases. 2. 5% - according to MCC codes ( Supermarkets : 5411, 5422, 5441, 5451, 5462, 5499, 5921 Gas stations : 5172, 5541, 5542, 5983 Cinema : 7832). 3. 25% - purchases from MTS partners. |

| Minimum payment: | 5% |

| Cash withdrawal limits: | 1. 50k - per day 2. 600k - per month |

| My mark: |

Hi all!

UPDATED-10/20/2019. Click on the questionnaire and let's see what people think about this record.

Today I will introduce you to a very profitable project that promises 5% cashback on supermarkets, gas stations and cinemas.

I think such numbers may be of interest to many. I’m not the only one who thinks so, but also the telecom operator MTS, which is why they issued a card called “Cashback” with such goodies.

ORDER A CARD WITH CASHBACK FROM MTS

Author's note. Friends, I already had an article on the topic of cashback in Mobile TeleSystems, but it was an overview of all the options for getting money back from purchases. In this material I focus on only one card. Therefore, if you missed the article, read it right now!

Let's start with the main thing!

MTS is a well-known telecom operator that is one of our big three.

Often his clients have problems, unexpected and unwanted charges, and so on. But this happens to everyone, so replacing an awl with soap is not always profitable.

But let’s move on to the universal card, or rather the “Cashback” cards from MTS.

The fact is that there are several of them:

- virtual;

- plastic debit;

- plastic credit card.

I will look at their features a little later, since the cashback calculation scheme is the same and does not differ between them.

Let's get straight to the main point.

| Category | Cashback amount |

| Cinemas | 5% |

| Supermarkets | 5% |

| gas station | 5% |

| All the rest | 1% |

| Purchases from partners | Up to 25% |

That is, the two most popular cashback categories are being closed - supermarkets and gas stations.

There are already few cards that give 5% cashback on supermarkets, so they are very popular. If you are interested, here is the first, here is the second, and here is the third.

Moreover, MTS-Bank did not skimp and made the maximum limit for cashback accrual really good - 10 thousand points per month.

I will list the MCC codes of this system so that all purchases will definitely be profitable.

| gas station | 5172, 5541, 5542, 5983 |

| Supermarkets | 5411, 5441, 5422, 5451, 5462, 5921, 5499 |

| Movie | 7832 |

If, for example, the nearest store near your home has an MCC code that is not listed here, then only 1% cash back will be given for it, even though it is a supermarket.

This is such a complex and unfair system.

So, if you plan to buy something expensive and get a good cashback from it, then it is better to check the MCC code in the organization itself or at least via the Internet.

What is MTS Cashback?

“Cashback” from MTS is not only the name of the card, but also the whole cashback system.

In simple words, this is something like a regular service , for example, “Letyshops” or “SecretDiscounter“.

That is, you:

- go to the MTS website,

- log in using your username and password,

- select the required store from the list,

- follow the link to the store itself,

- choose the desired product,

- pay,

- get cashback for three months

I will give some examples of partners and the expected return of money.

| Partner | Cashback percentage |

| "Daughters and sons" | 6% |

| "Kupivip" | 15% |

| "Kiwitaxi" | 12% |

| "Yandex.Taxi" | 2% |

| "Aliexpress" | 5% |

| "OZONE" | 5% |

| "Lamoda" | 8% |

By the way, if you often use taxis from Yandex or its other services, then take a closer look at the new Yandex.Plus card.

I have news for you: one is bad and the other is bad!

Yes, yes, cashback is awarded with points, but there is nothing wrong with that, since the point is equal to a ruble.

That is, there is no loss on any internal transfers. But there is also not very good news - MTS rounds up in its direction for the Cashback card.

For example, if you were supposed to receive a refund of 49.99 rubles, then only 49 will come. Although it would seem - only a penny and already half a thousand.

But this news is really just not good, because there is really bad news .

It consists in the fact that cashback cannot be withdrawn to a card and used to pay for anything.

There are only two ways to spend your refund:

- top up your mobile phone account with accumulated cashback;

- exchange it for a certificate for purchasing something at MTS communication stores.

How does cashback work on the card of the same name from MTS?

It is not necessary to top up your phone – you can do it for your children, parents, friends, neighbors and even Uncle Styopa.

- If the card owner is an MTS subscriber himself, but his account will be automatically replenished with cashback, if available, his own funds will not be debited.

- The second option – to spend cashback at an MTS salon – also has its own characteristics. You can cover your purchase completely – up to 100%, but you can’t spend any amount.

First you need to buy a certificate for one of the possible denominations.

Here they are:

- 100 rub.;

- 500 rub.;

- 1000 rub.;

- 2000 rub.;

- 3000 rub.;

- 5000 rub.;

- RUB 10,000;

- 15,000 rub. and so on.

The maximum certificate amount is 80 thousand rubles.

There is only one certificate per purchase ; they cannot be combined.

After paying for the certificate on the website, you will receive an SMS with its code, which you will need to call in the communication shop. This code can be given as a gift to someone - it’s not important.

Nuance! But for orders in an online store, such a certificate will not be valid. So in any case, you will have to go to the MTS communication salon.

For convenience, I will make you a map of the operator’s offices.

Well, of course, the certificate is used only once.

It would be strange if it were otherwise.

Thinking out loud

Let's think about whether this card will be beneficial to anyone.

- For example, I pay 200 rubles a month for mobile communications and am not an MTS client.

- I will not go shopping to the communication stores of this operator, because the prices there are too high.

- If you go there and spend points on a Cashback card from MTS, then the effective cashback will be lower, since there is an overpayment .

Why get a card for the sake of ineffective cashback?

- If I were a client of MTS, for example, with the same expenses, but this would not be particularly profitable for me either - after all, the cashback per month is more than 200 rubles.

It turns out that it would accumulate and accumulate in the account, and then you would still have to spend it in the telecom operator’s salon.

It’s another matter if the whole family is on MTS - this can already be profitable.

Interesting on the topic: Tinkoff “Drive” cashback card

Moreover, if you are connected to the “All MTS” tariff, which also includes home Internet and television.

It’s good at least that these points do not have an expiration date and can lie and wait for me as long as necessary.

It turns out that this card will only be beneficial for a fairly small section of society. To dilute this sadness and frustration a little, I’ll tell you about some of the benefits of Cashback plastic.

MTS Bank credit cards with cashback

These are popular products, so let's look at them first. The organization’s assortment includes two products for which cashback is awarded, so we’ll consider them.

The first option that clients apply for most often is the Cashback credit card . Already from the name it is clear that this functionality is the main one for the payment instrument. Using the limit provided by the bank, the client can receive a nice and large bonus every month.

What cashback do cardholders receive:

- 1% for all purchases made with a credit card;

- 5% for payment for gas station services and purchases in restaurants;

- up to 25% when purchasing from service partners. For example, for purchases on Aliexpress - 3%, in Ozon - 4%, in Perekrestok supermarkets - 4%, in Metro hypermarkets - 10%, for Litres e-books - 25% and so on. There is a wide range of partners.

Partner organizations include many different federal-level retail chains. For example, MVideo, Eldorado, MTS communication stores, Lenta, etc. MTS Bank has created a special website where you can find a complete list of partners and the amount of remuneration for purchases from them.

An MTS Bank card with cashback can be completely free for the client, since it comes with a grace period of up to 111 days. If you close the minus on the card completely within this period, there will be no overpayment at all. And if you consider that the service will be free if you issue a card online, the offer seems even more attractive.

Issue of a Cashback card costs 299 rubles. The bank sets the limit at its discretion based on the analysis of the application. The maximum it can be is 299,999 rubles. The rate will be in the range of 11.9-25.9% per annum, also set individually.

Nice things

Servicing any card will be free.

But if you want to have a plastic copy, you will have to pay 299 rubles for the issue.

This is not such a large amount, especially since the plastic is valid for three years .

In addition to the free service, there are several other interesting points:

- free withdrawal of your own funds from any ATMs around the world if they are equipped with NFS - but it is worth clarifying that MTS does not charge a commission, but the device’s bank may request it;

- cheap SMS notifications - 15 rubles per month, and the first two months are completely free;

- cheap interbank – commission is only 15 rubles for any transfer, regardless of the amount.

Now, I think, it’s time to move on to specific cards and their features. Let's start with a strange virtual option.

Supplement

The KB application has the following advantages:

- fashionable and stylish design;

- a suitable interface that allows you to instantly navigate the menu;

- after the first authorization, you can use the add-on further, that is, there is no need to go through this process every time;

- there is an opportunity to buy products through the program;

- observation of material that interests you;

- the latest versions have been created for well-known platforms;

- stability of work;

- no complaints about resources, runs on different devices;

- constant updating and improvement;

- a very convenient way of making purchase.

You can install the program in the official store.

Cashback hasn't arrived?

Instructions if you haven't received your points:

- Immediately check the deadline for cashback crediting in this store. It might be worth the wait.

- What to do if time runs out? Contact the contact center. Experts will tell you what the problem is.

- If the failure occurred due to the fault of the seller, then call technical support to transfer information about the purchase to MTS service.

- Please note that bonuses are sent to your mobile phone account on the first days of the month once a month.

Don’t get upset ahead of time, just monitor the accrual period, and after the end, contact support.

Virtual

A virtual card does not exist in the real world, since it does not have a shell, namely plastic.

The account and card numbers will be located in your personal account.

This copy of “Cashback” from “MTS” will be useful for:

- shop online;

- make transfers;

- withdraw cash;

- or link to Samsung, Google or Apple Pay and pay anywhere.

But for purchases in foreign online stores, I do not recommend this virtual machine, since the conversion rate is very unfavorable - it differs from the Central Bank by about three percent .

This also applies to plastic analogs of “Cashback” from MTS.

The huge advantage of this virtual machine is that it is absolutely free, that is, you don’t even have to pay anything for the release.

In fact, it is not being released. SMS, of course, still costs money. But why are they needed at all if you can always check the card through the application?

By the way, about applications.

Now the card is available only in MTS-Money, but they promise to launch it in My MTS soon.

Only here there is one not very pleasant nuance.

The card is available only to some MTS subscribers - those selected ones for whom it is displayed in the application as a special offer.

That is, you may really want and expect it, but you are simply unlucky, so you will not receive the card.

If it is available, then you just need to activate it.

How to activate? It’s as simple as that – the code will come in an SMS, you need to enter it on the website. There is no need to fill out any forms, much less go to the MTS salon. Everything is simple and accessible – that’s great.

Cashback rounding and expiration date

Separate attention should be paid to the issue of rounding the accrued cashback. The fact is that the cunning, prudent specialists from MTS thought about developing special conditions for rounding the amounts of payments and purchases from which cashback is calculated. Thus, if a client pays for a purchase in the amount of 49 rubles, the amount of 1% cashback will be 0 points. If the purchase size is 50 rubles, the amount of the refund will be 1 point, even though 1% of 50 rubles is equal to 50 kopecks.

As for the expiration date of accrued points, there is simply no expiration date; accumulated bonus rubles can be stored on the client account for an unlimited amount of time.

Debit card

Let me start right away with my indignation.

There is no interest on the account balance with this card None at all. Even a lousy 4-5% per annum.

And after this, does MTS, with its Cashback card, still count on something? Of course, I simply cannot recommend such plastic.

Okay, PNO is not on the virtual machine - you can at least somehow come to terms with this. must on a regular plastic card .

One of the best offers at the moment is considered to be “Benefit” from Home Credit Bank with its 7% on the balance.

And if you are a new user and get into the promotion, then there will be a full 10% per annum. So choose.

The Cashback debit card from MTS is available to all citizens of the Russian Federation over 14 years of age .

But minors can only have one with the written consent of their parents. There are no more requirements. As well as the desire to start her.

How to pay off debt for free

An important question that should be studied before applying for a credit card is how convenient it will be to repay the debt.

It is important to consider several points here: free, speed and restrictions on transfer amounts.

It is worth noting that MTS Bank has enough options for conveniently depositing funds onto a card:

1. Online payments:

- Through your personal account from a card or MTS Bank account - funds are received instantly and without commission. The operation limit is up to 500,000 rubles per day.

- Through a personal account from a card of another bank (card2card-drawing) - crediting is instant, no commission is charged by MTS, but it may be written off by the bank that issued the card. The limit is 15,000 rubles per transaction.

- MTS Money wallet - when you connect to a loan repayment service in an MTS salon, no commission will be charged when crediting it to the card.

- Through the bank's website from the sender's card number - a 1% commission of at least 49 rubles, the maximum amount for one transaction is 150,000 rubles. It is necessary to take into account the restrictions and tariffs of the third party bank. Enrollment period is up to 5 working days.

If the service is not activated, then when you top up your card, 0.9% will be debited.

For payment by account number, the commission will be 2.5%, minimum 30 rubles + 35 rubles.

Funds will be received instantly, the limit will be 15,000 rubles per transaction.

2. At ATMs or terminals of MTS Bank and MTS:

- Cash – funds are credited instantly and without commission. Limits – 15,000 rubles for one operation using the details, 600,000 rubles for one operation using plastic.

- From another card - the commission will be 1%, at least 49 rubles, the funds will be received instantly. You can transfer no more than 15,000 rubles per transaction and no more than 500,000 rubles per day.

3. For partners:

- MKB terminals - instantly and without commission. Up to 40,000 rubles per operation and up to 100,000 rubles per day.

4. Interbank transfer from the personal account of another bank. A number of banks offer free interbanking from a card account.

5. Transfer by phone number through SBP (fast payment system of the Central Bank of the Russian Federation). At the time of review, MTS Bank is not a participant in the SBP, but this is a matter for the near future. Follow the link to see which banks make transfers using this system without commission.

Taking into account the fairly wide network of MTS terminals and convenient online payment methods, holders will not have any difficulties replenishing the card.

Credit card

If you believe the reviews, in the case of “Cashback” from MTS, the credit card turned out to be much more interesting than the debit option.

Just like Tinkoff - its credit cards are always more interesting, and besides, they are approved by almost everyone.

Among the credit cards on the market there are practically no copies that would charge interest on the balance of one’s own funds, so the absence of PNO is no longer surprising or upsetting.

And some other moments are even pleasing.

For example, here the grace period is as much as 111 days.

That is, at this time you can use credit funds and not pay interest.

Yes, this is almost a third of the year! Other most popular options with a long credit period:

- “Delight” from the popular “Vostochny” in the Russian Federation;

- “100 days” from Alfa Bank - but no cashback is awarded for it, it’s not interesting.

At the same time, MTS’s interest rate is not so high – from 11.99 to 25.99%.

A more specific figure, of course, is determined individually. It is influenced by:

- the amount of money borrowed;

- credit history;

- spending and so on.

So you shouldn’t count on 12% on a credit card just for beautiful eyes - they are not included in the list.

A little intimidation

It is also important to say about the minimum payment: it is 5% of the money taken, but not less than 100 rubles.

This is the amount that must be paid monthly during these 111 days. Normal conditions of use, in which I do not see anything special.

But if the minimum payment is late, then for the next billing period an increased rate of 36.5% + 500 rubles .

Moreover, as you understand, this is not the entire rate, but precisely the amount of increase to the basic individual interest set by the bank. Tinkoff is famous for such harsh fines.

You can withdraw cash, but, as usual, doing it with a credit card is extremely unprofitable.

The commission is 3.9% + 350 rubles . Moreover, it does not matter where the cash withdrawal occurs.

But this only applies to plastic.

If the card is virtual, then you will have to withdraw money from your account at the MTS Bank cash desk, and this already threatens a commission of 4%.

And the limits are as follows, and they are equal for both plastic and virtual machines.

| Withdrawing credit funds from the card | Maximum amount |

| In a day | 50 thousand rubles |

| Per month | 600 thousand rubles |

Conditions of receipt

In this case, it is already more difficult to get the coveted card, since credit cards are not given to just anyone.

There are several conditions that must be met in order to receive a Cashback credit card from MTS:

- be a citizen of the Russian Federation;

- age from 20 to 70 years;

- have a proven work history in the last three months.

What won't they ask you?

- region of residence - this is understandable, because MTS, it seems to me, is everywhere;

- a certificate from work confirming income - and this is a plus for those who have a low salary;

- It is not necessary to be an MTS subscriber.

Interesting on the topic: Tinkoff-Perekrestok cashback card

That is, they don’t require anything special.

“Some conditions are too good! Surely there’s a catch?”

How are we in Rus' - and without a catch? It is forbidden! How is it even possible! And yes, this is MTS :).

There is one point about the cashback program - cashback is issued in points, and points can be exchanged exclusively for MTS services and goods:

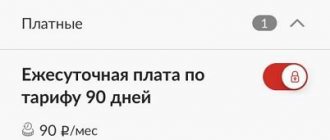

- Payment for MTS mobile communications. If you have the “All MTS” package connected, then also on their TV and Internet for the home. For example, this is how it works for me:

; - Certificate with a discount of up to 100% on purchases at MTS branded stores. They sell smartphones, tablets, accessories, etc. :

- There is also an “intermediate” option - one part of the cashback is used to pay for communications, and the other part is used for a certificate. For example, 300 rubles for a phone, and the rest for future purchases.

To be fair, the “spend only in MTS” restriction is not that scary.

If you are a subscriber of a “red” operator, you will receive free communication or at least a discount. Like this comrade:

If not , even pensioners today need smartphones and tablets. Save up money for a discount - and after some time you either buy a new phone for 1 ruble (since it’s not possible for free by law), or get a decent discount on a new one. Bonuses will not expire as long as you use the card at least occasionally.

Don't need a smartphone? Save up anyway - and then just sell a brand new and unpacked gadget on Avito for a couple of thousand cheaper.

“What other disadvantages are there?”

- When issuing a card, a one-time fee of 299 rubles is charged.

- If you don’t use MTS Cashback for six months, the bank has the right to close it.

- If you do not refuse at the stage of signing the documents, they will connect you with insurance. This is probably why there is no service fee - MTS hopes to “get” theirs through insurance. Fortunately, it’s not difficult to refuse - just call the hotline 8-800-250-05-20, dial 3, then 7 and follow the instructions from the auto-informer.

- Paid transfers to other banks - from 20 to 150 rubles.

- You can withdraw no more than 50,000 rubles per day.

- If the transfer is from an individual entrepreneur or LLC, and this is not a “social payment”, there will be a 5% commission. This is how MTS Bank fights illegal cash withdrawals.

- Not suitable for purchases abroad - because... the exchange rate is equal to “the rate of the Central Bank of the Russian Federation + 3%”, this is too expensive.

How to apply for and receive a Cashback card from MTS?

There are several ways to order a new plastic credit or debit card:

- in a communication salon;

- on the MTS operator website;

- on the MTS Bank website.

It’s always easier to submit an application online because you don’t even have to go anywhere.

Moreover, it is possible to do this through a State Services account, which will increase the future credit limit .

If you want to get a “Cashback” debit card from MTS, then you need to put 0 in the “Credit limit” field.

A notification about the finished card will be sent by email and SMS - it will indicate what limit has been approved.

This usually happens within a week or less. After this, you will still have to go to the communication store to get the plastic and sign an agreement there .

It is important not to forget your passport.

By the way, there is another way to find out the approved limit: in the mobile application. But this is only after the card is activated.

How to pay

To receive cash back through a website or mobile application, you need to select your current store, then follow the link, pay and wait for credits. And to receive salaries using promotional codes, we follow the algorithm:

- make a purchase;

- scan the QR code on the receipt in the program;

- We are waiting for enrollment.

Rules for accruing cache:

- switching to the Internet is realized only through cash-back.mts.ru;

- You can log in to your account on the market website and add assortment to your cart only after you have completed the transition;

- while shopping, do not visit Internet links of other resources;

- completion of the purchased assortment must occur in one browser session;

- you need to disable other cashback services in your browser;

- Before payment, check the transfer rules, that is, the minimum or maximum amount for the purchase of goods, their list, etc.

You can manage your savings using:

- applications for tablets and smartphones MTC Cash or “MyMTS”;

- Personal Area (cashback site);

- SMS commands *101*1#.

Pay attention to the cache statuses that come in the form of SMS messages:

- pending;

- accrued;

- rejected;

- written off.

Money transfers

Yes, this is not a determining factor for choosing a card for many, so I decided to put information about money transfers using the Cashback card from MTS Bank at the end of my review.

As I already said above, transferring from card to card is very profitable: 15 rubles for transferring any amount .

At least 16 rubles, at least 100 thousand.

It's a good news.

But then further clarifications begin, etc.:

- transfer from account to account in MTS Bank - 1.5%, but minimum 20 rubles, maximum 2000 rubles;

- by account number – 0.3%, minimum 20 rubles, maximum 150 rubles.

This all applies to those cases when we are talking about the client’s own funds.

If we talk about credit cards, then 3.9% + 350 rubles is the commission that I already mentioned. It is valid if the transfer is made from a card.

If we are talking about transfers from account to account, then the commission is already 7%.

Yes, this figure looks worse than the previous one, but in some cases it may be more profitable. For example, if we are talking about small amounts.

Receiving bonuses for purchases from program partners

As I said above, the main “item of income” from using “MTS Cashback” is making purchases from partners, offering quite favorable percentages of refunds for many of the company’s partners. Here, for example, you can find such “giants” as Aliexpress, Ozon, Yandex.Taxi or Sportmaster. However, “MTS Cashback” has no significant differences from, for example, “ePN” or “Letishops”, only the latter two offer to withdraw accumulated points into real money, rather than pay for services with them.

However, despite this, among the MTS Cashback partners there are many companies in which every person systematically makes purchases, and the cashback amount here is very, very decent.

The payment refund goes to the MTS Bank client's account within 90 days (or less). However, if you dig deep on the Internet, you can find reviews from users who did not receive cashback even after the agreed upon 90 days. In such cases, you must contact support.

Refer a Friend Bonus

If for some reason you are already eager to open this “Cashback” card, then hold your horses.

Now I will tell you how to do this as profitably as possible . The usual referral system is responsible for this.

Link to the program rules document - //static.ssl.mts.ru/mts_rf

If you register using someone’s promotional code, you can get up to 250 rubles, and I’ll tell you how to get even more:

- First, register in the “MTS-Cashback” program itself at mts.ru;

- during registration, indicate your email and promo code of the inviter;

- apply for a card online on the MTS website and receive a universal “Cashback” bank card;

- on the same day make a purchase using the card from 100 rubles.

If the inviting friend is not available, then you can look for a promotional code for the Cashback system from MTS on the Internet.

By the way, if you later want to invite friends and earn money from them, your promotional code will be in your personal account.

For each friend you refer, MTS will pay 100 rubles, with the maximum number of friends being 10.

A little life hack that I didn't mention!

If you are still an MTS subscriber, then you have the opportunity to earn another 34 rubles .

Do you understand, yes, what kind of fabulous money is being made here? There is one condition for this - not to use the MTS Music service before.

It comes with a cashback of as much as 20%, and a monthly subscription costs 169 rubles.

Can't smell money yet?

Patience…

First you need to pay for this service for a month. The bottom line is that the first month of using this subscription is free, so you can turn it off within 30 days, but the cashback will still remain in your account.

Yes, there is not much benefit, but there is a maximum of five minutes of action. Free ice cream, after all.

Features of the bonus program

One of the most attractive conditions of a free credit card from MTS Bank is the opportunity to receive cashback in the amount of 5% on selected categories and up to 25% from various partners. It’s worth clarifying right away that cashback in a bank refers to points that are used for various rewards from MTS, and not direct cash rewards. Therefore, in order to fully appreciate this offer, you should understand the terms of the program.

How to earn bonuses

Connection to the MTS Cashback program is carried out automatically when you issue a card. Accordingly, the accrual of bonuses begins immediately when the client makes purchases that fall under the conditions for accruing points.

To monitor the status of his bonus account and manage accumulated points, the participant should register in the MTS Cashback service. This requires:

- install a special application and go through a simple registration procedure;

- create a personal account on the service website.

It is important that not only MTS subscribers, but also owners of numbers of any other cellular operator can register in their personal account. The main thing is to confirm your actions by entering the SMS confirmation that comes to your phone. After successful registration, a confirmation SMS is sent to your number.

The client can earn bonuses as follows:

1. For filling out fields in your personal account - a one-time charge.

2. For purchases and actions from program partners - payment does not have to be made with an MTS Cashback card, but it is important that the conditions of the partners, which can be found on the website, be met. Also, the transition to the partner’s website must be made from the MTS Cashback page.

3. For purchases with an MTS Cashback card or virtual card:

- Basic accrual – 1% on all purchases;

- Increased cashback – 5% in the categories Supermarkets, gas stations and Cinemas.

The purchase category is determined by the MCC code (payment system classifier, which determines the type of activity of the trade and service enterprise) of the outlet.

4. For purchases with an MTS Cashback Lite card:

- Basic accrual – 1% on all purchases;

- Increased cashback – 5% in the categories Supermarkets, gas stations and Cinemas.

5. For performing certain actions in MTS services, as well as for payments in the MTS Money Wallet.

All bonuses are accounted for in a special account, detailed information about which is posted in your personal account. Accrual is carried out upon completion of the purchase, the maximum period is up to 90 days.

How to spend bonuses

In order to use accumulated bonuses, the participant will need:

- Log in to your personal account on the website;

- Log in to the mobile application;

- Use MTS SMS commands at *100#.

There are three main areas for spending bonuses:

1. Setting goals - they are automatically set for MTS subscribers and users, which includes TV, Internet, etc. In this case, an automatic write-off of bonuses is generated against the monthly payment for services or mobile communications.

Monthly debits are made on the 1st of each month.

The user can independently change or disable goals, the date of payment with bonuses, as well as the maximum payment amount. The only condition is that the goal cannot be paid more than once in 1 calendar month.

2. Payment for MTS services upon request - unlike automatic payment, bonuses will be debited as payment only upon the client’s instructions.

Important: you can pay with bonuses not only for a participant’s personal subscriber number, but also for any MTS number owned by a third party.

3. Payment for purchases in MTS stores is carried out through the purchase of certificates, which are subsequently used for payment. In your personal account you can purchase certificates of various denominations from 100 to 80,000 rubles. They can be stacked when paying one check. However, it will not be possible to pay for multiple purchases with one certificate. It must be used one-time for partial or full payment.

Points are exchanged for rewards at the rate of 1 bonus = 1 ruble.

Limits, restrictions and conditions for disconnecting from the program

Any program participant can disconnect from it at any time in their personal account. After this, all bonuses, as well as the transaction history, will be deleted without the possibility of recovery.

The company also reserves the right to terminate the program by notifying participants 30 days prior to termination.

The first difference you notice when studying the rules for calculating bonuses is the rounding of points. This is done in the program according to mathematical rules.

For example, when paying for a purchase with a 1% accrual for the amount of 20 rubles, cashback will not be credited (20 * 1% = 0.2, when rounded we get 0). But already when paying for 50 rubles, the participant will earn his bonus (50 * 1% = 0.5, when rounded we get 1).

The next feature is high accrual limits. With the card you can earn up to 10,000 bonuses in one month. Even if you pay only in high accrual categories, to reach the limit you will need to spend:

10,000*100/5 = 200,000 rubles.

It is unlikely that the card holder will hit the ceiling when using the card. So you can pay with peace of mind.

The list of exceptions at MTS Bank is quite standard: cash withdrawals, transfers, casinos, funds, insurance premiums, etc. However, payment of utility bills is not prohibited.

In terms of usage, there are some restrictions that should be taken into account when planning to spend points:

- The limit of 650 bonuses is set automatically for the payment goal and for the goal of setting up autopayment for replenishing an MTS number;

- The limit of 5000 bonuses is set for expenses on MTS services upon request;

- A limit of 3000 bonuses is set for expenses on MTS services upon request for one subscriber;

- The minimum additional payment is 1 ruble when paying for purchases in MTS stores. In this case, you can pay the entire remaining amount with certificates. You can use bonuses for offline or online purchases with subsequent pickup from the store.

When using a certificate, it is important to note that it is valid for the quarter following the quarter in which it was purchased. After this, you will no longer be able to use, exchange or return the certificate. Also, certificates cannot be returned once purchased.

Bonuses do not expire and do not expire.

Now let’s calculate how many bonuses you can earn with an average credit card spend of 50,000 rubles, taking into account the fact that in the categories of increased accrual, purchases average 10,000 rubles per month.

10,000*5% + 40,000*1% = 900 bonuses.

This means that over the course of a year, a participant will be able to accumulate 10,800 points for rewards, excluding the bonuses that he will receive when using MTS services and offers from partners.

Reviews

You know, I came across extremely positive reviews for this universal “Cashback” card from MTS.

Perhaps they were custom-made, but negativity is almost never found. Everyone just talks about how wonderful the employees work at MTS and how great they are.

It was like I was in a pink world with rainbows and unicorns.

If you dig deeper on Banki.Ru, you can also find a description of the nonsense about the Cashback card from MTS, which I like to show off.

For example, cards are issued to everyone (debit cards, of course), but no one can close them.

The girl had a situation where she received a card at a branch that later closed. Other branches refused to close her card. Of course, it’s not a big loss, because plastic is free.

But it will be difficult for perfectionists to come to terms with this.

If you dig even deeper, then, finally, you can come across reviews that MTS employees stupidly impose a “Cashback” card for large purchases , explaining practically nothing.

So if you are offered something like this, at a minimum, do not immediately agree to these adventures in the world of an egg on a red background.

One thing the reviews don’t tell you is how to succinctly refuse the imposition of a “Cashback” card from MTS, so as not to accidentally send someone away.

There is also a lot of negativity about the work of MTS Bank itself, but our review today is not about it.

Increased cashback categories

As part of this loyalty program, the participant is not required to independently select the type of “favorite” purchases. There are 3 permanent categories of spending for which 5% cashback is awarded, namely:

- “Food” (includes food delivery, cafes and restaurants);

- "Childen's goods";

- "Cloth".

If a client makes several spending transactions at the same point of sale during the day, then bonuses will be awarded only for the first two purchases.

Advantages and disadvantages

Let's not deviate from the tradition of collecting all the pros and cons of the card together.

I think this helps to create a more complete image about the product.

Let's start with the good:

- free service;

- good categories of increased cashback;

- if you need a credit card, it is issued without a salary certificate;

- cheap interbank card;

- free withdrawal of your own funds from ATMs all over the world;

- inexpensive SMS information.

But there are also negative points:

- cashback can only be spent on replenishing an MTS account or in their communication stores - not even through an online store;

- when working with credit funds (withdrawal or transfer), they charge a huge commission;

- high fines for late payments;

- if you don’t use the card for six months, the bank will automatically close it;

- there is no interest on the balance even with a debit card;

- it is unprofitable to make purchases abroad;

- inability to open an additional card for yourself or someone in your family;

- When replenishing a Cashback card from an individual entrepreneur's or legal entity's account, the commission is 5%.

conclusions

The universal “MTS cashback” card was previously interesting primarily because it gives 5% cashback on cafes and clothes.

Another significant advantage is the long and fair grace period - 111 days.

And finally, you can withdraw your own funds from the MTS cashback card without commission at any ATM in the world.

The main disadvantage of the card is that cashback is paid not in money, but in fact in goods from MTS stores and payment for communications.

Another drawback is the lack of information in the Internet bank and mobile application about the amount and repayment date of the grace period. You have to call the hotline or calculate it yourself. But this technical flaw will most likely be corrected in the near future.

Minor disadvantages include the unfavorable conversion rate for purchases in foreign currency and the lack of cashback for the third and subsequent purchases at one outlet during the day.

Considering that the card is free to use, it must be taken and used for purchases at pharmacies and gas stations in the absence of other cards with increased cashback in this category. If you buy on account of the grace period, you can still earn money on the temporarily freed funds by placing them on a deposit card of another bank or in a savings account at MTS Bank.

Apply for an MTS cashback card

Card loan and its repayment

As mentioned above, with the MTS cashback card it is possible to open a credit limit in the amount of up to 300,000 rubles. Loan repayment period up to 36 months.

There is a grace period for 111 days after payment for the goods, during which no interest will be charged for using the loan (it is worth noting that the benefits apply only to payments for goods and services and do not apply to cash withdrawals). Then they will start charging from 11.9 to 25.9% per annum for using the loan.

Dear reader! In this article we look at typical ways to solve your issue, but each case is individual.

If you want to find out how to solve your specific issue, please contact a consultant by phone :

+7 (Moscow) Ext. 773

+7 (St. Petersburg) Ext. 987

+ (Regions) Add. 917

We accept your calls 24/7 and 7 days a week. Basic consultation is FREE .

Features of payments for used credit money

Let's look at the nuances of how to use the card when paying for services and goods using credit money.

The conditions provide for a so-called “grace period” of 111 days. During this time, every month (until the 20th) you can repay 5% of the loan per month (minimum 100 rubles).

For example , if you bought something on January 1, then on February 20 you will need to deposit 5% of the money spent on the card, on March 20 - another 5%, and you must pay in full by April 20. If you do not make the minimum payment of 5%, this is fraught with the forced closure of the grace period, the immediate accrual of interest for using the loan, a damaged credit history, as well as a fine in the amount of 0.1% of the debt per day plus 500 rubles one-time for delaying the minimum payment amount.