The whole truth about cashback from MTS

The maximum amount of cashback that can be obtained using MTS reaches 80%.

But such generous offers only apply to purchases of services from this mobile operator. Article navigation

- Cashback from MTS - how it works

- What can you spend the money you save on?

- How to start receiving cashback

- MTS user personal account

- Program partners

- Frequently asked questions about the service

- How to get MTS cashback when buying a smartphone

- How to check the amount of bonuses on your account

- How to withdraw cashback to an MTS Money wallet

- Is it possible to transfer money from MTS to a card or cash out

- Cashback doesn’t arrive: what to do and where to go

- Where to get a promo code

- How to disable cashback

MTS cashback is a special service of a popular mobile operator, promoted to attract and retain subscribers. The company benefits from growing its customer base, and users save up to 50% on purchases! Having first heard about such an impressive benefit from MTS, users are asking questions about what it is and how to get discounts.

To get answers, and at the same time figure out how to take advantage of the bonus cashback program, just study a brief overview of the capabilities of MTS clients.

Cashback rounding and expiration date

Separate attention should be paid to the issue of rounding the accrued cashback. The fact is that the cunning, prudent specialists from MTS thought about developing special conditions for rounding the amounts of payments and purchases from which cashback is calculated. Thus, if a client pays for a purchase in the amount of 49 rubles, the amount of 1% cashback will be 0 points. If the purchase size is 50 rubles, the amount of the refund will be 1 point, even though 1% of 50 rubles is equal to 50 kopecks.

As for the expiration date of accrued points, there is simply no expiration date; accumulated bonus rubles can be stored on the client account for an unlimited amount of time.

Cashback from MTS - how it works

MTS has been operating in Russia since 1993 and has become one of the largest cellular operators in the country and abroad. The company attracts customers with quality services and favorable rates, but does not stop there and continues to improve.

As part of the development program, users were offered an impressive cashback, which differs from what other operators provide. The essence of the proposal is as follows: customers pay for goods or services from MTS partners, and for purchases they receive up to 80% compensation on the balance of their mobile device. In simple words, this means that users have a great opportunity to please themselves and loved ones with useful purchases, receiving a substantial discount in the form of bonuses, which are then exchanged at the rate: 1 point = 1 ruble.

The refund conditions are quite simple. As soon as the purchase is recorded and the system processes the payment made by the client, an SMS notification is immediately sent to his phone, displaying how many bonus points have been awarded under the cashback program.

This means that no burdensome actions are required from the user. He makes purchases, accumulating bonuses that can be spent profitably on purchasing new goods and paying for services.

Cashback is credited only if the transition to the online store - the MTS partner page was made from the user’s personal account on the official website of the cellular operator or from the MTS cash back mobile application.

Brief information about MTS

Public Joint Stock Company (PJSC) "Mobile TeleSystems" was created on the basis of a consortium that in 1992 took part in a competition and became the winner of a license to provide cellular communication services of the GSM-900 standard.

Now MTS PJSC is a large group of companies represented in the markets of Russia, Belarus, Armenia, Ukraine, Turkmenistan, Uzbekistan, and Kyrgyzstan.

The main owner of Mobile TeleSystems is the holding of AFK Sistema owned by Vladimir Yevtushenkov, which owns a 53.47% stake. The remaining shares are traded on stock exchanges in London, New York, Berlin, Munich, and Moscow . The British company Vodafone is a strategic partner.

MTS PJSC provides the following services:

- cellular communications of GSM, 3G, 4G standards for subscribers in Russia, Belarus, Ukraine and Armenia;

- APN, VPA, telephone answering machines and others for corporate clients;

- wired telephony through, where Mobile TeleSystems acts as the main shareholder;

- wired Internet for individuals and legal entities in Russia;

- Mobile Internet;

- cable, satellite and mobile television.

In addition to the above, it is developing its own network of retail stores selling mobile equipment on the Russian market. In the spring of 2018, the network consisted of 5.7 thousand communication stores . In branded stores you can purchase mobile devices from the brands Honor, Samsung, Apple, Xiaomi, Huawei, Asus, Nokia and others.

The domain shop.mts.ru operates a branded online store that allows you to purchase smartphones, tablets, quadcopters, smart watches, fitness bracelets and other equipment online.

What can you spend the money you save on?

It’s easy to accumulate bonus points with MTS; among the company’s partners there are 780 popular online stores that delight you with prices and assortment. Having received cashback, it is spent on:

- mobile phone balance replenishment;

- purchasing a smartphone in MTS stores;

- payment for communication services for your loved ones.

When connecting to the cashback program, each user is assigned the first goal by default in the form of payment for communication services. Therefore, when the first day of a new month arrives, bonuses are first written off, and then, if they are not enough, funds are debited from the account.

The goal setting function is used at your own discretion, for example, by setting a goal to accumulate a discount to pay for a phone in a retail network or in the MTS online store. Once the goal is achieved, all that remains is to place an order, pay for the phone and receive it.

Cash withdrawal conditions

The Bank's client can freely make both non-cash payments and cash withdrawals, subject to a positive balance. The transaction fee depends on whether the cardholder is attempting to withdraw personal or credit funds, as well as the withdrawal method selected. The answer to the question “Can I withdraw cash from the MTS cash register?” – this is, of course, “Yes”, but you should choose the interest-free option.

Withdrawals

| Their | |

| At ATMs in Russia and abroad, at MTS Bank cash desks, when a credit card is available | no commission |

| At MTS Bank cash desks without a card | for free |

| Credit funds | |

| At ATMs in Russia and abroad, at MTS Bank cash desks, when a credit card is available | 3.9% of the transaction amount + 350 rubles |

| At MTS Bank cash desks without a card | 4% of the transaction amount |

The maximum daily and monthly limits are set at 50,000 and 600,000 rubles, respectively.

How to start receiving cashback

To activate cashback, you must be an MTS user; bonus points are assigned to your mobile device number. To gain access to discounts, you should register by creating a personal account (abbr. LC) on the official website, or download the MTS cash back application. How to create a personal account is described below, and to receive a link to download the mobile application, you need to go here, indicate your mobile number and click “Submit”.

After logging in to the MTS.ru website or mobile application, proceed to study offers from 780 popular services and online stores that act as partners of the operator.

The amount of cashback depends on the selected offers:

- up to 5% refund when booking seats in restaurants;

- up to 15% for purchases in retail stores;

- up to 15% for travel;

- up to 25% for gifts to loved ones;

- up to 25% for purchasing goods in online stores;

- up to 75% for spending on leisure and entertainment;

- up to 80% for payment for services.

In order not to get lost in the variety of profitable offers, you can use filters when sorting, selecting among them:

- new;

- popular;

- with an increased cashback amount.

Although you can use the MTS cash back mobile application directly from your phone, to study offers it is more convenient to view them in the browser of a personal PC or laptop, and to do this, register on the operator’s official website.

Installing the application

You can receive cashback in MTS from various devices. Access to the site through a browser is available both on desktop computers and laptops, as well as on smartphones and tablets. In addition, mobile applications are available for Android and iOS operating systems.

The MTS Cashback Android application is downloaded from the official Google Play resource. Installation does not take much time and is similar to any other program for a smartphone. The required operating system version is 4.2 and higher.

For the iOS operating system, the corresponding application is downloaded from the App Store. Installs on iPod touch, iPad and iPhone. Requirement for iOS is version 9.2 and later.

MTS user personal account

To get your MTS cashback personal account at your disposal, follow the link cashback.mts.ru to the official website and select “My Account”. To authorize, you will need to obtain an access password. Therefore, users select the appropriately named option and see a special window. Enter your phone number, captcha and click “Next”. Then, having received the password in an SMS message, they use it to log into the account. At this point, registration is completed, and the user receives full access to all functions of the personal account.

When logging into your account using the MTS cash back mobile application, no password is required, authorization occurs automatically using your phone number.

In your personal account, you can view your account status. To do this, use the buttons located in the top block, allowing you to:

- check balance;

- top up your account with a bank card;

- activate the "Autopayment" function.

If you actively use the cash back program, you can forget about the need to pay a subscription fee. Otherwise, it won’t hurt to personally monitor the balance. Under the account status information block there are “Service Packages”, displaying information about the volume of Internet traffic, minutes for calls, SMS messages.

To control where funds are spent in the MTS system, the Personal Account provides a “My Expenses” section. To analyze expenses, the user, using a calendar, sets a time period of up to 3 months. After this, the system displays how much money was spent and where. To assess the total amount of expenses in individual areas, the section contains a pie chart. If you hover the cursor over a segment of the circle, a tooltip will appear showing the amount of spending for the selected service category.

To study the complete payment history in detail, use the “Detailed Statistics” menu subsection. This section is also used in cases where you need to view an unsaved caller number. But to search, you will need to at least approximately remember the date of the call, otherwise it will not be easy to find useful information in the abundance of detailed data for each user action.

At the bottom there is an information block that opens access to management and allows you to independently switch to a new plan. By clicking on it, the user will see three subsections:

- for special occasions;

- for computer and tablet;

- for phone and smartphone.

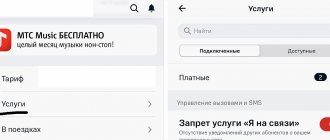

The “All Services” function allows you to manage options associated with a phone number. For the convenience of users, filtering is provided in two categories - paid and free. You can connect the function you are interested in or remove the unnecessary one with one click of the mouse.

The settings section allows you to:

- see who the number is registered to;

- block your SIM card if you lose your smartphone;

- link other MTS numbers to the current one, which allows you to control the costs of mobile communications of loved ones and top up the balance of their cell phones;

- view the full list of numbers linked to your passport data.

In comparison with the mobile application from MTS, the personal account is more functional, differing in that it provides:

- access to a full list of services;

- comprehensive information on tariff plans;

- a complete list of executed contracts and numbers;

- the ability to block your numbers;

- settings of SMS messages for authorization and confirmation of actions;

- the ability to send passport data to confirm the use of the number, as required by law, without personally visiting an MTS communication salon.

"Citylink"

This store interested me after I saw the rate from MTS.

And Citilink itself has not interested me for quite a long time, because after the fall of the ruble in 2014, it raised prices to the skies.

For a more detailed debriefing about this store and how to get a refund for purchases there, read yesterday’s article.

Now, if you sort products on Yandex.Market by price, you won’t find “Citylink” on the first or second pages.

Before it was easy.

MTS offers a full 1% refund on orders from this store.

Yes, this seems undignified now, but you haven’t seen offers from cashback services yet.

One of the reasons why I criticized Citylink was because the rates were lousy.

Competitors

- "ePN Cashback" will return as much as 0.2% of the order. Let's say Petya bought a computer worth 50 thousand rubles. This means he will receive 100 rubles cashback. In my opinion, now you can’t even buy a mouse pad with this money.

- Cashback.ru, which usually shows good results, this time offers only 0.25%. And not all products are eligible for returns: the exceptions include mostly children's items and furniture. Not impressive, right?

- “Kopikot” gives cashback, but it would be better not to give it at all: here they will return only 0.15% of the order. That is, Petya would receive 75 rubles for his computer for 50k. For this reason, I wouldn’t even bother with cashback.

- “Biglion” is another stranger among its own, because initially it was not a service for returning interest, but now it has created such a function for itself. And it gives a “generous” 0.25% of the order in Citylink.

I have prepared a separate material for you about the latest service, in which I tell you about saving options and shopping rates.

Mini-conclusion : MTS’s offer for Citylink is simply excellent. Cashback services could not reach him . This is amazing, in my opinion. A big plus for the operator.

Program partners

The number of MTS partners, from whom purchasing goods and paying for services will allow you to accumulate bonus points under the cashback program, is approaching 1000. Among the largest and most popular online stores, the following stand out:

- Aliexpress;

- Lamoda;

- KFC;

- MyToys;

- Tefal etc.

Customers buy the largest cashback of up to 80% when paying for MTS services: Second Memory, MTS TV, etc.

Promotions from partners are held on a regular basis, which allows you to purchase goods and services with additional discounts. Therefore, it is useful for every MTS user to look at the cashback.mts.ru/catalog section to keep abreast of current promotional offers with increased cashback.

Invite a friend

I'll swear again!

Well, if the company really and down to the smallest detail cannot create a normal program with cashback from MTS, then should we endure this again?

Why eat undercooked pasta if you're not Italian?

In fact, I like al dente, not a very good example, but indicative.

The meaning of the referral program here is the same as with other services: you have a promotional code that you can send to your friends in order to invite them to register in this torture program.

Once they sign up, you get cashback from them. Maximum you can get a percentage return for 10 friends . Anything more is no longer friendship, you simply don’t know how to be friends, so be happy with what you have. Moreover, you can send out as many invitations as you like.

But the main thing is not written in the “Questions and Answers” column - how much money will I get from this.

It’s not written here, and there’s nowhere else to look.

Let's say I don't have an MTS SIM card. How will I know if I should get one for such great deals?

The most interesting thing is that this information is not even in the program rules.

And how can I get it?

How can you use GLOBAL cashback from MTS if they don’t give you any information?

Frequently asked questions about the service

When starting to use the MTS cashback service, users often have the same questions. You can find answers to the most popular ones below.

How to get MTS cashback when buying a smartphone

MTS PJSC expanded the MTS Cashback program in 2021, and from that moment on, customers began to receive refunds from smartphone purchases in stores or online stores to the MTS Money wallet. Not all phones sold at MTS participate in the cashback program, but among those that allow you to receive a substantial portion of bonus points are premium models of Apple iPhone, Samsung, Sony, Huawei, etc. Customers are allowed to receive and transfer cashback when purchasing a smartphone in installment plan, compensating yourself in this way for the interest on it.

The checkout and cash back process is simple. For example, when purchasing a Samsung mobile device at an MTS store, the user:

- selects the model you like;

- informs the seller of his desire to purchase it;

- indicates that he is a participant in the MTS Cashback program;

- provides his number on the network, which serves as an identifier for the MTS Money wallet.

As soon as the purchase is completed, bonus funds will instantly be credited to the e-wallet balance, even if the client has never used it before. To gain access to these funds, all you need to do is download the MTS Money application or enter the payment.mts.ru section.

How to check the amount of bonuses on your account

To view the balance of bonus funds, use one of 3 options:

- send a USSD request from a mobile phone to *101*2#;

- go to the personal account section, where they find the subsection “Cashback accrual history”;

- open the MTS cash back application.

How to withdraw cashback to an MTS Money wallet

In MTS you cannot withdraw cashback to your MTS Money wallet. However, on a regular basis they hold promotions where the refund is not in the form of points, but in real money. After the purchase, they are credited to the balance of the MTS Money electronic wallet.

In addition, MTS Bank issues a debit card with Weekend cashback. To return part of the funds from purchases, it is enough to use it to pay for goods or services, receiving up to 10% cashback.

Is it possible to transfer money from MTS to a card or cash out

To withdraw funds from a smartphone to a card, use the following options:

- "Easy payment" service;

- money transfer systems BLIZKO, Contact, Unistream, etc.;

- MTS offices;

- electronic payment systems Qiwi, WebMoney, etc.

To withdraw the funds in your account to a Sberbank card or any other financial institution, it is more convenient to use the first option. Those who are interested in the opportunity to withdraw money in cash will be disappointed; such a method is not provided in the MTS system. Therefore, you will first have to transfer funds to a card or wallet of an electronic payment system, and only then will they be able to cash out.

Cashback doesn’t arrive: what to do and where to go

If points have not been credited after the purchase, then users act in accordance with the following algorithm:

- check the maximum period for cashback accruals in the selected store; for some sellers it reaches 75 days;

- if the maximum period for enrollment has already been passed, then contact the MTS support service, whose specialists will check why the cashback did not arrive;

- If it is determined that the store is at fault, then contact its contact center with a request to confirm the purchase and transfer the information to the cellular operator.

Where to get a promo code

To get the maximum cash back return, watch for the appearance of special promotional codes. To do this, you need to subscribe to the MTS operator’s newsletter and regularly visit the official website so as not to miss a new promotion.

Description of the map

- Cashback for purchases

- bonus program

- Calculation of interest on the balance

- Support for mobile payment services

- Individual design

- PayPass/PayWave

- Card with chip

- 3D Secure Technology

| Payment system | MasterCard |

| Cardholder age | from 18 years old |

| Card expiry date | 60 months |

| Receiving a card | at the courier, at a bank branch |

| Update date | 30.04.2021 |

"Aviasales"

If we have already looked at the hotel, then we need to look for air tickets. Aviasales will help with this.

- I really love this service, because there you can search for tickets not only for specific dates, but for any dates - as long as they are cheaper.

- You can also look for cheaper tickets not to a specific location, but to a region for specific dates.

For example:

- In Russia;

- Beach holiday;

- Schengen Area;

- Asia and so on.

In general, if you haven’t bought air tickets yourself yet, because you were afraid to do it, then go to Aviasales - it’s very simple and understandable for everyone.

MTS offers to return 1% from this service.

It’s impossible to say right away whether this is a lot or a little, because it greatly depends on the cost of tickets.

But for me it’s always not enough, not 50% return. Let's see if any of the competitors will satisfy my requests?

Competitors

- My favorite “SecretDiscounter” offers 0.7% on the purchase of air tickets. Yes, not much, but this money can be immediately transferred to charity if you want. The owners of the service do just that with part of their profits. If you don’t want to, the minimum for withdrawal is 350 rubles.

- Letishops has a lower initial rate - 0.65%, but according to our scheme it can be raised to 0.85%, which will still be lower than that of MTS. Is this mobile operator really going to have another plus?

- "EPN" offers to return 1.4% from the purchase of air tickets. That's it, let MTS cry now! Yes, yes, I'm still against him. My blog is why I tell you honestly all the shortcomings and make fun of them.

- “Cashback.ru” has not won our competitions yet, which is very strange. And now he won’t receive his medal either, since with Aviasales he returns only 1.3%.

Mini-conclusion: this time MTS was unlucky again; it was easily bypassed by two services . And the winner has a minimum wage of only 20 cents, so there is no point in arguing about the benefits here: everything is already obvious.

Mini life hack: Since I love my readers very much, I will share with you another life hack for saving money.

Aviasales is an excellent service for finding tickets, but you can buy it at a lower price.

There are many other intermediaries between the airline and the buyer.

Take, for example, “OneTwoTrip”: here, for the purchase of the same air ticket, “Cashback.ru” will return 1.75% of the cost.

A similar life hack can be done when booking a hotel.

For example, book not directly through Booking, but start from the Rumguru or Ostrovok website.

On the latter, there is generally a cashback of up to 6%, where you will find the best price offer for the hotel.

- If it is “Booking”, then go to it and book as usual.

- If not Booking, then you will be glad that you saved more.

And remember my main rule of saving: compare different options as much as possible.

But this is not all the offers from the mobile operator.

MTS also has its own bank card. Let's look at her.

Partner banks of MTS Bank - at which ATMs you can withdraw money from an MTS Bank card without commission

The interaction of MTS PJSC with other banks allows us to reduce card servicing costs. This is beneficial for customers because they can withdraw funds for free not only through their ATMs, but also through self-service machines operated by companies that partner with their financial institution.

The MTS Bank portal indicates which ATMs of other banks can withdraw money with a minimum commission. The rules for servicing credit cards are specified in detail in the tariffs and are recommended for familiarization if the client wants to make payments without overpayments.