- Cost of service - free for the first 2 months

- Payment for service will not be charged further if the following conditions are met: monthly turnover of 15,000+ or minimum balance of 30,000+ rubles

- It is profitable to keep your money - MTS Bank charges interest on the balance amount - up to 3.5% per annum

- 24/7 account transactions via Internet banking and mobile application

- Contactless payment based on PayWave technology

- Up to 5 additional debit cards linked to a single bank account

- Free reissue (at the end of the term)

- SMS information is free (not for all service packages)

- Replenishment from a card of another bank or an individual’s account is free up to 150,000 rubles per month (if it exceeds, a commission of 5% is deducted from the excess amount)

- Commission for transfers 0-1.5% depending on the method*

- Limits: from 10 to 600,000 rubles per transfer (maximum 50 transfers per month for a total amount of up to 1.5 million rubles)

- Overdraft late fee – 0.1% per day

Detailed tariff conditions PDF)

How to understand what an MTS Money Weekend debit card is?

- The MTS Money Weekend debit card is a banking product with an increased cashback of up to 5% and an accrual of up to 3.5% per annum on the account balance.

- The word “Money” in the name means the opportunity not only to spend money, but also to receive additional income in the form of bonuses and interest.

- The word "Weekend" [from English. – “Weekends”] means that the increased cashback is transferred before the weekend, i.e. on Friday so you can spend your bonuses on vacation.

Maximum Cashback

- MTS-Bank returns up to 5% cashback on the “Money Weekend” card in rubles

- When funds are deposited, you will receive an SMS message on your phone.

- Refunds are paid by transfer weekly every Friday

- Cashback amount is rounded down to the nearest whole number

- If in your opinion the cashback is calculated incorrectly, then write a request to the MTS Bank support service

- Cashback for special categories - 5%

- Basic on all purchases – 1% (except exceptions)

- When paying for the services of the Medsi medical center – 9%

- Maximum cashback amount – 3000 per month

List of MCC codes (PDF) that do not earn cashback

MCC codes for increased cashback 5% “MTS Weekend”

5% cashback is returned on the following categories of purchases:

| MCC codes | Purchase category |

| 5812, 5813, 5814 | Restaurants and cafes |

| 4121, 7512 | Taxi + rental under the Car Sharing program |

| 7832 | Cinemas and online movie services |

| 7922 | Tickets for concerts and other events |

| 5942 | Books, including e-books |

MTSBank may make changes to the list of MCC codes; check the current categories with the bank’s support or on the official website.

Conditions for savings account

The “Weekend” savings account from MTS allows you to receive income on the balance of your own funds:

- 3.5 percent per annum - for amounts up to 299,999 rubles

- 2% interest per annum - for parts over 300,000 rubles

- The savings account opens automatically upon withdrawal

- You can enable the “Piggy Bank” option to transfer money to a savings account from each purchase (the amount will be rounded up and the difference will be transferred to a deposit)

- Manage your account conveniently in the mobile application from MTS Bank.

You can receive money from your savings account at any time by transfer to your Weekend card or at a bank branch.

More information about the MTS debit card

The payment card from MTS Bank is made in the company's corporate color - red, with the MTS logo. It is intended for storing and managing, not borrowed, but personal money. It is very convenient to use it:

- purchase goods in stationary stores and on online platforms;

- participate in auctions;

- pay off debts on utility bills and loans;

- remove bills as needed;

- make transfers.

It is noteworthy that the card works in the Russian Federation and abroad.

To fully use the capabilities of the payment product, you need to install additional options:

- Mobile

, which allows you to return 3 percent of the total payment amount made on a card account to a phone number from MTS.

- Shopping

, which provides an automatic refund of 3 percent of the amount debited from your account for business expenses during the month. The amount of money spent on shopping should correspond to 15,000 rubles.

- Travel

, aimed at accumulating points for using the card resource not only within the country, but also abroad. You can spend points converted into rubles to create comfortable relaxation conditions.

Cumulative option

, in addition to being provided automatically to all MTS debit card holders, is intended to accrue interest on the balance of money on the card balance.

1000 rubles is enough for interest to accrue. The conclusion is easy to draw: the more money on the balance, the higher the profitability.

Current tariffs

| Payment system | Mastercard |

| Card type | World |

| Card currency | Ruble |

| Validity | 5 years |

| Cashback | 5% in special categories 1% on all purchases Up to 6% on Medsi services |

| Service cost | Free: - first 2 months - when spending over 15,000 rubles/month. — if you have a minimum balance of RUB 30,000. 99 rub./month. in other cases Issue - 299 rubles. |

| Cash withdrawal | Free up to RUB 100,000/month. at ATMs of any banks in the Russian Federation. Next - commission 1% of the excess amount per month |

All tariffs Documents

Differences and key features

The main feature of the MTS debit card is cashback. The word is unusual, but in fact it means that part of the money spent on purchases is returned to the account. Simply by paying for a daily grocery basket using an MTS debit card, the user receives a refund of a certain amount of money back to the card.

Another feature is that by storing money in a card account and managing it at your own discretion, without restrictions, you can make a profit. An increase of up to 6 percent is added to the balance on the card. It is logical that the larger the balance, the greater the profitability. It is sometimes difficult to obtain such income from credit institutions, even after making a deposit.

Often you have to face the fact that it is difficult to withdraw cash from plastic cards - you have to pay commissions. You can withdraw money from an MTS card for free using technical devices from at least two banks:

- Sberbank;

- VTB 24.

It is noteworthy that ATMs of these credit institutions are not difficult to find and they operate around the clock.

The peculiarity of the MTS card product is that you can pay with it using contactless payment technology and without the need to enter a PIN code. Card holder upon payment:

- holds her in his hands;

- attaches it to the terminal for a few seconds, thus making the payment.

The card supports 3-D Secure protection, which allows you to protect yourself from fraudulent schemes on the Internet. An operation performed online will be completed only after the user confirms it with a digital code sent to the cell phone.

Customer Reviews

Victoria, Krasnodar. Initially, I received the Weekend card as a salary card. I withdrew money from an ATM and used it at my discretion. And only a couple of months ago I found out that in six months of use I lost about 15 thousand cashback. Now I actively pay with it in cinemas, cafes and gas stations. I get about 600-700 rubles a week.

Valery, Rostov-on-Don. I collaborated with MTS Bank as a legal entity for a year and a half. I used all the products - made deposits, loans, current accounts and connected acquiring. And as an individual, I belonged to Sberbank, but over time I realized that the money that I always have in my account should also work. That is why I designed “MTS Weekend”. Now, in addition to cashback, I also receive interest on the balance. Despite the small percentage, the funds work and bring me income. I am planning to transfer the salary project for my employees to MTS Bank.

Zhanna, Kirov. In general, I am satisfied with everything about the “Weekend” card from MTS Bank, but, of course, the annual service is expensive - 1,188 rubles, if these two conditions are not met. But I always try to leave 30 thousand in my account so as not to overpay.

Olga, Omsk. I moved to MTS Bank from VTB because I opened a new deposit and wanted to independently manage the interest without visiting the office. I usually used a Sber card like everyone else, but there is no cashback. If you take into account my lifestyle - every weekend with friends I go to a cafe, club or cinema - then I can easily earn enough for a free dinner in a good restaurant in a month. I’ve been using the MTS card for the third month now, for the first month I received 1820 rubles, for the second 2289, and for the third 1003 rubles.

Thank you for watching!

If you liked the video, share it with your friends:

Share on Facebook

Card conditions

MTS Bank issues debit cards of Visa

,

MasterCard

and

MIR

of various levels.

Among the most popular cards are: MTS money Weekend

and

MTS Smart

.

Limits and restrictions of the MTS debit card Money Weekend

Visa Platinum card

It is not for nothing that it is positioned as a card for working days with cashback for weekends. Because you can use it as usual for a week, and on the next Friday you can receive a payment of up to 10 percent, with the opportunity to spend the money on the coming weekend.

You can withdraw cash without paying interest not only from branded ATMs. Limitations set:

- daily

- 50 thousand rubles; - monthly

- 600 thousand rubles.

Interest is accrued on the minimum balance of funds in the account, which varies depending on the amount of the balance:

- 6 percent

on balance up to 299,999 rubles; - 4 percent

for the part that exceeds 300 thousand rubles.

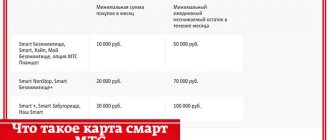

Limits and limitations of the MTS Smart debit card

Universal card MTS Smart Money

— debit card with the ability to credit an account. Designed for settlements and exemption from payment of subscription fees for cellular communication services. Despite the fact that in the application you can indicate not only your own number, but any subscriber’s.

Credit limit

on a card account it can be either 0 rubles or up to 300,000.

Interest for using borrowed money can be:

- be zero if the conditions of the grace period are met;

- be 29.9 percent if payments are overdue.

The fee for withdrawing cash from ATMs depends on the money being withdrawn:

- if the card holder, then 0 rubles;

- if credit - 3.9 percent of the withdrawal amount, plus 350 rubles.

The limit for withdrawing money from ATMs using an MTS Smart

is identical to the cash withdrawal limit for the

MTS Money Weekend

.

Cashback program MTS Money Weekend

Cashback of 1% will be awarded for any categories other than those that are exempt. This includes paying in casinos, pawn shops, receiving cash, replenishing electronic wallets and others. You can return 5% of the amount in the check when spending money in certain categories:

- bookstores;

- restaurants and cafes;

- cinemas;

- online video services;

- taxi, car sharing;

- event tickets.

The accrued points will be credited to your bonus account every Friday.

MTS debit card cost and tariffs

For the production of the card at the time of its issuance and for servicing, different amounts are charged depending on the type of card product. There are conditions that enable the holder of a plastic card not to pay for service.

| Map | Release* | Service* | Additional terms |

| MTS SMART Money | 199 | 0 | |

| MTS Money WEEKEND | 299 | 1188 | Free in the first two months and further with monthly expenses of 15,000 and a balance of 30,000 |

| Virtual | 0 | 50 | |

| Unnamed | 0 | 100 | |

| MTS Money Premium | 1000 | 12000 | Free for the first month and beyond with monthly expenses of 100,000 and a balance of 400,000 |

*

The unit of measurement is the ruble.

Service cost

A debit card can be issued by a citizen of any country living in the Russian Federation, even without official registration, the main condition is the age of 18 years and stay in the Russian Federation. The card production time takes 5 working days + delivery to the region. But the card is valid for 3 years.

A classic MTS Bank debit card of the Visa and MasterCard payment systems will cost the owner 599 rubles per year . Agree, the price is quite reasonable. If you are satisfied with the Maestro personalized payment card, then the annual service will cost only 100 rubles. However, this option has one significant drawback - it cannot pay for purchases and services via the Internet, and you won’t be able to travel far abroad with it.

How to apply for and receive a card?

You can get an MTS card at any company office. All you need is a Russian passport and the age of majority. It is not necessary to be a client of the MTS mobile operator.

Be prepared for what

- You will need to familiarize yourself and read a large number of official documents. It would be a good idea to make sure that the credit limit is 0.

- Security will take a photo of you.

Order a card

You can apply for a card in the traditional way by contacting any office of the company. Consultants will provide information support, help you fill out the form and immediately issue a card.

On the MTS Bank

, located online at www.mtsbank.ru there is an “online application for a card” option, in which you need to enter information about:

- FULL NAME;

- date and place of birth;

- passport details;

- registration address;

- contacts and the code word required to identify the client over the phone.

In less than a day, a manager will contact the potential client, ask clarifying questions and invite him to the MTS salon to receive a ready-made card. You can use it for 3 years.

What cashback can you get?

If you pay for purchases with a card, you can receive 5% cashback in the following categories:

- Taxi;

- cafes and restaurants;

- sporting goods;

- fitness clubs.

For purchases in other categories, 1% is returned. MTS Bank also often runs promotions with increased cashback. For example, 9% is returned when paying for medical services with a card and 8% is returned from purchases in beauty salons, cosmetics and jewelry stores, as well as hypermarkets selling household appliances.

The monthly cashback amount cannot exceed 3,000 rubles, that is, the maximum reward can be received for purchases of 60 thousand in the increased cashback category (5%) or for any purchases in the amount of 300 thousand.

It's easy to calculate your cashback. Let's say you paid for dinner at a restaurant for 4,000 rubles and returned home by taxi (for 1,000 rubles). Cashback will be 250 rubles (5% of the amount spent). Plus, you also spent money on the card, for example, bought groceries, paid for gasoline, etc., and spent 23,300 rubles. Thus, at the end of the month, 433 rubles will be returned to the card.

The annual cashback will be almost 5,200 rubles:

Using the card

It’s easy to work with the card, whether on the Internet, or in a supermarket or regular store. No special knowledge or skills are required. If you connect the card to one of the applications: Apple Pay

,

Google Pay

or

Samsung Pay

, then the card can be stored in a safe at home, and paid with one click of a smartphone.

How to top up the card?

There are numerous ways to replenish a card account, each user has the right to choose any:

- In the MTS Money electronic wallet.

- By transfer from a card of any bank via:

1. website of a mobile operator or bank;

2. in Internet banking or mobile application.

- At the company's sales offices.

- At bank tellers.

- In branded ATMs if they have a money acceptance function.

- Through hardware and software systems:

1. "Eleksnet";

2. “Cyberplate”;

3. "Kiwi";

4. "TelePay".

5. Through the Golden Crown payment system.

How to withdraw cash?

No problems with cash withdrawals. You can withdraw money from your card for free within established limits at ATMs of Russian banks.

What to do if MTS Bank has blocked your card?

The credit institution has the authority to block the card unilaterally, since it is its property. The reasons may be different: from simple expiration of the validity period to violation of the law on the part of the holder.

The bank has the right not to inform the holder of the reasons for blocking. The client is free to manage the funds in the account without using a card.

Prepare your passport, remember the code word and first of all call the Hotline by phone 88002500520

. If the issue is not resolved by telephone conversation:

- Write a claim and send it by registered mail to the territorial branch of MTS Bank

. - Send a message online directly through the feedback on the site.

Deposit methods without commission

| Way | Commission | Term |

| Branch | 0 rub. | Instantly |

| ATM | 0 rub. | Instantly |

| MTS (communication shop) | 0 rub. | 1 day |

| From cards of other banks | 0 rub. | Instantly |

| QIWI | From 0.5% (min. 50 rub.) | 1 day |

| Bank. translation | From 0 rub. | Up to 5 days |

| Eleksnet | 1.3% (min. 50 rub.) | 1 day |

| Svyaznoy | 1,5% | 1 day |

| Euroset | 1,5% | 1 day |

Pros and cons of the card

For those who earn money and actively spend their money during the month, the card not only replaces a wallet, but allows it to be replenished during use.

Objective advantages:

- Free services that make the process of using and managing the card comfortable: online banking with a simple interface, a high-tech mobile application and prompt notification via SMS.

- Free cash withdrawal at all ATMs throughout Russia.

- The opportunity to really save on maintenance by simply spending money on necessary purchases.

- If you follow the information, you can get increased cashback for purchases made during a certain period.

- High level of protection preventing unauthorized use.

The disadvantages include:

- The card is paid. But this disadvantage can be neutralized if you comply with the conditions for the turnover of funds on the card account.

- To receive cashback, you need to connect paid options, and you cannot do without this procedure.

- The inconvenience is that you can top up the card without interest only in MTS stores.

FAQ

How can I find out my account status?

Information about the status of the card account can be obtained from the Internet bank or application, as well as from a support employee (8 800 2500 520, +7 495 777 0001). When is cashback credited? Cashback is paid every Friday for the previous week for every transaction, except for the list of exceptions.

How do I change my PIN? The PIN code can be changed through a mobile application or Internet bank.

How much does it cost to withdraw cash abroad? 1% of the operation, but not less than 100 rubles.

In what currency can the card be issued? The card is issued only in Russian rubles.

Ask a question All questions

Reviews about MTS debit card

Reviews about the MTS Bank

, storing personal savings, are mostly positive. It should be noted that enthusiastic impressions are shared by those who initially understood what kind of product he was designing and for what purposes. The main condition for its effectiveness is active use.

The positive thing is that the card is quickly issued and there is no need to go to the bank office; just visit the MTS salon. There is no unnecessary bureaucratization when receiving a debit card - show your passport, show your registration and that’s it. Among the advantages is the fact that you can get plastic with a credit limit.

Fans of online shopping purchase a card specifically for these purposes, knowing about 3-D Secure technology so as not to put other cards at risk. By making safe purchases, users also save money, claiming that the cost of annual maintenance is more than recouped.

Negative statements do not relate to the product itself, but to the service. Unfortunately, many users note the low level of MTS consultants, who take a lot of time to prepare an answer. Often you have to deal with the fact that the answer of one consultant contradicts another. There are people who are dissatisfied with the answering service.

Answering the question stated at the beginning of the article: “ MTS debit card - what is it?

“It is worth saying that this is a modern payment instrument that simultaneously serves as a wallet and a piggy bank, reliably saving and even increasing money.

How to use

After receiving the card, you will need to activate it. To do this, generate a new PIN code for the card:

- Call the number.

- Once the voice menu becomes available, select the second option.

- Enter your passport details and the last 4 digits of the card.

- Enter the verification code. The bank sent it via SMS immediately after receiving the card.

- Create a new PIN

Calls to the specified number are not charged. The same algorithm must be followed if the PIN code has been lost.