Conditions for Megafon debit cards

Megafon offers its subscribers to combine a mobile phone account and a debit bank card.

For these purposes, 2 types of cards are issued from Mastercard. They have a full range of functionality of ordinary plastic cards, and they are issued by Round Bank. Until the card transaction is carried out, the money is on the mobile phone account. All cards are serviced free of charge and allow you to receive various discounts from partners. 8% per annum is charged on the balance of funds. The Megafon card can be successfully used both for payments in retail chains and for withdrawing cash. But in the latter case, an additional commission is possible.

Mastercard Standard NFC

The standard Megafon card allows you to perform all basic operations (pay for goods, withdraw cash, etc.). Megafon subscribers using the All Inclusive tariff line can receive it for free. The rest will have to pay 149 rubles.

In more detail, the conditions for servicing a card of the Standard category are given in the table:

| Issue cost | 0 — 149 rub. |

| Free service | Yes |

| Cashback | up to 15% |

| Bonus programs | Internet traffic for payment of purchases |

| Interest on balance | 8% per annum |

| Contactless payment | There is |

| For traveling | No |

| Cash withdrawal limit | 50,000 rub. per day and 300,000 rub. per month |

| Fee for cash withdrawals at other ATMs | up to 3,000 rub. per month - no commission, up to 10,000 rub. — 2.5%, up to 100,000 rub. — 3.5%, more — 4% |

When paying for purchases, 10 MB of Internet traffic is provided for every 100 rubles spent on the card.

Megafon Gold

The privileged category card is issued free of charge for subscribers using the All Inclusive tariffs (except XS, S). In other cases, you have to pay 249 rubles for issuing a gold card. (99 rubles - for “All inclusive S/XS” tariffs).

| Issue cost | 0 — 249 rub. |

| Free service | Yes |

| Cashback | up to 15% |

| Bonus programs | 10 MB of Internet for 100 rubles. spent on purchases, MasterCard privilege program |

| Interest on balance | 8% per annum |

| Contactless payment | There is |

| For traveling | No |

| Cash withdrawal limit | 50 thousand rubles per day and 300 thousand per month |

| Fee for cash withdrawals at other ATMs | up to 3 thousand rubles per month - no commission, up to 10 thousand - 2.5% of the amount, up to 100 thousand - 3.5%, more than 100 thousand - 4% |

The Megafon Gold card also offers a program of privileges and discounts from Mastercard.

Description

In total, Megafon offers three plastic cards and one electronic card. Their names:

- Megafon Standard.

- Megafon Standard NFC.

- Megafon Gold.

They differ in very little. The most noticeable difference is the set of tariffs to which they are tied, and the corresponding registration cost.

Features common to all:

- The cost of annual maintenance is 0 rubles.

- Possibility to pay in stores (regular and online).

- Cashback (money back) up to 20% of the purchase price, depending on the conditions of the partners.

- Mobile applications for Android and iOS, instant account management, transfers to clients of other banks, payment for television, Internet and more.

- Free SMS notifications about all ongoing operations.

- Free blocking and unlocking.

- 30 rubles per month for SMS card management.

- 10 megabytes of Internet traffic for every 100 rubles for any purchase. These accumulated megabytes must be spent within a year.

The differences between them are very small. Megafon Standard is the simplest card. Megafon Standard NFC, as the name implies, supports contactless payment technology. Otherwise there are no more differences. Megafon Gold also works contactless, and in addition to this, it offers premium promotions of the MasterCard payment system.

Now a little about the Virtual Card . It has exactly the same parameters as the Standard version, no differences. There is only one feature - the virtual machine can be released instantly directly on the Megafon Bank website. You don't have to go anywhere for this. After creation, if your phone supports NFC technology, you can start paying at checkouts in stores.

How to use the card

Along with the card, you get access to the Megafon.Bank application and Internet banking. You can perform the following operations in them:

- transfer money to a card of any bank;

- send transfers to Unistream;

- pay for various services;

- view detailed information about each transaction, limits, balance;

- replenish your Megafon card from a card of any other bank.

The Megafon card does not have its own separate account, and there is no way to send a payment using its details in the mobile application or online banking.

Virtual card

A virtual card can be obtained in two ways: in the personal account of a Megafon subscriber or on the Megafon Bank website. Let's look at the second method in more detail:

- Go to the company's website, and then to the "Maps" section.

- Select "Virtual Card" and click "Issue Now".

- Enter your phone number. You must be a Megafon subscriber.

- They will send you a code via SMS. Enter and click Continue.

- Create a password and confirm it. Then click "Issue Card".

In a few seconds the virtual card will be ready. After this, you will need to download the Megafon Bank mobile application and add the card to a contactless payment application, for example, Apple Pay, Samsung Pay or Google Pay.

The virtual card has certain limits. To remove restrictions, you need to purchase a plastic card. To do this, visit the Megafon office with your passport.

The table shows the limits on the use of funds with and without a plastic card.

| Without plastic card | ||

| Overall size | Daily limit | Monthly limit |

| 60 thousand rubles | 100 thousand rubles | |

| Cash withdrawal | 5000 | 40 thousand |

| Translation | 15 thousand rubles | 40 thousand |

| Online shopping | 60 thousand rubles | 100 thousand |

| With a plastic card | ||

| Overall size | 100 thousand rubles | 600 thousand rubles |

| Cash withdrawal | 100 thousand rubles | 300 thousand rubles |

| Translation | 100 thousand rubles | 300 thousand rubles |

| Online shopping | 100 thousand rubles | 600 thousand rubles |

It is not necessary to purchase a plastic card, but as you can see, the limits increase significantly if you have one.

How to top up your account

Topping up your Megafon card account is not difficult. To do this, you just need to add money to your mobile phone balance in any convenient way.

The balance on the card and the balance on the phone are one and the same. The only exceptions are bonus accruals to your mobile account, which can be spent exclusively on communications.

You can top up your card:

- by bank card;

- cash in salons and terminals;

- through electronic wallets and ATMs.

Advantages of cards

The Megafon card is a unique product on the Russian market. It allows you to combine the balance of your card and mobile phone. There are other advantages:

- free service;

- cashback from partners;

- low-cost or free release;

- a convenient application for monitoring transactions and making necessary payments;

- high rate on account balance;

- easy balance replenishment.

Sources:

- https://megafonme.ru/bankovskaya-karta-megafon-snyatie-nalichnyx/

- https://megafon-info.com/platezhnaya-karta-megafon-mastercard/

- https://debetcardsinfo.ru/stati/vsya-informatsiya-i-usloviya-ispolzovaniya-bankovskoy-karty-mastercard-ot-megafon/

- https://kartavbanke.ru/debet/debetovaya-karta-megafona.html

Payment card Megafon Mastercard

At the beginning of 2021, Megafon is the only mobile operator that issues its own payment card, similar to a bank card. The Megafon Mastercard card is issued by the company’s partner – the Moscow bank “Round”. The Megafon card has a number of advantages compared to regular bank Mastercards:

1. The card is issued within five minutes in almost any office of the company. Drawing up a contract with a minimum number of details. Everything fits on one sheet. The Megafon card can be linked to both an existing number and a new one. When linking to a new number, you need to top up your account in the amount of 150 to 250 rubles. It may be different in different regions.

2. The most important advantage. The card balance matches the balance of the mobile phone number. This means the following:

- Replenishment is carried out using all the usual methods suitable for replenishing a mobile phone account (through any payment terminals, at the operator’s office through a cash desk, etc.)

- when making telephone calls, consuming Internet traffic and sending SMS, the card balance decreases, and, conversely, when debiting from a payment card, the balance of the telephone number also changes accordingly.

Use Megafon Mastercard to withdraw funds from electronic payment systems (EPS) WebMoney and Yandex Money. When withdrawing to regular VISA/Mastercard, EPS charges a significant commission. In addition, funds may not be credited instantly. To withdraw money to a Megafon card, you just need to top up your mobile phone account from an electronic wallet, which happens in seconds and with a significantly lower commission. The mobile account replenishment limit, for example, for WebMoney is 5,000 rubles per day.

3. The Megafon card is similar in functionality to any Mastercard issued by Russian banks. There is also the possibility of contactless payment.

4. The Megafon card has no service fee, either monthly or annual.

5. There is a version of the card with cashback for purchases. It should be noted that this option has a very small service fee - 30 rubles per month.

6. The card is not personal. In the place where the owner’s first and last name is usually indicated, it is written: MEGAFON CLIENT. This may create some inconvenience when making payments on the Internet that require identification of the owner. For example, when booking a hotel or replenishing an exchange trading account. The problem is solved by sending the counterparty a scan of the application form filled out upon receipt of the card. This contract contains all the necessary identifiers.

Since the Megafon card is not personal, use it to store funds in the event of initiation of enforcement proceedings, or during a lengthy bankruptcy procedure for an individual. It has been verified practically: in the certificate from the tax authorities about the availability of bank accounts of a citizen, any accounts associated with the Megafon card do not appear! This may seem incredible. But that's how it is. This means that neither the bailiff nor the financial manager in bankruptcy will have access to the funds. Because both officials are obliged to act in accordance with strict regulations and not to show initiative.

How to block and close a card

The card is blocked by the owner if it is lost, stolen or the account is closed in the following ways:

- via SMS with the word BLOCK NNNN sent to number 5555. Instead of NNNN, the last 4 digits of the card are indicated in the message;

- using a special interface on the operator’s website;

- when calling 5555 from a mobile phone or 8800 550 0500 from any phone (toll-free).

The operator can also disable the ability to use the card unilaterally out of court if the terms of the program are terminated or the subscriber violates the payment requirements for services.

Megafon account. Payment by bank card

It would seem that there could be nothing new in the topic “How to top up a Megafon account from a bank card.” However, it is not.

Situations when it is advisable to pay for Megafon with a bank card rather than cash:

- funds are available only on credit cards (withdrawing cash from an ATM is very expensive, and payments for cellular communications by all Russian banks are equivalent to purchasing goods from a credit card);

- debit cards have balances that are not a multiple of 100 rubles and therefore cannot be withdrawn;

- There is no debit card issuing bank ATM nearby to withdraw cash.

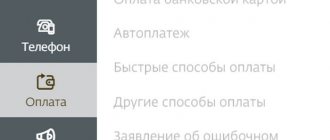

Using bank cards to top up your phone account:

1. Payment in the office. Starting from 2021, the most common terminals, similar to store ones, are being installed in Megafon offices throughout the country for payments with VISA/Mastercard/MIR contactless, by rolling or by entering a PIN code. It has been noticed that not all Megafon clients know about this and continue to pay in the old fashioned way through the cash register, or through Qiwi and Eleksnet terminals with a commission.

2. Payment through your personal account. Produced without commission. There are two ways to top up Megafon from a bank card:

- directly from the card by entering its details;

- by linking VISA or Mastercard to your mobile number and setting up auto-payment, which is made when your phone account balance drops below a certain amount.

A significant inconvenience of paying through your personal account is that the minimum replenishment amount by any method is 100 rubles, which is often excessive given the current cheap prices for mobile communications.

The second drawback of this replenishment method is that MIR cards are not yet accepted in personal accounts at the beginning of 2021.

3. Replenishment through Sberbank ATMs. We are not talking about the obvious option of replenishing a Megafon account from a card issued by Sberbank.

At the Sberbank ATM terminal you can top up your Megafon account from any card of any third-party bank without commission! This may sound incredible. However, it was tested practically in March 2021 in cities of the European part of Russia.

The method is very convenient for payments at night, since in any city there are numerous Sberbank pavilions open around the clock. The method is also relevant for those traveling around Russia, because even in the smallest town there are several Sberbank points, while the company’s office may be the only one in the entire locality. This is exactly the situation that takes place in the most popular tourist destination - Greater Sochi. Several dozen villages of different sizes over a distance of 100 kilometers.

At the beginning of 2021, replenishing a Megafon account from cards of third-party banks has not yet been implemented by other Russian banking “monsters” - VTB and Alfa Bank. Also verified practically.

How to withdraw money from Megafon without commission

To withdraw money from your Megafon account without commission, there are two ways. When choosing any of the options, you will have to visit the nearest office of the mobile operator.

- Method 1. Write an application to withdraw a certain amount from your account. You will be able to receive money from Megafon in cash not immediately, but after a certain time has passed (3-10 business days).

- Method 2. Terminate the contract with Megafon. In this case, the entire amount in the account will be returned to you. This operation will also take some time.

Note! You will not receive cash at Megafon offices. The company operator will transfer the money to the bank account. In your application you will need to provide the following details:

- BIC;

- TIN;

- checkpoint;

- correspondent account;

- account/card number.

You can find them out at the bank in the following ways.

- Call support.

- In your personal account.

- In the documents received when issuing the card.

As you can see, all this requires a lot of time. These methods are relevant only when the contract is terminated and if the need to receive and cash out the money is not too urgent.

Transaction limits

The banking product provided by the operator has many advantages. You can use your phone balance and manage your purchases with one click!

As you know, cash withdrawals from a Megafon card are made from two different media. You can own a digital card or a physical plastic card; they have different transaction limits.

Digital

Let's look at the digital version first.

The daily limit is 60,000 ₽:

- For issue – 5000;

- For translations – 15,000;

- To pay for goods – 60,000.

You can spend 100,000 ₽ monthly:

- For issuance – 40,000;

- For transfers – 40,000;

- For payment – 100,000 rubles.

We will discuss the interest rate for withdrawing cash from a Megafon card later - for now we are talking about the established restrictions. If the user is constrained by limits and wants to increase the amount, you can contact the office with your passport to get plastic.

Physical

If you use a plastic bank carrier, you can withdraw RUB 100,000 daily:

- For issuance – 100,000;

- For transfers – 100,000;

- To pay for goods – 100,000.

600,000₽ available for spending monthly:

- For cash withdrawal – 300,000;

- For transfers and payment for goods also - 300,000.

Unfortunately, withdrawing cash without a commission from a Megafon bank card is almost never possible! Let's discuss the established rules in order to comfortably use the operator's bank product.

How to withdraw money from Megafon through payment systems and cash out

You can withdraw a certain amount of money from Megafon and cash it out using various payment systems (QIWI, Yandex.Money, WebMoney, etc.). This method is beneficial if you have a bank card issued by one of these companies. The algorithm of actions is as follows.

- Go to the payment system website.

- Top up your wallet from your phone balance online or in another way.

- Cash out using any convenient method.

You will find detailed information about methods of transferring from Megafon to QIWI in this article.

Megafon together with Round Bank LLC have released a unique product - a bank card that has a single account with the phone. Now, when you top up your phone balance, you also top up your card. Need cash urgently? Withdraw money from your phone account at any ATM. What other opportunities open up for Megafon bank card holders, we will consider in this article.

Commissions

You can withdraw money from any ATM of any bank - there are no restrictions. You need to remember about percentages! They are low, consider the amount before receiving funds.

Transactions made at ATMs and Agent service points during the calendar month:

You can withdraw money from a Megafon card without commission if you withdraw up to 10,000 (and the turnover in the current month exceeded 3,000);

- When withdrawing up to 10,000 – 2.5%;

- From 10,001 to 50,000 – 3.5%;

- From 50,001 the commission will be 4.5%,

If you want to receive funds through a point of issue, be prepared to pay a commission of 4.99%. A small amount for quick receipt of funds!

The commission applies to both versions of the bank card - digital and plastic, without changes.

We told you how to withdraw money from a Megafon card - now you know where to look for the issue point and what additional expenses to expect. Be fully prepared and prepared for any situation!

How to withdraw money from Megafon using money transfer systems

You can withdraw funds from your Megafon account and cash out the received amount of money through money transfer systems in various ways.

On the mobile operator's website

Transfers to the following systems are available on the Megafon website.

- Post office.

- "Unistream Russia".

- Unistream CIS.

To withdraw existing funds, proceed as follows.

- Follow the link https://money.megafon.ru/.

- Open the “From phone to cash pick-up points” section.

- Select the desired service, for example, CONTACT.

- A special form will appear.

Fill it out, click on the “Transfer” button and follow the service’s instructions to confirm the operation. You can receive the amount withdrawn from Megafon in cash at any CONTACT office in just a few minutes.

Via SMS

The general principle is this:

- Create a message.

- Send it to the short number 8900.

The messages differ for different money transfer systems. These are the formats.

- BLIZKO - “Blizko sum full name.”

- CONTACT - “Con amount full name”.

- “Unistream CIS” - “Unim amount country code, full name of recipient, full name of sender).” CIS country codes: Tajikistan - tjk, Moldova - mda, Kyrgyzstan - kgz, Kazakhstan - kaz, Georgia - geo, Belarus - blr, Armenia - arm.

- “Unistream Russia” - “Unov sum full name”.

- Russian Post - “Post_meg amount full name postal_code_recipient”.

Transaction deadlines and fees

Amounts of money sent from Megafon arrive in the Unistream, CONTACT and BLIZKO systems within a few minutes. When working with Russian Post you will have to wait longer. The translation execution time is from 3 working days. The commission when choosing “Unistream”, CONTACT and BLIZKO depends on the payment amount.

- From 1 to 4999 rub. — 7.35% + 95 rub.

- From 5,000 to 15,000 rubles. — 7.35% + 259 rub.

Receiving money transferred from Megafon in cash through Russian Post takes longer, but is more profitable. Transaction fees are lower.

- From 100 to 2999 rub. — 3.5% + 51.5 rub.

- From 3,000 to 13,600 rubles. - 5.2%.

About the map

With the money that is on the mobile account of a Megafon subscriber, using Megafon Mastercard you can pay for purchases in regular stores, online and for services. That is, the card functions as a full-fledged bank MasterCard, but its account is the account of the subscriber’s phone number. The moment a subscriber tops up his phone balance, he tops up his card.

There are no restrictions on replenishing your phone account - there are no cards. You can top it up in the same way you top up your phone account: at Megafon post offices, through terminals, by automatic payment, through online banks, from other cards, from electronic wallets, etc. Just put money on your phone number and you can go to the store, where you can immediately pay by card.

The card is linked to Megafon.Bank. This is a free online operator service in which you can view all transactions, view and control expenses, and make free payments and transfers. However, any Megafon subscriber can register with MegaFon.Bank, regardless of whether they have a card. To manage your account, a special mobile application has been developed for iOS, Android, and WindowsPhone.

Megafon guarantees the safety of funds. The money is not kept in the bank, but with the operator itself: there have not yet been cases of revocation of the license of mobile operators. As another bonus, you can point out that the company blocks the possibility of falling into the coverage area of unwanted subscriptions for all holders of its plastic card. Thus, plastic owners are guaranteed to be protected from any accidental write-offs.

A Megafon subscriber can issue up to 10 cards in his name, which can be linked to one personal account. If the subscriber has several different personal accounts, then different cards can be linked to each of them, which will be issued in the same name.

You can withdraw cash from the card at an ATM of any bank, including abroad. The bank's commission for cash withdrawals is 2.5%. Don’t forget that the bank that owns the ATM can set its own commission for withdrawing cash from someone else’s card, but this will not be a surprise to you: the bank is required to display information about its tariffs on the device’s screen. There is no minimum threshold for withdrawal.

Types of cards from MegaFon Bank

The online service follows current trends, therefore it offers its subscribers not only a physical (plastic) card, but also a virtual one.

- Plastic card - supports contactless payment method, has a PIN code;

- Digital card - you can add it to your smartphone and pay for purchases from it (the device must support NFC technology). A digital card has lower limits compared to a plastic card. This is done for the safety of your funds.

What cards does Megafon offer?

The mobile operator offers 2 types of plastic:

- NFC standard;

- Gold.

Let's look at how much money needs to be deposited into the Megafon Mastercard account when registering, depending on the tariff. If you decide to issue a Megafon Mastercard Standard NFC bank card, then opening the card:

- for users of tariffs “Turn on! Listen/Speak/Chat/Watch/Premium" and "All inclusive" M/L/XL/VIP - free;

- for subscribers with tariffs “Turn on! Open/Write" and "All inclusive" XS/S - also free;

- subscribers with all other tariffs will need to deposit 149 rubles into their account.

If you decide to issue Gold, then you will need to deposit into her account during registration:

- holders of tariffs “Turn on! Listen/Speak/Chat/Watch/Premium” and “All Inclusive” M/L/XL/VIP no need to deposit money into your account;

- subscribers with tariffs “Turn on! Open/Write" and "All inclusive" XS/S you need to have 99 rubles with you;

- subscribers with all other tariffs will have to deposit 249 rubles into their account when registering.

MegaFon Internet banking capabilities

Registration in the service gives you the opportunity to carry out numerous financial transactions online, which significantly saves time:

- Payment for Internet, TV, fines, hosting, utilities. Repayment of loan debt and much more;

- Transfer of funds to an electronic wallet or another bank card. Making money transfers from Unistream (including to other countries);

- Top up your own account.

Also, a Megafon subscriber can issue a digital card without visiting a communication store and get acquainted with all transactions on the account. For example, you can find out about all expenses and income for a certain period of time. In the “Favorites” section you can add operations that you need to perform regularly.

How to get and start using the card

In order to receive a card, you only need to be a Megafon subscriber. You can get the card immediately when you apply for a new SIM card, or you can come to a Megafon salon and apply for a bank card with your passport for an old SIM card. The client signs the application and deposits an amount from 0 rubles to 249 rubles into the account, depending on the tariff of his phone. This money will remain in the account. The card is issued and issued immediately. All you have to do is activate it and get a PIN code. You can start using it the same moment you activated it.

How to activate a Megafon Mastercard bank card? Take the plastic in your hands and call from your phone number to which it is linked to the toll-free number 5555. Then all you have to do is follow the instructions of the automated system. Don’t forget to write down your PIN code or remember it well—it won’t be possible to change it to a more familiar one. The first purchase will need to be made in a store (or a withdrawal from an ATM) must be made by entering a PIN code.

Support

For Megafon Bank users there is a support service that will listen to complaints about work, solve problems, and provide information of interest. On the main page of the official website below you can find contact information for the support service. You can call the toll free number. The short number 5555 is available for plastic card holders. From other countries you can call the number.

In a special chat or mobile application, you can write to support specialists. But you will have to wait longer for a written response than for a telephone response. This will take 30 to 60 minutes.

Bank specialists recommend following simple rules to ensure security:

- do not disclose passwords to your personal account to strangers, even bank employees;

- come up with complex password combinations and change it more often;

- Always close your personal account after work;

- check payment details.

When connecting to bank employees via the hotline, you must clearly describe the problem. Employees may ask for personal information to establish their identity, for example, passport details, but not the password for their personal account. This is done to ensure safety.

Advantages

What are the main advantages of plastic from Megafon that can be listed:

- monthly accrual of 8% per annum on the account balance. In order for interest to be credited, you must make at least one transaction during the billing period and have a permanent account balance of more than 500 rubles. That is, if you have 10,500 rubles in your subscriber account every month, then you will receive as much as 800 rubles per annum;

- when making purchases from partners - cashback up to 50% return: up to 15% in Megafon communication stores, up to 10% in Rive Gauche perfume stores, up to 10% in Shokoladnitsa coffee shops, up to 25% in Burger King, etc. The number of promotion partners is constantly increasing , among them are large supermarkets, flower shops, furniture shops, boutiques, restaurants, gas stations, etc.

What other advantages can be noted in the plastic offer from Megafon:

- instant delivery;

- if you order a Megafon tariff in an online store, you can receive a card by courier;

- free SMS information.

Megafon Bank hotline phone number

Very often, when using a card, a lot of questions arise. The system is new, so some operations are not displayed in statistics and errors may occur.

If you have any questions or complaints, you must contact the Megafon Bank hotline. Just call 8 . It is free for calls throughout Russia. Here you can both get background information and talk to a specialist.

Hotline phone number

You also see that you can contact a company employee in a special chat. Just be prepared for the fact that they may respond to you with a noticeable delay. In some cases it is 30 minutes or even an hour. But such an expectation is justified; the employee needs time to double-check everything.

After the consultation, do not forget to rate the service specialist.

Card Features

The card is issued in the MasterCard payment system and is prepaid. That is, in order to activate it and make transactions using it, you need to top up your account with a certain amount.

In the first three months after activation, owners cannot dispose of the entire amount in the account. Depending on the tariff plan, the system will block a certain limit of funds. For example, 200 rubles. Whatever you put on top of this amount, you can use for expense transactions, but you will not be able to spend these 200 rubles.

Only after 3 months will it be possible to spend any amount of money on the card.

The card is replenished very easily in any convenient way: through terminals, Megafon personal account, and other services. The balance of funds, as noted above, will be charged 8% per annum, provided that the account has at least 500 rubles.

To control your expenses, you can use the Megafon-Bank service. It's easy to register:

- Go to the company's website.

- Click on the “My Bank” button and enter your phone number.

Here you can view the balance of not only your phone, but also the phones of loved ones.

How to find out your card balance using SMS

To do this, you need to connect SMS banking. After connecting, by sending various SMS commands to number 5555, you can find out how much money is left in the account, receive a statement for a given period and perform other operations.

The service is free for the first month of connection. In the future, 30 rubles will be debited from the account monthly.

Use these commands:

- BALANCE – to determine the account balance;

- PIN – to change the PIN code;

- HISTORY – information about the last 10 operations;

- HISTORY XXXX - if there are several cards, then you can find out the history of a specific card by typing the last 4 digits of the card together with the word “HISTORY”;

- BLOCK №№№№- block a specific card. Instead of “№№№№” enter the last 4 digits of your card. The operation is relevant if you have lost or had your card stolen;

- BLOCK ALL – block all Megafon cards.

You can also simply block by calling 5555 or in your Megafon-Bank personal account.