Of all the banking products from MTS, Weekend cards are considered the most popular among holders. Favorable rates, good credit limits and increased cashback set them apart from the rest. To increase the loyalty of its customers, the bank has also developed a children's card (for teenagers over 14 years old).

Each potential applicant can submit an application at a bank branch or fill out an online application on the official website. Let’s look at what the MTS “Money Weekend” card is and what a credit line, cashback and savings account are.

Application for opening a Money Weekend card

Unique benefits of the Weekend card

The main advantages of the Weekend debit card:

- Plastic emissions cost only 299 rubles.

- Annual maintenance is free if you have a monthly turnover of 15 thousand rubles. or when maintaining a monthly minimum balance of 30 thousand rubles.

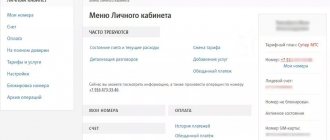

- Each client gets access to a personal account of MTS Bank, through which they can make transactions with their account.

- Cashback up to 3 thousand rubles is paid once a week.

- 4-6% is charged on the balance of funds.

- SMS notifications, Internet banking and mobile application are free.

- You can withdraw cash without commission at any ATM.

The advantage of the MTS “Money Weekend” credit card is that upon registration you can request a good credit limit (299-400 thousand rubles) and receive a grace period of up to 51 days .

Advantages

MTS Money Weekend card is a popular product. Its advantages include:

- Free account management.

- The plastic does not need to be activated; it is ready for use immediately after issue.

- Up to 5% cashback on debit card.

- Up to 6% is charged on the balance. This is higher than the rates on deposit accounts of many Russian banks.

- There is no fee for cash withdrawals.

- Plastic can be linked to an individual salary project and you no longer need to replenish it yourself from another card.

- Free SMS notification service.

- Personal account for constant control of balance and bonuses.

- The MTS Weekend debit card supports one-touch payment without entering a PIN code.

- To obtain a debit card, you can contact any branch.

- You can connect the piggy bank function and deposit the change from your change into a savings account.

A bank card serves as an excellent tool for everyday expenses. The MTS Money Weekend card has no tricks or hidden fees. The conditions are clearly stated, and the client can receive all additional information through his personal account 24 hours a day.

Types of Weekend cards

Weekend cards can be divided into 4 types:

- Credit. Offers its holder a limit of up to 299 thousand rubles. with a grace period of up to 51 days.

- Debit. A regular card without a credit line, but with a good cashback (up to 5%) and interest on your own balance.

- For children over 14 years old. A similar product, but without the ability to get a loan.

- For salary clients. It stands out among all free annual services in the first year and a good credit limit.

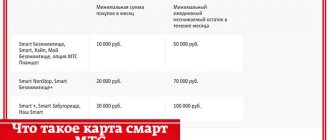

The main tariffs and conditions for Weekend bank cards are presented in the table:

| MTS “Money Weekend 14+” | Debit card “MTS Weekend” | MTS “Money Weekend” credit card | MTS credit card “Weekend for salary clients” | |

| Card issue | 299 rub. | For free | ||

| Annual maintenance | 99 RUR/month if the terms of free service are not met | 900 rub. | 0 rub. in the first year according to the offer, all subsequent years - 900 rubles. | |

| Interest on the card | — | 24,9-27% | 19,9-27% | |

| Grace period | 51 days | |||

| Credit limit | RUB 299,999 | 400,000 rub. | ||

| Cashback accrual | 5% – in special categories, 1% – in all others | 5% - in special categories, 1% - in all others, 9% - for Medsi services | ||

| Minimum payment | — | 5% of the debt amount, minimum 100 rubles. | ||

| Cash withdrawal | Per day up to 50 thousand rubles, per month no more than 600 thousand rubles. | |||

| Commission for withdrawal of credit funds | Free at any ATM in the country | 3.% of the transaction amount + 350 rub. | ||

| Top up your balance | Free via ATM, from a mobile account and intrabank transfer, in other cases - 1-3% | |||

| Fine for late payment | — | 0.1% of the debt amount per day | ||

MTS Money Weekend card: what's good about it

In mid-summer, MTS Bank released a new card, “MTS Money Weekend,” which, according to the creators, should become the bank’s new flagship product.

The MTS Money Weekend card is now offered in every MTS mobile operator store. It can be either credit or debit. In today's review we will look at both cards at the same time.

So, this is what the advertisement for the MTS Money Weekend card looks like on the website:

Subscribe to the @hranidengi channel on Telegram - only there is the most up-to-date information about updates, useful life hacks and other interesting things from the world of finance

Save the Money! recommends:

MTS Money Weekend debit card. Advantages

1 Inexpensive maintenance cost.

The issue of a chipped non-personal debit card MasterCard World costs 299 rubles. (issuing an additional card costs the same). There is PayWave and 3D-Secure:

GET MTS MONEY WEEKEND

Servicing the MTS Money Weekend card is free for the first two months, then 99 rubles/month. No commission is charged if you make purchases worth RUB 15,000 in a month. (purchases from the list of exceptions are not taken into account in this turnover) or maintain a total minimum balance on the card and savings account of 30,000 rubles.

Although the tariffs indicate that the first 2 months of card servicing are free, you must fulfill the free conditions from the second calendar month so as not to be charged a fee on the 1st of the third month:

If there is no money on the card, then the service fee does not accumulate and is written off in a single amount when the card is topped up:

Servicing up to 5 additional cards is free; you can get additional ones only at bank branches:

2 Wide geographic distribution.

You can get an MTS Money Weekend card not only at MTS Bank branches, but also at any MTS salon, of which there are quite a few throughout the country:

3 Interest on the balance.

The advertisement states that 7.5% is charged on the card balance:

And only after hovering the cursor over the question mark, we learn that interest is accrued on funds not on the card, but on a savings account, which opens upon receipt of the card:

Interest is calculated daily on the incoming balance at a rate of 7.5% per annum, and if on at least one day of the month the total balance on the card and savings account drops below 1,000 rubles, interest will not be paid:

The calculation of interest on the “Savings Weekend” account begins with the first replenishment of the savings account and is possible for less than a full month if a minimum balance of 1000 rubles is maintained. during this month:

UPD: 06/24/2020 As of 06/24/2020, the savings account has a balance of up to 300,000 rubles. accrued 4.5% per annum:

1000 rub. for a free Cashback card from Raiffeisenbank, 1000 rubles. for “100 days without %” from Alfa-Bank with a free year, 1,500 rubles. for Tinkoff Black, 4000 rub. for Tinkoff Platinum, 500 rub. for “EVERYTHING is possible” from Rosbank, 500 rubles. for “Moscarta” from “ICB”, 3000 rubles. for an Opencard credit card, 8,000 rubles. for Citi Select, 1000 rub. for “110 days without interest” from Raiffeisenbank with free cash withdrawal and free service.

Save the Money! recommends:

4 Weekly cashback.

The MTS Money Weekend card (and additional ones too) offers 1% cashback in regular categories and 5% in higher categories. There are no roundings not in favor of the client. Currently, 5% cashback is available in the categories “Cafes and Restaurants” (MCC 5812, 5813, 5814), “Sporting Goods and Sports Clubs” (MCC 7997, 5941) and “Taxi” (4121).

Cashback is credited to the card account every Friday for all purchases from Monday to Sunday of the previous week that managed to go through the account. Monthly cashback limit – RUB 3,000:

Here is a list of exceptions for which cashback is not provided (these operations are also not taken into account when calculating monthly turnover):

UPD: 08/12/2021 From 08/16/2021 MCC 9311 (taxes) is added to the list of exceptions.

When making several purchases in one TSP (trade and service enterprise) per day, cashback will be given only for the first two transactions:

UPD: 06/24/2020 As of 06/24/2020, 5% cashback is provided for purchases in the following categories: ● Cafes, restaurants (MCC 5812, 5813, 5814); ● Taxi, car sharing (MCC 4121, 7512); ● Event tickets (MCC 7922); ● Cinemas (MCC 7832); ● Bookstores: (MCS 5942); ● Online video: (MCS 7841).

From 07/05/2020, the “MTS Money Weekend” card will have cashback rounded down to the nearest whole number:

5 Free cash withdrawals from any ATMs.

You can withdraw funds from the MTS Money Weekend card at any ATM in the Russian Federation without commission, the daily limit is 50,000 rubles, the monthly limit is 300,000 rubles. The minimum amount of one withdrawal is not limited:

6 The card can contract.

The MTS Money Weekend card can withdraw funds from cards of other banks for free through the services of MTS Bank. It is only important to make sure that the donor card issuer does not charge its own commission for such transactions. You can read more about this in the article “Card2Card: How to transfer money from card to card for free” :

You can also top up your MTS Money Weekend card for free in MTS salons:

7 Withdrawal to card from MTS balance with a commission of 1.5%.

Using the MTS Money wallet, you can withdraw money from the balance of an MTS mobile phone to MTS Bank cards, including the MTS Money Weekend card.

As of 12/09/2018, the commission for such an operation is 0.9%. This property is useful, for example, if you need to cash out money from a credit card. You top up the balance of your MTS phone on the website of the mobile operator MTS with any credit card (there will be MCC 4814), as a rule, there is no departure from grace and no fine for this MCC, and then using the MTS Money wallet, transfer the funds to the MTS card Money Weekend” and withdraw from an ATM. The monthly limit for such operations is small, 40,000 rubles.

8 Free SMS information.

There is no fee for SMS notifications on the main and additional MTS Money Weekend cards.

9 Support Android Pay, Apple Pay, Samsung Pay.

The MTS Money Weekend card supports modern payment technologies using a smartphone:

To popularize these services, various promotions are held:

MTS Money Weekend debit card. Flaws

1 Is not a free donor.

The MTS Money Weekend card is not a free donor; when withdrawing funds from it through third-party services, a commission of 0.3% is provided, a minimum of 30 rubles.

UPD: 12/05/2017 From December 1, 2021, MTS Bank debit cards ceased to be anti-donors, i.e. Now you can withdraw funds from them without commission using the services of other banks ( which can do this for free ).

2 Slow transactions within the bank.

MTS Bank has a firmly established reputation as one of the slowest credit institutions. Internal transfers, as well as replenishments, are carried out extremely slowly, which is why various technical overdrafts often occur.

3 Imposing insurance.

After generating a PIN code for the card, the MTS Bank hotline, without hesitation, switches to an insurance company employee who is trying to sell insurance, and even asks for the CVC code of the card. Naturally, you need to refuse and not reveal your card details to anyone:

4 Commission for enrollment from individual entrepreneurs and legal entities.

For crediting funds from individual entrepreneurs and legal entities to MTS Bank, a commission of 5% is provided:

So it is better not to top up MTS Bank cards, for example, from a brokerage account:

5 Receipts must be kept for 1 year.

MTS Bank requires keeping all receipts for transactions for 1 year:

6 It is difficult to reach the operator.

Calling the MTS Bank hotline and chatting with a live operator is not such an easy task:

7 There is no free interbank banking.

Interbank to other credit organizations via Internet banking costs 0.3%, minimum 20 rubles:

8 Difficulties with closing the card.

You can apply to close your card and account at MTS stores, but sometimes problems arise with this.

Here is a review from a client who wanted to close his salary card, and a bank representative recommended turning to his former employer for help in resolving this issue, although an application to close the card and account can also be sent by Russian Post :

For another client, the bank employee did not offer alternative ways to close the card and account, other than personally contacting the bank:

In the following case, the card could not be closed in the MTS salon, since the system displayed that there was no such client:

9 Fee for inactivity.

If there have been no incoming (except for interest accrual) or outgoing transactions on the card account for 180 days, a commission of 300 rubles per month will begin to be debited. until the balance is reset to zero:

10 Unfavorable conversion rate.

The conversion rate of MTS Bank for purchases abroad is no different and can be about +4% to the rate of the Central Bank of the Russian Federation:

11 Use of the anti-money laundering law (115-FZ).

MTS Bank also has

already familiar clauses according to which the bank can refuse to carry out a transaction, block a card, or request documents Credit card MTS Money Weekend. Basic goodies

1 Inexpensive maintenance.

The credit limit for the MTS Money Weekend MasterCard credit card can be up to 299,999 rubles, the interest rate is 23-35% per annum (determined individually). The cost of maintenance is 900 rubles/year. (credit service is also paid). There is no issue fee. You can submit an application and find out whether the bank will approve a credit card for you online on the bank’s website .

ORDER MTS CREDIT MONEY WEEKEND

Unlike debit, credit card SMS notifications are paid:

2 Withdrawal of own funds without commission.

You can withdraw your own funds from the MTS Money Weekend credit card at any ATM in the Russian Federation without commission. Daily limit is 50,000 rubles, monthly – 600,000 rubles.

This feature will be very useful for Tinkoff Bank credit card holders who want to use the “Balance Transfer” option (read more in the article “Tinkoff Platinum Credit Card: Secrets of a Brewer” ).

When withdrawing your own funds, the amount with the commission is blocked, then the commission disappears, sometimes technical problems are possible:

3 Grace period up to 51 days.

The bonus program for the MTS Money Weekend credit card is the same as for the debit card, 1% cashback for everything and 5% in higher categories.

To get the maximum benefit, the card must be used in compliance with the terms of the grace period. The grace period for the MTS Money Weekend credit card is dishonest, i.e. In order for a new grace period to begin, the credit card must be withdrawn to zero in the payment period.

The billing period is a calendar month. The payment period lasts until the 20th day of the month following the billing month.

The main difficulty is that the grace period does not apply to transactions during the payment period if the debt for the billing period is not repaid. Here's how this feature is veiled in official documents:

However, it is quite possible to use the MTS Money Weekend credit card during the grace period and not pay interest. For clarity, let's draw a picture.

Let's say our billing period is from July 1 to July 31, the payment period is until August 20.

We need to repay 5000 by August 20, then we will not need to pay interest to MTS Bank for using the borrowed money.

However, if we want to use our credit card in August before we debit the card, then the grace period will not apply to this purchase. Those. in our case, the purchase is 2000 rubles. will not be preferential. If we withdraw the card to zero in August (the zero should “spend the night” on the card), and make a purchase after that, then a new grace period will begin, and 2000 rubles. will need to be repaid by September 20, and no interest will be paid for this period.

Such conditions of the grace period, of course, create a certain discomfort. It's no secret that invoice purchases actually take place after a few days. Those. if you make transactions using the MTS Money Weekend card at the end of the month, say on the 29th-30th, then these purchases will most likely be posted to the account as early as the next month, and the grace period will not apply to them.

Thus, it is better to carry out transactions using borrowed funds using the MTS Money Weekend credit card before the 25th.

Then there are two options left: you can pay off the debt at the beginning of the payment period and continue to use the card for purchases (i.e., in fact, the grace will be less than a month), or not make purchases during the payment period and pay off the debt closer to the 20th, i.e. . make the most of grace.

The grace period does not apply to cash withdrawals from an MTS Money Weekend credit card or transfers using a card number using borrowed funds (in addition, there will be a commission of 3.9% + 350 rubles).

If you do not make even the minimum payment, then, naturally, there will be a fine and a penalty.

UPD: 10/08/2018 From 07/01/2018 on old and new “MTS Money Weekend” and “MTS Smart Money” credit cards, instead of the inconvenient dishonest grace, when a new grace period began only after repayment of the debt for the previous billing period, fair grace began to be applied. The billing period is a calendar month, the payment period is the next 20 days.

4 It’s convenient to top up the card.

The MTS Money Weekend card can be topped up for free from cards of other banks, in MTS salons, as well as from the MTS Money wallet:

The service does not charge a commission for replenishing your MTS Money wallet from cards of other banks:

The MCC code for this operation (for an amount up to 1000 rubles) is defined as 6051 (Foreign Currency, Money Orders):

Some credit cards (there are very few of them) do not have a grace deduction or commission for this MCC:

Conclusion The MTS Money Weekend credit card can be used thanks to its fair grace period, weekly cashback, and convenient replenishment.

ORDER MTS CREDIT MONEY WEEKEND

A debit card also has a number of advantages. In a recent comparative review of the best debit cards with cashback and interest on the balance, the MTS Money Weekend card was among the leaders.

ORDER DEBIT MTS MONEY WEEKEND

I hope my article was useful to you; write about any clarifications and additions in the comments.

You can follow updates in this and other articles on the Telegram channel: @hranidengi . Channel mirror in TamTam: tt.me/hranidengi .

Subscribe to Telegram

Subscribe to TamTam

Subscribe to stay updated on all changes :)

comments powered by HyperComments

Conditions for receiving a card

You can apply for a credit and debit card at any bank branch or online using the official website. You will need to spend 15 minutes filling out the questionnaire, and the answer will come within 1-3 days.

Client requirements

The bank does not impose strict requirements on potential clients; only an age limit is established:

- for debit – from 14 years;

- for credit – 20-70 years.

When registering, you will only need to provide your passport.

How to apply

Methods for completing an online application for an MTS “Money Weekend” credit card:

1. Go to the bank’s official website, select one of the types of credit cards and fill in the primary data:

The first stage of completing the application form.

2. Confirm the specified phone number using the SMS code.

Phone number confirmation.

3. Decide on the card limit, indicate your income level, and enter personal and passport information.

Potential applicant questionnaire.

4. We register information about the place of work. In the second block we enter information on contact persons (it is advisable to indicate telephone numbers of close relatives).

Block with information about the work.

5. At the final stage, you need to choose an office where it will be convenient to pick up the plastic.

The last step to issue a card.

An SMS with a response to the application will arrive within 1-3 days, it will also indicate the approved limit and delivery office. Issuing a card takes no more than 5-7 days.

Also, each client can come with a passport to a bank branch and submit an application together with an employee. This method takes longer.

With an online application for a debit card, everything is much simpler:

1. Fill out a short form on the bank’s website by entering your full name, mobile phone number and email address.

Online application for a debit card.

- Wait for a specialist to call, confirm the data and wait for a decision.

The issue period depends on whether the client selected a personalized card or a non-named one. On average, you can receive plastic within 2 weeks.

How to get a card

You can arrange it at any MTS salon or by ordering delivery. Afterwards you will need to activate it:

- Call the number: 8 (800) 250-0-520.

- Press 1, selecting “Get or change PIN code”.

- Enter the sent code. Come up with a good password.

- Wait until the operation is approved by the autoinformer.

To restore your PIN code, you will also need to call the support number, press 2 after answering and follow the instructions.

Weekend debit card

Using a debit card, you can pay for purchases not only in stores, but also on the Internet. Its main advantage is that the owner receives monthly cashback of up to 5% and interest on the balance of his own funds.

Order an MTS Weekend debit card

Plastic can only be issued using a passport at a bank branch or at home, through the official website. After signing the contract, each client receives access to a personal account, with which you can track all movements on the account. You can also install a mobile application on your phone and connect the card to the contactless system. Legal entities can also use plastic from MTS Bank as a salary card.

Savings account

Weekend savings account is another product from MTS Bank that can be used as a deposit. Every month the owner can receive 5% income in the amount of up to RUB 299,999. and 3% on the portion of the balance above. You can open it at a bank branch or online on the website. The minimum first payment is 1000 rubles. The account is capitalized, it is possible to replenish and partially withdraw.

Its main difference from a standard deposit is that there is no fixed annual rate; income depends on the balance in the account.

How to use the card

Using a debit card is easy. You can pay with plastic at checkouts in stores, cinemas, cafes, etc. For convenient remote work with a debit card, the bank offers clients a personal account. You can enter it from the official website or install the mobile application on your smartphone. In your personal account you can:

- Transfer funds.

- Top up your phone.

- Pay for services, fines, etc.

- Convert currencies.

- Connect additional options such as “Autopayment”.

- View account statements.

Appearance

The bank card is always available, there are no restrictions on the types of transactions, you can spend money at your own discretion.

Weekend Credit Card

Even if you have a debit card, you can get a credit card; it will give the owner the right to use borrowed funds and make purchases even in the absence of free personal money.

Order a Weekend credit card

How to open a loan

To receive a credit card with an open line, you will need to submit an application at the bank or on the official website.

Credit limit amount

Credit limits depend on the chosen card: regular clients can receive up to 299,999 rubles, salary clients – up to 400 thousand rubles.

When a credit line is denied

Reasons for making a negative decision:

- High credit load.

- Non-compliance with bank requirements.

- Providing incorrect or unreliable information.

- Presence of active arrears.

- Salary does not correspond to the requested credit limit.

The “Weekend” debit card means that its user can only use his own funds, while the credit card allows him to spend borrowed funds. Unfortunately, a universal product in the Weekend line has not yet been released.

How to make payments

During the established grace period, it is necessary to repay the entire debt on the MTS “Money Weekend” card, otherwise interest will be accrued daily on the remaining debt. Also, we must not forget about the minimum payment - 5% of the debt amount, but not less than 100 rubles.

Money can be transferred from any card, through a terminal, ATM or bank branch. You are also allowed to use the services of online services or electronic wallets.

There is no need to make payments using a debit card, since your own funds are used, not your overdraft.

What is the grace period?

The classic MTS “Money Weekend” card and the plastic card for salary clients have up to 51 days.

Advantages and disadvantages

Among the main advantages of the mentioned payment instrument:

- the opportunity to regularly receive cashback;

- accrual of interest on the minimum balance;

- free service if several conditions are met;

- free mobile and internet banking;

- receiving privileges from Visa.

If the holder takes advantage of all the positive aspects of the “plastic” and fulfills the conditions for free service, there will be no disadvantages, and the only inconvenience will be the inability to borrow money. But for some people, this disadvantage is an important advantage, so the product has no obvious weaknesses or negative aspects.

Cashback conditions

The main advantage of the MTS “Money Weekend Visa” card is that it accrues a good cashback - up to 5%, and there is also the opportunity to earn money on usual spending. The client only needs to make purchases in certain categories and receive a payment to his account every Friday.

The funds earned are transferred to the savings account of the MTS “Weekend” card and can be spent on communication services or the purchase of goods.

What is it charged for?

You can get cashback for any purchases, except those that qualify as exceptions. 5% is charged on special categories, and 1% on all other expenses. For all cards, except for children's cards, you can receive a 9% cashback for paying for services at the Medsi clinic (the offer is valid until December 31, 2021).

You can calculate your approximate income using the online calculator on the bank’s official website.

Online calculator to calculate the cashback amount.

How and where you can spend cashback

The funds earned can be spent on paying for mobile communications or purchasing goods in the operator’s showroom.

When is increased cashback credited?

Increased cashback of 5% is awarded for paying bills in cafes/restaurants, as well as for purchasing tickets to cultural events and cinema.

Exception categories

In the “Terms of Use” column, the categories for which cashback is not credited are stated:

- Gambling and gambling establishments.

- Purchase of lotteries, precious metals.

- Payments to insurance companies and pawn shops.

- Transfers to electronic wallet accounts, cards.

- Cash withdrawal.

- Payment of fines, penalties, fees and commissions.

Cashback

Cashback is credited weekly on Fridays. When calculating the amount of credits, total expenses for the past week are taken into account (except for the restrictions listed above). The maximum savings amount does not exceed 3 thousand rubles per month. The cashback amount depends on the category of purchases:

- 9% – in the Medsi clinic network;

- 5% – for payments with an MTS Weekend debit card in bars, restaurants, cafes, clubs, theaters and cinemas, as well as taxis and car rentals;

- 1% – remaining purchases.

Changes are possible in the future, so if they appear, owners of “plastic” should visit the website or contact bank representatives and clarify the conditions under which the card can be used.

FAQ

Every day, MTS Bank operators are asked many questions, let’s look at the most basic ones.

They don’t give me a credit limit – what should I do?

First, you can try to get a consumer loan.

To avoid further difficulties with registration, it is worth checking your credit history and, if necessary, correcting it.

Is it possible to connect Google Pay and Apple Pay?

Can. In addition to using Contactless technology, the cardholder can pay for purchases using their phone with one touch.

How to check your card balance?

There are several simple options:

- On the official website, go to Online Banking. We authenticate using your login and password. Information about the balance will be displayed on the main page.

- Send any combination of numbers BALANCE ****, 1 ****, REMAINDER ****, OSTATOK ****, BALANCE ****, BALI **** to number 2121. Instead of asterisks, enter the last 4 digits of the card.

- Call the hotline number: 8 (800) 250-0-520 and contact the operator.

- Download the mobile application on IOS or Android. Log in and view your balance on the main screen.

- Insert the card into the ATM, enter the PIN code and click on the “Check balance” button.

- Visit the nearest bank office with your passport and find out the balance through an employee.

How to close a card?

You can close a “Weekend Visa” card only at a bank branch with written consent.

How to reissue a card?

You can immediately reissue an unnamed MTS Weekend card by contacting an MTS salon or a bank office with a passport. The personalized issue will take 5 working days. The cost of the service is 299 rubles, except for the following cases:

- the initiator of the reissue is the bank;

- a malfunction occurred due to the creditor’s error;

- The plastic has expired.

How to withdraw money?

Cash withdrawal is available at any ATM. You need to insert the card into the receiver, enter the password, click on the “Withdraw cash” section, indicate the amount and confirm the transaction.

What to do if cashback was credited incorrectly?

You need to call the number: 8 (800) 250-0-520.

If I cancel a purchase, will I receive cashback?

No, it will be deducted from the total cashback received.

How to track cashback?

When the refund is credited, an SMS is sent.

Reviews

vikuly95: “ Before applying for the card, I read a lot of reviews, most of them were negative, everyone complained that cashback on a debit card cannot be used for other purchases. On the contrary, I am very happy, because every month I spend 500-700 rubles on communications. For a month of using the card, I received 2,100 rubles in cashback, half of it was sent to my phone, and I will save the rest to give my mother a gift - a new smartphone.”

valeramihailov: “The MTS Bank card is such an interesting product: there seems to be no annual maintenance, but then they charged 99 rubles. It took me a long time to figure out where the money had gone, then I called the hotline and they told me everything. It turns out that you need to read all the terms of use - I haven’t spent 15 thousand rubles in a month. Now I’m thinking about a credit card, because the conditions are good, plus I’ll always have a good amount of money on hand, just in case.”

zhanna25devil: “Everywhere they write that it is almost impossible to get a positive decision for a large amount on the MTS Weekend credit card. I asked for 250 thousand rubles right away, I didn’t waste time on trifles. I received an answer on the same day, the employee offered to arrange free delivery, straight to my home, and told me about all the nuances. It’s a pity that you can only withdraw funds for a fee, otherwise I would use it all the time.”

Additional privileges for MTS cardholders

Debit card owners will be able to subscribe to the MTS TV application for just 1 ruble. After activating a special promotional code, customers will have access to 50 popular channels and more than 500 television series and films in the application.

Holders will also be able to take advantage of additional privileges:

- connect to the “Whole World” package with payment of 0 rubles for the entire first month with home Internet, mobile TV and communications;

- do not pay for the use of MTS Fitness and MTS Library for 1 month when connecting to MTS TV;

- at SmartMed you can consult a doctor of any specialization for free.

As part of the promotion, in cooperation with MEDSI, until December 31, 2020, the owner of the plastic card will receive an 8% cashback for paying for services at the clinic if he has not made a transaction in the last 12 months. If over the last year the client paid for the clinic’s services with a debit card, the cashback will be 3%. In addition, an additional 1% of the money spent is returned.