“MTS Money Wallet” is a convenient service for conducting various transactions with funds. This service provides the opportunity to make payments and money transfers from a personal account. In fact, this is an analogue of the usual electronic wallets, like WebMoney or QIWI.

Advantages of the MTS Money service:

- minimum commission fee;

- complete confidentiality and data security when paying for purchases online;

- it is possible to order even a virtual card;

- a mobile wallet is suitable for paying for various services/options/products in a few clicks;

- There is no fee for account maintenance;

- fast replenishment;

- several services in one (wallet + mobile bank);

- It’s easy to transfer money to a card from another bank;

- simplified payment procedure for cellular communications for MTS subscribers;

- automatic payments for fast transfers on time;

- special offer available for clients;

- the wallet can also be used by subscribers of other mobile operators, but MTS users receive more bonuses/privileges/opportunities;

- Fast contactless payment via the NFC system is active.

What can I pay from my account?

This wallet allows you to make a variety of payments, the most popular of which are:

- utility bills (gas, water supply, rent, electricity, Internet and TV, heating, cleaning, house maintenance, garbage removal and other sections);

- computer and mobile games/software/programs;

- transport services (taxi, air tickets or bus/train tickets);

- loan/mortgage debts;

- monthly loan/mortgage payments;

- mobile communications (both for yourself and for a friend);

- specialist services for life and property insurance;

- government services (taxes, traffic police fines, state duties, debts and other transactions).

When paying for some services, no commission is charged, for example, when purchasing Internet content or topping up your mobile phone balance.

You can also send money to friends and family by indicating their card numbers as the recipient. A regular money transfer is made, but in a short time and under favorable conditions on the part of the sender.

Video on the topic:

: how to borrow, maximum amount and how to turn it off

There is no automatic accrual of credit funds, so once you have applied for one and used the loan, there will be no automatic renewal. Therefore, there is no need to disable the one-time promotion. To remove the option from your phone, you can also call the hotline using the short number 0890 and get help from an operator. He will ask you to provide passport details and other information to establish your identity. After making sure that it is the owner of the phone who is calling, the operator will disable the unnecessary option. A report on the processing of the request will be sent via SMS within a few minutes.

- The client needs to be serviced under normal conditions for more than 120 days, it is important that the number has never been blocked;

- There should be no debt for what has already been borrowed and “In full confidence” is not activated;

- The subscriber has never used the deferred payment method to pay for services.

How to create an MTS Money wallet?

- We go to the official website of Payment MTS.

- Find the big “Registration” button and click on it. A form opens for entering data - enter your phone number.

- Click “Get password” and wait for the incoming SMS message.

- We indicate the access code (received numbers) to complete the procedure, the combination is entered in the “Password” line. The linked mobile number serves as the login.

After logging into the settings, it is advisable to change the password - this way your data will be protected, reducing the risk of falling into the hands of scammers and losing funds in your account. When logging in, you will also enter a new password; repeated confirmation via SMS will not be required. If you don’t want to waste time entering data every time, then you can save the new password and login. When you launch your personal account, the system will automatically offer this login information.

Is it possible to delete a wallet?

It is impossible to disable MTS Money through the settings of your personal account or application. The operator has excluded this function and completely removed it from the options.

How to remove a wallet from a mobile device:

- Unlock your smartphone.

- Enter settings.

- Click on the line “All applications” .

- Find MTS Money and click on the icon.

- Click on the trash can icon to start uninstallation.

After the operation is completed, the smartphone will not require a restart and will continue to operate as normal.

You can block the MTS Money card yourself or wait for automatic deactivation.

To automatically turn off a plastic card, you must meet the following conditions:

- do not use it for 12 months;

- have no debt on the credit line.

If these requirements are met, the MTS operator will automatically block the card and notify the owner about this via SMS.

You can close your MTS Money card if lost in the official service. To do this, the employee will need a completed application with the reason for refusing the service and a passport to confirm his identity.

In the communication salon, you can also perform such actions as refusing to link bank cards to the MTS wallet system.

Important. After deactivating the card, the system automatically transfers all remaining funds on it to the phone.

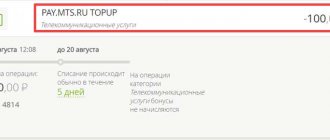

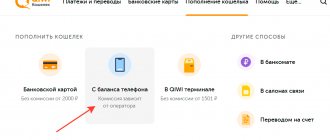

How to top up your wallet from the MTS Money service?

It is very easy to deposit funds into your account in this wallet. Choose one of the convenient replenishment methods:

- Payment terminals. Please note that this method involves a mandatory commission, which is charged by the terminal.

- From a card or personal account in another bank. You can make a transfer through the application, online assistant or personal account on your bank’s website. An MTS wallet can be specified when transferring from any resource; even autopayment is available for automatically transferring the required amount at a certain time/monthly/when the required balance is reached. For example, sending funds after exceeding the threshold of 10,000 rubles.

- At any ATM. You do not have to have plastic card from this institution; almost all modern ATMs allow you to transfer cash directly. You can also send funds through any bank branch.

- From electronic wallets. This method is perfect when you need a quick translation. Enrollment takes place within 1-2 minutes; confirmation does not require SMS or calls to support. A notification about the operation comes either to the specified email or via SMS message to your phone.

- In the nearest MTS showroom/store. The most convenient way if you regularly top up your mobile account offline. Along with changing your phone balance, you can also send money to your wallet account. The operation is usually completed in 5 minutes.

To deactivate the service yourself

- you can go to the MTS salon and give the employee an application;

- or dial the key combination *111*32#

call on your mobile device. And wait for the arrival of an SMS about disabling the service; - use your Personal Account and the “Connected Services” section on the mts.ru

; - on the same site, find a section such as “Internet Assistant” and through “Service Management” disable the “On full trust” option;

- or in the “My MTS”

in the “.

Thus, it becomes clear that disabling the credit limit on MTS can be automatic. This option terminates simultaneously with the blocking of the number if the client’s ability to go “in the red” is exceeded and the invoice is not paid on time. Or the option may be deactivated by the client after refusing. And the best thing is to stop following the bad habit and not go beyond the very initial limit. And you will always be in touch.

A reader contacted the editors of Onliner.by who was faced with unforeseen expenses caused by the transfer of the number from an advance payment method to a credit payment method. According to the subscriber, MTS “unilaterally took and connected to me this beneficial function, as they considered it.” As a result, the man lost 700 thousand rubles due to a banal navigator update.

“Let's start with the fact that I have always had an advance payment method for mobile communications. I actually found an old contract like this, the paper had already turned yellow. And it clearly says: advance. I didn’t sign any other papers, I didn’t do any manipulations with the phone related to connecting services. This is how I’ve been using my phone since 2004 or whatever year it was, and this is how this payment method stood. Zero rubles on the balance - calls are disabled. Put the money in - continue to use it. An excellent scheme that suited me quite well,”

– the subscriber writes.

According to him, at some point the operator unilaterally switched the account to a credit payment method. “Moreover, they set the loan amount for me - 430 thousand rubles. Speak - I don’t want to, as they say. Why 430 and not 320 or 610? I’m already silent about why the hell they even established this loan for me,”

– the reader is indignant.

The young man did not find out how to return to the advance method. Until one day the navigator installed on the tablet, when updated, took the subscriber into the minus by 700 thousand rubles.

“Some will say: this is retribution for inattention. In a way, yes, but we are all human, and we tend to make such mistakes. What was the first question that came to my mind? Of course, why exactly did the operator put me in the red by 700 thousand rubles? Why didn’t he turn off the traffic, like he turns off, for example, phone calls when the balance is negative? Turn it off and that's the end of it. That did not happen. Naturally, I wrote a letter asking for clarification of this misunderstanding, to which I received a completely expected answer a la “due to the fact that you have been our client for a long time, we decided to take care of you and set up a credit payment method for you in the amount of 430,000 Belarusian rubles."

Okay, stop, guys! Thank you, of course, but did I ask you about this, beg you, or perhaps somehow subtly hint? No, we supposedly just decided to give you a gift so that you would be comfortable and your calls would not be disconnected when you reach a negative balance. Well, thanks for the gift!

But how did it happen that with a loan of 430 thousand rubles I was driven to minus 700 thousand? The culprit, as it turned out, was the unfortunate features of some equipment. To the question “why are the problems of some features of some equipment being solved at the expense of the respected clients of the MTS company?” not only was there no definite answer, but simply no answer was given. Just a modest letter that the MTS company again met the needs of its customers and was able to recalculate the debt as part of some kind of service.”

We sent an email to MTS asking for clarification on whether the operator actually activates the credit payment method without the subscriber's request, sets credit limits and allows them to be exceeded. Unfortunately, the MTS press service was unable to respond to our request.

How to withdraw money from such a virtual account?

Receiving cash is also one of the transactions that is performed daily with bank cards or accounts. "MTS Wallet" is a single service for fast payment for services and instant transfers, but not a full-fledged banking product. You will not be able to get money from an ATM.

If you need to withdraw funds, you can send a transfer to your bank card or ask a friend/relative. This is the only sure and fast way to cash out money from an MTS wallet, avoiding all the paperwork and long transfers between services.

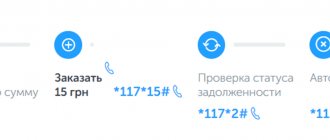

Disabling subscriptions via USSD commands and SMS

Disabling via USSD service commands is the easiest. However, many subscribers cannot always remember this set of commands, and the operator himself does not advertise them much. Here are the main options for deactivating third-party subscriptions:

- *152*2# + call - checking everyone paid subscriptions. A service menu will pop up, in which you can check all active subscriptions via “1”, and deactivate them all via “0”.

Service menu for disabling subscriptions - When you activate a subscription, you always receive an information message from a short number. This SMS contains all the information about deactivation. Most often you need to send a short message (for example STOP) to the same short number. If money begins to leave your balance quickly, check recent messages, or follow step 1.

For the future, I advise you to use, which is activated via a ussd request *984# + call . This service is free and prohibits any activation of paid subscriptions from short numbers.

The size of the established commission

This payment system offers very favorable conditions for MTS subscribers. Without commission, you can pay for housing and communal services, top up your mobile phone balance, send money to MTS cards, transfer funds to another wallet.

Transfers between cards also will not require a large commission fee - 1% of the amount, but not less than 35 rubles. When sending to other cards, there is a standard commission of 2% plus a fixed fee of 40 rubles (taken into account for each money transfer and any transaction amount).

Mobile app

If you actively use mobile applications from a cellular company, then the auto-payment service can be blocked directly in the program itself.

My MTS

1 Go to the application and select the “Connect auto payment” panel:

2 A list of connected automatic payments will appear on the phone screen. Click on the line with the green indicator:

3 On the page that opens, activate the “Disable” button:

4 Autopayment will be switched to inactive state:

5 After 1-2 seconds, a notification about service deactivation will be sent from the server to your phone:

How to pay for services and goods?

To pay for goods or services, everything necessary is provided: fast transactions, transactions through the application, automatic payments for prompt crediting of funds to the seller’s account. In the templates, you can specify the optimal time for debiting, for example, once a day or once a week.

You can pay using the MTS Money e-wallet in restaurants/cafes/hypermarkets/shops that support contactless payment. You can also tell the cashier the QR code generated for debiting funds or dictate the phone number associated with the account (if their system allows you to make a transaction by number).

Please note that not all organizations accept MTS Wallet, so check the payment option before purchasing.

Disabling services through your personal account

The classic option for deactivating paid subscriptions is to contact the free MTS hotline using the short number 0890. How to disable services on MTS through the official website?

How to disable paid services on MTS using support?

First of all, you need to make sure that the company’s paid services are actually connected to your MTS number; you can do this as follows:

That is, you need to find the number from which MTS sends mailings and respond to it with the text “

STOP ” (you can write STOP ). If everything is done correctly, then within 5 minutes a notification will be sent to your number about the successful deactivation of the service.

Identification and limits

Depending on the level of identification, the user receives more opportunities. In total, the system has three levels: without identification, simplified and complete.

At the first stage, a payment of 15,000 rubles is available, the limit of all payments per month in this service is 40,000. You cannot send and receive transfers, or top up bank cards.

At the second stage, the limits are higher - the minimum payment is 60,000 rubles, the maximum amount of transactions for 30 days is 200,000. Payments and transfers, purchases in foreign online stores/online services are available.

And the highest level allows you to send up to 600,000 rubles at a time, and store up to 1,200,000 on the MTS Wallet platform.

MTS subscribers can easily upgrade their wallet level; to do this, just link the bank client’s personal account (enter your login and password to authorize on the website).

Which companies does the service work with?

Many questions concern credit institutions with which MTS cooperates. Money is issued by many microfinance organizations that are reliable partners and have proven themselves to be excellent. Funds are transferred to the subscriber's specified account or balance in the form of a loan or debt limit. All transactions are carried out within the legal requirements. The interaction of the parties takes place on the basis of an agreement, which is formed automatically after a decision is made by the subscriber.

As a rule, Express Money from MTS is issued through Mig Credit LLC or Simberella LLC. Both companies conduct financial transactions and offer loans to Russian citizens at low interest rates. One of the additional areas is credit for mobile subscribers.

Data on the microfinance organization is sent to the client in a message when selecting an option. As already noted, transactions go through MTS Bank with a commission of 30% of the loan amount. You can control information on the Express Money service in your MTS personal account.

Automatic SIM card deactivation

The operator can block the SIM card himself without the knowledge of its owner. This may happen if:

- The number has not been working for a long time, that is, the client did not call from it, did not send messages, did not go online;

- The number has paid options, but none of them are used;

- The balance has been in the red for a long time, and the person does not replenish the account to pay off the debt.

If the initiator of blocking a phone number is the operator, then the activity of the SIM card cannot be restored. In this case, you will have to buy a new SIM card.

Sometimes disabling a number is a necessary measure to stop the operation of a SIM card. But before you disconnect your SIM card, you should weigh everything carefully and decide on the blocking option: temporary or permanent.