Each mobile operator, in addition to communication and Internet services, has a huge list of various subscriptions, access to which is provided for a fee. Moreover, many of them are connected without the participation of the subscriber. MTS users complain that money is debited from their accounts for incomprehensible services. Transactions are designated pay.mts.ru topup. It indicates a successful transfer of funds for using the “Easy Payment” option. There are effective methods that allow you to cancel unnecessary subscriptions that can cause a negative balance.

MTS Money wallet: what is it and how to use it?

The service is similar to a standard mobile bank. But unlike those represented by one financial institution, the MTS Money electronic wallet allows you to combine different sources of income. Users are not limited to only products released by the company. You can pay and transfer money here from your system account, from any linked cards and from your phone.

You can use the offered services from a computer or smartphone. To manage money, the system has a portal available at https://payment.mts.ru and a program of the same name for mobile gadgets. Before performing operations in the system, you need to register, but this action is simple and does not require special skills and data.

Internet banking functionality

MTS Bank provides remote banking systems for individuals and legal entities. They offer all the necessary functions for convenient management of accounts, loans, cards and other bank products. Any bank client can use the service.

For legal entities

Entrepreneurs who have opened a current account with MTS Bank have access to a reliable and secure client bank. With it they can:

- Track account transactions

- Make payments in rubles and foreign currencies

- Pay taxes, fees and salaries

- View account statements and statistics

- Manage corporate card settings

- Exchange documents with the bank

- Submit requests for other products

- Conduct currency control operations

- Interact with 1C and other accounting systems

For individuals

Internet banking for individuals also has all the necessary functionality. With it you can:

- Monitor the status of accounts, deposits and cards

- Pay for communications, internet, housing and communal services and other expenses

- Transfer money between accounts and send to other banks

- Pay off loan and credit card debts

- Manage account and card settings and limits

- Place applications for other bank products

Advantages

In comparison with mobile banks of financial organizations, the MTS project has a number of advantages:

- does not require filling out receipts with complex details when making transfers - money is sent via phone number, regardless of the operator servicing the SIM card;

- contactless payment is available even on devices not equipped with NFC - by number or QR code;

- Dozens of services are available for payment - from replenishing a Troika card to repaying loans from popular banks;

- There are no commissions for many transactions;

- you can pay in stores or withdraw money to cards directly from your phone account;

- Users are not limited to a card from one bank - collect all available ones in your wallet;

- It is possible to take out a loan without leaving the application.

How to avoid running into scammers?

To protect transactions and increase the security of transactions within the framework, the provider sends SMS messages from the service number “6996”, which describes the amount of the upcoming purchase and its description. To confirm the transfer of your funds, simply send a reply SMS with the code content; to refuse, enter the number “0”. Any payment transaction must be agreed upon and confirmed by the owner of the electronic account or bank card. Nowadays, scammers have started to take advantage of this. There is a popular deception scheme:

- The attacker makes a purchase, transfers money, or pays for services, and uses your phone number as details.

- After this, as part of the service, you receive a notification from contact “6996”.

- Then the fraudster tries to contact the consumer in any way and persuades him to give the password for the transaction. At the same time, he may introduce himself as your relative or close friend.

- A gullible subscriber dictates the treasured numbers, after which money disappears from his balance to an unknown account.

Moreover, the user may receive messages stating that there are insufficient funds, this is due to the fact that the attackers make a purchase for an amount that you cannot afford.

Attention! Never tell anyone your security codes, not even employees of the provider company or close people.

In addition, try to adhere to the following recommendations:

- Do not leave your mobile device unattended. A fraudster can change the password for your personal account and set up an automatic payment or transfer money from your balance to your phone.

- Do not reveal or show your bank card details to strangers, especially the three-digit code on the back.

- Do not download unknown or suspicious applications from the Internet onto your smartphone. Do not scan QR codes; they may contain virus programs that can hack access passwords to payment applications.

- Do not respond to messages from unknown numbers, do not open links or send outgoing SMS.

How to create an MTS Money wallet

To start using the MTS Money wallet, you need to create an account. The registration procedure is simple and takes place in 3 steps.

- Go to the operator's website. On the main page https://mts.ru, find a plate with a list of the main sections - we are interested in “MTS Money” under the wallet icon. Click on it and go to the service.

- Click on "Open wallet". Enter your phone number and password; if you don’t have it, request the latter via SMS. The account data matches the registration data in your personal account.

- Click on “Login” and take advantage of the project’s capabilities.

If you proceed to registration from https://payment.mts.ru/, the steps will be approximately the same. Click on “Register”, enter the number, the code from the picture and click on “Continue”. On the page that opens, enter the one-time code from the SMS in the appropriate field, create a password and proceed to the service.

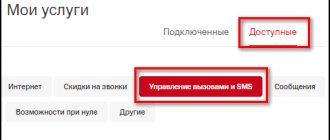

Pay MTS RU – service management

In this category of the Pay MTS RU website, a mobile and Internet connection subscriber can regulate all connected services and activate new ones. This applies to mobile communications, the Internet, SMS, and popular options. For example, configure the parameters of the unified Internet, return 20% for payment for Internet services. If an MTS user wants to add one of the numbers to the blacklist, he can refer to this section. Voice mail can also be set up here.

Those who frequently visit social networks are recommended to go to the “MTS Online” to take advantage of the chance to correspond on social networks without limits. Moreover, all SMS messages are free, without a limited number, for only 3 rubles per day. Additional parameters of SMS messages are valid with the activation of the SMS Pro . It comes to the aid of busy MTS network users who have no time to respond to SMS. By setting up the function of sending SMS and answering machine, all interlocutors will be informed that the subscriber is busy.

And, of course, in the “Service Management” section on the Pay MTS RU website you can connect the popular ones, My Content, MTS Search. “Gudok” is a service for setting a non-standard melody for incoming and outgoing calls instead of banal beeps. “My Content” service allows you to subscribe to constant newsletters of information on any topic: music, videos, games, horoscopes, sports and entertainment. MTS Search helps to determine the location of family and friends using an interactive map, and search for the addresses of the necessary establishments via a mobile phone.

MTS Gudok connection services, video:

How to get or change a password in Personal Account?

At the registration stage, after entering the number and captcha symbols, a one-time login code is sent via SMS. Enter it, and the portal will ask you to create a password yourself. It is advisable to remember the last one, but not necessary - if you forget, you can always get a new one. To do this, during authorization:

- click “Get password” next to the “Login” button;

- Enter in the fields that open the number for which the account is registered, the symbols from the image and click on “Continue”;

- check the SMS on your phone - you should receive a 6-digit code;

- enter the received numbers in the appropriate field on the website or application;

- create a new password, duplicate it in the verification field and save.

Opt-out options to use

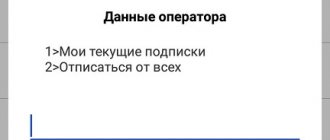

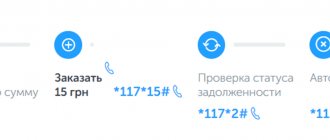

There are many quick and convenient ways to disable this functionality on MTS:

- Using an automatic service with hints. To do this, dial the number 0890 on your device, and then the number 0. Listen carefully to the informer, and when it asks you to disable easy payment, press the number that will be called.

- You can send a request to disconnect using the command using the symbol combination *111*1#, do not forget to activate the request using the voice call button. After a few minutes, the device display will display a message indicating the successful completion of all services provided for this functionality.

- If the client is located outside of his home region, then he should use the number +74957660166, this is what is used in roaming to deactivate the option. Listen to the automatic informant and follow all recommendations, only in this case the service will cease to operate.

- One of the simple ways to disable the service is to contact a customer technical support employee directly at 8 800 333 0890. After connecting, describe your problem and ask him to disable the payment service in real time, but you will have to provide your personal data and confirm classified information.

- If there is a sales salon nearby in your area of residence, you can request a disconnection there by presenting to the employee your general passport or other document confirming your identity as the owner of the number. After all, only the owners can fully manage all services at their own discretion - disable or enable additional options or tariffs.

How to use

The MTS Money wallet is essentially a regular electronic payment system. To use it, you first need to top up your account within the project, on your mobile phone, link a bank card or apply for a loan. Each of these operations can be carried out on the website or in the application, links to each are on the main wallet.

Let's say you want to pay your mobile bills using a card. You will have to proceed approximately as follows:

- log in to the portal;

- go to the “Mobile phone” category in “Transfers and payments”, select an operator;

- fill in the recipient's phone number, indicate the top-up amount and select a payment method;

- Confirm your intentions with the code from the message.

You can pay your communication bill from your mobile phone, your wallet itself, and cards. The latter can be linked on a permanent basis through the corresponding button on the main portal or each time you fill in the details for write-off manually.

Methods to disable the service

If you no longer want to use the payment system from your provider and decide to disable the service, then there are many ways to do this on your own or with the help of qualified operator employees. But unfortunately, it is completely impossible to turn off the service; the most you can do is deactivate bank cards and auto payments. Below, all possible methods are described.

Short commands

To permanently limit yourself from the actions of attackers, set a content ban. After this, your phone number will no longer receive notifications from the short number “7763” to confirm payments. To do this, simply dial the USSD encoding *152*2# and wait for a response from the company.

In the application or personal account

In this case, deactivation should be understood as unlinking a bank card from the service and deactivating automatic payments. To do this, log into your account in your personal account or in the mobile application. In the appropriate section “MTS Money”, disconnect all payment cards from the interface. After this, you will not be able to complete your purchase. The method through your personal account is only possible if you have an active Internet access point.

Address to employees

Find the nearest branch of the operator in your locality and ask a free consultant to activate the content ban service or assist you in disabling it, and you will be asked to provide an identification document. You can try calling the technical support service for MTS subscribers “0890”.

Attention! The article provides information for residents of the Moscow region. In other parts of Russia, the specifics of the provision and functionality of services may differ.

Mobile TeleSystems is not just a cellular provider, it is a full-fledged bank that will allow you to turn your smartphone into a convenient means of paying bills and making purchases. Today we looked at how this can be done using the MTS Money service.

What can you pay using the MTS Money wallet?

There are 7 categories of services available for payment on the portal. This:

- “Telephone” – subscribers of MTS, MegaFon, Beeline and Tele2 can top up their mobile balance;

- “Internet and TV”, in which products of the same name are hidden;

- “Games” like “Tanks offline” and World of Warplanes;

- “Rent Payment”, which allows you to close accounts for clients of Housing and Communal Services-Moscow, Mosenergosbyt, Upravdom ERC and PIK-Comfort in the capital;

- “Transport” to replenish your parking account, Troika card, and pay for a Maxim taxi;

- “Banks” with “MTS-Bank”, “Sberbank”, VTB24;

- “Miscellaneous” with remaining projects like “Absolute Insurance”, Dr. Web, Odnoklassniki, Liters.ru.

Mobile bank

The mobile application will help you carry out transactions with accounts and cards anytime and anywhere. A smartphone or tablet running iOS or Android will be enough for this. The application is available to both individuals and businessmen. It is connected together with Internet banking.

The main functionality of the mobile application is the same as that of online banking. In it you can monitor the status of your accounts, make payments and manage limits. The application will also help you find the nearest branch or ATM of MTS Bank. There is a built-in online chat for contacting support.

Connect easy payment MTS 7763

To make an easy payment using the short number 7763, you must first go through the registration procedure. It is very simple and does not differ from the generally accepted one. By visiting the Account, the client sees the available balance and options and list of services. By selecting the Payment for goods and services column in the menu, the user is shown a complete list: utilities, mobile, etc.

You will need to indicate the area of activity of the company, then select it from the list and indicate the payment parameters: amount, payment number, period (if necessary). Here you can choose the option: from an account or from a card. In the second situation, you need to enter data about it: number, CVV or CVC code, final validity date. There are situations when it is not possible to pay with a card due to a technical failure (in the absence of communication with the bank). In this case, you can always transfer money from the card to your phone and complete the transaction from the latter.

The Easy Payment service using the short number 7763 is available through a mobile application on your phone

You can use MTS Easy Payment on 7763 not only through a computer. With a smartphone or through a mobile application, this is also easy to do. At the end of the procedure, a message about the amount of the commission will appear. It is worth taking it into account in order to understand how much will be withdrawn. The bank commission when paying by card will be indicated as a separate parameter.