Once upon a time, mobile communication services were paid for by entering a special code, which was purchased at specialized points that sold starter packs and account top-ups. The subscriber bought a top-up card, erased the protective layer, under which a unique top-up code was printed, entered this code into the phone, sent an SMS, and the operator credited the money to the subscriber’s account. With the development of the Internet, this type of account replenishment has sunk into oblivion. Now you can top up your mobile account much easier and faster than before. This can be done, for example, by online payment from your bank card, the money will be credited within 1-2 minutes.

Withdrawing money from the operator's account to the card

Recently, mobile operators began to provide another type of service, allowing not only to top up a subscriber’s mobile account from his credit card, but also to make a reverse transaction, i.e., withdraw money from a mobile account to a card. This service is paid - the operator charges a commission for each such transfer. For example, the Kyivstar mobile network, when withdrawing money from a subscriber’s account to his card, will take a commission of 3% from the transfer amount, while the balance of the subscriber’s mobile account must remain at least 3 UAH. The monetary transaction itself is limited to minimum and maximum values equal to 50 and 3000 UAH, respectively. Within 1 month, you can withdraw funds from your mobile account to your card in the amount of no more than UAH 20,000.

How to get Extra Money on Kyivstar?

To borrow money from Kyivstar, you must (optional):

- Call the number *117#.

- Execute USSD request *117*1# to receive the maximum loan amount.

- Decide on a specific amount and execute the corresponding USSD request - *117*X#, where X is the amount you are interested in.

If you want to receive Kyivstar Extra Money for a certain amount, then remember that the company provides only the following options: 10, 15, 25, 40, 55, 75, 100, 150 or 250 UAH. one amount. That is, you cannot request 5, 7, 20 UAH. or any other amount that does not correspond to the announced proposals. The commission, by the way, directly depends on the amount borrowed.

Attention! Kyivstar has the right to independently determine the maximum amount for lending to a specific subscriber. The limit depends on expenses for the last 3 months (average monthly expenses for this period).

Transferring money through the Smart Groshi service

You can withdraw money from your Kyivstar mobile account to a bank card through the Smart-Groshi service. To do this you need to do the following:

- Follow the link money.kyivstar.ua

- Select “Transfer to bank card”

- Fill in the information in the dialog box: indicate the bank card number, the transfer amount, and the Kyivstar phone number from which the money will be debited.

- An SMS message with a confirmation code will be sent to the specified phone number, which must be entered in the appropriate field.

What is Smart-Groshi and why did Kyivstar launch its payment wallet

This is not the mobile operator's first attempt to enter the payments market. The key problem of market players is that they are gradually turning into “pipe”, that is, into Internet providers providing (mainly) mobile Internet services. If you look into the future, with a perspective of 3-5-10 years, then the story will repeat itself with traditional Internet providers, which 20 years ago provided users not only with the Internet, but also with web hosting, email, and today everything that subscribers need from them - a wide Internet channel, within which any person uses the service he is familiar with, choosing from the best, and not from what the provider gives him. It is quite obvious that the operators need to do something about all this, so they are doing it. It's better than sitting idly by, waiting for everything to work out on its own. It won't get better. And the transformation can only be slowed down by developing additional services (Internet of things, payments, streaming services, and so on - all operators are trying to do something).

What is Smart-Groshi (Smart-Money)

Smart-Groshi (or Smart-Money) is a new name for the existing Kyivstar “Mobile Money” service, the rebranding of which was announced back in June. We are talking about the website money.kyivstar.ua and the corresponding application for a smartphone (available for Android and iOS), which allows you not only to top up a mobile phone account without commission (there were many such opportunities before), or to transfer money between subscribers’ accounts (there are no one year, remember the sensational advertising with gangsters?) Now, thanks to the partnership with Mastercard (their MasterPass system is used, which allows you to store payment cards and not transfer data about them to third parties) and the national payment system Prostir, there are more than 3,000 services available for payment, including utility bills, banking services, payment of fines, purchase of tickets and so on. In essence, there is nothing that is not available in other popular payment systems (for example, Privat24 or Portmone). The only difference (which, however, does not give any tangible advantages) is that you can pay not only from a card, but also from the operator’s mobile account, but who stores money there if it’s not a bank. It is more profitable to store it in a bank - at least interest accrues there. And all progressive banks have their own applications for smartphones.

Why did Kyivstar launch Smart-Groshi?

As with the launch of the Veon messenger, doing something is better than not even trying. Kyivstar reminds us of its subscriber base of 26 million people (more precisely, SIM cards), which in itself makes it possible to reach and communicate with all these consumers. In practice, this figure only means that the launch is not from scratch, and there are already a number of subscribers ready to use the service. The company talks about a million transactions that have already taken place in earlier versions of the system. Payments can be made not only on the website or in the application, but also using SMS, USSD commands and (in the future, which is unclear when it will come, if at all) using the corresponding button on the online store website. By the way, a similar button has been offered to online stores and Mastercard for two years now, but its popularity is not noticeable.

What is your go-to-market strategy?

A secret behind seven locks. While they are talking about a target audience that does not use payment systems at all, which is good and correct - it is better not to compete with existing systems, but to educate your own rather large audience. But the problem is that these are consumers with a complete lack of skills in working with smartphones and payment cards, and a low level of trust in non-cash payments. Such an audience needs to be trained and educated for years. The same Privatbank spent a fantastically huge number of man-hours on training its clients, starting with its own employees and members of their families. For years, we have been accustoming clients to non-cash payments in each bank branch. With the help of terminals and their employees with tablets, who explained to everyone that now they need to communicate not with cashiers, but to make payments at the terminals. While generously issuing cards left and right, eventually coming to the point that there are practically no adults left in the country who do not have a Privatbank card (for example, the lion's share of payments in OLX are carried out between people through Privatbank cards).

For now, the emphasis is on three key points:

- 0% commission for replenishing your mobile account

- 0% commission for transferring funds to another mobile number

- 0% commission when transferring money to a bank card and withdrawing money from the system

So far they are saying that conditions will not change until the end of this year, and then perhaps the situation will change (after all, you need to make money on something). All this suggests that the project is experimental, and the company is not ready to announce any expected indicators.

Kyivstar also promises that some marketing campaigns await us ahead, the essence of which has not yet been disclosed (they refer to trade secrets). For now, you can only see a commercial that will be broadcast on television starting today:

What are the restrictions on transfers and amounts?

You can store no more than 8,000 hryvnia in your mobile wallet account at a time (legal limit is 14,000 hryvnia), the amount of a one-time transfer should not exceed 3,000 hryvnia, and the amount of transfers per year should not exceed 62,000 hryvnia. All these restrictions are related, firstly, to legislation, and secondly, to payment security, which is always put at the forefront.

What prospects does the Smart-Groshi system have?

For now, the analogy with the launch of the Veon messenger suggests itself. Likewise, the exit strategy was unclear, although the prerequisites were obvious (essentially the same as now, just from a different side and for a different audience). Likewise, no indicators were indicated that they were trying to achieve, citing the fact that it was better (as now) to brag about the results when they were available. By the way, we still don’t know anything about the results of the Veon messenger, which speaks for itself about the state of affairs.

Purely theoretically, Kyivstar has the already mentioned subscriber base on its side, but unimaginable resources must be invested in its training, which the operator is unlikely to do. Especially considering the fact that the service is not unique - Vodafone has Vodafone Pay and lifecell has Paycell. And both competitors are in no hurry to somehow develop them and invest in the development of services (in any case, no external signs of this are noticeable in the information space). Also alarming is the lack of a visible, simple and understandable exit strategy, and the difference between one’s own service and competing entities. Simply put, there is no difference, we make it happen. And then we'll see. A revolution in mobile payments is definitely not expected, if only because for Kyivstar this is not the main business (but there are a lot of companies for which the opposite is true).

For those who want to know more

- Vodafone Ukraine and Mastercard launched a universal mobile wallet Vodafone Pay

- Review of the updated Portmone application: how the smartphone application has changed

- The future of cellular operators: how not to turn into a pipe?

- When our smartphones become wallets: interview with Yuri Batkhin (Mastercard)

Transferring money through a mobile application

Smartphone owners can transfer money from a mobile account to a bank card using a mobile application, which must be downloaded from Google Play or the App Store and installed on the smartphone. To withdraw money through the mobile application, you must:

- Login by phone number

- In the menu that appears, select the withdrawal option

- Enter your bank card number and amount

- Confirm transfer

Using the mobile application, you can create a template that you can use in the future so as not to enter your bank card number every time.

Mobile money Kyivstar – security and additional questions

If in the question of how to cash out money from Kyivstar, you doubt the security of the transaction, these are unnecessary worries! As with any banking operations, transactions use the secure https protocol. Your data cannot be obtained by third parties. In addition, SMS confirmation guarantees even greater security of transactions.

For now, withdrawing money from your phone is a privilege only from the Kyivstar company. For the exclusive service of withdrawing money from your phone, Kyivstar charges a small commission. The minimum amount for withdrawal is 50 hryvnia. The commission in this case is 4 UAH. And further:

- 100 hryvnia – 8 UAH commission.

- 200 – 10

- 300 – 15

- 500 – 25

- 1000 – 40

- 3000 – 120

As we can see, even in the case of the maximum possible transfer of 3000 hryvnia, the commission is only 4%. What is noteworthy is that with a smaller transaction amount, the commission increases. For 200 hryvnia it is 5%, and for a minimum transfer – as much as 8%. Therefore, it is more profitable to make translations in a larger volume.

The features of the Kyivstar mobile money service are such that only prepaid subscribers can use it. In one calendar month you can make payments of no more than 10,000 hryvnia.

Payment occurs instantly, and the time it takes for money to arrive on a bank card is from 1 to 3 days, depending on the recipient’s bank.

Request for “Extra Money” on the Kyivstar network

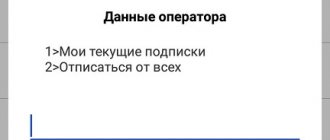

The easiest way to apply for a loan is the USSD short command system. The Ukrainian operator is adjusting its service in accordance with current trends in this area. It's important to remember a few basic commands:

- *109# – instant check of mobile phone balance;

- *117*1# – quick call to order “Extra Money” with a zero balance.

The system is constantly being debugged and improved, so that the quality of service becomes higher. Specialists ensure that each subscriber receives a full range of services without restrictions. They are also ready to tell you how to take out a debt on your phone on Kyivstar.

When sending a short request *117*1# in the USSD system, the subscriber's data is checked. If there are no restrictions, which were already mentioned earlier, then the debt is approved.

How to borrow money on Kyivstar while roaming?

For those who are roaming, slightly different requirements apply, namely, a narrower selection of amounts for replenishing the balance is provided. You can order a loan of only 100, 150 or 250 UAH. To receive the required amount, the subscriber needs (to choose from):

- Call *117# and select the amount you are interested in.

- Execute USSD request *117*250# to receive the maximum loan amount.

In addition, the fundamental difference is the absence of any commission. This service will cost the subscriber 0 UAH.

Features of replenishing a Kyivstar account in Russia, Ukraine, Belarus

The vast majority of clients of the provider in question live in Ukraine. In addition to the possibility of replenishing your balance using a MasterCard or Visa card product, they have a number of advantages over residents of Russia and Belarus. In particular, residents of Ukraine can deposit money into their mobile phone balance at one of the provider’s offices or using a special payment terminal. These opportunities are not available for Russians and Belarusians.

For residents of Russia and Belarus, the fastest, most convenient and profitable way to transfer money to the balance of this communication service provider is a transfer from a bank card. In addition, on the Internet you can find websites of intermediary companies offering services for transferring money to the accounts of a Ukrainian operator with WebMoney, Yandex Money and other payment methods popular in Russia and Belarus. For their services, intermediaries charge a certain percentage of the transfer amount.

How to top up Kyivstar from Qiwi wallet?

QIWI is an online payment system available in 14 countries, including Ukraine.

To top up your mobile phone from a Qiwi wallet, go to your personal account on the QIWI website and go to the “Pay” section. Here select “Cellular” - “All operators”:

In the list of operators, select “Kyivstar”, then enter the necessary information in a special web form:

The following data will be needed:

- Recharge phone number;

- Amount of payment.

- Comment – (optional).

Click “Pay” to top up the specified phone from your QIWI wallet.

Smart Groshi conquer the market

The prospects for mobile money transfers are very great, since the majority of the population still uses cash, avoiding bank applications and small payment services. KS hope to change consumer attitudes towards non-cash payments. First of all, they rely on their millions of subscribers who have been using the company’s services for more than 5-10 years. A gentle approach to them should encourage this segment of the population to use an E-wallet under the fairly good name Smart Groshi (SG). This is really smart money, because instead of a bank card that is constantly trying to impose loans and other unnecessary offers on you, the mobile operator will avoid this only by expanding the network of possibilities.

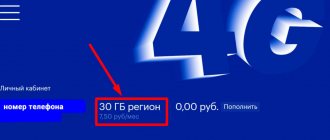

How to top up your Kyivstar account via a bank card

Let's consider the official service https://pay.kyivstar.ua/ru/, as well as the limitations and features of working with it.

Replenishment

- First go to https://pay.kyivstar.ua/ru/.

- Enter your mobile phone number in the field on the left of the screen to top up your balance or your personal account number to pay for home Internet and television.

- In the right column at the top, indicate the amount to be credited by entering the numbers on the keyboard, or selecting from the popular ones: 50, 100, 200.

- On the right side of the screen at the bottom, enter the details of your Visa or Mastercard bank card, as well as the expiration date, cvv2/cvc2 (the three-digit number indicated on the back of the card).

- To receive a receipt from the service, fill out the “Personal email” field at the very bottom.

- Click "Pay".

Auto replenishment

- Follow the link https://pay.kyivstar.ua/ru/.

- Enter your phone number in the field on the right side of the screen: 67ХХХХХХХ.

- Set the balance threshold: 5.10, 20 or 50 hryvnia, at which funds will be automatically credited from the bank card to the SIM card.

- Select the amount to be credited: minimum 5 UAH, maximum 1000 UAH.

- Specify the maximum number of top-ups allowed per month, for example, no more than 5 times.

- Enter the credit card details: 16-digit card number, expiration date : month, year, as well as the cvv2/cvc2 code located on the back of the plastic (three-digit number) .

- Click "Create AutoPay".

How to return Extra Money to Kyivstar?

After you receive the amount you need, do not forget to repay the debt, taking into account the accrued commission. If you don’t know or don’t remember exactly how much you need to give, just dial the combination *117*2# on your phone’s keypad and press the call button. You will be shown the amount you need to return.

How to disable Extra Money Kyivstar:

- Top up your phone account with an amount equal to or greater than the amount owed.

- The debt will automatically be removed from your balance.

- There is no need to enter any other combinations, but you can dial *117*2# to make sure that you no longer have any debts.

If there are insufficient funds, then an amount divisible by 1 hryvnia will be withdrawn from your balance. For example, your debt is 50 UAH, but you deposited only 20 UAH into your account. Then 20 UAH will be written off from the balance, and the debt will be 30.

Attention! You just need to top up your account balance in order to disable Extra Money Kyivstar - you won’t be able to cancel the service by transferring funds from one number to another.

If you do not repay the debt to Kyivstar, you will not be able to use this service again.

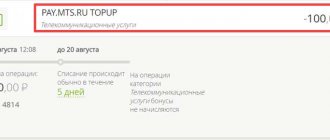

How to transfer money from Kyivstar to the account of another operator

In fact, there are no differences as such, and everything is done the same as if you were transferring money from Kyivstar to Kyivstar. The only caveat is the commission. In the case of transfers within the Kyivstar operator network, no fee is charged for transferring funds. If you need to transfer money to the account of another operator, the commission will be 2.5% of the transfer amount.

Where can you transfer money from Kyivstar:

- On Kyivstar (Kyivstar);

- On MTS (Vodafone);

- On Life (Lifecell);

- Intertelecom;

- 3Mob;

- PeopleNet.

If you send money online through the site, do not forget to select which operator you are sending funds to in order to avoid errors.

Possible restrictions when transferring money from Kyivstar to Kyivstar

There are several nuances that are also important to know about when transferring money from Kyivstar to Kyivstar:

- The service is also available in roaming, which is especially important for those who cannot top up their account while abroad - ask someone you know in Ukraine to transfer money, and your balance will be topped up.

- There are restrictions for new Kyivstar subscribers. They cannot transfer funds until the total turnover of expenses on their account reaches the 40 UAH mark, but even when this happens, another 2 days must pass before the service becomes available.

Attention! New subscribers are considered to be those who have only recently acquired a SIM card, as well as those clients who blocked their card and then restored it, or holders of SIM cards that have expired and have resumed the services of the mobile operator.

- You can transfer money from Kyivstar to Kyivstar only in the directions Kyivstar Prepayment - Kyivstar Prepayment, as well as Kyivstar Contract - Kyivstar Contract. You cannot transfer money from a Prepaid SIM card to a Contract.

- Contractors must submit a request to connect to this service before using it. This can be done at Kyivstar offices or by calling 922*40.

You can only send amounts that are multiples of 1 UAH. The minimum transfer amount is 1 UAH, the maximum is 1000 UAH.

Recommendations for replenishing Kyivstar accounts

Transferring funds to the balance of your own or someone else's mobile phone is a financial transaction, the implementation of which involves the use of bank details, passwords, one-time codes and other confidential information.

You can protect your data and avoid unpleasant situations by following recommendations that will be relevant for any financial transactions:

- use your data only on the official websites of banks, payment systems and communication service providers, as well as trusted intermediaries;

- do not disclose PIN codes and CCV/CVC codes of your cards to third parties;

- keep your passwords for your personal accounts on the websites of banks and mobile operators secret;

- check the correctness of the entered information before confirming the operation;

- Avoid services from unverified intermediaries.