Published: 01/01/2020

Updated November 2021

MTS Bank does not have its own wide network of ATMs and terminals, but its clients can use partner devices and receive cash on preferential terms. At ATMs of MTS Bank partner banks, money is issued without commission, but this tariff does not apply to all categories of cards. The current publication provides an up-to-date list of partner organizations, and also discusses the conditions for cash withdrawal.

Conditions for interest-free withdrawal of money

In order to be able to withdraw money without interest through an affiliate program, it is important to know that such an operation can be carried out under certain conditions. Eg:

- If a client of MTS Bank has issued cards such as “MTS Money” or “MTS Money Deposit”.

- When the client has a salary card, upon registration of which a clause was noted in the contract that allows cash withdrawal, but only within the framework of the OPC program.

The commission depends on what card the client has.

If cash withdrawal occurs using other devices of existing partner banks, then in this case it will be impossible to do without paying the established percentage commission.

Basically, the commission amount ranges from 0.5 to 1.5% of the cash out amount.

List of partner banks

Among the bans, MTS Bank has only two partners - Sberbank and VTB. In their devices, the client can withdraw and deposit cash under the same conditions as in “their” ATMs. No commissions will be charged for transactions there.

The fee for withdrawing cash from other devices depends on the card tariff:

| Map | Withdrawal fee |

| MTS Cashback | Free on any device |

| MTS Money Weekend | Free in the Russian Federation, 1%, minimum 100 rubles abroad |

| MIR-Maestro | 1%, minimum 100 rubles in any devices |

| Child's world | Cash withdrawals are not allowed |

| Visa Infinite | Free on any device |

| MasterCard World Black Edition | Free on any device |

Nuances you should know

If the owner of a bank card withdraws money from a financial institution that is not a partner, the commission can reach 3.9%. At the same time, for each withdrawal made you will need to pay an additional 350-450 rubles. In addition, it is recommended to pay attention to the following aspects:

- For owners of smartphones and tablets, you can install the MTS Money application. With its help, you can view information about financial institutions that provide the opportunity to either withdraw money from the card completely free of charge, or where you can do it much more profitably.

- In the absence of banking products “MTS Money” or “MTS Deposit”, even the bank itself provides for its clients to withdraw funds from credit cards with a commission of 3.99%, and for each transaction you will need to pay 399 rubles for its implementation.

If there is no “MTS Money” or “MTS Deposit”, you will have to pay for withdrawing funds from credit cards with a commission of 3.99%.

You can call the hotline number – 8 800-250-05-20 and clarify information about the location of MTS Bank’s partner banks.

Terms of Service

Interbank cooperation has the following advantages:

- Reducing the load on the central branches of the company.

- Increasing the speed of cash withdrawal.

- Possibility of using banking products without charging a commission.

- Maintaining a line of corporate clients and establishing relationships between banks.

Cooperation with third-party financial structures increases the level of the bank and allows you to receive good profits. The percentage varies depending on the use of plastic cards (debit, credit, salary).

Where to top up an MTS Bank card without commission

In addition to withdrawing cash, MTS Bank's partner banks provide the opportunity to top up cards without commission. Several partners offer commission-free top-ups.

The number of MTS Bank partners who make it possible to top up cards for free will increase

- In TelePay terminals, deposits are made instantly, and there is no commission fee at all.

- There is also no commission charged at QIWI payment system terminals.

- You can top up your MTS Bank account through CyberPlat self-service terminals without paying interest.

- MTS Bank clients can also replenish cards using payment terminals of the Moscow Credit Bank. There is no commission for the transaction, but there is a restriction on the transfer - the replenishment should not exceed 400,000 rubles.

The number of MTS Bank partners who allow customers not to pay commissions when withdrawing or replenishing bank cards will only increase in the future. Accordingly, bank clients will be able to withdraw money and top up their accounts at a larger number of ATMs and terminals without paying interest.

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Affiliate program MTS Money

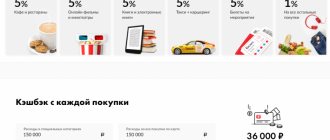

According to the terms of the affiliate program, when paying for purchases with a card, holders will receive cashback from 5% to 10% of the purchase amount. Each bank partner sets the terms of the promotion independently. They are the same for both credit and debit cards of MTS Bank.

Stores returning cashback to MTS Bank customers

As of June 2021, increased cashback is provided by the following organizations:

- Ostrovok.ru is an online accommodation booking service for travelers.

- Medsi is a medical clinic and rehabilitation complex for adults and children.

- liters is an online e-book store.

- Krovat.ru is a hypermarket of furniture and sleep products.

- Russia City Pass is a service for organizing excursions in Russia.

- Emprana is a service for selling certificates for entertainment.

- City Sightseeing - bus tours to attractions around the world.

Conditions for participation in the program

Every MTS Money card holder will receive cashback. To accrue it, you must register in the bonus program and activate the bonus offer. Otherwise, cashback will be credited at the standard rate for the selected spending category.

All major credit and debit cards of the bank are included in the promotion - MTS Cashback, MTS Money Weekend and MTS Money Zero. Depending on the type of card, the bank will return the money in rubles or points, which can be spent in MTS stores.

How to get cashback

The conditions for receiving cashback for each partner are listed in the table below.

| Partner | Cashback amount | Conditions of receipt |

| Ostrovok.ru | 5% | Pay for a hotel reservation through a partner’s website using an MTS card |

| Medsi | from 3% to 8% | Pay for clinic services with an MTS card |

| Lit-Res | 10% | Pay for any purchase by card |

| Krovat.ru | 5% | Pay for a purchase in the amount of 10,000 rubles or more |

| Russia City Pass | 8% | Cashback is credited for each purchase at the end of the month following the month of purchase |

| Emprana | 10% | Cashback is credited for each purchase at the end of the month following the month of purchase |

| City Sightseeing | 8% | Cashback is credited for each purchase at the end of the month following the month of purchase |

(11 ratings, average: 4.8 out of 5)

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

USSD command

This method can be used to transfer money from your phone to a card of any bank. The main thing is that your card belongs to the Master Card or Visa category.

- Send a request to the MTS interactive service:

*611*bank card number (16 digits without spaces)*amount# call

- After accepting the application:

A message will be sent from the mobile portal about the need to confirm the payment:

- If you change your mind about transferring money and send the number “0”, you will receive a notification that the operation has been cancelled:

The USSD command allows you to withdraw up to 15,000 rubles at a time. Commission – 4.3%, but not less than 60 rubles. You can withdraw no more than 15,000 rubles per day, and 40,000 rubles per month.

Calculation:

You transfer 500 rubles to your bank card. Commission on the amount: 500 rub. x 4.3% = 21.5 rub. But according to the terms of the telecom operator, the minimum commission is 60 rubles. Therefore, after the transfer, the following will be debited from your mobile account: 500 rubles. + 60 rubles = 560 rubles.

Cashback rounding and expiration date

Separate attention should be paid to the issue of rounding the accrued cashback. The fact is that the cunning, prudent specialists from MTS thought about developing special conditions for rounding the amounts of payments and purchases from which cashback is calculated. Thus, if a client pays for a purchase in the amount of 49 rubles, the amount of 1% cashback will be 0 points. If the purchase size is 50 rubles, the amount of the refund will be 1 point, even though 1% of 50 rubles is equal to 50 kopecks.

As for the expiration date of accrued points, there is simply no expiration date; accumulated bonus rubles can be stored on the client account for an unlimited amount of time.

What is the essence and benefits of partnership?

Today, almost any large financial institution enters into cooperation agreements with various credit companies to carry out joint activities to serve clients.

MTS Bank is also no exception. The credit institution cooperates with both Russian banks and European financial institutions. Thanks to this cooperation, bank clients have the opportunity to:

- using the terminals of partner banks, withdraw cash on a credit card without paying commissions;

- transfer funds from one bank card to another;

- make utility payments;

- pay for purchases in the store.

The main reason why MTS Bank began to cooperate with other financial institutions is the lack of its own ATMs to cover the entire territory of the state.

As a rule, the offices of a credit institution are located in large cities and therefore their residents have more opportunities to use MTS Bank terminals than residents of small towns.

Therefore, cooperation with other credit institutions allows people living in such cities to use the services of MTS Bank through the terminals of partner banks.

MTS Bank's ATM partners allow you to:

- establish new banking connections;

- maintain a general corporate line of clients;

- cover new regions with ATMs;

- service bank cards without commission;

- get cash quickly;

- reduce the flow of clients to the central offices of banks.

Any credit organization, cooperating with other partners, strives to make such interaction as profitable as possible.

ATM card for withdrawing and depositing cash without commission

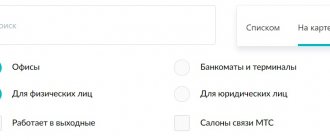

The ATM network of MTS Bank and partners covers more than 50 regions of Russia. Therefore, its clients can withdraw cash quickly and without obstacles. You can find out the address of the nearest ATM on the bank’s website, mobile application or by calling the hotline.

You can also top up your card for free at payment terminals:

- TelePay

- QIWI

- CyberPlat

- Moscow Credit Bank (free when replenishing a total amount of 400,000 rubles)