MTS Bank is very popular. The number of clients is constantly growing, as is the level of trust on the part of potential borrowers. For this reason, this credit institution can be called rapidly developing. To prove to customers that MTS Bank is not going to rest on its success, management decided to create a personal account. The account will allow citizens to refuse to visit the office to perform necessary transactions.

Functionality of MTS Bank personal account

The MTS Bank account was created specifically to use all the capabilities of the Internet and mobile communications. Using its functionality, it is possible to perform various financial transactions online without contacting a branch of the MTS banking organization. If necessary, in your personal account, without leaving home, via a PC or any other mobile device, you can:

- make payments for goods and services;

- make payments to the accounts of legal entities/individuals;

- pay for utilities;

- track financial flow;

- find out the balance of money on your account or card.

The design of your personal account differs depending on the device from which you log in. When using the functionality of the site, you can save time, since you do not need to go to the bank and stand in a long line to perform the operations listed above.

The service is completely safe, since information is transmitted via secure channels. When entering, a special code is used, which is available only to the client.

What does the client get?

Immediately after installing the application, the Bank client can:

- Check the status of your account or accounts, monitor all processes in real time;

- Displays account information for the credit balance. How much is left, what amount needs to be paid in the near future. In addition, the client can pay off the entire loan or the next installment at once;

- Transfer funds to other bank cards, and not only to MTS Bank, but also to other banks (the card number is enough);

- The client can open new deposits and close old ones, open savings accounts;

- You can temporarily or permanently block (if lost) a bank card, as well as unblock a temporarily blocked one;

- Transfer money for goods and services to organizations, pay for housing and communal services, top up your account online, order various goods, book tickets;

- It is convenient to pay fines, as well as taxes, other taxes and government duties through the application;

- Create and save templates for those payments that are made regularly, set up automatic payments;

- The ability to work with currencies for which you can quickly open a foreign exchange account and then buy/sell the currency at the official rate.

The Android version of the application, such as IOS, allows you to receive updated information about the bank's activities after installation, all current and future promotions become available. Messages can be filtered by various parameters. In addition, the mobile application has additional functions:

- Promptly contact technical, financial and other support of the bank to solve various problems and difficult situations;

- You can get real-time advice on a whole or a specific product;

- An application on a smartphone with a satellite navigation module shows with high accuracy all the nearest MTS Bank ATMs and all its branches nearby;

- A mobile customer may receive a larger account statement.

Advantages of the office

Internet banking has a user-friendly interface. Your personal account allows you to manage funds using the operating systems Windows Phone, Android, iOS. This means that it can be accessed from various mobile devices.

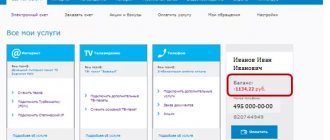

In the account, bank clients have access to information on all accounts, deposits, loans, and bank cards. At the same time, at any convenient time you can open deposits or repay loans using MTS Internet banking. The addresses of all bank branches and ATMs are available - information can be easily found by users with access to the personal account. You can also block/unblock the card if necessary. To do this, you do not need to call the hotline or go to the nearest bank branch.

Your personal account opens up wide opportunities for all MTS Bank clients who value their time.

Login to your personal Internet account of MTS Bank

To enter the personal account of MTS Bank, the client needs to type the address https://personalbank.ru/ in the browser and click the Internet banking login button in the upper right corner of the screen. Here you will need to enter your username and password, which are confidential information. If all the data is entered correctly, you get access to all the functionality of your MTS Bank personal account. When you first visit, please review the list of payments provided so that in the future you will have an idea of where and what you can pay for using your computer or mobile device.

Installing the application via PC

To use all the services of a banking organization, you can use a personal computer or laptop with an Internet connection. After downloading the application, you need to read the QR code from the monitor screen. Next, you go to the bank office with your passport and write an application to connect to the mobile banking service. After this, the bank will provide you with the necessary data for authorization in the system. After the service package is activated and configured, the user needs to deposit funds for the period specified in the contract. When this time passes, the service is frozen until the next top-up. You have the opportunity to connect to mobile banking online, at an ATM or bank branch.

You will need your passport details and email. The required type of access will be selected based on the types of operations you want to conduct. Bank users who wish to receive information only about the balance status can set up information access. If you want to be able to access all the main options, then the standard access type is suitable for you. These access options are provided to customers free of charge. If you want to use an extended type of access, then there is a monthly fee for the possibility of conducting an unlimited number of transactions with funds in your accounts.

+1

-2

Registration in your MTS Bank personal account

The user's personal account is an integral part of the services provided by MTS Bank to an individual, however, the use of this function is optional. If you did not specifically register such a service when concluding the contract, you need to call the support service and request a login and password for the first login to the user account. The operator may ask you to clarify your passport details and contract number for security purposes. Having received your login and password, you can start working with your account and all its functions. The completion of registration can be considered the receipt of a personal APIN code - it is necessary to confirm mobile payments.

System requirements

The user is not required to carry out additional actions remotely through the MTS Bank application. All you have to do is install the application from the desired source, register, enter your login information and use it. Everything is free.

How to download the MTS mobile bank application

As already mentioned, the user needs to download the application from one source:

- to iPhone from the App Store;

- on Android from Play Market;

- and for the Windows operating system from microsoft.com.

Select the desired store on your phone and click download MTS mobile bank. During installation, the application asks for the right to work with some functions, click “Allow” and install.

Personal account in Internet banking

In your own user account on the MTS Bank website, you can make various payments to individuals and legal entities to make purchases and pay for services. The list includes utility bills, payments for Internet and mobile communications, and purchases in online stores. Using MTS Internet banking allows you to save some time on mandatory monthly payments, as well as quickly purchase goods and services that you need right now. The service is absolutely safe, since the process uses a special confirmation code known only to the client. It is recommended to keep this code away from prying eyes and regularly change the password to your personal account if you are not the only user of your computer.

SMS banking

SMS messages sent to your mobile phone allow you to constantly be aware of the status of your own accounts on the MTS Money card. To do this you need to connect to the service. A fee of 50 rubles is charged for it. every month.

As a result, the user has the following options:

- control the balance on the card;

- learn about completed transactions;

- if necessary, slow down or resume calculations;

- pay for goods and services remotely at any time.

You can obtain information on this issue by calling the hotline.

Connecting the service

To connect to MTS Money SMS banking, you just need to request this service when registering a card. Then it will be automatically linked after activating the bank card. You can go into your application yourself and find the “Accepting applications” item in the menu. Then click on connect SMS banking.

For this service they will charge 600 rubles. in year.

Personal account in MTS mobile bank

You can even access your personal account from a mobile device if it is connected to the global network. The mobile version of the account looks visually “lighter” than the regular version, but contains full functionality that may be useful to an MTS Bank client. Making payments using a mobile device, such as a smartphone, is just as easy as using a credit card. Do not forget that to confirm all payments you need to use your personal password, which you receive when you first log into your personal account after registering in the system. Without it, mobile banking provides only background information about the current balance.

How to create an APIN key?

The APIN key is used to quickly make payments using your phone. To do this, you should install a special mobile application on your device. You can download it absolutely free on the Google Play portal. After installation, the user of a smartphone or any other gadget with Internet access can log into the MTS Bank personal account at any time and use all its options. Managing money from a smartphone is comfortable. Clients get access to Internet banking with the most convenient interface, intuitive even for beginners. Your personal account is designed specifically for remote customer service.

Before creating an APIN key, you must register:

- the service is activated in branches and offices of MTS Bank - Internet banking cannot be accessed by phone number, thanks to which clients are guaranteed a high level of security;

- the password/login comes in an SMS message, they must be entered at https://personalbank.ru;

- each user can change their password to a permanent one, which will allow them to access their personal account from their mobile phone;

- you need to visit the “Settings” section, go to “Change password”, and then click “Request APIN”.

This service is paid.

Description

MTS Money is now MTS Bank! We have combined all financial services in one application and added additional features. Since the application is now something more than an online wallet, we have renamed it MTS Bank. Connect cards from different banks, pay and transfer from each of them, pay for services from your MTS phone balance or using Apple Pay. Manage your money the way you want, and we've provided convenient tools for this: Pay with QR code and templates - you can register accounts and receive immediate notifications about new expenses. Transfer by any method: from a card, phone or wallet. No commission for MTS Bank clients for bank transfers via phone number and within the bank. Receive cashback: in the “My Cashback” section - for transactions in the application and with the MTS Cashback card - for regular purchases. Manage online: open MTS Bank virtual cards, change PIN codes and disable paid services directly in the application. You can also monitor the status of your loan application and conclude an agreement by signing it via SMS.

Sources

- https://MTSBanking.ru/mobilnyj-bank-mts/

- https://apps.apple.com/ru/app/%D0%BC%D1%82%D1%81-%D0%B1%D0%B0%D0%BD%D0%BA-%D0%BC%D1 %82%D1%81-%D0%B4%D0%B5%D0%BD%D1%8C%D0%B3%D0%B8/id1184367593

- https://mtsbank.ru-app.ru/

Security and confidentiality rules for the MTS Bank personal account

Any operations are carried out securely and confidentially, which is ensured using a special 3-D Secure system. It makes it possible to accurately identify cardholders making transfers/payments through their personal account. The client must confirm each operation. To do this, you should enter the SMS code that will be sent to your smartphone upon request. It is sent to the cardholder to the phone number that was left by the bank client during registration.

The service is provided completely free of charge for all clients. For 3-D Secure, if desired, the user can change the phone number in his personal account. You can also use an ATM for these purposes.

Connection to the 3-D Secure system is available in Internet banking in the “Settings” section. Using this technology, every MTS Bank client can rest assured that all payments and transfers will be protected from fraudulent actions of third parties.

Translations

The account also provides the ability to make transfers between cards and accounts. The cost of performing such transactions using Internet banking depends on the recipient of the money and the client’s status. But in general, cardholders should expect the following prices:

- transfers to MTS client accounts are made free of charge;

- sending money to clients of third-party banks costs 0.3% of the payment transaction amount (minimum - 20 rubles, maximum - 150);

- salary clients are required to pay 10 rubles per operation, regardless of the amount of funds transferred.

There are no additional conditions or requirements.