MTS Bank hotline phone number

For the convenience of clients, MTS Bank has implemented the ability to call the hotline for free within the country. You just need to select the desired number. Three multi-channel numbers have been allocated:

+7 (495) 777-000-1 for Muscovites and residents of the Moscow region;

8-800-250-0-520 for residents of the regions;

0512 for subscribers of MTS, Beeline, Megafon, Tele2.

The main purpose of the hotline is to serve bank card holders. But citizens can also obtain information on other MTS Bank products. The phones operate 24 hours a day, providing access to banking services 24 hours a day, 7 days a week.

A special line is dedicated to combating fraud, violations and abuse. Clients can inform the bank about such events by phone:

+7.

Obtaining loan data

MTS Bank clients have the opportunity to obtain data on the status of their debt using the loan hotline number and in their personal account. Regular and timely repayment of loan debts allows you to create a positive credit history. Even a minor delay can significantly worsen the credit image of a banking client. Consequently, in the future this client will not be able to count on the most favorable lending conditions. Willful defaulters will be punished with fines and brought to administrative responsibility.

Free hotline 8800

Telephone 8-800-250-0-520 allows residents from any corner of Russia to contact the bank. Calls within the country are completely free. To obtain information or take the necessary action, you need to follow the voice menu prompts.

Knowing the combination of menu items, you can quickly perform a number of actions without listening to the autoinformer. To dial commands, the phone must be in tone mode. Switch to tone dialing by pressing the asterisk “*” key. You should type commands after listening to the greeting.

Helpline for MTS subscribers

All MTS subscribers have access to the short number 0512 , which operates around the clock. After establishing a connection, the automatic informant offers to listen to the structure of the voice menu. Moving between sections is implemented using tone dialing. The subscriber must press the appropriate dialer keys:

- checking card balance;

- checking the minimum payment amount;

- receiving an extract;

- replenishment of cell phone balance;

- card blocking;

- restoring the validity of the card;

- list of commands.

Telephone numbers for operations in the central service center system

The call center is designed to provide 24-hour banking services to customers by telephone through an operator or in automatic mode using a pre-recorded voice message system that performs the Bank's call routing (IVR) function.

When the Client contacts the service center, a telephone Tcode is used. The Tcode is transferred with the provision of special envelopes or sent by the Bank to the Client in an SMS message to the main mobile phone number specified by the client in the Application. The Tcode is analogous to the Client’s handwritten signature.

Performing actions that require confirmation by affixing an analogue of a handwritten signature within the central service center system is available only within the framework of agreements for the issuance and servicing of bank cards.

How a support representative can help

It is important to understand that the support specialist's authority

clients are not unlimited. Each client can be guaranteed to receive information or assistance of the following nature:

- Receive clarification on current products that are presented in the bank.

- Block or temporarily block the card in case of loss.

- Change PIN code.

- Check the limit for both debit and credit cards.

- Find out the latest card transactions (mini statement).

- Get information about connected additional services and, if necessary, connect or disable them.

- Change your cell phone number, if changed, or indicate a contact for additional communication.

- Get information about the monthly payment amount on a loan or credit card.

- Find out the office address in the specified city.

- Check the exchange rate.

It is important to understand that in order to receive help, each client will need to introduce himself and, if available, voice a code word. If the code word has not been established, you may be asked to read out your passport details in order to confirm the identity of the applicant.

What can you find out over the phone?

Using the MTS Bank hotline, the client can perform the following operations and gain access to the following banking services automatically:

- informing about the payment limit of the card;

- mini-statement on the Card;

- blocking/unblocking the Card;

- Tcode replacement;

- as well as other services, the list of which is established by the Bank at its discretion.

- Through the central service center operator the Client can:

- block the Card;

- order a replacement Tcode;

- obtain information about the Payment limit of the Card;

- submit an application to connect/disable additional options;

- submit an application to change the telephone number for calculating rewards (if technically possible).

What information can a bank client receive?

Using the Voice Menu of the auto-informer, a bank client will be able to:

- Block the card.

- Get or change the PIN code or control code, activate the CUP card.

- Perform other transactions with bank cards.

- Contact the operator.

When contacting the support service operator on the hotline at Public Joint Stock Company (PJSC) MTS Bank, the client can find out the following information in a telephone conversation:

- About the bank services offered to clients currently in effect;

- Consultations on the use of any banking products;

- Get advice on a full list of costs of services provided by the bank, including taxes on all types of services;

- Individual features of replenishing an account or card and withdrawing funds from them, depending on their type;

- Find out what documents are required to obtain certain banking services and products;

- Get help opening a new account;

- Get advice related to the use of self-service terminals, Internet banking and the MTS Money mobile application;

- Register a complaint or wish regarding the bank's work, as well as many other questions.

If a bank client wants to be provided with information about his account or his plastic card, then an MTS Bank consultant may ask you to provide your card details, secret code word, agreement number and passport data.

In what cases will support not be able to help?

The bank may suspend transactions on accounts and bank cards if there is a suspicion of fraudulent activity or violation of service rules. In this case, the card can be unblocked only after all the circumstances have been clarified. To do this, the owner will have to visit a bank branch or customer service center.

It is impossible to close bank accounts, debit and credit cards, or terminate a contract over the phone. To carry out these operations, you must visit the offices of MTS Bank.

How to complain about unlawful actions of MTS Bank employees

To report fraudulent activities, non-compliance with anti-corruption laws or the code of ethics by employees of MTS Bank, its branches, subsidiaries or representative offices, you need to contact a separate Hotline. This can be done in the following ways:

- email: [email protected] ;

- postal address: 115432, Moscow, Andropov Avenue, 18, building 1, Head of the Internal Audit Department of MTS Bank PJSC;

- feedback form;

- answering machine.

Appeals are considered confidentially in accordance with the internal documents of the organization.

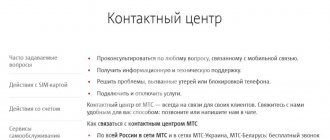

Other methods of communication

You can ask a question, leave a review, or send a complaint by sending a request to MTS Bank.

The credit institution does not provide communication via email. The application form is provided on the MTS Bank website.

Contact on the site

You can apply through the application form on the official website by clicking the “Contact Us” button in the top information bar, and then the “Write to Us” link. The application form includes information about the sender and contact information. The response will be communicated to the applicant by telephone or email.

Additional communication methods

In addition to the hotline, the credit institution has provided alternative communication options.

It is not possible to send written requests by mail, since the bank has not published the appropriate contact information. An analogue of mail is a virtual reception area on the website.

Feedback

To send a request, click the “Contact us” button at the top of the page. Then click “Write to us.” Please fill out the text fields carefully. Provide contact information and a detailed description of the problem. The consultants' response will be sent by email. It should be noted that written requests may take a long time to be processed. Therefore, it is advisable to solve urgent problems via the MTS Bank hotline.

Competence of MTS Bank operators

Many owners of MTS Bank bank cards complain about the work of the call center. Operators perform only one task - inform customers about bank products. However, more complex issues that arise during the service process are often impossible to resolve. Response times are also delayed when sending requests through the credit institution’s website. Clients are forced to go to branches. If there is no office, they are left alone with their problems, which sometimes leads to the accrual of illegal commissions and loss of funds.

How to call MTS Bank?

To contact the help desk, call the toll-free number 8800 250 0 520 and select the appropriate menu item. When calling from phones that do not support touch-tone dialing, simply stay on the line and wait for the operator-consultant to respond. To receive detailed personal information on your bank account, please be prepared to tell the call center employee your contract or credit card number and code word.

At the same time, no bank employee can ask for your secret PIN code or the three-digit code on the back of the card! Beware of scams. By disclosing this confidential data to third parties, you risk losing money.

If you are a customer of MTS cellular communications, you can check the support service numbers in the MTS Mobile Operator section. Can't get through to MTS Bank? Calls to the above call center number are free from any region of the country, including the largest cities: Moscow, St. Petersburg, Novosibirsk, Yekaterinburg, Nizhny Novgorod, Samara, Omsk, Kazan, Chelyabinsk, Rostov-on-Don, Ufa, Volgograd, Perm , Krasnoyarsk, Voronezh, Saratov, Krasnodar and Togliatti.

In what case will a specialist refuse to help?

It is important to understand that in some requests the MTS Bank hotline employee

may refuse.

So it won't work:

- Apply for a loan remotely and request an approved limit for any card by dictating the details.

- Close the deposit or request a transfer to a bank account in another bank.

- Open a new deposit and withdraw money from the current client card.

- File a claim. For example, if the financial company, in the client’s opinion, incorrectly calculated interest or wrote off funds for repayment. Such requests are accepted in the office or by leaving a request on the official website, through the “Message to the Bank” section.

- Transfer part of the money to a friend or relative's plastic. These are well-known transfers from card to card, which are available only to the plastic holder, through the bank’s personal account or a special service.

To receive assistance, the client will need to visit a bank office or log into his personal account to complete the necessary operation.

Unified toll-free support number for MTS Bank

All calls to a single 24-hour number 88002500520 are free for residents of all regions of Russia (for calls from mobile and landline phones).

MTS offers several contact numbers:

- 8 — free number for calls within Russia.

- 8 — number for residents of Moscow and the Moscow region.

- 8 — MTS technical support number.

- 0890 — a short number for callers from mobile phones.

Legal entities and individuals call the same number (by choice from the list above). Service for a specific problem is regulated by selecting a section in the voice menu or with the help of a bank operator.

Were you able to reach the Hotline?

Yes, we succeeded No, we failed

MTS Bank personal account for individuals

The online service completely replaces visiting branches. Internet Banking for individuals from MTS Bank allows you to:

- submit applications for loans and mortgages;

- open, close or block the card;

- save account and card details;

- make transfers to other individuals;

- pay utility bills, deposit funds into an account or transfer to government agencies;

- make payments on schedule or ahead of schedule;

- view data on completed operations;

- receive certificates and details.

Login to your MTS Bank personal online account is carried out using SSL technology, which guarantees the security of personal data. One-time codes are also used as a method of protection.