Funds credited to your mobile phone account can be spent on other purposes.

In this article, read about all the ways to withdraw funds from your SIM card balance to receive cash:

- cash out at an ATM;

- transfer to bank;

- receive by mail;

- transfer to an electronic wallet;

- issue a money transfer;

- obtain directly from the operator.

How to withdraw money from an MTS account

The mobile operator MTS provides subscribers with enough opportunities to use a personal account. With its help, you can easily pay for almost everything - rent, loans, transport, and even transfer money to charity.

Naturally, there are several ways to withdraw funds from an MTS mobile phone, although not for free. Payment in most cases will be made through the Easy Payment service. The operator tried to involve him in as many actions as possible.

MTS virtual card

If you don’t have time to issue a payment card, you can open a virtual MasterCard of MTS Bank. When opening such a card, the bank provides only its details, without physical media.

You will be sent a number, expiration date and cvc2 via SMS - this data is enough to make non-cash payments.

To pay for a hotel reservation or purchase of goods, you must enter card details. It is not possible to pay for such services from a mobile phone account.

Open a virtual card within a few seconds, transfer funds from your SIM card personal account to it, and pay online.

This card is sufficient for making online payments of all types. Money is transferred to the card from a mobile phone for 1.5% of the amount.

Apply for such a card through the MTS mobile application and MTS Personal Account - https://login.mts.ru/amserver/UI/Login.

Transfer to bank cards

In particular, a transfer from an MTS account to a bank card remains a convenient way. This service has been available since 2015 for Visa or MasterCard cards of any banks. Others, like Maestro or American Express, do not partner with a mobile operator.

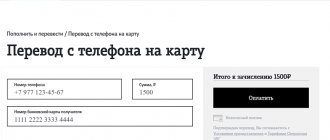

This is very easy to do - you just need to go to the website of the “ Easy Payment ” service from MTS and find the “ Payment Management ” section there. After which a list of all possible services will appear, among which a transfer from phone to card is hidden.

pay.mts.ru - Easy payment MTS

And now, in order to withdraw money from MTS to a Sberbank card or, for example, Tinkoff Bank, you need to perform several simple steps:

- Go to Payment Management - Money Transfers - Transfer from phone account to card

- Type your MTS SIM card number, starting with 9;

- Write the amount you want to withdraw to the card. The total amount along with the commission will be indicated just below;

- Select from which account you want to transfer funds. The default is MTS;

- Click on “Next”;

- Type the number of the bank card to which you want to send money;

- Confirm the transaction.

Transfer from MTS to a Sberbank card or any other bank is ready!

If it is not possible to use the Internet portal, then you can make a mobile MTS transfer using SMS messages or a USSD code.

So, in order to top up a Sberbank or other institution card via SMS, you need to send a message to the short number 6111. And indicate the following text in it:

Card (bank card number) (amount) – everything is indicated separated by a space and without brackets, quotation marks or other punctuation marks. For example:

Card 1111222233334444 5250

Thus, in this example, 5,250 were sent 1111 2222 3333 4444 .

Card is a prefix that allows the system to determine what the subscriber wants to do. Using it, she determines that the number indicated after the prefix belongs to the bank card. And that the amount written at the end of the message must be sent to her. Don’t worry that the money will go to the wrong place - all the banks in the world will not have a single card with the same number.

And the request via USSD should look like this:

*611*(number)*(amount)# - we indicate asterisks and hash marks as they are, we remove other punctuation marks. For example:

*611*1111222233334444*5250#

Here we also sent 5,250 1111 2222 3333 4444 .

611 is a request code that identifies the service being used. The card number you enter is the one where you want to send finance in the amount indicated after it with an asterisk. After dialing the combination, just click on “Call” and wait.

Important! Neither the SMS nor the USSD request can separate the bank card number with spaces or other characters. Only together!

The commission for transferring to a bank card is 4.3% of the amount, but a minimum of 60 rubles if the percentage is less. It is necessary to take this feature into account before completing the transaction, since after the transaction is completed, at least 10 rubles must remain in the account.

At the same time, you cannot send more than 5 transactions per day in the range from 50 to 15,000 rubles. The maximum amount for transfer to a card per day is 15,000 rubles, per month – 40,000 rubles.

How to get money from a Tele2 number

All transfers from a phone number can be found on the website https://market.tele2.ru. TELE2 impresses with its information content and affordable tariffs. Everything is very clear.

Tele2 operator website

A withdrawal operation by money transfer or to a bank account will cost 5.75% commission, to a card - from 50 to 400 rubles, which is similar to Beeline services.

Converting everything into percentages, we have:

- 1-250 rub. — from 20%;

- 251-730 rub. — 27-9.6%;

- 731-1410 rub. — 12-6.3%;

- 1411-1880 rub. — 8.5-6.3%;

- 1881-3800 rub. — 10.6-5.2%

- 3801-5700 rub. - 7.9-5.2%;

- 5701-14600 rub. — 7-2.7%

Commissions for limit amounts are always interpreted in favor of an increase, so it may be more profitable to split the amount into several payments.

Transfer via phone

It's much easier (and cheaper) to withdraw funds from your phone. Just dial *135# and select the desired service. The commission is the same - 5% of the withdrawal/transfer amount. Funds are received within three working days, there are limits:

- from 10 to 14,200 rub. one-time;

- no more than 150,000 rub. per day;

- 500,000 rub. per month.

What do we choose?

Withdrawing to the bank via SMS with a 5% commission is optimal for small amounts. How can you lower your interest rates? Consider: minimum commission 2.7% for a one-time withdrawal operation of 14,600 rubles. This means we will get 5% for 8,000 rubles. cashing out. Eventually:

- via *135# you can withdraw up to 8,000 rubles. for five percent;

- through the TELE2 website you can cash out from 8,000 to 14,600 rubles. for a commission of 2.5 to 5%.

To the account of another MTS subscriber

You can top up a friend or relative’s account without any problems if you use the service provided by the operator. To transfer money from MTS to MTS you will need to perform one simple operation using a computer or your own mobile phone.

If you have access to the network, you can use the “ Easy Payment ” service on the website and send finances through a special form. To do this, you need to open the website pay.mts.ru, select the “ Mobile phone ” section and click on “MTS”. Then select “ Payment from your phone account ”.

Here you just need to enter the number of the subscriber to whom you need to transfer money and the required amount. Then select where to pay from (from your MTS account) and click on “Next”. Then you will need to log in to your Personal Account using the number from which you intend to make the transaction and follow further instructions.

Or you can do it easier - use SMS or USSD.

In the first case, you will need to select in the phone book the number of the subscriber who needs money. It is to him that you will need to send a message with the following text:

#transfer (amount) – the amount must be indicated without brackets in the range from 10 to 5000 rubles.

That is, we do it simply. We find the desired contact, for example “ Spouse ” and send her an SMS with the text:

#translation 250

And the person you choose will receive 250 rubles to the account of their mobile number.

After sending, you will receive a message from the short number 6996 , through which you will need to confirm your intention to send money to the subscriber. You just need to follow the instructions in the message. And after confirming the action, a new SMS will be sent notifying you that the money has been successfully debited from the number.

The USSD code for transferring money to an MTS subscriber, in fact, is not such a code. You just need to dial *115# and click on “Call” to open the “Easy Payment” menu from your mobile phone. In this menu, you just need to select the subscriber who needs money and follow the instructions of the portal.

Using this service from your phone is very simple. Let's look at it step by step.

- On your phone, dial *115# and then “ Call .” In the window that appears, enter the number “1” - it corresponds to the “Mobile phone” item

- At this step we also enter the number 1, since we are going to put money on someone else’s number

- If we want to deposit money to an MTS subscriber, we enter the number - 1, if on Beeline or Megafon - 2 or 3, respectively.

- All we have to do is enter the phone number where we need to deposit money and the amount

The commission for transferring from phone to phone within the MTS operator is a fixed amount of 10 rubles.

You can make only 10 transactions per day from 10 to 5,000 rubles at a time. At the same time, you can send 30 thousand rubles per day, and 40 thousand per month.

Let's summarize

All mobile operators handle telephone transactions, but the service is not cheap! Own money is carried out with a commission of 5 to 20%. It all looks unattractive. For comparison: a deposit in Sberbank is 5-6% per annum! It seems reasonable only to pay for services (housing and communal services, for example) or pay taxes by phone. Moreover, some online platforms accept telephone transfers as payment for goods. In this case, no commission is taken. Well, if you still need cash, then the best choice is withdrawal from your phone to a bank account (no more than 3%).

If you periodically have extra money on your phone (for example, from the Internet: paid surveys, review sites and other sites for making money), then it is more advisable to buy an additional SIM card from the operator, with the lowest withdrawal fees.

If you have a Megafon and significant amounts of money accumulate on your phone from time to time, it is wise to purchase their plastic card. In stores you can pay directly from your phone, and if you need to withdraw money, the commission will be the lowest - 2%.

For subscribers of other telecom operators

In addition to paying for MTS numbers, you can also pay for numbers of other operators. Available today:

- Beeline;

- Tele2;

- Yota;

- Megaphone.

Attention, it will not be possible to transfer money from MTS to Tele2, Beeline, Megafon and Yota if one of the following tariffs is connected: “Super Zero”, “MTS Super”. They do not imply service by the “Easy Payment” service.

Methods for sending money from MTS to Beeline, Tele2 or Megafon are similar to methods for replenishing an MTS account. Only sending via SMS message does not work. But for Yota you will need a slightly different procedure.

Payment to the Yota operator from the MTS balance is made not to the phone number, but to the subscriber’s personal account number. Therefore, you must first find it out in your personal account. It consists of 10-11 digits.

After this, using the site already used above pay.mts.ru, go to the “Internet and TV” section, find the “Yota” button and click on it. There, in the “account number” column, you must enter the numbers received in your personal account and indicate the required amount. After this, click on “Next” and log in to the “Personal Account” of the mobile operator MTS, through which confirmation of payment will take place. Just follow the instructions.

And now a little about the commission:

- for a transaction from MTS to Megafon, Tele2 or Beeline, the amount will be 10.4% + 10 rubles for making the payment;

- To pay a Yota bill you will need to pay 1.8% + 10 rubles.

The limits for paying for phones from other operators are the same as when transferring money to MTS.

If you can’t withdraw money, the number may have a ban on transactions. You need to call the operator's hotline to resolve this issue.

Withdrawing funds through an ATM

There is another method of withdrawing money from an MTS operator’s phone in cash. You can simply deposit them at an ATM. You can only use ATMs of MTS or its partner SMP Bank. The procedure consists of the following points:

- Send a message to number 3232 with the text RUB XXXX (where instead of X, substitute the transfer amount). Confirm the actions after the incoming SMS.

- An SMS with a PIN code will be sent to your phone, which will allow you to withdraw funds from an ATM within 72 hours.

- Directly in the ATM menu, activate the “Cash from phone account” option, and then go to the “MTS money” category.

- Enter the PIN code from the message and withdraw the money.

If it was not possible to cash out within 4 days, the funds will be returned back to your personal account.

To electronic wallets

MTS also allows you to transfer finances to many popular electronic wallets:

- WebMoney (rubles only);

- QIWI;

- Yandex money.

There are a few different ways you can fund each of these e-wallets.

So, how can you withdraw money from MTS to Qiwi Wallet?

The first way is to use the Easy Payment service website. To do this, in the “Electronic Wallets” section, you need to select Visa QIWI Wallet and enter the number for which the account is registered in the system. Then select the amount (up to 5,000 rubles) and select an MTS mobile account. Then click “Next” and log in. The commission will be 9.9% of the transaction amount, as well as 10 rubles for conducting it. You can withdraw up to 5,000 at a time, and you can make no more than 5 transfers per day.

If the wallet number and the phone number from which you need to pay are the same, you can use the QIWI service. To do this, you need to go to qiwi.com and log in, then go to the “Top up wallet” section and select “From phone balance” in the right column. The commission in this case can range from 0 to 9.9%, depending on the current relationship between MTS and QIWI. The amount including it will be indicated directly on the website before sending the money.

There are several other methods available for WebMoney.

Standard - through the website. In the same section where the QIWI wallet is located, you must select WebMoney and enter the ruble wallet number.

Important! The letter R in the wallet number must be saved!

Then you should type the amount you want to transfer. And, having chosen payment from MTS, click “Next” and go through the standard procedure of authorization and confirmation of payment. Commission – 10.3% and 10 rubles additionally. The limit is up to 5,000 rubles with five transactions per day.

The second method is through the WebMoney wallet. You need to log in and attach a phone number to WMID, if this has not been done before. The procedure is available only for linked numbers. Then:

- Select the “My phone” button in the list of accounts and cards;

- In the menu that appears when you click on this button, select “Top up wallet”;

- Fill in the required fields;

- Wait for an SMS message with instructions;

- Confirm the replenishment of your wallet via a reply message.

- After this, the transaction will be completed.

Attention, the commission with this method is quite high - 11.6%.

Yandex.Money can also be topped up either from the “Easy Payment” website from MTS, or directly from the wallet itself.

On pay.mts.ru you need to find “Yandex.Money” in the “Electronic Wallets” section and click on this button. Then enter either the number of the wallet itself or the number of the mobile phone associated with it. Then enter the amount and confirm the payment as standard. The commission in this case will be at the level of 11.35% + 10 rubles per transaction. For Yandex.Money, MTS has set a limit of 15,000 rubles for five transactions per day.

Topping up Yandex.Money through the wallet website is available only to those subscribers whose number is linked to a Yandex account. To do this you need:

- Log in to your wallet on money.yandex.ru;

- Click on the “Top up” button;

- Select the section “From mobile balance”;

- Select the required number from the list of numbers (if there are several);

- Enter the required amount and click on “Top up”.

The commission for this method will be 10.86% of the transferred amount and 10 additional rubles for using the service.

USSD command

Withdrawing money is possible using just a smartphone.

- Dial *115#.

- Click on “Mobile phone”, then button “1”. Listen to the proposed operators and select the one whose client is the person you are sending to. If necessary, transfer to an MTS or Megafon number, the service is free. For Beeline users the commission is 10.4%, for Tele 2 - 10.5%.

If you use a USSD command to send from your personal balance to a bank card, you first need to make a request, indicating the following details: *611*card number*nominal value#.

Once the system processes the request, an SMS message with confirmation or refusal will be sent to the sender’s number. If at this stage you change your mind about performing the operation, press 0 and the previous actions will be canceled. Thus, from 60 to 15,000 rubles are processed per request. Commission – 4.3%. It is worth considering that the expected limit for a day is 15,000, and for a month - 40,000 rubles. Cards are accepted only MasterCard or Visa.

Through money transfer systems

If you need to withdraw money from your MTS SIM card in the form of cash, bypassing ATMs and e-wallets, you should turn to money transfer services.

Mobile operator MTS works with the following systems:

- UNISTREAM;

- Post office;

- CONTACT;

- Anelik;

- Blizko Russia.

For all systems, the money transfer scheme is the same:

- On the website pay.mts.ru you need to find the “Money Transfers” section;

- Select the desired payment system;

- Enter your phone number and amount;

- Click on “Next”;

- Fill in all required fields;

- Click on “Next” again;

- Log in and confirm the transfer.

Important! All data must be filled out extremely carefully. The error will not allow the recipient to pick up the money at the collection point. It is also important not to lose the transaction number.

The commission for any system will be 4.3%. In addition to Russian Post - it will take 4.2% + 55 rubles additionally.

At the same time, you can also withdraw money through UNISTREAM using an SMS message. To do this, you will need to send a message to number 7878 with the following content:

Uni (full name of the sender) (Series and passport number of the sender) (full name of the recipient) (Amount)

All data is indicated separated by a space without brackets or other punctuation marks. The series and number are written as one number, without spaces. Commission for payment via SMS is 7.5% of the amount.

Russian Post

Send yourself or another person a postal transfer from your personal account on the MTS website:

- To do this, in the “Manage Payments” menu in the “Money Transfers” tab, select “Cash Transfer”. Shipping methods include Russian Post.

- In the menu that opens, enter the phone number and the required amount - click “next”.

- On the next tab, fill in the recipient's last name, first name, patronymic and post office code. It is important to correctly fill in the recipient’s data in strict accordance with the passport data - it will not be possible to change it later.

- Select the type of transfer - on demand or with acknowledgment of delivery. The difference is that when you select “with notification,” the recipient will receive a notification about the money received at the specified postal address.

- The completed data will appear on the next tab. If everything is correct, then click the “get password” link, after which you will receive a message with a confirmation password. Enter your password in the box on the website and click the “Confirm transfer” tab.

For withdrawing cash via postal transfers, a commission of 4.2% of the amount plus 55 rubles is deducted from the phone balance. The amount cannot exceed 14,000 rubles. You can send no more than 5 transfers per day for a total amount of up to 30,000.

Issue is carried out by the post office, the index of which is indicated when filling out the transfer. The money will arrive by mail in 4 business days. To receive it, you need to present your passport and inform about the directed transfer.

The money remains in the post office for 32 calendar days. If you do not receive them during this time, they will be sent back to your personal mobile phone account, without taking into account the commission amount.

Is it possible to withdraw money without commission?

Of course, you always want to receive a free transfer to a card or another phone number without losing a penny of your hard-earned money. But, unfortunately, MTS does not provide such a service. The company charges its own percentage for any transaction. The cheapest service is intranet transfer, which costs 10 rubles.

One of the well-known ways to minimize commissions is to use money directly from your MTS account. In this case, the cost of operator services will be in the range of 1-4%. If you no longer want to use the operator’s services, you can simply terminate the contract with him.

Remember that if the contract is terminated, the phone number will be lost.

In this case, the operator will be obliged to return the balance of funds on the personal account. But not immediately - it can take up to 45 days.

Contacting the MTS office

Receipt of money in the office is available upon termination of service. When changing a cellular operator or refusing services, the client has the right to return the funds on the balance in a way convenient for him, including in cash.

Contact the MTS office with your passport and write an application in the prescribed form. In the application, indicate the number of the personal account or card where the money is to be credited.

The review process takes up to 45 days. After a decision has been made on the application, the money will be issued in the required manner.

Transfer fees and restrictions

The service will be provided for a fee. The transaction fee for clients not registered on the site will be 4%, minimum 60 rubles.

To reduce the commission, the user can register in the service. In this case, the commission amount will be 1.9%, minimum 10 rubles.

MTS has the following transfer limits:

| Restrictions | For unauthorized clients | After authorization |

| Maximum amount | 15 thousand rubles. | After passing simplified identification 60 thousand rubles, with full identification 600 thousand rubles. |

| Minimum amount | 50 rub. | 50 rub. |

| Number of transfers per month | Up to 5 pcs. | Up to 5 pcs. |

| Total amount of transfers per month | 40 thousand rubles. There must be a balance of at least 10 rubles in the account. | With simplified identification: 200 thousand rubles, with a wallet balance of up to 60 thousand rubles. With full identification 1200 thousand rubles. |

Money can go from a few minutes to 5 business days.