Have your family and friends run out of funds in their account? No problem, using simple combinations you can send them the required amount in a matter of seconds using the “Transfer” option. Below we will talk not only about how to transfer money from Tele2 to Tele2, but also to phones of other operators.

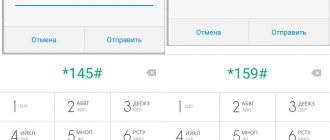

Before using the option to send funds, the first thing you need to do is check whether it is available at your number. To do this, simply dial the USSD command *104# on your mobile device and press the call key. In the response notification you will also learn about the maximum available amount for transfer.

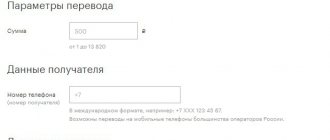

To transfer funds to another phone, you must enter the request *145*recipient number*desired amount for transfer# and press the “Call” button. For example, if you want to transfer 50 rubles by phone (904)123-45-67, you need to dial *145*89041234567*50# on your device. The money will be credited within a few minutes, after which you and the subscriber who accepted the financial assistance will receive a notification about the successful completion of the operation in the form of an SMS message.

It is important to know! The minimum amount for transfer is 10 rubles.

As you can see, there is nothing difficult about transferring money from Tele2 to Tele2, just follow the prompts.

Why transfer money from phone to card

Nowadays, mobile communications occupy such an important place in a person’s life that the fear of being left without communication makes people constantly worry about replenishing their balance. A random error may occur and the account will be replenished with a larger amount than planned. Sometimes a person simply cannot “talk out” the money he has. Regardless of the reason for which the savings were formed, their owners now have the opportunity to transfer them to bank plastic for a more rational use. This is the best option, since the “accumulated” would have to be spent on the operator’s services or payment for his goods.

To expand their clientele, large mobile operators offered their services as bankers: subscribers became able to withdraw “extra” funds to their own cards. Not all telecommunications companies and banks supported this innovation.

How to transfer money from your phone to a Sberbank card

To transfer money from your phone account to a card, you need to take into account some features. Not all bank cards are used for this service. It is only possible for those whose numbers contain no more than 16 digits (Visa and MasterCard), but the transaction is not available for Maestro. For clients of a banking institution, you can withdraw funds from the largest mobile operators: Megafon, Beeline, MTS, Tele2. Each company dictates its own conditions, commission fees and limits for the operation, and the client will have to decide for himself how beneficial this procedure is for him.

Transfer from Megafon to Sberbank card

Megafon subscribers, if necessary, can transfer money as follows:

- log in to the official website of the operator; Select “Money transfers” from the menu; stop at the “To a bank card” option; enter a phone number; receive the code from SMS and enter it; indicate the digital combination of plastic and the size of the transfer; confirm the transaction and complete it.

Basic conditions for crediting funds from the balance sheet of this company:

- commission – 7.35% + 95 rub. (1-4999 rubles), over 5,000 - the same percentage, but also an additional 295 rubles; It is allowed to transfer up to 15,000; There are no restrictions on the minimum transaction size, but due to the high commission fee, sending small amounts is not practical.

There is also a second option for enrollment - via SMS message to 3116. The text looks like this: “CARD_ plastic number of 16 digits_ month_ year of validity _ amount.” The entry has spaces after the word “CARD”, after the number, after the month, after the year. The commission is the same as for transactions through the site.

Transfer money from Beeline

How to make a transfer from Beeline to a Sberbank card? The instructions are:

- go to the Beeline website; Select “Pay from account” in the menu; then – “Money transfers”; choose a payment system; in the window that opens, enter the digital value of the plastic card, telephone number and amount of money transfer; complete the procedure by confirming it.

The conditions for sending funds are as follows:

- commission fee – 50 rubles. (from 50-1000 rubles), for others - 5.95% + 10 rubles; minimum transaction - 50 rubles, maximum - 14,000; The deadline for receipt is up to 5 days.

Another method involves transferring via SMS to 7878. The text and type of message are the same as when sent to Megafon, but the month and year of validity are missing in the text.

Transaction limits for one sender/recipient:

- the minimum amount of one transaction per sender/recipient is 10 rubles;

- the maximum amount of one transaction per sender/recipient is RUB 15,000;

- The maximum amount of transactions per day per sender/recipient is RUB 15,000. (no more than 10 transactions);

- the maximum amount of transactions per week per sender/recipient is RUB 40,000 (no more than 20 transactions);

- the maximum amount of transactions per week per sender/recipient is RUB 40,000 (no more than 50 transactions);

- The required balance on the account after the transfer is 50 rubles.

Information on transaction limits is given taking into account all commissions.

In case of problems with the limits for sending/issuing transfers, the sender/recipient must fill out the Explanatory Note Form and send it to the email address relation [email protected] attaching a scan of the passport (2-3; 4-6 pages). A decision on the possibility of issuing funds is made within up to 2 working days.

Transfer within Russia in rubles

Send to a short number 3116

SMS request indicating the required payment. SMS format:

Transfer to neighboring countries in rubles

Send to a short number 3116

SMS request indicating the required payment. SMS format:

Limits and tariffs for transferring funds

When sending money to the balance of another subscriber, you should take into account the type of transaction, established commissions, restrictions on sending by amount or by daily, monthly number of transactions. This must be done so as not to be surprised by additional debits in the notification of the transaction. For convenience, this information is provided in table form:

| Operator | Shipping method | Interior | External | Limits |

| MTS |

|

|

| For S.M.S:

There are no limits on other sending methods. |

| Beeline |

|

| 7.95%+10 rub. |

These limits apply only to domestic transactions. There are no limits on external transactions. |

| Megaphone |

|

|

| For USSD:

For SMS :

|

| Tele 2 |

|

|

| There are no limits. |

| Motive |

|

|

|

|

Transaction limits for one sender/recipient:

- the minimum amount of one transaction per sender/recipient is 10 rubles;

- the maximum amount of one transaction per sender/recipient is RUB 15,000;

- The maximum amount of transactions per day per sender/recipient is RUB 15,000. (no more than 10 transactions);

- the maximum amount of transactions per week per sender/recipient is RUB 40,000 (no more than 20 transactions);

- the maximum amount of transactions per week per sender/recipient is RUB 40,000 (no more than 50 transactions);

- The required balance on the account after the transfer is 50 rubles.

Information on transaction limits is given taking into account all commissions.

In case of problems with the limits for sending/issuing transfers, the sender/recipient must fill out the Explanatory Note Form and send it to the email address [email protected] attaching a scan of the passport (2-3; 4-6 pages). A decision on the possibility of issuing funds is made within up to 2 working days.

Transfer within Russia in rubles

Send to a short number 7878

SMS request indicating the required payment. SMS format:

Transfer from Russia in rubles

Send to a short number 7878

SMS request indicating the required payment. SMS format:

The transfer amount is indicated without kopecks. The transfer amount is from 100 to 15,000 rubles.

The last name, first name and patronymic of the Recipient of the transfer are indicated exactly as written in the identification document that will be presented upon receipt of the money transfer. (After the transfer is generated, it is possible to make changes to the Recipient’s full name).

All data in the SMS message is separated by spaces. There is no charge for sending an SMS message to service number 7878.

The amount indicated in the sent SMS message, plus a service fee, will be debited from your Beeline personal account.

After sending the SMS request, you will receive an SMS from number 8464 to confirm the transfer. You need to send a positive reply to the same number to confirm the transfer.

After making the transfer, an SMS from number 7878 will be sent to your phone number with information about the transfer: transfer amount, transfer fee, control number for receiving the transfer. Do not disclose the transfer control number to anyone other than the recipient of the transfer.

The recipient can contact any UNISTREAM money transfer issuing point in Russia. To receive a transfer you must:

- Inform that the transfer was made through the UNISTREAM system.

- Inform the transfer control number sent to you via SMS.

- Inform the amount of the transfer you are receiving.

- Provide the full name of the transfer sender.

- Present an identification document of a citizen of the Russian Federation: passport or residence permit.

For questions regarding cancellation and revocation of a transfer, please contact us by phone (calls within Russia are free).

What to do if you made a mistake during translation

Sometimes there are situations when a subscriber dials the wrong number, accidentally confirms a payment without checking the correctness of the entered data, and performs similar actions. This results in money being sent to an account that is different from the one intended. In such cases, you should promptly contact the call center to discuss options for a refund. In order for the mobile operator to return the money, you need to do one of three actions:

- call the call center;

- send an email describing the problem in detail, attaching a screenshot or photo of the payment receipt;

- visit the office of the mobile operator.

It is worth remembering that not all situations allow the return of an incorrectly sent transaction. If the specific request satisfies the requirements, and the recipient’s account has received funds, then only then, within a two-week period, the operator will be able to carry out a refund operation. An example of a non-refundable transaction is the sending or withdrawal of cash by criminals, since there is a deliberate transmission of the confirmation code.

In order not to fall into a non-refundable transaction or fall into the clutches of criminals, you cannot report the secret code sent by the operator, especially if you receive a call from a representative of a bank, mobile operator, MFO (micro-financial organization) - this is one of the most common methods of fraud. The main thing is to know that the codes are generated by the robot, that is, the operators do not know about them, they do not need them.

Transaction limits for one sender/recipient:

- the minimum amount of one transaction per sender/recipient is 10 rubles;

- the maximum amount of one transaction per sender/recipient is RUB 15,000;

- The maximum amount of transactions per day per sender/recipient is RUB 15,000. (no more than 10 transactions);

- the maximum amount of transactions per week per sender/recipient is RUB 40,000 (no more than 20 transactions);

- the maximum amount of transactions per week per sender/recipient is RUB 40,000 (no more than 50 transactions);

- The required balance on the account after the transfer is 50 rubles.

Subscriber reviews

Affected users report that in addition to number 313, they received messages from several other numbers, including 3116 and 312.

As a rule, after connecting to a paid subscription, calling the operator’s hotline is useless. Employees argue that it is impossible to return the money by saying that the client independently agreed to a paid subscription.

Of course, there are exceptions - the possibility of solving a problem is determined by the human factor. Sometimes it is enough to threaten to report to the police. And then Tele-2 employees readily agree to concessions. Sometimes more money is returned to your account than was spent during the paid subscription.

How to transfer money from an MTS account

- The minimum you can transfer is 1,700 rubles.

- The maximum you can transfer is 15,000 rubles.

- The transfer fee is 4%, but not less than 25 rubles.

- The number of transfers per day is no more than 5 times.

- You need to go to the “Easy payment” section on the MTS website.

- In the “Money transfers” section, select “Transfer to a bank card”.

- Enter your phone number, transfer amount and select the payment method “from mobile phone”.

- A new window opens. Enter the card details. Next, we confirm the payment.

Transfer to Tinkoff Mobile

You must log into your Personal Account or mobile application and perform the following operations:

- select the menu: “Payments” → “Transfers” → “By phone number”;

- enter or select a subscriber number from the address book;

- indicate the amount and click “Transfer”.

This method is available to subscribers only within the network. The Tinkoff Mobile application will show information about the commission before sending.

You can top up other SIM cards from a Tinkoff number using the service https://www.tinkoff.ru/payments/categories/mobilnaya-svyaz/. The commission will be 2.9%.

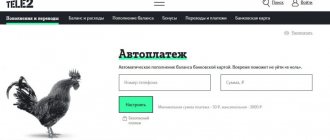

How to transfer money from a Megafon account

- Amount to pay: from 1 rub. up to 15,000 rub.

- The transfer fee:

- for amounts from 1 to 4999 rubles. – 7.35% + 95 rubles;

- for an amount from 5,000 to 15,000 rubles – 7.35% + 259 rubles.

- You need to go to the “Money transfers” section on the official website of the Megafon operator.

- Select “Transfer to plastic card”.

- Then enter the phone number. Select “receive code via SMS”. Enter the received code in the required field.

- Next, enter the card details, the transfer amount and confirm the payment.

Another translation method:

You can easily transfer money from Megafon to a Sberbank card by sending a message to number 3116.

SMS message format:

Message: CARD XXXXXXXXXXXXXXXX MM YY SSSS

Where ХХХХХХХХХХХХХХХ is the card number consisting of 16 digits, MM YY is the month and year of the card’s validity, SSSS is the amount to be transferred. The terms and commissions are the same.

Top up your balance from the mobile operator Motive for free

Ural Cellular Company carries out only domestic shipments. They do not charge a commission, they can only be completed in two ways:

- Using the USSD command:

- enter the command *104*108*9002223334*750#, where 750 is the amount, click on the “Call” button;

- Paroxysmal dry cough

- 12 reasons why grateful people live longer than others

- perform actions from SMS.

- By SMS:

- send a message in the format 9103168339 150 to number 1080;

- wait for an SMS with a confirmation code;

- send the code as a reply message.

What does the color of a bruise mean?

wait for a message with instructions from the operator;

How to transfer money from a Beeline account

- Amount to be paid: from 50 to 14,000 rubles.

- Transfer fee: 5.95% + 10 rubles.

- We go to the official website of the mobile operator Beeline. Select the “Pay from account” section.

- Next, select “Money transfers”.

- After that, select the payment system of your card: Visa, MasterCard or Maestro.

- Next, a new window opens where you need to enter your phone number, transfer amount and card number. After this you will need to confirm the payment.

Another translation method:

From Beeline you can easily and quickly send money to a Sberbank card via SMS. To do this, you need to send the following message to number 7878

SMS message format:

Message: VISA XXXXXXXXXXXXXXXX SSSS

Where MASTERCARD or MAESTRO can be entered instead of VISA, XXXXXXXXXXXXXXXX – card number, SSSS – transfer amount.

This payment method is valid for prepaid tariffs and SIM cards issued specifically to you according to your passport. This transfer method does not work for corporate SIM cards. The period for crediting funds can range from a few seconds to 5 business days.

Transferring funds from your phone to a Sberbank card is a fairly convenient option. But, as can be seen from the proposed transfer conditions, the most appropriate is to transfer to a Sberbank card from an MTS subscriber number, where the commission is quite adequate. Megafon subscribers are recommended to resort to this type of transfer in exceptional cases or in transactions with fairly large sums of money.

Who can use the service

provided to all Megafon subscribers, and even corporate clients. In order for the service to work on numbers registered to legal entities, the latter must activate the additional “Personal Budget” option.

With the “Personal Budget” function, enterprise employees are allowed to go beyond the limits set by management. Employees make money transfers from their personal funds.

Corporate clients prefer a credit payment system, where calls for the current month are paid at the beginning of the next month. If you have this type of service, you will not be able to transfer money to another operator. “Mobile payment” is available only to those subscribers who pay first and talk later (prepaid payment system).

An attempt to transfer money will fail if the transfer is made using an initial payment when connecting a SIM card. Let's say you purchased a Megafon SIM card with the “Switch to 0” tariff. According to the terms of the tariff, the initial payment is 300 rubles. Financial transactions will be available only for the amount you deposit in excess of 300 rubles.