You can transfer money from your Beeline account to the Qiwi electronic payment system using two methods that the mobile operator provides for its subscribers. The first method is to top up your Qiwi wallet by sending an SMS from your phone, and the second is to use the functionality of the website beeline.ru or qiwi.com and transfer money.

In what cases does it become necessary to transfer money from Beeline to QIWI?

The function is necessary to pay for goods and save funds.

The need to withdraw money to your wallet first arises when making purchases on the Internet. Sometimes you can pay for goods directly from your SIM card account, but most often websites do not provide this option. In this case, you will have to use the service of an intermediary - QIWI.

Another reason is the need to secure funds. If a large amount of money has been added to your balance, it is better to transfer it to a card or online wallet as quickly as possible. In the case of mobile operators, there is a high probability of losing part of your finances. This is due to hackers and paid subscriptions, which are often connected without notification. At some point, the subscriber may discover that the bill has decreased, go to the “Personal Account” and see a long list of additional services.

QIWI can partially replace a bank card or become an intermediary for cash withdrawals. The service allows you to create a virtual card that can be used like a Visa. Thanks to this, it is possible to pay for orders even where money from the wallet is not officially accepted. Another option is to subsequently transfer funds to another bank card for cashing out. However, the total commission in this case will be 10-11% + 50 rubles. versus 10% for direct transfer from a SIM card. This may only be convenient for withdrawing the remaining balance after a purchase.

Is it possible to top up Qiwi without commission: working methods

If you transfer money from your phone, a commission will be charged.

However, there are other ways to top up your Qiwi wallet:

- From a bank card.

- Through Internet banking.

- Through Unistream, Contact, Zolotaya Korona.

- In partner offices, and in this case nothing is charged for transferring money.

Well, if you urgently need money for your Qiwi wallet, you can apply for a loan from a microfinance company. In this case, nothing will need to be translated.

How to transfer money from Beeline to QIWI

There are several ways to transfer money from a mobile number to QIWI. The simplest one is SMS transfer. Alternative options are to use the operator’s official portal or the built-in set of functions on the payment system website.

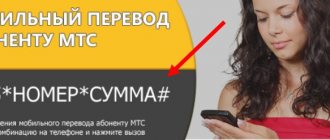

SMS transfer

To top up your QIWI Wallet balance, send a text message to 7878. In the text, indicate the service provider code (QIWI), wallet number without 8 or +7 and the amount to transfer. The application may look like this: “QIWI 9185184367 200”. After sending such an SMS, you will top up your account with number 9185184367 for 200 rubles.

Official portal of the operator

When transferring, you must take into account that there is a limit on the funds sent.

You can make a transfer through the official portal of the service provider. To do this, first log in, go to your “Personal Account” and find the “Pay by Phone” section. You will see a list of possible replenishment methods. Select the QIWI system. Fill in the editable fields. Enter your wallet number, your details and amount. Confirm the operation.

Payment system website

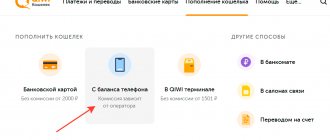

The QIWI Wallet website also has a special form for transferring funds through a Beeline mobile number. To find it, first log in. Select the “Top up wallet” tab and click on the “From mobile phone balance” button. Enter the amount and confirm your actions.

Is it convenient to pay for a phone using an e-wallet?

If the opposite task arises - to pay for Beeline via Qiwi, then the process is much simpler and cheaper. This can be done in the following ways:

- In your personal account through the tab “Payment for services – Mobile communications – Beeline”;

- Through the same tabs in the Qiwi mobile application;

- Through a payment terminal without authorization.

The commission for any type of replenishment via QIWI will be 5%. To use a mobile application or wallet, authorization is required. It is not required for machines, but difficulties may arise with accepting banknotes. The time it takes for money to be credited to your account using any of the above payment methods is a few minutes. You can top up the balance of any number, regardless of whether it is linked to a wallet.

You can transfer money from Beeline to Qiwi wallet using both the capabilities of a mobile operator and a payment system. The advantage of such a replenishment is speed. Among the significant disadvantages is the commission. For Qiwi e-wallets, this parameter is one of the highest.

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Restrictions and limits

The strictest restrictions apply to SMS transfers. You can top up your account with only 5,000 rubles at a time. The daily limit is 15,000 rubles, and the monthly limit is 30,000 rubles. For other methods, the restrictions are not so strict: for 1 transaction you can transfer up to 50,000 rubles.

Additionally, you need to consider the limits that apply to your account. They depend on status. For example, if it is minimal, you will be able to keep no more than 15,000 rubles on your balance. You can only get 40,000 rubles per month. The "Standard" status expands the user's capabilities. You can keep up to 60,000 rubles in your account. at one time. The monthly payment limit is RUB 200,000. At the third access level, the restrictions are conditional: you can hold no more than 600,000 rubles in your wallet. There are no limits on transfers.

When is it necessary to transfer funds from Beeline to QIWI?

An example of the need to transfer money from Beeline to QIWI are the following situations:

- A person who tops up his mobile phone balance using autopayment often accumulates large sums in his account. Using this money, you can pay for purchases and services in those companies that accept payments from electronic payment systems. You just need to use the service for transferring funds from Beeline to QIWI.

- A Beeline subscriber owes his friend a certain amount, but cannot pay due to lack of cash. But there is money on his mobile phone, which should be enough to pay off the debt. A friend has an account with QIWI. The debtor can transfer the required amount from his phone to a friend’s wallet.

Which translation method is better?

The method is chosen depending on the needs. If you need to minimize the commission, consider the option of transferring through the payment system website. Most often the percentage there is lower than in other cases. An alternative method is through the service provider portal.

The form on the QIWI Wallet website is also more reliable. You won't be able to make a mistake when entering your wallet number, so you're guaranteed not to lose money. According to user reviews, this method is faster. But SMS transfers allow you to top up not only your own account, but also someone else’s. This method can be used even if there is no Internet connection.

Cooperation between Beeline and QIWI

Cellular operators, trying to expand the range of services for their subscribers and attract new customers, gradually began to enter the financial market. Beeline’s cooperation with QIWI PS began with the creation of a new electronic wallet, Visa QIWI Wallet, which can be associated with a mobile phone number.

As a result of this interaction, several opportunities became available to clients at once:

- payments for purchases in online stores from a mobile phone account;

- convenient replenishment of your wallet by transferring money from your mobile phone;

- a single application with an improved interface that allows you to track your phone and QIWI balance.

Possible translation errors

In a critical situation, you must immediately contact technical support.

Sometimes the QIWI Wallet system gives an error and recommends using a different wallet or phone number. This happens when the operator’s country and the state in which the account is registered do not match. It will not be possible to correct the error, since the ban on international transfers is enshrined in the rules.

In rare cases, the error appears if the system considers you to be a bot. This happens more often with recently registered accounts. To verify that you are a person, fill out the personal information fields and add your email address.

If there is no error, but the money has not arrived within 3 days, call the operator’s technical support service. You will be advised by calling 0611. If you are calling from a landline phone, dial +74957972727. The employee will tell you at what stage the translation is at. You may need to additionally contact QIWI technical support.

Top up your account carefully. Take your time when filling out the forms. It's better to copy your wallet number. If you make a mistake, quickly contact the Beeline and QIWI call center employees. The chances of a refund are higher if your status is not lower than “Professional”. Employees' decisions will be influenced by the number of errors when entering information. If a completely different number was used, you will have to negotiate with its owner personally. The most favorable option is a random transfer to a non-existent wallet. In this case, you will be refunded immediately.

Additional recommendations

In 2021, there are many different ways in which you can top up your e-wallet account. The most popular of them is carrying out the procedure via mobile phone. Please note that the transaction is only possible if they are linked to each other. Otherwise, you will have to use third-party services or another transaction option.

Every user will be able to top up their Qiwi balance. The system interface is designed even for inexperienced clients, so it does not cause any difficulties in the process.

Safety regulations

An automatic algorithm is built into the translation system. It can block your QIWI Wallet account if you make suspicious transactions. For this reason, it is recommended not to use VPN services. The chance of blocking decreases when the status is upgraded to at least “Standard”.

Avoid scams. The most common one is called a magic wallet. Its owner promises to return you double the amount after the transfer. Most often, no payments are received into the person’s account. Some scammers make refunds, but only for small amounts. As soon as a large payment arrives, the attacker stops communicating.

When using QIWI Wallet, monitor the security of the gadgets from which you log into the system. Do not log into your account from other people's devices. Check the linked SIM card: if it is blocked and reissued, another person will gain access to your account. Regularly scan your smartphone or computer with an antivirus: malware can steal your passwords or send SMS to be transferred to someone else’s wallet.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- MirBekarys

03/14/2021 at 22:50 Nothing worked out for me

Reply ↓ Anonymous

24.11.2021 at 02:33Me too

Reply ↓

Other ways to withdraw money from a Beeline account

Transferring money from Beeline to a card is not the only option. You can withdraw money from your mobile account through ATMs. And if the subscriber uses electronic wallets, he can easily transfer money to them through the operator’s website.

Termination of an agreement

If the contract with the operator is terminated, all remaining money from the Beeline number is returned. To do this, you need to come to the office and write an application. It indicates the bank card details - the remaining funds will be credited to it. Cash withdrawals are not possible.

There may be sites on the Internet that offer transferring money to a card. It is not recommended to use their services - it is expensive and dangerous. The commission in such services is overpriced. In addition, the subscriber’s personal data may fall into the hands of fraudsters, which threatens the theft of funds from electronic accounts.

Sources

- https://beelinehelp24.ru/voprosy-otvety/perevesti-dengi-na-kivi

- https://brobank.ru/kak-perevesti-dengi-s-beeline-na-qiwi/

- https://MyTariffs.ru/finansy/perevesti-dengi-s-bilajna-na-kivi.html

- https://QiwiGid.com/perevod/s-bilayna

- https://www.topnomer.ru/blog/perevody-s-balansa-bilayn-na-bankovskie-karty.html

- https://obeeline.ru/sposoby-kak-popolnit-kivi-cherez-bilajn/

- https://QiwiHelp.net/perevody/s-bilajna-na-kivi-koshelyok

- https://kak-popolnit.ru/perevesti-dengi-s-bilajna-na-kivi/

- https://beeline-online.com/perevod-deneg-s-bilajna-na-bankovskuyu-kartu/

- https://mymeizu-online.ru/bilajn/s-bilajna-na-kartu.html

[collapse]

Basic information about the service

allows you to carry out operations not from the main number, but from an additional number, if it is linked. The operator makes sure that the client always remains in touch and prohibits the use of funds from the phone, which is intended for communication. After connecting, additional opportunities open up for the user: transferring money to other subscribers, paying for goods and services. The option is available for prepaid and postpaid subscribers.

For the latter type of service and for corporate clients, you will need to create an additional account where funds are deposited for further operations.

Mobile banking

You cannot pay Qiwi directly from a card via SMS command. The system is bypassed by creating a template. It is formed either in terminals or in your personal account. For example, in Sberbank Online templates are created according to the following scheme:

- go to “Settings”;

- select “Mobile Bank”;

- give the command “Create template”;

- indicate payment details;

- give the template a name, for example, “Kiwi”;

- confirmed by SMS command.

You can also write a corresponding application at the Sberbank office. The operator will need payment details and wallet number.

How to transfer money from a card to Qiwi through Sberbank mobile banking using the template: dial the command “Qiwi 000000000 1111”.

Here:

- “Qiwi” - recipient according to the name of the template;

- 000000000 — payment details (electronic wallet number);

- 1111 — transaction amount.

An SMS with the text is sent to number 900. A message with a one-time password will be received from the contact center. The code should be sent back. This confirms the operation.

Conditions required for the provision of the service

First of all, it is worth noting that the operation of transferring funds is absolutely free, the only thing the sender will have to pay is a commission to his operator. Such a service on Beeline has a number of restrictions and conditions:

- The amount of total funds in the mobile account must exceed the transfer amount by at least 60 rubles. That is, after sending, there should be at least 60 rubles left on the number’s balance.

- The percentage commission for each manipulation is not fixed and will be different, it depends on where exactly the money is transferred (card, mobile phone, bank account) and in what quantity.

- The minimum amount for one transfer is 100 rubles, the maximum is 15,000 rubles.

- The daily number of transactions cannot exceed ten transactions, weekly - 20, or transfers with a total amount of 40,000 rubles. At one time the monthly limit was 50.

- Even a minor citizen can send money, as long as the owner of the SIM card is over 14 years old.

- You can transfer money not only to residents of our country, but also to people living abroad. It does not matter which mobile operator the potential recipient uses.

The instructions for the manipulations are quite simple and do not include contacting the operator’s specialists. Beeline money transfers do not require any special technical knowledge or device settings. Let's look at exactly how to make a transfer, depending on the resource used.

What and how can you pay

allows you to transfer funds as payment for a variety of services:

- Mobile communications, Internet, television, telephony.

- Money transfers.

- Entertainment.

- Traffic police fines.

- Repayment of loans.

- Transport tickets.

- Utility bills and taxes.

- Charity.

- Electronic money.

The payment process is not complicated. Open the main page of the Beeline website, and in the “Payment and Finance” section, click on the “Payment for services” button. Then select the button with the appropriate name and click on it.

Inside you will see a form to fill out. Enter all the required data and click “Pay”.

Please note: for some services, funds can be transferred by sending SMS to number 7878. You can view the text for each type of service there, under the button with its name, to the right of the form to fill out. And we repeat: there is no talk of how to disable mobile payment on Beeline. This option is provided by default and cannot be disabled.

Recommendations for choosing a translation option

Each of the described methods has its own characteristics, and it is on their basis that the final choice must be made. If we talk about the commission, it will be the lowest when transferring funds using the official portal of the Qiwi system. But by using the Beeline website, the user will be able to transfer money to another number (this is an important nuance for many payers). Also, the mobile operator’s portal provides better protection of payment data. As for replenishing your wallet via SMS, it is, without a doubt, worth choosing for those who do not have access to the Internet.

So, we can conclude that the best option for transferring money is the website of the Beeline operator, but the final decision can be made solely by the payer himself.

What to do if you have difficulties

When trying to transfer the required amount from a telephone to a Qiwi wallet, users sometimes encounter difficulties. Main problems:

- The payment did not go through and an error message appears. You need to update and enter the information again, reduce the amount of payments. If there is no result, the operation is performed after a short period of time.

- The money is withdrawn, but the Qiwi EPS wallet balance is not replenished. The payment status is checked. If the transaction is shown to be successful, you need to write to technical support. It happens that it takes up to a week to transfer money.

To be on the safe side, you should send a screenshot of your payment receipt to the technical assistance service.

Only citizens of the Russian Federation living in the country can transfer money from a telephone to Qiwi EPS. A person must use a SIM card from a domestic mobile operator.

Translation from Kiwi

Let's see how to transfer money from Beeline to a Qiwi wallet. We really have such an opportunity. Thanks to some agreement between Qiwi and the black and yellow operator, we can use funds from our balance to pay for services from the Qiwi catalogue. But in this case we don’t need a directory.

In order to transfer money from Beeline to a Qiwi wallet, we will use a convenient tool for working with accounts. As you know, the Qiwi wallet number completely matches the phone number used during its registration. And this number is also an account in the system that can be used to pay for any services (if there is a surplus). You can view your accounts in the wallet interface - log in with your username and password.

Having entered your wallet, pay attention to the line with the current balance - click on it with the mouse, a list of available accounts will appear (including in US dollars and euros). Select the very last item “Working with accounts”

On the page that opens, go down to the very bottom and see the “Additional accounts” item there - select the “Transfer” item and wait for the next page to open.

Next we perform the following steps:

How to transfer money from megaphone to qiwi

- Select the transfer direction - from Beeline to Qiwi;

- We indicate the required amount in the field - it is this amount that will be transferred from Beeline to Qiwi;

- Click on the “Translate” button.

Then all you have to do is wait for the funds to be credited - the operation is completed!

The process of transferring money from Beeline to Qiwi was not without limits and commissions. Thus, the minimum payment amount is 1 ruble, and the maximum is 15 thousand rubles. Commission for transfer amounts up to 500 rubles. not charged. If the transfer amount from Beeline to Qiwi is more than 501 rubles, then the commission will be 8.95%. It is profitable to transfer small amounts, but not so much for large ones. But you can transfer money in several payments - this is prohibited by anyone (at least for now).

Replenishment methods

Account replenishment methods:

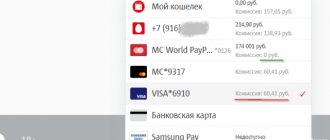

- Method number 1. Money transfer to Qiwi is carried out in the user’s account in the section where the participant’s accounts are located.

- Option No. 2 – approach using the “Top up wallet” function.

Through the section “Working with accounts”

- Log in to the site.

- In your account, click on the “Work with accounts” tab and then go to the page where the accounts are located.

- Select the operator menu in the list and click on the “Translate” button.

- On the new page, where there is an account link, you need to indicate the mobile operator in the “From account” column, and the Qiwi wallet in the “To account” column. Enter the required data, click “Transfer” and transfer the money.

Using the “Top up Wallet” tool

- Log in to the site.

- Click on the “Top up” tab, which is located on the toolbar at the top. This button got lost among “Pay”, “Transfer”, “Withdraw”.

- Select an operator from the pop-up list.

- Two sections will appear where the accounts are listed.

- Enter the appropriate amount and click on the “Pay” button.

Photo 1. On the top menu bar, click on the desired function.

Photo 2. Choose a method.

Another variant

Another option is possible. It is less convenient, but successful, like the first two methods, and you can transfer money using it by registering on your provider’s website. Or log in if registration is completed.

There are operators that allow you to transfer money from your phone account to pay for goods online or to replenish your wallet balance. Using exchangers, you can withdraw money from your mobile phone and put it into a Qiwi virtual wallet. When using this method, you need to take into account the commission.

Advantages of making payments and transfers through Qiwi

You just need to register and specify the recipient's details. Many people do not want to make online transfers because they are afraid of making a mistake with the details, because with regular payments all the data is entered for the client by the operator. However, competent and prompt work of the Qiwi technical support service will help correct the incorrect payment and return the money.

Using the service, you can pay utility bills, mobile communications, traffic police fines, and transfer money to friends. At the same time, the Qiwi system in many cases does not even charge a commission for its services, but other operators (counterparty banks, mobile operators) may require it. Thanks to the convenient interface, you will find out the amount of commission charged before making a payment.

We will tell you how to make payments and make transfers through the QIWI system in this article.