Finding out your call history is useful in several cases. For example, in the case of planning expenses and studying how much money is spent on mobile communications. In addition, sometimes you need to find a number that has been deleted from the history on your smartphone and the phone book. For this, there is detail from the operator. Today we will consider the question of how call history is received and deleted in the MTS personal account. Other ways of obtaining detail and working with it are also touched upon.

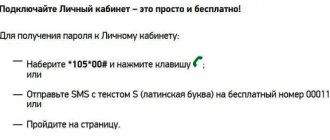

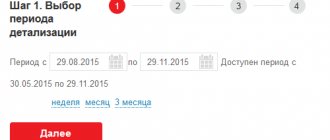

In your Personal Account on the operator’s website

A popular way to obtain details is to study MTS calls through your personal account. It can be used by a client of this mobile operator.

Login to your account

To access your profile, you only need a smartphone or computer and Internet access. First you need to take a few steps to help you log in to your account:

- Login to the official website of the company and click on the authorization button.

- Enter your mobile phone number and click on the “Next” button.

- Waiting for the code to arrive via message and then entering it in the appropriate field.

After these steps, access to most functions is granted.

You can view the history of paid actions immediately on the website.

Easy payment – what is this service?

MTS has long ceased to be a simple cellular communication provider; now it has created its own mobile bank, which opens up a huge number of opportunities for the consumer. The service simplifies payment transactions. For example, replenishing a personal account on the Internet. Once connected, you can pay all your bills without commission with the touch of a finger. You no longer need to remember the contract number and the timing of the next transaction. The system will automatically warn you in a timely manner about the need to complete the procedure. All payment transactions are managed through the subscriber's telephone number. This is a significant saving of time and nerves .

Currently the interface is called “MTS Money”. To connect it and start using it, you just need to log in to your personal account under your account. Enter your phone number, and then confirm it using a security password, which will be sent to your phone as an SMS message. On the main page you will see the corresponding e-wallet tab; by clicking on it, you will see the entire list of operations available to you. This service has two main directions of action - an electronic wallet and the provider’s banking products. Below we will look at each of them in more detail.

Online wallet

The service provides the user with the opportunity to create a separate dedicated account for carrying out payment procedures. You can top up at any time in your personal account interface. On the main page you will see the exact status of your balance at the current time, next to it the amount of money in your wallet is displayed. Click on it and select the replenishment option. A new window will open indicating where the money will be transferred from. Three options are available to the user - a personal balance on a mobile device, a bank card or another Internet wallet. After this, enter the amount for the transaction, the display will instantly display the exact amount of the commission fee, it will be approximately one percent of the transfer.

When managing this service, the subscriber receives the following benefits:

- Minimum commission fees for conducting transactions in various directions.

- You can use an electronic wallet to pay for any services:

- replenishment of mobile account balance;

- payments for home Internet and television from different providers;

- Payment of utility services;

- making transfers to SIM cards of different operators, to bank cards;

- pay the next loan amount from the bank in a timely manner;

- transport applications and taxi travel;

- online games and other entertainment in the network space;

- purchasing goods online and in any store;

- payment for restaurants, cafes and much more.

- The user is able to order a virtual bank card with advanced capabilities, which is not inferior to analogues of other plastic cards.

- A modern and advanced encryption system is used to protect all transactions, which minimizes the risk of theft and fraud.

- The consumer is able to store and save any amount in his account.

- The subscriber can replenish the main balance of the wallet quickly and easily in his personal account or in any provider’s salon.

- The operator does not charge any money for servicing your account.

- Enable automatic payments, let the system independently process all payments without your intervention.

- The user can transfer funds to any bank account.

- If your mobile device allows it, then perform contactless transactions using the Pay Pall standard.

- The service is available to all clients of the provider anywhere in the Russian Federation.

- A simple and convenient interface that will prevent you from getting confused and lost in control.

To make a transfer or payment for a specific service on the official website, you will need to complete several steps:

- Open the “MTS Money” tab.

- After this, the display will display a list of all possible directions and offers for replenishment. For example, select any mobile operator.

- In the next window, select how to perform the operation. As the payer, indicate your phone number, bank card or e-wallet.

- Confirm the operation and wait for the funds to be credited.

For convenience, you can create a template according to which you will perform the operation each time. You do not have to fill out all the fields and provide details again. Below, in the Easy Payment service there is detailed information about all completed transfers and financial transactions from the main balance.

Attention! Transfers and payments for MTS services are not subject to commission fees; in addition, there is currently a promotion under which it is not debited for Megafon clients.

Set up automatic payment so you don't have to constantly contact the service for payment. For this:

- Open the corresponding tab in the “MTS Money” section.

- Select the direction of the transaction, for example, mobile communications.

- Enter a name for auto payment.

- Indicate the recipient's details, in our case the phone number, as well as the amount of the transaction.

- Select the source - electronic wallet, plastic or personal account of the subscriber.

- Set the conditions under which the procedure will be performed:

- upon reaching a certain threshold on the balance. As soon as the user's funds reach a certain mark, the service will take effect. Enter the maximum limit for the monthly period;

- according to a periodic schedule. You need to define a transaction for each week, day or month, or set the exact time yourself.

- Confirm the changes.

Bank cards

The provider invites its consumers to order their own bank card and link an electronic wallet to it. There are currently several interesting products available for order:

- Credit card:

- MTS Zero. There is no commission or additional interest charged for using the offer for the entire life of the plastic – 36 months. You can withdraw your funds from any ATM in your home region, throughout the country and abroad;

- Weekend. Receive 5 percent cashback on every purchase, refunded every Friday. When purchasing goods in the official store of the provider, it can reach 10%. The maximum limit reaches 400,000 rubles. The grace period is 51 days from the date of activation;

- Universal. Receive 100 percent discounts on tariff plans from the Smart and “X”, “Tarfishe” line. 0% for up to 51 days.

- Debit cards – Weekend and Universal.

To start enjoying operator privileges, you need to submit a request for the production of plastic from your number. To do this, go to the appropriate section on the MTS Money service page. Select the product you like and activate it. You can order courier delivery to your home address or pick it up yourself at any service provider branch in your locality.

In addition to issuing a card, the user can take out a cash loan for any area of activity. To do this, you will need to fill out an application on the operator’s official website and wait for approval from the company.

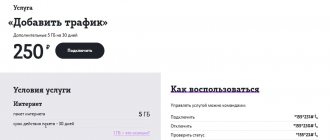

USSD command

Using the USSD command, you can get a small list of the latest numbers and messages that were sent and received on your smartphone. To use this method, a special keyboard is used, which opens by clicking on the “Call” button located on the main screen of the gadget.

After opening the USSD keyboard, just enter the command *152*1# into it, and then press the call button. After a few seconds, the operator will send an SMS message. It will contain information about how many transactions, dialings and messages have been made recently.

How does the “5 last paid actions” option work?

You can find another name for this on the Internet, but regardless of the name, the essence of the service is as follows: you send a short USSD code from your mobile phone and receive a mini-report in response:

- What telephone number was the call made to;

- The time at which the call was made;

- Duration of conversation;

- Call cost.

Paid services include not only calls, but also sending SMS messages (if the main package is exhausted or not connected), calls while roaming, access to the Internet when the traffic in the package is exhausted. When sending a request to check the last 5 paid actions on an MTS number, all operations for which funds were debited from the phone balance will be visible.

This report is like a mini statement that allows you to track your recent transactions. This service has gained popularity not only because it allows you to check write-offs. For example, your phone was recently in the hands of another person and you want to check where this person called from your phone (if the number is deleted in the call book). By sending a command, you can easily receive the desired information if the call was made not using package minutes, but using funds on your balance. However, if you use mobile communications a lot and have made a lot of calls in the last 30 minutes, then this method may not be suitable for you. In this case, it is better to use other methods, which we will discuss below.

It is worth noting that this option has no restrictions. The request is free and has no daily or monthly limit.

Through the mobile application "My MTS"

In addition to your personal account, using a USSD keyboard and visiting the office of a mobile operator, you can carry out several actions that will answer the question of how to delete calls in the MTS application. You can install the application on iOS and Android devices. It is sold free of charge, and it is quite easy to find it in any software market for smartphones.

To achieve your goal and delete call history in My MTS, just follow a few steps:

- Open the application and go to the Expenses section on the main screen.

- Studying the list of transactions that were carried out previously, or opening a section with an expense item.

- Studying which numbers the calls were made to.

How to block details via the Internet

Suspicions that a third party has personal call history often leads to a desire to block details. Some services offer such services for a fee, but they cannot guarantee the operation.

You can independently carry out actions with which you can only delete the history of calls and messages. To do this, just log in to your personal account on the operator’s website and go to the section with details. Here is the button for deleting information and statistics.

If you suspect that third parties have gained access to your account on the MTS website, it is better to change your password or contact the service’s technical support for help.

Is it possible to find out who deposited money on the phone? (Page 1 of 2)

If they make a mistake, they can call you! But don’t delude yourself at all, you can correct this - just come to the office and write a statement that you made a mistake. The money will be returned, the main thing is to keep the receipt! then, 3 weeks later, an SMS came from Kemerovo. with a request to return at least part of it, I am a kind and sympathetic person by nature. But. this has been used meanly so many times... that I decided to show meanness for once too

Mothers receive money from time to time! Either I’ll replenish it, or my brother, or it’s completely unknown who! So little things! Today I received an SMS from the operator that my balance has been increased by 200 rubles, although I haven’t done anything like that for 2 weeks. No, no, under no circumstances should I return it, everything is fine with my head! Just a nice little thing, I want to know who I should thank for this

Do not agree to transfer large amounts from the card! - it will be “your initiative”, and you will not prove anything subsequently. The fraudster finds several numbers with similar combinations of numbers and transfers amounts from a thousand rubles to them. He asks you to return the money, and you agree, but they call you a completely different number, not similar to yours.

You transfer money, and after a while the operator suddenly forcibly debits the same amount from you. The fraudulent scheme works either extremely simply or intricately, but it is always designed for the speed of your reaction. The less time you have to think about the situation, the more likely you are to be deceived. Therefore, never immediately return an erroneous payment, but carry out the simplest verification.

SMS message details

Calls are only one part of the detailing. In the user’s personal account, you can not only get an answer to the question of how to delete transaction history in MTS, but also get a list of SMS messages sent for a specific time period.

Message details are displayed along with calls, so there is no need to take additional actions. Only owners of the device and SIM card can view messages. Violation of this rule will result in disputes.