The Tinkoff Mobile operator is becoming increasingly popular among users. Subscribers are attracted by favorable prices for services and the opportunity to independently choose their volume. But this operator also has some differences from other companies, so it is impossible to take the promised payment to Tinkoff Mobile. This service is convenient because you can instantly top up your account with a small amount. This option is often used by subscribers of other operators, but few people know that Tinkoff has the most profitable alternative options.

Does Tinkoff Mobile have a promised payment?

Tinkoff Mobile introduced the “Promised Payment” service to its arsenal quite recently – on April 15, 2021.

How to take a trust payment from Tinkoff Mobile

The purpose of the campaign is to support customers who may have faced financial difficulties due to the spread of coronavirus infection.

To take the promised payment, you need to write to a consultant in the chat of the mobile application or call the toll-free number 8 (800) 555-97-77. The possible amount depends on the amount of expenses on the SIM card for the last 3 months.

Free minutes in roaming

Especially for Tinkoff Mobile clients who are forced to stay abroad due to the introduction of quarantine, the operator offers to take advantage of the “30 minutes incoming” package on preferential terms. Only until May 1 of this year, half an hour in roaming will be provided to subscribers free of charge.

The number of free minutes is updated daily, so you can use discounted rates for cellular services outside your home every day.

about the author

Anna Popovich - higher education and master's degree in jurisprudence from the Faculty of Economics and Law of Donetsk National University. For five years she conducted scientific and teaching activities at the Donetsk National University at the departments of civil and criminal law in the areas of “Economic Crimes”, “Criminal Procedure”, “Banking Law”, “Tax Discipline”. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How it works

If it happens that there is not enough money on your balance to renew any service or package, you can always borrow it from Tinkoff Mobile for a period of 5 days.

Requirements to receive a trust payment:

- The SIM card is issued to you and there is only one.

- More than 2 months have passed since activation and start of use.

- You have no debts on mobile communications or previously taken promised payments.

You can borrow 100, 200 or 300 rubles. The cost of the service is 15 rubles for every 100. That is:

- 100 rub. – payment 15 rubles;

- 200 rub. – payment 30 rubles;

- 300 rub. – payment 45 rub.

This money will be written off along with the trust payment 5 days (120 hours) after the service is issued.

Example: you borrowed 200 rubles, this means that after 5 days you must have at least 230 rubles in your account to repay it.

You can make the promised payment while in the Russian Federation or abroad. You can spend it on any services except purchasing a beautiful room.

How to pay on time and not go into the red

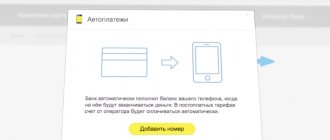

If you can’t borrow from Tinkoff Mobile, you need to find a way to replenish your balance in a timely manner. For example, you can activate “Autopayment” in advance so that you don’t forget to deposit funds into your mobile account on time.

When your balance approaches zero, the money will be credited automatically and you will not go into the red. To activate this function, you need to configure it once, indicating the card details and the top-up amount.

Advantages of automatic payment:

- Regular account replenishment.

- No commission.

- You can link any Russian bank card.

- Setting up the service takes just a few minutes.

What is auto payment

Autopayment is a popular service. It allows you to make regular payments and transfers according to a set schedule. This makes it possible to save yourself from having to replenish your account every time. With the client's consent, the bank will do this automatically.

How the service works

If everything is configured correctly, a fixed amount is debited every month. And with the help of a trust payment, clients have the opportunity to take an advance to pay off the subscription fee if it is not possible to pay it now.

Benefits of automatic payment

Autopayment has a sufficient number of advantages:

- free connection and disconnection of the service;

- saving time (no need to pay manually);

- ease of use;

- transparency of work (every action is confirmed via SMS).

How to set up auto payment

To forget about the need for the next payment, you only need to spend a few minutes.

- The service requires the Tinkoff Mobile application.

- To complete authorization you will need to enter your phone number, login and password.

- A selection is made in the menu: “More” - “Autopayment”.

- Choose an amount. Acceptable limit: from 100 to 3000 rubles.

- Click on the “Enable” button.

- Indicate bank card details.

Other ways to set up auto payments

There are several ways to connect to the service. The main condition is to have a valid bank account and debit card. The operation can be carried out using:

- mobile banking (via SMS);

- Internet banking (requires authorization in the system and the “My Payments” section);

- ATM (insert your bank card and find the “Automatic payments” column in the “Service” section).

How is the Tinkoff installment amount calculated and the installment payment amount?

Before applying for a Tinkoff installment plan, be sure to check the installment amount and the amount of the monthly payment.

The amount of the one-time payment depends on the duration of the installment plan and the bank’s commission. The conditions are usually set by the store

Any of the following payments must be made by the date indicated on the statement:

- Minimum payment (less than 8% of the credit card debt);

- Minimum payment in installments (minimum payment plus payments on all installments);

- Payment for the interest-free period (payment for purchases for which the interest-free period is ending, plus monthly installment payments).

Now let’s talk about when exactly you need to make payments on the Tinkoff installment plan. This is a very important point.

What is postpayment and who is it available to?

A postpaid service is available for a limited number of subscribers. It involves paying for the operator’s services after using them. The decision to provide the option is made by the service provider. Most often, these are elite card holders and clients who have proven themselves well.

The principle of operation is this: a person uses mobile communications up to the established limit, and only then receives a bill for it. Money must be deposited within 25 days. In case of non-payment, a fine will be imposed.

Bonus: I was deceived by Tinkoff

Our reader Vadim (name changed) sent the following review:

I took an installment plan for about 20k. I took out an installment plan for 12 months. Paid 2k+ for it. That is, in essence, it is the same loan. But the problem is completely different. I took out an installment plan for 12 months and began to use the bank’s money as usual, repaying the main debt in a couple of days. So there you go! After applying for an installment plan, I can no longer pay off the main debt on purchases! Be careful! Now any payment goes towards repaying this installment plan! I put down about 10k to pay off the debt on the purchase and still it all went towards paying off the installment plan! That is: I deposited 10k a month and all of it was simply spent in installments. But it is issued for 12 months! And I didn’t want to extinguish it right away. I wanted to pay off my shopping debt. This is how the bank is deceived. Support doesn't want to help, they only send idiotic replies. The Tinkoff installment plan is pure deception. I gave up all bank products and I advise you to do the same.

Methods for replenishing your Tinkoff Mobile account

You can top up your account by bank transfer, cash, or use automatic payment.

- If you have a bank card, money is transferred through an ATM (Tinkoff or partner banks), the Tinkoff Mobile mobile application) or from an account at your bank.

- Cash is deposited through any ATM or at mobile phone stores.

Every year the range of banking services develops and improves. Many services make life much easier and allow you to solve financial issues without the slightest effort.

When to make installment payments Tinkoff

It is important to make payments on time, otherwise debt will form. You will learn about the dangers of Tinkoff installment payments towards the end of our guide.

Especially for you: VTB received a confirmation code: scammers and security

It is important to make Tinkoff installment payments monthly, preferably on the same date, along with credit card payments

The bank can indicate a specific installment repayment date in three ways:

- In your personal account (section “Balance”).

- In the Tinkoff application (you need to click on the credit card account).

- In a monthly statement sent by email.

Knowing how to pay in installments at Tinkoff, you can repay the loan in the most convenient way.

Tinkoff fast payment system, limits, commission

The main advantage of SBP is the absence of additional fees for transactions with debit cards. For transfers from a Tinkoff credit card, a fee is charged according to the issuance program.

The limit on transferring funds without commission through the Fast Payment System at Tinkoff Bank is set at 1.5 million rubles per month. At the same time, no more than 150 thousand rubles can be transferred for free in one transaction.

SBP Tinkoff - how to connect

Tinkoff clients can start using the free online service from the Central Bank by connecting it in 2 ways:

- Through the Tinkoff application. Go to the “More” tab, then to “Settings” and “Translations”, turn on the toggle switch and press the connection key. In the same way, the SBP can be turned off by moving the toggle switch to the appropriate position.

- Through your personal account on the website. Go to “Basic Settings”, move the switch and confirm the action with a one-time password.

Before starting to use the SBP service, it is recommended that you familiarize yourself with the terms of transactions, their tariffs, costs and possible commissions.

Calculator

You can calculate the amount of overpayment in advance using a loan calculator. Select the loan amount, 1% rate and optimal debt repayment period. The cost of the loan is determined automatically.

Add overdue +

Late Fine ₽

Term, days Penalty %

Loan calculation

- Loan amount 1,000 ₽

- Overpayment 34,500 ₽

- Commission or fine 0 ₽

- Total cost of loan 8395%

- Total amount of payments 44,500 ₽

Requirements for borrowers

MFOs impose a number of conditions on their clients:

| Age restrictions | An adult client whose age does not exceed 75 years |

| Documents (mandatory) | Passport of a citizen of the Russian Federation, registration on the territory of the Russian Federation |

| Documents that may be additionally required | SNILS, identification number, driver’s license, pension certificate, documents confirming ownership |

| Who can act as a borrower (by category) | All individuals, including those who do not have a permanent job, students, retired persons, women who are on maternity leave. |

| Technical requirements | Availability of Internet, current email address, mobile phone number. |

| Sources of income | Wages, including unofficial ones, social benefits, benefits, scholarships, pensions, etc. |

| Map type | Debit, credit |

| Types of payment systems | Visa, Mastercard, MIR, Maestro |

| Map | Availability of a personalized card with a 16-digit number and current expiration date |

| Card balance | There must be 2 or more rubles on the card. If the card has a zero balance, then transfers are not made |

Terms of online loans on the Tinkoff card

To receive a microloan, the client needs to study the conditions on the basis of which the transaction is concluded. Today, the lender is offered many options:

- The loan amount can reach 100 thousand rubles.

- The minimum loan term is 5 days, the maximum is 1 year.

- The minimum rate is 0.45%/day, the maximum is 2.5%/day.

- The borrower's age is from 18 to 75 years.

A number of microfinance organizations are ready to provide loans without commission to attract clients. The term of such lending does not exceed one month.

Possible reasons for refusal

Cooperation with microfinance organizations is beneficial for clients who urgently need money, because almost all microcredit companies give microloans without refusal and work around the clock.

The loan arrives on the Tinkoff card 5-10 minutes after the lender transfers the money.

The borrower may be refused for the following reasons:

- incorrectly specified data, which the scoring system regards as fraud;

- the card details do not match the borrower’s data;

- The bank card has expired;

- lack of a positive account balance;

- balance is blocked;

- The card has expired.

There are other reasons why a client may receive a negative response from an MFO, for example:

- Invalid passport (no photo at 25 or 45 years old),

- blocked mobile number to which the company sends codes during registration,

- existing loans in other IFCs,

- legal proceedings are underway regarding the debtor.