Tinkoff Mobile is a new Russian telecom operator operating since the end of 2021.

This is another example of a virtual operator, that is, working on someone else’s physical infrastructure - in this case we are talking about the Tele2 operator. In those regions where Tele2 does not exist, Tinkoff Mobile connects to the networks of other operators. He also works abroad, in partnership with local networks.

Since the operator is quite new, subscribers have many questions about services, tariffs and number management. One of them is how to find out your Tinkoff Mobile number.

We will answer this question today, and also talk about other features of the virtual operator.

Look at the starter pack packaging

You can find out your Tinkoff Mobile phone number on the package of documents that the courier brought to you.

When purchasing a starter package, all the necessary information with the digital combination of the phone is written on the back of the package.

As an alternative, the number can be viewed in the test of the contract for the purchase of a SIM card, where it is mandatory.

Questions and answers about the Tinkoff virtual card

Why do you need a virtual card?

Using a virtual card you can perform the following operations:

The virtual card is linked to the Tinkoff Mobile Wallet; it can also be integrated with any electronic wallet of other systems, as well as with the PayPass service

What does a virtual card mean?

A virtual card is endowed with almost all the capabilities of a regular plastic card, but does not have real performance.

To use a card for non-cash payments, you also need to know its CVV or CVC code. For security reasons, it is not indicated on the screen, but is sent to the owner via SMS. If you lose a message with information, you can order it again at any time.

How to use a virtual card

You can use a virtual card only for non-cash transactions on the Internet. For this you need her details. Payments to companies on the Tinkoff list and transfers to individuals can be made from your personal account through the appropriate sections. According to the tariffs, in most cases there is no commission paid.

How to remove a virtual card

It is not possible to deactivate a virtual card. In this situation, you will need to completely remove Tinkoff Mobile.

If you change your SIM card, then access to the Tinkoff Bank virtual card will be terminated for you, and it is not possible to resume it

How to transfer money from a virtual card

To transfer from a virtual card, you need to go to the Transfers section and specify the recipient. You can select it from the list of your contacts on your smartphone, friends on VKontakte or Facebook. You can also indicate the details of his card. Then enter the amount and confirm sending via SMS.

How to open a virtual card

To create a virtual Tinkoff card, you need to register in the Tinkoff system. The creation of plastic occurs automatically.

How to withdraw money from a virtual card

You can withdraw cash from a virtual card through the Withdraw section. Today you can receive them on your phone account, on any bank card or account, incl. opened in Tinkoff.

How to declare a virtual card

It is necessary to declare the funds contained in the account if they act as a source of income. The declaration is made by an individual independently: the tax return indicates the amounts and sources of income.

When crossing the border, funds on the Tinkoff virtual card are not subject to mandatory declaration

How to create a virtual card

To apply for a virtual card, you need to register. The release occurs without user participation, immediately after visiting the Account.

How to top up a virtual card

You can replenish the card through the Replenishment item, selecting the appropriate option: from the card, by details, in cash, by QR code.

It’s easy to top up a Tinkoff Bank virtual card from a bank card

How to activate a virtual card

To activate a virtual card, you need to top it up in any convenient way: from a card of another bank on the Tinkoff website or through a terminal.

Login to the mobile application

You can go to the Tinkoff Mobile application and see your number there

. Considering that to activate the SIM card of the Tinkoff Mobile mobile operator you need to install the application, refreshing your phone number in your memory will not be difficult.

It is displayed on the main screen as soon as you log into the application.

How is a PIN code set at Tinkoff Bank?

In most “regular” banks, a PIN is issued to the holder during the initial issue of the card in a special secure PIN envelope. But at Tinkoff, the PIN code is generated electronically. This helps protect against many types of fraud. The code in paper form can become available to those who want to use the money on your credit card, but the electronic version will not be recognized by anyone except the holder.

You can get a PIN code from Tinkoff when activating a new card by making the appropriate request:

- to the helpline;

- to online banking.

The system generates a random set of numbers, which becomes your PIN code. It is difficult to find, and most often it does not resemble any of your data, such as your date of birth.

View in phone settings

Depending on the mobile device model, you can use the following approaches:

- go to the menu, select “Settings”, go to the “Phone” tab, where the folder called “My number” is located;

- go to “Settings”, select “SIM cards and mobile networks”, then go to the “SIM card settings” tab, where the basic data on the SIM card will be displayed, including the combination of numbers.

In any of these options, the names of the sections may be called slightly differently, depending on the operating system used, the manufacturer of the mobile device and other factors.

It should be understood that this option will only work if the combination of numbers is pre-entered into the phone’s memory or entered manually directly in the SIM card settings, which is recommended to be done immediately after purchasing and activating the SIM card.

How do I change my PIN code?

Changing the PIN code for a Tinkoff card is very simple and you don’t have to go to the bank to do this. There are 2 convenient ways to do this remotely:

Through the helpline by phone - 8-800-755-55-76

To talk with a specialist you need to prepare:

- take the card or its data - number, expiration date;

- know your details - full name, registration address, passport;

- remember the old pin (optional);

- remembering the code information is a mandatory item; the operator will use it to identify you as a card holder.

After connecting with a Tinkoff Bank employee, you will need to answer his questions, after which he will send you to the interactive system to change your password. The system will inform you of your new code, which you will need to confirm and that’s it – you can use it.

There is one difficulty with this option. If you decide to change the code, but give the control data incorrectly to the operator, your card will be blocked. You will have to reissue it, and it costs an additional 290 rubles.

Via Personal Account

How to change the PIN code for a Tinkoff card yourself and without unnecessary conversations? Very simple! Log in to your Personal Account, select the desired card number, go to the “Actions” tab and click the “Change PIN” menu item.

Call the operator

What to do when you don’t want to bother anyone because it’s already late evening or early morning? Then dial the Tinkoff Mobile support service - operators work around the clock and are always ready to provide comprehensive support to the company's subscribers. To do this you will need the following information:

- hotline numbers in the all-Russian format 8 (800) 555-49-29, for calls from abroad or as a short combination 995;

- passport data;

- number of the agreement concluded when purchasing the SIM card.

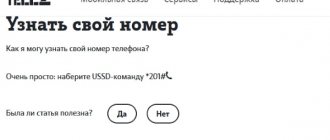

Another method that always works, except for rare situations with network problems, is sending the USSD command *100# and pressing the call key.

No matter what time you need information about a phone number, you can always choose the most convenient and accessible method that will help you quickly and effortlessly get the information you need.

Tariffs Tinkoff mobile

Surprisingly, you can now test the operator’s work for free: for the first month, new clients receive 600 minutes of calls, unlimited SMS, unlimited traffic on social networks and 20 GB of Internet for any needs.

From the second month you need to use the convenient tariff designer. There are no names here, but the services you want to pay for are simply installed: packages of traffic and minutes, unlimited for messengers and social networks, as well as unlimited for video services - YouTube itself quickly consumes traffic, but Tinkoff allows you to put unlimited on it.

Here's what the tariff for Moscow and the Moscow region might look like for 30 days:

- 600 minutes of calls - 199 rubles.

- 20 GB of Internet - 449 rubles.

- unlimited video on a 20 GB package - 1 rub.

- unlimited on social networks on a 20 GB package - 1 rub.

Total only 650 rubles. for a pretty decent package of services.

True, the operator also has unpleasant surprises - for example, the Internet distribution service in modem mode is purchased for 499 rubles. Therefore, it is recommended that you carefully read the full tariff conditions first. Probably due to inattention there are such conflicting reviews about this operator.

Documentation

There is no special command to find out your Tinkoff Mobile number. If you can’t install software from your operator on your phone, you can look at the numbers in the documentation. The subscriber must receive them upon concluding a contract and connecting to the network.

If you are one of those people who do not throw away the starter envelope after taking out the SIM card, then it will not be difficult for you to find out the numbers. It is enough to find a bag where they will be written.

This method will not work if you have changed your number or edited any other data since connecting.

Where are the CVV2 and CVC2 codes located on the Sberbank card?

A standard form that will need to be filled out when paying for goods or services on the Internet, indicating, among other things, the CVV2 or CVC2 code

Mostly the secret code on Sberbank cards is on the back side under the signature tape. It consists of 3 digits. On some plastic cards of the MasterCard payment system, such information is located on the front side. It is located immediately after the 16 digits of the payment instrument number. Typically, the card number is embossed and the secret ID is flat.

All plastic issued by Sberbank is highly secure. It has several levels of protection. So, when paying via terminal, the client enters a personal identifier - PIN code. To confirm non-cash transactions on the Internet, security codes CVV2 and CCV2 are used.

In the mobile application: “Home” → “Open a new product” → “Link a card of another bank” → enter the card details → “Add card”. Another bank’s card will be linked automatically if you top up your Tinkoff card from it in your personal account on tinkoff.ru.

They are available in your personal account on Tinkoff.ru and in the Tinkoff mobile application. In your personal account. Log in, select a card account on the main page and click “About account” → “Details”.

[THERE IS A SOLUTION] How to block a Tinkoff card through your personal account - answer the question

In the mobile application: card icon → “Actions” → “Details”. To find out the CVC code, click “Show code” and confirm the transaction with the code from SMS.

How to make a virtual Tinkoff card

In essence, a virtual card is a regular bank account. To open an account, you need to visit the bank’s website and register in your personal account, if you have not already done so. The system will ask you to enter a series of data, including your mobile phone number.

After registration, a code will be sent to the entered number; you will need to enter it in a special field. As a result of all actions, the client will be in his personal account, where the Tinkoff Mobile Wallet will appear.

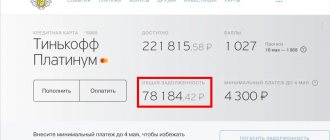

When opening a card, the client can go through an identification procedure. Otherwise, the funds limit is 40 thousand rubles. Once identified, the bar is raised. There are other points worth knowing:

- A client can perform no more than 20 withdrawal operations per month, the number of operations per day can reach 5;

- There can be no more than 50 settlement transactions per month;

- You can top up your card with no more than 15,000 rubles at a time.

To fully use the card, you need to download the mobile phone application. You will find it on Google Play or AppStore. Topping up your account can be done from your existing plastic card or at any terminal.

It is noteworthy that the issuance of a digital card occurs instantly; you do not have to wait for the card to be produced, as is usually the case with digital analogues. A Tinkoff Bank virtual card can be created without a physical card, unlike a Sberbank digital card.

Via Internet banking

In order to issue a digital card through Internet banking, you must:

- On the website page, click on the “Login” button;

- Register or log in with your existing password and login;

- Tinkoff Mobile wallet appears in your personal account;

- The card is activated upon the first replenishment; you do not have to call the call center.

In just a minute you will be able to use the card. Payments within the system occur without commission; there is no fee for servicing such a card. To make a money transfer, you only need to know the recipient’s phone number, email address, or social network login. A person can accept transfers without having an account with Tinkoff Bank. The mobile wallet will be created automatically. The person to whom the money is sent will receive a link to register.

Using the mobile application

To apply for a Tinkoff virtual card through the mobile application, you need:

- Download the application and wait for installation;

- In the application, click “Login”;

- Enter your phone number;

- Click "Next";

- Enter the code that will be sent to your smartphone;

- Come up with a four-digit access code; it will be used for authorization.

Some bank clients use a virtual account until they receive a real card.

In what situations is a bank card number required?

Plastic cards are already becoming an integral attribute of everyday life, so all citizens should be able to handle them. The most popular operations with them are activities such as:

- payment for fuel at gas stations;

- shopping in supermarkets;

- purchasing goods through online stores;

- transferring funds between accounts.

The last two points require knowledge of the unique number printed on the front side of the plastic. Without it, it is unlikely that you will be able to successfully complete the desired action.

Bank cards have individual numbers

Important! It is not recommended to provide card and card account information to third parties in order to avoid fraudulent activities against you.