Via the Tinkoff Mobile mobile application

The easiest way to top up your Tinkoff Mobile balance is through a special proprietary application. To do this, you must first download it to your smartphone from the application store.

Next, go into the program, activate the menu with the subscription fee and click on the “Top up” button. There are two ways to pay for cellular communications, and everyone chooses the most suitable one:

- Via Google Pay. For those subscribers who are users of this service, you can confirm the payment by pressing just one button.

- Using any bank card that has been previously linked to a phone number. For example, you can use a Tinkoff or Sberbank card.

In the window, indicate the required replenishment amount and then click on the button to make the payment.

When paying with a bank card, you must indicate its number, expiration date and a special CVC code, which is located on the back of the banking product. If the payment is made through Google Pay, then you need to confirm such a payment with a fingerprint or go through identification through the Face ID application, which is available on many new smartphone models.

When paying this way, the money is credited to your account almost instantly. There are no longer delays in enrollment, as was the case several years ago.

You can set up auto payment in the mobile application. In this case, the account will be replenished every time the balance reaches the set threshold.

Poor connection quality

Some subscribers want to terminate the contract due to poor communication quality. Typically, an uncertain network signal is observed in remote settlements, where there are not enough mobile communication towers of the Tele2 operator, on whose equipment the virtual operator works. People living in rural areas are not recommended to buy Tinkoff SIM cards or have SIM cards from other operators in order to constantly stay in touch.

You can evaluate the quality of communication using the interactive map available on the website. But it is worth remembering that the landscape and building density are not taken into account here, which can also greatly affect the network signal. It is better to check the quality of communication in your locality experimentally. To do this, just insert a SIM card into your smartphone and try to make a call or go online.

On the operator's website

You can top up your Tinkoff Mobile account directly on the operator’s website. There are two methods of replenishing your account - using a standard form of payment or through your personal account. The universal form can be found here. Using this method, you can pay without a commission for communication services of any operators in Russia and various CIS countries. In the form you should indicate the phone number, details of a valid bank card and the actual replenishment amount. Then you should confirm the operation and wait for the money to appear in your account. You can top up your phone using this method with an amount from 10 rubles to 15 thousand.

In addition, the universal form allows you to quickly pay for the services of local operators when traveling abroad

It is also possible to pay for mobile communications through your personal account. To do everything correctly, you need to follow the following instructions:

- Log in to your personal account; to do this, you need to write your phone number and then enter the confirmation code from the SMS message;

- Enter the amount by which you plan to top up your account on the main screen of your account;

- Indicate the details of any valid bank card and complete the payment.

To top up your mobile account, you can use any of the above methods.

What are the options for disabling auto payment at Tinkoff?

You can only disable autopayment remotely, since Tinkoff does not have fixed offices. Deactivation, as well as activation, can be carried out in 3 ways: in your personal account, in the mobile application and by calling a representative of the institution. The credit card holder can send an email to Mail for debit card holders. Detailed instructions will be sent in response from the institution.

Via a call to the hotline

The first option on how to disable Tinkoff auto payment is to talk directly to a bank representative by calling technical support at 8-800-555-10-10. It is necessary to explain the essence of the problem to the operator, and he will independently disconnect from autopayment. The only thing is that the bank representative will ask for information confirming that you are the account owner. This could be passport data, code word, date of birth or contract number. Within a few minutes, the AutoPay service will be disabled.

Deactivation of Tinkoff Bank auto payment through your personal account

You can cancel autopayments remotely using the Internet banking service. To do this, you need to go to the official website of the institution and make adjustments in the settings:

- On the main page, find the “Templates” tab and go to it.

- All automatic payments are marked with the letter “A”. We turn them off using the “Off” or “Disable” button.

- Confirm the action using the code in the message. It must be entered in the appropriate field and the operation must be confirmed.

The process will take no more than 5 minutes, and you can be 100% sure that Tinkoff autopayment is disabled.

Using a mobile application

In order to fully use the Tinkoff mobile application, you need to install it. You can set up a bank via phone completely free of charge by first installing the application on your smartphone. You can download the mobile version of your personal account in the Play Market and AppStore, depending on the gadget’s operating system.

For those who are already a registered user, it is enough to use the same data as for logging into your online banking account. New users must register: enter their mobile phone number and confirm its authenticity using an SMS code. The next step is to come up with a password for authorization, after which the account becomes registered.

Navigation in the mobile application is almost identical to your personal account, so canceling a payment is done the same way: go to the “Templates” tab, click the “Turn off” button next to automatic payments.

Payment via Sberbank-Online

Topping up your Tinkoff Mobile number is also possible through Sberbank. This payment can be made in different ways:

- Log in to the payment service and log in by entering your username and password. After that, go to the “Transfers and Payments” section, click on the “Mobile Communications” item there and mark the Tinkoff Mobile operator. After this, write the phone number and the required top-up amount; if there are several bank cards, then select the one you need. They confirm the operation by entering the code from the SMS message, after which they receive an electronic receipt.

- In the installed Sberbank Online mobile application, you should go through “Payments - Mobile Communications”, then select your operator, indicate the phone number and replenishment amount.

Cash appears on your balance sheet almost instantly. Very rarely the cool-down is a few minutes.

Mobile banking users have another option for replenishing their account. You can send an SMS message with the text “TEL number amount” to the short number 900. After this, you should confirm the payment and wait for the funds to be credited to your balance.

Setting up Internet for your phone

It seems clear how you can connect to the Internet. This can be done very quickly through the mobile application. You can download the application to activate the SIM card by connecting to a Wi-Fi network. Next, you need to figure out how to configure the SIM card, which can be automatic or done manually.

Automatic settings

To get automatic settings, just insert the SIM card into your mobile device and wait a few minutes. After this, the SIM card will be automatically configured. The subscriber receives an SMS message with the settings. They should not only be applied, but also preserved. If the user still does not receive such a message, it means that the phone does not support automatic settings. Most often this happens if the subscriber uses an outdated mobile phone or a device from an unknown manufacturer.

Manual setting

You can also get Internet settings manually. This setup will also not cause difficulties if you follow certain instructions. The presented instructions are suitable for Android and iOS operating systems:

- For smartphones running Android OS. Go through “Menu – Settings – More – Mobile network – Access points (APN)”. In the last paragraph you should write m.tinkoff. After that, go to the main menu, connect mobile data, and then check network access. If the Internet does not work, then you need to go through all the steps again;

- For owners of Apple iPhone devices, the instructions are slightly different. Go to Settings - Cellular - Cellular Data Network. The m.tinkoff access point is prescribed here. Then you need to reconnect to mobile data and check the Internet.

In the same way, you can configure computer tablets that run on Android and iOS OS.

It is worth paying attention to the fact that on individual Android devices the path to setting up the SIM card menu may be slightly different. There are a number of commands for additional Internet settings

Replenishment via electronic wallets

You can also top up your phone account from electronic wallets - Yandex.Money, Webmoney and Qiwi. The replenishment is identical in all cases, enter the payment catalog, mark the desired operator, write the replenishment amount in the window and confirm the payment. Most often, a one-time SMS message is sent for confirmation.

For example, you can consider the payment system from Yandex. First, you need to log in to the service, then go through “Payment for services – Mobile phone”. Next, indicate your mobile phone number and write the top-up amount. You can confirm payment for cellular communications through a one-time code from an SMS message or through a notification in the mobile application. In this case, there is no commission fee, but when making payments through the Webmoney wallet, you will have to pay a 0.8% commission for each transaction.

You can quickly top up your balance through mobile applications of all the considered payment systems.

Ways to disable auto payment

Tinkoff Bank serves clients remotely using the Internet, since it does not have a network of stationary offices. Therefore, you can refuse Tinkoff auto payment remotely:

- call the support hotline and report your intention;

- go to your personal account and disable the service;

- use the mobile application and make the appropriate settings.

A personal visit to a bank office is not considered, since the three above methods allow you to quickly cancel an auto payment from Tikkoff. Next, it is worth considering each method in detail.

Call support

To get help from bank employees, you need to call the toll-free 24-hour support service number 8-800-555-10-10. A consultant will answer the call and explain the essence of the problem. Next, the bank employee will ask the client for some personal data (passport information, code word, etc.) and send a request to cancel the service. The service will be disabled in a matter of seconds.

Disabling Tinkoff Bank auto payment through your personal account

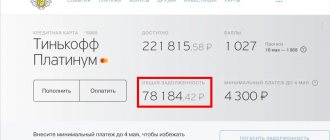

Tinkoff disabling auto payment

If you do not want to personally communicate with a bank specialist, but you need to understand how to disable the auto payment service from Tinkoff, you can use your personal account on the official website of the financial institution. To do this, a number of actions should be taken:

- log in to the Tinkoff Bank website by entering your cell phone number or login;

- click on the “Templates” section;

- all payments opposite which the letter “A” appears are automatic. You need to switch the button to the “Off” state. If necessary, you will need to confirm the action with a one-time code that will be sent to your mobile phone.

That's all that needed to be done. Thus, setting up auto payment from Tinkoff is very easy. You just need to switch the “On” and “Off” keys to the desired state and easily manage automatic payments for certain services.

Using the Mobile App

Before you disable Tinkoff autopayment using the mobile application, you will first need to download and install it. You need to go to the official Play Market or AppStore (depending on what operating system your smartphone/tablet is running on), download and open the utility.

Then you will need to register (if this has not been done previously on a stationary device) by entering your mobile number in the appropriate field. Next, an SMS message is sent to your phone with a code to confirm your account registration. For those who are already registered in Tinkoff Internet Banking, simply enter your login details.

The interface of the mobile application is absolutely identical to the PC version of the client’s personal account. Accordingly, the same steps must be taken to disable auto payment. You should go to the “Templates” section and switch those that are o to the “Off” state.

Cash

You can now pay in cash only in branded communication stores. Here you can pay for the services of absolutely any operator, including Tinkoff Mobile. To top up your account, just give your phone number and amount. But you need to remember that a number of communication shops charge a small commission for services, but, as a rule, it is not higher than 3%. Basically, the amount of the commission fee depends on the region and the company to which the salon belongs.

Via Tinkoff ATM

If you only have cash in your pocket and need to top up your Tinkoff Mobile account, then you can use any ATM of the bank of the same name. To do this, select “Pay – Mobile communications” at the ATM, and then deposit cash. Please note that the ATM cannot issue change, so the entire deposited amount is credited to the balance. ATMs from Tinkoff work with banknotes in denominations from 100 to 5 thousand rubles. In addition, currencies are accepted for payment - US dollars and euros, but only in denominations of 50 and 100.

After replenishing your mobile account through an ATM, it is recommended to take a receipt confirming the payment.

Via terminals

Payment terminals from different companies are installed in crowded areas. These could be metro stations, railway stations, supermarkets and shopping centers. Such terminals accept paper bills of various denominations and can be used to top up mobile devices.

To top up your Tinkoff Mobile account, select mobile payment in the menu, then enter your phone number and deposit the required amount into the bill acceptor. The deposited amount and the amount that will appear in the account after deducting the commission fee will appear on the screen. Depending on the type of terminal, the commission amount can vary from 3 to 10%.

Tinkoff Mobile subscribers can top up their accounts using terminals that are available in MegaFon, Beeline, Tele2 and MTS stores. In this case, a commission of 3-5% may be charged.

In Euroset and Svyaznoy stores

In dealer showrooms you can also pay for services, either in cash or with a bank card. To pay in cash, you need to go to the cashier, but remember that there may be a minimum amount limit.

For example, at the box office of Svyaznoy salons they often accept payments of only 300 rubles and no less. In addition, payment is possible using terminals, both using bank cards and cash.

Setting up auto payment

To set up auto payment, you need to go to the Tinkoff Mobile mobile application. In the main menu, select “More – Autopayment”. Enter the replenishment amount here; it will be automatically debited from the account after less than 50 rubles remain on the balance. Additionally, a fee will be debited from the bank card for the renewal of connected service packages.

You can pay for services using a Tinkoff Bank plastic card and plastic cards of other Russian banks. You can always, without any problems, change the payment amount if it seems too large. This will allow you to remember to replenish your phone in a timely manner, since replenishment will occur automatically.

Access point settings for traffic distribution

To start Internet distribution, you must activate the access point and create a password of at least 8 characters. The operator recommends using mixed-case characters in the password to increase data security. If desired, you can change the name of the access point to the SSID.

You can distribute Internet traffic without a password, but it is worth considering that in a crowded place the traffic will be greatly consumed. That is, in fact, anyone nearby can connect to the mobile Internet without any problems.

It is quite convenient if the access point activation button is placed on the top control panel of the smartphone. But this is not possible on all models of mobile devices, it all depends on the manufacturer.

To make access really fast, you can install a special “WiFi Hotspot” application.

The shortcut is placed on one of the desktops of the mobile device, which allows you to almost instantly turn on the access point. This application weighs very little, so the smartphone’s memory is not overloaded.

Limits on replenishment of Tinkoff Mobile

Tinkoff Mobile has a limit for replenishing a mobile account; it is 15 thousand rubles per month. The operator does not specify daily limits. In addition, limits can be set in payment systems that are used to replenish your account. For example, you can top up your phone through the Webmoney service with no more than 6 thousand rubles per day, although the site itself indicates a limit of 15,000 rubles.

Of all the available methods for replenishing a Tinkoff Mobile mobile account, we can highlight the most practical:

- Using a mobile application and a bank card attached to the number;

- Through Tinkoff banking and a special Sberbank-Online application;

- Using a universal form of payment, which is available on the Tinkoff website.

However, according to user reviews, it is most convenient to use automatic payment. This service allows you to forget about replenishing your mobile account. When the balance reaches less than 50 rubles, the account is replenished automatically. Activating this service will not take much time. In the mobile application, you just need to activate the slider next to the option, enter the card number and payment amount.

0 0 Votes

Article rating

Disadvantages of promised payment

This service has certain disadvantages:

- The presence of a commission means you will have to return more than you took. Almost like being in a bank;

- To activate the payment, you must meet certain requirements - have no debts on other personal accounts, have been serviced by the operator for more than two months;

- Amount limit – it depends on monthly spending. The more you spend, the higher the payment amount (and the higher the commission);

- As a rule, you cannot take one payment while another is active;

- Trust payment causes confusion, because the subscriber has to repay the debt and pay a commission, and then top up his account - there is a feeling of overpayment.

Moreover, there is only one plus - the ability to replenish your account when there are no funds or opportunities to replenish it at hand.

Useful tips

To install applications, use only licensed programs. Fraudsters can use the “gray” extension to gain access to other people’s finances.

- Hide the card in a special case that does not transmit radio signals.

- Check your transaction history at the end of the day. There are repeated withdrawals due to a system failure. Report each case and demand the return of excess funds withdrawn.

- Do not bend or wet the card.

- Lock the plastic immediately if lost.

Tinkoff NFC ring

In addition to cards and payment by phone, Tinkoff will soon be able to offer an NFS ring. This accessory can also help make payments.

In appearance, the product will be no different from similar products from competing banks. It will be made of ceramics and tungsten for strength. The design can be classic or have some patterns.

An NFS chip will be placed inside the ring. It will allow you to make contactless payments. To conduct a transaction, the user will simply need to bring the ring closer to the terminal.

Attention! NFS bracelets will soon become available.

If the payment is not credited

For those clients of a financial structure who often top up their mobile balance, a system such as automatic payment is provided. In your personal account, you can set up a payment template. In this case, funds will be transferred to the specified number automatically.

Template payment options:

- Setting the amount that will be transferred from plastic to mobile.

- Setting a minimum balance or a specific date at which a transaction will be carried out.

- Selecting a current account or plastic card as a payment instrument.

In the menu we find the “Set up auto payment” section, set the payment criteria and create a template. In order not to get confused, we give a name to the auto payment, which will be visible only to the account owner.

Sometimes situations arise when the client put money on the phone, but it did not arrive. There are several options why such situations occur:

- Due to the load on the operator's server, the payment message does not arrive on time.

- The problem arose on the bank's side, in this case you just need to wait a little.

- An incorrect number was specified for crediting funds.

It is worth saving the receipt every time after payment. When paying through an ATM, you must always print a receipt. It will come in handy if money was sent to the wrong number. You can call the VTB hotline and find out the status of the payment.

If you enter an incorrect number, you must provide a photo or screenshot of the receipt. Most likely, the payment will be canceled and the money will be returned to your account.

Based on the above, there are many ways to transfer money from VTB to your phone. When choosing any method, the bank does not charge a commission. The most convenient way for bank clients to transfer money is through a mobile application. It does not require transaction confirmation via SMS.

How to use correctly

To pay for a purchase through Android Pay Tinkoff, you don’t have to look for an Internet connection. The user only needs to follow the instructions:

- Turn on your smartphone.

- Click on the bank application icon.

- Click on contactless payment.

- Log in (enter password).

- Bring your phone to the terminal.

- Wait until the transaction is completed.

Attention! You don’t have to worry about the security of funds in your account. No card information is displayed to the seller.

Contactless cards

The progressive payments system announced itself even earlier than communicators with contactless debit and credit cards. The buyer does not need to enter an access code or place a facsimile for amounts exceeding the permitted amounts.

Contactless plastic with PayWave and PayPass technologies is produced. The functional properties of the two methods are almost no different.

PayWave

It is affiliated with Visa and makes contactless payments. The Visa payWave card is not inserted into the terminal, but rather applied to it. The version is supported by the worldwide EMV standard.

PayPass

The project, similar to Visa, introduces MasterCard Contactless technology. It is implemented using technology that supports contactless payments of various systems.

Pros and cons of contactless payment using a Tinkoff card

The innovative payment method not only looks impressive, but has a lot of positive aspects:

- record speed;

- PIN code is not entered (up to 1000 ₽):

- application in terminals and machines;

- worldwide geography of reception;

- free service.

In the near future, contactless equipment will be included in every retail outlet. So far, innovative payment is exotic, and there are very few terminals. This is a big minus at this time.

Disadvantages of the system include the unpredictability of technology: the device may run out of power and the Internet may be disconnected. The gadget must be prepared in advance for the procedure: open, unlock, enter a PIN code for a large purchase.

Review analysis

Young people enthusiastically perceive new technologies and strive to pay for their communicators in sports clubs, bars, and cafes.

Some users express dissatisfaction with the limit, which can be written off without entering a password. Others complain about technical support. She does not always respond competently to a signal for help. There are concerns about the protection of funds and information leakage.

On social networks and forums, people are generally positive about the contactless payment method.

Safety in use

The project complies with safety standards accepted by the international community:

- The devices use a virtual account that is not stored on the device. This ensures complete confidentiality of the transaction.

- The signal cannot be intercepted, since the module only responds at close range.

- The payment instrument remains in the hands of the user and is not handed over to the cashier.

- The terminal immediately turns off after the sound signal, so funds will not be debited twice for one service.

- Each transaction is equipped with a password issued at a certain point for a specific product.

- The devices do not contain financial information or information about the holder’s personal data.