If there is insufficient funds on their phone account, subscribers can borrow money from Tele2 and continue communicating with family and friends. A quick loan is provided by the provider if certain conditions are met. Tele2 gives its subscribers the opportunity to quickly top up their phone account without leaving home. In this case, it is necessary to repay the borrowed funds in a timely manner and in full.

Requirements for borrowing money on Tele2

To determine how a subscriber can get Internet, free minutes and SMS from Tele2, you can consider the conditions from the provider. The loan can be obtained by using it if important conditions of the operator are met.

It is possible to apply for borrowed funds on Tele2 remotely, without concluding a contractual relationship. The client is provided with a one-time service of obtaining such an option. For a one-time loan of funds, you will not need to enable or disable the tariff. The amount of the amount can be selected through a Tele2 service employee.

If a subscriber wishes to issue a trust payment in an automated mode, he should set the settings in his personal account after the registration procedure on the website.

Disconnection methods

To find out how about subscribers on Tele2, you should take into account that refusal is possible only with a positive balance. In addition to deactivation, the subscriber has the right to prohibit the activation of credit in the future on his tariff plan. This is relevant if a child uses the SIM card.

Personal Area

Registration steps are required for remote deactivation in the web account. After logging into your profile you must:

- Find the “Connected Services” tab.

- Select the subsection “Prohibition of receiving “Top up my account””.

- Click on the “Disable” button.

If the operation was successful, the user will receive an SMS notification.

Technical support or service center

Employees of support centers will help you turn off “Delayed payment” by calling the following numbers: 8-951-520-06-11 or 611. The call is free. After the operator answers the call, he will ask several personal questions to make sure that the caller is the owner of the number and will bar the system himself. There is no fee for canceling an activated service. The user pays only for using the option when credit funds are credited. Commission is 10%.

You can also remove your subscription in the Tele2 communication salon. The location of Tele2 branches can be found on the office map.

How to borrow funds on Tele2 with a zero balance?

Special instructions will help resolve this issue. You can view it in your personal account. The borrower must meet certain requirements.

The funds limit can only be provided to those people who have a Tele2 SIM card and have been using it for more than 2 months. The subscriber has the right to spend money for various purposes; it is only important to return it at the right time. You can re-borrow a cash limit after paying off the previous loan.

Important! In case of systematic violation of payment terms, the provider has the right to block the possibility of taking out a loan on this number.

Only carriers of federal license plates are entitled to receive a loan. Subscribers of corporate networks, as well as landline telephones Corporate clients and direct landline numbers operate only on a prepaid basis and cannot accumulate debts.

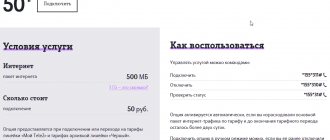

The user can take an amount in the amount of: 50, 100, 200 or 300 rubles. At the same time, a commission fee for this service is charged depending on the loan amount. The user must return the due amount within 3 days.

The “Promised Payment +” tariff has different conditions. The difference will be in the loan amount and commissions.

What is it for

Currently, services of mobile operators are especially popular, which allow you to continue using cellular communications even with a zero or negative balance. When, for various reasons, it is not possible to immediately top up the subscriber’s balance, “Promised Payment” comes to the rescue - a service that allows you to borrow funds from the Tele2 operator, credited to the subscriber’s number, for a certain period.

The borrowed amount of funds will be debited from the subscriber's account a few days after crediting. Re-use of the service will be possible only after repayment of the loan no earlier than one day later.

Terms of debt repayment

Unfortunately, not all users can receive a Tele2 trust loan. Limitations relate to the amount of the loan and the period for its repayment. During the first two months of use, subscribers are not able to activate this function. After this period, the client can use the loan, but in a minimum amount.

Before you disable or enable the promised loan function, you need to know how you can borrow money from the provider. Let's consider the main conditions of this procedure:

- Subscribers who are in cooperation with the company for a period of at least 60 calendar days can borrow an amount of 50 rubles.

- When using Tele2 communications for more than 4 months, a subscriber can count on a loan ranging from 100 to 300 rubles.

- Funds are provided to subscribers within 24 hours a day. This applies even to those users who are abroad.

Features and Specifications

The most important feature of using this card is the bonus system. When making purchases in Tele 2 stores, or when replenishing a mobile number, bonuses of 3% are awarded. Interest is charged on the entire purchase, but it is only 1%.

The bonuses accumulated during the use of the card can be spent in one of two ways:

- Make a purchase in Tel 2;

- Top up your phone account from this operator.

The main advantages of receiving a microloan are as follows:

- A user who has run out of funds on a mobile number has the opportunity to stay in touch. He is provided with making calls to subscribers of all operators in an amount not exceeding the credit limit;

- Many options for obtaining a microloan. Subscribers are offered several options for obtaining a loan and everyone can choose the most suitable one for themselves;

- The operator immediately credits the funds. Therefore, the client will not have to experience inconvenience due to lack of communication.

In addition to the obvious advantages of receiving a microloan in, it will be useful for a subscriber planning to use the service to learn about the disadvantages:

- Microcredit is offered only to residents of certain regions, so some residents will not be able to get a loan on the phone2;

- There is a certain commission charged for using funds;

- In case of non-payment, the subscriber's number will be blocked.

Other program conditions

A cash loan is available exclusively to the subscriber and not to third parties. Information on how to borrow money to use communication services can be obtained by persons who have a SIM card from the Tele2 provider. At the same time, it must be obtained in the official showroom of the operator, or from intermediaries with accreditation in this field.

In case of refusal to provide money, the user can clarify the reason for such a decision with the auto-informer. The subscriber's request does not involve charging commissions, or debiting minutes or Internet access.

What is the permissible loan amount?

There is no fixed loan size. It is determined automatically, and it takes into account what region the client lives in, how long he has been using the services of this operator and how active he is. Naturally, the longer and more actively you use the services of Tele 2, the more trust you have, and, as a result, the loan size may be higher. In order to find out exactly about this option specifically for you, call the service number 655 or 637, and all your questions will be answered. The call is free.

Instructions for obtaining a loan

The step-by-step instructions describe how to take out a loan in the amount of 50 rubles on Tele2. The sequence of actions is the same, regardless of the tariff plan.

Step-by-step algorithm:

- On your phone you should dial *122#.

- After selecting the desired amount to borrow, the subscriber confirms it with a response in the form of an SMS message with a number related to a certain monetary value.

After this, the account balance will decrease by 10% of the amount of funds that the user borrowed from the provider. The person will receive an amount of money reduced by the commission amount to their phone account.

Knowing how to ask for minutes on credit on Tele2, it is important to remember a simple rule: if there is no payment from the user on the account, the phone number becomes temporarily blocked.

Now you know, to borrow money, you just need to dial *122#. In the smartphone window that appears, information will appear with possible amounts and the commissions provided for each of them.

In addition, Tele2 customers can use the “Promised Payment+” tariff. To receive it, you need to send + to number 315. In automatic mode, the system itself will calculate the largest loan amount. After this, the user will receive an SMS message with information about the amount issued and the period within which it must be returned. The subscriber can confirm the agreement to receive a loan by sending a response letter to the provider with certain information.

There is no need to disable this tariff, since it is presented once. Payments made automatically must be configured separately by the user. To do this, he needs to go to the official website of the Tele2 company and follow the specified steps according to the pop-up tips.

What conditions does a credit card loan on TELE 2 offer?

The most important advantage of the service is favorable conditions for use:

- Annual maintenance is only 590 rubles;

- The interest rate on the loan is 19.9%;

- 300 points for initial use;

- The maximum loan limit amount is as much as 300,000 rubles;

- There is no need to pay for card issue and registration;

- The interest-free period is a full 55 days!

The main advantage of the card is the long period of interest-free use. Therefore, it is possible to use the credit limit without paying interest. This will require replenishment of the account within the period specified in the terms of the agreement.

Receiving a card

The receiving process is quite simple and requires very little time. All you need to do is visit the official website. Then fill out the form and send it.

When filling out, the following information is required:

- Contact phone number (yours);

- Contact phone number (of one of the relatives);

- FULL NAME;

- Place of work;

- Loan amount;

- Passport details.

Plastic is provided at the nearest office.

If it is not possible to visit the branch, you can receive it by mail. You will need to write your residential address and the system will send you to the nearest point of inpatient service.

Deadlines for providing funds

The periods for which you can borrow money may vary. It all depends on the amount borrowed:

- 50 rubles – period 3 days, commission fee will be 5 rubles.

- 100 rubles – term 3 days, commission amount – 10 rubles.

- 200 rubles – duration 5 days, commission – 20 rubles.

- 300 rubles in debt - period for 7 days, commission amount - 30 rubles.

When using, the subscriber must take care of returning the entire amount of the debt, including commissions. You can top up your account using any of the convenient methods offered by the telecom operator Tele2.

The user can receive a second loan for communication purposes only 24 hours after paying off the previous loan.

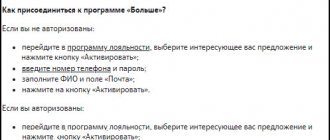

How to activate auto payment on Tele2?

In order to promptly close a previously taken out loan from a provider, it is important to know how to use the auto payment option.

First you need to go to the website autopay.tele2.ru and log into your registered account. Next, go to the “New auto payment” section. You need to fill in the active lines in it:

- The subscriber's active phone number to which the payment will be credited.

- Type of auto payment (depends on the final amount of money in the account).

- Set a threshold balance value at which funds in a certain amount will be withdrawn from the user’s card account.

- Set the size for the transfer (minimum value - 50 rubles, maximum - 1000 rubles).

- Define a limit on automatic replenishment of funds during the month (if it is reached, the option is suspended for a certain time).

Next, the user must check the correctness of the filled-in information, then proceed to enter personal card information. The service interacts with bank cards that support protection using an SMS password. To receive the information, you can call the customer support service of the bank that issued the card.

Important! When the service is activated, an amount ranging from 1 to 10 rubles is debited from the subscriber’s account. After a few minutes the funds are returned.