The success of a mobile operator now often depends not only on the communication services provided, but also on additional services. With the help of a mobile phone, a subscriber should be able to solve the maximum number of his problems. Beeline, being one of the largest cellular operators in Russia, keeps up with modern trends and allows its subscribers to transfer money from Beeline to a Sberbank card. It’s quite easy to top up a Sberbank card via Beeline. There are two different ways this can be done. The choice depends solely on the preferences and convenience of the client.

In addition, funds on your mobile phone balance can be spent on paying for services, tickets, or transferred to the balance of another mobile operator subscriber. However, in order to pay for services, for example, housing and communal services, you need to create a special advance account, while you can put money on a Sberbank card without this.

How to transfer money from Beeline to a card

To send money to a plastic medium, OSS Beeline offers clients three methods. Citizens using the company's services can transfer from mobile to card using the following methods:

- via the Internet, using remote access to the website of the communication service provider;

- sending an SMS message directly from the phone if there is no access to the Internet, and the deduction of funds needs to be made urgently;

- using the ussd command, an internal operator service, using the mobile portal.

Each method of sending funds requires careful compliance with the instructions of the telecom operator. Often you need to transfer money from Beeline to a Sberbank card, one of the largest and most extensive financial companies. The sender must know all the details of his account, carefully enter digital codes and letter messages so that the funds are not sent to another recipient, and monitor all stages of the transaction. Transferring money from Beeline to a Sberbank card will not take much time if you follow the rules for sending finances established by the operator.

- How to properly apply foundation on your face

- How to cook chickpeas at home

- How to lay tiles in the bathroom

By SMS

Payment via SMS allows you to use the service at any time, anywhere; you do not need an Internet connection to make it. It is enough to remember the number to which the message should be sent - 7878, and its contents:

Visa 4444555566667777 500

Where:

- 4444555566667777 is the card number;

- 500 – payment amount.

When entering the text of the message, you need to be careful; an error in the card number may lead to the money being sent to another recipient. After sending the message, an SMS will be sent to the subscriber’s phone with further instructions to confirm the payment. On average, funds arrive on the card within 5 minutes; in some cases, the transfer period can reach several days.

Conditions for transferring funds

All methods of sending funds from a Beeline OSS mobile device to a card account of Sberbank or another financial and credit organization imply compliance with certain restrictions imposed on the user of the services. To transfer money using the required details, you must meet the following conditions:

- Have a SIM card for this OSS.

- Perform transactions only for an account containing no more than 16 digits. If there are 18 or more of them, like Maestro’s social plastic media, then payments cannot be made in any of the 3 ways.

- Comply with the maximum and minimum contribution limits established by the OSS.

- Be prepared to pay a transaction fee.

- 12 reasons why grateful people live longer than others

- Reasons for a small pension with long working experience

- Lip tint - what is it?

Possible problems

During the process of transferring money, the client may encounter problems:

- The money did not arrive on the Sberbank card. The solution to this issue can be contacting the customer support service of Beeline and Sberbank. It is necessary to find out why the money is not yet available (the details for the transfer were entered incorrectly, the payment was not due, etc.).

- Another problem is that the payment cannot be completed, the money does not leave Beeline. The answer, most often, is that the client has reached the limit of allowed daily or monthly transfer transactions.

Note! If you have any problems, please report the problem to the operator. A timely request will help resolve any payment difficulties in the shortest possible time!

Every subscriber can transfer money to a Sberbank card from a Beeline operator account by performing basic steps. However, do not forget that such a service is not free. In addition, when sending money, it is important not to make a mistake in the details of the recipient of the funds. If the payment is sent to another person, it will no longer be possible to return the funds without the permission of the person to whom they were credited.

Limits and restrictions

The OSS sets restrictions on the transfer of money. The minimum amount to be transferred to the card per day is 50 rubles. The upper daily limit is 14 thousand rubles. You can make no more than 10 transactions per day. The total amount for them is also set at 14 thousand rubles. The weekly limit is 20 transfers. The total amount of transfers should be limited to 40 thousand rubles. No more than 50 money transfers are allowed per month. The upper monthly limit is limited to 50 thousand rubles.

Service cost

The use of this service itself is not paid for by the client. The mobile operator only charges a fee for the transaction itself.

The cost of the transaction directly depends on the amount of funds transferred. Transfers not exceeding 5,660 rubles are subject to a fixed payment amount (350 rubles). When transferring funds from 5,661 to 14,000 rubles, the commission is calculated at a percentage rate (5%).

| Established range (in rubles) | ||

| Commission charged (in rubles) | From | Up to (inclusive) |

| 50 | 10 | 250 |

| 70 | 250 | 730 |

| 95 | 730 | 1430 |

| 120 | 1430 | 1880 |

| 230 | 1880 | 3800 |

| 350 | 3800 | 5660 |

| 5 % | over 5661 | 14000 |

Transfer from Beeline to Sberbank card via SMS to short number 7878

To transfer funds to your own or someone else’s card, you must strictly follow the instructions of your cellular service provider. If there is no Internet, then you urgently need to transfer funds, then follow this template:

- Specify which payment system (hereinafter – PS) the card belongs to – Mastercard, Visa, Maestro.

- Dial sequentially, separated by a space, the system code, card account number and amount to be paid. For each PS, the operator has set its own codes - Mastercard - Master, Visa - Visa, Maestro - Maestro. If you do not know the recipient's plastic carrier system, you can type the word Card. The message should look something like this: Master 1234567891011346 1000.

- Send an SMS using the service number 7878.

- If everything is done correctly, you will receive a notification via SMS indicating the amount to be paid, the recipient's details and a request to enter a one-time code to confirm the transaction.

- After entering the digital code, the money will be sent to the recipient.

In what case will it not be possible to translate?

The payment can be completed successfully if the above conditions for the number of transactions per day, week, month are fully met. The transaction amount and number of transactions cannot be higher than those set by the operator. Otherwise, the payment will be rejected and the money will not be debited from the account.

The recipient's card must be active, opened in national currency. If the transfer is made through your personal account, the system will immediately notify the user of the error. You need to be careful when paying for services via SMS; one of the most common mistakes made by users is that after sending a message with the card number and amount, some do not wait for the confirmation SMS with the password, which may not arrive due to technical reasons. Without confirming the payment with a password and a message that the payment was successful, the money will not be transferred.

Many Russian operators offer money transfer services, including Beeline. The provider's subscribers have the opportunity to make a transfer from a mobile phone account to a bank card if there is a surplus of funds on the balance. The procedure is very simple and takes minimal time.

Internet payment on the official Beeline website

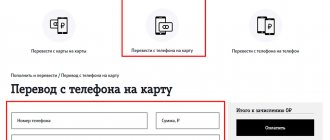

You can use the option of remote money deductions. The service is provided to owners of a SIM card of this OSS, regardless of whether they are authorized in their Personal Account on the company’s official website. To make a payment this way, follow these instructions:

- Go to the official Beeline page.

- Click the transfer button from the site and follow the link.

- In the window that opens, enter the details of the recipient's card account, the number of your own mobile device, and the amount you want to send.

- After the commission is automatically calculated, confirm your agreement with the amount of deductions by clicking on the payment button.

- An SMS notification about the upcoming deduction will be sent to your phone asking you to confirm the transaction.

- Send an SMS message to the specified number confirming the correctness of the actions.

- Wait for the automatic notification that the operation is complete.

Via SMS

You can transfer money from a SIM card to a Sberbank card using an SMS request:

- Open a new message on your phone.

- In the text box, enter the following command:

- card <card number> <amount>.

- All values are separated by spaces. For example, the message text might look like this:

- card 1234123412341234 2000.

- Send this SMS to number 7878.

The amount is indicated in rubles, as a whole number, without spaces or commas. For Maestro cards, the service is available only if their number consists of 16 digits (some cards of this system have an 18-digit number - the payment will not go through on them).

How to withdraw money from Beeline to a Sberbank card through a mobile portal

If you have a Beeline SIM card, you can try to make a payment through the mobile portal using the ussd service command. With such a transfer of money, the person receiving the amount decides where to send it - to a card account, bank account, telephone device number, or receive cash. To use this payment method, proceed as follows:

- Dial service code * 135#. The system will take you to the “Translations” menu.

- On the page that opens, enter the number of the recipient's telephone device and the required amount for transfer.

- When choosing a payment method, click the “From Mobile Phone” button. You will receive a notification that the funds have been sent.

- The recipient will receive an SMS message about the received money, select the method of depositing funds - bank account, card account, phone balance - and use the money.

Is it possible to transfer funds without commission?

Unfortunately, this is not possible with self-translation. The operator will withdraw the interest due to him in any case.

But there is still a way not to give Beeline money. To do this, you need to contact the mobile operator’s office directly and either permanently terminate the contract with it (in this case, you will have to be left without a phone, so it’s suitable for those who no longer need a Beeline ), or write an application for a refund of funds credited to the account by mistake.

In this case, you can get money at the office cash desk or ask for a free transfer to another phone number or bank card.

How much will it cost

Of course, it is not profitable for the operator to conduct transactions on a charitable basis; he receives his profit from transfers thanks to the commission:

| Translation costing less than 1000 rubles | In the amount of more than a thousand rubles |

| The commission is 50 rubles | 5.95% + top 10 rubles |

It is important to consider here that if you transfer to bank accounts, it will be much more profitable - 2.99% of the total transfer amount. Therefore, if a large payment is being transferred, it makes sense to find out the account number and transfer funds to it.