Sometimes the money on your phone runs out unexpectedly, or it turns out to be insufficient for the monthly tariff payment. A negative balance completely blocks everything, preventing you from even making a call. In a critical situation, this would be a serious miscalculation. The “Express Money” option will come to the rescue. This is the provision of funds to subscribers from microfinance organizations.

At MTS, the conditions for using services are flexible. Many subscribers have been clients of the company for a long time. It is a giant in the communication services industry that has earned its reputation and has the ability to assist customers.

Description of service

Before using the Express money service from MTS, you need to understand the features of the option. Its essence is simple. If at the time of the call there is insufficient amount in the user’s account, the system offers to top up the balance from 20 to 2600 rubles. The amount of payments and the amount to be refunded (including the commission payment) are indicated in the message with the service offer. To agree, you need to send “1” in the response message.

The service is available for tariff plans from the Cool group, but not basic (092013). In addition, there are limits on the fixed use of network capabilities. At the same time, to enable the Express money service on MTS, you do not have to be a corporate client.

The essence of the option is the same as when applying for a loan on a bank card; each user has his own credit limit. Taking into account existing restrictions, the company offers the subscriber an amount for the use of mobile communications, and the subscriber returns this debt to the company.

Which cards are suitable for obtaining a loan from an MFO?

Microloans are issued online to the card of any bank and any payment system. Lenders allow you to use any plastic card, as long as it is personal and has a positive balance.

✅ When applying for a loan on an MTS card online, the application is approved in 90-95% of cases.

Attention! The following types of cards are not suitable for obtaining a microloan: “Virtual”, “Gift”, “Student”, “MTS Money Deposit” and any types of credit cards.

How to use an express loan

To use the option, you need to understand how to get express money on MTS. The action algorithm is as follows:

- Receiving a notification to the subscriber's number with a request to deposit funds into the account.

- If the funds in the account are less than zero, the company sends an offer to order the required amount.

- The message contains information about the creditor (telephone number and Internet resource).

- Providing options with the replenishment amount.

- Indicate the number of the lender whose amount you are most interested in.

After two to three hours, information about the status of processing the request is sent to your phone. If the client has fulfilled all the requirements, the answer will be yes. Funds are issued in national currency (rubles).

Before connecting MTS Express Money, it is important to consider additional costs. In particular, the user is charged a commission of 30%. The exact amount of the commission payment is indicated in the message inviting you to use the option. The latter can be provided in two qualities - as a debt limit or a loan.

Many people ask how to disable the Express Money service on MTS. This action is not necessary. There is no automatic accrual of funds, therefore, if you have applied for and used a loan once, there will be no prolongation. Therefore, there is no need to disable the option.

Free options

You can use communication services even with a minus balance. To do this, the operator offers to activate services that allow you to not interrupt communication. Their connection is free, and the subscriber does not have any debt obligations to the mobile operator.

Help me out

The service involves a client in debt making calls and SMS at the expense of another user. For a client with a negative balance, the call will be free. The “Help Out” option does not require additional activation. To communicate with others, you must dial the correct number.

| SMS message | 5880[subscriber number] |

| Call | Call 0880 and dial the 10-digit phone number |

| 0880[subscriber number] call button |

In international roaming, the SIM owner, wishing to contact the user at his expense, must dial: *880*[number of the called user]#call key.

The subscriber who receives such calls should not worry: if he does not want to receive the message or call, then he can reject it. If you agree, a connection is established, and the called person pays for the conversation according to the terms of his tariff plan. has features:

- When the called user is out of range, he will receive a message asking him to contact the subscriber. The number of such SMS is limited: no more than 10 per day.

- The client can create a black and white list of numbers as part of the service. This allows you to control the number of calls made at your own expense and weed out unwanted contacts. To connect, use the command *111*785#.

- The option can be disabled if it is necessary to prohibit receiving calls from users.

call me back

The service is active if the subscriber has a negative balance. The client can contact absolutely any mobile communications user in Russia. The essence of the option is that the phone of the person being called will display information about the missed call. The request is formed as follows: *110*number of the called user*#call key.

The use of the service is limited to no more than 5 calls per day. If the user is unavailable, then later he will receive a message asking him to call back.

Top up my account

If it is impossible to deposit into the account in the near future, the subscriber may ask to borrow money from another mobile user. The client should be notified as follows: *116* subscriber number # call key. Or by requesting *111*7#call key.

An SMS will be sent to the number specified in the request with a request to top up the balance. The user can deposit money into the account:

- in MTS showrooms and centers;

- using special payment cards.

The option does not require activation or payment for connection. All clients can use it, even those who are roaming. There is a limit for the service - no more than 5 notifications per day.

Conditions of receipt

When registering for the Express Money online service from MTS, you must take into account a number of requirements for subscribers.

Conditions:

- The client is an individual.

- A valid contract for communication services for 30 days or more (counting from the date of conclusion).

- Active use of the tariff plan.

- No debts during use. So, do not forget to find out about any debts on your personal account before doing this.

- Reliable personal data.

- The rate is not corporate. Exception, tariff plans Cool, fixed line or Basic 092013.

- There is no prohibition on returning part of the advance.

- There is no prohibition on transferring personal data to third parties.

- No financial block.

- There is no ban on issuing microloans.

To receive Express Money on MTS on your phone, you need to take these requirements into account, and they must be met.

Where are microloans issued on MTS Bank cards?

To get a loan on an MTS Bank card without refusal, you should contact any microfinance organization that operates online. A complete list of such services is presented in our catalog.

Often, microfinance organizations provide microloans for up to 30 days, and the available amount for new clients is up to 15,000 rubles. The interest rate is calculated individually, but not more than 1% of the total loan amount. For the first time, clients of many services have access to an interest-free loan for 3 to 10 days of use.

✔️ This loan option frees the user from collecting documents and does not oblige him to indicate his place of work, take a certificate of income or look for guarantors.

An instant loan from MTS Bank is issued if you have one document - a passport of a Russian citizen.

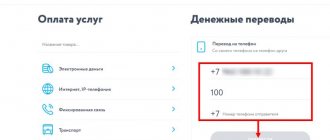

How to return funds

The next question that is relevant for debtors is how to pay off the debt via Express Money on MTS. Funds are automatically debited when you top up your account using any convenient method. In this case, a fee for services is taken first, and then the debt is repaid. There are two options here:

- Partial write-off. This is relevant when the money received into the account covers debts and fees for transferring funds.

- Complete write-off. Occurs in a situation where the received money is enough to pay off the debt and the transfer fee for the Express Money service.

Payment of debt under the Express Money instrument occurs using the MTS-Money Wallet service. In case of partial or full payment, an SMS is sent with transaction data.

To find out how much debt you have on your MTS account via Express Money, send an SMS with the text info to the short number 1976.

Subscriber capabilities at zero

The MTS operator has developed a whole system of opportunities with a zero balance. Subscribers have access to a wide range of options related to both temporary debt liquidation and communication when there is a minus on the account.

| Function | Option name |

| Help in replenishing your balance | With full trust |

| Promised payment | |

| Express money | |

| Free services to communicate with users | Help me out |

| call me back | |

| Top up my account | |

| Positive zero |

With such options, owners of MTS SIM cards can freely use the offers of the cellular operator and be in touch with the latest events.

Which companies does the service work with?

Many questions concern credit institutions with which MTS cooperates. Money is issued by many microfinance organizations that are reliable partners and have proven themselves to be excellent. Funds are transferred to the subscriber's specified account or balance in the form of a loan or debt limit. All transactions are carried out within the legal requirements. The interaction of the parties takes place on the basis of an agreement, which is formed automatically after a decision is made by the subscriber.

As a rule, Express Money from MTS is issued through Mig Credit LLC or Simberella LLC. Both companies conduct financial transactions and offer loans to Russian citizens at low interest rates. One of the additional areas is credit for mobile subscribers.

Data on the microfinance organization is sent to the client in a message when selecting an option. As already noted, transactions go through MTS Bank with a commission of 30% of the loan amount. You can control information on the Express Money service in your MTS personal account.

Requirements for borrowers

If you need to apply for a loan on an MTS Bank card, keep in mind that companies impose certain conditions on the borrower. By complying with all the requirements, you can easily apply for a microloan with a transfer to the card urgently and without refusals. ⬇️

| Recipient's age | List of documents | Registration | Required condition |

| From 18 to 70 years. | Passport is the main one. Additionally, you may need SNILS, INN, driver's license or international passport (optional). | Need it, permanent or temporary? | Card loans are issued only if there is a stable source of income. |

A detailed list of requirements is established depending on the operating rules of a particular company. Before submitting an application, we recommend that you familiarize yourself with the terms and conditions of the selected organization on its official website or in our loan catalogue.

Reviews

Despite the popularity of the service, there are not many reviews about it on the Internet yet. They are mainly found on forums and in comments on interest-related sites, where users consider the possibilities of certain options.

Let's highlight the advantages that users highlight in their reviews:

- Quickly receive funds into your account.

- Minimum requirements to receive the service.

- Cooperation with reliable microfinance organizations.

- Lack of bureaucratic red tape.

Minuses:

- High commission.

- Not available on all plans.

Methods of issuing money and paying debt

There are several ways to obtain a loan remotely:

- To a personalized Visa, MIR or MasterCard card with the owner’s name and secret code. You can get a loan on a Sberbank card at any microfinance organization - almost every company issues money this way.

- Transferring funds to a Yandex.Money or Qiwi e-wallet.

- According to the details of the recipient's current account.

- Loan money can be obtained in cash at the office or delivered to your home.

- Transfer using the “Golden Crown” or “Contact” system.

☑️ You can return the microloan using the same methods that are available for receiving funds. The deadline for transferring money occurs instantly, for example, through the Sberbank Online application, or within 3-5 business days. To avoid delays, we advise you to make loan payments in advance.

What can be replaced

If for some reason you are not satisfied with the Express Money option from MTS, you can use other options. In particular, MTS offers a promised payment option, which can be received with a balance of at least -300 rubles. The money spent must be returned within three days, otherwise the funds will be blocked. The maximum limit is 1000 rubles. Connection is possible in several ways:

- My MTS application;

- Personal Area;

- sending command *111*123#;

- free call 1113.

The loan period is 72 hours. When receiving up to RUR 30, no additional fee will be charged. In other cases, you will have to pay a commission.

Clients do not have to borrow the required amount. All you need to do is call at the expense of another subscriber. In this case, you need to dial 0880 (subscriber number, 10 characters), and then click on the Call item. Alternatively, you can dial 0880, wait for the informant to contact you, and then enter the sponsor’s phone number. No more than 10 calls or SMS are allowed per day.

The option considered is very convenient, so it is in demand.

So, to disable Express Money on MTS, you do not need to dial 1976, because there is automatic prolongation. Providing funds without the client’s knowledge is also impossible, which eliminates risks. Everyone decides for himself whether he needs a loan on such terms or not. If our article helped you, please like it!

Option “In full confidence”

The good thing about this feature is that the user does not need to constantly monitor the balance on the phone. Upon activation, the client will not be blocked if the account runs out of funds. The main thing is that there is no minus of more than 300 rubles. The client will be able to pay for mobile services once a month without worrying about being disconnected due to missed deadlines for returning money borrowed from MTS.

The company provides regular subscribers with a pleasant bonus: after 3 months of using the function, the limit increases by 20%. Connecting the option does not require payment, just like using it. The service is activated in three ways:

- Make a request *111*32#.

- Log in to My MTS, go to the “Invoice and Payment” section, click “Zero Opportunities” and select the option.

- Virtually through your personal account.

Unlike the promised payment, the function does not involve the withdrawal of any commissions. When an invoice issued by a company is not paid on time, the operator has the right to reduce the monetary limit if the balance is negative. Therefore, the user needs to occasionally monitor the formation of debt using the *132# command. To top up your account, you can use any of the possible methods.

The good news for the client is that 120 bonus points will be added to the account. They can be exchanged for additional minutes or other bonuses at your discretion.

Who can use

Not everyone is given credit for mobile communications. It is possible to receive funds if you:

- subscriber of a tariff plan from the Cool line;

- necessarily not a corporate client;

- use the number for at least 120 days;

- during this time the number was not blocked;

- no other debts;

- “On full confidence” or “Promised payment” options are not active.

If registered clients fulfill the conditions, the company will review and give a positive response to the loan.