If you forget to top up your balance or simply don’t have time for it, Beeline is for you. After connecting this function, money will automatically be credited to your account, and you will not be left without a penny at the wrong time. There are several ways to manage the option. We have collected all the necessary information about the service in one article.

Description of the Autopayment service

Paying a bill in cash is gradually being replaced by non-cash replenishment methods, since the latter method is more convenient and faster than the first. Most telecom operators offer their customers to use the auto-payment service, which will allow them not to be distracted by transferring funds from their account to their phone number. Payment will be made according to a pre-arranged scheme.

The option is free and available to all users. It is available throughout the Russian Federation.

Replenishment is made in one of the following ways:

- on the specified day, the system requests the replenishment of funds from the specified account;

- money is transferred when the mobile account balance reaches below the established threshold (for a prepaid system).

The threshold is set by the subscriber independently. You can also set the amount that will be transferred.

Connection methods

works with a large number of banks and other financial organizations. They are included in the list of partners. The user will not be able to use the service if the bank servicing his account is not on the list.

To use the auto payment option, do the following:

- Bank account;

- online wallet.

We present the most famous Beeline partners throughout Russia:

- Russian Standard Bank;

- Sberbank;

- Bank of Moscow;

- Alfa Bank;

- WebMoney;

- Yandex money;

- Raiffeisenbank;

- Corn map.

The option is also available for those subscribers who pay based on the results of using the number per month. The amount is set by the operator and automatically debited. There is no need to set a monetary limit.

In order to activate the service, you must notify the financial institution about this. It is she who will automatically give the go-ahead for the transfer of the set amount from the account each time until the user disables the auto-payment service from a bank card or wallet.

- “Autopayment” on Tele2: how to activate and deactivate the service?

Via Personal Account

How to disable “Autopayment” from a bank card via Beeline Personal Account:

- Go to the official website of the operator using the link https://beeline.ru.

- Find the “Personal Account” button at the top of the page.

- Log in to the online system using your username and password.

- Go to the "Connected services" section.

- Find "AutoPay".

- Deactivate the service.

You can also refuse the service in the Beeline mobile application. The algorithm of actions in this case is exactly the same. The only exception is that the authorization process is completed only once. Afterwards, a password or fingerprint identification is used to enter the application.

Options for tracking unintentional spending

- The bank manages the auto payment. Beeline responds by offering Autopayment. The concepts are equivalent, but the places where options are controlled differ. Autopayment is activated using the bank’s services; autopayment is enabled using Beeline means:

- Personal account my.beeline.ru (Menu → Payment and finance → Autopayment). Alternative way: Menu → Payment and finance → Top up your account.

- Application (Menu → Finance → Payment tab → Autopay).

- USSD *114#, disable options: No secret code: *114*0#

- *114*0*secret_code#

detailed instructions

Using your personal account my.beeline.ru.

Service activation

During the process, the bank threatened to withdraw 10 rubles, but in reality the account remained the same. Perhaps later...

- Fill in the fields (card number, expiration date, mailbox).

- Press the yellow button.

- The bank page will open: Beeline checks liquidity.

- Enter the received SMS (phone number linked by the card issuing bank).

- The card is connected.

Secret code

After activation, Beeline will send a secret code. Remember the numbers, otherwise the reverse process (unlinking) will become much more complicated. You'll have to visit the office.

Deactivation

- After visiting your personal account my.beeline., follow the paths indicated above (equivalent).

- Click Change settings→ Unlink card.

- You will need a secret code (see above).

- Enter the numbers, press the yellow button.

- Ready!

How to activate “Autopayment” on Beeline?

You can activate AutoPay in several ways:

- Through your personal account or application;

- By calling the special support number – 0611;

- By contacting specialists in the departments;

- By visiting branches of Beeline partner banks.

In order to activate the option through your personal account and link your bank card to your cell phone there, you must register. After you have registered, you need to log into your personal account, go to the “Payment and Finance” section, then “My linked cards” and link your bank card.

- Termination of an agreement with Beeline: how to refuse mobile services, home Internet or TV?

To link, you must enter the card number, its validity period - up to: month, year and other data. Then save all changes.

Please note that only individuals who hold VISA, MasterCard or Maestro cards issued by Russian banks can activate the service.

To complete the procedure, you will need to enter the 6-digit SMS code received on your mobile phone. In this case, the amount of 10 rubles will be written off. and it will be immediately transferred to your mobile balance.

After linking the card, you will receive an SMS message with a 4-digit code - it will serve as confirmation when performing certain autopayment transactions.

Connect Sberbank auto payment in Sberbank branches

Using the help of a bank employee is the most reliable option. The specialist will definitely do everything correctly, and there will be no problems with making automatic payments.

At the bank branch, you need to contact the employee responsible for connecting autopayment. He will tell you in detail about the procedure for transferring money and other capabilities of the service, and will help you connect the service. Help from a banking specialist is free. The client only needs to provide his bank card and provide the mobile number associated with it.

Autopayment from Sberbank is a convenient, popular service that can be activated in a variety of simple ways. It is enough to issue a payment template once to automatically pay for mobile and Internet communications and other services that require monthly pricing.

Description

Do you often forget to top up your balance in advance and let yourself down? Beeline, together with its partner banks, offers you an excellent way out of this situation - connection. With this option, you no longer need to think about how much money is left on your phone, because the balance will be automatically topped up using your bank card.

The principle of operation of this service is simple: as soon as your balance falls below a certain minimum, the service automatically transfers funds from your bank card to your phone.

The convenience of automatic payment using a bank card is:

- Efficiency. Your balance will never go negative, as it is replenished automatically;

- Availability. Connecting this option does not require any connection costs, even if you are roaming;

- Flexibility. The service properties can be configured based on your personal communication costs;

- Versatility. This service can be connected to 10 numbers, as well as to pay for television and the Internet;

- Security. Every transaction is securely protected because it is carefully encrypted. No information becomes available to third parties.

Via Internet Banking

Let's look at the example of Internet banking from Sberbank:

- Open the Sberbank website.

- Find the Personal Account button.

- Log in using the ID and password received in the terminal.

- Go to the "Manage Payments" section.

- Find the service you require.

- Click the "Operations" field.

- Click Disable.

Afterwards, all you have to do is confirm the deactivation of the option. The service will cease to operate on the same day. A similar operation can also be performed:

- through a payment terminal;

- in the mobile application;

- at a bank branch.

Attention! If you deactivate via an ATM, you will need your card and PIN. If you want to turn off the service with the help of a bank employee, take your ID with you.

How to disable on Beeline

Don't need automatic top-ups yet? Then you just need to deactivate the option. To do this, do one of the following:

- Dial USSD combination *114# call button;

- Use the voice menu using the short digital combination 0533;

- Use an ATM.

Disconnections through personal accounts are carried out through the automatic payment menu (see the previous section on connection) according to the instructions provided by the site.

If you can use a terminal, follow these steps:

- Insert the card into the terminal;

- Find the section regarding auto payments and select Beeline;

- Click "Disable" in the menu that appears;

- Follow further instructions.

If these listed methods do not work for some reason, you can disable “Autopayment” on Beeline through the bank’s contact center. For example, call the Sberbank hotline 8 (800) 5555550 .

Disabling AutoPay

In the event that the template is no longer needed, it can be deactivated using any Sberbank remote service or directly at a bank branch.

Before disabling the Autopayment service for housing and communal services in Sberbank, you will need to go to the list of personal templates. From there, select the desired option and click “Disable.”

Quick access to the list of personal saves is as follows:

- in your Personal Account in “My Auto Payments”;

- through an ATM in the “Payments and transfers” section, and then - “Autopayments”;

- via Mobile Banking, send a message with the text: TEMPLATES to number 900. The response will contain a list of settings.

If it is not possible to use remote methods to disable autopayment, you can call the Contact Center for advice or personally visit a bank branch.

Methods for refusing services

If at some point you decide to unlink your phone from your bank card and disable the service, the company provides several ways to do this. This can be done either by phone or by using an ATM. The user just needs to choose the option that suits him best.

USSD Team

The easiest way to turn it off on your phone is to dial a special command. Just remember the combination *114# and press the call key. The service will be disabled automatically. It's quick and won't take much time.

You can also activate the service using a similar command. In principle, Beeline has ussd commands for almost all services and options. Combinations can be viewed on the official website.

Disconnection via Personal Account

If you have an authorized account on the official website, then there is nothing easier than logging into your Personal Account. Then you need to open the “Autopayments” tab and disable all services. This is a very convenient method, since it does not take much time and it is enough to have the Internet at hand.

If you have not logged in before, you can do so within a few minutes. You will receive a one-time password via SMS, which will help you log into your account.

Opt-out via SMS

“Autopayment” can also be disabled via SMS message. You need to type the word “AUTO PAYMENT” and send it to number 900. The service will be disabled automatically.

Call the customer support center

Another way is to call the customer support operator at 0611. In this case, a live person will explain everything to you in detail and, if desired, disable the annoying service. The only negative is that if the operators are busy, you will have to wait.

If you don’t like waiting and listening to the robot’s instructions, then this method will not suit you. At the same time, communication with a real person is much more reliable, which is what inclines many users towards this method.

If you prefer to communicate with live managers, then just grab your passport and go to any service center. There you will quickly be disconnected on Beeline. But without a document nothing will work.

You can also call the Sberbank call center. There's a phone for that. The operator there will also explain everything in detail, but you may need passport data or a control word from the card.

Canceling a service using an ATM or terminal

It's also quite a convenient way. First you need to insert the card into the ATM and go to the “Disable Auto Payments” tab. In this case, it is important to enter the phone number correctly in the window that opens and indicate the operator. The entire procedure requires confirmation by entering a PIN code.

The ATM is required to issue a receipt containing information about the service deactivation. If you haven’t received a check in your hand, it means you entered erroneous information, so the bank will not notify you about the disconnection. Disabling through an ATM takes a little longer than with other methods, but is also free and reliable.

Disconnection methods

As mentioned above, Beeline’s “Autopayment” option allows you to top up your phone balance using a bank card attached to your account. In today's review we will look at deactivation options using the example of a Sberbank card. However, using identical methods, you can disable autopayment on a phone with cards from any banks.

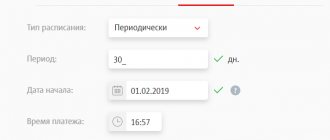

The principle of automatic replenishment is quite simple. After connecting the option, you just need to go to the program menu and set the desired settings. You can set a threshold amount at which your balance will be replenished independently. You also set the transfer amount from the card that should be credited.

When the amount in your account approaches the established mark, a certain amount of money will be credited from the attached card. For example, if you set a minimum threshold amount of 30 rubles, and the replenishment amount is 100 rubles, then each time your balance will be automatically replenished by 100 rubles when you reach the mobile threshold.

Of course, this service is quite convenient. After all, a subscriber who has activated it on his phone no longer needs to think about where and how to get money to top up his account or where to look for the nearest ATM. All transactions will be processed automatically.

Also, through this service, Beeline subscribers can transfer money to the phones of their friends and acquaintances. In total, up to 10 subscribers can be connected to the option. Every time before funds are credited to someone else’s phone, you will receive a notification, after confirmation of which the transaction will be considered completed.

You can link a bank card to your number at any Sberbank branch or on the Sberbank Online website. You can also connect to the system through your Beeline Personal Account or by sending a short USSD *114#.

And also one cannot fail to mention the rules and limits of the service. By the way, they will differ depending on how you linked your card to your phone.

For example, when connecting the option through your mobile operator (Beeline Personal Account, sending a system request), the conditions will be as follows:

- number of bank cards linked to the number – no more than 3;

- per year you can change (link) no more than 5 different cards;

- the maximum cash equivalent transferred per day should not exceed 1,500 rubles;

- The maximum amount transferred per month is 2,000 rubles.

If the service is activated through the banking system, the limits will be as follows:

- You can link up to 3 cards to one number;

- You can make up to 10 bindings per year;

- the maximum cash equivalent transferred per day is 10,000 rubles;

- You can make auto payments of no more than 15,000 rubles per month.

However, the system also has its significant disadvantage. An activated payment service does not allow you to save money. Since there is always money in the mobile account, users often spend more on mobile communications than they planned. That is why an increasing number of Beeline subscribers are deciding to disable autopayment.

You can deactivate the service in various ways:

- through the office;

- through Beeline Personal Account;

- by sending a system request;

- by calling the operator;

- through the bank's website;

- through a branch of a financial institution.

However, it is important to understand that deactivation must be done in the same way as it was connected to the number. That is, if activation took place through the office, then deactivation should be carried out there as well.

Disconnection through the office

All you need in this case is to come to the nearest bank branch and tell the employee your fin. institutions about their decision to remove the service. You need to have your passport and phone number with you, since after deactivating the function, your mobile device will receive an SMS notification that you will need to confirm.

In the same way as how to disable Beeline through a bank branch, you can order the service to be disabled by the permanent representative office of the television system itself.

Via Personal Account

If you do not know how to disable “Autopayment” in Beeline through your personal account, then the entire algorithm for deactivating the service is described below. In fact, everything here is simple and straightforward:

- log in to your page and go to the “Autopayments” section;

- Next, select the desired functionality from the list and uncheck “On”.

USSD request

You can also refuse the service by sending a special system request from your phone. To deactivate, dial the digital combination *141*10# on your mobile phone and press the call key. If the option is used on several mobile numbers at once, you will need to enter the number for which this option is no longer relevant. For example: *141*10*ХХХХХХХХХ# and the “Call” key.

Call to operator

To deactivate the automatic replenishment service through the telesystem service department, call 0611 and inform the manager of your decision. You must understand that in order to deactivate the service, the operator has the right to request personal data and payment details from you. It may also ask for the code word you came up with when registering in the system. Therefore, even before making a call, all the necessary data should be at your fingertips.

Via Internet Banking

“Autopayment” Beeline with a linked Sberbank bank card can be turned off through the Sberbank Online website.

To do this, log in to the system and go to your website. Select “Auto payments” and then follow the detailed instructions. After turning off the service on the website, a password will be sent to your phone, after confirming which, the service on the number will be disabled.

We connect the service through the bank

Beeline's partner banks also provide for the management of regular replenishment. To do this, you need to use Internet banking in a personal account on the official portal of your bank. Algorithm of actions:

- Log in to your account on the bank portal.

- In the proposed menu, find the “My auto payments” section ( on the Sberbank website it is in the menu on the left ).

- Click "Connect".

- Select the Beeline company from the list provided.

- Specify the account or card from which the balance will be replenished.

- Confirm your actions by clicking on “Continue”.

- Specify the minimum balance and replenishment amount in the proposed lines.

- Click “Save” and wait until you receive a notification that the operation has completed.

It will only take a few minutes to connect using this method.

Creating a template for Autopayment in Sberbank Online

Before you create a template for automatic payment for housing and communal services, you should understand in more detail what it is and how it works.

This program can operate according to two algorithms, which are chosen at your discretion:

- Sberbank sends a request to the selected company to obtain the necessary information about the amount of client debt. A message arrives with the specified amount to make the transfer. You can cancel the operation within 24 hours.

- On the appointed day, Sberbank independently transfers the money to the company’s account.

To connect Autopayment for housing and communal services, there are several options to choose from:

- through an ATM;

- Mobile bank;

- Sberbank Online;

- bank branch.

You will need to set parameters that are saved in the settings database. Subsequently, they can be disabled or adjustments made.

Automatic payment for housing and communal services in Sberbank - connection, disconnection through online banking requires activation of your Personal Account. It can be accessed at a bank branch or by telephone. During registration, the entered numbers are entered into the field of the same name and a secret password is assigned.

To activate Autopayment through Sberbank Online, you need to go from the main menu to the “My Autopayments” section, and then to the “Create Autopayment” item.

Then you need to fill out the following fields:

- purpose or type of payment: rent, gas, electricity, etc.;

- company - enter its name;

- account - from the list that appears, select the card from which funds will be transferred;

- amount - indicate the amount if it will not change from month to month;

- regularity of payment - once a month, quarterly or other;

- date - name the day when the bank will send the request to the company;

- type of payment - every month or upon debt;

- limit, excess of funds, which stops payments.

How to disable Sberbank Autopayment via Beeline phone

There are several options for canceling the service. This can be done via telephone, ATM, Internet or sales office specialists.

Via phone:

- by sending an SMS notification;

- by making a call to support bank clients.

Disabling the service via SMS is done by sending a message to the “900” service with the text “Autopayment”. When writing the text of a message, you do not need to put quotation marks.

The hotline operates 24 hours a day at 8 (800) 555-55-50. The specialist will cancel the automatic transfer of money, but information about your passport, code word, details for transferring funds, as well as the card number may be required.

USSD request

The connected function can be canceled by sending a system request. To do this, you need to dial *141*10# on your cellular device and press the button to call. If the option is connected to several phones, then it must be deactivated by specifying the subscriber number to deactivate in the system request: *141*10*<phone number>#. Then press the button to call.

Via Personal Account

“Autopayment” on a Beeline number can be disabled in your Personal Account on the website www.beeline.ru. Authorization will be required at the specified address. Next, you need to select the section with the name of the service and uncheck the “On” box. from the connected function.

Call to operator

You can disable auto-replenishment from your bank card account by calling 0611. The service can be canceled if you inform the manager about it. Passport details, payment details, and a code word may be required. Before calling a specialist, you need to prepare all the necessary data in advance.

Setting up a trust payment from Beeline

You can use the service from, if your phone bill reaches 50 rubles, the operator will replenish the funds in your account, and the amount of this payment depends on your expenses over the last three months.

To connect:

- Enter the request * 141 * 11 # , press dial.

- Display information about the amount of payment * 141 * 9 # , press “call”.

To turn off, dial the characters * 141 * 10 # and the call key on the phone keyboard.

There is no charge for connecting a trust payment. For the provision of such a service, a commission interest in the amount of 50 kopecks is charged on the first day. For the following days, 75 kopecks. These are small commissions, but your mobile phone will always be connected to mobile communications if there are no funds on your bank card.

Beeline auto payment through a bank employee

All types of plastic cards issued by Sberbank make it possible to automatically top up mobile operator accounts. Only the balance amount is subject to the limit. The Beeline operator has established three acceptable balance limits, upon reaching which the “Autopayment” function is activated:

- 600 rub.

Thus, you can set up automatic payment for your expenses. In addition, for security purposes and force majeure situations, you can set a daily limit on replenishing your phone account. This is very convenient if you often have to use roaming, where it is almost impossible to predict the pricing of mobile services. For other mobile operators, restrictions apply exclusively to maximum and minimum limits. And some of them, the same NSS, Tele2, do not provide for any limits at all. To activate an automatic payment, you simply need to order its activation during the registration process for any Sberbank payment card. You just need to tell the bank employee your mobile phone number and the transfer amount. After this, the operator will make the appropriate settings. An easier way to disable Beeline Sberbank auto payment is to contact the Contact Center. After calling the hotline, you will need to reach the operator by pressing 0 on the phone. Be sure to prepare information for the bank employee:

- amount.

To work with the system yourself, you can ask a consultant for clarification.

Advantages of auto payment for a loan

The main advantages of the service are:

- Automatic payment of consumer loans;

- Free connection and use of the option;

- The versatility of the tool – the ability to activate additional services;

- Low commission when making payments to other banks - from 0 to 1% (no more than 500 rubles).

The advantages of automatic payment also include the convenience of connecting and disconnecting if necessary.

Promotion “Plus 1 GB free”

During the period from May 16, 2021 to December 31, 2021 , there is a special offer for owners of SIM cards with a prepaid tariff system - “1 GB as a gift.”

To become a member, you must be connected to Autopay. To verify that you are a participant in the promotional offer, send an SMS message with the number 1 to the number 03330.

Video on the topic:

You will receive 1 GB immediately as you become a participant in the promotion, and others until the 10th of the current or next month. Please note that this gigabyte is added to those that you already have on your tariff.

If in doubt, request your amount of Internet traffic through your personal account or the application available before joining the promotion.

Manage auto payments via mobile banking

The fastest way to provide remote service is Mobile Banking.

It allows you to send short commands that involve requesting a service:

- Connecting to the client's phone: AUTO PAYMENT AMOUNT (the amount is written in numbers separated by a space).

- Disabling replenishment of a phone connected to a card: AUTOPAYMENT-.

- Disabling another number: AUTOPAY phone number, last 4 digits of the plastic card.

Actions will also require confirmation.

Features of "Autopayment" on Beeline

Not all users remember when and how much they need to top up their balance. Some people simply don’t keep track of the amount of money in their account. That's why Beeline provides one. The essence of the service is that the user’s bank card is attached to the phone, and when there is less than a certain amount of money left on the phone, the system automatically tops up your balance from the linked card.

The advantages of the service are obvious:

- Scale. The user can connect 10 numbers to one card at once, so the balance will not run out not only for him, but also for his children, spouse and other necessary people. If there are funds on the card, then there will always be money on the connected numbers and the balance will not go into the minus.

- Availability. The service is provided free of charge and works even in roaming. This is convenient for travel lovers who do not know where abroad they can spend money on their phone. In any convenient place and at any time, wherever a person is, his balance will be in positive territory.

- Convenience. Now your balance will not suddenly become minimal at the most unexpected moment. There just needs to be enough money on the card to top up your balance.

A special feature is its complete safety. No one can track your payments because the information is specially encrypted. And the most important thing is that the moment of error is excluded when the user, having mixed up one digit, paid for a completely different number. You can only pay for the number that is actually connected. It is very difficult to return money sent by mistake. With a linked card, the required number is topped up every time.

Another advantage is the complete absence of commissions. But, at the same time, the company has provided a number of limits that must be observed. You cannot top up your account by more than 10,000 per day, and 15,000 per month. There should be no more than 10 linkings per year. The number of linked cards should not be more than 3.

You can transfer money to unlinked cards at any time once.

How does it work

The Beeline company has created similar services with similar capabilities, these are “Autopayment” and “Autopayment”. They make it possible to top up your phone account automatically from a bank card that was previously linked to the phone. The operating principle of these services is simple. If the balance on the phone drops below a specified threshold, the service automatically transfers money to it from a bank card.

The main advantages of the Autopayment service are:

- Ease of use. All you need to do is set up this service once, and your account will never be left without money.

- Flexibility. You can adjust the operation of autopayment for yourself, taking into account the costs of cellular services.

- Availability. The auto payment service can be activated without any payment; there are no commissions even when roaming.

- Safety. All money transfers are carefully encrypted and are inaccessible to unauthorized persons.

- Scale. Automatic payment from one bank card can be activated for ten numbers at once. In addition, you can automatically pay for home TV and Internet.

When you auto-top up your phone account from a bank card that is assigned to the number, you are protected from the risk of erroneous payment. This service is free of charge and has no commission for replenishing your account. However, there are some restrictions on its use that you should be aware of.

- The largest replenishment amount within a day is 1,500 rubles, per month – 2 thousand rubles.

- The largest number of bank cards used is 3 , the number of annual bindings is no more than five.

When linking a bank card at a customer service office or at an ATM and payment terminal, there are the following restrictions:

- The maximum daily replenishment is 10 thousand rubles, monthly replenishment is 15 thousand rubles.

- The largest number of linked cards is three, the number of annual bindings is no more than ten.

Features of work

Beeline customers can top up their Beeline phone account through a bank card, without even attaching it to their number. The service in question has gained great popularity, and is currently used by many subscribers throughout the country. This service can be activated not only through the Beeline operator, but also in Sberbank. To do this, you need to submit an appropriate application. Beeline auto payment has settings that can satisfy any subscriber.

You can set your limit, upon reaching which the number will be automatically refilled, as well as set the replenishment amount and add Beeline numbers for replenishment. In this case, you can add any subscribers across the country registered in the Beeline network. The maximum number of such subscribers should not exceed ten. When you top up your account, you will receive notifications in the form of an SMS text message.

Connection and service management

You can connect “Autopayment” to Beeline in several ways:

- USSD command;

- Through the operator's hotline;

- Through Internet services;

- Through the bank.

Activation via USSD request is the easiest way. You just need to dial the combination *114*9#, press the call button and follow the instructions that will come to your phone. You can also call the short number 0533. You can contact the support service to activate automatic replenishment by calling 0611. The operator will help you activate the option.

If you have access to the Internet, you should use the operator’s official website or its special application. To activate automatic payment using this method, follow the instructions:

- Open the operator's official portal.

- Log in to your personal page. If you have not yet registered, please follow the steps required to do so.

- In the site menu, find the item “Top up your account” and then “Connect auto payment”.

- In the fields provided, enter your card number and expiration date, set the amount of automatic funds transfer and the balance threshold.

- Confirm that you are not a robot by entering the numbers from the picture.

- Check the box next to the agreements (at the bottom of the page), click “Save” and wait for the system to confirm the operation.

Automatic payment using an ATM

The easiest way to disable Beeline Sberbank auto payment is considered to be an ATM. Procedure:

- Select “Connect” or “Disconnect”.

If activation is required, in the section that appears, select the type of payment: housing and communal services, traffic police, loans, cellular communications. Then a list of telecom operators will open, where you need to select Beeline, and then simply enter all the data into the template:

- Mobile phone number - initially a valid number is linked to the bank card. If you need to top up the balance of another phone, enter its number.

All that remains is to press the “Save” button and confirm the action with a code that needs to be redirected to Sberbank number 900. The ATM will issue information about the activation of the service in the form of a receipt, which you will need to save.

As for the instructions on how to disable Beeline autopayment in Sberbank, it is much simpler and shorter than activation. After the “Disable” function is selected in the “Automatic Payment” section, a list of templates linked to the card will appear on the ATM display. From them you need to select the one you need and click “Disable”. Next, you will receive an SMS with a code as confirmation of your actions. It must be sent to number 900 and, finally, the ATM will issue a check.

Connecting auto payment for housing and communal services in Sberbank

- On the main page of Sberbank Online you need to select “My auto payments”.

- Indicate what housing and communal services you need to pay for.

- An organization providing housing and communal services can be found using a payment receipt.

- Fill in the details and confirm the service activation with the code received via SMS.

All created settings will be saved in the template and placed in the “My Auto Payments” section, where you can go from your Personal Account.

To activate the service through a terminal, ATM or telephone, the instructions are similar.

How to disable?

You can disable the option using the same methods you used to connect. The easiest way is through your personal account or mobile application, as well as number 0533 or the following USSD commands:

If you have not disabled the use of a secret code, then you should dial the command *114*0*secret_code#, and if the code is not used, then simply *114*0#.

You can block using the command *110*191#.

If you decide to disable the “Autopay” option with the help of a Beeline office specialist, you will need to take not only your passport, but also the bank card that you linked to top up your balance.

Shutdown options

“Autopayment” is a service that allows you to automatically top up your account per day for a total amount of up to 10,000 rubles. Through your personal account, you can manage financing: change the way money is written off, reduce or increase the payment, without attaching a bank card to your number. The desire to disable may arise when changing the tariff plan. If a person begins to spend less money on mobile communications or switches to per-minute billing, then it is unknown how much money will be required to deposit at the end of the month. Then it is more convenient to pay upon the fact, at the end of the reporting period. Methods for disabling AutoPay are given below.

Through your personal account

If the user has the “My Beeline” application installed or has an authorized profile on a virtual resource, then the algorithm of actions is as follows:

- Find the “My Auto Payments” section.

- Select the desired position.

- Press the “Disable” button.

To log in to the portal, just enter your phone number and receive a verification code via SMS.

Short command

It is convenient to cancel the option using *114#. After entering the combination, instructions for use will appear on the screen. You can go through all the steps by selecting the desired sections or switch to the voice menu.

At the operator's office

You can disable “Autopayment” of Sberbank or another organization on your phone at any cellular branch, even if the person is in another city, outside of your home region. The employee is presented with an identification document. After checking personal data, remote deactivation is carried out in the provider’s database. Even if Autopayment was connected through online banking, it will turn off.

We recommend: Instructions for installing the My Beeline application

Call technical support

Unable to access the network or come to a Beeline branch, the shutdown is carried out through the technical support service. You should dial 0611 or 8-800-700-8000. The operator will answer at any time of the day. Before disabling the desired service, the employee will ask several personal questions; this is done as part of security.

Using the voice guide

In Beeline, disabling is available through a voice request using the command 0533. The autoinformer will pronounce menu items, and the user must select the item that matches his request.

Linking a card for “Autopayment”

To be able to use Beeline, you must be the owner of a payment bank card. To link a card to a subscriber number, you will need to use the following details:

- card number;

- first and last name of the holder;

- card expiry date;

- CVV code or CVC code.

The procedure for linking a card can be performed on the website or at the provider’s office, Beeline Personal Account, bank branch or through an ATM.

The selected card linking option determines the permissible limit for daily and monthly payments. If the Beeline website was used for this procedure, the subscriber can count on a daily payment amount of no more than 1,500 rubles. When you link a card through an ATM or provider's office, transaction limits increase many times over. But in any case, no more than 3 cards can be linked to a number at the same time.

After completing the card binding procedure, the subscriber receives a secret code, which is necessary for requests for provision.

The secret code must be carefully stored, since it can only be restored at the provider’s office or by calling the Beeline customer support center.

How to link a bank card

To start using the service, you need to link a bank card to your account. This procedure is performed on the official Internet resource of the Beeline operator. To link a card, you will need card details. The card number, expiration date, cardholder details, and a special three-digit code are indicated. After this, all linked Beeline clients will receive an access code used to make a manual payment, as well as to set up automatic payment.

Attention: the secret code should be kept in a safe place, since if it is lost, recovery can only be done at customer service offices or through a support center.

After linking the card, you need to activate “Autopayment” by sending a request * 114 # , clicking on the “call” button, and start setting up the service. For this, the best option is your Personal Account. However, another simple way remains to manage settings by sending short requests.

Autopay settings

To configure the option itself, you need to go to the “Top up your account” section, it is located in “Payment and Finance”, then click on “Connect”.

Here you should enter the amount by which the balance will be replenished, the minimum amount upon reaching which automatic payment will occur and your cell phone number.

The number can be yours or any of your friends, acquaintances or relatives who use Beeline services.

After filling out all the information, enter the secret code from the SMS message, then click to agree to the rules and “Save”.

The same steps will need to be done when connecting the option through the “My Beeline” application. The only thing is that linking a card is only possible through your personal account, and you can perform all other settings in the application.

As an alternative way to connect, you can use the USSD command. To do this, dial 0533 on your mobile phone, press call and follow the instructions in the voice menu.

Convenient USSD commands for connecting automatic payment

Before using these codes, you need to link the card to your phone number, as it uses a secret code. Here is a list of the most popular commands:

- Automatic payment with standard settings *114*9*[secret code from SMS]#

- Setting an auto payment threshold of 30 rubles *114*9*3*[secret code from SMS]*2*1#

- Setting an auto payment threshold of 150 rubles *114*9*3*[secret code from SMS]*2*2#

- Setting an auto payment threshold of 900 rubles *114*9*3*[secret code from SMS]*2*3#

- Setting up an automatic payment of 150 rubles *114*9*3*[secret code from SMS]*4*1#

- Setting up an automatic payment of 900 rubles *114*9*3*[secret code from SMS]*4*2#

- Setting up an automatic payment of 1500 rubles *114*9*3*[secret code from SMS]*4*3#

- Disable the service *114*0*[code from SMS]#.