For those who do not want to constantly monitor their balance, it was developed by MTS: what it is and how to use it, we will tell you further.

from MTS - this is an automatic account replenishment from any bank card linked to a personal account. The operator has a total of 59 partner banks that provide this service. In first place, of course, is Sberbank. In addition, Yandex.Money, Qiwi and WebMoney provide this opportunity. The service can be connected to Visa, MasterCard and MIR.

This service has a number of undeniable advantages:

- Instant replenishment of your account at any time of the day or night, regardless of your location. The main thing is that there is money on the card.

- The service is provided to both corporate clients and individuals.

The option is configured in two ways:

- by threshold – upon reaching a certain amount in the account. This method is suitable for those who cannot clearly predict their spending on mobile communications and the Internet. Most often, this type of “Autopayment” is activated on tariffs without a subscription fee;

- on a schedule - on a specific day of the week or month. This option, as you understand, will be ideal for a tariff plan with a subscription fee and for those who know how to clearly plan their expenses.

Most often, subscribers choose the first method. As soon as the balance is reduced to the amount chosen by the subscriber, the amount of money is automatically debited from the card. Its size is indicated when connecting to the service, which is completely free.

By the way, in this way you can top up your account and the balance of your friends and family.

Important! No one can force you to activate the auto-refill service. So choose the most suitable option for you to top up with a bank card or cash.

Service details

has two settings:

- On the threshold . When choosing this option, the MTS client will be able to appreciate the benefits of automatic replenishment of the balance, which will not allow it to go into the negative. Setting a threshold is best suited for tariffs without a subscription fee, when money is withdrawn only for completed transactions.

- Scheduled . If you select “Auto-payment on a schedule” provided by MTS from the specified card, then a certain amount of funds is transferred to the phone balance at a set time. This service is useful for clients whose tariff plans contain a subscription fee paid at a set frequency: weekly, monthly.

You can top up your balance not only on your own number, but also on the numbers of your loved ones.

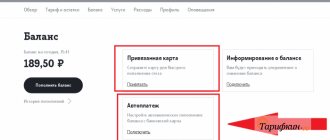

You must first link a payment card in your personal account from the account of which financial transfers will be made. At the time of binding, 10 rubles are debited from it, which after successful completion of the operation are returned back to the account.

Operator bonus - 10% discount

For all subscribers who have set up this service, there is a 10 percent discount; the conditions for MTS auto payment are listed below:

- Validity period is one year.

- Users of the tariffs below and all modifications, including archived ones, depending on the region, participate.

- Activation occurs only when setting up automatic replenishment of the balance through the payment sites autopay.mts.ru, wallet payment.mts.ru, in the MTS Money and My MTS applications, as well as through Viber.

- You only need to activate the auto payment service during the program’s validity from March 1, 2021. Those who set it up earlier will not participate.

- If discounts have already been made, and the option was disabled for some reason, then re-enabling will not return the bonus.

- If you connect through a terminal or online banking, the discount is not provided.

- The promotion ends on 02/28/2019.

Of course, MTS did not want to surprise anyone by creating the “Autopayment” option. Most likely, he just wanted to compete with other operators. But it still caused him surprise. Well, with what other telecom operator, by connecting “Autopayment”, you could get a dozen additional paid options without your knowledge? That’s right, none of them!

Therefore, be careful and careful!

The function itself is useful for the subscriber, but do not be fooled by the operator! If our article helped you, please like it!

How to connect MTS Autopayment

When connecting, you need to enter your personal account, where in the proposed “Financial services and payments” section of the main menu, select the required subsection. In it, MTS offers to automatically top up your mobile phone account.

Connecting "Automatic payment by threshold"

This option has the following required parameters:

- cell phone number;

- payment amount;

- balance threshold upon reaching which funds are credited;

- card from which money is transferred.

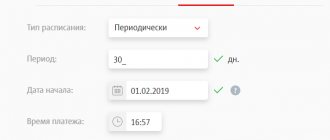

Activation of "Automatic payment according to schedule"

To activate this service, certain fields are entered:

- phone number whose balance needs to be topped up;

- replenishment amount;

- payment method;

- time at which money will be credited to the balance;

- a schedule indicating the frequency of this operation.

MTS does not charge a commission for connecting or disconnecting Autopayment.

Program partners

The number of MTS partners, from whom purchasing goods and paying for services will allow you to accumulate bonus points under the cashback program, is approaching 1000. Among the largest and most popular online stores, the following stand out:

- Aliexpress;

- Lamoda;

- KFC;

- MyToys;

- Tefal etc.

Customers buy the largest cashback of up to 80% when paying for MTS services: Second Memory, MTS TV, etc.

Promotions from partners are held on a regular basis, which allows you to purchase goods and services with additional discounts. Therefore, it is useful for every MTS user to look at the cashback.mts.ru/catalog section to keep abreast of current promotional offers with increased cashback.

How to disable MTS Autopayment

When contacting a communication store, the consultant will clearly explain how you can disable “Autopayment” on MTS through a mobile application or in your personal account.

In the main menu, select the “ My Account ” section, which contains all the services connected to it. Among these, when you click on it, all available automatic payments are displayed on the screen. On the right side of the line, if the option is active, there is a red button. When you click on it, a menu will appear asking you to delete or temporarily suspend the payment. You should select the desired item and “Autopayment” will be disabled.

What can you spend the money you save on?

It’s easy to accumulate bonus points with MTS; among the company’s partners there are 780 popular online stores that delight you with prices and assortment. Having received cashback, it is spent on:

- mobile phone balance replenishment;

- purchasing a smartphone in MTS stores;

- payment for communication services for your loved ones.

When connecting to the cashback program, each user is assigned the first goal by default in the form of payment for communication services. Therefore, when the first day of a new month arrives, bonuses are first written off, and then, if they are not enough, funds are debited from the account.

The goal setting function is used at your own discretion, for example, by setting a goal to accumulate a discount to pay for a phone in a retail network or in the MTS online store. Once the goal is achieved, all that remains is to place an order, pay for the phone and receive it.

How to disable MTS Autopayment from a Sberbank card

There are several ways to disable MTS Autopayment from a Sberbank card:

- Send a message to the Sberbank service number 900 with the following content: auto payment-ХХХХХХХХХХ YYYY, where ХХХХХХХХХХ is the phone number to which the service is connected, and YYYY is the last digits from the Sberbank card. After some time, a response message will be received indicating that the service has been disabled.

- When you disable the service through the Sberbank application, select the “Transfers and Payments” section from the main menu, which contains information called “My Payments”. The required auto payment is located there. The button is pressed to turn it off. If done correctly, a message will be sent to your mobile number.

- Sberbank offers to disable the service through an ATM. After activating the card, the following actions are performed in a certain sequence: “Mobile Bank” → “Autopayments” → MTS → disable .

By calling the toll-free number 8-800-550-550-550, you can find out how to disable MTS Autopayment from a Sberbank card.

Mobile version easy payment

For ease of use, the provider has implemented an official mobile application with the same name “MTS Money”, with its help you can perform any functionality from your phone, just like an Internet service. It is provided completely free of charge to all users and is available for free download on any software site. With its help, you can forever forget about your wallet, which takes up a lot of space in your pocket. Make purchases and pay for services in stores, cafes, restaurants and in vehicles with one touch of your mobile device. In addition to the official application, you can use highly targeted services for certain equipment and smartphone models for transactions. Below we will consider them separately.

Attention! For each payment made on the Internet, an additional fee of 10 rubles is charged, a kind of commission from the operator for sending SMS confirmation.

Apple Pay Apple

The payment is made by simply touching your phone to the terminal. Moreover, you don’t even need to wake the gadget from sleep mode or lock; bring it to the cash register, and the system will do everything automatically. But to do this, you will need to link an MTS Money bank card or another from any bank to the interface. Iphone owners need to do the following:

- Launch the Wallet utility.

- On the top panel, open the adding section.

- After this, fill in the plastic details and confirm entering the data into the system.

There is no need to worry about security; it is in no way inferior to standard credit cards; your data is not sent anywhere during the transaction. This Pay MTS function is supported by all devices from version 6 and higher.

Google Pay

This service has similar functionality as the previous representative, but is implemented for devices with the Android operating system. The application is provided completely free of charge; there is no subscription fee for using the interface. To start paying for products, you need to add an MTS Bank card and have a smartphone with software higher than version 4.4. To activate the plastic you need:

- Launch the Google Pay utility on your phone.

- Click on the add card button and enter its details in the appropriate fields.

- After this you need to confirm it. Your SIM card will receive a notification with a security code, which must be entered in the registration field.

- Ready.

The MTS Pay application does not work on devices that were imported into the territory of the Russian Federation illegally and unofficially.

Samsung Pay

Install the official Pay Pass application on your Galaxy phone and add a card from MTS and make payment transactions directly with the touch of your gadget. The advantage of the service is that you can make payments at any payment terminal, even those that do not support contactless communication. The secret is that Samsung smartphones are able to imitate the magnetic tape signal of your credit card.

To get started, update your device's software and download the official Samsung Pay app. In the main menu, select the card activation option and enter its number and personal data. After this, an alert with a secret code will be sent to your phone number; write it in the appropriate field. The utility allows you to link up to 12 bank cards to one device.

What are the restrictions on the payment amount?

There are certain restrictions when using this option. The threshold for making a payment set by the MTS client has its limits:

| bottom bar | 1 ruble |

| top bar | 10,000 rubles |

More than 10,000 rubles cannot be debited from one card per day. The limit on the write-off amount per month is 30,000 rubles.

When connecting the service through your MTS personal account, the minimum replenishment amount is 50 rubles, the maximum is 10,000 rubles. When contacting a communication store, the client will be able to set the minimum amount for replenishment in the amount of 100 rubles.

Connection conditions

Before you connect “Autopayment” from MTS, please note that a number of requirements apply:

- The minimum threshold for the auto payment service is 30 rubles. You cannot specify a lower amount at which automatic accrual will occur. Maximum – 10,000 rubles.

- When setting up the service, you can specify any number from 50 to 10,000 rubles, which will be transferred to your mobile account. At the same time, within a month you cannot top up your account with more than 30,000 rubles from 1 card using “Autopayment”.

- You must also have a card from any bank from the list of supported ones.

- You cannot link more than 10 phone numbers to one card.

View terms and conditions for the 10% promotion

How to connect MTS Autopayment without linking a bank card

You do not need to link a bank card to use it. You can use the Eleksnet electronic wallet. Payments for cellular communication services are made without commission. You must register on the website www.elecsnet.ru or in terminals and deposit a certain amount into your account.

“Autopayment” on MTS is a service that is very popular among cellular customers. The balance can be topped up using a bank card or electronic wallet linked to the number. You can install the service in your personal account, using the mobile version of MTS or a communication salon. When connecting, you enter the parameters under which cellular payments will be made.

The whole truth about cashback from MTS

The maximum amount of cashback that can be obtained using MTS reaches 80%.

But such generous offers only apply to purchases of services from this mobile operator. Article navigation

- Cashback from MTS - how it works

- What can you spend the money you save on?

- How to start receiving cashback

- MTS user personal account

- Program partners

- Frequently asked questions about the service

- How to get MTS cashback when buying a smartphone

- How to check the amount of bonuses on your account

- How to withdraw cashback to an MTS Money wallet

- Is it possible to transfer money from MTS to a card or cash out

- Cashback doesn’t arrive: what to do and where to go

- Where to get a promo code

- How to disable cashback

MTS cashback is a special service of a popular mobile operator, promoted to attract and retain subscribers. The company benefits from growing its customer base, and users save up to 50% on purchases! Having first heard about such an impressive benefit from MTS, users are asking questions about what it is and how to get discounts.

To get answers, and at the same time figure out how to take advantage of the bonus cashback program, just study a brief overview of the capabilities of MTS clients.

Payment password recovery

When registering on the MTS Money website, the client enters a phone number. In the future, one-time codes will be sent to it to confirm payments, transfers and other monetary transactions. You need to enter them in specially designated fields and confirm your actions in this way.

If the password to enter the site has been lost, it is easy to recover it::

- Go to the login page.

- Click on the “Get password” button.

- Enter the characters from the picture.

- Enter the OTP, then your email address, then the numeric code from the email that will be sent to your email address.

- All that remains is to come up with a new password and confirm it. At the end of the procedure, the system will notify you that the password has been changed via SMS.

What's the catch

There are no tricks or pitfalls - the promotion is as transparent as a tear. “Autopayment” is provided without commission, therefore, overpayment is excluded. No additional paid actions are required, which also indicates transparency. The promotion is launched every year and is designed for new subscribers - you will not be able to use the discount again on the current number. Otherwise everything is clean and transparent.

Rate this article

Author

Vyacheslav

For several years he worked in mobile phone stores of two large operators. I understand tariffs well and see all the pitfalls. I love gadgets, especially Android ones.

From your subscriber page

Open the “Autopayment” service, enter all your bank card information. In order for the card to be linked, a small amount will be withdrawn from your card, and you will receive a message from the bank about this. The amount indicated by the bank must be entered in the link line - this is how the card belongs to the subscriber. After successfully completing the card binding, an SMS message with a password to log into the auto payment system will be sent to the network client’s mobile device. This password should never be lost or forgotten! Without it, it will be impossible to correct write-offs and other parameters! If for some reason it is still forgotten, then you can restore it using the interactive command * 111 * 625 # and dialing, a message with your personal password will be sent to your number again.

What is the Autopayment service?

It’s very convenient - not to think about replenishing your account, to always be online and use the Internet. The service allows you to set up automatic debiting from a bank card to the balance of one or several mobile devices at once. When a certain threshold is reached, the money will immediately be sent to your mobile device. That is, the service will always monitor and inform the bank about the critical balance, and will immediately send a request for replenishment.

You can use Visa or MasterCard payment systems cards issued by any financial institutions when opening a debit account.

Scheduled write-offs

This functionality is not limited by any limits or thresholds - on a certain day, money will be automatically debited from the plastic card, regardless of the state of the mobile account, even with a positive balance. You can set up a schedule from the subscriber’s personal account, for example, replenishment after 7, 10, 30 days. Here you can set the amount of write-offs.

- In other cases (if there is no money on the card), auto-replenishment cannot be completed, and the operator informs his client about this in an SMS message.

- If the validity period of a bank card (the one linked to the phone) has expired, then all automatic payments are suspended until all parameters are adjusted from the personal account page.

MTS by balance threshold or schedule

You can always be in the network of the MTS mobile operator only if you have a positive mobile account balance; as soon as the money runs out, the phone will be unavailable for communication. Therefore, it is very important to know your balance and top up your mobile account on time.

Sometimes, in the hustle and bustle of modern life, you simply forget that you need to top up your phone balance, and in order to always stay online, even where there are no ATMs or payment points nearby, you can activate a convenient service - MTS Autopayment. Almost all operators have similar services. The main condition when activating the service is that the subscriber must have a plastic card, from which money will be debited for auto-replenishment with a minimum balance.

Via Internet banking

Any owner of a plastic bank card has a personal client page. To log in, enter your ID and permanent password. Note! Here you need to find an automatic payment service or scheduled payments - select the desired option and fill out the form. From now on, the bank will regularly top up the balance of your mobile device. You can adjust payments on the same page.