It is no secret that many Russians prefer Sberbank to other banks for its reliability and experience in the field of financial services. But we should not forget about its modernity. Technologies are developing and this requires banks to change accordingly. Thus, it is now difficult to imagine a bank without an official website and mobile application that allow you to perform all Sberbank actions online. Connecting a mobile bank via the Internet is also easy. Let's look at how this can be done and what benefits it provides.

Connecting the service via phone

To activate a mobile bank, it is not at all necessary to go to the Sberbank office or go to the nearest ATM. Any plastic card holder can go through the registration procedure in the system without leaving home. To do this, it is enough to have a smartphone in your hands.

Through Sberbank Online

This activation method is not suitable for owners of push-button phones, since the Sberbank Online application cannot be installed on them. In turn, owners of smartphones (even old ones) can download the software without any problems by using the search in Google Play or the App Store. The program is provided free of charge.

After downloading the Sberbank Online application, you need to open it and register in the system. To do this, you will need to provide your bank card details, as well as personal information. If all fields are filled out correctly, the program will prompt you to create a login password or set a fingerprint. After this, you can proceed to connecting your mobile bank:

- In the application, click on the “Settings” section, then “Notifications”.

- Go to the “Connection Details” tab and click on “Connect”.

- Select a tariff.

- Click on the “Connect” button.

- Check that your personal data is filled out correctly and confirm the operation.

In total, it takes users 2-3 minutes to connect to a mobile bank through the application from the moment they register in the system.

Call 900

The Sberbank Online application only works with active access to the Internet. Otherwise, you will not be able to connect Mobile Banking this way. You will have to use the short support number.

To connect, you need to dial 900 on your phone, wait for the connection and press the “0” button. This action will transfer the client to a communication line with a call center operator. In a conversation with a bank employee, you should inform that the MB connection is required. In order for the operator to activate the service, the client needs to provide the following information about himself:

- Last name, first name and patronymic.

- Passport details.

- Card details.

- Password or code word.

- Information about the last paid action on the card.

All this will allow the call center employee to understand that you are the owner of the bank card. Once you confirm all the necessary information, you will be asked to select a tariff for the MB operation. Next, an instant connection will occur, which the client will be notified about in a response SMS.

Frequently asked questions about connecting Sberbank banking to a smartphone

Answering the most common questions will help you fully understand all the nuances of the function.

What to do if SMS does not arrive?

For persons with active accounts, data on completed transactions can be sent via Push notifications.

In cases where the SMS does not arrive for a long time, check the availability of cellular communication. If everything is in order, then restart your smartphone and delete all unnecessary messages from number 900. You can also check the black list, which Sberbank could accidentally be on, because then all messages from it will be automatically redirected to the Spam folder.

A call to the Contact Center will help you understand the situation.

In cases where the SMS does not arrive for a long time, check the availability of cellular communication. If everything is in order, then restart your smartphone and delete all unnecessary messages from number 900, after which you can send the request again

The phone is lost or changed - what will happen to the mobile client?

If you lose your phone, you should disable the SMS banking service in the online application or contact the nearest Sberbank branch with your passport. You can do the same thing when changing your number. It will not be possible to change the phone number for SMS distribution by phone or in the terminal if the current information does not coincide with what was specified in the contract when receiving the card.

If the information is not changed, notifications will continue to be sent to the old mobile number.

How to activate the SMS banking option?

There are several ways to connect to SMS banking: visiting a bank branch, through a terminal, online and by calling an operator. The last two methods allow you to achieve results without leaving your home. A call to the Contact Center will help solve the problem if the service is linked to the number specified in the contract.

SMS Banking is a convenient service that allows you to track all banking transactions. The capabilities of the function do not depend in any way on the method of its connection or the cellular operator. You can activate the option either independently through the Contact Center, Online Banking or terminal, or by contacting the nearest Sberbank branch.

Connecting to the service via an ATM

Another option for activating a mobile bank is to use the nearest Sberbank ATM. This method is chosen most often by clients who do not have access to the Internet. It is good because the user does not have to fill out a huge amount of information about himself, but simply inserts the card into the ATM and follows a few simple steps.

There are Sberbank terminals in every city in Russia and in most populated areas of the country. You can use online maps to find the nearest ATM.

Having a Sberbank card in your hands, you can safely go to the terminal. Next you will need to do the following:

- Insert the card into the ATM.

- Enter your password.

- Go to the “Mobile Bank” section.

- Select “Connect main card”.

- Click on the name of the tariff you are interested in.

- Confirm your phone number.

- Enter the code from the reply SMS message.

Navigate through the ATM menu using the touch screen or buttons located on the sides. Numerical values are entered using the keyboard located at the bottom of the screen. Before connecting to a mobile bank, you should make sure that there is enough money on your balance for the first debit (if you have chosen the full package).

Which notification method should I choose - SMS or push notifications?

SMS is only suitable for you if you do not use the SberBank Online mobile application. Otherwise, push notifications have more advantages:

- Visual notification feed. You can easily find a transaction by its amount.

- Convenient search. In the notification feed it is easy to find the required payment or transfer by the name of the store or the name of the person.

- Reliable and safe. To prevent anyone from accessing your notifications, simply hide the feed.

Connect push notifications

Read also: The most delicious porridge. 9 recipes

Was the answer helpful?

Not really

At a bank branch

If the client is accustomed to connecting certain services through personal communication with employees of various organizations, then an excellent way to activate the MB would be to contact a Sberbank branch. The company has offices in almost every major locality in the country, which means that finding the nearest representative office will not be difficult.

When going to the bank, do not forget to take your passport, bank card and phone with you.

There is absolutely no need to sit in line at a Sberbank branch. You can approach any available employee and ask for help connecting through the terminal. He will tell you how to perform the operation, and the mobile bank will be activated.

You can also activate the service after waiting for your turn, if you first take a coupon. In this case, the client will be connected in the first available window through the computer, filling in the card and passport information. This will take much longer than with activation via a terminal. So it is not recommended to choose this method.

Contact the bank operator

The procedure for connecting banking through a Sberbank branch will require the client to spend the greatest amount of time, since he will need to personally appear at the nearest office of the company. The user must bring with him:

- plastic roller,

- cellular telephone,

- passport.

Next, in the presence of a representative of the organization, the client must write an application with a request to connect the option and submit it for consideration. Then you need to sign a special agreement with the bank, after which the instrument will be connected to the specified number within a period of one to three days.

Disabling the service from your phone

Over time, some people come to the understanding that there is no longer a need to use Mobile Banking, due to which money is debited every month. After all, the same functions are available in the completely free Sberbank Online application. Therefore, there is a need to disable the option.

You can refuse to use MB at home, without going to a Sberbank office to perform the operation. The easiest option is to send a message with one of the following texts to number 900:

- BLOCKING SERVICES.

- BLOCKSERVICE.

- BLOKIROVKAUSLUGI.

- 04.

After this, access to the service will be blocked, and the client will no longer receive SMS notifications about account movements. However, you can reactivate the service at any time by sending a message to 900 again. But then you will have to enter another text: UNBLOCKING SERVICES, UNBLOCKSERVICE, RASBLOKIROVKAUSLUG or 05.

If you have several cards linked to your phone number, in addition to the message text, you must indicate the last 4 digits of the card.

Sources

- Official website of Sberbank (Sberbank Online)

- Official website of Sberbank (mobile bank)

Recommended for you

- A record amount was withdrawn from Sberbank foreign currency accounts

- Sberbank allows bank cards to disappear

- Sberbank will filter calls from scammers

Arthur Karaichev CEO #VZO. Since 2011, he has been closely studying the topic of finance, in 2021 he received a higher education in the field of

. Manages the project, manages heads of departments and is responsible for the creation of new services.

(22 ratings, average: 4.4 out of 5)

How to find out if your mobile bank is connected

Sometimes MB users experience the problem that notifications do not arrive on their phone. This usually happens because the service is turned off. So you need to understand how you can easily and quickly find out whether your mobile bank is activated. Also, such information will be useful to those who are not sure about the need to connect to the service.

There are several options for checking this information.

For example, you can go to the nearest Sberbank office and ask a question to a company employee. But it would be much more rational to send an SMS with the text “Help” to number 900. The response letter will ask you to choose one of five numbers. We are interested in the “five” because it is responsible for information about cards connected to the MB. By sending the appropriate text, the client will find out whether his mobile banking is activated.

If the service is activated, but notifications do not arrive, then most likely there are simply not enough funds on the card balance for further debits. If this is not the case, it is recommended to contact the Sberbank office to sort out the problem.

The company’s customer support team is ready to answer all questions of interest to customers, available at 8-800-555-5550.

Main differences

Despite some similarities, there are many more differences between the services. First of all, this is functionality. In Sberbank Online you can open new products and carry out any transactions with old ones. Mobile banking is used mainly to receive notifications and perform actions that require promptness (for example, blocking cards)

Ease of use also plays an important role. Most Sberbank clients do not even know that Mobile Bank allows you to manage your account using SMS commands. It is difficult to learn all the commands and their meanings, so for many it is easier to perform the necessary actions in the Internet bank or contact the office.

Another difference is the cost. Sberbank Online is provided free of charge, and a mobile bank with full functionality costs from 30 rubles per month. However, for cards with a status higher than classic it is also provided free of charge.

Features of mobile banking from Sberbank

Mobile banking is a useful service that allows you to monitor various movements in your account:

- Withdrawal.

- Replenishment.

- Payment for services and purchases.

- Transfers to other clients.

In addition, with the help of MB, a person will receive instant notifications on their phone, request a balance and make any transactions for transfers and payments for various services. Today, Mobile Banking is an indispensable service that is highly recommended for any Sberbank client.

In addition to control over designated operations, the IB guarantees people the use of a number of other benefits, namely:

- Receive pre-approved loan offers and pay off current debts.

- Replenishment of electronic wallets.

- View the history of financial transactions on the account.

- Information about bank requests.

- Participation in the “Thank you” bonus program.

You can connect to the service in any convenient way; fortunately, there are several activation options. But, before performing the operation, it is recommended to familiarize yourself with the Mobile Bank tariff plans. Since it is with the choice of TP that acquaintance with online banking begins.

Selecting a Mobile Banking tariff plan

When a person decides to activate a useful banking service, he will be asked to choose from two packages. The first is called “Economy”, and the second is called “Full”. To understand what restrictions apply to the simplest tariff, consider the table.

| Name | SMS notifications | Access to Sberbank Online | Request for account statement | Service cost |

| Economical | No | Yes | From 3 to 15 rubles per request |

|

| Full | Eat | Yes | For free |

|

The economical mobile banking package implies significant restrictions on obtaining information on a Sberbank card. Thus, the owner will not be able to receive SMS notifications about replenishments and other transactions, and will also be forced to pay for each request for an account statement. In this regard, using the "Full" package seems more reasonable.

If you do not want to pay money for using the full Mobile Bank package, it is recommended to download the Sberbank Online application to your phone. The program is absolutely free, and its functionality is completely on par with MB.

Tariffs based on the cost of the service

As already noted, the mobile bank is connected and used by Sberbank clients at will. In this case, the bank uses its own tariff schedule. The following packages are provided for standard cards:

- “Full” - the client receives SMS messages and push notifications for each transaction made on the card.

- “Economy” - its cost is 0 rubles, while the cardholder receives only messages to confirm transactions (3-D Secure technology).

For now, only these two tariffs are available on cards. It is not possible to disable all notifications, including 3-D Secure technology. This option is the default.

Does mobile operator matter?

The mobile bank is connected according to the above algorithm, regardless of the name of the mobile operator. This can be either a company that is one of the largest, or a small regional operator.

The mobile communication tariff is also in no way connected with the operation of the mobile bank. All messages and notifications are received free of charge, within one paid month.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Cost of connecting to a mobile bank

Using the MB service imposes an obligation on the client to make a monthly payment. Or rather, it is written off independently and amounts to 30-60 rubles, depending on the type of card. But is it necessary to pay for the first or repeated activation of the option?

The answer to this question will be negative. Money for activating the service is not debited. But you need to take into account that the money for the first monthly payment is withdrawn immediately. Therefore, before connecting, you must have at least 30-60 rubles on your balance.

Full package

Includes SMS notifications about completed banking transactions using the card . For example, if your salary has been credited to your card, you will receive an SMS message. The message will contain information about the amount of credit and indicate the final balance of the card. In principle, this is very convenient and is a plus, but there is also a minus. For this convenience you will have to pay about 60 rubles every month. The amount will be debited from the card balance every month automatically. For the year the amount will be equal to 720 rubles.

When you subscribe to the Full package, the first two months of the service are free! During these two months, you can take advantage of all the capabilities of the service and decide whether to keep the full package or switch to an economical one.

Limits and restrictions on transactions

Mobile banking is a very useful service that simplifies the process of interacting with your bank account. But one should not assume that the client can dispose of any amounts an indefinite number of times.

There are noticeable restrictions in MB that affect the operation of the service. This was done to control and suppress corrupt transfers. In any case, the bank itself states this. Perhaps the restrictions are related to the fear of managers to lose a large amount of money from their turnover. But this information is not official.

Let's talk in more detail about the existing restrictions:

- For example, there is a daily limit of 4,500 rubles for paying for services through a mobile bank.

- And if a person wants to top up his mobile phone number using the service, he will not be able to deposit more than 1,500 rubles.

- Transfer restrictions also apply. The designated threshold is equal to the amount of 8,000 rubles.

- Also, you cannot perform more than 10 operations per day. And payments in favor of certain organizations should not exceed 10 thousand. But, if the client makes a transfer between his accounts, then his daily limit is not so terrible.

- Every day you can transfer up to 100 thousand rubles.

Similar restrictions apply to any other bank. Don’t think that this is Sberbank’s personal initiative. Therefore, no matter how reliable the organization, a person will not be able to transfer money in an amount exceeding the limit. However, this feature can seriously help if the client has lost his phone with his details.

2.5/5 — (2 votes)

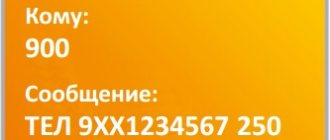

How to transfer money by phone number using an SMS command?

To transfer by phone number, send SMS: “Transfer 9ХХХХХХХХХ 500”, where 9ХХ1234567 is the ten-digit mobile phone number of the recipient to which the SMS bank is connected, and 500 is the transfer amount in rubles. This method can only be transferred to SberBank cards. Limit - 8000 ₽ per day.

If you want to transfer money from a specific card, after the word “Transfer”, indicate its last 4 digits. Otherwise, the transfer will go out from any card with enough money on it.

Basic operations with

Activation of banking significantly expands the capabilities of remote management of Sberbank services. The cardholder will be promptly notified of ongoing transactions and will also be able to perform various actions on the account.

The range of available options and information services depends on the tariff plan - Sberbank has two of them: basic and full. The basic one is provided free of charge, but has some limitations - requesting a statement and balance is paid, and there is no SMS notification about completed transactions.

The full tariff has advanced features - statements and alerts are enabled by default. You can link your main card and up to eight additional cards to your banking account.

The entire list of services and capabilities of Mobile Bank:

- Making money transfers between your accounts, to legal entities or individuals.

- Payment for mobile communications (your own phone or a number belonging to any individual).

- Manage auto payments - activate, deactivate, suspend.

- Management of deposits through the call center service (opening, closing).

- Blocking cards.

- Request for balance, statements of recent transactions.

- Request for debt on a loan or credit card, including payment of the fee, configure payment parameters (change the amount, write-off date).

- Connecting and disabling the “Fast payment” function.

- Donate money to charity as part of the Gift of Life program.

- Register in the “Thank you” program, check the balance of accrued points.

- Unblock or deactivate “Mobile Bank”, switch from the “Basic” to “Full” tariff.

Checking service status

By default, all Sberbank clients are connected to this service at the stage of opening an account and issuing a bank card. This is stated in the contract. However, in some cases you will have to install (connect) Sberbank Mobile Bank on your phone yourself (for example, if you refused this option or accidentally disabled it).

To avoid wasting time on extra steps, check to see if your number has this service. You can read more about this in the articles: How to check if Mobile Banking is connected and For which cards it is connected.

Summing up

“Mobile Bank” from Sberbank is a modern and convenient option; it opens up a lot of opportunities and allows you to independently manage financial services remotely. Transfer money, pay loans, bills - everything can be done at any time via phone. It is worth noting the progressive organization of the bank’s work - you can activate the option through online banking or by calling the call center. Traditional options are also provided - contacting specialists at operational offices, using an ATM.

The benefits of mobile banking are extensive:

- Move money, pay a loan or pay bills via phone, regardless of Internet access.

- By making transactions using templates, the limits on transfer operations are canceled - if a user can send up to 8,000 rubles via SMS message, then using a ready-made template created in Sberbank Online - up to 100 thousand rubles.

- Receiving complete and reliable information about the card account and loyalty program - there is absolutely no need to contact a call center or bank branch, all information is available on the phone.

- Ease of use - just open the SMS command directory, it is posted on the official Sberbank website www.sberbank.ru.

Currently, mobile banking from Sberbank is one of the best among its competitors. The service combines extensive capabilities and easy management of funds from a card account. If necessary, Mobile Bank can be quickly disconnected and reconnected - without paying additional fees.

Sources

- https://banksb.ru/sberank/servis/mobilnyy-bank/

- https://sberbank-sbrf.ru/podklyuchit-mbank-v-sberbanke/

- https://sbotvet.com/mobilnyj-bank/podkljuchit-cherez-telefon/

- https://bankiinfo.com/sberbank/drugoe/podkljuchit-mobilnyj-bank-cherez-telefon.html

- https://zen.yandex.ru/media/brobank/kak-podkliuchit-mobilnyi-bank-sberbanka-5d931428ddfef600af16d902

Solutions

Internet banking is connected once and is associated with one phone number. Deactivation of the service and change of the linked number is possible only by visiting a bank branch in person and filling out the appropriate applications.

Please note: when re-issuing a bank card, you should immediately check your access to online banking. If the login fails, contact a specialist immediately, as the option should be activated automatically.

Features and Alternatives

The cost of receiving notifications on the card depends on the tariff chosen by the client (Economy or Full) and the card connected to the following restrictions:

- There are no notifications about card transactions;

- A single balance and limit request costs 5 rubles;

- A single transaction history request costs 15 rubles.

The “Full” tariff offers the user several weight advantages:

Free notifications about all card transactions. Information about your balance and recent transactions is also provided free of charge;

The subscription fee for connecting the service is determined by the type of card:

- 0 ₽ for Visa Gold, Gold MasterCard

- 30 ₽ for Maestro, Electron visa;

- 60 ₽ for Visa Classic, MasterCard Standard.

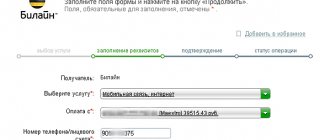

If desired, a Sberbank client has the right to change the selected tariff plan. You can connect a new tariff in 2 ways:

- Come to a Sberbank branch and fill out the appropriate application;

- Send an SMS message to 900. To switch to Economy – “ECONOMY – last digits of the card”, to switch to Full – “FULL – last digits of the card”.

There are two types of mobile banking disabling – temporary (suspension) and permanent. To temporarily block the service, the client sends an SMS to 900 with the text “BLOCKING SERVICES – last 4 digits of the card.” With this blocking format, notifications do not arrive on the phone, but the subscription fee is charged. Disable the option forever, possibly in all Sberbank offices. To do this, the client writes a statement from the cardholder, a sample of which is presented below.

Push notifications have become a modern alternative to SMS banking. In 2019, Sberbank began to massively transfer users connected to . Thanks to push notifications, alerts about transactions are sent to clients through the Sberbank smartphone application, which must be installed. All transactions performed are saved in the application archive and are divided into categories for convenience (“Debits”, “Credits”, etc.).

Using an ATM

To activate, you don’t have to go directly to the bank itself and stand in line there – registration is also available through an ATM.

To do this, you only need a card and a PIN code. After inserting the card and entering the PIN code, select the item in the menu that is called “Mobile Bank”. You will see a submenu, among which will be what we need, namely, connecting the main card. You can then choose which option you prefer - full or economy. The period for consideration of the application is the same as in the previous case - several days (maximum three).

The undoubted advantage of this option is that there is no need to go to a bank branch, waste time and fill out paperwork, this way everything goes much faster. In addition, unlike the first option we considered, in order to connect through an ATM, you do not need to already be registered in the Sberbank Online system.