A bank card allows its owner to open up numerous opportunities, including fast payment for online purchases or easy transfer of funds. However, the standard procedure for issuing a card at a bank can take quite a long time. A Beeline bank card is available for registration to all subscribers of the cellular communication company. It expands the range of customer opportunities, and also gives a lot of gifts and pleasant bonuses to each user.

Advantages of the Beeline Mastercard bank card

Among the main advantages are:

- possibility of registration without investment of funds;

- the service is free of charge;

- if lost, no fee will be charged for re-issue;

- Clients are informed free of charge;

- the ability to accumulate bonuses by making daily purchases;

- can be used not only in Russia, but throughout the world;

- You can manage and control expenses using a mobile application;

- conversion of rubles into local currency is carried out at the rate of the Central Bank of Russia, and no additional interest is accrued;

- many ways to replenish your balance;

- accepting transfers from different cards.

Depending on the type of card that the company’s client has chosen, the list of bonuses and additional opportunities provided is significantly expanded.

Additional Information

Apart from the new design and bonuses from, this product is almost exactly the same as the analogue from Alfa-Bank.

Reissue in case of loss or loss will cost the client 290 rubles.

The card is managed through the Alfa-Bank application.

“Beeline 100 days” involves using not only borrowed money, but also your own money. If necessary, the client can use it as a simple debit card.

Beeline card with interest on balance

This type allows you to receive up to 7% per year of the amount that remains in the subscriber’s account. Among the main advantages it is worth highlighting:

- Interest on the balance is calculated every day. A Beeline client receives a one-time payment every month. Its size directly depends on the size of the remainder;

- There are no usage or maintenance fees. The client can make an unlimited number of payments in shops, cafes and other establishments every day, and no additional fees will be charged;

- free information about all transactions and balance of funds.

At the same time, the client is not deprived of standard services inherent in any card, including free account replenishment or withdrawal of funds, for which no commission is charged.

Interest on balance

The annual interest rate, which is credited to the account once a month, may vary depending on the amount stored on it:

- 15,000 – 100,000 rubles – 3%;

- 100,000 – 300,000 rubles – 4%;

- 300,000 – 1,000,000 rubles – 6.5%;

- 1,000,000 or more – 7%.

If the final amount remaining in the account is less than 15,000 rubles, then 0.01% is charged per year.

Important! The larger the amount stored, the greater the final interest that will be accrued to the person after one month.

At the same time, the company fully ensures the safety of all funds.

Recipient requirements

The bank has the right to impose a number of conditions on the recipient of services.

The applicant will receive this banking product if:

- is a citizen of the Russian Federation;

- reached the age of majority;

- acts of its own free will, has no beneficial owners or beneficiaries;

- is not a public official;

- confirms the absence of information that negatively affects his reputation;

- has a good financial position;

- does not intend to violate the information security of the bank’s electronic resources;

- expresses consent to the use of his personal data in accordance with the legislation of the Russian Federation.

Beeline cashback card

The bonus program allows you to return interest on the amount spent on purchases. So each client will receive:

- refund of 1% of the amount spent when paying using a card, including online purchases;

- bonuses increased to 5%. In their personal account, each subscriber will be able to independently select 3 categories of the most visited establishments presented in the list, in which the cashback percentage will be 5%;

- increased bonuses when paying with company partners. Their size can reach 15% depending on the frequency of purchase and the cost of the product.

Important! When making purchases on the Internet, it is recommended to additionally use another cashback service. This will allow you to get the maximum benefit from your purchase.

A person can spend accumulated points:

- to pay for cellular communication services;

- when making purchases in Beeline stores. You can use bonuses to purchase phones or mobile accessories. It is impossible to pay for services using bonuses;

- from partners of the bonus program.

Important! The subscriber can pay only up to 90% of the cost using points. This restriction applies both when paying for mobile communications and when purchasing from partners.

It is worth considering that when paying for housing and communal services, cellular communications, insurance services, the Internet or when transferring funds, bonuses are not awarded.

Customer Reviews

Vadim, 24 years old, Voronezh:

I saw an advertisement for a new credit card in the Beeline application. It turned out that it was “100 days without interest” from Alfa-Bank. The desire to take advantage of the new offer took over. The process at the salon took a long time - 40 minutes, but it was worth it. Cash is withdrawn without commission, and replenishment is also without problems. In addition, there are no imposed insurance services.

Vlad, 36 years old, Astrakhan:

The first year of service is free, which is great. It can be processed without any problems; if the loan amount is small, a passport will suffice. The main advantage is that you don’t have to go to the other end of the city. You can apply for and receive it at your nearest Beeline office. In addition, the operator offers a good promotion with cashback when purchasing in its stores from 2 thousand rubles.

Oksana, 29 years old, Saratov:

100 days without interest" is a good help if you stay within the grace period. However, monthly payments still need to be made. In fact, “100 days” turns out to be not so honest. But this is a small matter.

Sergey, 44 years old, Novosibirsk:

I received a plastic card, used it, everything was fine. Didn't have time to pay off the debt. After 100 days, interest was accrued on 23 thousand rubles. Keep a close eye on the delay.

Beeline credit card with credit limit

A credit limit is necessary for people who cannot competently distribute available funds for a month’s stay or a longer period. With this, the client gets the opportunity to make purchases at any convenient time, regardless of the amount in the account. The Beeline card, the registration fee of which is 500 rubles, allows subscribers to repay the loan within 55 days without accruing interest. Starting from day 56, the interest rate can reach 28.9% per year. Tinkoff Bank acts as a partner bank.

Important! Beeline commission is charged when withdrawing funds from the account in the amount of 4.9% of the amount plus 500 rubles.

Credit limit

This type can be applied for by citizens aged 18 to 70 years. In this case, the interest rate will be calculated individually, but it cannot be less than 19.9% per year. The maximum credit limit amount is 300 thousand rubles. However, it can be changed at the request of the borrower.

Who can take advantage of a microloan from Beeline?

Of course, before using the service provided, you need to familiarize yourself with the conditions and obligations required to be fulfilled by the client. In case of non-compliance with obligations, the mobile operator has the right to unilaterally terminate the agreement and disable the service provided without prior notice.

So, a loan from Beeline, which is provided additionally, is given on the following conditions:

- repayment of funds received through the service is carried out no later than three days from the moment of its activation;

- early repayment is welcome, funds in full can be deposited before the expiration of the required payment period;

- funds spent on operator services over the last three months should not be less than fifty rubles for each month;

- The client must use it continuously for at least two months to obtain the right to use.

According to the cellular company’s standards, there is a direct relationship between the amount of the loan provided by Beeline and the amount of money spent on the company’s services by the direct client over the past three months.

The numbers are as follows:

- a loan of fifty rubles is provided if at least one hundred rubles have been spent in the last three months;

- eighty rubles are issued to those who have spent from one hundred to a thousand rubles on operator services;

- from a thousand to one and a half thousand rubles spent gives the right to qualify for a loan of one hundred rubles;

- two hundred rubles of credit will be received by those who spent from one and a half to three thousand;

- finally, those who spend more than three thousand rubles on calls and other services are provided with a microloan from Beeline in the amount of four hundred and fifty rubles.

These prices are correct when you are in your home region.

For roaming there will be different numbers:

- fifty credits are given for spent funds in the amount of up to three thousand rubles;

- over three thousand rubles of monthly expenses entitle you to a credit of five hundred rubles.

The terms of the loan provided can be obtained by dialing the command “*141*7#” on the device and then making a call. All information will be sent in a response message to the client’s device.

Providing this option also entails debiting funds from your personal account. This must be taken into account when calculating the amount required to be received. As a rule, provision is carried out for fifteen rubles, but this depends on the regional location at a given time.

How to apply for a Beeline Mastercard bank card

Each person will be able to go through the procedure of obtaining a bank card. To do this, you need to contact any of the company’s cellular communication stores. To register, you only need to have your passport with you. The procedure itself takes no more than 15 minutes. This time is required to fill out the form and check that all data has been entered correctly. There is no processing fee. Immediately after filling out the standard form, the client receives a card in his hands, resulting in significant time savings.

Important! If desired, anyone can issue a personal option. This will allow contactless payment, as well as a number of additional benefits. However, this type will take longer to produce.

It is worth noting that you do not have to be a client of a mobile operator to register.

Conditions for obtaining a Beeline MasterCard bank card

Anyone can receive a card, regardless of whether they use the company’s services or not. There is an age limit. It can be obtained by people aged 18 to 70 years.

Issue is carried out immediately after checking all the data. If the client purchases a card with a credit limit, the procedure may take a little longer. This time is necessary to make a decision and set a limit.

Card replenishment

Topping up your Beeline balance is possible by contacting any office of the company. This is the most commonly used method. To do this, you need to take your passport with you. The amount transferred to employees will be credited to the account within a few seconds. Moreover, with this method of replenishment there is completely no commission, regardless of the type.

It is also possible to top up your balance using the application. When replenishing your account with an amount of more than 3,000 rubles, the service is provided completely free of charge.

Cash

Recently, all clients of the mobile operator have the opportunity to deposit cash into their card balance independently. To do this, you need to use ICD terminals. Funds are credited to the account within a few seconds, of which the client will be notified by receiving an SMS message.

From another card

You can also top up your balance using transfers from cards of other users. At the same time, when transferring between Beeline card users, no commission is charged. If the transfer is made from other banks, a commission is charged. However, it is canceled if the transfer amount exceeds 3,000 rubles. In this case, the total monthly amount of transfers should not exceed 100 thousand rubles.

What else do you need to know when borrowing for a phone?

A subscriber who is going to use the described service must remember some features accompanying the option:

- the number should not be blocked for any reason;

- some cases provide for a period of permanent relationship with a client other than three months;

- the loan amount received must be used only for communication services provided by the mobile operator.

tries to ensure the provision of services to the end client with maximum comfort, but the client must also comply with the proposed rules so that unforeseen situations do not arise that require lengthy resolution.

A microloan from Beeline in the form of the “Trust payment” option will allow you to stay in touch in any situation, even if the funds in your personal account show a negative value.

Cash withdrawal

The company's client can contact any office of the mobile operator, regardless of location, to withdraw cash. There is no withdrawal fee. The maximum cash withdrawal limit per month is 1,000,000 rubles.

Important! The exception is a credit card. When withdrawing cash, a commission of 4.9% of the amount plus 500 rubles is charged. At the same time, the amount should not exceed the established credit limit.

At an ATM

Withdrawing funds using an ATM is carried out in the same way as when using other cards. Cash withdrawal without commission is possible only at ATMs of Alfa-Bank, MKB, UBRD and others. The full list can be found in your personal account.

At a bank branch

Withdrawals are carried out at any bank in the Russian Federation. In this case, a commission of 4% of the total amount will be charged, but it should not exceed 350 rubles.

Advantages and disadvantages

“Beeline 100 days” has a number of differences from its analogues.

Advantages of this banking product:

- Interest-free period of 100 days.

- First year of service - 0 rub.

- Free card issue.

- Cashback from .

- Stylish design.

- Possibility to repay a loan from a third-party bank.

Disadvantages of the banking product:

- High interest rate in case of late payment and exceeding the grace period.

- Paid card maintenance after the first year of use—RUB 1,490.

- Mandatory monthly payment.

- Limit on cash withdrawal per month.

Late payments are subject to a high interest rate.

Internet bank "Beeline"

With the help of Internet banking, people will be able to:

- have full access to your balance at any time of the day;

- control expenses by reviewing information about all transfers and payments;

- create templates that can be used when paying for goods or services of a mobile operator;

- fully manage available bonuses.

This service is available to all subscribers. Use is free of charge.

Login to your personal account

To log into your personal account for the first time, you will need to enter the thirty-digit card number and the phone number to which it is linked. When logging in again, only the phone number is indicated.

Mobile app

The application allows you to use all the features of Internet banking. It is available on Android and IOS devices. With its help, you can manage your card, find out your balance, or connect additional services.

Registration and login to Beeline Mastercard personal account

The personal or payment account of a Beeline MasterCard plastic card holder is available to every individual who has this means of payment, regardless of the type of card.

The mobile operator offers MasterCard plastic in three varieties:

- “classic” category MasterCard Standard - for subscribers of all Russian mobile communication providers, subject to replenishing the card account by 100 rubles;

- MasterCard World - only for its subscribers, subject to replenishment of the card account by 500 rubles. Bank cards of the World category are classified as premium products, but this does not apply to non-branded plastic from Beeline;

- personalized MC World card with contactless payment technology, available to a Beeline subscriber who has previously received any of the two non-personal cards from the operator.

Important: the issuance and maintenance of all types of Beeline MasterCard plastic is free, and a personalized embossed card is always better than a non-named one. To exchange one for another, you need to pay only 200 rubles for delivery of new plastic by Russian Post.

Ordering a card with your name without wasting time visiting a mobile phone store is one of the opportunities that opens up after registration and authorization in your personal account.

The Beeline payment account is located at: bank.beeline.ru.

To gain access to the service, you need to go to the site, enter the 13-digit code printed on the back of the plastic under the barcode in the “Login” field, and click the “Login” button.

After registering and receiving a password to enter the payment account, you can log in by entering the phone number linked to the card instead of a “barcode”.

Possibilities of the payment account of the Beeline MasterCard card

For the user of the Beeline MasterCard card, the personal account gives the opportunity to:

- replenish the balance by non-cash transfer from a bank card account;

- transfer Card2Card money in the opposite direction - to your own bank card accounts linked to the service;

- make transfers from a Beeline card within Russia, to the CIS countries and Georgia;

- make payments on loans and microloans in any Russian banks and microfinance organizations;

- pay for housing and communal services, government services, TV and Internet, mobile communications and many other services from hundreds of providers “in two clicks”;

- create payment templates and set up automatic payments, allowing the system to automatically pay for services at a given time and with the required amount of funds;

- receive comprehensive information about the movement of funds and all transactions on the card in detail, the available balance on the balance.

The security of payments and transfers is ensured by 3-D Secure technology.

To link a bank card, you need to go to your personal account using the “Card Replenishment” link, then click “Details for replenishment”. In the tab that opens, enter the card details - number, expiration date and secret code on the back (last 3 digits).

Please note: to confirm the link, you must enter an amount of up to 10 rubles, specifically debited from your card account. You can find out through the Internet bank or mobile application of the issuing bank or by calling its call center. A few days later this amount is returned to the balance.

If a Tinkoff Bank debit card is linked, a commission of 90 rubles is also deducted from it, as when withdrawing cash in the amount of 3,000 rubles, but a few days later this money is returned to the card account. Moreover, Tinkoff Bank is a partner of Beeline, lending to holders of Beeline payment cards.

The minimum replenishment of Card2Card without commission from Beeline is 3,000 rubles. If the transaction amount is less, RUB 50 will be charged. The commission of the bank from whose card money is transferred depends on its conditions.

For transfers in the opposite direction - from the Beeline MasterCard card account - a commission of 1.5% is charged, not less than 50 rubles. The maximum transaction amount is 125 thousand rubles.

Transfers between Beeline cards through the payment account are free.

What cannot be done through the payment account

If you do not have a Beeline bank card, your personal account at bank.beeline.ru will not help:

- get a PIN code;

- to plug ;

- apply for a loan from Tinkoff Bank;

- set limits on card transactions, increasing the security of funds.

The last option is not provided; the PIN code is generated after calling a special phone number, and for other services you should contact the telecom operator’s salon.

Important: Beeline MasterCard is not actually a banking product, but is produced through the cooperation of the mobile operator with the Payment Center RNKO.

This organization does not participate in the deposit insurance system, so if the Payment Center’s license is revoked, cardholders cannot count on insurance compensation (unlike card clients of banks).

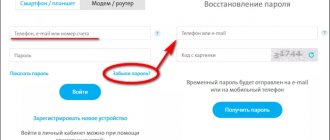

How to recover your password

If you have forgotten the password for your Beeline card personal account, click on the “Remind” link. Enter your phone number and card barcode. Click "Next".

The service will send password recovery data via SMS

SMS Service

Using the SMS service, it becomes possible to control by sending special commands to the number 61-19. With its help, you can find out your balance, make payments and other actions. A complete list of available options and codes is presented in your personal account.

Anyone can get a card, even if they are not a subscriber to a mobile operator. It is provided free of charge. The registration procedure does not take more than 15 minutes. In this case, a person can refuse the card at any time and block it.