MTS's "Easy Payment" option provides customers with the opportunity to quickly carry out various financial transactions. By activating this service, you can transfer money to your card and balance to other subscribers, pay for the Internet, television, housing and communal services, pay off loans on credit cards, and make purchases in online stores. You can find out more on the Easy Payment website - www.pay-mts.ru.

As a rule, there is no commission or a very small percentage charged for all these operations - this is the main advantage of the service.

What can you pay on the MTS Pay service?

So, let's figure out what you can pay online using the MTS "Easy Payment" service. The list of goods and services is quite wide, so we will highlight only the most popular areas:

Photo 1: How to pay for services from your phone through the MTS Pay service?

mobile connection

Using the MTS Pay service, you can not only top up the balance of your MTS mobile phone, but also the numbers of other mobile operators such as Beeline, Megfon, Yota, Tele2. In addition to Russian cellular companies, several operators from neighboring countries are also available.

Internet and TV

In this section you can pay for home Internet and television. Website owners can also find popular hosting providers and domain name registrars in the list.

Games

If you are an avid gamer and often top up your account in online games, then this category is for you. Here you can deposit money into your account in games such as World of Tanks, Warface, World of Warships, Arche Age and many others.

Rent

This category is intended to pay for housing and communal services and electricity. Homeowners associations and management companies are presented here for each region.

Loan repayment

If you have an outstanding loan, you can list your monthly payments in this section. The list includes almost all large banks, credit and microfinance organizations.

Money transfers

Here you can transfer money to anyone in a way convenient for you and the recipient. You can send money to your mobile phone account, make a money transfer to receive cash, transfer money from a bank card or phone to another card.

Connection

You can pay for certain communication services not included in the previous sections here. To make a payment you will need a contract number or login.

Electronic money

This category contains links to pages for replenishing wallets of various electronic payment systems. Here you can deposit money into Webmoney or YandexMoney, or, for example, top up your QIWI wallet from your MTS mobile phone.

Charity

If you are not indifferent to the grief of others, you care about environmental issues and animal protection - here you can make a contribution to a good cause directly from your mobile account or from a linked card.

Transport

In this section you will find links to payment for various transport services, such as: travel and airlines, gas stations, unified travel cards, parking, as well as traffic police fines.

In addition to the services listed above, you can also pay for the services of various companies that are not included in any of the mentioned categories. You can find a complete list of partners on the official MTS Pay website.

You can make payments either from your phone balance or from a bank card. To do this, you need to link one of them in the “My cards” section.

It is worth noting that not all services can be paid with a bank card. For many of them, this function is not available and only top-up from the phone balance is active.

Before making a payment, you should familiarize yourself with the terms and conditions of its execution and tariffs. In various cases, the commission can range from 0 to 10 percent or more. You will be shown the full amount including all fees before payment is confirmed.

Each mobile operator, in addition to communication and Internet services, has a huge list of various subscriptions, access to which is provided for a fee. Moreover, many of them are connected without the participation of the subscriber. MTS users complain that money is debited from their accounts for incomprehensible services. Transactions are designated pay.mts.ru topup. It indicates a successful transfer of funds for using the “Easy Payment” option. There are effective methods that allow you to cancel unnecessary subscriptions that can cause a negative balance.

Advantages and disadvantages

The advantage of this functionality is the simplicity and accessibility of all operations. You can use it from your mobile phone while in any city in the Russian Federation or abroad (while roaming).

You can connect to the service one or more bank cards of the Visa or Master Card systems, issued by any Russian bank. The restriction applies only to cards without a security CVV code (a three-digit code printed on the back of the card). You can also make a payment from the official MTS website, from the user’s Personal Account.

You can make payments in several ways:

Pay MTS RU – phone number management

Options for managing a phone number with Pay MTS RU include checking the account balance, actions with the number, managing services and options. The section combines three subcategories. Let's look at them in more detail.

Account information

- Account status – in this subsection you manage your mobile communications expenses, optimize your tariff plan, and manage additional options. To fully use the service, it is recommended to log into your MTS personal account using your phone number and password.

- Account detailing – viewing a report with information about the balance, tariffs for calls, SMS, and the Internet. Here the subscriber finds out when and for what money was debited from the account.

- Monthly Invoice – An account itemization format with information about account balances at the beginning and end of a calendar month or billing period. It is accompanied by data with expenses for the previous month. An example of a monthly bill is a prepaid bill.

Actions with number

ATM or terminal

You can instantly transfer money without additional fees in order to reduce your debt at ATMs and MTS terminals with the cash in function. Money in the amount of no more than 15 thousand rubles. will be debited from the payer’s card account opened in any financial institution, or will be accepted in cash using the agreement number, parameters of the card linked to the loan account.

Other terminals

If you have plastic associated with your account, you can repay the loan using the services of TelePay, QIWI, CyberPlat, Quickpay, Xpat, EuroPlat and others. For transfer amounts exceeding 15,000 rubles. passport required.

The time, requirements and cost of services of various terminals are presented in the table.

| Terminal | Service price (in rubles) | What do you need |

| Instant crediting of funds to the card linked to the loan account | ||

| TelePay | Free from MTS card account, prices vary from other accounts | |

| SprintNet | 1% of the amount, from 50 | |

| QIWI | For plastic and in MTS stores no commission, for others from 100, 1.6% | |

| CyberPlat | With MTS-Money plastic and in MTS showrooms without additional payment, with others there is | |

| Sberbank | Non-cash 1% no more than 1 thousand, cash 1.5% from 30 to 1 thousand. | Borrower's full name, card number, loan agreement number |

| EuroPlat | 1%, from 50 | |

| By contract number in one to three working days | ||

| Quickpay | 1%, not less than 50 | Debtor's name, phone number |

| XPlat | 1%, from 50 | Borrower's name and telephone number |

| EuroPlat | 1%, 50 and more |

The procedure is intuitive and simple. When performing them, you need to follow the program prompts.

How to activate the service

The connection is carried out remotely, without visiting an MTS salon or a bank office. To perform transactions, you need to download and install the service on your mobile device. You can download the MTS Easy Payment application on the operator’s website.

The application works on all phones: iPhone, Android, Windows Phone, Symbian, Java, etc. To download the application, you must enter your phone number and receive an SMS message containing a download link. The program can also be downloaded from the App Store or Google Play.

iPhone app

The developers offer a new free version 3.3. 65.2 MB in size. It includes a new section “Autopayments”, with which you can automatically transfer funds as payment for loans, utility bills, etc. In addition, the “Money transfers from card to card” service has been improved, thanks to which you can easily register bank cards and save transfer templates. Successful installation requires iOS 6.0 or later. Compatible with iPhone, iPad and iPod touch.

Windows Phone app

The client will be pleasantly surprised to see the new improved version 1.0.0.0. 10.17 MB in size. Now the commission amount is displayed on the payment page. You can make a payment using a bank card not only in the service, but also on the “Easy Payment” website. If you purchase a new mobile device, all data is automatically displayed in the application.

One hundred percent discount on MTS TV Light

The service runs on the operating systems Windows 10 Mobile, Windows Phone 8.1, Windows Phone 8. It is provided absolutely free.

Blackberry app

You must select an operating system: iPhone (follow the link in the App Store or iTunes from Apple), Android (follow the link in Google Play), Windows Phone (follow the link in the Windows Phone Store), BlackBerry (with an operating system version less than 10 th).

- MTS service Easy payment - fast payment for services

Devices that support Java Mobile

The application download depends on the screen size of the mobile device. The creators offered three options to choose from:

- presence of a large touch screen;

- lack of touch screen;

- presence of a small touch screen.

The phone must support MIDP 2.0/CLDC 1.1 standards, have 2 MB of free memory for installation and 2 MB of RAM to run the application.

We've already looked at the iPhone version, so let's take a closer look at Android. The latest version is dated late 2021. The developers took into account the shortcomings and errors of the previous version, for example, they expanded the set of permissions.

For adequate operation of the service, Android version 2.2 or later and 20 MB of free memory are required. The application is provided absolutely free.

Advice! To avoid installation difficulties, it is better to first download the application to your computer and then save it on your phone.

How to pay for an MTS Bank loan - repayment methods

Without exception, all recipients of loans from this financial institution are interested in how to make the next payment in order to avoid delays and repay the debt as promptly as possible. The organization offers several methods of application. It is possible to choose the optimal method based on indicators such as:

- The presence or absence of a commission;

- With immediate enrollment or longer.

The company supports several methods of repaying loans and debt on issued plastics at a fairly high level. Almost all of them are easy to use and understandable. To quickly make your next payment, you just need to choose the best option for yourself and repay the loan with a minimum amount of time and without fees.

Below is a more detailed list of the options offered. Many of them can be used to pay the next installment without any problems:

- Terminals and ATMs.

- Internet bank.

- Mobile app.

- Bank office.

- Operation Easy payment.

- MTS showrooms.

- Euroset.

- Messenger.

- Russian Post.

- Eldorado, M-video and Tekhnosila.

- Megaphone.

- Rostelecom.

- Other financial organizations.

Pay MTS RU – service management

In this category of the Pay MTS RU website, a mobile and Internet connection subscriber can regulate all connected services and activate new ones. This applies to mobile communications, the Internet, SMS, and popular options. For example, configure the parameters of the unified Internet, return 20% for payment for Internet services. If an MTS user wants to add one of the numbers to the blacklist, he can refer to this section. Voice mail can also be set up here.

- 6996 MTS - what is this service and how to disable it?

Those who frequently visit social networks are recommended to go to the “MTS Online” to take advantage of the chance to correspond on social networks without limits. Moreover, all SMS messages are free, without a limited number, for only 3 rubles per day. Additional parameters of SMS messages are valid with the activation of the SMS Pro . It comes to the aid of busy MTS network users who have no time to respond to SMS. By setting up the function of sending SMS and answering machine, all interlocutors will be informed that the subscriber is busy.

And, of course, in the “Service Management” section on the Pay MTS RU website you can connect the popular ones, My Content, MTS Search. “Gudok” is a service for setting a non-standard melody for incoming and outgoing calls instead of banal beeps. “My Content” service allows you to subscribe to constant newsletters of information on any topic: music, videos, games, horoscopes, sports and entertainment. MTS Search helps to determine the location of family and friends using an interactive map, and search for the addresses of the necessary establishments via a mobile phone.

MTS Gudok connection services, video:

Who is the service available to?

All subscribers with an operator SIM card can transfer funds.

The option is available when using either a cell phone or tablet, or via a desktop computer.

- When paying for services, in addition to the required amount on your personal account or card, your phone must be active (not blocked) on the network.

- Payment is not made from funds that were credited to your account for the promotion.

- Bonus points are not available for this either.

Registration in the “Easy Payment” service is not required; all clients of the company are connected automatically after activating the subscriber’s SIM card.

Making a payment using is not at all difficult. This can be done using several services:

- Send an instant ussd request.

- Install the mts pay mobile application.

- Use the MTS-Info application built into the SIM card.

- Transfer money via SMS.

- Use your MTS personal account.

Each of them will equally quickly help you transfer money to the desired account.

Remember that some types of payments incur a commission, the amount of which can reach 10%.

MTS bonus on the website pay mts ru

MTS Bonus program gives its subscribers gifts for using communication services. Such gifts are additional minutes for calls, Internet traffic, unlimited calls and traffic, favorable SMS tariffs, money in the account and other bonuses. This is a permanent loyalty program for the operator’s customers, allowing them to reward them for choosing MTS and introduce new communication services.

On the pay mts ru website you can accumulate, spend, and convert accumulated points into real purchases. You can make an order for the desired purchase in partner stores or in stationary MTS Russia stores. By logging into your personal account via Pay MTS RU, you can manage personal bonus accounts, check the history of bonus accumulations, and give points to other subscribers. Special MTS Bonus offers include tickets to cultural events, access to music tracks, online games, educational content, purchases in online stores, English language courses and other programs.

MTS Bonus program, video:

Loan payment procedure

MTS Bank applies a standard scheme for issuing and paying off loans. When taking out a cash loan, the client repays the debt with annuity payments. This means that he makes the same payment every month.

When issuing a loan, the bank gives the borrower a clear payment schedule, which he must comply with. The schedule describes the payment procedure, the composition of each payment and the date on which the money in the required amount should be in the account.

We recommend making payment in advance. If you need to pay on the same day, choose instant methods, otherwise there will be a delay.

In the case of an MTS Bank credit card, there is no schedule; the borrower repays the debt in the way that is convenient for him. There are two conditions: first, the payment must be no less than the minimum allowable, second, it must be paid once a month. You can deposit money into your account at least every week in a month, but only one transaction will be considered a monthly payment.

MTS Bank regularly sends messages to MTS credit card holders indicating the amount of the minimum payment and the date by which it must be paid.

How to disable “easy payment mts” 6996

Separately, we should mention the easiest way to disable the “Easy Payment” function - send a message to the short number 6996. This message will become an automatic request to disable the presented option.

Another reason why people refuse this function is the increasing incidence of fraud. After all, it is enough to receive an SMS with an access code to the payment system, your account will be completely emptied and the fraudster will have access not only to your personal account on the operator’s website, but also to your bank card.

The first euphoria quickly passes when the phone owner finds out that in addition to regular payments, commissions are charged, so many people have a question about how to disable MTS easy payment. And cybersecurity issues also force the user to decide to disable the service. After all, not only a mobile account on MTS is connected to the easy payment system, but also a bank card, and if the application is used ineptly, this can give attackers a free hand.

How to pay a loan at MTS Bank through Sberbank Online: methods

Users have 2 ways to pay for an MTS loan through the SB online network:

- Internet banking “Sberbank-Online”;

- bank mobile application.

Let's look at each method in more detail.

Computer way

When issuing cards, obtaining loans, opening accounts, etc., clients are offered to open Internet banking along the way. Sberbank Online provides complete control of personal savings and allows you to remotely carry out a large number of financial transactions on favorable terms.

As a Sber client, be sure to register in its online service. This will allow you to carry out transactions via the Internet and spend seconds on what, in the absence of banking, takes hours and days.

To make a payment on debt on a loan taken out from MTS Bank through Sberbank Online, you should proceed as follows:

- Log in to the main page of SB.

- Go to Internet banking by entering your login information on your personal page.

- Make sure that there are sufficient funds in your account for the transfer.

- Select the “Transfers and Payments” tab. It is located at the top on the long green panel.

- Choose a repayment option that allows you to close loans from other financial institutions.

- Since the required institution will not be found in the list proposed on the next page, enter the payment section by BIC.

- Enter the numbers “044525232”.

- Click on the “Confirm” command.

- Fill out the 3rd line of the opened electronic form: Full name of the owner of the account being replenished, loan agreement number, account number.

- Click on the “Continue” button.

- Indicate the number of the payment instrument for debiting funds.

- Enter the amount to send.

Using mobile banking

The mobile bank is designed for users who want to manage their finances anywhere in the city or country.

Smartphone users can log into the mobile version of Sberbank Online. This is a simplified version of the utility created for PC. The program control algorithm is similar to that described above. You can use its tools only if you are connected to the Internet. There is also a mobile application that works on a completely different principle.

The advantage of an application for mobile devices is that you can make transactions even without an Internet connection. To pay the creditor, you need to send a corresponding message to number 900. In the SMS you need to indicate:

- payment amount;

- data of the creditor's organization.

Opt-out options to use

There are many quick and convenient ways to disable this functionality on MTS:

- Using an automatic service with hints. To do this, dial the number 0890 on your device, and then the number 0. Listen carefully to the informer, and when it asks you to disable easy payment, press the number that will be called.

- You can send a request to disconnect using the command using the symbol combination *111*1#, do not forget to activate the request using the voice call button. After a few minutes, the device display will display a message indicating the successful completion of all services provided for this functionality.

- If the client is located outside of his home region, then he should use the number +74957660166, this is what is used in roaming to deactivate the option. Listen to the automatic informant and follow all recommendations, only in this case the service will cease to operate.

- One of the simple ways to disable the service is to contact a customer technical support employee directly at 8 800 333 0890. After connecting, describe your problem and ask him to disable the payment service in real time, but you will have to provide your personal data and confirm classified information.

- If there is a sales salon nearby in your area of residence, you can request a disconnection there by presenting to the employee your general passport or other document confirming your identity as the owner of the number. After all, only the owners can fully manage all services at their own discretion - disable or enable additional options or tariffs.

Methods to disable the service

If you no longer want to use the payment system from your provider and decide to disable the service, then there are many ways to do this on your own or with the help of qualified operator employees. But unfortunately, it is completely impossible to turn off the service; the most you can do is deactivate bank cards and auto payments. Below, all possible methods are described.

Short commands

To permanently limit yourself from the actions of attackers, set a content ban. After this, your phone number will no longer receive notifications from the short number “7763” to confirm payments. To do this, simply dial the USSD encoding *152*2# and wait for a response from the company.

In the application or personal account

In this case, deactivation should be understood as unlinking a bank card from the service and deactivating automatic payments. To do this, log into your account in your personal account or in the mobile application. In the appropriate section “MTS Money”, disconnect all payment cards from the interface. After this, you will not be able to complete your purchase. The method through your personal account is only possible if you have an active Internet access point.

Address to employees

Find the nearest branch of the operator in your locality and ask a free consultant to activate the content ban service or assist you in disabling it, and you will be asked to provide an identification document. You can try calling the technical support service for MTS subscribers “0890”.

Attention! The article provides information for residents of the Moscow region. In other parts of Russia, the specifics of the provision and functionality of services may differ.

Mobile TeleSystems is not just a cellular provider, it is a full-fledged bank that will allow you to turn your smartphone into a convenient means of paying bills and making purchases. Today we looked at how this can be done using the MTS Money service.

How to do this through your personal account

You can deactivate the option using the network subscriber’s personal page.

- On the official website of the mobile communication service provider, follow the Personal Account link and enter all the necessary client authorization data.

- After entering the secret code sent to the user’s mobile device, you will be redirected to your personal page. Draw your attention to! If you use a modem or a branded tablet from the company to access the Internet, then you do not need to log in to the site, everything happens automatically.

- Then go to the “Services” section and select the desired option, and after the transition, check the “Disable” box.

- You should receive a notification that the operation was successful.

Important! Don't forget to unlink your bank card from this service! You can do this here, in the “Options” section. Just click on the “unlink card” icon. It is also necessary to disable SMS notifications about all payment transactions on MTS. To deactivate message processing, enter the characters *152*2# and press the voice call button.

Reboot your mobile device; now easy payment will not be available from it.

Mobility and comfort when using communication services by MTS subscribers is a priority task, which is accomplished through the introduction of new services and functions. Many have appreciated the MTS easy payment service, which opens up the possibility of transferring funds from the user’s personal account (mobile number) to a bank card or to the account of a utility company, or simply allows you to top up the account for yourself and your loved ones.

It is worth noting that the MTS Easy Payment service is provided to all customers in the Russian Federation and abroad, since this option can be used in several ways, even while roaming - through the official website, using your personal account or mobile application. This is definitely a modern solution with 24/7 access from any location.

Easy payment in MTS allows you to pay for mobile phones, Internet and television, top up your account in the game, repay a loan and make a bank transfer between users in Russia and the CIS countries. In addition, the service allows you to pay rent and all services related to housing and communal services (water supply, gas supply and much more).

The first category is represented by a selection of mobile operators, Internet providers and game developers.

The second corresponds to the banking sector and housing and communal services.

In the third block you can find charitable foundations and digital payment systems.

The fourth category contains the main transport carriers, government agencies for paying fines and online stores.

If you are an active and modern subscriber, you can make transfers to electronic wallets of world-famous systems (QIWI, Yandex Money, Wallet One).

Other useful payment options include the ability to pay in online stores (AliExpress, LitRes), pay off a traffic police fine, and buy a plane or train ticket.

There are two key factors that directly influence the successful completion of a monetary transaction: the presence of a MasterCard or Visa bank card or a sufficient MTS personal account balance to make a payment.

How to avoid running into scammers?

To protect transactions and increase the security of transactions within the framework, the provider sends SMS messages from the service number “6996”, which describes the amount of the upcoming purchase and its description. To confirm the transfer of your funds, simply send a reply SMS with the code content; to refuse, enter the number “0”. Any payment transaction must be agreed upon and confirmed by the owner of the electronic account or bank card. Nowadays, scammers have started to take advantage of this. There is a popular deception scheme:

- The attacker makes a purchase, transfers money, or pays for services, and uses your phone number as details.

- After this, as part of the service, you receive a notification from contact “6996”.

- Then the fraudster tries to contact the consumer in any way and persuades him to give the password for the transaction. At the same time, he may introduce himself as your relative or close friend.

- A gullible subscriber dictates the treasured numbers, after which money disappears from his balance to an unknown account.

Moreover, the user may receive messages stating that there are insufficient funds, this is due to the fact that the attackers make a purchase for an amount that you cannot afford.

Attention! Never tell anyone your security codes, not even employees of the provider company or close people.

In addition, try to adhere to the following recommendations:

- Do not leave your mobile device unattended. A fraudster can change the password for your personal account and set up an automatic payment or transfer money from your balance to your phone.

- Do not reveal or show your bank card details to strangers, especially the three-digit code on the back.

- Do not download unknown or suspicious applications from the Internet onto your smartphone. Do not scan QR codes; they may contain virus programs that can hack access passwords to payment applications.

- Do not respond to messages from unknown numbers, do not open links or send outgoing SMS.

Features of payment via Easy Payment 7763

Each person needs to bear systematic costs for the use of some resources. The Easy Payment service from MTS 7763 allows you to make the following:

- services of companies providing mobile communications;

- Internet providers;

- payment of rent;

- cable TV;

- making loan payments;

- payment of traffic police fines;

- orders from online stores;

- performing translations.

Thanks to the Easy Payment service using the short number 7763, you can pay for many services without wasting time, including traffic police fines, housing and communal services, cable television and much more.

By default, payment is made from the client's account, i.e. from money deposited on a mobile phone. It is possible to link a bank card so that all transfers are made from it.

Methods for repaying MTS Bank loans

The credit company offers borrowers different types of loans: consumer, mortgage, credit cards, loans for the purchase of goods.

When choosing which bank to apply for a loan from, you should not only compare the parameters for issuing loans in companies, but also analyze the methods of paying off debt.

For example, if a bank does not have options for repaying a loan via the Internet, its ATMs are out of reach, paying off the debt will be difficult for the borrower. It will have to use paid debt service options, which will increase the overall cost of the deal.

MTS Bank offers 32 loan repayment options, including 6 free, with 12 instant credits:

- At bank representative offices. The money will be credited instantly, up to 10 thousand rubles. a commission of 30 rubles is charged, with a contribution of more than 10 thousand rubles, the operation is carried out free of charge. Disadvantage of this method: you will have to visit the office of the credit institution during operating hours, which is not always convenient for the borrower.

- Through ATMs and terminals. Cash contributions are allowed in an amount of up to 15 thousand rubles. Funds will be credited instantly, no commission is charged. The disadvantage of this method is the need to look for an ATM to carry out the transaction.

- Through shops, payment services “Svyaznoy”, “Euroset”. The money is received within 3 business days, the commission will be from 1 to 2.5%. The client will have to make a payment in advance, this method should be chosen only if other options are not available, because the commission amount is quite high.

- Post office. Postal transfers are sent with a commission of 1.9%, the money will arrive within 1 day.

- Sberbank cash desk and terminals. The money will be received instantly, the commission will be 1-2%.

- Product loans can be repaid through store cash registers, money is received within 3 days, commission from 1%.

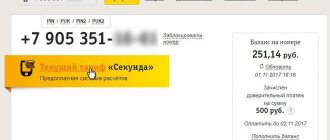

Connect easy payment MTS 7763

To make an easy payment using the short number 7763, you must first go through the registration procedure. It is very simple and does not differ from the generally accepted one. By visiting the Account, the client sees the available balance and options and list of services. By selecting the Payment for goods and services column in the menu, the user is shown a complete list: utilities, mobile, etc.

You will need to indicate the area of activity of the company, then select it from the list and indicate the payment parameters: amount, payment number, period (if necessary). Here you can choose the option: from an account or from a card. In the second situation, you need to enter data about it: number, CVV or CVC code, final validity date. There are situations when it is not possible to pay with a card due to a technical failure (in the absence of communication with the bank). In this case, you can always transfer money from the card to your phone and complete the transaction from the latter.

The Easy Payment service using the short number 7763 is available through a mobile application on your phone

You can use MTS Easy Payment on 7763 not only through a computer. With a smartphone or through a mobile application, this is also easy to do. At the end of the procedure, a message about the amount of the commission will appear. It is worth taking it into account in order to understand how much will be withdrawn. The bank commission when paying by card will be indicated as a separate parameter.

Early repayment

To make an early repayment, the client must replenish the credit account with the desired amount on the date of the regular payment debit according to the schedule.

The deposited amount will be written off automatically in full to pay off the debt. In this case, the loan term will be shortened. The client does not need to notify the bank in advance of his intention to repay the debt early. In order to avoid late payments and not to spoil the credit history, the borrower must pay loan obligations strictly according to the payment schedule, that is, on the date specified in the document. However, it is worth considering that funds will not always be credited instantly. Therefore, it is recommended to make a payment at least 5 working days before the upcoming payment date.

2+

Last modified: 12/03/2019

How to disable easy payment MTS 7763

Today, responses from those dissatisfied with the imposition of the Easy Payment 7763 service and those wishing to disable it have become more frequent. They operate by withdrawing money from the balance for performing an operation. The essence is that MTS withdraws 10 rubles from the account for transfers. Since the notification does not indicate exactly why the money is being withdrawn, users unknowingly accuse MTS of fraud and theft of money. But once you understand the situation, what can be done through consultation with an operator, the picture becomes clearer.

One of the ways to disable Easy Payment MTS 7763 is a refusal application, which can be filled out at any telecom operator office

If such a service is not needed, there are several ways to disable Easy Payment MTS 7763:

- Execute auto request: *152*22#. Next, the voice menu will request the actions the client needs. You must press the buttons corresponding to the refusal of Easy Payment.

- Visit an MTS salon and fill out a refusal form. In this case, the application is called Content Prohibition 0. You will need to fill out the fields, indicating your details and phone number.

- Contact customer service (0890). Explain your request to the operator.

As reviews say, the latter option is ineffective. It is better to contact the salon in person or automatically disable Easy Payment 7763 according to the prompts of the autoinformer.

Commission and restrictions when performing a transaction

This information should be obtained immediately before making a payment. This way, you can find out in advance the total cost, including interest on the transfer.

When paying for the loan, a small fee of 1% of the total cost is charged. Regardless of the transfer amount, the maximum commission will be 500 rubles. Thus, this is a convenient method for paying off debt early. There is no commission when sending funds through ATMs. Payment at Russian post offices is not cheap (1.9%). If you want to carry out the transfer procedure from an MTS mobile number, then this method is the most expensive. The commission will be 2.3% + 10 rubles. This amount is required to be paid only for sending the transfer. But do not forget that you must first top up your personal account with the appropriate amount, and this is also not always free.

Are there any disadvantages?

- Commission for conducting payment transactions.

- The limit on making a payment for a product or service is 15,000 rubles.

- You can transfer no more than 30,000 rubles per day.

- The amount of transfers per week should not exceed 100,000 rubles.

- You can use the option only 5 times in one day.

- Once one payment has been sent, the next one can be made no earlier than 15 minutes later.

- There are many scammers who try to deceive subscribers using the service.